The structure of the tax service has departments, each of which has its own responsibilities and tasks. The desk audit department analyzes and monitors various tax reports and documents related to the calculation of taxes and other payments.

In addition, employees of this department of the tax service are assigned a number of other responsibilities.

What it is

Before considering the main tasks and structure, it is necessary to give a clear definition that will reflect the essence of the work of the desk audit department .

This department represents a team of tax employees whose main task and function is to monitor compliance with the tax obligations of enterprises based on the reporting they provide. In general, the main function of the department can be described as the verification of tax reports and documentation. The peculiarity of the employees of this department is that all the work on analyzing and studying documents takes place in the department of the tax service itself, without visiting taxpayers.

What does the desk audit department do in the tax service?

As already noted, the main function of tax inspectors from the audit department is to analyze and study the financial reports of taxpayers. In addition, the list of responsibilities of department employees includes the following tasks :

- Reception and processing of documentation related to tax calculations and payments.

- Consideration of controversial issues arising in the process of calculating contributions and other payments.

- Initiating audits and sending requests to other tax authorities in order to obtain information about the taxpayer.

- Preparation of the legislative framework for competent registration of violations against unscrupulous citizens.

It is worth noting that the duties of employees include processing documents for all available reports. After identifying deficiencies in the documentation, the inspector is obliged to initiate proceedings against the taxpayer.

Objects of inspections

Any commercial enterprises and legal entities that receive profit as a result of their activities may be subject to inspections by the office department . It is now quite common practice for only those organizations that are engaged in commercial activities to be inspected.

If necessary, tax inspectors from the office department can begin checking various religious and charitable organizations that do not make a profit.

As a rule, in most cases, only those enterprises and organizations that, in the course of their activities, have already had shortcomings in the matter of taxation are subject to inspection. Also often subject to inspections are those commercial organizations whose tax payments are much lower than payments made by enterprises of the same income level.

With timely and “transparent” payment of contributions and taxes on the part of enterprises, the likelihood of meeting with the office department is sharply reduced , because The main share of all audits carried out by the tax service falls on already “notified” organizations.

The legislative framework

In the process of work, employees of the desk inspection department are guided by acts and decrees strictly prescribed by law. At the moment, the camera room is obliged to use in its work the rules of law prescribed in articles , , , of the Tax Code of the Russian Federation.

Orders of the Federal Tax Service (FAS) also have supreme force for department employees. All main issues related to the desk department are clearly stated in Article 88 of the Tax Code of the Russian Federation.

In addition to the fact that tax officials rely on already published legislative acts, the office department carefully monitors all changes in legislation . Such monitoring of the legislative framework allows inspectors to carry out their activities with maximum efficiency.

Division of the desk audit department by sector

A desk service may have several subsections. The quantity depends on the service territory covered by a specific division of the Federal Tax Service

Each is assigned individual functions, detailed in local management instructions, which are developed and approved by the head of the department, using tax and labor law.

The contents of the instructions for each department look like this:

- Desk inspection department 1, what does it do;

- what is the number of employees;

- Full name of the head;

- detailed job description for each employee, etc.

Let's consider an example of constructing sectors of the office department using the example of Federal Tax Service No. 43, Moscow

The department consists of 6 sectors, each working with a corresponding category of taxpayers.

- Office audit department 1 - responsible for 3-NDFL, 4-NDFL, administers insurance premiums and trading fees for individual entrepreneurs.

- Office audit department 2 – administers VAT issues for organizations, monitors the completeness of payment, the legality of refunds, and the application of the 0% tax rate.

- Department of Desk Inspections 3 – his department is responsible for income tax. Inspectors are also responsible for reporting personal income tax. persons During the audit, they study the composition of taxable income, tax deductions, the procedure for withholding and contributing to the budget, and verify the correctness of the 6-NDFL and 2-NDFL declarations.

- Department of Desk Inspections 4 – deals with issues of the unified social tax, as well as transport land and property tax for both organizations and individuals. Persons

- Department of desk audits 5 - oversees the issues and reporting of organizations working under the simplified simplified tax system and UTII.

- Department of Desk Inspections 6 – deals with debtors and residents who did not submit reports on time. Department employees summarize the results of the audit, communicate with taxpayers, prepare reports, lists of violators for submission to the legal department and the debt settlement department.

There is no single rule for the distribution of functions between sectors. Each inspection branch establishes its own operating procedure, depending on the territory it controls.

In each specific Federal Tax Service, there may be more or fewer subsections of the cameral department. The distribution of categories of taxpayers served by each subsection may also be different.

