Tax agents are business entities who, by force of law, must calculate and pay tax for their counterparties, legal entities or individuals. An example of a tax agency is the obligation of organizations to withhold personal income tax from the income of their employees and transfer it to the budget. There is also a tax agency for VAT - in certain cases, legal entities, regardless of whether they pay this tax themselves or not, are required to perform the functions of a taxpayer for their suppliers.

When do the duties of a tax agent for VAT arise?

Cases of the VAT tax agency are given in Article 161 of the Tax Code. A tax agent is a business entity registered in the Russian Federation if it:

- purchases products (work, services) on the territory of Russia from a foreign person who is not registered in our country as a taxpayer;

- is a lessee or buyer of property from state authorities or local government;

- is an intermediary participating in settlements when selling goods, works or services on the territory of the Russian Federation by a foreign person who is not registered with the Russian Federal Tax Service;

- sells confiscated goods, ownerless valuables, treasures or property subject to sale by court decision.

In practice, the most common lease of property from municipal authorities, as well as the purchase of goods from a foreign counterparty.

Moment of determining the tax base

The moment of determining the tax base for the purpose of calculating and paying VAT is different for tax agents determining the tax base including VAT and tax agents determining the tax base excluding VAT.

Tax agents who determine the tax base taking into account VAT (buyers, customers and recipients of goods, works, services) charge tax payable to the budget on the day of payment for the purchased goods (works, services). That is, either at the time of their advance payment (in full or in part), or at the time of final settlement with the counterparty. This follows from subparagraph 1 of paragraph 3 of Article 24, Article 161 of the Tax Code of the Russian Federation and is confirmed by letters from the Ministry of Finance of Russia dated January 21, 2015 No. 03-07-08/1467 and the Federal Tax Service of Russia dated August 12, 2009 No. ShS-22-3/ 634.

Tax agents who determine the tax base excluding VAT (sellers and intermediaries selling goods, work, services) charge tax payable to the budget either on the day of shipment (transfer) of goods (work, services), or on the day of their payment, depending on which of these events occurred earlier (subclause 1, clause 1, clause 15, article 167 of the Tax Code of the Russian Federation).

An example of VAT calculation when purchasing goods located in Russia from a foreign organization that is not tax registered in Russia

Alpha LLC purchased goods worth $11,800 from a foreign organization. A foreign organization is not registered with tax authorities in Russia. When selling such goods in Russia, VAT is charged at a rate of 18 percent. “Alfa” is a tax agent, therefore it is obliged to withhold the amount of VAT from the income of a foreign organization and transfer it to the budget. VAT must be transferred to the budget in the general manner. That is, monthly in equal installments no later than the 25th day of each of the three months following the reporting quarter (clause 1 of Article 174 of the Tax Code of the Russian Federation).

The amount of VAT that Alpha withholds from the income of a foreign organization is equal to: 11,800 USD × 18/118 = 1,800 USD.

The income of the foreign organization was paid on January 20. On this day, the US dollar exchange rate (conditionally) was 29.50 rubles/USD. On the Alpha settlement day:

- transferred payment for goods to a foreign organization – 10,000 USD (11,800 USD – 1800 USD);

- determined the amount of VAT in rubles to be paid to the federal budget - 53,100 rubles. (RUB 29.50/USD × USD 1,800).

The goods were accepted for accounting on January 24. On this day, the US dollar exchange rate (conditionally) was 29.70 rubles. Despite the difference in rates, the Alpha accountant did not recalculate the VAT amount on the date the goods were accepted for accounting.

A Russian company buys goods from a foreign company

Before concluding a deal to purchase products from a foreign company, it is worth finding out whether it has a representative office in Russia. If it is available, then the buyer does not have additional obligations, since the representative office will handle the calculation and payment of VAT. To confirm the fact of its existence, it is advisable to request from a foreign company a copy of the tax registration certificate in Russia.

Note! The above is true if the buyer enters into an agreement with a representative office of a foreign organization. If the agreement is concluded with the head office, that is, the local representative office does not participate in the transaction, the buyer becomes the VAT tax agent of its foreign counterparty. Confirmation - letter of the Ministry of Finance of Russia dated November 12, 2014 No. 03-07-08/57178.

