What employer expenses are reimbursed by the Social Insurance Fund?

In 2022, employers continue to pay, with subsequent reimbursement from the fund:

- Part of the disability benefit financed by interbudgetary transfers from the federal budget;

- Average earnings for four additional days off per month to care for disabled children;

- Funeral benefit (or reimbursement of the cost of funeral services provided according to a guaranteed list by a specialized service);

- Funds for preventive measures to reduce industrial injuries and occupational diseases of workers.

We will not touch on the last type of expense in this article - you can read about it in the article “How to reimburse expenses for injury prevention from the Social Insurance Fund.” Next, we will talk about the first three types of reimbursable expenses.

Work with electronic sick leave according to the new rules in Externa

Disability benefits through interbudgetary transfers

In most cases, sickness benefit consists of two parts:

- for the first 3 days it is paid by the employer from his own funds;

- all the following days are paid directly by the FSS from its budget.

But there is another source of financing - interbudgetary transfers from the federal budget. From these funds, additional expenses for the payment of part of the hospital benefits in an increased amount are reimbursed (Article 3 of the Federal Law of December 29, 2006 No. 255-FZ, Article 4 of the Federal Law of December 6, 2021 No. 393-FZ). Next, we will explain what is meant by these expenses and how to reimburse them.

Standard manual

The procedure for calculating sick leave benefits is defined in paragraph 1 of Art. 7 of Federal Law No. 255-FZ.

The standard benefit is 60%, 80% or 100% of average earnings for each day of illness. Exactly what percentage should be taken for calculation depends on the employee’s insurance experience. If, in terms of a full month, the benefit turns out to be below the minimum wage, it must be calculated based on the minimum wage.

Calculate disability benefits automatically and without errors

Increased benefit

Sometimes sickness benefits are calculated at a higher interest rate than is required based on the length of the insurance period. As a result, the payment amount is greater than the standard one. This procedure applies in the following cases:

- The employee is covered by benefits for “Chernobyl victims” (persons exposed to radiation as a result of accidents at the Chernobyl nuclear power plant and at the Mayak production association, nuclear tests at the Semipalatinsk test site, discharges of radioactive waste into the Techa River). A rate of 100% is applied (law of May 15, 1991 No. 1244-1 and others).

- Military or other service (in internal affairs bodies, fire service, etc.) during which the person was not insured is counted toward the length of service for calculating benefits. The rate is applied depending on the total length of service, that is, the non-insurance period is added to the insurance period (clause 4 of article 3, clause 1.1 of article 16 of Federal Law No. 255-FZ).

In these cases, there is an excess of the benefit amount over the standard one, that is, determined according to the rules of paragraph 1 of Art. 7 of Federal Law No. 255-FZ. It is this excess that constitutes the employer’s additional expenses for the payment of sick leave benefits and is financed from the federal budget. This difference (for the first 3 days of illness) must be reimbursed to the employer from the Social Insurance Fund.

Example. Smirnov’s average daily earnings for calculating sick leave benefits are 1,600 rubles, his insurance experience is 4.5 years. Previously, he completed military conscription for one year (completed in 2015). The period of military service must be taken into account when calculating sick leave.

Based purely on the insurance record, Smirnov would need to be paid for the first 3 days of illness: 1600 × 60% × 3 = 2,880 rubles. But taking into account the service, the employee’s length of service is 5.5 years, and the benefit is 80% of average earnings: 1600 × 80% × 3 = 3,840 rubles.

The difference in amount turns out to be: 3,840 − 2,880 = 960 rubles. These are the employer’s additional expenses for sick leave, which the FSS must reimburse him.

There is another case when sick leave is paid at an increased rate: caring for a sick child under 8 years of age. The benefit is calculated based on 100% of average earnings, regardless of length of service (clause 1, clause 3, article 7 of law No. 255-FZ). But the Social Insurance Fund pays it from the first day of sick leave, and not from the third, as usual. Therefore, the employer does not apply for compensation.

Documents for reimbursement

To receive compensation for additional expenses, you need to send the following documents to the territorial office of the Fund:

- application for compensation in the form from Appendix No. 5 to the FSS order No. 26 dated 02/04/2021;

- documents and information necessary for calculating sick leave benefits in the general case.

The deadline for referral is no later than five working days after receiving the employee’s application for payment of benefits. If the employer interacts with the Fund under the TKS, it sends electronic registers of documents. Otherwise, documents are submitted on paper with an inventory (Appendix No. 3 to the FSS order No. 26 dated 02/04/2021).

