Coding of payments to individuals for personal income tax

Each remuneration paid to an individual has a corresponding coding. The full list is contained in Appendix 1 of the Federal Tax Service order No. ММВ-7-11 dated September 10, 2015. What code the bonus has in 2-NDFL depends on what it was accrued for: for production results or on other grounds.

The certificate indicates the income code bonus for production results 2002, if the remuneration is related to the employee’s performance of his job duties: for performing certain work, for exceeding the plan, etc. Thus, if a monthly, quarterly or annual bonus is paid, the personal income tax code is always will be 2002 (letter of the Federal Tax Service dated 08/07/2017 No. SA-4-1/).

If a one-time bonus is paid that is not related to the performance of work duties: for a holiday, a bonus for an anniversary date, indicate a different income code - 2003.

Table: income code bonus in the 2-NDFL certificate

| Code | Type of payment |

| 2002 | Bonus for labor performance:

|

| 2003 | Bonus due to profit:

|

Table of other income in certificate 2-NDFL

| Encoding | Type of payment |

| 2000 | Wage |

| 2010 | Payments under contract agreements |

| 2012 | Vacation pay |

| 2013 | Compensation for unused vacation |

| 2300 | Payment of sick leave |

Documentation of additional payments

It should be noted that such payments must always be documented. There are several ways to do this.

The simplest of them is to stipulate in the employment contract the terms of payment, procedure and size. But, if the bonus is specified in the employment contract and is indicated, for example, as a percentage of wages, then it becomes periodic and mandatory. The organization will not be able to pay it on a “whim” if the employee has fulfilled all the necessary conditions. Moreover, when you need to change the amount of such payments, you will have to make changes to the employment contract itself and enter into an additional agreement, which is impractical.

Therefore, the most rational way would be to create an internal local act at the enterprise. This may be the Regulations on remuneration and bonuses. Or a separate Regulation on bonuses, which will spell out all the cases and conditions for the accrual and payment of certain remunerations to employees, as well as their regularity and frequency. And the employment contract will need to indicate that the company may pay bonuses in accordance with the Regulations on Bonuses.

A memo from the head of the unit, approved by the director, is the basis for drawing up an order for the enterprise.

Coding of personal income tax deductions

The 2-NDFL certificate encodes not only payments to individuals, but also deductions provided.

Currently, an employee has the right to receive standard, property and social deductions from the employer. Tax deduction coding table

| Encoding | Deduction |

| Standard | |

| 126 | For the first child |

| 127 | For a second child |

| 128 | For the third and subsequent children |

| Property | |

| 311 | For the purchase of housing |

| 312 | For mortgage interest |

| Social | |

| 320 | For your training |

| 321 | For a child's education |

| 324 | For treatment |

A complete list of deduction codings is contained in Appendix 2 of the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11/

What can bonuses be paid for?

Bonuses for certain results or volumes of work for different employees can take into account completely different indicators. So, for example, for programmers it could be:

- uninterrupted operation of servers,

- high repair speed,

- implementation of new solutions,

- development or modification of certain software products to increase operational efficiency with their help.

For HR and accounting department employees, you can enter indicators such as:

- performing an increased number of operations,

- no comments on inspections,

- timely, error-free preparation and submission of reports, and so on.

Sales department employees can be rewarded for:

- number of new contracts concluded,

- small percentage or absence of terminated contractual obligations with regular customers,

- achieving a certain sales volume,

- absence or a certain number of complaints and claims regarding services and product quality.

It should be noted that bonuses cannot be awarded for those functions and volumes that are included in job responsibilities. Accordingly, in order to award an employee a bonus, these indicators must be higher and more effective, which must be specified in the bonus regulations.

You should also pay attention that often the bonus is paid only to the manager. This should not be done. This will certainly raise questions from the inspection authorities.

For top managers, it is necessary to think through a specific sales plan for the entire department, for example, or the entire enterprise. You can include surcharges for

- increasing marketing efficiency,

- reduction in claims from buyers,

- achieving sales volumes for the entire team,

- improving the performance of a department or the entire enterprise.

For the general director, any remuneration and bonuses are established by agreement with the founders of the company, therefore, payments are made on the basis of such a decision. If the director himself is the sole founder of the enterprise, then all the expenses in question are also taken into account according to the general rule under Art. 255 and 346.16 of the Tax Code of the Russian Federation.

When developing motivational additional payments, it is recommended that company management agree on all indicators and amounts with human resources and accounting. To ensure that all legislation is complied with.

The deadline for submitting 2-NDFL is 2022

Employers report to the tax authorities on amounts paid to employees and personal income tax withheld from them in the form approved by Order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/

Each type of employee remuneration corresponds to a four-digit digital coding. What income code the premium has depends on what the reward was paid for.

