In general, during employment, the employer does not have the right to demand from a new employee more documents than are prescribed in the Labor Code (Article 65). An exception is cases when special documents are required for registration: a certificate of absence of disqualification, a diploma of education, a certificate or certificate of qualifications, a certificate of health.

In particular, when applying for employment, minor applicants undergo a mandatory medical examination. The Labor Code provides similar conditions for catering workers associated with traffic and engaged in hazardous work. The Code says that requirements for a preliminary or periodic medical commission may be specified in other regulations. For example, for teaching staff they are provided for by the Law on Education No. 273 Federal Law (clause 9, clause 1, article 48).

Need for a medical examination

It should be noted that not only profession and position determine the need for a health check, but also other factors:

- Difficulty of work (physical activity, static posture).

- Presence of harmful and (or) hazardous production factors:

- biological (allergens, dust, toxins, poisons);

- chemical (pesticides, acids, gases);

- physical (radiation, electromagnetic field, vibration).

- Difficult conditions (altitude, difficult climatic conditions, especially responsible work: rescuers, firefighters, crane operators, when the presence of health problems can adversely affect the life and health of other people).

Important! More detailed information is in the List approved by Order No. 302n dated April 12, 2011 (hereinafter referred to as the List).

A special assessment of working conditions (SWA) identifies harmful factors and determines which workers will have to undergo regular medical examinations.

If your organization has recently been registered and jobs have just been created, then you have a year to conduct an SOUT. However, you shouldn’t wait that long, because the employer’s obligations and the right to benefits arise by law upon employment or performance of relevant work, and not after receiving special assessment data.

How an ordinary job can become harmful

If you think that there are no harmful factors in the office, this is a mistake. The List contains subclause 3.2.2.4., which calls working with a PC more than 50% of the working time a harmful factor.

Office workers spend most of their time at the computer: managers, accountants, especially programmers and system administrators. In 2022, the Ministry of Labor was going to make changes to the List and exclude the item on computers from the list, because machines are being improved and now their effect on vision is not the same as before.

This is just a draft for now, so the rule remains in effect until changes are made. However, officials believe that the results of the SOUT also need to be taken into account. If working conditions for a specific workplace (several similar places) are considered acceptable or optimal, then medical examinations may not be carried out, because it turns out that there is no harmful influence.

True, their opinions further diverge: should we recognize as safe all such workplaces in general or only those where working time on a computer takes up less than 50%. Judicial practice in this sense is also contradictory. To avoid disputes, it is still recommended to conduct medical examinations.

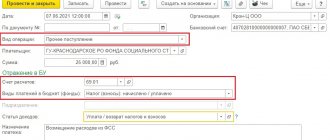

Payments from the Social Insurance Fund

The main subsidies paid from the Social Insurance Fund are the following payments:

- temporary disability benefits, postings will be presented below;

- for pregnancy and childbirth;

- in connection with registration in the early stages of pregnancy;

- at the birth of a child;

- caring for a child up to one and a half years old;

- when adopting a child;

- caring for a sick child or other family member;

- additional days off to care for disabled children;

- upon receipt of a work injury;

- at burial.

In another article, we provided a detailed breakdown of the list of such payments and methods for calculating them.

For an interview with a certificate

Procedure if a candidate comes to you for a job and needs to undergo a preliminary medical examination:

- Specify the applicant's intended position.

- Check internal documents and lists of workplaces with mandatory medical examinations; if they are missing, you will have to check the List.

- Issue a referral for a medical examination. It indicates the exact name of the position, with the group, category, rank. You will also need a link to the List item - it is necessary to clarify which factors are present in the work. The composition of the medical commission depends on this.

- The candidate goes through a commission, and if the company does not have a concluded agreement with a specific medical institution, then the employee himself chooses the place and provides the result to the potential employer.

Note! It is difficult for a non-specialist to determine the presence of harmful or dangerous factors. An accountant or HR officer should contact the person responsible for occupational health and safety (in a small organization this may be a manager who has undergone appropriate training) for clarification and instructions on whether to require a certificate from the employee or not.

If the examination was successful and there are no contraindications, then you can register the employee. More details in the article at the link.

