Is a document on the functioning of the accounting department required?

Not a single law, not a single regulation on accounting and reporting, nor any other by-law requires that an organization develop and approve a LNA dedicated to the functioning of the accounting department.

But if this is a separate structural unit, it is desirable that the regulations for its activities be approved. It should spell out the rights and responsibilities of employees of such a department, their powers and responsibilities. If there is no document, no one will be punished, but its presence will also not be a violation.

What to focus on when developing

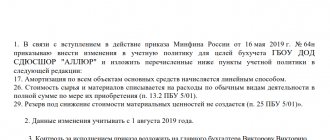

The regulatory framework relating to accounting is quite large. The main sources of information are Federal Law No. 402-FZ dated December 6, 2011 and the regulations on accounting and reporting that explain it, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n. In addition, there are numerous PBUs that describe actions in various areas and are mandatory for all organizations.

But Order No. 34n, the accounting regulation, is the basic document that accountants rely on in their work. And it is this that can become the basis for the formation of not only the job description of an accounting employee, but also the entire department.

The text of the accounting regulation No. 34n is quite voluminous, and almost every paragraph of it contains certain requirements for the work of the accounting department or a specific employee. For example, clause 77 of the Accounting Regulations describes the procedure for writing off debts, including receivables, that are unrealistic for collection, and clause 78 of the Accounting Regulations concerns the procedure for writing off and recording accounts payable and depositors. In both cases, debt write-off is allowed only on the basis of inventory results, written justification and the corresponding order of the manager. That is, the accountant cannot write off debts at his own discretion, he is subject to the decision of management, and this must be stated somewhere. Another example: clause 70 of the Accounting Regulations requires that the company create reserves for doubtful debts, which may subsequently relate to financial results. An accountant should do similar things, and this fact also needs to be recorded in some LNA, so that later, if necessary, it can be punished for violating the company’s internal norms.

Typical accounting errors identified during an audit

Practice shows that almost no audit is complete without identifying errors in accounting or tax accounting and the preparation of financial statements. Of course, some errors arise due to simple inattention, but still a significant part is the result of accountants’ incorrect understanding of the theoretical requirements of the law relating to accounting and the preparation of financial statements.

Based on our practice, in this article we will analyze the most common accounting errors identified during the audit, as well as recommendations from our auditors that will help to avoid them.

Existence of debt with expired statute of limitations

Write-off of receivables and payables, the statute of limitations for which has expired, is the responsibility of the organization (clauses 77, 78 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

However, often accounting employees, not receiving timely information about the terms of contracts with counterparties from the legal department, do not have data on the expiration dates for the obligations of the parties to the transaction.

Before preparing annual reports, each organization is required to conduct an inventory of property and liabilities, during which the specified debt is identified, if any. At the same time, it is no secret that the annual inventory is often carried out formally, and therefore all receivables and payables accounted for in accounting are indicated as current, despite the fact that some amounts have not been confirmed by reconciliation acts with the counterparty for more than three years , and sometimes the counterparty itself has long been liquidated or excluded from the Unified State Register of Legal Entities.

Regardless of whether the organization took measures to collect overdue debt, after the expiration of the statute of limitations, it must be written off from the balance sheet.

The corresponding amounts are written off for each debt and obligation that are identified during the inventory of settlements. The documentary basis for write-off is the order (instruction) of the head of the organization, as well as the corresponding written justification.

Accounts receivable must be written off from the balance sheet if they are unrealistic for collection, including (clause 77 of Regulation No. 34n):

- receivables for which the statute of limitations has expired;

- debt of liquidated organizations or excluded from the Unified State Register of Legal Entities;

- debt in respect of which the bailiff issued a decision to terminate enforcement proceedings and return the writ of execution to the recoverer due to the impossibility of collection.

Accounts payable are subject to write-off if one of the following circumstances exists:

- in relation to the debt, the statute of limitations has expired (clause 74 of Regulation No. 34n);

- the creditor is a legal entity liquidated or excluded from the Unified State Register of Legal Entities by decision of the tax authority as an inactive organization (clause 9 of Article 63, Article 64.2, 419 of the Civil Code of the Russian Federation, clause 6 of Article 22, clause 1 of Article 21.1, clause 9 Article 22.3, paragraph 1 Article 22.4 of the Law on State Registration of Legal Entities and Individual Entrepreneurs).

If the basis for writing off accounts payable is the expiration of the limitation period, then the debt is written off in the reporting period in which the expiration date of the limitation period falls (clause 16 of PBU 9/99 “Income of the organization”).

