Taxes

Home articles Taxes

01/17/2022 print

In some cases, the VAT that must be paid to the budget for a particular transaction is determined by calculation. Since 2022, the list of such cases has been supplemented with one more situation - in the spirit of the times.

The tax base

Determine the tax base in accordance with Articles 154–159, 161–162 of the Tax Code of the Russian Federation. For more information on determining the tax base for specific transactions, see:

- How to calculate VAT on the sale of goods (works, services);

- How to calculate VAT on the sale of property rights;

- How to calculate VAT when transferring goods (work, services) free of charge;

- How to calculate VAT when transferring goods for your own needs;

- How to calculate VAT on construction and installation work for your own consumption.

VAT payable

The total amount of accrued VAT is determined based on the results of the tax period - quarter (Article 163 of the Tax Code of the Russian Federation).

The total tax amount can be reduced by the amount of input VAT minus the amounts recovered. As a result, calculate the amount of VAT payable to the budget using the formula:

| VAT payable | = | VAT to be charged | – | Input VAT accepted for deduction | + | VAT restored in the tax period |

Such rules are established in paragraph 1 of Article 173 of the Tax Code of the Russian Federation.

Procedure for paying VAT

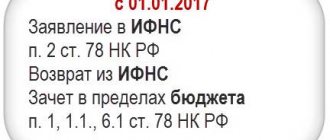

Clause 1 of Article 174 of the Tax Code of the Russian Federation talks about the procedure and deadlines for paying VAT. Payment is made during the quarter in equal installments. Then, when the deadline falls on a weekend, payment is transferred to the nearest working date. The law provides for accelerated tax payment. It is quite possible to pay the entire amount at once.

A very important factor is checking the details of the tax authority that receives the amount of money. Because there are times when they change, then you have to deal with the bank:

Then, when a company is late in payment, tax officials will impose a fine on it. Tax agents are an exception. They must pay the tax before the purchase is paid for, otherwise the bank does not have the right to accept payment.

In order to avoid any troubles with the tax service, you must clearly know the rules and procedure for paying value added tax. It is also important to submit the declaration on time, then the entrepreneur will avoid paying large fines and the ensuing consequences.

Payments in foreign currency

Situation: how to calculate VAT when selling goods in Russia whose value is expressed in foreign currency? Payment for goods is made in foreign currency in two stages: partially in advance, partially after shipment

Calculate VAT in rubles at the Bank of Russia exchange rate on the date of shipment of goods.

In accounting and tax accounting, revenue from sales under contracts denominated in foreign currency is defined as the sum of two quantities: the received advance and the receivables outstanding on the date of shipment. This is explained by the fact that advances received under contracts, the value of which is expressed in foreign currency, are not recalculated either on the reporting date, or on the date of shipment, or on the date of final settlements with the buyer (clauses 9, 10 PBU 3/2006, para. 3 Article 316 of the Tax Code of the Russian Federation).

However, for VAT purposes these rules do not apply. When making advance payments, the VAT tax base is determined twice:

- first, the seller charges VAT at the rate of the Bank of Russia on the date of receipt of the advance (according to the settlement rate);

- then the seller charges VAT on the cost of the shipped goods at the Bank of Russia exchange rate on the date of shipment (at a direct rate), and takes the amount of VAT accrued on the advance payment (at the rate in effect on the date of receipt of the advance payment) for deduction.

This procedure follows from the provisions of paragraph 3 of Article 153, paragraphs 1 and 14 of Article 167, paragraph 8 of Article 171 and paragraph 6 of Article 172 of the Tax Code of the Russian Federation and is confirmed by letters of the Ministry of Finance of Russia dated October 4, 2012 No. 03-07-15/130 and the Federal Tax Service Russia dated September 24, 2012 No. ED-4-3/15921.

An example of reflection in accounting and taxation of proceeds from the sale of goods, the cost of which is expressed in foreign currency. The goods are sold to a representative office of a foreign organization located in Russia (payment for the goods is made in foreign currency). The contract provides for partial prepayment, final payment is made after shipment

Torgovaya LLC entered into an agreement for the supply of goods with a representative office of a foreign organization located in Russia for the amount of USD 11,800 (including VAT - USD 1,800). Cost of goods sold – 200,000 rubles.

