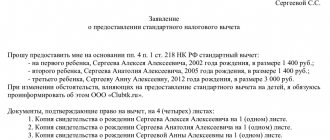

How to correctly indicate code 327 in 3-NDFL

A taxpayer who makes voluntary contributions to the above funds has the right to a refund of the tax paid through the Federal Tax Service.

It belongs to the section of social tax deductions. To do this, a citizen must fill out a 3NDFL declaration. Where should I put this code? It should be indicated on sheet E1 intended for deductions:

- standard benefits for parents for children up to an income of 350 thousand rubles. indicated in lines 030-060;

- social deductions (327) are recorded in lines 150, 160;

- contributions stipulated by insurance contracts must be indicated in line 140;

- Contributions to non-state pension funds should be reflected in line 150, and voluntary contributions to a funded pension are also summed up here.

In addition, the declaration must also fill out sheet E2, where you need to decipher the expenses reflected on sheet E1. That is, by filling out line 150, in subsection 1.1 you will have to indicate the details of your agreement with the NPF, and in 2.2 - all contributions paid to this fund.

This data must be filled out if you prepare reports in the Declaration program. The details of the insurance company are also indicated here - name, tax identification number, checkpoint, contract number.

Explanation of situations related to code 327

Procedure for receiving a deduction

The procedure for returning taxes under codifier 327 from a tax agent or the Federal Tax Service raises a lot of questions. The most common question taxpayers ask is how can they take advantage of the contribution cost relief? You need to act according to the instructions:

- Fill out the declaration, indicating personal information, information about income received and all expenses, as well as contributions made to funds;

- Take a 2-NDFL certificate from your employer for the previous year, which indicates the taxes withheld;

- Prepare a copy of the agreement with the fund; when insuring, this document may not be present; its role is played by the policy;

- Take checks or receipts that contain the actual expenses incurred - they can be paid either one-time or annually (the second option is preferable if the total amount of insurance compensation exceeds 15,600);

- Provide the tax authority with a package of documents - do not forget to take the originals with you for the inspector to review. This must be done at the territorial department at your place of residence.

If the deduction agreement is drawn up for a close relative, documents confirming the relationship will be required.

The excess tax amount withheld will be returned after verification of the information. If you don’t want to wait for the end of the calendar period, you can take a notice from the Federal Tax Service and apply for a social deduction directly from the employer.

Several social deductions in one year

Another situation related to receiving a deduction arises if the taxpayer wants to take advantage of several benefits at once in one period. The maximum amount for reducing the tax base is limited to 120 thousand rubles, that is, to return over 15,600 rubles. per year will not work. Even if you paid contributions to a non-state pension fund, underwent paid treatment and at the same time spent money on educational services.

Thus, information on code 327 will be useful to taxpayers who have entered into agreements with insurance companies or for voluntary pension provision. You must indicate the amount of expenses incurred in the declaration to refund part of the taxes, and if the benefit is provided by the employer, you can find this information in the 2-NDFL income certificate.

What does deduction code 327 mean?

The Federal Tax Service has assigned codes to all deductions and income included in the personal income tax database. The deduction codes are given in the order dated September 10, 2015 No. ММВ-7-11/ [email protected] (as amended on October 24, 2017). These codes are indicated by employers when filling out 2-NDFL certificates.

Code 327 indicates a deduction in the amount paid by a citizen during the tax period:

- pension contributions under non-state pension agreements concluded with non-state pension funds in their favor, in favor of family members or close relatives, disabled children under guardianship (trusteeship);

- insurance premiums under voluntary pension insurance contracts concluded with an insurance organization in its favor, in favor of a spouse (including a widow, widower), parents (including adoptive parents), disabled children (including adopted children under guardianship (trusteeship) );

- insurance premiums under voluntary life insurance contracts for a period of at least five years, concluded with an insurance organization in its favor, in favor of a spouse (including a widow, widower), parents (including adoptive parents), children (including adopted children, under guardianship (trusteeship).

