A tax audit is one of the types of tax control measures listed in the Tax Code of the Russian Federation. They come in two types: desk and away.

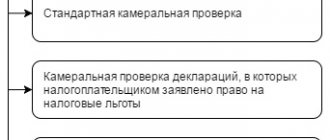

The first are carried out by the fiscal authority without entering the territory of the organization on the basis of previously submitted declarations and calculations. Such audits are carried out in a semi-automatic mode; sometimes the taxpayer may not even realize that he is being audited.

The second type of checks is carried out based on the decision of the head of the Federal Tax Service or his deputy in the organization’s office. As a rule, tax officials do not inform about their visit in advance, however, such inspections are carried out in relation to organizations included in advance in the plan of on-site inspections for the current period. Tax officials prefer to keep the list of organizations for which on-site visits are planned secret, relying on the factor of surprise. And yet, based on a number of signs, a company can with a high degree of probability predict a meeting with representatives of fiscal authorities.

In exceptional cases, an on-site inspection may be carried out in relation to a company not included in the pre-approved plan. Such an audit is called unscheduled. Its appointment is more difficult to predict, which means the organization will have no time to prepare at all.

Unscheduled tax grounds for carrying out

The Tax Code of the Russian Federation mentions only one basis for conducting an unscheduled tax audit - liquidation or reorganization of a company.

In this case, the question of its feasibility is decided based on the information available to the inspectorate about this company, as well as data from its liquidation balance sheet or transfer act. If the company’s activities do not raise claims from the tax authority (there are no debts to the state, the company has not been found to be using dubious tax optimization methods), then an audit may not be ordered. However, companies that do not plan to cease operations or reorganize should not relax. Law No. 294-FZ of December 26, 2008, which regulates the procedure for protecting businesses during state and municipal control, lists a number of cases when unscheduled audits may be carried out in relation to an organization or entrepreneur.

Most of the situations listed in the law relate to inspections carried out by bodies such as various fire, technical, sanitary, labor inspectorates, and bodies responsible for the preservation of cultural and artistic values.

In relation to tax legal relations, attention should be paid to the possibility of an unscheduled audit in the event of:

- receiving a justified complaint from a citizen or organization about non-compliance with legislation in the field of taxes and fees

- instructions from the prosecutor's office on materials and appeals received by it.

That is, we are talking about situations when the fiscal authority receives information about violations committed by a company or entrepreneur in the field of taxes and fees.

In a letter dated May 30, 2022 No. ED-2-15/ [email protected] , the Federal Tax Service explains that an unscheduled on-site tax audit can be carried out if documents and other evidence are received from citizens indicating possible violations of tax legislation by organizations and individuals.

Unscheduled inspections

This type of inspection is carried out if there are circumstances that may lead to a violation of safety rules, as well as if they were not eliminated during the observations of previous inspections. Another reason may be appeals from citizens or demands from the prosecutor’s office.

To carry out a documentary check, it is necessary to send a certain list of documents to the location of the inspection body.

An on-site inspection is carried out if during the study of documents it is not possible to form a complete picture.

Notification of an unscheduled inspection is sent no later than 24 hours in advance. If the basis is based on facts that pose any threat of harm to life and health, then notification will not be made.

Tax audit of an organization: features of unscheduled audits

A special feature of unscheduled audits is the so-called preliminary check.

It is relevant in cases where the basis for control measures is an appeal from “ill-wishers” or a request from the prosecutor’s office. At this stage, the Federal Tax Service has the right to:

- Request additional explanations and evidence from the person who sent the violation report

- Analyze the information and information available to the inspectorate about the person being inspected

- Carry out control measures on this issue without interaction with the person being checked (for example, carry out a “exit at the address” in order to record the fact of the person’s absence in a given place)

- Request the person in respect of whom the “signal” was received to provide their explanations

It is impossible to hold someone accountable based on the results of a preliminary inspection, but if during its implementation the facts of a violation are confirmed, then a reasoned submission is prepared to order an unscheduled inspection.

Otherwise, the procedure for conducting scheduled and unscheduled audits is similar. The procedure begins with the decision by the head of the inspectorate or his deputy to conduct an inspection, which must indicate:

- taxes that will be audited

- a period of time

- Names and positions of officials participating in control activities. The group leader must be indicated. If the participation of law enforcement officials in the audit is expected, this should also be indicated in the decision.

