As is known, when calculating VAT payable to the budget, a company has the right to reduce it by input VAT received in invoices from its counterparties. But if, during the verification of the information provided, the Federal Tax Service considers the counterparty to be an unscrupulous taxpayer, then it has the right to refuse to issue a deduction or refund VAT from the budget.

To reduce their risks and prevent such a negative scenario, taxpayers are recommended to exercise due diligence when choosing business partners and check them in advance. In particular, it is worth making sure that the counterparty is not a fly-by-night company and actually conducts business activities.

This aspect is especially important due to the fact that the Federal Tax Service has significantly tightened control over paid VAT since 2015. When the tax authorities receive a VAT return, the data from it is cross-checked for all buyers/sellers. As a result, an entry from the seller’s Sales Book must necessarily be found in the buyer’s Purchase Book.

If during this audit it is revealed that there are discrepancies regarding the VAT amount or invoice details, the taxpayer will be required to make clarifications.

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call:

- Moscow.

- Saint Petersburg.

- Regions.

And if the counterparty meets the criteria of a one-day business, the deduction may be cancelled.

Therefore, under conditions of total control over the calculation of VAT, the likelihood of removing part of the deductions increases many times over.

How to find out from the counterparty

Often, during an audit, a potential partner is asked to provide official confirmation from the Tax Inspectorate that his organization is a VAT payer. This request puts the taxpayer in a difficult position.

The fact is that there is no special form of information letter that would confirm the fact of application of the general system of taxation and payment of VAT to the budget. Only simplified taxpayers can receive such a letter and thereby confirm the legality of issuing invoices without allocated VAT.

But you can request other documents from the counterparty that officially indicate its status as a VAT payer.

This:

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call:

- Moscow.

- Saint Petersburg.

- Regions.

- a copy of the last submitted VAT return/its cover page with a mark from the Tax Inspectorate on its acceptance;

- a copy of the Sales Book (not all partners are ready to provide this document and declassify the list of their partners and turnover);

- registration documents (including an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs).

You can also ask your potential partner for a letter on her letterhead about the applicable tax system. This letter is drawn up in free form and contains the details of the organization, contact information and the beginning of work at OSNO. The document is signed by the chief accountant or manager.

Additional confirmation of the fact that the counterparty is not one of the fly-by-night companies is a certificate of absence of debt to the budget, received by it from the Federal Tax Service at the place of registration.

It is important to understand that the provision of all specified information by the counterparty is carried out on a voluntary basis. But usually in the business community they treat such requests with understanding when concluding an agreement and provide the documents they have only if they do not contain information that constitutes a trade secret.

Inconsistencies in Sections 1–7

If the value of the code at the location (accounting) (title page) is equal to 231, the code according to OKTMO (section 1, line code 010) may not be specified and is required for other values of the code at the location (accounting).

When the value of the code at the location (accounting) (title page) is equal to 231, the budget classification code (section 1, line code 020) may not be specified and is required for other values of the code at the location (accounting).

When filling out OKTMO (section 1, line code 010), one of the following amounts must be indicated:

- The amount of tax payable to the budget in accordance with paragraph 5 of Article 173 of the Tax Code of the Russian Federation (section 1, line code 030);

- The amount of tax payable to the budget in accordance with paragraph 1 of Article 173 of the Tax Code of the Russian Federation (section 1, line code 040);

- The amount of tax calculated for reimbursement from the budget in accordance with paragraph 2 of Article 173 of the Tax Code of the Russian Federation (section 1, line code 050).

In the absence of OKTMO (section 1, line code 010), the amounts are not indicated.

Section 1 of the VAT return must be completed. If the details in the settings are filled in, open section 1 for editing and click “Save” - the section will be filled in automatically.

Note.

Section 1 must be completed, even if the declaration is “zero”.

The tax period code (title page) can take values from 01 to 12 only if the code value at the location (accounting) is equal to 250

If the location code is other than 250, check the Tax Period (Code) field on the cover page. Possible values: “21 | I quarter", "22 | II quarter", "23 | III quarter", "24 | IV quarter" (in case of reorganization/liquidation - a separate list of codes). It is impossible to change the period in a declaration that has already been downloaded: you need to make corrections in the accounting program and upload the file again.

If the value of the tax amount payable to the budget in accordance with paragraph 5 of Article 173 of the Tax Code of the Russian Federation is greater than 0, the element “Priznal12” must be present and have a value.

If line 030 of section 1 is full, you must generate section 12. If you do not provide section 12, clear line 030 in section 1.

If there is no amount by which the tax base is adjusted when the price of sold goods (work, services) decreases (section 4, line code 110), the amount by which the tax base is adjusted when the price of sold goods (work, services) increases (section 4) must be indicated. , line code 100).

If there is no amount by which the tax base is adjusted when the price of sold goods (work, services) increases (section 4, line code 100), the amount by which the tax base is adjusted when the price of sold goods (work, services) decreases must be indicated (section 4 , line code 110)

In section 4, clear lines 060 and 090.

Note.

