A new participant in an LLC: what to do before and after paying the share?

The emergence of a new founder in an LLC can occur either with an increase in the authorized capital or without it (if a new participant in the company acquires the share of the retired founder).

Let's consider the scheme of the emergence of a new participant, accompanied by an increase in the authorized capital (hereinafter also referred to as the authorized capital).

In this situation, before the new participant pays for the share, it will be necessary (Articles 17–19 of Law No. 14-FZ):

- check whether all current participants have paid for their shares - if not, an increase in the authorized capital is not allowed;

- make sure that the company’s charter does not prohibit increasing the capital capital at the expense of contributions from third parties;

- receive an application from a new participant with a request to accept him into the company (indicating the amount of the contribution, the timing and procedure for payment);

- convene a meeting of participants to resolve issues of introducing a new participant into the founders, increasing the capital and other related issues on the agenda;

- draw up the minutes (decision) of the general meeting, which must reflect:

- the fact of accepting a new participant into the LLC and increasing the capital due to his contribution;

- the size and nominal share of the new participant, adjustment of the shares of the remaining founders;

- approval of a new version of the LLC charter in connection with an increase in the authorized capital.

A new participant can contribute money or property.

Find out how to reflect in accounting the contribution of authorized capital to the cash desk of an enterprise in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

What property can be contributed to the authorized capital of an LLC?

The most liquid asset is money, so payment of the authorized capital of an LLC most often occurs in cash. Moreover, the minimum amount of the authorized capital cannot be contributed by anything other than money. Although not so long ago, until 2014, the first asset of an LLC could be contributed by inexpensive office property (usually a table, chairs, office equipment).

But now the method of contributing the minimum amount of authorized capital is fixed in Article 66.2 of the Civil Code of the Russian Federation: “When paying for the authorized capital of a business company, funds must be contributed in an amount not lower than the minimum amount of authorized capital.”

In addition to the minimum amount, payment of the authorized capital of an LLC can be made with any amount of money or property. This could be real estate, equipment, transport, intangible assets, shares and shares in other companies, government and municipal bonds.

The founders may establish a ban on the contribution of certain property, for example, non-core equipment, as payment for shares of the management company. The general meeting of participants must approve the amount of the property contribution. And if the value of the property exceeds 20,000 rubles, then an independent expert must be hired to evaluate it.

When is paying for a share in an LLC through a cash register impossible or illegal?

Obstacles to depositing a share through the cash register may arise if the company makes all payments by bank transfer - the deposit will have to be paid to the current account.

In some cases, making a contribution to the authorized capital (including through a cash desk) may be considered illegal, for example:

- money is contributed by a non-resident founder (violation of currency legislation);

- the monetary statutory contribution was received by the cash desk from a person who does not have the right to act as a founder of the company (violation of the Civil Code and other laws);

- in other cases (for example, a contribution to the authorized capital of an insurance company was made to the cash desk with borrowed funds, which is a violation of paragraph 3 of Article 25 of the Law “On Insurance Business in the Russian Federation” dated November 27, 1992 No. 4015-1).

Let's take a closer look at the first two situations.

The money was contributed by the non-resident founder

If your founder is a foreign legal entity, accepting a cash contribution from him to the cash desk will be a violation of subclause. 9 "b" clause 1 art. 1 of the Law “On Currency Regulation” dated December 10, 2003 No. 173-FZ.

Depositing money into the authorized capital in this case (even if it happens in rubles) is a currency transaction, and it cannot be carried out through a cash desk. According to clause 2 of Law No. 173-FZ, payments for such operations are made through bank accounts in authorized banks (the procedure for opening and maintaining them is established by the Central Bank).

Find out how currency regulation is organized in our country here.

For accepting funds from such a founder into the cash register, you may be punished financially under clause 1 of Art. 15.25 of the Code of Administrative Offenses of the Russian Federation (from 3/4 to 1 of the amount of the illegal transaction).

The founder who contributed the money cannot be a participant in the LLC

Before accepting money from an LLC participant as a contribution to the authorized capital, check whether the participant’s stay in this status is legal.

The legislation establishes that:

- foreign firms, domestic companies with foreign participation in the authorized capital of 50% or more, citizens of the Russian Federation with dual citizenship are prohibited from acting as founders of radio and television channels, television, radio and video programs (Article 19.1 of the Law “On the Media” dated December 27, 1991 No. 2124-1);

- an LLC consisting of one participant cannot be the sole founder or participant of another LLC (Clause 2, Article 7 of Law No. 14-FZ);

- Persons in military service cannot act as founders - clause 7 of Art. 10 of the law on the status of military personnel of May 27, 1998 No. 76-FZ, other citizens (civil servants, etc.)