An on-site audit is carried out through the implementation of individual control activities, such as:

- Request for documents (information) from the person being inspected, its counterparties and other persons (banks, licensing authorities, self-regulatory organizations, etc.);

- Obtaining bank statements of the person being audited, as well as his counterparties along the chain;

- Conducting inspections of the territory (office, warehouse, production premises, etc.)

- Removal of objects and materials;

- Obtaining witness statements. Not only the director and accountant of the company being audited, but also current and especially former employees can be called as witnesses; directors and founders of counterparties; any persons who are able to provide officials with the necessary information;

- Conducting examinations and attracting specialists. Most often, examinations are carried out to assess the value of real estate objects and the authenticity of the signature.

The inspection must be completed within 2 months, but if there are significant grounds, it can be extended by a decision of a higher authority. The actual inspection period is much longer and can last up to a year, because officials constantly suspend the inspection: they sent a request to submit documents - they suspended the inspection until the results were received; sent demands to counterparties - suspended.

When the inspection is suspended, it is prohibited to carry out control activities, but as a rule, this time is actively used to analyze documents and information already received. The audit ends with the preparation of a certificate and report. The report records all detected violations.

If the taxpayer does not agree with the conclusions of the report and has sufficient evidence to refute them, he has the opportunity to file objections, which, together with the report, are considered by the head of the Federal Tax Service and taken into account when making the final decision on the audit.

Scheduled inspections of employers

On July 23, 2022, Decree of the Government of the Russian Federation dated July 21, 2021 No. 1230 came into force, approving a new regulation on the procedure and rules for conducting scheduled and unscheduled inspections of employers. Scheduled inspections of employers, which are scheduled for the current year and whose start date occurs after July 23, 2021, are carried out according to the new rules.

Scheduled inspections are carried out on the basis of a plan for conducting planned control activities for the next calendar year, agreed upon with the prosecutor's office.

According to the new procedure, which is based on a risk-based approach, the frequency of scheduled inspections directly depends on which risk group the employer belongs to. In total, the new rules identify 5 risk groups: high, significant, medium, moderate and low. The assignment of an employer to a particular risk group is carried out on the basis of a decision of the state labor inspector.

Taking into account the risk level assigned to the employer, scheduled inspections are carried out at the following frequency (clause 15 of the Regulations):

- 1 time every 2 years – at high risk;

- 1 time every 3 years - with significant risk;

- Once every 5 years – with average risk;

- Once every 6 years - with moderate risk.

Scheduled inspections are not carried out for employers classified as low risk. Moreover, if the employer is not classified in a certain category, he is considered to be classified specifically in the low-risk category.

Assignment of a risk level to employers is carried out annually, before July 1 of the current year, for its application in the next calendar year. Information about the risk categories assigned to organizations and individual entrepreneurs is posted on the official website of Rostrud. For example, the list of employers whose activities are classified as high risk as of 07/01/2021 can be found here.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. Decree of the Government of the Russian Federation dated July 21, 2021 No. 1230 came into force, approving a new regulation on the procedure and rules for conducting scheduled and unscheduled inspections of employers by state labor inspectors.

2. According to the new procedure, which is based on a risk-based approach, the frequency of scheduled inspections directly depends on which risk group the employer belongs to. In total, the new rules identify 5 risk groups: high, significant, medium, moderate and low.

3. Assignment of a risk level to employers is carried out annually, before July 1 of the current year, for its application in the next calendar year.

4. Unscheduled inspections are carried out by GIT inspectors on an emergency basis, without prior notice and often unexpectedly for employers.

5. The law establishes an exhaustive list of grounds for conducting unscheduled inspections of GIT.

6. From 2022, the State Inspectorate can also carry out control activities such as an inspection visit and an on-site inspection.

7. From 2022, the time frame for conducting labor inspections has been significantly reduced compared to what was previously in force.

Let us note that since 2022, scheduled inspections of organizations and individual entrepreneurs classified as small businesses, information about which is included in the unified register of small and medium-sized businesses, are not carried out (clause 7 of the Decree of the Government of the Russian Federation of November 30, 2020 No. 1969). Thus, only employers classified as medium and large businesses are included in the annual inspection plan.

