Many controversial situations in taxation can be avoided if, at the stage of planning business situations, you analyze the wording of the legislation and adhere to these wordings when drawing up the relevant documents. Payments to employees established by labor legislation are no exception.

Let's consider the taxation of reimbursement amounts for employees who moved to work in another area. The issue of withholding personal income tax from such amounts is addressed in the letter of the Ministry of Finance of Russia dated March 17, 2017 No. 03-04-06/15550. We will be interested not only in personal income tax, but also in insurance premiums for these payments, as well as in accounting for such reimbursements in income tax expenses.

Analysis of labor relations

The Labor Code of the Russian Federation contains Article 169, the name of which fully corresponds to the analyzed economic situation - “Reimbursement of expenses when moving to work in another area.” It follows from it that moving to work in another area is carried out by prior agreement between the employee and the employer. This wording implies that the employment contract was concluded before the move.

The employment contract must indicate the place of work, and in the case where an employee is hired to work in a branch, representative office or other separate structural unit of the organization located in another area, the place of work indicating the separate structural unit and its location (Article 57 of the Labor Code of the Russian Federation ). Due to the move, this entry needs to be changed.

The legislator does not delve into the reasons for the employee’s move. For example, this could be a transfer to work in another area together with the employer, or the transfer of an employee to a structural unit located in another area (Article 72.1 of the Labor Code of the Russian Federation). In any case, changes to the employment contract are coming. However, Article 169 of the Labor Code of the Russian Federation indicates the need for prior agreement between the parties. It also requires compliance with written form. It seems that in this document it is necessary to agree on the time for the move, during which the employee will not perform his labor functions. After all, the employment contract has not been terminated.

New employee relocation costs

Situation: how to take into account when calculating income tax the costs of moving a new employee to his new place of work (if the employment contract already indicates the address of the organization's location or the employment contract has not yet been concluded with him)?

In the case of hiring a new employee and paying for travel to his place of work specified in the employment contract, the application of the provisions of Article 169 of the Labor Code of the Russian Federation is unreasonable. A similar procedure applies to paying relocation expenses for a new employee with whom an employment contract has not yet been concluded. Consequently, when calculating income tax, such costs cannot be taken into account on the basis of subparagraph 5 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

At the time of relocation, an employment contract must be drawn up with the employee, which provides for the payment of compensation for relocation and settlement expenses. When calculating income tax, the amount of this compensation can be taken into account as a tax allowance (subclause 5, clause 1, article 264 of the Tax Code of the Russian Federation). That is, the provisions of Article 169 of the Labor Code of the Russian Federation apply in the case when an employee, in agreement with the organization, moves from one place of work where he performed his job duties to a new place of work.

The Ministry of Finance of Russia adheres to a similar point of view in letters dated November 23, 2011 No. 03-03-06/1/773, dated July 23, 2009 No. 03-03-05/138, dated July 14, 2009 No. 03-03 -06/2/140.

At the same time, if an employment contract is concluded with a new employee, which indicates the new address of the organization, the costs associated with his relocation can be taken into account when calculating income tax based on another cost item - as part of labor costs ( clause 25 of article 255 of the Tax Code of the Russian Federation). The main condition is that the payment of such compensation must be provided for in an employment (collective) agreement.

Similar conclusions follow from letters of the Ministry of Finance of Russia dated November 23, 2011 No. 03-03-06/1/773 and dated July 23, 2009 No. 03-03-05/138. Despite the fact that these clarifications are addressed to organizations that compensate relocation expenses for foreign employees, they can also be applied in the case of relocation of Russian citizens.

It should be noted that in private explanations, specialists of the Federal Tax Service of Russia take a different position. They point out that compensation amounts for relocation costs for new employees cannot be included in labor costs, since they are not remuneration for labor (despite the fact that such payments are provided for in the employment contract). Consequently, they are not taken into account when taxing profits. Thus, the inclusion of relocation costs for new employees with whom employment contracts have been concluded as part of tax expenses may raise objections from inspectors.

Advice: there are arguments that allow organizations to take into account, when calculating income tax, the costs of relocating a new employee before concluding an employment contract with him. They are as follows.

When calculating income tax, expenses that are economically justified and documented are taken into account (clause 1 of Article 252 of the Tax Code of the Russian Federation). If an organization can prove that paying the costs of moving to the place of work of a new employee (before concluding an employment contract with him) is economically justified, it can take them into account in accordance with subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. For example, the payment of compensation can be justified by the fact that the new employee is highly qualified and his hiring is crucial for the organization's activities. Therefore, paying for his moving expenses as a condition of going to work will have a high economic return.