Starting with reporting for 2022, new deadlines for submitting certificates in form 2-NFDL have been established. Now there is one month less time allotted for reporting preparation. Previously, certificates were submitted no later than April 1. Now it is required to submit reports no later than March 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation). If the due date falls on a weekend, the due date is postponed to the first next working day. So, in 2022, March 1 falls on a Sunday, so certificates of payments and taxes for employees are submitted no later than 03/02/2020.

Previously, before March 1, it was necessary to report only if income was paid to an individual from which it was impossible to withhold tax. This order will continue in 2022.

Thus, starting from 2022, one deadline has been set for all cases - no later than March 1.

Application of standard deductions when calculating bonuses

The bonus can be paid along with the advance payment, with the salary or during the interpayment period. Tax should be withheld simultaneously with the transfer of income to the employee. And in order to withhold tax, it is necessary to calculate the tax base. It is at this moment that the Tax Code of the Russian Federation provides for the provision of deductions (clause 1 of Article 218 of the Tax Code of the Russian Federation). But pre-payroll deductions may be unnecessary due to the fact that after payroll the employee's total income exceeds the deduction limit. Let us remind you that in 2022 the maximum tax base is 350,000 rubles.

The 1C: Salary and Personnel Management 8 program, edition 3, automatically processes such situations, and personal income tax is recalculated when payroll is calculated. Let's consider cases of additional personal income tax accrual and their reflection in the 6-NDFL report.

Case 1. A deduction was provided when calculating the bonus

Employee S.S. Gorbunkov has registered the right to social deduction with code 126 for the first child. After calculating wages for September, the tax base for determining the right to deduction amounted to 300,000 rubles. In mid-October, a decision was made to pay a bonus of 10,000 rubles.

In accordance with the bonus regulations adopted by the organization, the bonus with code 2002 has the category Other income from labor activities and is paid during the interpayment period. The payment date of the said premium is scheduled for 10/11/2017. When paying the premium, personal income tax must be withheld. Therefore, it is necessary to calculate the tax when it is calculated.

Since the calculation base as of October 11, 2017, taking into account the bonus, is 310,000 rubles, the social deduction for a child is 1,400 rubles. should be applied. Please note that at the time of accrual and payment of bonuses, the accountant cannot foresee how much the employee’s salary will be accrued, since unplanned events may occur (for example, unpaid leave, absenteeism, death, etc.). The calculated personal income tax is 1,118 rubles. ((RUB 10,000 - RUB 1,400) x 13%)). When transferring funds that must be paid to an employee, the tax is withheld and no later than the next day is transferred to the budget system of the Russian Federation.

Payroll period begins in early November. Employee S.S. Gobunkov worked regularly all month, and he receives his salary for October in full - 75,000 rubles. Taking into account the salary received, the tax base for calculating the right to deduction is 385,000 rubles. (RUB 300,000 + RUB 10,000 (bonus) + RUB 75,000 (salary)), which exceeds the limit of RUB 350,000. Thus, in October S.S. Gorbunkov loses the right to deduction. The deduction was excessively applied and must be reversed. When calculating wages, additional taxes are calculated.

The accrued personal income tax on salary is 9,750 rubles. (RUB 75,000 x 13%)).

Personal income tax on the premium is additionally charged in the amount of 182 rubles. (RUB 10,000 x 13% - RUB 1,118). The deduction applied to the premium is 1,400 rubles. now applies to all income for October (RUB 85,000). The deduction is distributed in proportion to income: 164.71 rubles. accounts for the premium and 1,239.29 rubles. - for payment according to salary.

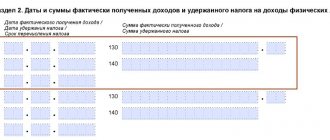

Salaries are transferred to employee accounts on November 6, 2017. The payroll registers the amount of tax to be transferred separately by Type of income: Other income from labor activity - 182 rubles. and Salary - 9,750 rubles. Additional accrued 182 rubles. taxes must be transferred no later than the day following the day of payment of wages. This is exactly the picture that Section 2 of the annual report 6-NDFL displays (Fig. 2).

Rice. 2. Section 2 of form 6-NDFL for the year for Case 1

Lines 110 and 120 determine the period when tax in the amount indicated in line 140 is due to be transferred. That is, the additional accrued 182 rubles. must be transferred within the period 06.11.2017-07.11.2017. In this case, the value of line 130 of the block corresponding to additional tax calculation is equal to 0. Income in the amount of 10,000 rubles. and the tax withheld from him on October 11, 2017 in the amount of 1,118 rubles. are displayed as a separate block.