On October 14, 2015, the representative office transferred an advance payment in the amount of $5,000 to Hermes. On October 26, 2015, Hermes shipped the entire consignment of goods to the buyer. The final payment is due on November 25, 2015. Title to the goods passes to the buyer on the date of shipment (26 October). Hermes applies a general taxation system and pays income tax quarterly.

The conventional US dollar exchange rate is:

- as of October 14, 29.40 rubles/USD;

- as of October 26, 29.70 rubles/USD;

- as of November 25, 30.00 rub./USD.

In accounting, the Hermes accountant reflected the received advance and subsequent shipment of goods with the following entries.

October 14:

Debit 52 Credit 62 subaccount “Settlements on advances received” – 147,000 rubles. (5000 USD × 29.40 rubles/USD) – an advance was received to pay for goods;

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” - 22,424 rubles. (RUB 147,000 × 18/118) – VAT is charged on the advance received.

October 26:

Debit 62 subaccount “Settlements for shipped goods” Credit 90-1 – 348,960 rubles. (RUB 147,000 + USD 6,800 × RUB 29.70/USD) – revenue from the sale of goods is reflected;

Debit 62 subaccount “Settlements for advances received” Credit 62 subaccount “Settlements for shipped goods” - 147,000 rubles. – the received advance is counted towards payment;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 53,460 rubles. ((10,000 USD × 29.70 rubles/USD) × 18%) – VAT is charged on proceeds from the sale of goods;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances received” – 22,424 rubles. – accepted for deduction of VAT on advance payment;

Debit 90-2 Credit 41 – 200,000 rub. – the cost of goods sold is written off.

The same amount (200,000 rubles) is included in expenses that reduce the tax base for income tax.

Due to the fact that the contract provides for partial prepayment, and the organization makes the final payment after shipment, an exchange rate difference arises in accounting. It appears only in relation to the subsequent (second) part of the payment - USD 6,800 (including VAT - USD 1,037). The advance payment is not recalculated.

The exchange rate difference is reflected in accounting on the date of receipt of final payment.

November 25:

Debit 52 Credit 62 subaccount “Settlements for shipped goods” – 204,000 rubles. (6800 USD × 30.00 rubles/USD) – final payment for the goods has been received;

Debit 62 subaccount “Settlements for shipped goods” Credit 91-1 – 2040 rubles. (6800 USD × (30.00 rub./USD – 29.70 rub./USD)) – reflects the positive exchange rate difference on the date of final settlement.

When calculating VAT, the resulting exchange rate difference is not taken into account.

In the VAT return for the fourth quarter of 2015, in line 010 (section 3), the Hermes accountant indicated (as part of the general indicators) revenue in the amount of 297,000 rubles. (10,000 USD × 29.70 rubles/USD) and the amount of VAT accrued in the amount of 53,460 rubles. (RUB 297,000 × 18%).

To calculate income tax, the accountant calculated the proceeds as follows: – regarding the advance payment: (5000 USD – 5000 USD × 18/118) × 29.40 = 124,568 rubles; – regarding subsequent payment: (6800 USD – 6800 USD × 18/118) × 29.70 = 171,161 rubles.

The total amount of revenue was: RUB 124,568. + 171,161 rub. = 295,729 rub.

When determining the tax base for income tax, the accountant included:

- included in income from sales is revenue in the amount of RUB 295,729;

- non-operating income includes a positive exchange rate difference in the amount of 2040 rubles.

Thus, with the advance form of settlements for transactions denominated in foreign currency, the indicators of revenue from sales (without VAT) in accounting (295,500 rubles), revenue from sales in tax accounting (295,729 rubles) and the tax base for VAT ( 297,000 rub.) vary.

Situation: how to determine the amount of VAT deduction from the cost of goods (work, services) purchased for foreign currency?

Determine the deduction amount in rubles at the Bank of Russia exchange rate on the date of recording of the property.

