Many questions arise when filling out the 6-NDFL calculation: in particular, the difficulty is caused by a misunderstanding of the difference between the period for assigning benefits and the terms of its payment, or the situation of recalculating sick leave.

- Procedure for assigning and paying benefits

- Features of calculation and deduction of personal income tax when paying sick leave

- Reflection of sick leave payments in 6-NDFL reporting

- Recalculation of benefits in 6-NDFL and 2-NDFL

- Reflection of sick leave in 2-NDFL

Salary for March, paid in April in 6-NDFL

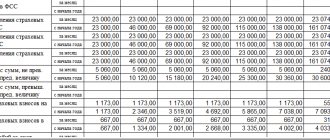

For the first quarter, show:

- in the field 110 and 112 sections. 2 – the amount of wages accrued for March;

- in field 130 section. 2 – the amount of personal income tax deductions provided in March;

- in field 140 section. 2 – the amount of personal income tax calculated from the salary for March.

Salaries for March and personal income tax accrued from them are not included in other calculation indicators for the first quarter. Including personal income tax, which as of the reporting date (March 31) was not withheld from the March salary, does not need to be included in the field indicator 170 section. 2.

Salary paid on the last working day of December in 6-NDFL.

Reflect as follows

Calculated for the first quarter of the year in Sec. 1 specify:

- in field 020 – the total amount of tax withheld, the payment deadline for which falls in the last three months of the reporting period, including that withheld from wages for December;

- in field 021 – the first working day of January next year;

- in field 022 - the amount of personal income tax withheld from wages for December.

Vacation pay in 6-NDFL

As a general rule, in the calculation of 6-NDFL, information about vacation pay must be reflected in the period in which they were paid. An exception is if you paid vacation pay in the last month of the quarter and its last day falls on a weekend (non-working) day. Then the deadline for transferring personal income tax on vacation pay will come in the next period. The date of actual receipt of income in the form of vacation pay is the day of their payment. Therefore, in the calculation, reflect only paid vacation pay, and there is no need to indicate vacation pay that is accrued but not paid.

Such vacation pay must be included in section. 2 in the period of their payment, and in Sec. 1 calculation of 6-personal income tax already in the next period. For example, if vacation pay is paid in December and December 31 is a day off, in section. 2 they need to be included for this year, and in Sect. 1 – in the first quarter of next year.

In Sect. 1 needs to be reflected:

- in field 020 – tax withheld (including from vacation pay), the payment deadline for which falls in the last three months of the reporting period;

- in field 021 – the last day of the month in which vacation pay was paid. If it falls on a weekend (non-working) day, then indicate the working day following it;

- in field 022 - the total amount of tax withheld (including holiday pay), the payment deadline for which falls on the date specified in field 021.

In Sect. 2 needed:

- in field 110, include the amount of vacation pay in the total amount of income accrued for all individuals since the beginning of the year;

- in field 112, include the amount of vacation pay in the total amount of income accrued under employment agreements (contracts) for all individuals from the beginning of the year;

- in field 120 reflect the total number of individuals who received income, including in the form of vacation pay;

- in field 140 indicate personal income tax calculated on all income from the beginning of the year, including vacation pay;

- in field 160 , indicate the total amount of personal income tax withheld since the beginning of the year, including tax withheld from vacation pay.

When filling out the calculation for the tax period, information about vacation pay and the corresponding personal income tax is also reflected in the certificate of income and tax amounts of the individual. As a rule, they are presented as part of the generalized data in Section. 2 certificates and in the Appendix to it.

Filling procedure

Current algorithm for how sick leave is reflected in 6-NDFL in 2020.

We begin reporting from section 1, which reflects generalized information on settlements with personnel. Fill in the following order:

- In line 020 we reflect all amounts of benefits paid by the employer in the reporting period. Please note that the amount is indicated together with income tax. That is, personal income tax from sick leave in 6-NDFL on line 020 of the calculation cannot be deducted from the total amount of accruals.