Sending employees for medical examination

the Medical examinations workplace on the Employees by selecting the required employees and clicking on the Generate referrals :

In the form that opens, you need to indicate information about the planned medical examination and click on the Generate or Generate and print :

As a result, a Direction for each employee:

The directions can be printed:

Hiring expenses

The costs of medical examination of candidates are taken into account in accounting as normal expenses for core activities, in the corresponding accounting accounts:

D 20 (26,23,25,44) K 76(60)

In tax accounting (for the purposes of calculating income tax or single tax under the simplified tax system), expenses are also accepted (see paragraphs 7 and 8, paragraph 1, Article 264 of the Tax Code of the Russian Federation and paragraph 5, paragraph 1, Article 346.16 of the Tax Code of the Russian Federation). In particular, according to the simplified tax system, according to the explanations of the Ministry of Finance, these costs are included in material costs, as part of the production process.

It doesn’t matter whether the candidate was selected or not, even if the results of the medical examination turned out to be unacceptable for hiring, they can be taken into account. Although some controversy is caused by the situation when a potential employee independently enters into an agreement for a medical examination and then presents documents to reimburse him for such costs.

In most cases, tax authorities and courts recognize that the employer is required by law to bear these costs, so reimbursing the employee for expenses does not lead to the formation of income subject to personal income tax and contributions. I note that compensation is possible if the employee himself applies for it. The main thing is that the organization conducting the medical examination has a license, and the employee provides an agreement, documents on payment and provision of services. For an organization, expenses can be accepted into accounting on the basis of acts of services rendered, but for tax accounting using the simplified tax system, the fact of payment is important.

Note! From July 1, 2022, the cash receipt must indicate the name of the buyer (customer), his tax identification number and some other details (clause 6.1, article 4.7 of Law 54-FZ), if the settlement is made with an organization (individual entrepreneur), including through an accountable face.

Another reason not to pay fees for a candidate is the lack of an employment relationship. Since an individual is not an insured person, there is no need to pay contributions.

Reimbursement to the employee for undergoing a medical examination

How to reflect in the accounting and tax records of an organization the expenses incurred by an employee for mandatory periodic medical examinations if they are reimbursed by transferring funds to his personal card?

Situation

An employee assigned to the organization underwent a periodic medical examination. The cost of a medical examination according to the health care institution’s act dated August 31, 2021 was 65 rubles. (without VAT).

The employee independently paid the cost of the medical examination and provided the organization’s accounting department with an advance report dated 08/31/2021 with all the necessary documents attached. The organization compensated the expenses incurred by the employee from the current account by crediting it to his personal card on 09/03/2021.

General provisions

Employees of organizations undergo periodic medical examinations during their work to ensure occupational safety and prevent occupational diseases. Workers engaged in work with harmful and (or) dangerous working conditions or in work where, in accordance with the law, there is a need to assess the health status of the worker to determine his suitability (unfitness) to perform certain types of work, undergo such medical examinations for the purpose of health protection (Part 1 of Article 27 of Law No. 356-Z).

The procedure for conducting mandatory and extraordinary medical examinations of workers is established by the Ministry of Health in agreement with the Ministry of Labor and Social Protection (Part 2 of Article 27 of Law No. 356-Z).

In particular, the procedure for conducting periodic medical examinations is provided for by Instruction No. 74.

Medical examinations, including periodic ones, are carried out when performing work in harmful and (or) dangerous working conditions, depending on harmful and (or) hazardous production factors in accordance with Appendix 1 to Instruction No. 74, as well as when working in harmful and (or) ) hazardous working conditions depending on harmful and (or) dangerous production factors (conditions) in accordance with Appendix 2 to Instruction No. 74. In addition, workers undergo such medical examinations during work where, in accordance with the law, there is a need to assess the health status of the worker for its suitability (unsuitability) for performing certain types of work in accordance with Appendix 3 to Instruction No. 74 (clause 4 of Instruction No. 74, Part 1 of Article 27 of Law No. 356-Z).

Medical examinations are carried out by special medical commissions. They are created in state healthcare organizations, as well as organizations contained in the list established in Appendix 4 to Instruction No. 74 (clauses 5, 6 of Instruction No. 74).

If it is necessary to conduct a medical examination, the employer must draw up and issue a referral to the employee in the prescribed form (Appendix 5 to Instruction No. 74). When conducting a periodic medical examination, referrals are issued only for workers not included in the list of professions (positions) of workers subject to mandatory periodic medical examinations (clause 19 and Instructions No. 74).