As a rule, an organization pays for property acquired in Russia (work, services, property rights) in rubles. This is due to the fact that it is prohibited to use foreign currency in payments, except in cases provided for by law (clause 3 of Article 317 of the Civil Code of the Russian Federation). Such cases, in particular, include the acquisition of property (works, services, property rights) from a representative office of a foreign organization located in Russia (subclause 7, paragraph 1, article 1, article 6 of the Law of December 10, 2003 No. 173- Federal Law).

If the property (goods, work, services) was purchased for foreign currency, then deduct the input VAT on it in the amount of the ruble equivalent. Calculate the deduction amount at the Bank of Russia exchange rate in effect on the date the property (work, services, property rights) was accepted for accounting, using the formula:

| Amount of tax to be deducted | = | Tax amount presented on the invoice (in foreign currency) | × | Bank of Russia exchange rate in effect on the date of acceptance for accounting of acquired property (work, services, property rights) |

This procedure follows from paragraph 4 of paragraph 1 of Article 172 of the Tax Code of the Russian Federation.

Solving VAT problems

Topic: Solving VAT problems

1. Calculation and payment of VAT on advances received (pages 206-207)

2. Calculation of VAT on interest received on trade loans, bonds and bills (p. 207-208)

3. The concept of deducting “input” VAT (page 208 example 210).

4. Regular invoices (pp. 244-245).

5. Solving VAT problems:

Example 2.5. The enterprise sold 400 units of products: 1) trading company No. 1 (80%) in the amount of 576 thousand rubles. (without VAT); 2) trading company No. 2 (10%) in the amount of 80 thousand rubles. (without VAT); 3) own branch (10%) for 56 thousand rubles. Market price (excluding VAT) - 2 thousand rubles. Is it legal to recalculate taxes from the Federal Tax Service? Solution: Selling price: 1) TF No. 1: 576,000 / 320 ed. (80%) = 1,800 rub. 2) TF No. 2: 80,000 / 40 ed. (10%) = 2,000 rub. 3) branch: 56,000 / 40 ed. (10%) = 1,400 rub. Deviation from the market price for the branch = [(2,000 - 1,400) / 2,000] x 100 = 30% (>20%). The recount is legal.

Example 2.6. The company's revenue from product sales amounted to 236 thousand rubles. Materials worth 70 thousand rubles were used to manufacture the products. Determine the VAT payable to the budget. Make entries in the accounting accounts. Solution: VAT received: (236 / 1.18) x 0.18 = 36 thousand rubles. (D62 – K90) (D90 – K68.1) Credited VAT = 70 x 0.18 = 12.6 thousand rubles. (D68.1 - K19.3) VAT payable: 36 - 12.6 = 23.4 thousand rubles. (D 68.1 - K 51)

Example 2.7. The company's quarterly revenue from product sales amounted to 472 thousand rubles. Material costs for manufacturing products are equal to 150 thousand rubles. Determine and reflect in accounting the accrual, offset and payment of VAT to the budget. Solution: accrued VAT - (472 / 1.18) x 0.18 = 72 thousand rubles. (D 90 - K 68.1); VAT credited - 150 x 0.18 = 27 thousand rubles. (D 68.1 - K 19.3); VAT payable - 72 - 27 = 45 thousand rubles. (D 68.1 - K 51).

Example 2.8. Determine the amount of VAT to be paid to the budget. Make entries in the BU. Initial data: 1) 400 products were sold at a price of 295 rubles. (with VAT), 2) total costs for the production of 400 products - 80 thousand rubles, 3) labor costs - 16 thousand rubles, 4) depreciation charges - 5 thousand rubles, 5) other costs - 14 thousand roubles. Solution: 1) VAT received = [(400 x 295) / 1.18] x 0.18 = 18 thousand rubles, (D62 - K90) (D90 - K68.1) 2) material costs = 80 - (16 + 5 + 14) = 45 thousand rubles, (D20 – K10) 3) VAT credited = 45 x 0.18 = 8.1 thousand rubles, (D68.1 – K19.3) 4) VAT payable = 18 - 8.1 = 9.9 thousand rubles. (D 68.1 - K 51)