Worker's compensation

Article 169 of the Labor Code of the Russian Federation establishes the following mandatory compensation:

- expenses for moving the employee, members of his family and transporting property (except for cases where the employer provides the employee with appropriate means of transportation);

- expenses for settling into a new place of residence.

The accountant has no questions regarding moving expenses. But what are the costs of arrangement?

We did not find an answer to this question in regulatory documents or court decisions. In the absence of other sources, we will find out what is meant by such expenses for a federal government employee. According to subparagraph “e” of paragraph 2 of the “Rules for reimbursement of expenses associated with the relocation of a federal civil servant...” (approved by Decree of the Government of the Russian Federation of August 11, 2007 No. 514), expenses for arrangement at a new place of residence are reimbursed based on:

- for a civil servant - 2.5 monthly salary of a civil servant in accordance with the position he fills at the new place of duty;

- for a spouse - 1.5 of the specified salary of a civil servant;

- for each moving family member - 1 specified salary of a civil servant.

By the way, the amounts are considerable! As for the costs of renting living quarters for civil servants and members of his family, they are reimbursed only in the event of an involuntary delay along the route.

This example shows that the costs of arrangement are not detailed and are not reduced to the employee’s expenses for hiring a living space. Exactly how the employee uses the funds allocated to him is not the employer’s concern and the employee is not required to report on this. And he can immediately buy housing or live with relatives.

Similarly, these issues are resolved in relation to employees of the Investigative Committee of the Russian Federation (Resolution of the Government of the Russian Federation dated July 7, 2011 No. 542). Thus, the Government of the Russian Federation, as the supreme executive body, does not consider it advisable to regulate the composition of expenses for development.

note

A preliminary agreement between the employer and employee regarding the latter’s move to work in another area must be formalized in writing. At the same time, we recommend agreeing on the procedure for returning compensation payments for relocation in the event of termination of the employment contract.

Reimbursable expenses for renting residential premises are expressly stipulated in labor legislation (Article 168 and Article 168.1 of the Labor Code of the Russian Federation). For this reason, excessive detailing of development costs can lead to tax disputes. The wording of the Labor Code should not be distorted or supplemented.

Payment for relocation of a foreign employee

Situation: is it possible to pay for moving to a new place of residence for a foreign employee with whom an employment contract has been concluded? By prior agreement, the employee moves to work from abroad to the location of the organization.

Answer: yes, you can.

On the territory of Russia, labor legislation also applies to labor relations with the participation of foreign citizens (Article 11 of the Labor Code of the Russian Federation).

When transferring a foreign employee to work in another location by prior agreement, the employing organization is obliged to reimburse him for expenses related to:

- with the relocation of the employee himself, his family members, as well as the transportation of property (except for those cases when the organization provides the employee with transport);

- with settling into a new place of residence.

This procedure is provided for in Article 169 of the Labor Code of the Russian Federation.

However, the rules of Article 169 of the Labor Code of the Russian Federation apply only to situations where, at the time of the move, the employee is in an employment relationship with the same employer, by agreement with whom he is moving. That is, when hiring a new employee, including a foreigner, and compensating him for moving expenses, one cannot be guided by Article 169 of the Labor Code of the Russian Federation. This conclusion is confirmed by the Ministry of Finance of Russia in letters dated November 23, 2011 No. 03-03-06/1/773 and dated July 14, 2009 No. 03-03-06/2/140.

However, this does not mean that the organization does not have the right to establish additional compensation for employees. There is no prohibition in labor legislation to improve the situation of employees. Therefore, the organization has the right to reimburse a foreign employee hired for the costs of moving to another area (Article 41 of the Labor Code of the Russian Federation).

The taxation procedure for the payment made depends on the basis on which the employee’s relocation expenses are reimbursed.

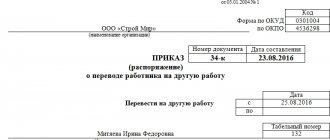

Documentation of compensation

Article 169 of the Labor Code of the Russian Federation states: in cases not established by regulatory legal acts, the procedure and amount of reimbursement of expenses when moving to work in another area for employees are determined by a collective agreement or local regulation or by agreement of the parties to the employment contract. Please note that the procedure and amount of compensation are determined, but not the composition of expenses!

