The cashier-operator must draw up a document that accompanies the closing of the cash register after the shift. This document is called a cashier's certificate report . The document contains the necessary information about the meter data, specific amounts associated with collection, and any other data with which you can track the movement of cash. The document also indicates the closing date of the shift. If the senior cashier used several cash registers, then it is necessary to prepare a summary report that will contain information from the KM-7 form document. Now we will look at the rules for drawing up this document. You can at the end of this article.

The KM-7 form must be filled out in one copy. It must be submitted to the accounting department before the cash day begins, as well as other reports, such as receipts, return statements and other documents. The sample can be downloaded here.

KND form 1110021 is filled out if there is a need to open, re-register or deregister a cash register.

Who should use forms KM-7 and KM-6

Form KM-7 is a document that is directly related to the use of a cash register system that has an ECLZ.

The obligation to use it has been abolished since July 2016 with amendments to the Law “On the Application of CCP” dated May 22, 2003 No. 54-FZ. And from July 2022, this form becomes unnecessary altogether due to the cessation of the use of cash desks equipped with ECLZ. However, this does not prevent the continued use of the KM-7 form only insofar as it concerns information about the amount of revenue received per shift. At the time of the use of cash registers equipped with EKLZ, the KM-7 form was a mandatory attachment to another unified form - KM-6, which the cashier-operator had to draw up. But with the introduction of amendments to the law “On the Application of Cash Register Machines”, form KM-6 is filled out only at the request of the business entity.

Find out what documents need to be completed when using online cash register systems from the Ready-made solution from ConsultantPlus. If you don't have access to K+ yet, get a trial access. It's free.

The report on form KM-7 contains columns for indicating the factory and registration numbers of all used cash registers. Moreover, it was required to create it for any number of available cash registers, including for a single cash register.

The KM-7 form was approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. You can download it on our website.

For a list of documents that may be required from you when checking cash discipline, see K+. Trial access to the system is provided free of charge.

The procedure for filling out the “Cashier-operator’s certificate-report”

The certificate-report is drawn up in a single copy, for each operating cash desk of the company separately. At the end of the shift, or at the end of the day, the cashier transfers the received proceeds to the bank, or according to the receipt order, to the senior cashier (or to the manager, if there is no senior cashier in the organization), attaching the cashier’s report, completed in form No. KM-6. The report form can be found in the album of unified forms approved by Decree of the State Statistics Committee of the Russian Federation No. 132.

The cashier fills out the form in the following order:

- The name of the organization is entered in the very top line of the form, and the address and telephone number of the company are also indicated there. If necessary, enter the name of the structural unit of the organization. In the tabular part on the right, the company’s tax identification number and the type of activity code according to OKVED are indicated.

- The line “Cash register” indicates the model of the cash register used - its class, type, brand. The KKM registration number and manufacturer's serial number must be entered in the corresponding cells of the table on the right. You can specify the software you are using in the Application Program line.

- The surname and initials of the cashier are entered in the “Cashier” cell, and the number of the corresponding shift is indicated in the “Shift” cell.

Next, you should fill in the serial number, the date of compilation, the beginning and end of the working hours - these are the details of the cashier’s report (the form can be downloaded below):

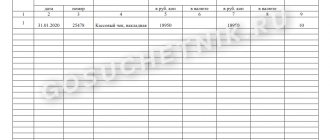

The main part of the “Cashier-Operator Certificate Report” is a table of ten columns.

- Column 1 “Sequential number of the fiscal memory report at the end of the shift/day” must contain the serial number of the Z-report.

- Columns 2 and 3 – indicate the number of the department and section (if any).

- Column 4 does not need to be filled out.

- Column 5 contains the readings of the summing cash counter at the beginning of work (beginning of the day or shift) and must coincide with the data in column 6 of the KM-4 “Cashier-Operator Journal” for that day or shift.

- Column 6 – readings of the same meter at the end of the working day/shift, which correspond to column 9 of the KM-4 log.

- Column 7 – the amount of revenue received per working day/shift, according to the counter. This indicator is calculated as the difference between columns 6 and 5 and must correspond in amount to column 10 of the “Cashier-Operator Journal” for that day/shift.