To check the legality and correctness of the accrual of hospital benefits in an increased amount, the Social Insurance Fund may request:

- information about the insured person;

- certificate of incapacity for work in paper form;

- documents on the basis of which the increased benefit was assigned, including confirmation of non-insurance periods;

- benefit calculation;

- personal account (payslips) of the employee;

- work book or employment contract;

- form STD-R or STD-PFR after January 1, 2022, if the employee switched to an electronic work book;

- documents confirming expenses for payment of benefits;

- salary certificate in form No. 182n.

What documents must be submitted for reimbursement?

Order of the Ministry of Health and Social Development No. 951n dated December 4, 2009 established what documents are needed for compensation from the Social Insurance Fund for sick leave in 2020; the application form is contained in the Letter of the Social Insurance Fund of the Russian Federation No. 02-09-11/04-03-27029 dated December 7, 2016. We remind you that a new list of documents applies for payments from 01/01/2017.

| Period until December 31, 2016 | Period after 01/01/2017 |

| Policyholder's application calculation in form 4-FSS for the period confirming the accrual of expenses for the payment of insurance coverage | Statement, certificate-calculation, breakdown of expenses, supporting documents (required for policyholders who apply tariffs of 0 percent (Article 427 of the Tax Code of the Russian Federation)), power of attorney (if necessary) |

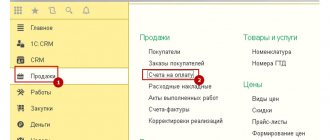

In general, step-by-step instructions for reimbursing sick leave from the Social Insurance Fund in 2022 are as follows:

Step 1. Complete an application according to the form from the Letter of the Federal Social Insurance Fund of the Russian Federation No. 02-09-11/04-03-27029 dated 12/07/2016;

| To the head _____________________________________________ (position of the head (deputy head) of the body monitoring the payment of insurance premiums, full name) Application for the allocation of necessary funds to pay insurance coverage Insured Limited Liability Company "Clubtk.ru" __________________________________________________________________________________________________________ (full name of the organization (separate division), last name, first name, patronymic (if any) of an individual entrepreneur, individual) registration number with the insurance premium control authority

in accordance with Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, requests the allocation of funds for the payment of insurance coverage in the amount of 5178 (five thousand one hundred seventy-eight) rubles . by transferring funds to the policyholder's account

BIC 0987654 OKTMO 1234567 Personal account number* ___________________________ ___________________________________________________________________________________________ (name of financial authority) __________________________ *filled out by an organization that has a personal account with the Federal Treasury

(812)7121212 (position of manager (signature) (full name) (contact phone number) organization (separate division))

(contact number) Print location (if available) policyholder | ||||||||||||||||||||||||||||||||

| Legal or authorized representative of the policyholder | Voronov | Voronov A.V. | ||||||||||||||||||||||||||||||

| (signature) | (FULL NAME.) | (date of) | ||||||||||||||||||||||||||||||

Name and details of the identification document of the representative of the policyholder_____

Document confirming the authority of the policyholder's representative_______________________________________________________________________________

_______________________________________________________________________________________

Certificate of calculation submitted when applying for the allocation of funds for the payment of insurance coverage (Appendix 1 to the Application for the allocation of the necessary funds for the payment of insurance coverage) and Explanation of expenses for the purposes of compulsory social insurance and expenses carried out through interbudgetary transfers from the federal budget (Appendix 2 to the Application for the allocation of the necessary funds for the payment of insurance coverage) are submitted by the policyholder

_______________________ _________________________________________ __________________________

(signature) (full name) (date)

To be filled in by the head of the organization (separate division)

To be completed if there is a chief accountant

Step 2. Fill out a calculation certificate for reimbursement of benefits to the Social Insurance Fund in 2020;

Step 3. Attach a breakdown of expenses;

Step 4. Create a package of documents according to clause 3 of Order No. 951n;

Step 5. Send the papers to the territorial office of the Social Insurance Fund where the policyholder is registered. The method of sending must confirm the date of sending the application (registered letter with notification, by hand, via TKS);

Step 6. Wait for the decision to be made.

Submitting an application is impossible without submitting a certificate of calculation. Use the following step-by-step instructions on how to fill out a calculation certificate for reimbursement of benefits from the Social Insurance Fund:

Step 1. In lines 1, 21, 10, 11, write down the amount of debt of the policyholder and insurer for insurance premiums at the beginning and end of the reporting period;

Step 2. Fill in lines 2–5 with the amount of accrued insurance premiums, broken down by the last 3 months;

Step 3. Indicate additional accrued insurance premiums in line 6;

Step 4. Include in line 7 the amount of expenses not accepted for offset, if any;

Step 5. Write in line 8 the amount of funds received from the Fund to reimburse expenses incurred;

Step 6. In line 9, indicate the amount of returned (credited) overpaid (collected) insurance premiums;

Step 7. Lines 12–15: we write down how much money was spent on OSS purposes, broken down over the last three months;

Step 8. Lines 16–19: reflect the insurance premiums paid, broken down for the last three months;

Step 9. In line 20, we record the amount of the policyholder’s debt written off.