These lines must be filled out for the printed form, in accordance with Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

If there is no amount by which the tax base is adjusted when the price of sold goods (work, services) decreases (Section 6, line code 140), the amount by which the tax base is adjusted when the price of sold goods (work, services) increases (Section 6 , line code 120).

If there is no amount by which the tax base is adjusted when the price of sold goods (work, services) increases (section 6, line code 120), the amount by which the tax base is adjusted when the price of sold goods (work, services) decreases must be indicated (section 6 , line code 140)

In Section 6, clear lines 070 and 110.

The file does not match the schema. Element: “Information about the taxpayer - seller (legal entity)” parameter “Section 2, line 030. INN of the taxpayer - seller” has the incorrect value “0000000000”. The parameter must contain 10 characters. Taxpayer identification number of the organization.

In section 2, check line 030: if the seller taxpayer does not have a TIN, leave the line empty without filling it with zeros. If the taxpayer-seller is an individual entrepreneur, please indicate the appropriate o.

If the value of the transaction code (section 2, line code 070) is equal to 1011712 or 1011703, information about the taxpayer - the seller (section 2, line code 020 and 030) must be indicated. If the value of the transaction code (section 2, line code 070) is equal to 1011703, the TIN of the taxpayer - the seller (section 2, line code 030) must be indicated.

In section 2, fill in information about the taxpayer-seller: lines 020 (name) and 030 (TIN). Information must be filled in for transaction codes 1011703 and 1011712.

Independent verification of the counterparty

What measures can a company take to protect itself from unscrupulous counterparties and what is important to check the counterparty for?

Among the criteria that are worth paying attention to are:

- the correctness of the details in the invoice received from the company;

- the validity of its registration data (whether the company has been excluded from the register of legal entities and individual entrepreneurs), whether the company is on the list of liquidated ones;

- checking senior management for disqualification;

- whether the company is a shell company;

- existence of debts on taxes and fees;

- form of taxation.

Today, a significant amount of information about a legal entity can be obtained from the electronic services of the Federal Tax Service (they are combined in the block “Check if your business is at risk?”).

The service “Information on state registration of legal entities, individual entrepreneurs, peasants/farms” (https://egrul.nalog.ru) allows you to understand whether the company is registered in principle, information about its management, etc. An extract from the Unified State Register of Legal Entities is also available for download here/ EGRIP.

The invoice verification service (https://npchk.nalog.ru) allows you to check the correctness of the submitted invoice. Since, according to the new rules, starting from 2015, information in the VAT return must contain data from the Book of Purchases and Sales, this resource will save time on identifying errors in the declaration.

The search can be conducted using the organization's INN/KPP.

Electronic services of the Federal Tax Service of the Russian Federation to help individual entrepreneurs when calculating VAT

The Tax Service of the Russian Federation has developed several useful online services for entrepreneurship. They are very helpful in running a business, speed up processes and save personal time.

Checking the correctness of invoices

The electronic service of the Federal Tax Service of the Russian Federation is designed to speed up and simplify the verification of the details of its suppliers or recipients when issuing invoices for generating VAT reporting. It makes it possible to clarify online all the data on received and issued invoices. You will save a lot of time at the control stage of filling out VAT accounting documents: purchase and sales books, as well as financial accounting journals.

For now, the “Counterparty Verification” service is operating in test mode. But its importance is obvious, given the requirements of tax inspectors for the expanded declaration of VAT transactions since 2015.

Using this service you can find out online:

- whether the organization or private entrepreneur is registered in the register of taxpayers (USRN);

- what status the counterparty is in: active or, according to the Federal Tax Service, does not have this tax status (and does not pay VAT);

- correct or incorrect TIN is indicated;

- does the gearbox comply, etc.

The input data must be entered strictly according to the system requirements (spaces, date form, etc.), otherwise the service will generate an error. You can enter one company at a time or as a list.

The Federal Tax Service is interested in making paying taxes convenient

Steps when using the invoice verification service:

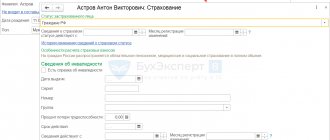

- Correctly enter the counterparty's data into the control fields of the electronic form. All fields, oh, must be filled out. When checking a legal entity, it is recommended to indicate the checkpoint to obtain data on a specific branch.

- Click the check button.

- To clarify the transaction for the selected date, you need to fill in the appropriate field, in this case the period will be checked, including 6 days before and after.

- If the service gives an error in the details of the counterparty, you first need to check the accuracy of the entered numbers.

- But if the data matches what is indicated in the invoice, and the resource reports an error, in this case you need to inform your supplier about the need to check and correct his data.

- If the system indicates an error in your credentials, you need to contact online services technical support. Maybe it's just a glitch in the program. In order for your electronic record to be quickly checked, it is recommended to attach a scanned copy of the TIN certificate. Such applications are considered first.

The result of the check “3-The checkpoint does not correspond to the TIN specified in the request (the date may or may not have been indicated)” means that the counterparty’s TIN is indicated correctly, and the checkpoint corresponds to the format and the indication of such a checkpoint will not be an error when submitting a declaration and office verification.