Thus, it is necessary and sufficient to establish the amount of compensation for accommodation based on the amount of the employee’s salary, taking into account the moving members of his family. This approach will be fully consistent with the concept of compensation.

We emphasize: arrangement is a temporary event, the period of which is limited to several months. Under such circumstances, it is inappropriate to raise the question of long-term rental of residential premises.

On the other hand, it is not prohibited to determine the amount of compensation for the arrangement not in a fixed amount, but through the cost of renting residential premises in a new area - say, six months in advance. Then this is exactly how you need to explain yourself to the tax inspectors and under no circumstances require the employee to confirm the expenses incurred. With such a requirement, the employer violates the rights of the employee by interfering in his private life. After all, the legislator does not require a report on construction costs.

Income tax: rental housing costs

Situation: how to take into account, when calculating income tax, the costs of renting housing for employees who moved to work in another area with the organization?

When calculating income tax, the legislation provides for taking into account expenses associated with compensation for an employee’s move to work in another area, including expenses for arrangement (lifting) (subclause 5, clause 1, article 264 of the Tax Code of the Russian Federation). Expenses for renting housing are not directly provided for by the Tax Code.

At the same time, an organization can include in its labor costs any costs associated with the maintenance of employees provided for by labor (collective) agreements (Article 255 of the Tax Code of the Russian Federation). In accordance with the labor (collective) agreement, upon written application of the employee, remuneration may be made in other forms that do not contradict Russian legislation. At the same time, the share of wages paid in non-monetary form cannot exceed 20 percent of the accrued monthly amount. This is established by Article 131 of the Labor Code of the Russian Federation.

Thus, the cost of renting housing for an employee can be taken into account for profit tax purposes in an amount not exceeding 20 percent of the amount of his monthly salary. But subject to the simultaneous fulfillment of the following conditions:

- the presence of an employee’s application for the payment of part of the salary in kind;

- the presence of such a form of remuneration in the labor (collective) agreement.

The correctness of this approach is confirmed by the Ministry of Finance of Russia in letters dated October 22, 2013 No. 03-04-06/44206, dated September 30, 2013 No. 03-03-06/1/40369, etc.

It is worth noting that the stated rules do not apply to potential employees with whom an employment contract has not yet been concluded. If an organization has incurred expenses for housing during a period when the contract has not been concluded and the person is not on the organization’s staff, such expenses cannot be taken into account when taxing profits. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated September 30, 2013 No. 03-03-06/1/40369.

For more information on accounting for labor costs if an organization pays employees more than 20 percent of the accrued salary in non-monetary form, see How to record salary payments in kind.

Tip: when calculating income tax, you can take into account the entire amount of expenses for renting housing for employees. However, following this position will most likely lead to disputes with inspectors. The following arguments will help.

The full cost of renting residential premises for employees can be taken into account on one of the following grounds:

– as payments related to settling in a new place of residence (Part 1 of Article 169 of the Labor Code of the Russian Federation). When calculating income tax, such payments can be qualified as deduction amounts and taken into account as part of other expenses (subclause 5, clause 1, article 264 of the Tax Code of the Russian Federation);

– as payments related to wages. The costs of renting residential premises are associated with providing employees with working conditions. This means that such expenses are associated with the production activities of the organization. If the obligation to pay the costs of renting housing is provided for in the employment contract, they can be classified as labor costs. After all, the list of such expenses is open. This follows from Article 255 of the Tax Code of the Russian Federation. In arbitration practice, there are examples of court decisions in favor of this position (see, for example, the resolution of the Federal Antimonopoly Service of the Central District dated September 29, 2010 No. A23-5464/2009A-14-233).

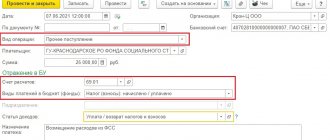

Tax accounting of compensations

In the above-mentioned letter, the Russian Ministry of Finance clarified that compensation to an employee in the form of reimbursement of his moving expenses is not subject to personal income tax taxation. The basis is paragraph 11 of paragraph 3 of Article 217 of the Tax Code of the Russian Federation. Of course, this answer suits us all.