If there is no representative office (or it does not participate in the transaction), then the Russian buyer has obligations as a tax agent for VAT. An exception is that a foreign organization sells goods, works or services that are not subject to VAT in accordance with Russian legislation. In this case, the buyer will not have the obligation of a tax agent.

Tax calculation

If the contract specifies an amount including VAT, then the tax is calculated at an estimated rate using one of the formulas:

- at a VAT rate of 18% - VAT = Cost of GWS x 18 / 118 ,

- at a VAT rate of 10% - VAT = Cost of GWS x 10 / 110 .

Let's look at it with an example. A Russian company purchased from a foreign counterparty goods subject to VAT at a rate of 18% in the amount of 1 million rubles. The supplier does not have a local representative office, therefore, the Russian buyer must withhold VAT.

The tax amount will be: 1,000,000 x 18 /118 = 152,542.37 rubles.

This means that the Russian buyer must transfer the following amount to the foreign counterparty: 1,000,000 - 152,542.37 = 847,457.63 rubles.

The foreign counterparty may insist that a fixed amount be transferred to it, and that the buyer pays the taxes due “on top.” With this wording in the contract, VAT is calculated at the appropriate rate (18 or 10%) and is transferred to the budget from the buyer’s own funds. That is, for the latter, the cost of purchased goods, works or services will increase by the amount of VAT and other mandatory payments - this must be taken into account when concluding a contract.

If a Russian company is a tax agent of a foreigner for both VAT and income tax in accordance with Article 309 of the Tax Code of the Russian Federation, then taxes are calculated in the following order:

- VAT is calculated and withheld,

- its amount is excluded from the income tax base,

- The amount of income tax withheld is calculated.

Payment order for VAT payment

General details

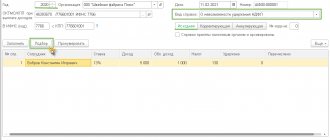

A payment order for payment of VAT by a tax agent to the budget is generated using the Payment order in the Bank and cash desk section - Bank - Payment orders.

In this case, it is necessary to correctly indicate the type of transaction Tax payment , then the document form takes the form for payment of payments to the budget system of the Russian Federation.

You can also quickly generate a payment order using the Tax Payment Assistant :

- through the section Main – Tasks – List of tasks;

- through the section Bank and cash desk – Payment orders using the Pay button – Accrued taxes and contributions.

Please pay attention to filling out the fields:

tax when performing the duties of a tax agent is not predetermined in the Taxes and Contributions directory, so you can:

- use VAT and manually adjust the Account in the document Write-off from the current account ; But at the same time, it is not recommended to change the parameters in the predefined VAT Taxes and Contributions directory !

- create a new element in the Taxes and Contributions . PDF

In our example, we will not create a separate element in the Taxes and Contributions , but will change the Account manually in the document Write-off from the current account .

- Tax – VAT , selected from the Taxes and Contributions directory. The following parameters are specified for it: the corresponding KBK code;

- text template inserted into the Payment purpose ;

- Account – 68.02 “Value added tax”, which will need to be adjusted manually in the document Debiting from current account.

Recipient details - Federal Tax Service

Since the recipient of the VAT is the tax office with which the taxpayer is registered, it is its details that must be reflected in the Payment order .

- The recipient - the Federal Tax Service, to which the tax is paid, is selected from the Counterparties directory;

- Recipient's account – bank details of the tax authority specified in the Recipient .

Currently, in the 1C program it is possible to use the 1C: Counterparty service, which allows you to automatically fill in and monitor the relevance of the details of government bodies.

If the details are no longer relevant, the 1C:Counteragent will offer to update them in the Counterparties directly from the payment order form. PDF

- Recipient's details - TIN , KPP and Recipient's name , these are the data that are used to print the payment order. If necessary, the recipient's details can be edited in the form that opens via the link.

Filling out payment details to the budget

The accountant needs to control the data that the program fills in using the link Payment details to the budget .

In this form, you need to check that the fields are filled in:

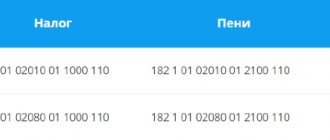

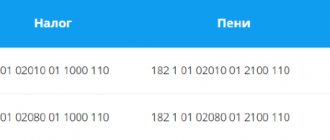

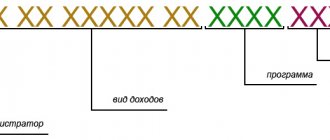

- KBK – 18210301000011000110 “Value added tax on goods (work, services) sold on the territory of the Russian Federation.” KBK is entered automatically from the Taxes and Contributions directory;

If the KBK is not known for any payment to the budget, you can use the KBK Designer by following the link to the right of the KBK .