In this case, the amount of the benefit is equal to the taxpayer’s expenses, but cannot be more than 120,000 rubles. (Clause 2 of Article 219 of the Tax Code).

- How to fill out and submit half-year reports

- reportingNew milestones for semi-annual

- for VAT How to convince the inspectorate to accept reports

- for the half-year How to fill out section 3 in the calculation of contributions

- to the tariff Why is it dangerous to lie to 4-FSS about a special assessment for the sake of a discount

- salary How to show early and rolling salary in 6-NDFL

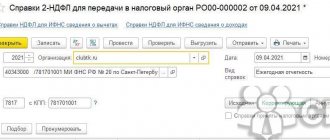

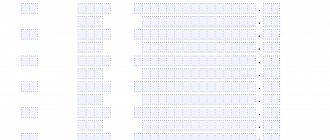

Thus, if you receive a social deduction for pension insurance from your employer based on a notification from the Federal Tax Service, when you withhold personal income tax, the tax base is reduced. And the 2-NDFL certificate for the year is filled out with code 327. Then the accountant indicates income, amount and type of deduction (code). See a fragment of the 2-NDFL certificate below.

Fragment of certificate 2-NDFL

Code in the certificate 2-NDFL

Starting from 2022, there is no such thing as “personal income tax certificate 2” as an independent document. The certificate became part of the annual calculation of 6-NDFL. Instead of certificate 2 of personal income tax, two different certificates of income of individuals are used - for the Federal Tax Service (Appendix No. 1 to calculation 6 - personal income tax) and for citizens (Appendix No. 4). These applications were approved by Order of the Federal Tax Service dated September 28, 2021 No. ED-7-11/ [email protected]

Read more: Help 2 Personal Income Tax—changes

Both new certificates are called “Certificate of income and tax amounts of an individual,” so from now on we will call them in the old fashioned way certificate 2 personal income tax.

Certificate 2-NDFL reflects data on the employee’s sources of income, salary and taxes withheld. Each source of income or tax deduction has its own code in certificate 2 of personal income tax. These codes were approved by Order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/ [email protected]

At the end of 2022, the tax service changed the list of codes (Order dated October 24, 2017 No. ММВ-7-11/ [email protected] ).

The list of Federal Tax Service income codes was last updated in 2022. Order of the Federal Tax Service of Russia dated September 28, 2021 N ED-7-11/ [email protected] “On amendments to appendices No. 1 and No. 2 to the order of the Federal Tax Service of Russia dated September 10, 2015 N ММВ-7-11/ [email protected] “On approval of codes for types of income and deductions.” This order introduced new codes for income and deductions, and also canceled and adjusted some of the existing codes.

The new version of the order cancels codes 1400 and 2400, which are intended for rental income, but instead adds seven new codes for types of income. These codes are valid from January 1, 2018 to the present.

The article provides current codes and shows which codes to enter in the 2-NDFL certificate for 2022 in 2022.

Where to indicate social deduction with code 327 in the 3-NDFL declaration

You submit a 3-NDFL declaration if you want to receive a social deduction from the tax office. Then fill out deduction code 327 in the 2022 3-NDFL declaration in the following order.

Take the tax return form 3-NDFL, which was approved by order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11 / [email protected] (as amended on October 25, 2017). Fill in it:

- title page;

- sections 1 and 2. They are completed by all individuals;

- sheet A. On it, write down all income (main at the main place of work and all additional ones), as well as personal income tax calculated and withheld by the employer;

- sheet E1. On it you will indicate the social deduction with code 327.

Let's look at sheet E1 in more detail. Here you will indicate standard and social deductions.

If you have a child, you receive a standard personal income tax deduction for up to the month in which the amount of income exceeds 350,000 rubles. (subparagraph 3, paragraph 1, article 218 of the Tax Code). Indicate such a benefit in lines 030 – 060 of sheet E1.

For social deductions, the Federal Tax Service has allocated lines 080 – 180 on sheet E1. You will write deductions with code 327 in lines 150 or 160 of sheet E1.