An exception is made for representatives of small businesses who were previously brought to administrative responsibility for committing a gross violation (in accordance with the Code of Administrative Offenses of the Russian Federation) or to punishment in the form of disqualification or administrative suspension of activities. Such small businesses are also included in the inspection plan on a general basis.

How to understand that a tax audit is coming?

It is very difficult to predict the purpose of an unscheduled audit.

However, if a decision is made to close a business or change its structure, you need to be prepared in advance to schedule an inspection. And although tax authorities do not check absolutely all companies that are in the process of liquidation or reorganization, the risk of falling under control measures is high. The presence of an acute conflict with a counterparty, clients or competitor can also serve as an impetus for an audit if the offended party reports violations of the law on your part to regulatory authorities, for example, the prosecutor's office or a higher tax authority.

Who will be checked more often?

New approaches to inspections are prescribed in the Federal Law of July 31, 2020 No. 248-FZ “On State Control (Supervision) and Municipal Control in the Russian Federation,” the norms of which, for the most part, came into force on July 1, 2021.

The law stipulates that when planning inspections, inspectors must use a risk-based approach: the higher the risks in relation to the object of control, the more frequent the inspections.

Inspectors are not allowed to simply select a company for inspection. The choice must be justified. For this purpose, a new concept was introduced - the category of risk of harm (damage) (Article 23 of Law No. 248-FZ).

The risk of harm (damage) is the probability of events that may result in harm (damage) of varying scale and severity to legally protected values.

Risks are divided into six categories:

| Risk level | Frequency of control activities |

| Extremely high | At least one, but no more than two events per year |

| High/significant | At least one event every four years and no more than two events every two years |

| Medium/moderate | At least one event every six years and no more than one event every three years |

| Short | There are no events |

It turns out that inspectors will come with inspections more often to those businessmen whose activities result in negative consequences for the interests of society.

If the likelihood of such consequences occurring is minimal, inspections will not be scheduled or carried out. The list of indicators of the risk of violation of mandatory requirements by type of control and the procedure for their identification are approved by government authorities at each level: federal, regional and municipal. For example, risk indicators when carrying out fire supervision are listed in the Order of the Ministry of Emergency Situations dated 06/07/2021 No. 364.

How to avoid an unscheduled tax audit?

You can try to evade the audit at the preliminary inspection stage if the Federal Tax Service Inspectorate asks you for an explanation of the “signal” received. Under no circumstances should the officials' request be ignored. If possible, you should provide documents proving your innocence. If you feel that you cannot cope on your own, it is better to seek the help of professional consultants. They will help you correctly draw up explanations, and if necessary, they will visit the Federal Tax Service with you to give oral explanations.

Electronic verification passport

In the register of inspections, a separate electronic passport (KNM passport) is issued for each control and supervisory event, be it an inspection or a preventive procedure.

The KNM passport reflects a set of information about the verification:

- the nature of the event (for example, “Scheduled inspection under 248-FZ, approved according to plan 294-FZ”);

- status (for example, “pending”);

- date of registration in FSIS ERP;

- type (on-site inspection, documentary inspection, etc.);

- details of the decision to conduct an inspection: date, number, full names of officials;

- start and end dates of the audit;

- the name of the prosecutor's office with which the inspection was agreed upon;

- subject of verification (more on this in the next section);

- address of the place of inspection;

- date and method of notifying the person being inspected of the inspection.

This is open data that anyone can get acquainted with by entering, for example, the name of the organization or its tax identification number in the search bar:

Information about the decision based on the results of the inspection and the measures taken are available only to the person who was inspected. You can get them using your account on the State Services portal or your personal account in the departmental information system.

What to do if a tax inspector knocks on your door?

Given the suddenness and difficulty of predicting an unscheduled audit, there are a number of tips that will help companies and entrepreneurs avoid serious mistakes at the very beginning.

The inspectors rely on the surprise of their appearance, hoping to take you by surprise and thus gain more information.

First and most importantly, you need to calm down. The manager's confidence will have a positive effect on both employees and will show inspectors that you have nothing to fear. You should familiarize yourself in advance with the rules for conducting inspections, the rights of inspectors, and your rights. This will prevent officials from exceeding their powers and making unnecessary materials and information available to them.