- OKTMO code is the code of the territory in which the Organization is registered. The value is filled in automatically from the Organization directory ;

- Payer status – 02-Tax agent ;

- UIN - 0 , UIN can only be specified from information in tax notices or requests for payment of tax (penalties, fines);

- Basis of payment - TP payments of the current year , is entered when paying the tax on time;

- Tax period – quarterly payment , since the tax period for VAT is equal to a quarter;

- Year – 2018 , the year for which the tax is paid;

- Quarter – 2 , the number of the quarter for which the tax is paid;

- Document number is 0 , the document on the basis of which the payment is made is a declaration, and it does not have the Number ;

- Document date – 0 , payment is made before the date of signing the declaration, i.e. date is not determined (clause 4 of Appendix No. 2, approved by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n).

Find out more about the details of payments to the budget .

- Purpose of payment - information for identifying the payment, filled in automatically using a template from the Taxes and Contributions directory. The field can be edited if necessary;

To transfer VAT when performing the duties of a tax agent, it is recommended to indicate:

- name of the tax;

- what the tax payment is related to;

- accrual period;

- tax payment deadline;

- payment amount.

In our example, the Payment Purpose will look like this:

- Value added tax withheld by the tax agent from the cost of services purchased from a non-resident POSexpert LLC, for the second quarter of 2022, transferred no later than 06/01/2018. (Amount 63900-00).

You can print a payment order by clicking the Payment order . PDF

The company leases property from authorities

When concluding a lease agreement for federal or municipal property, you need to carefully consider who the lessor is. If this is a government agency or a federal or municipal unitary enterprise (for example, a hospital or a train station), then the tenant will not have duties as a tax agent under this agreement. Organizations of these types pay their own taxes.

If the lessor is a city administration, municipality, state property management committee or similar body, then the tenant becomes a tax agent for VAT. It does not matter what kind of agreement is concluded: bilateral, that is, between the lessor and the tenant, or tripartite, between the balance holder, the lessor and the tenant. In any case, the company that rented the property will have to calculate VAT on the rent and pay it to the budget.

How the tax amount is calculated depends on what conditions are stipulated in this regard in the contract. If it indicates that VAT is included in the rental price, the tax is calculated at an estimated rate using the formula:

VAT = Rent x 18 / 118

If the contract specifies the amount of rent without VAT or there is no mention of tax at all, it is calculated at a rate of 18% above the rent. In this case, the tax is paid by the tenant out of his own pocket, increasing the cost of rent.

Tax rate

The tax rate depends on the type of goods (work, services) that the tax agent organization buys or sells on the territory of Russia (Article 164 of the Tax Code of the Russian Federation).

The amount of VAT that must be transferred to the budget is determined at the calculated rate:

- if the tax base includes VAT;

- upon receipt of an advance (partial payment) for upcoming supplies of goods (work, services), for the sale of which the tax base is determined without taking into account VAT.

This follows from the provisions of paragraph 4 of Article 164 of the Tax Code of the Russian Federation.

If the cost of goods (work, services) in the contract is established without VAT, the tax agent must transfer the tax to the budget at his own expense. In this case, determine the tax amount in the following order. First, increase the tax base (the value specified in the agreement) by the amount of VAT at a direct rate - 18 or 10 percent. And then, based on the increased tax base, determine the amount of VAT at the calculated rate: 18/118 or 10/110 (letter of the Ministry of Finance of Russia dated September 8, 2011 No. 03-07-08/276).

If the tax base does not include VAT, the amount of tax that needs to be transferred to the budget is determined at a direct rate - 18 or 10 percent. This rule applies to two categories of tax agents:

- on intermediaries selling goods (work, services) of foreign principals or principals in Russia (clause 5 of Article 161 of the Tax Code of the Russian Federation);

- on organizations (entrepreneurs) that sell confiscated and ownerless property (clause 4 of article 161 of the Tax Code of the Russian Federation).