- In fields 040 and 070 we reflect the amount of income tax on benefits paid. We indicate personal income tax calculated at the appropriate tax rates. On page 040 we record the amount of the calculated liability, and on page 070 we record the tax already withheld from the benefit.

Let's move on to filling out section 2 of the calculation. Here we show all personal income and benefits paid in the last quarter of the reporting period (letter of the Federal Tax Service dated November 1, 2017 No. GD-4-11 / [email protected] ). Procedure, step by step:

- on pages 100 and 110 - we record the date of receipt of sick leave income in 6-NDFL (this is the day of payment when the money was issued from the cash register or transferred to the employee’s card);

- page 120 - calendar date - the last day of the month in which social benefits were issued to the employee. If it is a day off, indicate the first working day of the next month (clause 7 of article 6.1, clause 6 of article 226 of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated May 16, 2016 No. BS-4-11/ [email protected] );

- on page 130 - we show the amount of sickness benefits, but only together with personal income tax, the amount “on hand” is not required to be reflected in the calculation;

- on page 140 - we register the tax withheld from social benefits.

When reflecting personal income in the calculation, follow the standard rules for filling out the calculation.

Sick leave in 6-NDFL

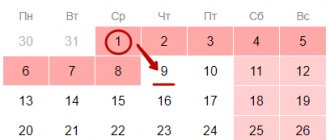

The date of actual receipt of income in the form of temporary disability benefits is the day of its payment. Therefore, in the calculation of 6-NDFL, only the benefits paid are reflected. A benefit accrued in one reporting period and paid in the next is reflected in the calculation for the next period.

As a rule, information about paid sick leave and the tax withheld from it and transferred to the budget is reflected in the calculation of 6-NDFL for the period in which the sick leave was paid.

An exception is the situation when sick leave was paid in the last month of the reporting period and the last day of this month is a day off (non-working day). In this case, the tax must be paid to the budget no later than the first working day of the next reporting period. Information about the benefit and personal income tax withheld from it must be reflected:

- in Sect. 2 calculations for the reporting period in which sick leave was paid;

- in Sect. 1 calculation for the next reporting period;

- in the certificate of income and tax amounts of an individual (when filling out the calculation for the tax period).

In Sect. 1 must be reflected (clauses 3.1, 3.2 of the Procedure for filling out the 6-NDFL calculation):

- in field 020 - the total amount of personal income tax, the transfer period of which falls on the last three months of the reporting period, including the tax withheld from sick leave;

- in field 021 – the last day of the month in which sick leave was paid. If it falls on a weekend (non-working) day, then indicate the working day following it;

- in field 022 - the total amount of personal income tax withheld (including sick leave), the transfer deadline for which falls on the date specified in field 021.

In Sect. 2 follows:

- in field 110, include the amount of sick leave in the total amount of income accrued for all individuals since the beginning of the year;

- in field 112, include the amount of sick leave in the total amount of income accrued under employment agreements (contracts) for all individuals since the beginning of the year;

- in field 120 indicate the total number of individuals who received income, including in the form of benefits;

- in field 140 reflect the personal income tax calculated on all income from the beginning of the year, including sick leave;

- in field 160 reflect the total amount of personal income tax withheld since the beginning of the year, including the tax withheld from sick leave.

When reflecting sick leave in the calculation, follow the general rules for filling out the calculation.

Results

Sick leave payments are reflected in 6-NDFL in the reporting period in which the sick leave was actually paid. A special feature is that personal income tax on such payments is transferred to the budget no later than the last day of the month of payment.

If the last day of the month is a weekend, then the tax payment deadline is shifted to the next month, but from 2022 this does not lead to sick leave being reflected in calculations for two reporting periods.

Sources:

- Tax Code of the Russian Federation

- Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Financial assistance in 6-NDFL

Reflection of material assistance in the calculation of 6-personal income tax depends on whether it is subject to personal income tax.

Material assistance that is subject to personal income tax in full (i.e., without establishing standards below which it is not taxed) must be reflected in the calculation of 6-personal income tax.