According to current regulations, in order to reimburse expenses for temporary disability benefits paid to employees, the following documents must be submitted to the territorial body of the Social Insurance Fund:

- statement;

- reference-calculation;

- breakdown of expenses;

- certificate of incapacity for work (mandatory for policyholders applying a zero tariff, for others - optional).

According to the Order of the Ministry of Health and Social Development, the documents for reimbursement of maternity benefits in the Social Insurance Fund in 2022 are similar to the package of documents for sick leave (clause 3 of Order No. 951n).

Payment for additional days off to care for disabled children

The Labor Code guarantees the parent of a disabled child four additional days off every month. They can be used by the mother or father, or the parents can divide these days between themselves.

For each such day off, the employee must be paid average earnings. These funds are reimbursed to the employer by the Social Insurance Fund in the manner approved by Decree of the Government of the Russian Federation dated 08/09/2021 No. 1320.

To reimburse expenses incurred, the following documents must be submitted to the Social Insurance Fund:

- Application for compensation in the form from Appendix No. 10 to the FSS order No. 26 dated 02/04/2021. In 2022, a new application form should be introduced (the order has already been prepared and is going through the registration stage);

- A copy of the order to provide additional days off to care for disabled children, certified by the employer.

Resolution No. 1032 contains only a statement and an order. But to confirm the right to additional vacation days and the correct calculation of benefits, the Fund may request other documents:

- A copy of the disability certificate issued by the Bureau of Medical and Social Expertise;

- Documents confirming the place of residence of a disabled child;

- A copy of the birth certificate;

- A certificate from the second parent’s place of work stating that in the same month the employer did not provide him with preferential days off (or provided him partially);

- Documents that will confirm that the payment was made legally and in the correct amount: calculation of payment for additional days off;

- employee's personal account (payslips);

- work book or employment contract;

- if the work book is kept in electronic form - STD-R or STD-PFR for the period from 01/01/2020;

- documents confirming the fact of payment.

The Fund will consider the application within 10 working days from the date of receipt of the documents. If a positive decision is made, the money will be credited to the account no later than two business days from the date the fund makes the decision.

Required documents

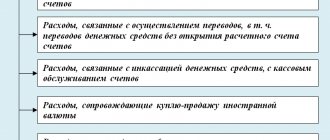

The figure below shows a list of documents that the employer must prepare and submit to the fund:

Additional documents include documents confirming the correctness of the calculation of benefits and the validity of their payment depending on the type of benefit: certificates of incapacity for work, birth certificates of children, certificates of registration of pregnant women in medical institutions, certificates, calculations, etc. Certified copies of documents or their originals (upon request during verification by fund specialists).

Funeral expenses

The state provides little financial support to a citizen who has taken on the responsibility of burying a deceased person (Federal Law No. 8-FZ of January 12, 1996). And in two cases this support is provided through the employer:

- if an employee died (on the day of death an employment contract was in force with him);

- if the employee’s minor family member has died.

Typically, assistance is provided to the relatives of the deceased, since they are the ones who take on funeral responsibilities. But the payment can also be made to another person - relationship does not play a role in this matter. The main thing is that the person took upon himself the responsibility to bury the deceased.

Assistance is provided in one of the ways the citizen chooses:

- in the form of a social benefit for burial (Article of the Federal Law of January 12, 1996 No. 8-FZ). The amount of the federal benefit in 2022 is 6964.68 rubles;

- in the form of a guaranteed list of funeral services - in the same amount as social benefits (Article of the Federal Law of January 12, 1996 No. 8-FZ).

Reimbursement of expenses for funeral benefits

The employer is obliged to pay benefits on the day of application. To do this, the citizen writes an application in free form, and also provides a copy of his passport and the original death certificate from the registry office.

To return the benefit amount through the Social Insurance Fund, you need to submit to the territorial body:

- application for reimbursement of expenses in the form from Appendix No. 9 to the order of the Social Insurance Fund dated 02/04/2021 No. 26.

- death certificate received from the person to whom the benefit was issued.

The Foundation may also check other documents:

- confirming payment of benefits;

- confirming the employment relationship - an employment contract, work book, form STD-R or STD-PFR, order of dismissal due to death.