During the period of medical examinations required by law, the employee retains his place of work and average earnings (Article 228 of the Labor Code).

Based on the results of the periodic medical examination, the healthcare organization issues a certificate or report (clause 15 of Instruction No. 74).

The costs of medical examinations of employees are borne by the employer (Part 6, Article 27 of Law No. 356-Z).

Procedure for reimbursing an employee for medical examination expenses

As mentioned earlier, the costs of medical examinations, including periodic ones, are borne by the employer (Part 6, Article 27 of Law No. 356-Z).

In our case, the employee himself paid for the medical examination with personal funds, and the organization compensates him for these expenses based on the provided report.

Thus, the legislation of our country allows the issuance of cash Belarusian rubles to an employee on account. Organizations, regardless of the presence of a current (settlement) bank account, carry out cash settlements in Belarusian rubles with other legal entities, their separate divisions, individual entrepreneurs, including by depositing cash Belarusian rubles directly into bank cash desks with their subsequent crediting to current (settlement) bank accounts recipients, in a total amount of no more than 100 basic units during one day, with the exception of cases provided for by Instruction No. 117 and other acts of legislation. At the same time, the actual amount of settlements also includes the amount of personal funds of employees in Belarusian rubles spent in the interests of the organization (Part 1, Clause 76, Part 1, Clause 97, Clause 101 of Instruction No. 117).

The provision by the employee of a report on the amounts of Belarusian rubles spent for each current operation is provided for within the time limits established by clause 90 of Instruction No. 117. Thus, in order to reimburse the costs of a medical examination in our case, the employee must submit a report on the amounts spent no later than 15 working days from the date of purchase services (excluding the day of purchase) (part 1, clause 76, clause 90 of Instruction No. 117).

Accounting

In the situation under consideration, the employee paid for the periodic medical examination with his own money. The amounts spent by the employee in the interests of the organization are reflected in the credit of account 71 “Settlements with accountable persons” in correspondence with the debit of the accounts on which the organization reflects the costs of employees undergoing mandatory medical examinations (part 2, clause 56 of Instruction No. 50).

And since the costs of mandatory periodic medical examination of the organization’s employees are provided for by law (Part 1, Article 27 of Law No. 356-Z), these costs are included by the organization in the expenses of current activities.

Depending on the type of activity of the organization, as well as on which personnel (production, service, etc.) the employee belongs to, an entry is made in accounting to the debit of accounts 25 “General production costs”, 26 “General expenses”, 44 “ Sales expenses" with a credit to account 71 "Settlements with accountable persons" (clauses 27, 28, Instructions No. 50).

When an employee is reimbursed for expenses incurred by transferring funds from the organization's current account to his personal card, it is reflected in the accounting records as the debit of account 71 “Settlements with accountable persons” and the credit of account 51 “Current accounts” (part 2, clause 40, part 2 clause 56 of Instruction No. 50).

Income tax

Income tax is not imposed on amounts in the amount of the cost of medical services provided by healthcare organizations or other organizations carrying out medical activities in the manner established by law, and maintained at the expense of organizations and individual entrepreneurs that are the place of main work (service, study) for such a payer ( Subclause 2.11 of Article 196 of the Tax Code).

Consequently, when reimbursing the employee for the funds spent in this case on undergoing a medical examination, income tax is not withheld.

Mandatory insurance contributions to the Social Security Fund and Belgosstrakh

Analyzing Art. 2 of Law No. 138-XIII and paragraph 2 of Regulation No. 1297, as well as para. 1 and 5 clause 4 of the List of payments N 115, we conclude that the amounts of the organization’s funds allocated for medical examinations of employees provided for by law refer to payments for which insurance contributions to the Social Security Fund and Belgosstrakh are not charged.

Thus, for the amount of costs associated with conducting a mandatory periodic medical examination of an employee, insurance contributions to the Social Security Fund and Belgosstrakh are not charged.

Accounting Entry Table

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| The costs of periodic medical examinations are reflected <*> | 25 (26, 44) | 71 | 65 | Order from the manager, report on amounts spent, KSA check, health care institution report, health certificate |

| Funds were reimbursed to the employee by transfer to a personal card | 71 | 51 | 65 | Payment order, bank account statement |

| ——————————— <*> Taken into account as part of costs when calculating income tax (clause 1, article 169, clause 1, article 170). | ||||

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

Routine medical examinations and their recording

If the company has passed the SOT and there are lists of those positions and workplaces where employees are required to undergo regular medical examinations, then you can draw up a schedule for their implementation and coordinate it with the medical organization chosen to conclude the contract. The frequency depends on the assignment of work or factors to a particular item on the List.