This publication will tell you when and in what order they are removed from the military register.

What is authorized capital

Authorized capital is the money that the founders deposit into the account or cash desk of the organization when opening an LLC. It is needed to ensure the operation of the company at the start and to protect creditors. The minimum amount is 10,000 rubles (Clause 1 of Article 14 of the Federal Law of 02/08/1998 No. 14-FZ).

Contribution of the authorized capital is the responsibility of the founders; they cannot refuse. Shares in the authorized capital determine who owns the company and in what proportion. This is important when:

- decision making: the vote of the founder with the majority of the authorized capital is more significant;

- upon liquidation of a company: property is distributed among the founders in proportion to their shares.

Results

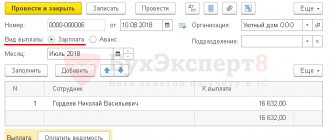

The founders of an LLC can make a monetary contribution to the authorized capital at the initial stage of activity or during its operation (when a new participant appears). Confirmation of payment of the deposit is a cash receipt order.

To add authorized capital to the cash desk, it is necessary to check the legality of such an operation, as well as formalize amendments to the charter (if the contribution increases the authorized capital) and other documents (application of a new participant, decision of the general meeting, etc.).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible to spend authorized capital?

The LLC manages the amount of its authorized capital at its own discretion: pays rent, utilities, buys raw materials, and so on. There are no restrictions. The minimum authorized capital of 10,000 rubles does not mean that there must always be at least 10,000 rubles in the account or cash register.

The main thing is that, starting from the second financial year, the organization has at least 10,000 rubles of assets on its balance sheet.

Example.

When you deposit the authorized capital, 10,000 rubles will go into the liability side of the balance sheet in the line “Authorized capital” and 10,000 rubles will go into “Cash and cash equivalents”. You can use this money to buy raw materials, then the amount will move from cash to the “Inventories” line. At the same time, the equality of assets and liabilities is maintained.

Deadlines for contribution of authorized capital

The time for contribution of shares is determined by the founders. But this period should not exceed four months from the date of registration of the company (Clause 1, Article 16 of the Federal Law of 02/08/1998 No. 14-FZ). The founders stipulate a fine or penalty for missing a deadline in the agreement on establishing the LLC.

If one of the founders does not contribute the share on time, it is distributed among the other participants. In addition, only the paid-up part of the authorized capital gives voting rights, so all decisions made during this time will lose force.

The legislator does not impose fines. But if the authorized capital of the LLC is not paid in 4 months, the company may be forcibly liquidated.

Find your bank to maintain your account

Select bank

Find your bank to maintain your account

Select bank

Authorized capital

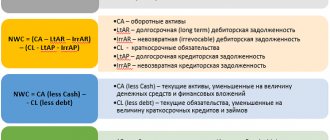

The authorized capital of an organization determines the minimum amount of its property, which guarantees the interests of its creditors.

The law may establish a minimum amount of authorized capital. For example, for limited liability companies the minimum authorized capital is 10 thousand rubles, for closed joint-stock companies - 10 thousand rubles, for open joint-stock companies - 100 thousand rubles.

In all cases where the law limits the minimum amount of the authorized capital, the actual amount of the authorized capital is compared with the value of the organization's net assets. If the authorized capital exceeds the value of the organization's net assets, it must be reduced to the value of the net assets. If, as a result, the authorized capital becomes less than the minimum amount established by law, the organization is subject to liquidation.

Forms of authorized capital:

- share capital - in a general partnership and limited partnership;

- mutual or indivisible fund - in a production cooperative (artel);

- authorized capital – in joint-stock companies, limited and additional liability companies;

- authorized capital - in unitary state and municipal enterprises.

The timing of the contribution of the authorized capital is determined by law and the constituent documents of the organization. The authorized capital can be paid for in cash and other property, property rights.

At the same time, the following types of property (property rights) cannot be made as a contribution to the authorized capital:

— rights of permanent (indefinite) use of land plots;

— lease rights to land plots;

— land plots, the powers to manage and dispose of which have been transferred to government bodies of the constituent entities of the Russian Federation;

— lease rights to a forest area;

- property transferred by state authorities and local governments as part of the support of small and medium-sized businesses, with the exception of state and municipal property purchased by the tenants of this property.