Also reflect in the calculation of 6-NDFL material assistance paid in excess of the non-taxable amount, if it is established by the Tax Code of the Russian Federation (for example, 50,000 rubles). We recommend that material assistance paid within the non-taxable amount be reflected in 6-NDFL, since it can be paid several times a year and ultimately exceed the limit.

Financial assistance in the amount of up to 4,000 rubles. in the calculation of 6-NDFL for this reason. If you pay it several times a year and thus in one of the periods the non-taxable amount is exceeded, all assistance paid (both within the limit and above it) must be reflected in the calculation of 6-NDFL, taking into account a deduction in the amount of 4,000 rubles . in a year.

Assistance that is completely exempt from personal income tax (that is, without establishing standards beyond which it is taxed) does not need to be included in form 6-NDFL. For example, there is no need to reflect financial assistance in connection with the death of an employee or a member of his family.

In Sect. 1 of the 6-NDFL calculation, tax on material assistance is reflected if the deadline for its transfer falls on the last three months of the reporting period. Reflect it like this:

- in field 020, include the personal income tax withheld from financial assistance, the transfer deadline for which falls on the last three months of the reporting period;

- in field 021, indicate the deadline for transferring the tax;

- in field 022, reflect the personal income tax, the payment deadline for which falls on the date specified in field 021.

If necessary, fill in other fields in section. 1.

In Sect. 2 calculations , reflect information about financial assistance as part of the generalized indicators as follows:

- include the total amount of accrued and paid financial assistance in field 110;

- include the non-taxable part of financial assistance (deduction amount) according to the code values of the taxpayer’s types of deductions in the indicator of field 130;

- personal income tax calculated from material assistance in the total amount for the period, include field 140 in the indicator;

- personal income tax withheld from financial assistance in the total amount for the period, include field 160 in the indicator.

Payments under GPA in 6-NDFL

Remunerations under civil contracts must be included in the calculation of 6-NDFL starting from the reporting period in which they were paid to the individual, since the day of actual receipt of such income is the date of their payment.

Please note that the date of signing the act for work performed or services provided does not matter.

In Sect. 1 of the 6-NDFL calculation, you need to reflect the amount of tax withheld from payments under civil contracts, if the deadline for its transfer falls on the last three months of the reporting period:

- in field 020, include in the total tax withheld for the last three months of the reporting period the amount of personal income tax withheld from remuneration under civil contracts;

- in field 021 indicate the first working day following the day of payment of remuneration;

- in field 022 reflect the amount of withheld personal income tax, the transfer deadline for which falls on the date specified in field 021.

If remuneration is paid to an individual in parts, then each of them is reflected in a separate block of fields 021, 022. This is due to the fact that the timing of the transfer of personal income tax on each part of the remuneration paid is different.

In Sect. 2 calculations of 6-NDFL, remuneration under a civil contract and the corresponding tax must be reflected on an accrual basis, starting from the report for the period in which the payment was made until the end of the reporting year as follows:

- in field 100 – indicate the rate at which the tax on remuneration under the contract is calculated (for example, 13);

- in field 110 - the total amount of income for all individuals since the beginning of the year, which are taxed at this rate, including remuneration under a civil contract;

- in field 113 – taxed at the rate reflected in field 100, the total amount of income for all individuals from the beginning of the year under civil contracts, the subject of which is the performance of work (rendering services);

- in field 120 - the total number of individuals who received payments reflected in field 110;

- in field 130 - the total amount of tax deductions for personal income tax provided for payments from field 110, including deductions for remuneration under a civil contract;

- in field 140 - the amount of personal income tax calculated on all income indicated in field 110 (including deductions), including tax calculated on remuneration under a civil contract;

- in field 160 - the total amount of personal income tax withheld since the beginning of the year, including the tax withheld from remuneration under a civil contract.

If remuneration under a civil contract is paid on the last day of the reporting period, the deadline for paying personal income tax on it will expire in the next reporting period. In this case, the remuneration should be reflected in section. 2 calculations of 6-NDFL for the period in which it was paid, without reflection in section. 1 of this calculation. In Sect. 1 payment of remuneration will be reflected in the calculation for the next reporting period.