At the same time, the Russian Ministry of Finance refused to exempt the taxpayer from paying personal income tax on amounts received to reimburse the costs of renting residential premises made by the employee in connection with the move. Formally, the officials are right, but the manager who signed the improperly executed documentation must be considered “guilty.” Why shouldn't the employer reimburse the employee for the cost of a new refrigerator for the reason that he left the old one at his mother-in-law's previous place of residence? We gave a grotesque example, but we clearly illustrated the essence of the problem. There is no doubt that personal income tax will be collected for the refrigerator, but it’s the same for paying for rent. Construction costs should be general in nature; it is dangerous to specify them.

Contrary to tradition, we will not analyze arbitration practice (judicial “roulette”!). If your tax dispute goes into court, we recommend building your defense on the above-mentioned positions: the price of renting a residential property is just a way to determine the amount of compensation for the arrangement. And the monthly payment of such compensation is nothing more than a procedure for reimbursement of expenses that falls within the competence of the parties to the employment contract.

In terms of insurance premiums, the same benefits are provided as for personal income tax. Namely, paragraph ten of subparagraph 1 of paragraph 2 of Article 422 of the Tax Code of the Russian Federation establishes: all types of compensation payments established by Russian legislation (within the limits established in accordance with the legislation of the Russian Federation) related to the performance of labor duties by an individual are not subject to insurance premiums, in including in connection with moving to work in another area.

note

The employer’s expenses for reimbursing the employee’s relocation expenses are non-productive in nature, therefore there is no reason to attribute such amounts to expenses for ordinary activities (clause 5 of PBU 10/99 “Expenses of the organization”). We propose to take them into account as part of other expenses: DEBIT 91 CREDIT 73

— compensation accrued;

DEBIT 73 CREDIT 50 (51)

- compensation paid.

If you decide to insist that for the purpose of arrangement you paid the employee for the rental of living quarters, then you also cannot avoid a dispute with the tax authorities regarding insurance premiums.

Finally, exactly the same benefit is provided for contributions for “injuries”. It is established by paragraph ten of subclause 2 of clause 1 of Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

In conclusion, we will find out how an employer can take into account compensation payments for relocation when taxing profits.

There is no doubt that such compensation is taken into account as part of income tax expenses. The fact is that compensation payments in favor of employees are mandatory, the employer cannot evade them, therefore such amounts, in principle, satisfy the criteria of paragraph 1 of Article 252 of the Tax Code. The Ministry of Finance of Russia, by letter dated May 15, 2013 No. 03-03-06/1/16789, proposes to recognize these expenses in accordance with subparagraph 4 of paragraph 1 of Article 264 of the Tax Code. However, it refers to the amounts of “paid allowances within the limits established in accordance with the legislation of the Russian Federation.” Meanwhile, the term “lifting” does not appear at all in the Labor Code of the Russian Federation.

Payments of lifting allowances are provided for, in particular, by the Federal Law of December 30, 2012 No. 283-FZ “On social guarantees for employees of certain federal executive bodies and amendments to certain legislative acts of the Russian Federation” (Clause 1, Part 3, Article 3), Federal Law of 07.11.2011 No. 306-FZ “On monetary allowances for military personnel and provision of certain payments to them” (Clause 1, Part 2, Article 3), Federal Law of 19.07.2011 No. 247-FZ “On social guarantees for employees of internal bodies affairs of the Russian Federation and amendments to certain legislative acts of the Russian Federation” (clause 1, part 3, article 3). But in relation to private companies, we did not find any official mention of lifting.

As a result, we cannot agree with the position of letter No. 03-03-06/1/16789. Our conclusion is confirmed by the wording of paragraph 37 of Article 270 of the Tax Code: when determining the tax base, expenses “in the form of amounts of allowance paid in excess of the norms established by the legislation of the Russian Federation” are not taken into account. Obviously, in a private company there will be no excess payments, since it sets compensation standards independently.

In such situations, the “universal” subclause 49 of clause 1 of Article 264 of the Tax Code comes to the rescue, with the help of which the list of other expenses associated with production and sales is made open.

However, there is another basis for classification - paragraphs 3 and 25 of Article 255 of the Tax Code of the Russian Federation. In accordance with them, payments to the employee can be included in labor costs.

Compensation for moving expenses

The materials were prepared by a group of consultants and methodologists of ACG “Intercom-Audit”

Compensation for moving to work in another area

In the practical activities of business entities, a situation often occurs when an employee is transferred to permanent work in another area. In this case, the Labor Code of the Russian Federation provides for the employee’s right to compensation for expenses associated with relocation, if this relocation is carried out by prior agreement with the employer.