If accounts payable are subject to write-off in connection with the liquidation of the creditor or his exclusion from the Unified State Register of Legal Entities, then they are written off in the reporting period on which the date of making the corresponding entry in the Unified State Register of Legal Entities falls (clauses 6, 7, Article 22, clause 9, Article 22.3 , clause 5 of article 22.4 of the Law on state registration of legal entities and individual entrepreneurs, clause 16 of PBU 9/99).

In addition, we must not forget that if an organization untimely writes off accounts payable and does not reflect the corresponding income for tax purposes, the tax inspectorate during the audit will charge additional non-operating income, as well as, accordingly, income tax, penalties and a fine.

Non-accrual of required reserves

Financial reporting indicators must give a reliable picture of the financial condition of the organization and the financial result of its activities (Part 1, Article 13 of the Federal Law of December 6, 2011 N 402-FZ, clauses 6, 18, 21 PBU 4/99).

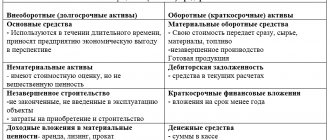

There are two groups of provisions in accounting: provisions and provisions. The former are necessary in order to reliably reflect the value of assets (that is, not to overstate the value of assets in the balance sheet), the latter - to reliably reflect liabilities (not to understate the value of liabilities).

Valuation reserves include reserves for doubtful debts, for depreciation of financial investments and for depreciation of inventories.

Estimated liabilities are upcoming unavoidable expenses (liabilities) with an uncertain amount and (or) maturity date (clauses 4, 5 of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”).

In this article we will discuss two reserves in which mistakes are most often made.

Provision for doubtful debts

More than ten years ago, the concept of a provision for doubtful debts was for a long time an absolutely theoretical concept for many accountants, since accounting legislation allowed them to decide for themselves whether to create a provision for overdue receivables or not. At the same time, starting from 2011, by virtue of the provisions of paragraph 70 of Regulation No. 34n, the creation of reserves for doubtful debts with the attribution of their amounts to the financial results of the organization in the event that receivables are recognized as doubtful has become a mandatory norm.

However, during an audit (especially when an organization is being audited for the first time), even today a situation quite often occurs when an organization does not accrue a reserve for doubtful debts.

The reasons are different, ranging from simple ignorance of this obligation (more often the arguments are: “we are a small enterprise and, therefore, this does not concern us”), ending with an incorrect interpretation of regulations governing accounting.

In addition, in a crisis, some organizations deliberately refuse to accrue reserves completely or try to reduce their amounts to a minimum, wanting to inflate the financial result of the organization's activities. Indeed, if an organization has a small profit, then the formation of a reserve for doubtful debts will entail an increase in other expenses and, as a result, an even greater decrease in profit and, possibly, even the occurrence of a loss.

Let us recall that financial statements must provide a reliable picture of the financial condition of the organization. And despite the reasons that prompted the accountant not to create a reserve for doubtful debts, upon inspection this circumstance may be recognized as a gross violation of the accounting procedure.

I would like to separately draw the attention of small enterprises that have the right to conduct simplified accounting in accordance with Part 4 of Art. 6 of the Law on Accounting, due to the fact that there are no preferences for this category of organizations regarding the obligation to create a reserve for doubtful debts. All organizations are required to create a reserve for doubtful debts.

In accounting, regardless of the source of debt formation, a necessary and sufficient basis for recognizing it as doubtful is the fulfillment of two conditions:

- the debt is overdue or is highly likely to become overdue;

- the debt is not secured by guarantees.

The fact of delay is determined by the terms of the concluded agreement.

In this case, the organization determines the criteria for recognizing receivables as overdue independently, enshrining it in its accounting policies.

Thus, all types of doubtful receivables, including advances paid to suppliers and loans issued, are subject to reservation in accounting. From the point of view of filling out financial statements, accounts receivable are reduced by the amount of the created reserve.

Reserve for vacation pay

In the accounting regulations “Estimated liabilities, contingent liabilities and contingent assets” (PBU 8/2010), obligations to pay for upcoming vacations are not directly listed among estimated liabilities.

However, all the conditions of paragraph 5 of PBU 8/2010 necessary for recognition of an estimated liability are met, namely:

- Employees each month have the right to a certain number of days of paid leave in accordance with labor legislation, but it is not known for certain when the obligation to pay vacation pay will be fulfilled (an employee can postpone the vacation, leave it earlier or quit altogether);

- payment of vacation pay is carried out by maintaining the average salary of the employee, while reducing the economic benefit of the organization;

- the amount of obligations may vary (average earnings, on the basis of which vacation pay is calculated, are determined based on the twelve months preceding the vacation), but it can be reasonably and reliably estimated monthly.