When selling goods (work, services, property), such tax agents are required to present the calculated VAT amounts to buyers (clause 1 of Article 168 of the Tax Code of the Russian Federation).

An example of VAT calculation for the sale of goods to a foreign organization that is not tax registered in Russia under an intermediary agreement

Alpha LLC (commission agent) sells goods to a foreign organization under a commission agreement. The foreign organization (committent) is not registered in Russia for tax purposes. When selling such goods in Russia, VAT is charged at a rate of 18 percent.

The sale price of goods agreed with the principal is RUB 2,000,000. (excluding VAT). The commission (including VAT) is 10 percent of the sale price of the goods (including VAT) and is retained by the commission agent from funds received from buyers.

The amount of VAT that Alpha imposes on customers is: RUB 2,000,000. × 18% = 360,000 rub.

The selling price of goods including VAT is: RUB 2,000,000. + 360,000 rub. = 2,360,000 rub.

All goods were sold and paid for. The following entries were made in Alpha's accounting records:

Debit 004 – RUB 2,360,000. – goods received on commission are accepted for accounting;

Debit 62 Credit 76 – 2,360,000 rub. – the shipment of the consignor’s goods is reflected;

Debit 76 Credit 68 subaccount “Calculations for VAT” – 360,000 rubles. – VAT has been charged for the foreign principal;

Loan 004 – RUB 2,360,000. – goods sold under a commission agreement are written off;

Debit 76 Credit 90-1 – 236,000 rub. (RUB 2,360,000 × 10%) – reflects the amount of remuneration under the commission agreement;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 36,000 rubles. (RUB 236,000 × 18/118) – VAT is charged on commission fees;

Debit 51 Credit 62 – 2,360,000 rub. – payment for goods has been received;

Debit 76 Credit 51 – 1,764,000 rub. (RUB 2,360,000 – RUB 360,000 – RUB 236,000) – funds were transferred to the principal.

Situation: at what rate should a tax agent withhold VAT on amounts received from buyers and charge VAT on his remuneration when selling confiscated goods taxed at a rate of 10 percent on behalf of the Federal Property Management Agency?

The amount of tax that must be withheld and transferred to the budget from the cost of sold confiscated goods is determined at a rate of 10 percent. Present the VAT amount calculated in this way to the buyer in addition to the price of the goods sold (clause 1 of Article 168 of the Tax Code of the Russian Federation).

Calculate VAT on the remuneration amount at a rate of 18 percent (clause 3 of Article 164 of the Tax Code of the Russian Federation). Regardless of what goods are sold on behalf of the Federal Property Management Agency.

An example of calculating VAT and reflecting in accounting transactions for the sale by an organization of confiscated goods, subject to VAT at a rate of 10 percent, on behalf of the Federal Property Management Agency

Alpha LLC, on behalf of the Federal Property Management Agency, but on its own behalf, sells confiscated goods (the agreement was concluded on a competitive basis).

On January 17, Alpha received for sale a consignment of goods confiscated at customs - 1000 packages of Czech-made Libero baby diapers. The sale price of the goods agreed with the Federal Property Management Agency was 500 rubles. per package. This corresponds to the level of market prices. Thus, the total amount of the shipment was 500,000 rubles. (1000 packages × 500 rub./pack).

On January 20, Alpha sold the entire batch of confiscated goods. The buyer was Torgovaya LLC. On the same day, the proceeds from the sale of goods in full were credited to Alpha's bank account.

Sales of baby diapers in Russia are subject to VAT at a rate of 10 percent (subclause 2, clause 2, article 164 of the Tax Code of the Russian Federation).

The amount of VAT that Alpha presented to Hermes in addition to the price of the goods sold was: RUB 500,000. × 10% = 50,000 rub.

The selling price of goods including VAT is equal to: 500,000 rubles. + 50,000 rub. = 550,000 rub.

Alpha presented Hermes with an invoice dated January 20 for the cost of the goods shipped. The Alpha accountant registered this invoice in the sales book on the same day.

According to the agreement, Alpha's remuneration (excluding VAT) for the sale of confiscated goods is 10 percent of the sales value of these goods (including VAT).

The remuneration amount is transferred to Alpha's current account after approval of the report on the sale of confiscated goods. The report on the sale of confiscated goods was approved on January 24. On the same day, the remuneration amount was credited to Alpha's bank account.