Federal Tax Service of the Russian Federation

https://www.nalog.ru/

UKEP is an important tool for private business

The presence of an enhanced qualified electronic signature is necessary for document management in modern conditions. UKEP is developed using cryptographic means taking into account all personal security requirements. The UKEP certificate for business is confirmed by the FSB of the Russian Federation. Any documents certified by such an electronic signature have full legal force.

Electronic document management is a modern requirement

Tax legislation requires VAT payers to ensure electronic interaction with the Federal Tax Service within 10 days from the date of registration. All VAT reporting documents are submitted only through EDI. To do this, you need to obtain a qualified electronic signature key certificate and enter into an agreement with an electronic document management operator.

To obtain UKEP, it is enough to contact any of the accredited certification centers; their current list for each city of the Russian Federation can be found on the government services portal.

The package of documents required for obtaining a UKEP certificate for a private entrepreneur includes:

- passport;

- TIN;

- SNILS;

- extract from the Unified State Register of Individual Entrepreneurs;

- statement.

Having a qualified electronic signature is a prerequisite for working with government service portals, the Interdepartmental Electronic Interaction System, submitting reports to tax authorities, sending banking and other documents via the Internet, performing state and municipal functions and when performing other legally significant actions.

Public services

https://www.gosuslugi.ru/

VAT office of an Internet company

There is a specialized service for Internet companies that are required to register with the Federal Tax Service of the Russian Federation as VAT payers on electronic services. These include individual entrepreneurs who provide paid online services: access to music, movies and games, sale of domain names and hosting, etc.

On the “VAT Office of an Internet Company” resource, you can independently check whether you need to register; to do this, you just need to pass a three-minute test. You can submit an online application for registration, submit declarations and use all legal forms for conducting online business.

Searching for information in the register of disqualified persons

(https://service.nalog.ru/disqualified.do) allows you to check by full name, name and details of a legal entity whether the manager is on the list of disqualified persons.

You can also look for the leader in the list of those who are prohibited from leading the organization.

Some of the signs that a company is a one-day company are: the fact that several legal entities are registered at its legal address (so-called “mass registration addresses”; verification according to this criterion can be carried out at https://service.nalog.ru /addrfind.do); the fact that its director is the founder of several legal entities at the same time (you can check this data at https://service.nalog.ru/mru.do).

The service “Information on legal entities that have tax arrears/do not submit reports” allows you to identify legal entities with arrears to the budget. If a company is on this list, this increases the risk that it will not remit VAT and it will be impossible to offset it in the future.

Contacting the tax office

Contacting the Federal Tax Service in order to clarify whether the supplier is a VAT payer and how conscientiously he fulfills his obligations to pay taxes and submit reports will be a common waste of time. The Federal Tax Service is not obliged to disclose such information at the request of taxpayers and will most likely ignore the request. Confirmation of this position of the tax authorities is the letter they distributed in 2015 about the availability of all information that does not constitute a commercial secret in the public domain.

In 2016, the Tax Inspectorate announced its plans to make information about the special regimes applied by the company publicly available. Those. the service will allow you to find out whether the taxpayer pays VAT or is legally exempt from it. But this resource is not yet available to ordinary taxpayers.

The use of public land is regulated by the legislation of the Russian Federation.

Which banks offer mortgages for the purchase of land? Find out about this by reading our article.

Sometimes, when purchasing a plot of land, it is necessary to draw up an advance payment agreement. You can find out how to do this in the material.

Contour-Focus

The Kontur.Focus system allows the accountant to carry out a preliminary comprehensive check of the counterparty to reduce the risks of withdrawing VAT deductions. In this case, the accountant himself selects a list of criteria (from 1 to 12) to check his potential partners for their reliability.

These criteria include, in particular:

- the fact that the company was recently registered;

- the organization is at the stage of bankruptcy or liquidation;

- its managers include disqualified persons;

- she acts as a defendant/plaintiff in legal disputes involving a large amount;

- a number of enforcement proceedings have been opened against her;

- the company shows no signs of activity;

- has negative financial indicators;

If, as a result of the inspection, it turns out that the company received a negative assessment according to several criteria at once, then the inspection organization will always have the opportunity to refuse to enter into questionable contracts.

Another advantage of the resource is the ability to track the dynamics of assessment according to all specified criteria for the most important parameters.

You can also automate the reconciliation of data on issued and received invoices through the “Kontur.Sverka” system. This system monitors that the documents do not contain errors in details, discrepancies in amounts, dates and numbers of issued invoices. But in order to use the “Kontur.Sverka” service, both counterparties must be registered in the system, which is not always possible to achieve.

Thus, checking an organization to determine whether it transfers VAT to the budget is not the direct responsibility of taxpayers. But it is required in order to avoid possible losses associated with the refusal to accept VAT for deduction. The range of available resources for preliminary verification of a counterparty is limited for an organization and none of them can guarantee the fact that the supplier will transfer the VAT received from the buyer to the budget.

Dear readers, the information in this article may be out of date. If you want to find out how to solve your particular problem, call:

- Moscow.

- Saint Petersburg.

- Regions.