If you paid insurance premiums under voluntary personal insurance contracts, as well as under voluntary insurance contracts for your spouse, parents or children (wards under the age of 18), write down the amount in line 140.

If you transferred pension and insurance contributions under contracts of non-state pension provision, voluntary pension insurance and voluntary life insurance, as well as additional contributions to a funded pension, fill out line 150.

Example: How to reflect social deduction with code 327 in the 3-NDFL declaration

A.I. Ivanov paid contributions under a voluntary personal insurance agreement in the amount of 15,000 rubles. There were no other standard and social deductions in 2022. We will show how Ivanov will reflect the amount of the benefit in the 3-NDFL declaration.

See below for a fragment of the 3-NDFL declaration.

Deduction by code 327 in 3-NDFL

- New clarifications from officials!

- Correct the primary report in a new way - tax authorities have tightened the rules

- Officials have changed their requirements for those accountable: how to calculate personal income tax and contributions now

- Who will the bank block the VAT account to please the Central Bank?

Deduction code for personal income tax certificate 2 2022

The following deduction codes are used in personal income tax certificate 2 for 2021:

Standard children's deductions (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation)

— Deduction for a child under the age of 18, as well as for a full-time student under the age of 24 to the parent, spouse of the parent, adoptive parent who is supporting the child:

- 126 — when providing a deduction for the first child;

- 127 - when providing a deduction for a second child;

- 128 - when providing a deduction for the third and each subsequent child;

- 129 - when providing a deduction for a child who is a disabled person of group 1 or 2.

— A double deduction for a child under the age of 18, as well as for a full-time student under the age of 24 – for a single parent, adoptive parent:

- 134 — when providing a deduction for the first child;

- 136 - when providing a deduction for a second child;

- 138 - when providing a deduction for the third and each subsequent child;

- 140 - when providing a deduction for a child who is a disabled person of group 1 or 2.

— A double deduction for a child under the age of 18, as well as for a full-time student under the age of 24 – to one of the parents, if the other parent refused to receive his child’s deduction

- 142 — when providing a deduction for the first child;

- 144 - when providing a deduction for a second child;

- 146 - when providing a deduction for the third and each subsequent child;

- 148 - when providing a deduction for a child who is a disabled person of group 1 or 2.

Codes of property deductions: (Article 220 of the Tax Code of the Russian Federation)

- 311 — Expenses for the construction/purchase of housing on the territory of the Russian Federation, the acquisition of land plots for individual housing construction (IHC), land plots on which the purchased residential buildings are located.

- 312 — Interest expenses on targeted loans received for the construction/purchase of housing in the Russian Federation, the acquisition of land plots for individual housing construction, land plots on which the purchased residential buildings are located.

Social deduction codes (subparagraph 2 and subparagraph 3, paragraph 1, article 219 of the Tax Code of the Russian Federation):

- 320 — Taxpayer’s expenses for his or her brother’s or sister’s education under the age of 24 full-time in educational institutions within the established limit.

- 321 — Expenses of the taxpayer-parent (guardian, trustee) for full-time education of their children (wards, former wards) under the age of 24 in educational institutions within the established limit.

- 324 — Expenses for medical services provided to the taxpayer himself, his spouse, parents, children (including adopted children), wards under the age of 18, as well as expenses for medications prescribed by the attending physician and purchased by the taxpayer at his own expense funds within the established limit.

- 325 — deduction for contributions paid for voluntary health insurance for oneself, spouse, parents or children (including adopted or warded) under the age of 18;

- 326 - deduction for expenses for expensive treatment;

- 327 - deduction for expenses on paying contributions to non-state pension funds or under long-term voluntary life insurance contracts for yourself, your family members, close relatives;

- 328 — deduction for additionally paid by the taxpayer savings contributions to the Pension Fund.

