What is a 2-NDFL certificate?

Certificate 2-NDFL is a document containing the following information:

- source of income;

- salary amount;

- volume of taxes withheld.

This information is provided in relation to the following categories of citizens:

- workers;

- contractors;

- citizens receiving dividends.

The employer or tax agent is required to issue personal 2-NDFL certificates.

It is necessary to pay attention to the fact that from January 1, 2022, in accordance with the Order of the Federal Tax Service of October 2, 2018 No. ММВ-7-11/ [email protected] the following were approved:

- form of information on the income of individuals and amounts of personal income tax “Certificate of income and amounts of tax of an individual” (form 2-NDFL);

- the procedure for filling out the form for information on the income of individuals and amounts of personal income tax “Certificate of income and amounts of tax of an individual” (form 2-NDFL);

- format for presenting information on the income of individuals and amounts of personal income tax “Certificate of income and amounts of tax of an individual” (form 2-NDFL) in electronic form;

- the procedure for submitting to the tax authorities information on the income of individuals and the amount of personal income tax and notification of the impossibility of withholding tax, the amount of income from which tax was not withheld, and the amount of unwithheld personal income tax;

- form of a certificate of income received by individuals and withheld amounts of personal income tax “Certificate of income and amounts of tax of an individual.”

The new 2-NDFL certificate contains information on the income of individuals and the amount of personal income tax for the tax period 2022.

The tax agent provides 2-NDFL certificates to the Federal Tax Service within the following deadlines:

| Help Feature | Sign | Submission deadline |

| Income is reflected regardless of personal income tax withholding | 1 | Until April 1 of the year following the reporting year |

| Income for which personal income tax is not withheld is reflected | 2 | Until March 1 of the year following the reporting year |

What income code should I indicate when paying financial assistance for vacation?

For example, in 2-NDFL, financial assistance up to 4,000 rubles paid to an employee (clause 28 of Article 217 of the Tax Code of the Russian Federation) must be shown with income code 2760 and at the same time with deduction code 503. Similarly, the certificate indicates a lump sum payment accrued to the employee in connection with the birth of his child. As you know, it is not subject to personal income tax up to 50 thousand rubles. for each child, but for both parents, and provided that it is paid within a year from the date of birth. For this financial assistance, income code 2762 and at the same time deduction code 504 are used (Appendices No. 1, No. 2 to the Order of the Federal Tax Service of September 10, 2021 No. MMV-7-11 / [email protected] ).

So, any financial assistance that is not subject to personal income tax in a certain amount must be reflected in the 2-personal income tax certificate. It is necessary to show the entire amount of income in the form of financial assistance and the deduction applied to it (in the amount not subject to personal income tax).

Where is a 2-NDFL certificate required?

Certificate 2-NDFL is required by the Federal Tax Service. From this document the tax authorities receive the following information:

- employee's salary;

- tax deductions;

- deductions that were made from the employee.

In addition to the Federal Tax Service, where the 2-NDFL certificate is provided by the employer or tax agent, this document can be requested from the taxpayer in the following cases:

| Situation | Who can request a certificate? |

| Getting a loan | An employee of a credit institution to confirm the income declared in the application form |

Receiving a tax deduction in the case of:

| Inspectorate of the Federal Tax Service |

| Change of place of work | New employer |

| Applying for a visa to travel abroad | Employee of a foreign state mission |

| Getting a mortgage loan | An employee of a credit institution to confirm the income declared in the application form |

In all cases, the form of the 2-NDFL certificate is unchanged; there are no specific features for filling out the certificate depending on the situation.

Where do you need Form 2-NDFL?

2-NDFL is needed by different users, including:

- employers who report to the tax office on accruals and deductions made for each employee. The provided certificates indicate that the business entity has entered into official labor relations with its employees and pays the amounts due to them in accordance with the requirements of labor legislation. In addition, the document confirms the 2-NDFL income codes for 2022, the calculation of personal income tax on them and its payment to the state budget;

- tax inspectorate, which checks employers' compliance with labor and tax laws. According to regulatory legal acts, the employer must submit the 2-personal income tax forms generated for employees within the established time frame. If the employer does not do this, the inspectorate applies penalties to him;

- employees who have the right to a tax deduction and use 2-NDFL with deduction codes for children to generate a 3-NDFL declaration. In addition, they need the document when applying for a loan, since many banks require salary information on this form. A certificate is also needed when applying for a new job, since the new employer needs data to provide deductions.

Do I need to count vacation pay as separate income?

In accordance with Art. 114 of the Labor Code of the Russian Federation, employees are granted annual leave while maintaining their place of work (position) and average earnings.