Example 2.9. Calculate the amount of VAT contributed to the budget based on the following initial data: 1) wholesale price of the enterprise (selling price = wholesale + VAT) - 50 rubles, 2) fixed costs (FC) - 50 thousand rubles, 3) variable costs (VC) - 120 thousand rubles, 4) material costs - 40% of the vehicle (FC + VC), 5) sales volume - 4000 units. Solution: 1) Income = 50 x 4000 = 200 thousand rubles, 2) total costs (TC) = 50 + 120 = 170 thousand rubles, 3) material costs = 0.4 x 170 = 68 thousand rubles. , 4) VAT received = 200 x 0.18 = 36 thousand rubles, (D62 - K90) (D90 - K68.1) 5) VAT credited = 68 x 0.18 = 12.24 thousand rubles. (D68.1 - K19.3) 6) VAT payable = 36 - 12.24 = 23.76 thousand rubles. (D 68.1 - K 51)

Example 2.10. In December 2010, the organization sold a minibus for 290 thousand rubles. The amount of accrued depreciation is 120 thousand rubles. The minibus was purchased in 2006 for 350 thousand rubles. Determine the amount of VAT payable to the budget. Solution: 1) Residual value = 350 - 120 = 230 thousand rubles. 2) DS for this transaction option (including VAT) = 290 - 230 = 60 thousand rubles. 3) VAT payable to the budget = (60 / 1.18) x 0.18 = 9.153 thousand rubles. (D 68.1 - K 51)

Example 2.11. The organization in the tax period: - sold products for 1,062 thousand rubles. (VAT included); — sold 140 products to an interdependent organization at a price of 472 rubles. (including VAT) at a market price of 520 rubles. (without VAT); — built a warehouse using economic methods (the cost of construction and installation work amounted to 236 thousand rubles including VAT). For the manufacture of products, materials worth 700 thousand rubles were purchased and released into production. (paid 590 thousand rubles including VAT). Determine the amount of VAT payable to the budget. Solution: The amount of tax payable to the budget is determined as the difference between the tax amounts received from buyers for sold products and the amount of tax deductions (clause 1 of Article 173 of the Tax Code of the Russian Federation). At a VAT rate of 18% (as of 01/01/13): 1. VAT on product sales: (1,062: 1.18) ? 0.18 = 162 thousand rubles. 2. VAT on sales of an interdependent organization: [(140 ? 472) : 1.18] ? 0.18 = 10.08 thousand rubles. 3. VAT on the construction of a warehouse: (236: 1.18) ? 0.18 = 36 thousand rubles. VAT, total (credit account 68.1) = 162 + 36 + 10.08 = 208.08 thousand rubles. The amount of tax deductions (Article 171 of the Tax Code of the Russian Federation) is equal to (590: 1.18) ? 0.18 = 90 thousand rubles. VAT payable to the budget is equal to 208.08 – 90 = 118.08 thousand rubles. According to Art. 40 of the Tax Code of the Russian Federation for transactions with interdependent organizations cannot deviate downward by more than 20% from the market price of identical goods. Based on the conditions of the problem, the selling price of one unit of a product of an interdependent organization deviates from the market price by 23.08% (>20%): [520 – (472: 1.18)]: 520 = 0.2308. The amount of additional VAT assessed by the tax authority: [(520 – 400) ? 140] ? 0.18 = 3,024 rub.

Contracts in conventional units

Situation: how to determine the amount of VAT deduction when purchasing goods (work, services) under contracts concluded in conventional units, the rate of which is tied to the foreign currency rate? Settlements under the agreement are carried out in rubles

When purchasing goods (works, services) under contracts concluded in the That is, the amount of input VAT must be deducted on the basis of received invoices in the amount indicated in these invoices (clause 1 of article 172 of the Tax Code of the Russian Federation).

Invoices for deliveries under contracts concluded in Ukraine. e., are billed in rubles (subclause “m” of clause 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). The tax amount is calculated by the seller and indicated on the invoice.

There is no need to recalculate VAT after final settlement with the seller (performer), since the right to deduction arises at the time of receipt of goods (work, services). Exchange differences that arise during the final settlement should be included in non-operating income or expenses (clause 11.1 of Article 250, subclause 5.1 of clause 1 of Article 265 of the Tax Code of the Russian Federation).

This procedure follows from the provisions of paragraph 5 of paragraph 1 of Article 172 of the Tax Code of the Russian Federation. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated January 17, 2012 No. 03-07-11/13.