Professional deduction codes: (Article 221 of the Tax Code of the Russian Federation)

- 403 — documented expenses incurred during the performance of work (provision of services) under civil contracts;

- 404 — documented expenses associated with receiving royalties;

- 405 - the amount within the standard costs associated with receiving royalties (as a percentage of the amount of income).

Codes of deductions for income not subject to personal income tax within certain amounts (subclause 8 and subclause 28 of article 217 of the Tax Code of the Russian Federation)

- 501 and 502 - deduction from the value of gifts received from organizations and individual entrepreneurs;

- 503 and 504 - deduction from financial assistance provided to employees, as well as former employees who quit due to retirement;

- 505 — Deduction from the value of winnings and prizes issued as a result of competitions, games and other events held for advertising purposes;

- 506 — deduction from one-time financial assistance paid to a disabled person by a public organization of disabled people;

- 507 — deduction deduction from one-time financial assistance or gift given to a participant in the Great Patriotic War;

- 508 — Deduction from one-time financial assistance to employee-parents (adoptive parents, guardians) at the birth (adoption) of a child;

- 509 — deduction for income issued by products to an employee of an agricultural producer;

- 510 — deduction for additional savings contributions to the Pension Fund of the Russian Federation paid by the employer for the taxpayer.

Tax system

The tax and fee system is a certain set of basic elements that determine this type of mandatory payments. It includes the definition:

- taxes;

- payers;

- objects;

- legislative acts;

- tax elements.

The entire set of fees is divided into groups depending on various reasons. So, they can be (depending on the level of budget revenue):

- federal;

- regional;

- local;

- mixed.

Types of social tax deductions.

Depending on the object:

- profitable;

- property;

- others.

Depending on the subject:

- from citizens;

- from law firms and individual entrepreneurs.

Depending on the collection procedure:

- straight;

- indirect.

The subjects of legal relations are:

- payers – individuals, organizations and businesses;

- the state – as the main recipient of funds;

- tax departments - as the main regulatory body acting on behalf of the state.

The latter are accountable to the main branch of the Federal Tax Service, the activities of which, in turn, depend on the Ministry of Finance.

The Tax Code is the main collection of laws in this area.

All actions of participants, their rights and obligations are contained in the following legislative acts:

- constitution;

- Tax code;

- Presidential Decrees;

- Government Decrees;

- Orders of the Federal Tax Service;

- other legal acts.

In addition to compliance with the laws, for the normal functioning of the system it is necessary to ensure the presence of basic features: legality, proportionality, equality, legality and others.

What does code 327 mean?

In accordance with the established rules, tax deductions are entered into the 2-NDFL certificate under digital codes indicating their type.

Code 327 is intended to account for the expenses specified in subparagraph. 4 paragraphs 1 art. 219 of the Tax Code of the Russian Federation. Includes payments for non-state pension provision (insurance) or life insurance made by the taxpayer for himself or his relatives. This is a social deduction.

You can receive social deductions using code 327 from the tax office at the end of the year or from your employer. However, a tax reduction at the place of work is only possible if there is a notification from the tax authority.

The amount of expenses included in the social tax deduction is limited to 120 thousand rubles (except for fees for children’s education and expensive treatment).

Social deduction limit = 120 thousand rubles. * 13% = 15.6 thousand rubles.

You can receive a deduction only if you have taxable income. The deduction is valid during the tax period in which the contributions were paid. Does not carry over to subsequent years.

If the employer's tax has not decreased during the year, the citizen has the opportunity to receive a deduction by submitting a declaration to the inspectorate at the place of registration.

You can see whether expenses for pensions and life insurance were deducted when calculating tax and in what amount in certificate 2 of personal income tax. If deductions were not made or were made incompletely, you should submit a 3-NDFL report to the tax service.