Goals and types

The main task of inspections carried out by employees of the department is to identify violations by taxpayers and individual commercial enterprises .

The cameral department is obliged to regulate compliance with tax laws by citizens, as well as to help prevent violations. If violations are detected, inspectors are required to initiate tax and administrative proceedings. Despite the fact that in most cases the audit is carried out directly at the tax service (in the department), when various shortcomings are identified, employees carry out on-site inspections .

To obtain a unified database with taxpayers, cameral employees are required to collect and systematize information about them. At the moment, there are several types of verification :

- A formal check involves a simple analysis of an enterprise or legal entity for the presence or absence of a specific document. In addition to the fact that during a formal inspection, employees check the availability of reports, they are required to identify shortcomings in their completion and execution.

- Regulatory verification is carried out on the basis of current legislation.

- Arithmetic gap analysis involves checking all numerical indicators in documents.

Highlights ↑

If desk audits are assigned to a specific enterprise, they should familiarize themselves with the following important points in advance:

- what it is?

- objects of inspections;

- legal grounds.

This way it is possible to avoid complications when carrying out inspections of the type in question. The Federal Tax Service has an extensive list of rights.

Up to blocking transactions on bank accounts of specific enterprises. Such actions are carried out in the event of detection of various serious violations in the maintenance of accounting records and the formation of the tax base.

What it is

The Department of Desk Inspections of Legal Entities and Individual Entrepreneurs checks compliance with current tax legislation.

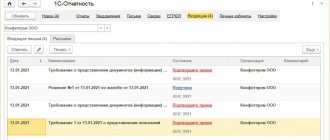

Detection of errors leads to the formation of a corresponding desk audit report. It indicates all detected errors and inconsistencies in the compiled documentation.

The enterprise will be obliged to eliminate all of them within the period specified in the legislation. If objections arise, an appropriate document must be generated.

It is sent in writing, by registered mail to the territorial offices of the Federal Tax Service. Drawing up such an objection has its own nuances - all of them should be taken into account.

All issues affecting the desk audit are discussed in as much detail as possible in Article No. 88 of the Tax Code of the Russian Federation.

The right to conduct it arises only after submission to the tax service:

- declarations;

- report.

There are special deadlines for submitting these documents. It is important not to violate them. Otherwise, the Federal Tax Service will have the right to order an inspection at any time.

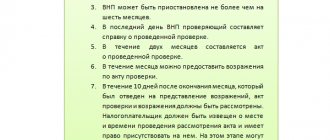

The duration is 3 months. Clause 9.1 of Article No. 88 of the Tax Code of the Russian Federation lists the reasons why this period of time may be increased.

The Federal Tax Service may require additional documents (in addition to the standard set) in special cases:

- a certain amount of value added tax has been claimed for reimbursement;

- the declaration was submitted to the tax office by the participant in the partnership or investment agreement;

- the enterprise has declared rights to any benefits;

- The company's profit-making comes from natural resources.

The department of the Federal Tax Service engaged in desk audits has the right to the following actions:

| Request for documents | In the cases provided for in Article No. 93 of the Tax Code of the Russian Federation |

| Obtaining all necessary information about counterparties | In the cases specified in Article No. 93.1 of the Tax Code of the Russian Federation |

| Conducting witness interviews | Article No. 90 of the Tax Code of the Russian Federation |

| Involvement of external experts | Translators and others (Articles No. 95 and 97 of the Tax Code of the Russian Federation) |

An act with the results of the inspection is drawn up within 10 days from the completion of this procedure.

No later than 5 days from the date of drawing up the act must be handed over to the taxpayer. All objections must be submitted within 1 month.

The head of the department conducting desk audits must familiarize himself with the objection and the report of the audit performed.

Based on the results of this action, appropriate decisions must be made. It is possible to assign additional tax control measures.

This is interesting: What does a sample of filling out a cash receipt order for a sub-report look like?

The Federal Tax Service is obliged to always warn the management of the enterprise about the inspection in advance. This rule is strictly mandatory.

Objects of inspections

The selection of an object for conducting a desk audit is carried out in accordance with a special regulatory document - Order of the Federal Tax Service of the Russian Federation No. MM-3-06/333 dated May 30, 2007.

This NAP lists in as much detail as possible all the criteria on the basis of which specific taxpayers are selected.

The fundamental criteria are the following:

- the tax burden on a specific payer is slightly lower than the average in this segment for other enterprises;

- the financial statements indicate the loss of the last several tax periods in a row;

- There are a large number of deductions in the reporting.