The amount of remuneration (excluding VAT) was 55,000 rubles. (RUB 550,000 × 10%). The remuneration amount including VAT is RUB 64,900. (RUB 55,000 + RUB 55,000 × 18%).

Alpha presented the Federal Property Management Agency with an invoice dated January 24 for the amount of its remuneration. The Alpha accountant registered this invoice in the sales book on the same day.

The working Chart of Accounts of Alpha (approved as an annex to the accounting policy) provides that a subaccount “Settlements with the Federal Property Management Agency” is opened to account 76 “Settlements with various debtors and creditors”.

Alpha's accountant made the following entries in the accounting.

January 17:

Debit 002 – 550,000 rub. – goods received for sale are accepted for accounting.

January 20th:

Debit 62 Credit 76 subaccount “Settlements with the Federal Property Management Agency” – 550,000 rubles. – reflects the selling price of goods shipped to the buyer;

Loan 002 – 550,000 rub. – the cost of goods shipped to the buyer is written off;

Debit 76 subaccount “Settlements with the Federal Property Management Agency” Credit 68 subaccount “Settlements for VAT” - 50,000 rubles. – fulfilled the duties of a tax agent to withhold VAT;

Debit 51 Credit 62 – 550,000 rub. – payment for goods sold has been received from the buyer;

Debit 76 subaccount “Settlements with the Federal Property Management Agency” Credit 51 – 500,000 rubles. (550,000 rubles – 50,000 rubles) – funds were transferred to the Federal Property Management Agency for goods sold (minus withheld VAT).

January 24:

Debit 76 subaccount “Settlements with the Federal Property Management Agency” Credit 90-1 – 64,900 rubles. – the amount of remuneration under the contract has been accrued;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 9900 rubles. (RUB 55,000 × 18%) – VAT is charged on remuneration;

Debit 51 Credit 76 subaccount “Settlements with the Federal Property Management Agency” – 64,900 rubles. – the amount of the reward was credited to Alpha’s bank account.

Payment of VAT to the budget

Payment of VAT by tax agents must be made in three equal installments no later than the 25th day of each month of the quarter following the reporting one. The exception is the purchase of works and services from a foreign company. In accordance with paragraph 4 of Article 174 of the Tax Code of the Russian Federation, in this case, VAT to the budget must be paid simultaneously with the payment of funds to the foreign supplier (performer). If, along with a payment order for the transfer of money for services (work), you do not submit a payment order for the transfer of VAT to the budget, the bank will simply not accept the documents from the buyer.

Procedure for paying VAT by a tax agent

Let us examine the procedure for paying VAT by a tax agent using the example of leasing state and municipal property. The tenant is recognized as a tax agent if (clause 3 of Article 161 of the Tax Code of the Russian Federation):

- takes property for temporary use from state authorities or local governments;

- this property is located on the territory of the Russian Federation.

Tax agents will also be those organizations and individual entrepreneurs that apply special regimes in the form of the Unified Agricultural Tax, the simplified tax system, the PSN (clause 4 of article 346.1, clause 5 of article 346.11, clause 11 of article 346.43 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated September 24, 2015 No. 03-07-11/54577).

The tax base should be determined as the amount of rent, including VAT, separately for each object (clause 3 of Article 161 of the Tax Code of the Russian Federation).

The moment the tax base arises is the date of transfer of all or part of the rent (letter of the Ministry of Finance of the Russian Federation dated June 23, 2016 No. 03-07-11/36500).

To calculate VAT, the tax base must be multiplied by the tax rate. Depending on whether the contract specifies the fee including VAT or without it, the tax should be calculated as follows:

- if under the contract the rent includes VAT, then the amount of tax is determined by the calculation method: the amount of the rent including VAT is multiplied by 20/120 (clause 4 of Article 164 of the Tax Code of the Russian Federation);

- if the rent does not include VAT, then first the rent amount is increased by VAT at a rate of 20 percent, and then the result obtained is multiplied by 20/120 (clause 3 of Article 161, clauses 3, 4 of Article 164 of the Tax Code of the Russian Federation) .

The rent should be transferred in the amount provided for in the contract, without deducting VAT from it. You must pay taxes to the budget from your own funds.

Example.