These blocks cannot be merged. If you add 182 rubles. in the block displaying the calculation of the premium, then a debt is generated for the tax agent, because the indicated 182 rubles. could not be transferred within the period 10/11/2017-10/12/2017, since at that time such debt did not exist. Inclusion of the premium amount of 1,000 rubles. and withheld tax of 1,118 rubles in the additional accrual block will lead to a violation of the reflection of the date of actual receipt of income and the date of tax withholding. And this is fraught with fines.

Generated in the 1C: Salaries and Personnel Management 8 program, edition 3, the 6-NDFL report is fully consistent with the situation in Case 1 and does not create any trouble for the tax agent due to the fact that social deductions legally applied in the middle of the month turned out to be unnecessary at the end of the month .

Case 2. Double deduction provided when calculating bonuses

Employee S.S. Gorbunkov has registered the right to social deduction with code 126 for the first child. After calculating wages for September, the tax base for determining the right to deduction amounted to 300,000 rubles. In mid-October, a decision was made to pay a bonus of 10,000 rubles. In accordance with the bonus regulations adopted by the organization, the bonus with code 2002 has the category Other income from work and is paid along with the October salary on the day established for the payment of salaries in November. Features of bonus distribution in the organization provide that accrual is made according to a separate document before salary calculation. At the time of accrual of the bonus (11.10.2017), which is planned to be paid on 06.11.2017, the employee’s total income including the bonus is 310,000 rubles. Social deductions per child in the amount of 1,400 rubles. should be applied twice: both for October and November. The use of deductions for two months is due to the fact that tax must be withheld when paying income. Accordingly, the calculation should be made on the date of payment of income. There is no information about subsequent charges yet. The calculated personal income tax is 936 rubles. ((RUB 10,000 - RUB 2,800) x 13%)).

The payment of the bonus is planned along with the salary. Payroll calculation occurs on November 3, 2017 before funds are transferred to the employee. Excessively applied deductions to income of the type Other income from labor activities are reversed, and an additional tax is charged in the amount of 264 rubles. The payroll registers in the 1C: Salary and Personnel Management 8 program, edition 3, the withholding of tax on the day of salary payment by income category, taking into account the documents accruing it. Please note that in the personal income tax decoding form in the payroll, the Income Category is named Type of Income.

Income tax of the type Payroll with the date of receipt of income on the last day of the month (October 31, 2017) is 9,750 rubles. Personal income tax on Other income from employment with the date of receipt of income on the day the money is transferred to the employee’s account (11/06/2017) is saved separately in two amounts in accordance with the accrual documents: 936 rubles. (document Award) and 364 rubles. (document Calculation of salaries and contributions). In this case (Case 2), in Section 2 of the annual report 6-NDFL, the premium tax is combined into one block due to the coincidence of the dates of actual receipt of income, tax withholding and transfer deadline (Fig. 3).

Rice. 3. Section 2 of form 6-NDFL for the year for Case 2

How to fill out a 2-NDFL certificate in 2022

The reporting form consists of a general part, three sections and an appendix. The bonus code in 2-NDFL, as well as other payments, is indicated in the application. Filling should be done in the following order:

- A common part. It indicates the details of the organization and the Federal Tax Service, the certificate number, and the reporting period.

- Section 1. It is intended to reflect the data of an individual: full name, taxpayer status, passport details.

- Application. It contains information about income and the corresponding tax deductions, including the bonus income code in 2-NDFL.

- Section 3 reflects the annual amounts of tax deductions provided.

- Section 2 is intended to reflect the total amount of payments to an individual, the calculated tax base, calculated, withheld and transferred to the budget tax

Accounting for payments for tax purposes

In order for the premium to be taken into account for tax purposes, a number of conditions must also be met.

- First, it should not be paid from net profits, special purpose funds or earmarked proceeds. Because in this case, such a premium will not be taken into account as expenses for profit tax purposes, according to Article 270 of the Tax Code of the Russian Federation.

- Secondly, the bonus must be specific. The regulations must state what the bonus is paid for.

- Thirdly, the bonus calculation indicators must be indicated:

- either it is fixed at a certain amount, or

- differentiated and accrued, for example, as a percentage of the salary. Or it is generally calculated according to a certain formula, which directly depends on KPI or the quality of this work.

- Fourthly, the sources of payment must be indicated.

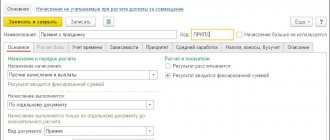

Accrual of a one-time bonus in 1C: ZUP

For other one-time accruals, the program uses a special document, which is called that and is located in the “Salary” menu.

It creates various allowances, compensation payments, etc. You can also display a one-time document from the “All Accruals” journal. To see how everything works, it is recommended to first set up the appropriate accrual. Suppose you want to create a one-time incentive payment for the National Unity Day holiday.