According to Article 169 of the Labor Code of the Russian Federation:

“When an employee moves, by prior agreement with the employer, to work in another area, the employer is obliged to compensate the employee for:

expenses for moving the employee, members of his family and transporting property (except for cases where the employer provides the employee with appropriate means of transportation);

expenses for settling into a new place of residence.

The specific amounts of reimbursement of expenses are determined by agreement of the parties to the employment contract.”

Thus, organizations have the right to independently establish the amount of such compensation, fixing this provision in the employment contract concluded with the employee.

The employer, when reimbursing the employee for expenses associated with relocation, has the right to take such expenses into account for tax purposes, but only within the limits established in accordance with the legislation of the Russian Federation.

Note that today such standards are established only for organizations financed from the budget. We are talking about Decree of the Government of the Russian Federation of April 2, 2003 No. 187 “On the amount of compensation by organizations financed from the federal budget for expenses of employees in connection with their move to another area” (hereinafter referred to as Decree No. 187).

There are no such rules for commercial organizations yet. However, according to the authors of this book, if organizations that are not financed from the budget are not ready to defend their opinion in court, they should also be guided by the norms of the specified document (before the approval of the relevant norms), since Chapter 25 of the Tax Code of the Russian Federation limits these expenses for tax purposes exclusively for all organizations that pay income tax (Letter of the Ministry of Finance of the Russian Federation dated March 14, 2006 No. 03-03-04/2/72).

Note!

On the issue of reimbursement of expenses to employees in connection with moving to work in another locality by the General Prosecutor's Office of the Russian Federation in Letter dated August 6, 2004 No. 10/4-2113-04 “On reimbursement of expenses to employees in connection with moving to another locality” for information and use In the work, the Letter of the Ministry of Labor of the Russian Federation dated June 25, 2004 No. 581-10 was sent. According to the explanation, Resolution of the USSR Council of Ministers of July 15, 1981 No. 677 “On guarantees and compensation when moving to work in another area” has not yet been officially recognized as invalid and, by virtue of Article 423 of the Labor Code of the Russian Federation, can be applied on the territory of the Russian Federation in part, not contradicting the Labor Code of the Russian Federation. At the same time, an analysis of the text of this Resolution shows that a significant part of its provisions are reproduced in Resolution No. 187 and are not actually applied.

Please note that what should be understood as an employee moving to another area is explained in paragraph 1 of Resolution No. 187, which explicitly states that this is a move to another locality according to the existing administrative-territorial division.

The procedure and amounts for reimbursement of travel expenses, payment of daily allowances and expenses for settling into a new location are established by paragraph 1 of Resolution No. 187. If it is not initially possible to accurately determine the amount of compensation, the employer has the right to give the employee an advance amount.

Resolution No. 187 established:

- Relocation expenses for the employee and his family members are reimbursed in the amount of actual expenses, but not higher than the cost of travel:

– by rail – in a compartment carriage of a fast branded train;

– by water transport – in the cabin of a group V sea vessel of regular transport lines and lines with comprehensive passenger services, in the cabin of category II of a river vessel of all lines of communication, in the cabin of category I of a ferry vessel;

– by air – in the economy class cabin;

– by road – in public vehicles (except taxis).

If the employee does not have supporting documents for travel, then expenses are reimbursed at the cost of travel:

– by rail – in a reserved seat carriage of a passenger train;

– by water transport – in the cabin of the X group of a sea vessel of regular transport lines and lines with comprehensive passenger services, in the cabin of the III category of a river vessel of all lines of communication;

– by road – in a public bus.

- Costs for transporting property by rail, water and road transport (public) in the amount of up to 500 kg per employee and up to 150 kg for each moving member of his family are reimbursed in the amount of actual expenses, but not higher than the tariffs provided for the transportation of goods by rail. If the property was transported by other transport, then the costs are reimbursed at the price of transporting the property by air from the nearest railway station to the place of work or from the nearest sea or river port open for navigation at a given time.

- The costs of settling an employee at a new place of residence are reimbursed in the amount of his monthly official salary (monthly tariff rate) at the new place of work, and for each moving family member - in the amount of 1/4 of the official salary (monthly tariff rate) at the employee’s new place of work.

- For each day an employee is on the way to a new place of work, he is paid a daily allowance in the amount of 100 rubles.

Note!