Or on the website. It's fast and free!

Author of the article Vyacheslav Sadchikov Lawyer. Practice in real estate, labor law, family law, consumer protection.

When establishing the payment amount for transfer to the budget, the organization has the right to reduce the final VAT payable by the incoming payment received in invoices from its counterparties. However, if, when performing an analysis, the fiscal authority evaluates the counterparty as dishonest, then there is a risk of losing the deduction, or the fee will need to be reimbursed from the budget.

In connection with this problem, a popular question is how to find out whether an organization operates with VAT or without it. It is recommended to clarify whether the partner is a shell company. This reduces the likelihood of problems with tax authorities.

Confusion with the VAT amount when deducting in parts

Based on paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation, the taxpayer has the right to claim VAT deduction within three years. The Ministry of Finance in its letter dated 05.18.15 No. 03-07-RZ/28263 explains that the amount of tax to be deducted can be declared in parts. At the same time, taxpayers often make a mistake in column 15 of the purchase book and, accordingly, in line 170 of section 8 of the declaration.

In accordance with Resolution No. 1137, if only part of the VAT is claimed to be deductible, then in column 16 of the purchase book only the part of the tax that is subject to deduction in this quarter should be reflected. The same amount will be reflected in line 180 of section 8 of the declaration. In this case, in column 15 of the purchase book and line 170 of section 8, the full amount of tax corresponding to column 9 of the invoice is indicated. The same amount should be reflected in column 13b of the sales book “Cost of sales according to invoice” and in column 14 of the journal for recording issued invoices (“Cost of goods”).

Self-check of VAT payer

There are some ways to find out whether an organization is a VAT payer on its own. There are criteria that you pay attention to when choosing a partner company.

It is necessary to clarify the correctness of the details in the invoice and establish the veracity of the registration information. It is checked whether the person is included in the register of companies or individual entrepreneurs with VAT, whether the organization is included in the list of those subject to liquidation, whether the management of the legal entity has been disqualified. You should check which taxation system is applied.

Signs of a one-day existence of an organization, the presence of delays in paying taxes and other payments are a negative sign, and it is advisable to refuse to work with such a company.

The necessary information can be obtained using the Federal Tax Service service. There are other services that allow you to check the reliability of your counterparty. A service with information on state registration of legal entities and individual entrepreneurs is used.

The invoice is also checked by entering the TIN and KPP data. In the register of disqualified persons, based on the legal entity and full name, you can determine whether the person is a manager of the company.

To identify whether a legal entity has debts, a service with a database of legal entities by debt is used. This is how it is determined whether the counterparty has a debt to the fiscal authorities. If the answer is yes, there is a high probability of developing a problem with deductions.

Which individual entrepreneurs are VAT payers?

In 2022, entrepreneurs are required to pay VAT:

- those on OSNO (if you have not received an exemption from taxpayer obligations, we will talk about this later);

- transferred to the general system upon loss of the right to use the special regime;

- applying Unified Agricultural Tax (from January 1, 2022);

- combining OSNO with PSN (in terms of income from the general regime);

- working in special modes of the simplified tax system and PSN when issuing an invoice with VAT, importing goods into the Russian Federation and performing the duties of a tax agent for VAT (for example, when leasing state property).

Free tax consultation

Special services for checking the counterparty

The search for VAT payers is carried out using special services that allow you to see whether a person has debts for certain types of tax, you can also find whether the company or individual entrepreneur is liquidated, etc.

The programs are provided free of charge and can be easily accessed online. The most commonly used website is the tax service, which includes several services for searching data about counterparties. This way you can get real data about debts, the correctness of an invoice, and you can determine how conscientiously a person fulfills tax obligations.

For example, if the organization has previously been liquidated, there will be no current invoices, and the presence of a director in the register of disqualified persons is also an unfavorable sign.

A popular service is “Contour – Focus”. It is a tool for analyzing data about a counterparty before starting collaboration. The system is used to reduce the risks of subsequent refusal to deduct VAT. This system can be used by an accountant. First you need to select criteria for reliability analysis.

You can set the following:

- How long ago was the company registered?

- Whether the agent is bankrupt or whether the company has been liquidated.

- Do the directors include disqualified persons?

- Is the organization a debtor?

- Are enforcement proceedings ongoing against the organization? Is there a negative trend in finances?

If the assessment is negative based on several criteria, the least risky option would be to refuse to cooperate and enter into contracts with the person.

Searching for taxpayers on this server allows you to check, using the entered last name, first name and patronymic, whether the head of the enterprise is included in the list of disqualified persons. You can find, among other things, people who do not have the right to lead the organization.

Before checking this data, you should clarify the full name, name of the legal entity, etc. If the company is a one-day company, there is a risk of denial of deduction for value added tax, and other problems may arise with the fiscal authorities.

Signs of an organization’s unreliability are the presence of several legal entities registered at its address, the manager simultaneously established several legal entities, and there is a debt to the budget.

VAT and Unified Agricultural Tax

It is not for nothing that we have allocated entrepreneurs for agricultural tax purposes in a separate section. From 2022, individual entrepreneurs using the unified agricultural tax are required to pay value added tax. These changes were made to the Tax Code by Law No. 335-FZ of November 27, 2022.