It is necessary to carefully read the inspection decision and check the identity of the inspectors who came to visit. Make sure that these persons are indeed employees of the Federal Tax Service. It happens that competitors or raiders come under the guise of officials and want to take over your business.

After this, it is necessary to isolate the inspectors as quickly as possible, allocating them a separate room for work.

This will protect them from “accidentally” receiving information not intended for them. After that, try to understand as clearly as possible what exactly interests them. Most likely, the company will immediately receive a request to provide documents. You have 10 working days to complete it. If, according to preliminary estimates, this time is not enough to prepare documents, ask for an extension of the deadline.

After the inspectors have been transferred to a separate office, employees should be instructed about the inadmissibility of unauthorized contacts with field workers and the need to restore order to their desks and closets. The office should not contain illegal documents, as well as documents and items belonging to other organizations (for example, seals of other companies, originals of their constituent documents, etc.).

After completing the main steps given above, it is necessary to assess the possible risks for the company and make a decision regarding the need to involve lawyers who specialize in supporting inspections.

For verification - only with a QR code

According to the new rules of Law No. 248-FZ, controllers are required to coordinate almost all control and supervisory activities with the prosecutor’s office and receive a QR code for each event.

Such a code is generated by a unified register of KNP, which provides a transition to a page on the Internet containing an entry from a unified register about an inspection or preventive measure within the framework of which the document was drawn up (clause 21 of Government Decree No. 604 dated April 16, 2021).

If the inspectors did not present the businessman with a decision to conduct an inspection with a QR code, or the businessman did not find a specific inspection in the unified KNM register (if, by law, it should be there), he has the right not to allow inspectors into his territory at all. If the inspectors nevertheless carried out an unauthorized control event, such an inspection will not be recognized as legal and its results will be easy to challenge.

Information about each inspection in the KNM register is reflected under a separate unique number, by which the merchant can immediately familiarize himself with the subject of the inspection and other information placed in the inspection passport.

Control and supervision reform: what has changed since July 1, 2022

What areas does the new Inspection Law apply to?

In general, the scope of the new law has not changed compared to Law No. 294-FZ on the protection of the rights of legal entities and individual entrepreneurs (hereinafter referred to as the previous law on inspections). The new law, like its predecessor, does not regulate tax, currency, customs audits, procurement control under Laws N 44-FZ and N 223-FZ, financial control. There are other exceptions.

What are the features of the entry into force of the new Law on Inspections?

The law begins on July 1, but transitional provisions are provided.

The inspection plan for 2022, approved by the previous inspection law, also applies to inspections that take place in the second half of the year. In this case, the planned on-site inspection may be replaced by a one-day inspection visit, which will be notified in advance.

Inspections that have not been completed by July 1 are carried out and documented according to the rules that were in force at the time they began. According to the same rules, it is necessary to appeal such inspections, even if the organization or individual entrepreneur files the complaint after July 1.

If the complaint was filed before July 1, it will be considered in the manner that was in effect on the start date of the inspection.

Regional and municipal inspections are carried out according to the old rules until regulations on the types of regional and municipal control are approved. Such documents must be accepted before January 1, 2022.

Until the end of 2024, the previous law on inspections continues to apply to a number of types of control (antimonopoly control, control in the field of government defense procurement, etc.). Also, this law continues to apply upon notification of the start of certain types of business activities.

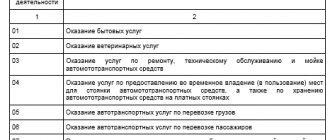

In what ways can an organization or individual entrepreneur be verified?

The law divides control measures into two groups. Conventionally, they can be called “contactless”, when there is no interaction with a controlled person, and “contact”.

“Contactless” methods - monitoring compliance with mandatory requirements (safety monitoring) and on-site inspection - can be used for any type of control. In this case, a departmental assignment is sufficient.

A closed list of “contact” inspection methods should be established in the regulation or law on a specific type of control. These methods can include a documentary inspection, an on-site inspection, a test purchase, a monitoring purchase, a random inspection, an inspection visit, and an on-site inspection. Rospotrebnadzor, for example, can use all methods during inspections in the field of consumer rights protection (clause 22 of the Regulations, approved by Decree of the Government of the Russian Federation of June 25, 2021 N 1005).

As before, “contact” inspections can be carried out on a scheduled or unscheduled basis.

