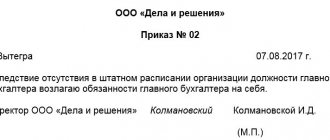

Establishing document

Responsibilities, like rights, cannot be unreasonable. When an enterprise hires an employee, it issues him a document called a job description. According to its provisions, the employee is obliged to organize his work activities. If we consider the work of an accountant, then the job description, regardless of the area of accounting, contains the following information:

- general provisions;

- employee rights;

- responsibilities of an accountant (on materials, OS, wages);

- material liability.

The document is signed by the head of the department, the newly hired employee and the main person in the legal department of the enterprise. By certifying his agreement with the working conditions, the accountant must fulfill his duties and bear financial responsibility for shortcomings. In addition, if violations of the law are detected, the specialist may be brought to administrative or criminal liability.

Qualification Requirements

The responsibilities of an accountant for materials of a budgetary institution or commercial enterprise begin with meeting the necessary qualification requirements. Material desk specialist is a fairly serious position. To maintain high-quality accounting in this area of the financial activity of an enterprise, an accountant will need work experience and an appropriate level of education. Most employers agree to hire a material accounting specialist with a secondary specialized or higher economic education for the position.

However, the main requirement for the candidate is work experience as an accountant in any or chosen field. Typically this period is 3 years. During this time, the specialist manages to acquire the necessary experience for work. As confirmation, the employer sends a request to the applicant’s former boss or relies on entries in the work book.

The position of a primary accountant and its features

The primary documentation accountant accepts and processes invoices and acts, transport documents, sales receipts, invoices and other primary documents. He can work in a company that is engaged in trade, transportation, construction - the main thing is that this organization has a large flow of primary goods, so it requires a separate specialist or even an entire department to process it.

Workers in this position have to painstakingly check data in documents and transfer them to the accounting system, so the main requirements for such a specialist are attentiveness, accuracy, perseverance, and willingness to do monotonous work. It is also important to have a good knowledge of paperwork and the rules for filling out documents.

Another difference between this profession in many cases is the unevenness of the workload. At the end of the reporting quarter, when it is necessary to enter the received primary documents from suppliers into the accounting system, a lot of primary documents often accumulate. During this period, many primary accountants work in emergency mode.

Knowledge is power?

The duties of a materials accountant would be impossible without a certain amount of knowledge. The profession requires constant training: legislation is amended annually, or even more often. The requirements for accounting are also being actively improved, which an accountant should undoubtedly be sincerely interested in in order to improve their own qualifications. A job description establishing the responsibilities of a materials accountant in a budget or a commercial enterprise first of all contains the “Must know” clause.

What knowledge do you need to have to cope with inventory accounting? Let us list the main requirements. A materials (or OS) accountant must have up-to-date knowledge of:

- legislative acts, regulations, orders and other documents regulating the organization of asset accounting and reporting;

- methods and forms of accounting in commercial enterprises or budgetary institutions;

- chart of accounts and rules for its use for materials accounting (OS);

- the procedure for registration and reflection on the accounts of the arrival of materials (OS) and their release (write-off);

- methods of analyzing the economic and financial activities of a legal entity or budgetary institution;

- organization of document flow in the materials accounting area (MS);

- procedure for document audits;

- provisions of financial, economic and labor legislation.

The employer has the right to add to the list of requirements for the accountant’s knowledge of maintaining inventory records.

Job responsibilities of a primary accountant

For a primary documentation accountant, there is a job description that lists the main daily responsibilities of a specialist. In many ways, these responsibilities depend on the accounting area that is assigned to the accountant. Here is their approximate list:

- filling out outgoing primary documents;

- timely collection of documentation from employees and contractors;

- checking received documents for correctness and compliance with the laws of the Russian Federation;

- timely entry of received documents into the accounting system - this is the task that often takes up most of the primary accountant’s time;

- registration of correspondence documents on accounting accounts based on the documents entered into the accounting program;

- registration of accounting registers to summarize received information;

- preparation of summary reports for internal and external use, especially for the company’s chief accountant;

- control over the correctness of document flow;

- generation of documentation sets;

- transfer of primary paper originals to the archive;

- participation in the inventory of the enterprise, assistance in recording the results of the audit;

- if necessary, participation in work to optimize the process of collecting, checking and entering primary data into the accounting system.

A primary documentation accountant must have the following knowledge and skills:

- laws and regulations of the Russian Federation that regulate document flow and archiving;

- tax, accounting and financial laws;

- internal company documents;

- standards for filling out primary documents on paper and electronically;

- rules for working with 1C or other accounting program, databases, reporting and electronic invoice transmission services;

- rules for storing documents and rules for maintaining an archive.

Responsibilities of a materials accountant

A material group specialist, depending on the conditions and requirements of the employer, can account for not only inventories, but also fixed assets, goods, intangible assets, i.e., the entire group of inventories and inventory items or a separate category. Of course, if the company is small, then one accountant can handle the responsibilities. In a large production facility, the material group consists of several specialists.

What actions should a materials accountant perform? This is monthly and continuous accounting of inventories with the implementation of all actions required by its organization:

- reception of materials and its documentation;

- calculation of the cost of inventories;

- control of economical consumption of materials;

- preparation of primary documentation for processing;

- reflection of data on the movement of materials on accounting accounts;

- accrual of payments to the budget;

- formation and maintenance of databases on accounting at the oil and gas plant site.