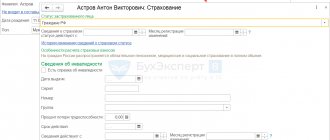

Features of calculation and deduction of personal income tax when paying sick leave

Temporary disability benefits, just like other types of income of individuals, are subject to personal income tax. This is directly stated in paragraph 1 of Art. 217 Tax Code of the Russian Federation. The exception is a certificate of incapacity for work with code 05 (“Maternity leave”) - this benefit is not taxed.

The calculation of the amount of personal income tax on the income of individuals must be made by the employer - tax agent on the date of actual receipt of income (clause 3 of Article 226 of the Tax Code of the Russian Federation). For sick leave benefits, the date of actual receipt of income is the day of payment of this income (on sick leave), according to paragraphs. 1 clause 1 art. 223 Tax Code of the Russian Federation.

In accordance with paragraph 4 of Art. 223 of the Tax Code of the Russian Federation, the employer’s obligation to withhold personal income tax from sick leave arises on the day of actual payment of income (benefits).

That is, according to the established norms of the Tax Code of the Russian Federation, the dates for calculating and withholding personal income tax from temporary disability benefits are the same - calculation and withholding of tax must be carried out directly on the day of payment of the benefit (the nearest established day of salary payment after the assignment of the benefit). Otherwise - according to the norms of Federal Law No. 255-FZ of December 29, 2006 - within 10 calendar days the employer is obliged to calculate the amount of benefits due to the employee, and on the next day of payment of this benefit - according to the rules of tax legislation, calculate and withhold personal income tax from sick leave.

When calculating personal income tax on sick leave, it is also important to take into account the right to tax deductions and the status of an individual taxpayer.

Separately, it should be noted that personal income tax on temporary disability benefits must be transferred by the tax agent (employer) no later than the last day of the month in which the benefits were paid. That is, if, for example, sick leave was paid on January 10, 2022, therefore, personal income tax must be transferred by the deadline of January 31, 2022.

Payments in kind in 6-NDFL

Income in kind is reflected in 6-NDFL according to the general rules, but there are some peculiarities.

Such income may be taxed at a rate of 13%, 15% or 30%, depending on who it is paid to and on what basis. If you paid income to individuals taxed at different rates, fill out section. 1 and 2 separately for each of them.

In Sect. 1 Personal income tax on income in kind is reflected if the deadline for its transfer falls on the last three months of the reporting period. The tax must be reflected as follows:

- in field 020, include the personal income tax withheld from such income, the transfer deadline for which falls on the last three months of the reporting period;

- in field 021, indicate the deadline for transferring the tax;

- in field 022, reflect the amount of personal income tax, the payment deadline for which falls on the date specified in field 021 of the corresponding line.

If necessary, fill in other fields in section. 1.

Section 2 is drawn up as of the reporting date on an accrual basis from the beginning of the year in relation to income taxed at the appropriate rate. Starting from the reporting period in which income in kind was transferred to an individual, reflect it in section. 2 as follows:

- in field 100, indicate the rate in relation to which the section is being filled in (for example, “13”);

- in field 110, include the amount of income in kind;

- in field 120, indicate the number of individuals who have received taxable income from you since the beginning of the year, including in kind;

- in field 130, reflect the total amount of tax deductions that you have provided since the beginning of the year;

- in field 140 , reflect the calculated personal income tax on income in kind starting from the reporting period when the income was transferred to the individual;

- in field 160 , reflect the withheld personal income tax on income in kind starting from the reporting period when the tax was withheld. If the tax was not withheld from it (for example, due to the fact that the individual was not paid income in cash), then put “0” in field 160 (provided that the tax at the appropriate rate was not withheld from other income).

- in field 170, indicate personal income tax that was not withheld as of the reporting date.

If necessary, fill in other fields in section. 2.