- a copy of the death certificate.

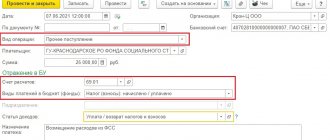

Features of reimbursement of expenses in the Social Insurance Fund in 2020

Since 2022, the payment of insurance premiums in case of temporary disability and maternity has come under the control of the tax inspectorate. The information specified in the “Calculation of Insurance Premiums” is transferred by the Federal Tax Service to the Social Insurance Fund, which verifies the data received and, based on the documents received from the policyholder, makes compensation.

Only deductions for “injuries” (from accidents and occupational diseases), which should be displayed in the Calculation according to Form 4-FSS, remained completely under Social Insurance.

The form of the application that the employer must submit to the Social Insurance Fund will depend on exactly when the overpayment occurred:

- until January 1, 2022 - the application is drawn up in Form 23-FSS, approved by Order of the FSS of the Russian Federation dated November 17, 2016 No. 457;

- after January 1, 2022 - the application is drawn up in the form recommended for use by the FSS letter dated December 7, 2016 No. 02-09-11/04-03-27029.

Documents for reimbursement of expenses to the Social Insurance Fund in 2022 can be submitted in person to the Social Insurance Fund branch where the organization or individual entrepreneur is registered. You can also provide them via email and through the State Services website.

Compensation for the cost of a guaranteed list of services to a specialized service

Instead of benefits, a relative of the deceased can receive state-guaranteed burial services. In this case, an amount equal to the benefit will not be received by him, but by the specialized funeral service that provided these services. The employer in this scheme participates in the role of an intermediary. The order is:

- The funeral service submits to the deceased's employer an application for reimbursement of expenses (Appendix No. 11 to the FSS order No. 26 dated 02/04/2021), a death certificate from the registry office and an invoice for payment of the compensation amount;

- The employer sends them to the Social Insurance Fund within 2 working days from the date of receipt of the documents;

- The fund reviews the documents and makes a decision on compensation for funeral services no later than 5 working days. The FSS must transfer funds to the funeral service account within 2 business days.

The Fund can check whether the deceased (a relative of a deceased minor) and the employer actually had an employment relationship.

How does the Social Insurance Fund reimburse expenses?

Reimbursement of expenses of any kind, with the exception of compensation to the funeral service for guaranteed services, is made according to the following scheme:

- The employer sends documents to the Social Insurance Fund;

- The Fund reviews them and makes a decision within no more than 10 working days from the date of receipt;

- If a decision on compensation is made, the Social Insurance Fund transfers the funds to the employer’s current account within no more than two working days from the date of the decision.

Note! The Fund is changing some of the documents used to reimburse policyholders. The corresponding Order is being registered with the Ministry of Justice. Among other things, the application for payment of additional days off to care for disabled children will change. The new form should come into force in 2022.

The new order does not provide for updating applications for reimbursement of disability benefits from the federal budget and for funeral expenses, as well as for reimbursement of the cost of guaranteed services of a funeral organization. It is likely that, as before, the forms approved by Order No. 26 will be used. But it cannot be ruled out that the FSS will approve their new forms separately.

Need for social insurance reimbursement

The employer has the right to reduce the amount of contributions to the budget by the amount of accrued benefits. When expenses exceed deductions, a budget debt arises to the enterprise. The employer applies to the Social Insurance Fund for compensation of funds paid for insured events if an overpayment occurs. The excess of payments over contributions accrued based on employee income is covered by the Social Insurance Fund.

Example for determining the amount of reimbursement of expenses

Enterprise IP Novikov M.M. has a staff of hired workers, pays remuneration for labor, and pays insurance premiums. In the second quarter of 2022, the individual entrepreneur accrued the amount of wages to employees in the amount of 1,390,000 rubles, the amount of deductions for which to OSS amounted to 40,310 rubles. IP Novikov M.M. in the 2nd quarter, he made payments for social insurance expenses in the amount of 55,000 to pay for leave under the BiR, disability benefits in the amount of 79,000 rubles (including the amount of payment at the expense of the enterprise in the amount of 3,000 rubles).

Based on the results of the quarter, the individual entrepreneur made a calculation: (click to expand)

- Determined the amount of expenses incurred at the expense of the Social Insurance Fund: C = 55,000 + (79,000 – 3,000) = 131,000 rubles.

- I calculated the amount due for reimbursement from the Social Insurance Fund: C2 = 40,310 – 131,000 = (90,690) rubles.

Reimbursement of expenses is made upon the application of the employer accompanied by documents confirming payments.