With a permanent contract, you will have to follow a certain procedure:

In accounting and tax accounting, routine examinations are taken into account in the same way as during employment. Payments are only more often made by bank transfer, and the organization is given supporting documents with transcripts of who, from which specialists, with what result, and for what amount the inspection was carried out.

This will allow you to correctly post costs, which is especially important when it comes to multiple taxation systems. For example, some workers are engaged in retail trade, transferred to UTII, and some are engaged in the provision of services to OSNO or simplified tax system. The costs will have to be divided accordingly.

Note! Only expenses for mandatory medical examinations can be accepted for calculating the tax base. If an employer sends employees to medical examinations at their own request, then payments for them cannot be taken into account in the NU.

Tax authorities will insist on taxing such amounts of non-mandatory medical examinations with personal income tax and contributions, because They consider them a benefit to the employee. After all, such compensation is not listed as non-taxable in Article 422 of the Tax Code of the Russian Federation. The courts do not agree with this position and side with the workers.

Financing costs for labor protection

An organization can pay for labor protection measures from budgets of all levels, extra-budgetary funds, through voluntary contributions from third-party organizations or individuals (Article 226 of the Labor Code of the Russian Federation).

An important clarification: this area of the institution’s activities cannot be paid for from employees’ funds, no deductions from salaries and no purchase of special clothing at one’s own expense are allowed. Some activities can be paid for from the amounts of contributions to the Social Insurance Fund, which must be transferred in the current year. The amount of funding is no more than 20% of the amount of contributions for the previous year minus similar expenses.

The list of measures that can be paid for through insurance premiums is lengthy. For example, these may be the costs of conducting a special assessment of working conditions, purchasing first aid kits or protective clothing if they were produced in the EAEU countries, and others.

Expenses compensated from the Social Insurance Fund are reflected in accounting as follows:

| the name of the operation | Debit | Credit |

| Insurance premiums charged for injuries (2%) | 0 109 XX 213 | 0 303 06 730 |

| Funds were transferred for inventories purchased as part of measures to reduce injuries | 0 302 34 830 | 0 201 11 610 |

| Funds were transferred for work and services as part of measures to prevent injuries | 0 302 25 830 0 302 26 830 | 0 201 11 610 |

| Material supplies received as part of measures to prevent injuries | 0 105 36 340 | 0 302 34 730 |

| Reflects the costs of paying for services and work as part of measures to prevent injuries | 0 401 20 225 0 401 20 226 | 0 302 25 730 0 302 26 730 |

| Claims have been accrued for compensation of expenses incurred by the institution as part of measures to prevent injuries | 0 209 30 660 | 0 401 10 130 |

| The expenses incurred by the institution as part of measures to prevent injuries were offset by counterclaim to the Social Insurance Fund | 0 303 06 830 | 0 209 30 560 |

| Insurance contributions to the Social Insurance Fund are transferred minus expenses as part of measures to prevent injuries | 0 303 06 830 | 0 201 11 610 |

Waybills

The biggest problem for any organization that owns or leases vehicles is waybills. Filling them out causes dissatisfaction and discomfort among drivers and irritates both managers and accountants who are forced to tinker with large amounts of data.

However, this is the main document for confirming (directly or indirectly) such expenses as:

- fuels and lubricants (fuel, oils);

- related products (antifreeze, washer fluid);

- travel to the place of business trip, shift, regular work, flight, transportation, etc.;

- repair and purchase of auto parts;

- vehicle maintenance – washing, diagnostics, tire fitting;

- drivers' wages;

In addition, accounting maintained on the basis of vouchers helps to identify drivers who use the organization’s property for other purposes:

- travel on personal business (number of kilometers on the odometer);

- drain gasoline (discrepancies in filling data, refueling data and fuel residues);

- attach “wrong” receipts (discrepancy between tank volume, fuel consumed and submitted documents).

In short, waybills serve good purposes, but maintaining them is burdensome. Not least because of the need to make notes about undergoing a medical examination.

Important! The obligation to mark a medical examination is specified in paragraph 7 of Art. II Order of the Ministry of Transport No. 152 of September 18, 2008. This is part of the driver's information.