An example of determining the amount of VAT deduction when posting goods under an agreement concluded in U.S. e. According to the terms of the contract, the goods are paid for after delivery

LLC "Torgovaya" buys goods at prices expressed in USD. e. According to the terms of the supply agreement 1 cu. e. equal to 1 US dollar at the official exchange rate of the Bank of Russia on the date of payment.

The reporting period for income tax is a month.

On October 12, 2015, Hermes received goods worth $11,800. e. (including VAT – 1800 USD). The supplier invoice states:

- cost of goods – 315,000 rubles;

- VAT amount – RUB 56,700.

Hermes paid for the goods on October 19, 2015.

Conditional US dollar exchange rate:

- on the date of capitalization (October 12, 2015) 31.50 rubles/USD;

- on the date of payment (October 19, 2015) 31 rubles/USD.

The following entries were made in the accounting records of Hermes.

October 12, 2015 (posting date):

Debit 41 Credit 60 – 315,000 rub. – purchased goods are capitalized;

Debit 19 Credit 60 – 56,700 rub. – input VAT is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 56,700 rubles. – accepted for deduction of input VAT.

October 19, 2015 (payment date):

Debit 60 Credit 51 – 365,800 rub. (11,800 USD × 31 rubles/USD) – goods were paid to the supplier;

Debit 60 Credit 91-1 – 5900 rub. ((RUB 315,000 + RUB 56,700) – RUB 365,800) – reflects the positive difference in settlements with the supplier.

On the day of payment, Hermes does not adjust the amount of VAT previously accepted for deduction.

When calculating income tax for October, the Hermes accountant included the resulting positive difference (5,900 rubles) in non-operating income.

An example of determining the amount of VAT deductions when posting goods under an agreement concluded in U.S. e. According to the terms of the contract, prepayment is provided

LLC "Torgovaya" buys goods at prices expressed in USD. e. According to the terms of the supply agreement 1 cu. e. equal to 1 euro at the official exchange rate of the Bank of Russia on the date of payment. The cost of purchased goods is 11,800 USD. e. (including VAT – 1800 USD).

The reporting period for income tax is a month.

On November 2, 2015, Hermes transferred the seller a 30 percent advance in the amount of 134,520 rubles against the upcoming delivery. (11,800 EUR × 30% at the exchange rate on the date of payment). On November 4, 2015, the accountant recorded the goods supplied. The final payment to the seller was made on November 16, 2015. The conditional euro exchange rate was:

- on the date of transfer of the advance – 38 rubles/EUR;

- on the date of receipt of goods – 40 rubles/EUR;

- on the date of final settlement – 41 rubles/EUR.

The following entries were made in the accounting records of Hermes.

November 2, 2015:

Debit 60 subaccount “Settlements on advances issued” Credit 51 – 134,520 rubles. (3540 EUR × 38 rubles/EUR) – an advance payment is transferred towards the upcoming delivery of goods.

After receiving an invoice from the supplier for the amount of the advance:

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances issued” – 20,520 rubles. (RUB 134,520 × 18/118) – VAT paid to the supplier as part of the advance is accepted for deduction.

The total amount of debt on capitalized goods will be: RUB 134,520. + (11,800 EUR – 3,540 EUR) × 40 rub./EUR = 464,920 rub.

This amount is indicated in the invoice that the supplier prepared when selling the goods.

The amount of VAT claimed is: RUB 464,920. × 18/118 = 70,920 rub.

The cost of the registered goods without VAT is: 464,920 rubles. – 70,920 rub. = 394,000 rub.

November 4, 2015:

Debit 41 Credit 60 subaccount “Payments for goods” – 394,000 rubles. – purchased goods are capitalized;

Debit 19 Credit 60 subaccount “Payments for goods” – 70,920 rubles. – VAT on goods received is taken into account;

Debit 76 subaccount “Calculations for VAT on advances issued” Credit 68 subaccount “Calculations for VAT” - 20,520 rubles. – VAT, previously accepted for deduction from the advance payment, has been restored;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 70,920 rub. – accepted for deduction of VAT on goods received;

Debit 60 subaccount “Payments for goods” Credit 60 subaccount “Settlements for advances issued” – 134,520 rubles. – the advance payment transferred to the supplier is credited.