Thus, the organization’s obligations in connection with the emergence of employees’ right to receive paid leave in accordance with the legislation of the Russian Federation are estimated obligations.

All organizations, with the exception of those who have the right to keep simplified accounting (all small enterprises, except those listed in Part 5 of Article 6 of Law N 402-FZ), are required to create a reserve in accounting for vacation pay (clause 3 of PBU 8/2010, clause 20 of the Information of the Ministry of Finance of Russia dated June 29, 2016 N PZ-3/2016).

There is no special procedure for calculating the amount of an estimated liability in PBU 8/2010, but it is stated that the monetary value of such a liability should reflect the most realistic amount of expenses necessary for settlements on it (clause 15 of PBU 8/2010).

Thus, the procedure is developed by the organization independently, taking into account the provisions of Section III of PBU 8/2010 and is enshrined in the accounting policies of the organization. In addition, the organization can use the Methodological Recommendations MR-1-KpT “Estimated Obligations for Settlements with Employees”, adopted by the BMC Interpretations Committee on 09.09.2011.

The reserve for vacation pay can be formed in different ways, for example:

- calculate the reserve based on the average salary for the organization as a whole. Then, to determine the amount of the vacation reserve, the total number of vacation days not used by all employees at the end of the period is multiplied by the average salary and the amount of insurance contributions related to it;

- make a personalized calculation of the estimated liability for each employee (including insurance premiums), and then add up the resulting amounts for all employees (as recommended in the methodological recommendations MR-1-KpT);

- calculate the reserve based on the average salary of individual categories or groups of personnel. In this case, the amount of the obligation to pay vacation pay is determined for each group, based on the number of days of unused vacation of employees in each group, as well as the average salary for this group (including mandatory insurance contributions). The total amount of the reserve that must be formed will be equal to the amount of such liabilities.

The organization must record the chosen methodology for calculating the estimated liability for vacation pay in its accounting policies for accounting purposes.

Companies do not include fines and penalties awarded by the court as income.

Often, an organization’s accounting department does not receive prompt information about the status of litigation. This leads to the fact that the organization does not reflect or does not timely reflect in its income the amounts of penalties, fines and other payments due and awarded by the court. Late reflection of such income leads to a distortion of accounts receivable and financial results, as well as underpayment of income tax.

Fines, penalties, penalties for violations of the terms of contracts, as well as compensation for losses caused to the organization are accepted for accounting in amounts awarded by the court or recognized by the debtor (clause 7, 10.2 of the Accounting Regulations “Income of the organization” PBU 9/99).

In accordance with clause 16 of PBU 9/99, fines, penalties, penalties for violation of the terms of contracts, as well as compensation for losses caused to the organization, are recognized in accounting in the reporting period in which the court made a decision to collect them, or they were recognized as a debtor.

Taking into account the above, we recommend that accountants monitor the results of legal proceedings to timely reflect their results in the accounting records.

Anna Zadubrovskaya, general. Director of ProfConsulting LLC, practicing auditor, head of the committee for audit and financial and legal consulting of the Khabarovsk regional branch of OPORA RUSSIA

Sample

The approximate structure that is used when developing the operating regulations of a department is as follows:

- a common part;

- tasks and functions of the department;

- its structure;

- powers and procedures for interaction with other departments;

- duties and responsibilities of employees.

We recommend using it when you draw up a document regulating the activities of the accounting department. Taking into account Order of the Ministry of Finance No. 34n (accounting regulations), it may look like this:

This is a template formed on the basis of current labor, tax and other regulations. You can supplement or change it, the main thing is that the final text does not contradict the law.

Interim financial statements

48. The organization must prepare interim financial statements for the month, quarter on an accrual basis from the beginning of the reporting year, unless otherwise established by the legislation of the Russian Federation.

49. Interim financial statements consist of a balance sheet and a profit and loss account, unless otherwise established by the legislation of the Russian Federation or the founders (participants) of the organization.

50. General requirements for interim financial statements, the content of their parts, and the rules for evaluating items are determined in accordance with these Regulations.

51. The organization must prepare interim financial statements no later than 30 days after the end of the reporting period, unless otherwise provided by the legislation of the Russian Federation.

52. The presentation and publication of interim financial statements is carried out in cases and in the manner provided for by the legislation of the Russian Federation or the constituent documents of the organization.