Profit is distributed among the organization's participants in proportion to their shares in the authorized capital.

When a participant leaves the organization, he is paid the value of part of the organization’s property corresponding to his share in the authorized capital.

To summarize information about the amount of the organization’s authorized capital, the “Authorized Capital” account is provided.

In the financial statements, the authorized capital of the organization is reflected:

- on line 1310 of the balance sheet;

— in the statement of changes in equity.

An example of the formation of authorized capital in accounting

LLC "1" was created by the decision of 2 founders. The authorized capital of LLC “1” is 10 thousand rubles, the share of founder 1=10%, the share of founder 2=90%. The authorized capital is paid by 60%. At the same time, founder 1 paid for the authorized capital contribution in cash, and founder 2 paid for office equipment.

1. The formation of the authorized capital is reflected:

Dt account 75 “Settlements with founders” <Founder 1> Kt account 80 “Authorized capital” 1000 rub. (=10 thousand rubles*10%).

Dt account 75 “Settlements with founders” <Founder 2> Kt account 80 “Authorized capital” 9000 rub. (=10 thousand rubles*90%)

2. Payment of the authorized capital has been received

Dt account 51 “Current account” Kt account 75 “Settlements with founders” <Founder 1> 600 rub. funds were received to pay for the authorized capital.

Dt inc. 10 Kt inc. 75 “Settlements with founders” <Founder 2> 5400 rub. – office equipment received from founder 2 as payment for the authorized capital was capitalized.

How to deposit authorized capital into a current account

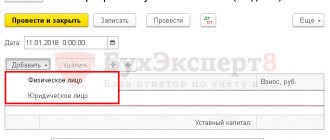

To deposit the authorized capital into the account, you need an open or reserved bank account. If you don’t have one yet, read about the procedure for opening a current account. There are three deposit methods.

Method 1. Transfer money to your account by bank transfer

Transfer money from an individual’s card to the LLC’s current account. In the purpose of payment, indicate “Contribution of the founder’s full name to the authorized capital of LLC Romashka”, “Payment by the founder of the full name of the authorized capital of LLC Romashka”, and so on.

If the founder is an organization, you need to issue a payment order with a similar purpose of payment.

In this case, it is necessary to obtain and keep a document confirming the contribution of your part of the authorized capital.

If you have not yet chosen a bank to open a current account, we will help you choose the tariff for cash settlement services that is most beneficial for your business.

The best tariff for a new LLC

Method 2. Deposit cash through a bank cash desk

The procedure for individuals, individual entrepreneurs and organizations is similar. Visit the branch and deposit the required amount into your account. The bank will record the receipt in the cash receipt order and give you one copy of this document. Check that the purpose of the payment corresponds to the purpose - “Contribution to the authorized capital”.

Here you can look at the list of tariffs at your bank and check which tariff has the best interest rate for depositing money into your current account.

Method 3. Deposit money into a reserved account

Some banks allow you to use the account even before signing the agreement. This is a reservation or account reservation service. It's free - you just need to go to the bank's website and fill out the form.

You can also deposit authorized capital into a reserved account. When the bank approves the application and you sign the agreement, the reserved account will automatically become a settlement account, and the authorized capital will appear on it.

There is no need to report to the Federal Tax Service on the contribution of authorized capital. She knows it from your constituent documents and balance sheet.

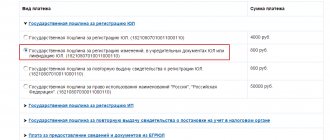

When payment of the authorized capital is prohibited

The law introduces a number of restrictions on the contribution of authorized capital. The following actions are considered illegal:

- depositing money into a management company by a non-resident through a cash desk is a violation of currency legislation, since most foreign exchange transactions are carried out only through a bank account (clause 3 of article 14 of Federal Law No. 173-FZ of December 10, 2003);

- a foreign or domestic company, in which more than 50% of the authorized capital belongs to a foreign person, makes a contribution to the management company of radio, television, channels and programs (Article 19.1 of the Federal Law of December 27, 1991 No. 2124-1);

- An LLC with one participant wants to become the founder of another LLC (Clause 2, Article 7 of Federal Law No. 14-FZ dated 02/08/1998);

- military personnel act as founders of the LLC (clause 7, article 10 of the Federal Law of May 27, 1998 No. 76-FZ).