The agreement states that the rental amount is 500 thousand rubles excluding VAT. The tax base will be equal to 500 thousand 500 thousand x 20 percent = 600 thousand, and VAT will be 100 thousand rubles (600 thousand x 20/120). The landlord should transfer the rent under the agreement in the amount of 500 thousand rubles and pay 100 thousand rubles to the budget for VAT.

The company must pay the withheld VAT at its location within a general period of time - no later than the 25th day of each of the three months following the quarter in which the tax was withheld.

Paid VAT amounts can be deducted in the quarter in which the tax was paid. To deduct, the following conditions must be met (clause 3 of Article 171, Article 172 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated January 26, 2015 No. 03-07-11/2136):

- a company or individual entrepreneur is registered with the tax authorities and is a VAT payer. If they apply special regimes or do not pay VAT, then the withheld tax cannot be deducted;

- the taxpayer has payment documents that confirm that the withheld tax was transferred to the budget;

- a company or individual entrepreneur uses leased property for activities subject to VAT;

- the taxpayer accepted rental services for accounting;

- the company or individual entrepreneur has a properly executed invoice issued for the seller.

Documenting

The tax agent must issue an invoice according to the general rules, that is, it must be drawn up no later than 5 calendar days after payment. The document is drawn up in two copies, one of which is registered in the sales book, and the second in the purchase book when the taxpayer has the right to deduct.

When filling out an invoice by a tax agent, there are some peculiarities. So, in lines 2, 2a and 2b you must indicate the details of the supplier (seller or lessor). If the seller is a foreign organization, then in the INN and KPP columns (line 2b) you need to put a dash. It was said above that when purchasing work and services from a foreign counterparty, VAT must be paid simultaneously with the transfer of money to the supplier. In this case, line 5 of the invoice indicates the number and date of the payment order for the transfer of tax to the budget.

VAT on agency agreement

Business activity without the involvement of an agent, when the buyer is on OSNO and the seller is on the same taxation regime, does not raise questions regarding the calculation of VAT. The situation is the same with tax in an agency agreement. Accounting difficulties arise if one party uses the OSNO and the other the simplified tax system. Let's see how to account for VAT depending on who pays the VAT.

Agent on the simplified tax system, principal on the OSNO

An agent on the simplified tax system does not pay VAT, therefore he does not issue an invoice to the principal on OSNO for his services and does not allocate the amount of tax from the remuneration.

If an agent on the simplified tax system operates on behalf of the principal-buyer, invoices received from the seller are issued to the principal. The intermediary’s task is only to transfer these documents to the principal within the time period specified in the agency agreement.

If the intermediary is instructed to sell goods (works, services) on behalf of the principal to third parties, he transfers to the buyer the principal's invoice issued in the name of this buyer.

If a simplified agent acts on his own behalf, he issues an invoice to the principal-buyer on OSNO on behalf of the seller. The intermediary transfers data from the invoice received from the seller and independently assigns a number to the document, taking into account the chronology of its document flow, but with the date specified by the seller.

When selling the principal's goods on OSNO on behalf of the agent on the simplified tax system, the intermediary issues an invoice in the name of a third-party buyer and informs the principal of the document indicators for re-issuing it on behalf of the principal. The principal then issues an invoice to the buyer on his behalf.

An agent on the simplified tax system is obliged to keep a log of invoices received and issued in relation to business activities in the interests of a third party.

The mediator fills out the section of the journal “Information on mediation activities.” The journal must be submitted to the Federal Tax Service on a quarterly basis in electronic form according to the format approved by Order of the Federal Tax Service of Russia dated March 4, 2015 N ММВ-7-6/93 , no later than the 20th day of the month following the expired quarter ( clause 5.2 of Article 174 of the Tax Code of the Russian Federation ).

If the intermediary allocates VAT in the amount of the agency fee, in accordance with clause 5 of Art. 173 of the Tax Code of the Russian Federation, he has the obligation to calculate and pay tax, as well as submit a VAT declaration to the Federal Tax Service.

At the same time, there is no right to deduction for simplification even in this case, because organizations using the simplified tax system are not VAT payers ( clause 5 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 ).