Let us remind you that until 2022, agricultural producers and those who provided services to them were exempt from VAT, as were individual entrepreneurs using the simplified tax system (USN) / PSN. Starting from 2022, the situation has changed and those who apply the unified agricultural tax have been made VAT payers. They are the only ones of all special regimes who must transfer value added tax to the budget. But there are some exceptions. Let's look at them.

In what cases may an individual entrepreneur using the Unified Agricultural Tax not pay VAT?

The specifics of exempting agricultural tax entrepreneurs from the obligation to pay value added tax are specified in Art. 145 Tax Code of the Russian Federation. Thus, individual entrepreneurs who meet one of the following conditions may not pay VAT in 2022:

- the amount of income for 2022 did not exceed 70 million rubles. Please note that only income from activities on the Unified Agricultural Tax is taken into account. This amount is established from 2022 and is gradually decreasing (see table No. 1);

- The transition to the unified agricultural tax and exemption from VAT were made in one year.

Table No. 1. Dynamics of income for obtaining exemption from VAT on the Unified Agricultural Tax

| Year for which income is calculated | Maximum income (rub.) |

| 2018 | 100 000 000 |

| 2019 | 90 000 000 |

| 2020 | 80 000 000 |

| 2021 | 70 000 000 |

| 2022 and beyond | 60 000 000 |

In what cases will an individual entrepreneur using the Unified Agricultural Tax be unable to obtain an exemption from VAT?

- Income for the past year exceeded the limits indicated in the table.

- The entrepreneur has been selling excisable goods for the last three months.

- The individual entrepreneur has not confirmed his right to be exempt from paying this tax.

What needs to be done to avoid paying VAT for individual entrepreneurs on the Unified Agricultural Tax

In order to receive an exemption from paying value added tax, agricultural tax entrepreneurs must draw up a written notification. The form of this document was approved by Order of the Ministry of Finance of Russia dated December 26, 2022 No. 286n.

The notification must be submitted to the Federal Tax Service at the place of registration before the 20th day of the month from which the individual entrepreneur applies the exemption. After sending the notification, the entrepreneur will be able not to pay VAT for 12 months.

note

that you cannot refuse this benefit until it ends. The only case is receiving income in excess of the specified limit. If this happens, the individual entrepreneur is considered to have lost the right to exemption from value added tax from the 1st day of the month in which the excess was made.

What VAT obligations do entrepreneurs have on the Unified Agricultural Tax?

Starting from 2022, individual entrepreneurs subject to agricultural tax who have not received an exemption from paying value added tax must:

- charge VAT on the amount of sales of goods (works, services);

- pay taxes to the budget within the time limits established by law;

- submit a declaration quarterly (electronically only);

- issue invoices to counterparties with the allocated tax amount;

- keep books of purchases and sales.

But along with the obligation to pay VAT, agricultural producers received the right to reimbursement from the budget. This is a plus for those who work with companies on OSNO and issue them invoices with the allocated tax amount. But in general, entrepreneurs on the Unified Agricultural Tax have lost more than they received from the introduction of VAT. The obvious disadvantages are:

- an increase in the tax burden for those individual entrepreneurs who do not cooperate with VAT payers;

- complication of accounting, as it is necessary to additionally maintain books of sales and purchases, issue invoices, and submit quarterly reports;

- additional costs for an accountant, since it will be difficult for those who have not previously worked with him to immediately understand the intricacies of accounting and VAT calculation;

- costs of organizing an electronic document of turnover with the tax office for submitting value added tax reports.

Why do you need to check?

Checking the VAT payer is a mandatory step before concluding an agreement with a person, regardless of whether it is an LLC or an individual entrepreneur (entrepreneur). If the supplier is found to be dishonest, there is a risk of losing the deduction, the fee cannot be reimbursed, and other negative consequences of the transaction may arise.

In this regard, before working with a counterparty, you should check its reliability. First you need to establish whether the company is a shell company or not. Checking a partner is not an obligation, but a person’s right; it is not necessary to do this, but it is advisable.

There is no liability for a company working with an unscrupulous payer. But in practice, the company may encounter problems - there is a risk of loss of deductions, increased attention from the tax service is possible, and proof of correctness in court may be required when such cases develop.

If you do not check the payer in advance, there is a risk of losses due to loss of reimbursement as a result of the customer being unable to fulfill its obligations. To conduct a thorough analysis, you can contact specialized organizations or use services.

Whose cow mooed?

The second violation is also associated with excessive requests from tax officials. They ask to provide: a staffing table, a decision of the founders on the appointment of a director, an order for the appointment of a director and other documents .

During a desk audit of a VAT return, the taxpayer was asked for copies of:

- veterinary certificates for cattle, waybills, explanations regarding payment for meat;

- staffing table, acts of reconciliation with counterparties, decisions of the founders on the appointment of a director, an order on the appointment of a director, the director’s work book;

- contracts with buyers of products, balance sheets on accounting accounts for purchased and sold goods.