The procedure for calculating the tax burden is carried out in accordance with Appendix No. 3 to Order No. MM-3-06/333.

In a simplified form, the burden is calculated as the ratio of the amount of all taxes paid to the revenue (average annual turnover) of a particular organization.

Tax data submitted to the Federal Tax Service and income readings from Rosstat are taken into account. Differing from average indicators. Deductions also usually cause serious suspicion among the tax authorities.

For example, if the amount deducted for value added tax for the last year exceeds 89% of the tax amount.

The objects of inspection can be:

| Legal entities | Regardless of the form of ownership |

| Individual entrepreneurs | For any tax scheme used |

| State and non-state enterprises | — |

The enterprise must engage in any commercial activity on the territory of the Russian Federation. Charitable and other non-profit organizations are usually not inspected by the Federal Tax Service.

But in some, individual cases, desk audits are allowed. There must be some serious reasons for this.

Legal grounds

Conducting desk audits is subject to many regulatory and legal documents. One of the most important is the Tax Code of the Russian Federation, its following sections:

| Article No. 88 of the Tax Code of the Russian Federation | The most important points related to the desk audit are reflected |

| Article No. 93 of the Tax Code of the Russian Federation | Allows for the requirement of certain documents and the possibility of their withdrawal |

| Article No. 93.1 of the Tax Code of the Russian Federation | The procedure for requesting various documents and information from counterparties (related to conducting a desk audit) |

| Article No. 90 of the Tax Code of the Russian Federation | Based on this article, the department of desk audits of the Federal Tax Service has the right to interrogate witnesses |

| Article No. 95 of the Tax Code of the Russian Federation | External examination |

| Article No. 87 of the Tax Code of the Russian Federation | involvement of a private, independent expert (translator or other) |

| Art. No. 91, 92 of the Tax Code of the Russian Federation | Regulates the procedure for examining documents and other items related to taxation |

| Article No. 100 of the Tax Code of the Russian Federation | Establishes a deadline for the formation of an act with the results of the inspection and its submission |

Certain provisions of federal legislation also regulate the procedure for conducting desk audits.

To avoid any comments, the head of the enterprise should study all the above-mentioned NAPs. It is important for an accountant to monitor changes in current legislation.

This is interesting: The procedure for conducting a desk tax audit in 2022

First of all, Federal Tax Service employees conducting desk audits pay attention to errors related to reforms.

Department functions

In general, the desk tax service carries out a huge amount of work, which can be divided into several main functions :

- Analysis and verification of documentation.

- Identification of violations.

- Preparation of the legislative framework for initiating an on-site inspection.

- Creation and updating of a single database with additional data.

- Personnel retraining.

In most cases, inspectors have to carry out the entire scope of work on a continuous basis, because... document flow increases every year.

Current structure

At the moment, the structure of the department includes employees of the following positions :

- head of a department with a wide range of responsibilities;

- specialists in the field of high technology;

- accountants;

- lawyers;

- economists.

Depending on the specific tax authority, the composition and structure may be reduced, which leads to the fact that one employee performs responsibilities in several areas at once.

Job of a state tax inspector

In the process of retraining and additional training, tax inspectors gain access to more responsible and difficult tasks, so his work can be characterized as a constant process of identifying legal and tax violations by commercial and non-commercial enterprises.

The employee’s responsibilities also include collecting information and statistics on taxation for the region as a whole.

What does the cameral service do?

The cameral department is part of the Inspectorate of the Ministry of the Russian Federation for Taxes and Duties of the region to which it is assigned.

The main tasks that the desk department solves are monitoring taxpayers for timely and full payment of taxes and fees to the state budget, in accordance with the rules regulated by the legislation of the Russian Federation.

Taxes in force on the territory of the Russian Federation are paid to state, local and regional budgets.

The following main taxes are currently in effect:

- Federal:

- value added (VAT);

- on the income of individuals (personal income tax);

- at a profit;

- excise taxes;

- unified social (UST);

- National tax;

- other.

- Regional:

- transport (TN);

- on the property of organizations (NI).

- Local:

- Land;

- on the property of individuals.

An organization can choose the type of tax accounting for itself, depending on the conditions for conducting business:

- simplified system (STS);

- taxation system for producers of agricultural products (UST);

- unified tax on imputed income for certain types of activities (UTII);

- a special system for the implementation of production sharing agreements.

Legislative standards that guide the service in its work:

- Constitution of the Russian Federation;

- tax code of the Russian Federation;

- federal laws and other decrees, orders and acts of the President and Government of the Russian Federation and other legislative authorities;

- other documents.