Organizations located in the regions of the Far North or equivalent areas are obliged to pay workers who arrived from other regions of the Russian Federation with whom they entered into an employment contract compensation in the amount of the cost of travel for the employee and members of his family within the Russian Federation for actual expenses, as well as payment luggage transportation (not more than 5 tons per family) at actual costs, but not more than the tariffs provided for transportation by rail (subclause 12.1. Article 255 of the Tax Code of the Russian Federation).

All expenses for payment of compensation are borne by the enterprise, institution or organization to which the employee is transferred, sent or accepted.

Note that Resolution No. 187 obliges the employee to fully return the funds paid to him in connection with moving to work in another area in the event of:

– if he did not start work on time without a good reason;

- if, before the end of the work period specified in the employment contract, and in the absence of a specified period, before the expiration of 1 year of work, he resigned of his own free will without a good reason or was dismissed for guilty actions, which, in accordance with the law, were the basis for termination of the employment contract.

An employee who does not show up for work or refuses to start work for a valid reason shall return the funds paid to him minus the expenses incurred for moving him and his family members, as well as for transporting property.

Note!

Paragraph 7 of Resolution No. 187 states that it does not apply to categories of workers for whom, in accordance with the legislation of the Russian Federation, other amounts of reimbursement of expenses are provided for when moving to work in another area.

It should be noted that this category of workers includes employees of organizations in the Far North and equivalent areas. In this case, the amount of compensation is established in accordance with the requirements of the Law of the Russian Federation of February 19, 1993 No. 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas.”

According to Article 340 of the Labor Code of the Russian Federation, compensation in connection with relocation to the place of work is paid to employees sent to work in representative offices of the Russian Federation abroad. Decree of the Government of the Russian Federation of December 20, 2002 No. 911 “On guarantees and compensation for employees sent to work in representative offices of the Russian Federation abroad” established the rules for the provision of such compensation. In addition, on the issue related to the provision of guarantees and compensation to employees sent to work in representative offices of the Russian Federation abroad, it is necessary to be guided by the Decree of the Government of the Russian Federation of July 10, 1999 No. 788 “On the procedure for calculating and paying the salaries of federal civil servants replacing government positions of the federal public service in representative offices of the Russian Federation, representative offices of federal executive bodies and representative offices of state bodies under federal executive bodies abroad, in diplomatic missions and consular offices of the Russian Federation", by Decree of the Government of the Russian Federation of March 24, 2007 No. 176 "On payment labor of employees of federal state bodies holding positions that are not positions of the federal state civil service", Decree of the Government of the Russian Federation of October 16, 2000 No. 788 "On the procedure for calculating and paying tariff rates (salaries) in rubles to employees of representative offices of the Russian Federation, representative offices of federal bodies executive power and representative offices of state bodies under federal executive bodies abroad, diplomatic missions and consular offices of the Russian Federation.”

Please note that in Chapter 25 of the Tax Code of the Russian Federation this type of compensation is called “lifting” (subparagraph 5 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, paragraph 37 of Article 270 of the Tax Code of the Russian Federation).

In accounting, the organization's expenses for paying allowances when an employee moves to another area, in our opinion, should be classified as expenses associated with the selection of personnel. Therefore, in accordance with PBU 10/99, they represent expenses for ordinary activities. Costs for the payment of allowances are recognized in accounting in full in the reporting period when they are incurred. We remind you that in order to recognize an expense in accounting, it is necessary that all the conditions established by paragraph 16 of PBU 10/99 are met.

The instructions for the application of the Chart of Accounts approved by Order No. 94n establish that to reflect expenses for ordinary activities, production cost accounts are provided (for example, 20 “Main production”, 25 “General production expenses”, 26 “General business expenses”, 44 "Sales expenses").

To reflect transactions with settlements with employees of the organization other than wages, Order No. 94n provides account 73 “Settlements with personnel for other transactions.” The accrual of the lifting amount will be reflected in the credit of account 73 “Settlements with personnel for other operations” in correspondence with the debit of the production cost accounts. Payment of the allowance amount will be reflected in the debit of account 73 “Settlements with personnel for other operations” in correspondence with account 50 “Cash”.

In tax accounting, the taxpayer's expenses for paying allowances when an employee moves to another area are included in other expenses associated with production and sales (subclause 5 of clause 1 of Article 264 of the Tax Code of the Russian Federation). Moreover, as we noted above, as an expense taken into account for taxation, the income tax payer can only take into account the amount of allowances within the limits established by Resolution No. 187.