Vacation payments cannot be considered in the form of wages, because according to Art. 129 of the Labor Code of the Russian Federation, wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions that deviate from from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

In other words, wages are paid to the employee for work, and vacation pay is paid for absence from the workplace and failure to fulfill work duties.

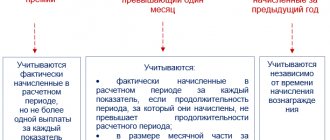

There are also differences in the calculation and payment of personal income tax:

| Type of income | Period for calculating and withholding personal income tax | Normative base |

| Wage |

| clause 2 art. 223 Tax Code of the Russian Federation |

| Vacation pay |

| clause 1 art. 223 Tax Code of the Russian Federation |

The Russian Ministry of Finance explained the mechanism for calculating, withholding and transferring personal income tax in its letter dated January 17, 2022 No. 03-04-06/1618: the tax agent is obliged to calculate and withhold personal income tax on vacation amounts upon their actual payment, and transfer it to budget - no later than the last day of the month in which such payments were made.

Thus, thanks to the vacation pay codes in the 2-NDFL certificate, the Federal Tax Service has the opportunity to monitor compliance with the deadlines for transferring personal income tax to the budget of the Russian Federation.

Financial assistance income code and deduction code 2022

In accordance with the requirements of paragraph 28 of Art. 217 of the Tax Code of the Russian Federation, financial support paid to a company employee for one year, provided that it does not exceed 4,000 rubles, should not be subject to taxes. In this case, the corresponding tax deduction is used.

The Tax Code establishes different procedures for taxing financial aid with personal income tax depending on the reason for which it is paid or what “type” this financial aid is. Conventionally, all financial assistance can be divided into 2 groups: limited by the amount not subject to personal income tax and unlimited.

Income code for vacation pay in certificate 2-NDFL

According to paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, the duty of tax agents is to submit to the tax authority at the place of their registration a document containing the following information:

- on the income of individuals of the expired tax period;

- the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation for this tax period for each individual.

This document is submitted annually no later than April 1 of the year following the expired tax period, in the form, formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees. We are talking about a 2-NDFL certificate.

In order for the Federal Tax Service to determine the correctness of personal income tax payment, the column “Income Code” indicates the codes approved by Order of the Federal Tax Service of September 10, 2015 No. MMV-7-11 / [email protected] “On approval of codes for types of income and deductions” "

So, for vacation pay the following codes are provided:

| Code | Type of payment |

| 2012 | Amounts of vacation payments |

| 2013 | Amount of compensation for unused vacation |

Example:

To the employee of ABV LLC, R.R. Rublev. in December 2022, vacation pay in the amount of 18,640 rubles and wages in the amount of 25,150 rubles were paid. He received all payments at once and in one amount, which amounted to 43,790 rubles.

In this case, in the 2-NDFL certificate opposite the amount 18640 there will be code 2012, and in the line opposite the amount 25150 there will be code 2000.

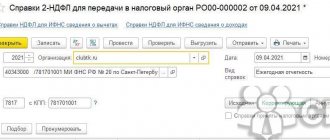

Reflection of income type codes in “1C: Salaries and Personnel Management 8”

The 1C: Salaries and Personnel Management 8 program, edition 3, implements all the necessary functionality for organizing payments to individuals in accordance with current legislation.

Setting up income types for enforcement proceedings

In the Accruals card on the Taxes, contributions, accounting tab, a new field Type of income for enforcement proceedings has been added (Fig. 1).

Rice. 1. Setting up the “Type of income” for enforcement proceedings

The values of the Type of Income for enforcement proceedings correspond to the Directive of the Central Bank of the Russian Federation dated October 14, 2019 No. 5286-U:

- Wages and other income with restrictions on recovery corresponds to code “1” when transferring funds that are wages and (or) other income for which restrictions are established by Article 99 of Law No. 229-FZ. This type of income is indicated for all accruals included in the calculation base of the deduction under the writ of execution: salary, bonus, sick leave for disability, etc.;

- Income that cannot be levied (without reservations) corresponds to code “2”: when transferring funds that are income, which, in accordance with Article 101 of Law No. 229-FZ, cannot be levied, with the exception of income, to which, in accordance with Part 2 of Article 101 of Law No. 229-FZ, restrictions on foreclosure do not apply. This type of income is established for accruals that are not included in the calculation base of the withholding under the writ of execution: child care benefits, maternity benefits, compensation payments, daily allowances, etc.;