- Column 8 – the amount of refunds to customers for unused cash receipts. Here you need to indicate the total amount of all money returned to customers and checks punched by mistake. In the “Cashier-Operator Log” this column corresponds to column 15 for the same shift. If there are no returns, this column is crossed out.

- In columns 9 and 10, the head of the department/section puts his last name, initials and signature. In the absence of the manager, your full name. and the cashier signs.

- The “Total” line of the table separately summarizes the indicators for columns 7 and 8.

The line “Total revenue in total” should be filled out as follows: rubles in words, kopecks in numbers. This indicator is calculated as the amount of revenue minus returns (the total line of column 7 minus the total of column 8).

Next, indicate the date and number of the cash receipt order (PKO), according to which the proceeds, and the cash report attached to it in the KM-6 form, are transferred to the accounting department of the company, or its head. You must indicate the details of the bank to which the proceeds are subsequently deposited. If the organization is small, with no more than two cash desks, the cashier-operator can immediately hand over money to bank collectors. This is also reflected in the cashier's report indicating the bank that accepted the proceeds, the number and date of the receipt received from the collector.

“The cashier-operator’s certificate-report” is signed by the senior cashier, the cashier-operator and the head of the organization with transcripts of their signatures.

What are the features of filling out a report on form KM-7

Form KM-7 had to be generated daily in 1 copy and submitted to the accounting department before the start of the next work shift together:

- with form KM-6;

- PKO, RKO;

- acts in the KM-3 form (for the return of funds to customers).

The table, which is the main element of the KM-7 form, indicated and summarized the indicators for all fiscal counters of cash register systems, as well as for cash revenue for the trading entity as a whole or broken down by department (in this case, the figures were certified by the signatures of the heads of the relevant departments).

The amounts reflected in the acts in the KM-3 form, that is, returned to the company’s buyers, were indicated in words in a special column located under the table.

The information recorded in the KM-7 form was certified by the head of the trading entity, as well as by the senior cashier.

Read about the KUM-3 form in the material “Unified form No. KM-3 - form and sample” .

How to fill it out

Resolution No. 132 provides the procedure for drawing up a cashier's cash report in the KM-6 form. It is filled out in accordance with actual operating revenue data. The certificate is prepared in one copy, the frequency of generation is daily.

Instructions for filling out a cashier-operator certificate:

- We enter the name of the organization, its address, and contact phone number. We write down the TIN, OKPO and OKVED in the code table.

- We indicate the name and model of the cash register. We note the production and registration numbers. If necessary, enter the application program.

- Enter your full name. cashier.

- We fill out the shift in accordance with the Z-report number.

- We reflect the cash meter readings at the beginning and end of the day (shift).

- We indicate the amount of revenue per day.

- We show returns from customers for unused checks.

- We sign the certificate from the cashier, indicate his full name.

- Let's fill in the results. The final indicator corresponds to column 7 with reflected revenue for the operating day.

The completed certificate is certified by the senior cashier, the responsible operator and the manager. Legislative regulations explain which documents are included in the cashier's report: cash receipts and expenditures, and other primary documentation. All proceeds are received through the PKO - cash receipt order. Its number is reflected in cash reporting. When an organization transfers proceeds to the bank, a confirming receipt is attached to the statements and its number is indicated in the certificate.

Certificate-report of the cashier-operator (form KM-6)

certificates in the KM-6 form

A cashier-operator's certificate-report is a primary document that displays the results of the company's work and is intended to account for the organization's revenue received for a working day (shift).

The certificate-report is drawn up based on the information in the cashier-operator’s journal (KM-4) filled out for a given day (shift) or according to the X- and Z-reports.

The Z-report refers to the report that the cashier takes from the cash register at the end of the shift (working day). It provides data on cash transactions performed. Based on the balance indicated in the Z-report, the cashier checks the cash and transfers it to the administrator.

The X-report refers to the report that the cashier takes from the cash register to determine the amount of cash processed during the day (shift). It can be withdrawn an unlimited number of times at any time, the information will not be displayed anywhere, and the revenue will not be reset.

Indicators contained in the certificate report: data on payments in cash and payment bank cards (non-cash transfers of funds to the company's current account are not taken into account), refunds made to customers.