We defined detailed rules for each event. First of all, the events differ in the set of permissible control and supervisory actions: inspection, inspection, questioning, requesting documents, experiment, etc. This will provide the business with additional guarantees that inspectors will not act arbitrarily.

Where to find information about inspections

The unified register of inspections maintained by the Prosecutor General's Office is being transformed into a unified register of control (supervisory) activities. Until the end of 2022, the old register can be used by regional and municipal inspectors, if there is no provision on the type of control in accordance with the new law.

The new register accumulates all the information about the inspection: who carried out the inspection and when, what decisions were made, how they were carried out, who was punished and how.

A “contact” check cannot be carried out until information about it is in the register. However, there is an exception. Thus, an on-site inspection can develop into a test purchase if this is provided for by the regulations on the type of control. Then the information will be added to the register after the fact.

The decision to conduct an inspection must have a QR code. Using the code, you can go to information about the check in the registry.

Also, a controlled person can use an account on the government services portal or a personal account in a departmental information system to gain access to information about inspections against themselves.

The government has determined in detail what information should be entered into the register and within what time period, as well as the levels of access to it. There are three levels:

- information is open;

- information can only be seen by a controlled person after authorization;

- information is open, but only after the end of a specific event.

For example, information about a test purchase is open to everyone, but only on the next working day after it is carried out. Information about the decision of the control body and the measures taken is available only to those who were inspected.

If the inspection was appealed pre-trial through the public services portal, the text of the complaint, status and result of the review will be included in the register.

During a judicial appeal, the register will include information about the results if the decisions or acts of the inspectors are canceled or changed.

How long can they check?

Documentary inspection - no more than 10 working days (the period is counted from the moment the requested documents are submitted to the inspectors).

On-site inspection – no more than 10 working days. If an organization has divisions in different regions, the deadline is set separately for each division. The total time of interaction between inspectors and small businesses is limited to hours - no more than 15 hours for micro-enterprises, no more than 50 hours for others.

Inspection visit - no more than 1 working day at one site.

Raid inspection - no more than 10 working days (including no more than 1 working day for interaction with one controlled person).

The timing of other activities is determined based on the period of time that is usually needed for the purchase, removal of samples or carrying out examinations.

Should warnings be given about unscheduled inspections?

They will not notify you in advance:

- on test purchase;

- monitoring procurement;

- selective control;

- inspection visit.

An unscheduled on-site inspection will be notified in advance no later than 24 hours in advance. Laws regarding specific types of controls may provide exceptions to this rule. For example, they will not notify the catering organization during sanitary and epidemiological control.

In addition, there is a general rule: if there is a threat of harm, any unscheduled control event can be carried out without notice.

Will checklists be used?

Not yet. The cases of mandatory use of checklists will be determined by the government. The corresponding norm will come into effect only from March 1, 2022.

How to appeal the results of an inspection

If the inspection was carried out within the framework of federal control and under the new Law on Inspections, then before filing a complaint with the court, you need to check whether pre-trial procedure is required. The Plenum of the RF Armed Forces has already drawn attention to this point. From July 1, 2022, the pre-trial procedure is valid for 62 types of control, including inspections by Rostrud, the Ministry of Emergency Situations, and Roszdravnadzor.

A complaint, unless it contains information protected by law, is submitted through the government services portal. More detailed information can be found on the portal.

Prevention of violations

We secured the priority of preventive measures in relation to control and supervisory measures and provided, in particular, for the following preventive measures:

- measures to incentivize integrity - non-material incentives for those who faithfully comply with mandatory requirements. To do this, the regulations on the type of control will be able to determine the procedure for assessing integrity, the types of measures to stimulate it;

- self-examination is a voluntary independent automated assessment of compliance with mandatory requirements. If, based on its results, a legal entity or individual entrepreneur receives a high rating, then he will be able to accept a special declaration, if the provision on the type of control allows this;

- preventive visit - a conversation at the place of business of a legal entity or individual entrepreneur. Even if violations are discovered during the visit, an order to eliminate them will not be issued.

So, for example, Rospotrebnadzor can award reputational status to companies and individual entrepreneurs working with consumers. A controlled person can publicly post this information, for example, on its website or in advertising (clause 16 of the Regulations, approved by Decree of the Government of the Russian Federation of June 25, 2021 N 1005).