Why should vacation time be taken into account separately from basic earnings?

Vacation payments to an employee are one of the forms of social guarantees provided for in Art.

114 Labor Code of the Russian Federation. But they cannot be considered as wages, since during vacation the employee de facto does not work. The difference between payments for time worked and for annual rest is significant, since they provide for different points for calculating the taxable base for personal income tax:

- earnings for days worked - the last day of the month of its accrual or the day of termination of the working relationship (clause 2 of Article 223 of the Tax Code of the Russian Federation);

- vacation pay - the day of the expense transaction for their payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

That is, the tax agent is obliged to calculate and withhold personal income tax at the time of payment of vacation pay, and he has the right to transfer the withheld amount to the budget until the last day of the month in which the payment was made.

This judgment was officially confirmed by the Russian Ministry of Finance in its letter dated January 17, 2017 No. 03-04-06/1618.

Thus, a separate reflection of the vacation pay code in the 2-NDFL certificate is required so that tax authorities can monitor compliance with the deadlines and amounts of tax transfers.

Recommendation from ConsultantPlus: We recommend filling out the 2-NDFL certificate in the following order: general part; section 1; Application; section 3; section 2. Line-by-line algorithm for filling out 2-NDFL, see K+. Trial full access to the K+ system can be obtained for free.

The current personal income tax code in 2022 for vacation pay and for its compensation

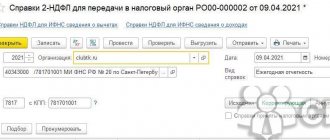

Clause 2 Art. 230 of the Tax Code of the Russian Federation defines the employer’s obligation to provide tax authorities with 2-NDFL certificates every year. They must be compiled reflecting payments received from the enterprise by month of accrual, codes of types of income and separate divisions, as well as indicating tax deductions that the recipient of payments uses.

Do not forget that from 2022 the form of calculation of 6-NDFL has changed, and the 2-NDFL certificate, as a separate document, has been cancelled. The form was approved by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] (as amended on September 28, 2021). We also remind you that you need to report on the form no later than March 1st. In 2022 it is a working Tuesday. This means there will be no transfers. In addition, the report must be submitted electronically if you have more than 10 employees. See details here.

Possible payment codes that are practiced when filling out personal income tax registers are mentioned in Appendix No. 1 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11 / [email protected] For vacation pay, the code is highlighted separately - 2012 “Vacation pay amounts,” he continues valid this year as well; changes in the code book did not affect it.

Payments of compensation to an employee for unused vacation days due to dismissal are also worthy of special mention. Since for them, starting with reporting for 2022, a new code 2013 “Amount of compensation for unused vacation” was introduced.

And for severance pay exceeding three times the average salary, code 2014 is provided.

Since 2022, other income and deduction codes have been introduced for filling out the 2-NDFL certificate.

For a complete list of income codes in the 2-NDFL certificate, see the article “List of income codes in the 2-NDFL certificate (2012, 4800, etc.)”

Main types of “income” codes

To make it easier to navigate, we will divide the most used codes into several types.

Payments for labor relations:

- The income code “2000” in the 2-NDFL certificate is used for data on employee salaries and maintenance, allowances for military personnel, excluding those listed in clause 29 of Article 217 of the Tax Code (remunerations under GPC agreements are not included here).

- Bonus in 2-NDFL - more than one income code is provided, since bonuses can be based on different sources of formation. Amounts are included in employer expenses in different ways, so you will have to choose based on the following conditions:

income code “2002” in 2-NDFL is indicated if accrual depends on production results, and remuneration is provided for by local acts and labor legislation;

- the income code “2003” in the 2-NDFL certificate is applied to bonuses paid from profits, target sources, and special-purpose funds.

- code “2014” – payment of severance pay, average earnings during the period of employment, as well as compensation to management exceeding 3 times (6 times in the Far North) the average salary;

Other payments

For other income, it is also necessary to indicate for what and on what basis the funds were paid. There are a lot of codes, so it is more correct to check the entire list given in order No. ММВ-7-11/387. For some types it is easy to select the required value, for example:

- For dividends - income code “1010” in the 2-NDFL certificate is needed if dividends were transferred to the company’s participants in the reporting year.

- The income code “2010” in the 2-NDFL certificate is used for remuneration to individual contractors under GPC agreements (except for royalties).

- The income code “2720” in the 2-NDFL certificate indicates the value of the gifts given to the recipient.

Other codes are longer and more difficult to understand. For example:

- Income code "2510» In the 2-NDFL certificate, an entrepreneur or company indicates if they:

paid for the employee the cost of any goods (work, services), including expenses for utility bills, study, food, and recreation;

- paid for the acquisition of personal property rights.