Storage: since the certificate refers to the primary documents confirming the implementation of cash payments via cash register, the storage period is 5 years.

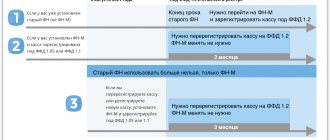

Innovations from 2017-2020

According to the explanations of the tax inspectorate (letter of the Federal Tax Service of the Russian Federation dated September 26, 2016 No. ED-4-20 / [email protected] and the Ministry of Finance of the Russian Federation No. 03-01-15/19821 dated April 4, 2017), the transition to online cash registers is made by filling out a cashier’s certificate report -operator optional (all information about ongoing cash register transactions is stored in your personal account on the Federal Tax Service Inspectorate website).

Instructions for filling out the KM-6 form

The cashier-operator's certificate-report is filled out daily in a single copy. A legally developed form - form KM-6, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132

Cap part

- Name - must correspond to that specified in the constituent documents (in practice, an abbreviated name is most often used, but only if it is specified in the documentation). An individual entrepreneur indicates his full last name, first name, and patronymic (in accordance with registration documents with the Federal Tax Service).

- Address: as a rule, the legal address is indicated for organizations and the address of residence for individual entrepreneurs; telephone.

- Structural unit (if available)

Here you can find information about the cash register model, the manufacturer's number (serial number of the cash register indicated in the documentation) and the registration number indicated in the registration card of the cash register with the Federal Tax Service.

Attention! The list of cash registers approved for use from 2022 is presented on the official website of the tax service (https://www.nalog.ru/rn77/related_activities/registries/reestrkkt/).

Rules for filling out a report line by line

The form is filled out in the following order:

- Cap – indicate:

- name of the organization and contact details;

- if available, the name of the structural unit;

- OKPO, INN, activity code;

- cashier-operator number for the past day;

- form number, date and time of filling it out.

- cash register numbers;

- equipment serial number;

- cash desk numbers assigned upon registration in the TIN;

- number at the beginning and end of the Z-report shift;

Important: the 5th column is not required to be filled out today, since modern machines do not reset their counters to zero at the end of the working day.

- meter readings at the beginning and end of the work shift;

- cash register revenue including returns;

- if there are departments, data for each separately with the certifying signature of the responsible persons. If there are no departments then columns 9 – 14 remain untouched.

At the end of the form, you need to add a total for the store and for each department individually.

However, there are some peculiarities during and after the data entry process:

- the form is filled out once a day, at the end of the shift, in a single copy;

- it must be submitted with forms KM-6, PKO, RKO, acts in form KM-3;

- You need to enter data into the table for all fiscal cash register counters, as well as for cash. Here you will learn what to do if the fiscal drive breaks down;

- if there are more than 3 departments, several forms must be filled out;

- in the field for indicating return receipts, you must also indicate erroneously entered ones;

- Information is reflected only for cash amounts; for bank transfers it is not indicated.

Important: previously this form was mandatory; if at least one copy was missing during a tax audit, the company was liable.

Submission deadlines

The cashier-operator is required to submit a report to the accounting department before the start of a new shift, and it is filled out daily at the end of the shift.

Sample of filling out information about KKM meter readings, form KM-7

Form KM-7, according to the counter data at the beginning and at the end of the work shift for a separate cash register, contains the calculation of revenue. Accounting is made of its distribution by departments and sections. The heads of these departments verify all data with signatures.

The necessary table is compiled, at the end of it the totals of the information from all cash register counters and all the total revenue of the enterprise are compiled, with its distribution among departments.

If during the work of the shift there was a fact of return, and a certain amount of money was returned to the client on the basis of the provided check, then a special regulatory act is drawn up, which indicates the returned amount of cash, and it is signed by the head and chief cashier of the institution. This amount ultimately reduces the total revenue.

Method of entering information into the KM-7 form

When filling out the KM-7 form, a certain order is taken into account.

Initially, the details of the organization are filled out in the form for information about KKM meter readings. Forms are entered according to the general Russian classifier of management documentation and the classifier of institutions and organizations.

Each form has an individual serial number. Numbering starts from the beginning of the year, indicating the date and real time.