The company refused to provide veterinary certificates, a staffing table, a decision of the founders, a copy of the work book, balance sheets for the accounting accounts, citing the fact that these documents do not directly relate to the calculation of VAT by virtue of clauses 7, 8 of Art. 88, Art. 172 of the Tax Code of the Russian Federation.

The court indicated that the documents requested by the inspection (staffing table, decision of the founders on the appointment of a director, order on the appointment of a director, a copy of the director’s work book) do not relate to documents confirming the legality of applying VAT deductions; the taxpayer’s failure to comply with the requirements of the controllers is considered lawful (Resolution of the Arbitration Court of the Central Election Commission No. F10-2225/2017 dated May 30, 2018 in case No. A48-5582/2016).

When conducting a desk audit, the tax authority does not have the right to request from the taxpayer additional information and documents other than those provided for by the Tax Code of the Russian Federation.

How to find out the necessary information from a counterparty

To obtain information about a partner, to clarify whether the counterparty pays contributions to the budget, or is a bona fide taxpayer, use services or request all the necessary information directly from the counterparty - an organization or an individual entrepreneur.

The request may cause difficulties for the counterparty, since there is no established form of document confirming payment of the fee. Enterprises and individual entrepreneurs can request such papers using the simplified tax system - copies of the latest VAT return, registration data, and the taxation system used.

These documents show tax status, but not all individuals provide detailed information. For example, almost no one will give a customer a copy of a sales book. The information is provided by the counterparty voluntarily with his consent; it cannot be required.

What is VAT?

VAT is usually divided into two types:

- Imported. Paid when importing goods into the territory of the Russian Federation. All individual entrepreneurs are required to pay “import” VAT, regardless of the taxation system used. Moreover, if an entrepreneur uses the simplified tax system of 6% or PSN, he will not be able to take the tax into account as expenses. A simplified individual entrepreneur with the object “Income minus expenses” can include the paid VAT as an expense, but does not have the right to reimburse it from the budget.

- Interior. Transferred when carrying out transactions within the country. In this case, the tax is paid by individual entrepreneurs to OSNO, Unified Agricultural Tax, as well as tax agents. Special regime officers pay it only when issuing an invoice to the counterparty with the allocated amount of VAT.

So, all individual entrepreneurs pay VAT on imports. This obligation does not depend on the chosen tax system.

How to check whether a company is a VAT payer

The need to verify VAT payers usually arises from their counterparties. If the supplier is recognized as an unscrupulous taxpayer, the company is denied a VAT deduction or refund. That is, verification will allow you to avoid the negative consequences of the transaction.

Before cooperating with a new counterparty, you need to check its reliability. First of all, you need to make sure that the potential partner is not a fly-by-night company. It is important to confirm that the counterparty pays taxes correctly.

The law does not oblige the company to carry out verification. This is the right of every company, not an obligation. However, it must be taken into account that the invoice provided by the supplier is invalid if he is deprived of a taxpayer certificate. That is, it will not be possible to receive a deduction for input VAT. Therefore, the company will have a loss.

The law does not provide for any liability for a company that has entered into an agreement with an unscrupulous taxpayer. There are no sanctions imposed on her. However, in practice, the firm has responsibilities. In particular, these are the following negative consequences:

- Deprivation of the right to deduct input tax.

- Special attention from the Federal Tax Service.

- The need to prove your case in court if the company does not agree with the Federal Tax Service.

That is, the company has reasons to exercise caution.

To check, it is not necessary to seek help from special services directly. You can request all the necessary information from the counterparty himself. In particular, you need to ask for paper from the tax office stating that the person is a tax payer.

However, such a request may put the counterparty in difficulty. There is no established document confirming payment of VAT. Only persons using simplified documents can request such documents. These are the following papers:

- A copy of the latest VAT return with a tax stamp confirming its acceptance.

- Sales book.

- Registration papers (extracts from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs).

- A document confirming the taxation system used by the counterparty.

All these papers officially indicate the tax status of a person. However, not all companies are ready to provide them. In particular, it is rare that a counterparty will give the customer a copy of the sales books, since it contains information of commercial importance (list of partners, turnover). The counterparty can also provide a certificate of absence of tax debts. You can obtain it from the Federal Tax Service at your registration address.

IMPORTANT! All listed documents are provided by the counterparty solely on a voluntary basis. They cannot be demanded. However, you can usually get all these papers, if they do not constitute a trade secret, without any problems.

First of all, the customer needs to do these steps:

- Analyze the correctness of the details specified in the invoice.

- Determine the accuracy of registration information.

- Check the company management for disqualification.

- Check for tax and fee debts.

- Find out the form of taxation.

The necessary information can be taken from the electronic services of the Federal Tax Service. It is contained in the block “Check if your business is at risk?”

Let's consider other services for checking:

- “Information on state registration of legal entities and individual entrepreneurs” (https://egrul.nalog.ru). The service is needed to check the registration of the counterparty. Here you can download an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs.

- Checking invoices (https://npchk.nalog.ru). Provides verification of the correctness of the invoice that was provided by the counterparty. The search is carried out through the INN/KPP.