- Income that cannot be foreclosed on (with reservations) corresponds to code “3”: when transferring funds that are income to which, in accordance with Part 2 of Article 101 of Law No. 229-FZ, restrictions on foreclosure do not apply. Only alimony can be withheld from such income. For example, income with code “3” includes compensation for harm caused to health, some other income not related to wages;

- Income without limitation of penalties (code not specified) corresponds to the case when the type of income code is not specified. Namely, the payment type code is not indicated for amounts that cannot be collected. At first glance, the name does not correspond to the content of the mentioned paragraph 2 of the Directive of the Central Bank of the Russian Federation. In the program, the name of the type of transfer for enforcement proceedings states “without limitation of penalties,” and in the Directive of the Central Bank of the Russian Federation it is stated that “collection cannot be levied.” The fact is that paragraph 4 of the Order of the Ministry of Justice obliges banks to include in the calculation of the amount for which collection of funds can be applied, those funds in respect of which Article 99 of Law No. 229-FZ establishes restrictions on the amount of withholding and which cannot be recovered . Thus, for a transfer without specifying a code, it turned out that the names in the program “Income without limitation of collections” and in the legislation “payments that cannot be collected” mean the same thing. Firstly, this transfer is not necessarily income (for example, reimbursement of expenses, transfer of own income from business activities). Secondly, the bank should foreclose on this amount.

From all of the above, it is clear that banks will not collect only from income with code “2”.

For existing accruals in the program, the value is set automatically in accordance with the specified Accrual Purpose on the Main tab. Next, be sure to check the autofill result. If the Type of income in the accruals used was automatically determined incorrectly, then it should be adjusted.

When setting up accruals and deductions, additional control is performed. Accrual with the established Type of income for enforcement proceedings. Income that cannot be recovered (without reservations) cannot be included in the calculation base of deductions for writs of execution.

When conducting accrual documents, all amounts are recorded taking into account the established Types of income for enforcement proceedings. Therefore, it is important to perform the correct settings before performing calculations in the program. Otherwise, after changing the settings, the accrual documents will have to be reposted.

Registration of deductions made

The information letter of the Bank of Russia dated February 27, 2020 No. IN-05-45/10 “On indicating the amount collected in the settlement document” clarifies that the obligation to indicate in the settlement document the amount collected under the writ of execution rests with the persons transferring to the debtor’s account in bank or other credit organization wages and (or) other income.

In the program "1C: Salary and Personnel Management 8" edition 3, a new column Collected has been added to non-cash statements (Statement to the bank, Statement to accounts) (Fig. 2).

Rice. 2. Statement to the bank

The Collected column is filled in with amounts calculated in accordance with registered executive documents.

In the 1C: Salaries and Personnel Management 8 program, edition 3, alimony and other enforcement documents are registered with the document Writ of Execution. The Worksheet document is available if in the salary calculation settings (section Settings - Payroll calculation - link Setting up the composition of accruals and deductions) on the Deductions tab, the Deductions by executive documents flag is selected.

The Collected field in non-cash statements is filled in with the amount calculated on the Deductions tab in the documents Accrual of salaries and contributions and Accrual under contracts. The calculation in the document Accrual for the first half of the month currently does not affect the calculation of deduction for the month and is not displayed in the statements.

It should be understood that manual correction of the collection amount in the advance payment statement will entail the need for continued monitoring and subsequent manual correction in the monthly payroll statement.

In addition, at the moment, when filling out the Collected field, the data recorded in the Limitation of Collections document is not taken into account. Changes in amounts made manually in the Collected column are not taken into account in subsequent entries.

Version 3.6 of the standard for exchange with a bank

The standard for exchange files with a bank for a salary project is not regulated by law and may be different for each bank.

Together with Sberbank of Russia, a standard for electronic information exchange based on XML technology has been developed, which is supported by many other banks (more about the format). File generation in the program is implemented according to this standard.

The requirements for transmitting information to the bank about the types of income under enforcement proceedings and the amounts withheld under enforcement documents are implemented in the new EBI Standard with the bank version 3.6.

To interact directly from the program with a bank that, for some reason, does not support the standard, but the exchange of electronic documents with which is generally possible (according to the bank’s standard), will require its modification, which can be done in different ways.

Without modification, you can obtain the required information about employees and amounts from the program and manually transfer it to the program of such a bank.

In the program “1C: Salary and Personnel Management 8” edition 3, the Standard EPO with a bank (version 3.6) is indicated in the Salary Project card in the File Format field (Fig. 3).