This is especially strict in passenger transport, because the responsibility here is much higher. If the company does not have a full-time physician, then again you will have to enter into an agreement and constantly use the services of a medical institution. Usually the examinations are quick: the doctor checks your general well-being, blood pressure level, pulse rate, and temperature.

Why did I dwell in detail on the purpose of waybills? As you understand, they are necessary to confirm a number of expenses of the organization. Even if compensation is simply paid for the use of the employee’s personal transport and no costs are separately reimbursed, the very use of the car for work purposes must be confirmed.

Since part of the mandatory details of the voucher is a medical examination note, its absence may attract the attention of tax authorities. They will question the validity of such a document and may try to withdraw the corresponding costs from it to NU.

The courts, however, here too are loyal to taxpayers and restore the right to take costs into account.

FSS: how to report and receive compensation

The special assessment is reflected not only in the declaration submitted to Rostrud, but also in the 4-FSS report (Table 5), starting from the first quarter of 2022. Medical examinations are shown in a separate row in the same table. Until the new year, this data remains unchanged, because... values are set at the beginning of the year. When sending the calculation for the 1st quarter of 2022, do not forget to check whether changes have occurred and fill out the table.

In order to reimburse its costs for mandatory medical examinations, the employer applies to the Social Insurance Fund for appropriate funding (the Rules were approved by Order of the Ministry of Labor No. 580n dated December 10, 2012).

Important! The application must be submitted this year before August 1 (i.e., July 31 inclusive). The deadline for 2022 has already expired, now you can use the benefit only in 2022 and the sooner the better, because the Fund may refuse to provide funding if budget funds are exhausted.

The calculation of the amount that the Social Insurance Fund will reimburse (allocate) is made based on data from the previous calendar year using the formula:

(Accrued contributions for injuries - expenses for paying for “accidental” sick leave and vacations for the period of treatment and travel to the place of treatment in addition to regular annual leave) x 20%

An insured who takes care of pre-retirees and allocates additional funds for their sanatorium-resort treatment can count on 30%.

For enterprises that did not apply for financing in the previous two years and whose staff does not exceed one hundred people, more favorable conditions have been established. They can make calculations not from one previous year, but from three previous years at once. However, the amount of assistance should not be higher than the amount of contributions for the current year.

For reimbursement you will need (the list is relevant for financing for medical examinations): an application, a plan for preventive measures and their financing for the current year (originals), lists of measures to improve working conditions and labor protection (based on the results of the special assessment of labor protection) and a list of employees subject to medical examinations in the current year year in the form of copies, an agreement with a licensed medical organization and its license (copies).

Note! Some branches will ask you to duplicate certain documents electronically by email or through informal correspondence via TKS.

When the FSS gives the go-ahead, the policyholder will have to submit a quarterly report on the use of contribution amounts in addition to the 4-FSS calculation. Additionally, you will need copies of reports from medical commissions and information from them, as well as copies of payment and other documents confirming payment for medical examinations and actual receipt of services (invoices, payment orders, cash receipts, acts).

So far, interaction with the FSS via telecommunication channels, excluding reporting submission, has not been established, so most of the documents will have to be carried personally (if you are sending a representative or a responsible person - not a manager, then do not forget to give him a power of attorney). You can also use the State Services website.

Expenses for mandatory periodic medical examinations

After completing the planned activities, the policyholder submits documents confirming the expenses incurred to the territorial body of the Social Insurance Fund. Expenses actually incurred by the policyholder, but not confirmed by documents on the intended use of funds, or made on the basis of documents that were incorrectly executed or issued in violation of the established procedure, are not subject to offset against the payment of insurance premiums.

The costs of periodic medical examinations are confirmed by documents:

- a copy of the list of employees subject to mandatory periodic medical examinations (examinations) in the current calendar year, approved by the employer;

- a copy of the agreement with a medical organization for conducting mandatory periodic medical examinations (examinations) of employees;

- a copy of the license of a medical organization to carry out work and provide services related to mandatory preliminary and periodic medical examinations (examinations) of employees;

- the final act of the medical commission based on the results of mandatory periodic medical examinations (examinations) of employees;

- a copy of the act of completion of work (services);

- copies of financial documents confirming payment for medical examinations (examinations) of employees (bills, invoices, payment orders).