- Register of disqualified persons (https://service.nalog.ru/disqualified.do). The search is conducted by full name, name of the legal entity, and its details. The service allows you to find out whether the head of the company is a disqualified person, or whether he can manage the company at all.

- Service https://service.nalog.ru/addrfind.do. Through it you can find out how many legal entities are registered at one legal address. The multitude of registered persons indirectly confirms that the company is a one-day company.

- Page https://service.nalog.ru/mru.do. Allows you to find out how many legal entities are managed by one person.

- Service “Information about legal entities with tax debt.” Provides identification of counterparty debts to the budget. If there is a debt, there is a high risk that the person does not pay VAT. That is, his partner will have a problem with deducting taxes. The company may not provide tax returns, which is also a red flag. You can also find this information on the service provided.

It is advisable to use several services at once. They are free, and therefore it will not be difficult.

Can I contact the tax office?

Contacting the tax office is the most logical action. It is this body that has all the necessary information. However, this appeal makes no sense. The fact is that the Federal Tax Service has no obligation to disclose related information. That is, the request will probably simply remain unanswered. The absence of an obligation for inspectors to provide information is confirmed by Letter of the Federal Tax Service No. ED-4-2 / [email protected] dated July 24, 2015.

The procedure established by the Tax Code

Article 88 of the Tax Code of the Russian Federation regulates the procedure, timing, and powers of officials during a desk audit of a VAT declaration. The inspectorate conducts a desk inspection on its territory (clause 1 of article 88 of the Tax Code of the Russian Federation). In general, it lasts up to two months, but its period can be extended to three months (paragraphs 4 and 5 of paragraph 2 of Article 88 of the Tax Code of the Russian Federation).

Cases when a tax inspector has the right to request information and/or documents are established by Art. 88 Tax Code of the Russian Federation:

- If a desk tax audit reveals errors in the tax return and (or) contradictions between the information , or discrepancies are identified between the information provided by the taxpayer and the information contained in the documents available to the tax authority and received by it during tax control, the taxpayer is informed about this with a request provide within 5 days or make appropriate corrections within the prescribed period (clause 3);

- When conducting a desk tax audit, inspectors do not have the right to request additional information and documents from the taxpayer, unless otherwise provided by this article or if the submission of such documents along with the declaration is not established by the Tax Code of the Russian Federation (clause 7).

During a desk audit of a declaration with VAT refund, the tax authority has the right to request from the taxpayer (Article 88 of the Tax Code of the Russian Federation):

- documents confirming the legality of applying tax deductions: invoices, primary and other documents (clause 8);

- if contradictions are identified in the declaration or its data diverges from the reporting of the counterparties of the inspected person, the tax authority may request: a sales book, a purchase book, a log of received and issued invoices (clause 8.1).

What violations do tax authorities commit?

Systems "Contour-Focus" and "Contour.Sverka"

The Kontur-Focus system is a comprehensive tool that allows you to check the counterparty before starting cooperation with him. It is also intended to reduce the risk of refusal to deduct VAT. The accountant himself uses this system. He can independently select a list of criteria for checking counterparties for reliability. These could be the following criteria:

- Recent company registration.

- The company is going through bankruptcy or liquidation.

- The managers include disqualified persons.

- The counterparty is the defendant in the debt collection case.

- Enforcement proceedings are ongoing against the company.

- The company was not found to be conducting any activity at all.

- Negative financial indicators with a tendency to worsen.

FOR YOUR INFORMATION! If the counterparty receives a negative assessment based on a number of criteria at once, it makes sense to refuse to enter into contracts with him. The system has a number of advantages. It provides tracking of assessment dynamics and quick receipt of all information.

There is also the “Contour.Sverka” system. It provides automation of information reconciliation between issued and received invoices. The system allows you to check the accuracy of the information provided, the presence of errors and discrepancies. However, to use the service, not only the company itself, but also its counterparty must register.

What happens if you don’t check the VAT payer?

Ignoring the need to verify the counterparty leads to these negative consequences:

- Loss associated with refusal to deduct VAT.

- Losses associated with the fact that the customer cannot fulfill its obligations.

- Increased attention from the tax authorities.

For an in-depth check of VAT payers, you can contact specialized companies. However, in most cases this is not necessary. All required information can be obtained from free services.

How to find out if your counterparty is a VAT payer

From July 1, 2022, buyers of goods (works, services) do not have the right to offset the amount of VAT indicated in the invoice issued by a supplier who is not a VAT payer ().

Information on the registration of taxpayers with the state tax service as VAT payers can be obtained through the official website of the State Tax Committee in real time.

In order to convey to taxpayers the essence and significance of the changes made to tax legislation, let us consider the following situation:

Enterprise “A”, which is not a VAT payer, supplied goods (work, services) worth 100 million soums. to enterprise “B” – a VAT payer. At the same time, enterprise “A” unreasonably reflected in the invoice the amount of VAT of 20 million soums, i.e. in total, including VAT, for a total amount of 120.0 million soums.