The date of recognition of expenses in accordance with subparagraph 4 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation for taxpayers using the accrual method is the date of transfer of funds from the current account (payment from the cash desk).

The amount of excess allowances is not taken into account by the taxpayer when calculating the tax base for income tax. This follows from paragraph 37 of Article 270 of the Tax Code of the Russian Federation.

Due to the fact that the amount of paid allowances in accounting is accepted as an expense in full, but in tax accounting – only within the limits of the norms, the taxpayer will have a permanent difference. Consequently, the accountant must apply PBU 18/02 and record the amount of the permanent tax liability.

Let's look at an example.

Example 1.

Let’s assume that a production organization (Omsk city) hired an out-of-town specialist (Novokuznetsk city) with a salary of 35,000 rubles.

The employment contract stipulates that the employer reimburses the employee for all expenses associated with moving to the city of Omsk, namely:

- travel expenses for the employee and his family members (actually amounted to 15,000 rubles);

- expenses for transporting property (actually amounted to 7,000 rubles);

- arrangement costs in the amount of 1.5 monthly salary - 52,500 rubles;

- daily allowance – 100 rubles (one day of travel).

Since it was not immediately possible to determine the exact amount of compensation, the accountant of the production organization gave the employee an advance in the amount of 25,000 rubles.

Let’s assume that the employee’s travel expenses exceeded the norm established by Resolution No. 187 by 2,000 rubles (the figures are taken tentatively).

This is reflected in the organization's accounting as follows.

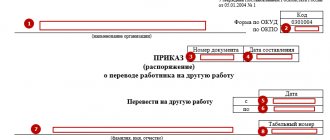

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 73 | 50 | 25 000 | An advance was issued to the employee for moving to a new place of work |

| 26 | 73 | 74 600 | The actual amount of moving expenses is reflected (15,000 + 7000 + 52,500 + 100) |

| 99-2 | 68-1 | 480 | A permanent tax liability is reflected in terms of excess travel expenses (2,000 × 24%) |

| 73 | 50 | 49 600 | The remaining amount of compensation to the employee was issued |

End of the example.

Regarding taxation, we note that the payment of allowances to an employee is not subject to personal income tax and unified social tax, since it is in the nature of compensation payments. This is indicated in the Letter of the Ministry of Finance of the Russian Federation dated February 20, 2006 No. 03-03-04/1/130, in which employees of the financial department provided clarification on the issue of taxation of payments made to an employee when moving to another area. Let us briefly summarize the essence of the answer.

Article 169 of the Labor Code of the Russian Federation determines that when an employee moves, by prior agreement with the employer, to work in another area, the employer is obliged to reimburse the employee: expenses for moving the employee, his family members and transporting property; expenses for settling into a new place of residence. These payments are so-called allowances, the amount of which is determined by agreement of the parties to the employment contract.

At the same time, based on the provisions of Article 264 and Article 270 of the Tax Code of the Russian Federation, expenses for the payment of allowances are recognized by the employer for profit tax purposes, but only within the limits established by the legislation of the Russian Federation. The sizes of lifts for employees of organizations financed from the federal budget are established in Resolution No. 187. In the absence of similar regulations for other organizations, when determining the size of allowances for their employees, they should also be guided by the above-mentioned Resolution of the Government of the Russian Federation.

At the same time, employers should keep in mind that lifting benefits are in the nature of compensation payments, and, therefore, in accordance with paragraph 3 of Article 217 and paragraph 1 of Article 238 of the Tax Code of the Russian Federation, they are not subject to personal income tax and unified social tax.

Note!

Chapter 23 “Income Tax for Individuals” of the Tax Code of the Russian Federation provides that the amounts of allowances within the limits of the norms are withdrawn from taxation for an individual. No such norms have been established with regard to this tax, therefore, an individual’s personal income tax should also not be withheld from the excess amount. Unified social tax is not accrued on amounts of excess lifting allowances on the basis of paragraph 3 of Article 236 of the Tax Code of the Russian Federation.

You can find out more details regarding

Published on Audit-it.ru: October 30, 2007

If you find an error, please select a piece of text and press Ctrl+Enter.

…OR TERMINATION OF EMPLOYMENT RELATIONS

If the employee does not agree to be transferred to another location together with the employer, then for this case the labor legislation provides for a special basis for dismissal.

Labor relations are terminated in accordance with the general procedure provided for in Art. 841 Labor Code of the Russian Federation. The peculiarity of termination of an employment contract on this basis is the execution of documents preceding the issuance of a dismissal order.