For the principal at OSNO, this situation is also difficult. He expects to receive a deduction, but tax authorities may question the deduction from the organization using the simplified tax system. Judicial practice in the issue of obtaining a deduction from a simplified person takes the side of the taxpayer ( Determination of the Constitutional Court of the Russian Federation dated March 29, 2016 No. 460-O ). However, the Ministry of Finance has a different position: if an invoice was issued by an organization using the simplified tax system, which is not a VAT payer, then the tax cannot be deducted ( Letter of the Ministry of Finance dated October 5, 2015 No. 03-07-11/56700 ).

If the principal at OSNO decides to take a risk and accept VAT deduction on an invoice from a simplifier, you need to be prepared for legal proceedings with the tax authorities.

To strengthen your position, we recommend paying attention to the clause in the agreement on the intermediary’s remuneration - the amount of VAT must be allocated, and also keep the agent’s written confirmation of the payment of tax to the budget. Properly executed documents prove the agreement of the parties in this situation and the conscious intention to impose the payment of VAT on the agent.

Are taxes too expensive? We know 45 ways to legally reduce them!

The funds saved can be used to develop your business!

More details

Agent on OSNO, principal on simplified tax system

The intermediary on OSNO, being a VAT payer, issues an invoice for the amount of his remuneration. If acting on his own behalf, the agent on OSNO reissues the seller's invoice in the name of the buyer on his own behalf, similar to the procedure specified above for agents on the simplified tax system.

An invoice for agency fees is not entered into the Register of received and issued invoices ( clause 3.1 of Article 169 of the Tax Code of the Russian Federation ).

Please note that invoices re-issued by an agent for a principal or by a principal for a third-party buyer are not recorded in the sales ledger and purchase ledger of the intermediary.

If an agent on OSNO purchases goods on his own behalf for the principal-buyer and re-issues an invoice from the seller in the name of the buyer, it does not need to be taken into account in the agent’s sales book, since he does not have the obligation to charge VAT ( clause 3 of the Rules for maintaining the sales book , approved by Resolution No. 1137 ).

When an intermediary sells a customer’s goods on his own behalf, he does not make an entry in the sales book, since the goods belong to the principal, and the intermediary does not have the obligation to charge VAT ( clause 20 of the Rules for maintaining the sales book ). Having received a reissued invoice from the principal, the intermediary does not make an entry in the purchase book ( clause “c” clause 19 of the Rules for maintaining the purchase book ).

Reporting, deductions and expense write-offs

Regardless of whether the tax agent is a VAT payer or not, he must file a VAT return. Paying agents report strictly electronically, and agents who do not pay VAT themselves can submit reports in paper form.

As for VAT deductions, those tax agents who themselves are payers of this tax are entitled to them. VAT is deducted by agents on a general basis. To do this, all necessary conditions must be met, namely:

- availability of an invoice (it is issued by the tax agent, that is, the company itself) and a payment document confirming the transfer of funds to the budget;

- posting of purchased goods, works or services;

- their use in activities subject to VAT.

VAT non-payers can include the amount of tax paid in the cost of purchased goods, works or services.

Example

A company that carries out VAT-taxable and non-VAT-taxable activities rents office space from the municipality for 200 thousand rubles per month. In accordance with the terms of the agreement, the rent includes VAT.

The amount of tax included in the rent will be: 200,000 x 18 / 118 = 30,508.47 rubles.

The following will be transferred monthly towards the rent: 200,000 - 30,508.47 = 169,491.53 rubles.

Let’s assume that the share of transactions subject to VAT corresponds to 5% of the revenue, that is, the company can deduct 5% of the VAT paid.

Subject to deduction: 30508.47 / 100 x 5 = 1525.42 rubles.

The remaining tax amount, namely 30508.47 - 1525.42 = 28983.05 rubles, will be attributed to income tax expenses as part of rental costs for the specified month.

conclusions

If a company begins to work with a non-standard type of counterparty, namely with foreign companies or government agencies, it is worth carefully studying the issue of the emergence of additional tax obligations. It is quite possible that she will have to act as a tax agent for VAT and other payments. In this case, the taxation regime applied by the company itself (OSNO, simplified tax system, patent, UTII) does not play any role.

It is worth considering that if a tax agent does not fulfill his obligations to pay VAT, he bears the same responsibility as if he had not paid his own tax. In addition to the fact that he will be charged arrears and penalties for late payment, the Federal Tax Service may impose a fine under Article 122 of the Tax Code of the Russian Federation in the amount of 20% of the unpaid amount.