- if this is only a rental of the car itself, then the meaning of the applied code is “2400»;

For payments that cannot be classified into other categories, use the income code in 2-NDFL “ 4800 ”. Such income, for example, includes payment for downtime, daily allowances in excess of the taxable limit, as well as all others for which it is not possible to find a different value.

Read also: Citizenship (country code) in 2-NDFL

The table below shows income codes for 2-NDFL (2019) - a complete list of them in accordance with Order No. MMV-7-11/387.

What accrual period for vacation pay income code should be in the 2-NDFL certificate?

Another question that concerns an accountant in the “Salaries and Personnel” section is how to correctly calculate personal income tax for a time period, taking into account the employee’s tax deductions.

As you know, vacation is paid according to the average earnings for the entire vacation period at once. If in a situation where the vacation period falls within the framework of one month, everything is clear, then what to do with “rolling” vacations, the end date of which does not fall in the month when they were paid?

The answer to this question has been repeatedly given by both tax authorities and the Ministry of Finance, including in the letters that we mentioned earlier: regardless of the start and end dates of the vacation, the period for receiving income will be the month in which the vacation pay was actually paid.

Read about the new procedure for receiving deductions from your employer starting in 2022 here.

Results

In the 2-NDFL certificate, payments to vacationers must be separated from wages and accounted for under a separate income code. This will allow you to comply with the requirements of tax legislation regarding the procedure for tax accounting and filling out reports.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Vacation in 2-NDFL (examples, difficult situations)

From reporting for 2022, income certificates are submitted to the tax office as part of the annual calculation of 6-NDFL (but we will continue to call them 2-NDFL from now on). The principle of reflecting vacation pay in them has not changed.

Holiday pay is subject to income tax as usual. This means they should be included in the income certificate:

- in section 2 - as part of general information about income and tax;

- in the appendix to the certificate - here with details: in relation to the month and indicating the income code.

The income code for vacation pay is 2012, and for compensation for unused vacation is 2013.

We talked about these codes in more detail in our article. See also the full list of income in certificate 2-NDFL.

See an example of filling out a certificate of income with vacation pay for free in ConsultantPlus by signing up for a trial access:

When you draw up vacation certificates, consider the following nuances.

Payment month

Vacation pay in 2-NDFL must be shown in the month in which they were paid. This is important for vacations that move from month to month or are paid in one month and started in the next. Most often they doubt the January holidays paid in December. So, there is no need to doubt it. If you paid out the money in December 2021, and the employee was on vacation in January 2022, vacation pay should be included in the certificate for 2022.

Cancellation, recall from vacation

If the vacation is canceled or the employee is recalled from it, vacation pay and personal income tax from them are recalculated and reversed, and he receives a salary for the days worked. In this case, in 2-NDFL, vacation pay is either not reflected at all (if vacation is cancelled) or is partially reflected (for those days that the employee managed to take time off). The reversal itself in 2-NDFL with minuses does not need to be shown.

An example of recalculating vacation pay if the month of accrual is closed, from ConsultantPlus The employee went on vacation for 28 days from 11/09/2022 to 12/06/2022. Salary - 55,000 rubles, average daily earnings - 1,700 rubles, vacation pay - 47,600 rubles. (RUB 1,700 x 28 days). On 12/06/2022 he was recalled from vacation. You can view the entire example in K+ by getting free trial access.

Deduction for unworked vacation upon dismissal

A difficult situation arises when an employee used his vacation in advance and then quit. In this case, filling out 2-NDFL will depend on whether it was possible to retain or receive excess vacation pay from the employee upon dismissal.

Option 1. The amount of salary upon dismissal was enough to withhold or the employee returned it voluntarily.

Vacation pay with code 2012 is shown in the month of their payment minus the amounts reversed.

In the month of dismissal, reflect the salary (code 2000) in the accrued amount without deducting deductions for vacation.

Option 2. The amount of dismissal pay was not enough to withhold; the employee refused to return the extra vacation pay.

In the month of vacation pay:

- with code 2012, show vacation pay taking into account recalculation;

- with code 4800 - vacation pay that the employee still owes.

In the month of dismissal, reflect the salary (code 2000) without deducting deductions for vacation.

The procedure for filling out a certificate upon dismissal

When dismissing an employee, in the 2-NDFL certificate, reflect all his income from the beginning of the year, including compensation for unused vacation. Be sure to pay attention to the income codes:

- 2000 - for wages;

- 2012 - for vacation pay;

- 2013 - for compensation for unused vacation;

- 2014 - for severance pay.

Find more explanations on filling out 2-NDFL in this section of our website.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.