Rice. 3. Selecting the payroll project file format

Responsibility of the employer for refusal to provide a 2-NDFL certificate

Failure by an employer to provide a 2-NDFL certificate upon a written application from an employee is a violation of labor legislation and entails administrative sanctions (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

| Violator category | Administrative punishment |

| Executive | Warning or fine 1000-5000 rubles. |

| Individual entrepreneur | Fine 1000-5000 rubles |

| Entity | Fine 30,000-50,000 rubles |

| In case of repeated violation | |

| Executive | Fine 10,000-20,000 rubles or disqualification for 1-3 years |

| Individual entrepreneur | Fine 10,000-20,000 rubles |

| Entity | Fine 50,000-70,000 rubles |

If the applying citizen is not a current employee of the enterprise, in relation to this case, Article 5.27 of the Code of Administrative Offenses of the Russian Federation does not apply, but Art. 5.39 Code of Administrative Offenses of the Russian Federation. According to Art. 5.39 of the Code of Administrative Offenses of the Russian Federation, an unlawful refusal to provide a citizen with information, the provision of which is provided for by federal laws, untimely provision of it, or provision of knowingly false information shall entail the imposition of an administrative fine on officials in the amount of five thousand to ten thousand rubles.

Financial assistance in personal income tax: taxation and preparation of tax certificates

Financial assistance is a complex concept and relates to socio-economic categories. The calculation of this type of payment, as well as the principles of taxation, are clearly defined by regulatory legal acts. It is important to know that not all types of financial assistance are subject to personal income tax.

- deduction code 503, no more than 4 thousand rubles - payments to employees or retired employees;

- deduction code 504, no more than 4 thousand rubles – payments from disabled organizations to their members;

- deduction code 508, no more than 50 thousand rubles - at the birth of a child, registration of guardianship, adoption.

We recommend reading: Transfer of a residential building from residential to non-residential

Questions and answers

- Our employees go on vacation from January 15, 2022 to January 13, 2022. How to calculate personal income tax in this case, given the fact that the vacation begins in one month and ends in another?

Answer: When paying vacation pay, the employer is responsible for transferring funds to the employee no later than 3 days before the employee goes on vacation. Thus, the employee receives all vacation pay in the month when the vacation begins. Based on this, the period for receiving income will be the month in which vacation pay was paid.

- The employee went on sick leave during vacation, but he was paid vacation pay. How to note payments for sick leave in the 2-NDFL certificate?

Answer: After you receive a certificate of temporary incapacity for work from the employee, there will be a need to pay benefits according to this document. When calculating benefits, enter code 2300 in the column opposite the benefit amount.

What is the income code for financial assistance up to 4000 rubles?

- A precise list of events when an employee may receive this type of support from his employer.

- The exact amount of financial assistance, payment procedure.

- Documents that must be submitted to receive such support.

The legislation does not contain the concept of financial assistance. In practice, such assistance usually means funds that are provided to employees upon the occurrence of certain events in their lives, for example, weddings, deaths of relatives, etc.

Income code financial assistance

- 2710 - financial assistance (except for that provided by employers to their employees, as well as former employees who resigned due to retirement due to disability or age, disabled people, public organizations of disabled people and one-time financial assistance to employees (parents, adoptive parents, guardians) upon the birth or adoption of a child) ;

- 2760 - financial assistance provided to employees, including former employees who resigned due to retirement due to disability or age;

- 2770 - compensation (payment) by employers to employees, their spouses, parents and children, their former employees (age pensioners), as well as disabled people for the cost of medications purchased by them (for them), which were prescribed to them by their attending physician.

When financial assistance is calculated for the birth of a child, taxation allows you to exclude an amount of up to 50,000 rubles from the personal income tax base. for each of the children (clause 8 of article 217 of the Tax Code). This limit is exempt from personal income tax during the first year from the date of birth (adoption). Moreover, the maximum permissible amount of 50,000 is set for each parent. This is the opinion of officials (letter of the Ministry of Finance of the Russian Federation dated 08/07/2021 No. 03-04-06/50382). Let us remember that previously the limit was set for both parents.

Income code financial assistance

This article regulates the procedure for accounting for material assistance in the expenditure portion of the tax base of an enterprise. Article 422 of the Tax Code of the Russian Federation. The standards of this article regulate the procedure for calculating insurance premiums accrued for financial assistance. Financial assistance is regulated only by the provisions of tax legislation. The Labor Code does not contain this definition and does not provide for any specific regimes for its settlement.

If we are talking about assistance that is associated with the death of a family member or a natural disaster, with payments to parents in the range of 50,000 rubles, financial assistance in the range of 4,000 rubles, then these amounts, in principle, are not displayed in the employee’s income certificate.