If you create such an accrual as “Premium”, then personal income tax and insurance premiums will be charged from it. However, we are looking at a premium that is paid out of net profit. Therefore, you should select, for example, “Other accruals and payments.” Please note that the accrual is carried out on a separate document.

Set the switch to the “Result is displayed as a fixed amount” position. Uncheck the positions

- “Include in payroll” on the “Basic” tab,

- “Include in the accrual base when calculating average earnings” for vacations and business trips and for calculating benefits on the “Average earnings” tab.

On the “Personal Income Tax” tab, you should set a marker on what is taxed according to income code 2003. You can also set code 4800 “Other income”. It all depends on the established order in the company.

The income category is important in organizations where foreigners work - preferential non-residents; the percentage of personal income tax depends on it. In this case, this is not important; you can select “Other income from employment.” Set markers:

- the payment is fully subject to insurance contributions,

- statistical reporting is not taken into account,

- is not included in labor costs for income tax purposes,

- in accounting “As specified for accrual”.

Select the appropriate subaccount, or it will be set automatically.

Finally, press the “Record and close” button to activate the accrual.

Reflection of monthly bonus accrual in 1C: Salary and personnel management

Let’s assume that the company introduced monthly bonuses in the amount of 20% of salary from September 1, 2022, due to an increase in sales volumes. To create this bonus, go to the “Settings” - “Accruals” menu. Clicking the “Create” button will open the creation of a new accrual.

Basic information should be filled in by analogy with the type of income described above, and on the “Basic” tab you need to specify the calculation formula. To do this, you can take the formula for existing charges:

Percentage of Monthly Premium / 100 * Calculation Base

and correct it.

Or set it up yourself. In the case under consideration - 20% of the salary. Accordingly, you should click the “Edit formula” hyperlink. In the window that opens, select the appropriate indicator, enter the calculation and press the “Check” button. After passing the verification, click “OK”.

On the “Average Earnings” tab, you should also determine how remuneration is included in the accrual base. Here you need to understand whether, in the event of an incomplete month of work, the bonus will be equal to 20% of the salary. Or should it also be taken into account partially. Recommended by Fr.

On the “Taxes and Contributions” tab, everything is indicated in the same way as in the case discussed above.

After making all the settings, you should write down the accrual using the button of the same name. For clarity, we suggest creating a document Change of employee pay from the “Salary” menu. In the created document you need to add a bonus, for example, for Bulatov I.V.

After adding the corresponding line, the payroll will change from 75,000 rubles. (salary), for 90,000 rubles. (salary plus bonus). The document must be dated September 1, 2022. After entering the information, click the “Post and Close” button.

How to set up a monthly premium

First, you need to go to the “Settings” menu in the “Accruals” section and see if such a payment may already be configured.

To make searching easier, you can use the search bar.

Regular payments are prescribed by personnel documents, for example, an employment order. As you can see, this remuneration for work is calculated monthly as a percentage of the salary. Due to the fact that this amount is included in the payroll fund, you should set the appropriate “marker” opposite “Include in payroll.”

On the “Dependencies” tab, a list of accruals is indicated, the calculation base of which includes this premium (then it will be displayed on the left side), or in the list of deductions. The latter is logical for this payment, therefore it is reflected on the right side, for example, “Deduction based on writs of execution.” That is, such deductions are made in the percentage established by law and the order of the bailiff from all the employee’s income. Therefore, the "Dependencies" tab is populated.

Next, you must indicate whether this payment is included in the accrual base when calculating average earnings. If yes, then the corresponding “tick” is checked on the “Average Earnings” tab.

On the “Taxes, Contributions” tab, a “marker” is placed indicating that the payment is subject to personal income tax. Indicate the income code. It is indicated what is meant by the month for which the income is accrued. In this example, this is the month during which the calculation is carried out.

Then a note is made that this payment is subject to insurance premiums and is taken into account in labor costs under paragraphs. 2 tbsp. 255 Tax Code of the Russian Federation.

If your version of the program does not have such an accrual, then setting it up will not be difficult according to the given scheme. And also to determine the types and conditions of payment of bonuses, you can study the article “How to calculate bonuses in 1C Accounting 8.3?”

Selecting a premium in the document

Now in the “One-time accrual” document you can select the created bonus.” By clicking the “Fill” button, you can specify the amount if it is the same for everyone. Otherwise, you will need to enter manually for each employee.

When the payment is one-time and non-productive in nature, then the directly planned date should be indicated under the table “Payment during the inter-settlement period”. The tax is calculated immediately in the document on the date of payment. By clicking on the tax amount, a transcript will open in which you can open the accounting register. It indicates exactly this date - November 3, 2022 - payment and transfer.

This document is a settlement document and does not require anyone’s approval in the program, therefore it is carried out immediately and is displayed in the journal without bold highlighting. This means that it is immediately taken into account.