November 16, 2015:

Debit 60 subaccount “Payments for goods” Credit 51 – RUB 338,660. (8260 EUR × 41 rubles/EUR) – the debt to the supplier is repaid.

On the day of payment, Hermes does not adjust the amount of VAT previously accepted for deduction.

After the final payment, a negative difference of RUB 8,260 appeared in accounting. (464,920 rubles (cost of goods received) – 134,520 rubles (advance payment) – 338,660 rubles (final payment)).

Debit 91-2 Credit 60 subaccount “Payments for goods” – 8260 rubles. – reflects the negative difference in settlements with the supplier.

When calculating income tax for November 2015, the Hermes accountant included the negative amount difference (RUB 8,260) as non-operating expenses.

Example of VAT calculation

Using the above formulas, we will analyze how to correctly calculate VAT (in excess of the amount, including), using examples.

LLC "X" sells a batch of concrete blocks in the amount of 100 thousand pieces. at a price of 55 rub. a piece. The VAT rate is 20% (clause 3 of Article 164 of the Tax Code of the Russian Federation), tax is not included in the price. How to calculate VAT 20% and the final cost of the shipment including tax?

- First, we determine the cost of the batch without VAT (tax base):

55 rub. × 100,000 pcs. = 5,500,000 rub.

5,500,000 × 20/100 = 1,100,000 rub.

5,500,000 + 1,100,000 = 6,600,000 rub.

- Or you can determine the total amount immediately, without first calculating the tax:

5,500,000 × 1.20 = 6,600,000 rub.

Accordingly, the following must be indicated in settlement documents and invoices:

- cost without VAT - 5,500,000 rubles,

- VAT 20% - RUB 1,100,000,

- total including VAT - 6,600,000 rubles.

According to the price list of X LLC, the price of a curbstone including VAT is 240 rubles. for 1 piece The buyer ordered a batch of 10 thousand pieces. Let's calculate VAT 20%.

- First, let's determine the final cost of the batch:

240 rub. × 10,000 pcs. = 2,400,000 rub.

- We will calculate VAT including:

2,400,000 / 120 × 20 = 400,000 rub.

2,400,000 – 400,000 = 2,000,000 rub.

It can also be found without prior allocation of tax:

2,400,000 / 1.20 = 2,000,000 rub.

You can check the correctness of the calculation by charging VAT on the received value without tax:

2,000,000 × 20/100 = 400,000 rub.

Accordingly, the following must be indicated in settlement documents and invoices:

- cost without VAT - 2,000,000 rubles,

- VAT 20% - 400,000 rubles,

- total including VAT - 2,400,000 rubles.

For information on how to reflect the calculated VAT amount in the VAT return and in accounting, see the Ready-made solution from ConsultantPlus. Get trial access to K+ for free.

The organization acts as a tax agent

When determining the total amount of tax payable to the budget, there is no need to take into account the VAT amounts accrued by the organization in the performance of its duties as a tax agent. The organization must report on these amounts and transfer them to the budget separately. This follows from paragraph 3 of Article 166 and paragraph 4 of Article 161 of the Tax Code of the Russian Federation. In some situations, the organization may deduct the amounts of VAT paid while performing the duties of a tax agent. For example, when purchasing from foreign organizations works (services) intended for use in activities subject to VAT.

Concept of VAT

Definition 1

Value added tax (VAT) is a form of indirect tax that involves the withdrawal of part of the cost of a good.

VAT is created at all stages of production of the final product or service. The burden of paying the tax falls on the end buyer. The seller receives a tax refund through the sale. However, receipts to the budget begin long before the final realization of the benefit occurs. Each participant in the production chain makes payments to the budget.

The tax was invented by Maurice Lauret in the fifties. Testing of the new tax was carried out in one of the colonies of France. It gave a positive result, so since 1958 the French began to use it within their economy. By the early seventies, value added tax began to be used in all European countries.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Note 1

The governments of many countries use VAT as a tool to influence the country's economy. Benefits are widely used for certain groups of goods or for enterprises in certain sectors of the national economy.