Income code in personal income tax certificate 2 2022

The following income codes are applied in personal income tax certificate 2 for 2021:

- 1010 — transfer of dividends;

- 1401 — income received from leasing or other use of residential real estate;

- 1402 - income from leasing or other use of property, except for income related to group 1401;

- 1500 - income from contracts for the purchase and sale (exchange) of securities, which are taxed on the basis of paragraph. 2 p. 1 art. 226 Tax Code of the Russian Federation;

- code 2000 is wages, including additional payments and allowances (for harmful and dangerous work, for night work or combined work);

- 2001 - this is the remuneration of directors and other similar payments received by members of the organization’s management body (board of directors, etc.);

- code 2002 - bonus for production and similar results that are provided for in employment contracts, collective agreements or legal norms;

- 2003 — remunerations paid from the organization’s profits, special-purpose funds or targeted revenues;

- 2004 — monthly monetary rewards from the federal budget to teachers - class teachers from state and municipal educational organizations;

- 2010 — income from civil contracts, excluding copyright contracts;

- code 2012 - vacation pay;

- code 2013 - to compensate for unused vacation;

- 2014 — severance pay, compensation payments in the form of average monthly earnings for the period of employment after dismissal, compensation to managers, deputy managers, chief accountants in excess of earnings for 3 or 6 months (regions of the Far North and equivalent areas);

- 2015 — daily allowance in excess of 700 rubles for each day of a business trip within the Russian Federation and no more than 2,500 rubles for each day of a business trip outside the Russian Federation;

- code 2300 - sick leave benefit. It is subject to personal income tax, so the amount is included in the certificate. At the same time, maternity and child benefits are not subject to income tax, and they do not need to be indicated in the certificate;

- 2301 — fines and penalties paid by the company by court decision for failure to satisfy consumer demands voluntarily;

- code 2510 - income in the form of payment for an individual and in his interests by organizations or individual entrepreneurs for goods (work, services) or property rights, including utilities, food, recreation, training;

- 2520 — income in kind received in the form of full or partial payment for goods, work, services performed in the interests of the taxpayer;

- 2530 — remuneration in kind;

- 2610 - denotes the employee’s material benefit received from savings on interest on loans;

- 2611 — Amounts of terminated obligations to pay debt in connection with the recognition of such debt as uncollectible, except for the cases listed in clause 62.1 of Art. 217 Tax Code of the Russian Federation;

- 2763 - the amount of financial assistance provided by an organization carrying out educational activities in basic professional educational programs, students (cadets), graduate students, adjuncts, residents and assistant trainees;

- 2790 — The amount of assistance (in cash and in kind), as well as the value of gifts received by veterans of the Great Patriotic War, home front workers of the Great Patriotic War, disabled people of the Great Patriotic War, widows of military personnel who died during the war with Finland, the Great Patriotic War, the war with Japan, widows of deceased disabled veterans of the Great Patriotic War and former prisoners of Nazi concentration camps, prisons and ghettos, as well as former minor prisoners of concentration camps, ghettos and other places of forced detention created by the Nazis and their allies during the Second World War;

- 3010 - income in the form of winnings received from participation in gambling conducted in a bookmaker's office and totalizator

- 3011 — winnings from participation in the lottery;

- 3020 — interest on bank deposits;

- 3023 — income in the form of interest (coupon) received by taxpayers from ruble bonds of domestic organizations issued after January 1, 2022;

- code 4800 is a “universal” code for other employee income that is not assigned special codes. For example, daily allowances in excess of the tax-free limit, additional sick pay, stipends;

Codes of income that are subject to personal income tax when the limit is exceeded

- 2720 - cash gifts to an employee. If the amount exceeds 4,000 rubles, then tax is charged on the excess. In the certificate, the amount of the gift is shown with income code 2720 and at the same time with deduction code 501 .

- 2760 - financial assistance to an employee or former employee who retired due to disability or age. If the amount of assistance exceeds 4,000 rubles, then a tax is levied on the excess. In the certificate, the amount of financial assistance is shown with the income code 2760 and at the same time the deduction code 503 .

- 2762 - one-time payment in connection with the birth or adoption of a child. If the amount exceeds 50,000 for each child, but for both parents, then tax is charged on the excess amount. In the certificate, this amount is shown with income code 2762 and deduction code 504 .