For reflecting the VAT evader in the invoice in the amount of 20.0 million soums. VAT to enterprise “A” a financial sanction (NC) will be applied in the amount of 20% of the amount of illegally allocated VAT, i.e. 4.0 million soums. and enterprise “A” will have to pay only 24 million soums to the budget.

In such a situation, financial sanctions will not be applied to enterprise “B”, but it will be obliged to recalculate the budget and pay the amount of VAT of 20.0 million soums, which was unlawfully offset by it.

In order to prevent such cases, it is recommended to exercise due diligence when choosing business partners by checking them:

- registration with the tax authorities as a VAT payer;

- business reputation;

- financial condition;

- availability of production base and personnel.

Information about the counterparty can be obtained on the State Tax Committee website using the “Identification of VAT payers” button. In the selected window, you can use the search functions by the name of the region, district or the name of the VAT payer or INN.

After entering the TIN in the “Enter TIN or VAT payer name” window and clicking the “Search” button, you will receive the following information:

- name of the VAT payer;

- taxpayer identification number and state registration date;

- certificate of state registration as a VAT payer;

- date of submission of the last calculation (recalculation) for VAT;

- the amount of VAT accrued according to the latest calculations;

- date of the last VAT payment;

- the amount of the last VAT payment;

This service will allow you to determine whether your counterparty is a VAT payer or not, and eliminate the risks of committing tax offenses.

VAT declaration and reporting

All participants in the payment of VAT (it should be noted that these are both taxpayers and tax agents) must submit a tax return to the Federal Tax Service at the place of registration.

Since 2014, the declaration of value added tax takes place in the form of electronic document management using the taxpayer’s UKEP. Declarations submitted on paper are not accepted and are not considered submitted.

When filling out the VAT return, you need to take into account every ruble

It should be taken into account that the VAT declaration is filled out in rubles (without kopecks), kopecks are rounded according to the arithmetic rule.

The main reporting document for VAT - the declaration - must be submitted no later than the 25th day of the next month of the quarter.

Attention! If the taxpayer fails to submit a tax return to the tax authority within 10 days after the expiration of the established period, transactions on the accounts may be suspended (clause 3 of Article 76 of the Tax Code of the Russian Federation).

Federal Tax Service of the Russian Federation

https://www.nalog.ru/

In addition to blocking the account, for late submission of the declaration, individual entrepreneurs can be fined from 5 to 30% of the VAT amount or charged from 1000 rubles. (the fine also includes a larger amount). In this case, sanctions will apply for each month of delay.

Table: registration of VAT declaration by sections

| Sheet number/section | Who submits, in what case it is filled out |

| Title page and first section of the declaration | All VAT payers, including those whose VAT base is zero |

| Sections No. 2—12 | Only if necessary operations are available |

| Sections No. 4—6 | If the activities of an individual entrepreneur are subject to a VAT rate of zero percent |

| Sections No. 10–11 | If a contract is issued and (or) received when carrying out business activities in the interests of another person (commission agreements, agency agreements, etc.) |

| Section No. 12 | If payers are exempt from VAT or are not payers |

Photo gallery: VAT declaration pages

The first section must be completed by all VAT payers

Some sections are completed only if there are operations

Section No. 12 is filled out by those who are exempt from VAT

If necessary, additional sheets can be added to the declaration

Invoice journal

In addition to the declaration, there is another VAT reporting document - the invoice journal. This form is regulated by paragraph 5.2 of Article 174 of the Tax Code of the Russian Federation. It applies to intermediaries: developers, contractors, agents, freight forwarders, who are not recognized as VAT payers, but allocate it in accounting documents when providing their services.

Just like the VAT return, the invoice journal report is submitted based on the results of each quarter. Thus, based on the results of the first quarter of 2022, the journal must be submitted by 04/20/2018. If the intermediary did not receive or issue tax invoices with VAT in the past quarter, then there is no need to report on the journal.

Reports on accounting of invoices must be submitted through the portal of the Federal Tax Service of the Russian Federation using electronic document management.

Table: deadline for submitting VAT reports

| Regularity | View | Deadline | Where/in what form |

| Quarterly | VAT declaration at the end of each quarter | Until the 25th of the first month of the next quarter | Federal Tax Service / EDF |

| Quarterly, when carrying out activities subject to VAT | Invoice journal | Until the 20th of the month of the next quarter | Federal Tax Service / EDF |

When to pay VAT

Each VAT payer can choose one of two payment options: quarterly or annually. In any case, the tax regulator has allocated 25 calendar days after the end of the payment period.

The main rule of timely payment to the state budget is to avoid delays. In order not to fall under sanctions, it is recommended to transfer the tax 2-3 days earlier than the deadline established by the Tax Code of the Russian Federation.

Delays in paying tax to the federal budget are punishable by a fine on the entrepreneur - from 20 to 40% of the VAT amount.

Table: current budget classification codes (BCC) for VAT

| Payment Description | KBK for tax transfer (contribution, fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| VAT on goods (work, services) sold in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| VAT on goods imported into Russia (from the Republics of Belarus and Kazakhstan) | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| VAT on goods imported into Russia (payment administrator - Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |