When to write an answer

If, as a result of an audit, the organization received a letter from the tax office requesting clarification, most likely, errors were identified during automatic reporting control. But an institution is not always obliged to respond to a request from the Federal Tax Service. Explanations must be sent if the inspector has questions regarding the conduct of desk audits of periodic or final reporting.

The most common inaccuracies that imply a response to a request from the tax office for clarification are:

- errors in tax returns - errors in VAT, income tax;

- discrepancies in information from related documents and taxpayer reports;

- discrepancy between the information provided by the organization and the data available to the Federal Tax Service;

- errors in documents and actions to obtain tax benefits.

An explanatory letter in response to a request for clarification must be sent if discrepancies are identified during desk audits (clause 3 of Article 88 of the Tax Code of the Russian Federation). But it won’t hurt the taxpayer if he sends explanatory information to the Federal Tax Service’s request that is not related to the camera room. This will help formulate a clear position of the institution in resolving a particular problem.

Claim (tax claim)

Taxes that are not paid on time become arrears, on which penalties are charged for each day of delay. If there is such a debt, the tax authority sends a demand (this is the next version of the letter from the tax office). The demand is a notification about the existence of a tax debt with a requirement to pay it off, about the amount of penalties accrued for the days of delay.

Typically, the request is sent within 3 months from the day following the due date for tax payments. Penalties in the request are calculated on the day specified in the request. For penalties that accrue after this date, a separate claim will be sent after the tax amount has been paid.

The tax must be paid within the period specified in the request (if the request does not indicate a deadline, then you have 8 working days from the date of receipt of this document ).

If the requirement is not fulfilled, the tax authority has the right to go to court to collect taxes and penalties.

Do you have questions about the legality of the actions of the tax authority?

Let's help YOU!

Order a consultation

What happens if you don’t send a response to the tax office?

If the enterprise that has received a request for clarification ignores the request, then under paragraph 1 of Art. 129.1 of the Tax Code of the Russian Federation, the consequence will be administrative liability and penalties in the amount of 5,000.00 (if the answer is not provided once) to 20,000.00 rubles (if this is a repeated violation).

Providing detailed explanatory information will lead to a dialogue with the Federal Tax Service and further resolution of the situation, while an unanswered request will entail serious proceedings that do not exclude going to court.

Letters of happiness

Often auditors send information letters.

Receiving such a document is a very important signal indicating the need to pay attention to tax accounting in the organization. What can controllers tell merchants and accounting departments about in such a letter?

For example, auditors in this way report the relationship of an organization with a dubious counterparty; usually in the same letter, auditors offer to carefully look at their own company from the outside, and then independently adjust individual transactions in tax accounting. Such messages are certainly very valuable information for managers and accountants.

Significant legal consequences or application of sanctions for non-compliance with the opinion expressed by the tax authority in a letter have usually not previously occurred. However, in the absence of any reaction from the company, such letters may hint at an on-site audit in the future, because the very fact of receiving a message from the tax office means that the company has a high level of risk.

And although there is a possibility of starting control measures, it follows from our practice that it is small.

Why?

The fact is that the tax authority’s assessment of a counterparty may simply include a set of events that auditors interpret as some kind of established and proven fact of the company’s dishonest behavior.

What criteria do auditors use to evaluate companies?

Controllers may classify an enterprise as dubious if it has not submitted accounting and tax reports to the tax authority or has submitted a zero return. At the same time, the controllers do not indicate in what period such actions were committed; both of these facts are interpreted equally.

Subscribe to the magazine “Calculation” or “Calculation. Premium" for the 1st half of 2022!

Other reasons to send a chain letter:

- the legal entity does not comply with tax obligations;

- does not have the ability to fulfill the terms of the contract;

- is not located at the registration address;

- does not respond to requests;

- does not have a website and does not advertise;

- does not have expenses typical for entrepreneurial activity (rent, office supplies, etc.).

On this basis, controllers draw a logical chain to the fact that the company imitates transactions, maintains a formal document flow and, as a result, has signs of a tax offense established in Article 54.1 of the Tax Code of the Russian Federation. Accordingly, controllers inform businesses about the possibility of applying penalties in the amount of 40% and offer to voluntarily review and make changes to reporting in accordance with Article 81 of the Tax Code of the Russian Federation. Such a letter may concern both the activities of the company itself and its business partners.

By the way, it is not uncommon for auditors to send repeated letters if the organization did not respond to the first message. The rhetoric of new information messages is filled with diplomatic idioms with clearly expressed threats.

For example, the letter may contain information that priority for inclusion in on-site inspection plans are those payers who have refused to reconsider their tax obligations. And taking into account the period of audits, their duration, as well as the mechanisms used during control activities, when making a final decision on encouraging a company to voluntarily clarify its tax obligations, it is recommended to independently assess the administrative burden in the event of a tax audit.

How to write an explanation for a request from the Federal Tax Service

All deadlines and rules for how to write a letter to the tax office in response to a request to pay tax are prescribed in the Tax Code of the Russian Federation. After completing a desk audit of periodic or final reporting, the inspector sends a letter to the institution in paper or electronic form about identified discrepancies that are subject to clarification, clarification or adjustment.

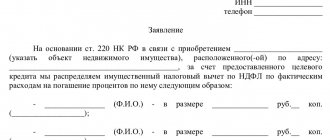

The organization must generate and submit explanatory material within five working days from the date of receipt of the request from the Federal Tax Service (Clause 3 of Article 88 of the Tax Code of the Russian Federation). The letter is written in any form. If a taxpayer is preparing a response to a request regarding a desk tax audit, then he should use a sample response to a tax request for clarification.

The response is submitted through an electronic document management system with the mandatory use of an electronic signature, by email, by courier, or directly to the inspectorate (the letter will be registered in the office). To prove his position, the taxpayer prepares a package of documents with all the necessary attachments, certified and signed by the head.

If the specialist is sure that there are no inaccuracies or discrepancies in the submitted reports, then according to the instructions on how to correctly respond to the Federal Tax Service’s request for clarification, the answer must indicate that the declaration or report for the specified period does not contain errors. If errors were nevertheless made, the taxpayer will provide an adjustment to the declaration clarifying the submitted information (clause 1 of Article 81 of the Tax Code of the Russian Federation).

If you find technical errors or inaccuracies that do not affect the taxable base and the amount of calculated tax, describe the current situation in explanatory material, noting that the correct version is provided in the response to the request or in the updated declaration.

Response to VAT return requirement

A sample response to a request for a VAT return is generated electronically if the organization, by law, must submit a report through electronic document management tools (clause 3 of Article 88 of the Tax Code of the Russian Federation). To respond to a VAT request, there is a specially approved form, therefore, based on clause 1 of Art. 129 of the Tax Code of the Russian Federation, the taxpayer is obliged to comply not only with the conditions for electronic submission, but also with the form of explanations submitted. As supporting documentation for VAT, the specialist will prepare copies of invoices and purchase and sales books.

Reply to a claim request

The correct sample letter to the Federal Tax Service in response to a request for explanations of losses contains information why the taxpayer has an excess of expenses over income. The main thing that the specialist notes when drawing up an explanation is the economic efficiency and feasibility of the increased costs and attach supporting documents to the answer for each type of expense incurred. This is what the response to the tax office looks like when asked to provide explanations of profits or losses:

Tax sanctions

As for sanctions , various types of liability may be applied for violation of the law in the area in question. Thus, for non-payment of taxes there is a fine of 20% of the debt amount (tax liability).

For failure to provide information to the tax service as part of control measures - a fine of 100 to 300 rubles for individuals (administrative liability). If tax evasion is large or especially large, then criminal liability is applied.

We hope we have helped you understand what forms of interactions and consequences are hidden behind the wording of the letter from the tax office . There is no need to shelve this document: solving the problem in a timely manner will help prevent a bigger problem.

TOP materials on the topic:

Appealing the decision of the tax inspectorate in court

The IRS files for bankruptcy. Procedure for individuals and legal entities

Taxes: main changes from 2022

What happens if you don't pay taxes by December?