In addition, like a specialist in another area of accounting, a materials accountant must comply with general requirements, such as acting in accordance with the law, strict adherence to PBU and accounting instructions, as well as internal orders of the enterprise.

Sample job description for materials accountant

I approve [position name, signature, transcript of the person authorized to approve – usually this is the manager] [endorsement date]

M.P.

Job description of an accountant for materials [name of organization, institution]

The basis for the development and approval of this job description are the norms of the Labor Code of the Russian Federation, Order of the Ministry of Labor No. 1061n dated December 22, 2014. When drafting, other regulations are also involved that define the legal relationship between the employer and the employee.

General provisions

1.1. The basis for the appointment is an order from the head of the institution. 1.2. The applicant is subject to a mandatory requirement for secondary vocational education in the field of finance, confirmed by a diploma. Seniority and experience in the accounting field do not matter. 1.3. The specialist is subordinate to the chief accountant of the enterprise. 1.4. The theoretical training of an accountant in materials should include general issues of law and economics, as well as special issues:

- on working in specialized accounting programs;

- according to the correspondence of accounts in accordance with the company’s accounting policy when reflecting transactions with materials;

- on the specifics of the documentation support of the process (invoices, write-off acts, requirements for issuance, etc.);

- according to the rules for acceptance, posting and ensuring the safety of materials received or sent to contractors;

- according to the rules of interaction with debtors and creditors;

- on the nuances of the inventory process regarding materials received from suppliers or transferred to consumers.

Job responsibilities

The functionality of an accountant for materials [name of organization, institution] is presented:

2.1. Maintaining accounting records for materials owned by the company. 2.2. Calculation of the actual cost of materials. 2.3. Reception and processing of primary documentation. 2.4. Reflection on the accounting accounts of all transactions with materials. 2.5. Calculation based on the actual cost of materials, taking into account the costs incurred. 2.6. Drawing up reconciliation reports with counterparties. 2.7. Preparation of reports within the framework of its activities. 2.8. Resolving issues of receivables and payables. 2.9. Inventory of materials. 2.10. Maintaining and storing documentation. 2.11. [Other functionality taking into account the specifics of the institution’s work].

Rights

The materials accountant is entitled to demand and receive:

3.1. Full social package provided for by the labor law of the Russian Federation. 3.2. Reports and other information about the functioning of the company necessary to fulfill assigned duties from your boss or from other departments directly. 3.3. Support for the manager in implementing the functionality and exercising the rights provided for in this document. 3.4. Draft administrative documents and local acts of the organization affecting its activities. 3.5. Participate in meetings regarding materials handling issues. 3.6. Equipment and a workplace that complies with SanPiN standards, as well as other conditions for the implementation of functionality in full. 3.7. Advanced training through participation in courses, seminars and other training forms. 3.8. [Other rights provided for by internal local acts of the institution].

Responsibility

The current norms of the Labor Code, the Criminal Code, the Code of Administrative Offenses, and the Civil Code of the Russian Federation make it possible to hold a materials accountant accountable for:

4.1. For negligence or complete neglect of your duties under these instructions. 4.2. For violation of the law in the process of performing assigned functions. 4.3. For causing damage to the employer's property.

The development of the job description was carried out on the basis of [name, number and date of the document]. Head of the HR department: [transcript] [signature] [date of compilation] Agreed by: [position] [transcript] [signature] [date of approval] I have read the instructions: [transcript] [signature] [date of review]

Responsibilities of an OS accountant

Fixed assets directly affect the production process, its efficiency and the overall quality of the organization. The responsibilities of an accountant for materials and fixed assets are quite similar, since both groups are the main assets of the enterprise. Accounting for fixed assets occurs somewhat differently than for inventories, but is not fundamentally different from it. Often, a specialist simultaneously deals with both materials and fixed assets.

The asset accountant must perform the following responsibilities:

- carry out work on accounting and tax accounting of property;

- control primary documentation on your site;

- reflect changes in the relevant accounting accounts in a timely manner;

- make calculations based on the actual cost of the operating system;

- provide OS reporting and prepare data for its preparation.

Structure of the job description of an accountant for accounting of fixed assets (FA)

Like any other, an accountant’s instruction on fixed assets (fixed assets) is developed by human resources and legal services and approved by the head of the enterprise/organization. The generally accepted structure of such a document involves the presence of 4 main sections:

- General provisions.

- Responsibilities of an OS accountant.

- Accountant's rights under OS.

- Responsibility of the accountant for OS.

The first section contains only general information about the requirements for such a specialist (education, experience, etc.), so we will not dwell on it. The remaining sections play a more important role - so we’ll talk about them further.

Responsibility

The responsibilities of a materials accountant in a manufacturing or other industry must be fulfilled. If they are violated, different types of liability may arise: disciplinary, material, administrative or even criminal. Financial crimes in modern society are punished severely. An accountant is a person who is called upon to prevent violations in the economic relations of a legal entity and other entities. If shortages are detected, the materials specialist is responsible for covering them.

A materials accountant is a qualified specialist erudite in the fields of law, accounting and economics. An employee interested in his competence and professionalism complies with all requirements for accounting for inventory or inventory, successfully monitoring the movement and use of assets of this group.