Thus, the employer, according to the scheme provided above, notifies the employee about the move and offers him a transfer to another location together with the employer. It is advisable to document the employee’s refusal to accept such a transfer.

In order to save money, our organization is moving to another area - from Moscow to the Tver region, where production sites are located. The move is planned for the summer, when the traditional downturn in the market is expected and it will be possible to devote several weeks to matters related to such a move without affecting production. As usual, the main problem is not how to transport equipment, sell an office in the city and purchase office space in another area. The main difficulties await us when deciding which employees will be willing to travel to work in another area or change their place of residence due to this. There are quite a lot of people who are dissatisfied with the situation and who do not agree to move, so we will formalize dismissals. How should employees currently refuse to be transferred to another location be formalized together with the employer, so that there are no problems later?

Indeed, in order to avoid conflict situations, it is advisable to record in writing the refusal of an employee to continue working in your organization moving to another location. How to do it? The law says nothing on this matter, but in practice there are several options for formalizing such a refusal.

Firstly, an employee can express his disagreement with a transfer to another location already on the notice (offer) of the transfer, indicating, for example: “I do not agree to be transferred to another location with the employer,” and then putting his personal signature and date.

Or, if some time has already passed since the receipt of the notice (offer) of transfer, the employee can contact the employer with a written statement indicating that he refuses to be transferred to another location. Remember that the employee is not required to explain the reasons for making such a decision.

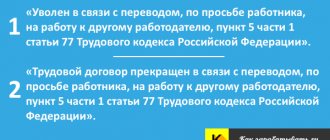

Next, the employer issues an order to dismiss the employee on the grounds provided for in paragraph 9 of Part 1 of Art. 77 of the Labor Code of the Russian Federation, in connection with the employee’s refusal to be transferred to work in another location together with the employer. To formalize dismissal, commercial organizations have been using their own order forms since January 1, 2013. Based on the order, a dismissal entry is made in the employee’s work book (Appendix 3).

Please note: in addition to all amounts of money due to the employee in connection with dismissal (unreceived wages, compensation for unused vacation), the employee must be paid severance pay in the amount of two weeks' average earnings (Article 178 of the Labor Code of the Russian Federation).

By the way

| It should be noted that moves to another area can have a so-called targeted nature, i.e. be specially provided for certain categories of citizens, among whom the unemployed should first of all be distinguished as persons without work (earnings), looking for work and registered in in accordance with the established procedure at the employment agency. Thus, the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population in the Russian Federation” provides for standards that help laid-off workers, as well as first-time job seekers, other categories of unemployed people in finding work, and employers in selecting the necessary personnel . The employment authorities' search for work for the unemployed is related to the location of a suitable job, which cannot be considered as such if it is associated with a change of residence without the consent of the citizen. If work in another region turns out to be suitable for him, then the employment service agency may (is obliged) at the request of the applying citizen, find such a job and, upon receipt of consent, pay him compensation associated with moving to another area. The Law on Employment in 2011 was supplemented by a special norm (Article 22.1) on assistance to unemployed citizens in moving to another area for employment upon the direction of the employment service authorities. Thus, when unemployed citizens move to another area for employment, at the direction of the employment service authorities, they are provided with financial support, including: • payment of the cost of travel to and from the place of work, with the exception of cases when the employee’s move is carried out at the expense of the employer;

The provision of these compensations is carried out on the basis of an application from an unemployed person who has agreed to move to another area, as well as an agreement concluded between him and the relevant employment agency. A private type of relocation to work in another area can be considered the employment of graduates of higher educational institutions in accordance with a contract concluded between a graduate student and an employer on the basis of Decree of the Government of the Russian Federation of September 19, 1995 No. 942 “On targeted contract training of specialists with higher and secondary specialized education "(hereinafter referred to as Resolution No. 942). Such training is carried out from among those studying at the expense of the federal budget and the budgets of the constituent entities of the Russian Federation, and in the event of a graduate moving outside his permanent place of residence, appropriate compensation is provided to reimburse the costs of the move. Currently, the Federal program “Social development of rural areas until 2013”, developed to ensure the influx of young specialists in the field of healthcare to work in rural areas, is of particular relevance, according to which a young specialist who has agreed to move to a rural area acquires the right to receive a one-time payment of 1 million rubles. At the same time, he will be required to work in the appropriate locality located in a rural area for 5 years. |