That is, partnership is partnership, but “if you want peace, prepare for war.” The agency recently published a list of the most common violations of the law identified during inspections, in the hope that it will “help companies and citizens independently prevent possible violations, reduce risks and clarify obligations.” Read, they say, and draw conclusions, so that later neither you nor us will be painfully sad.

In total, the list includes 86 of a wide variety of violations that poison the lives of inspectors and interfere with the establishment of trusting relationships with their wards. Whether they were placed in descending order, in order of decreasing “degree of popularity,” or simply at random, is not known for certain. The top 5 most common violations for each tax are as follows.

Corporate income tax

The palm in terms of the number of “inconsistencies” identified by inspectors during calculation and payment belongs to the income tax. The digest published by the tax department includes as many as 26 typical problem situations. The most common:

1. Overestimation of expenses taken into account when calculating income tax for transactions involving shell companies (inaccurate information in primary documents, expenses not documented, lack of real business transactions for the purchase of goods (works, services) from problematic counterparties).

2. Understatement of the tax base as a result of the sale of goods (work, services) to interdependent persons in foreign trade transactions at prices below market prices for identical (homogeneous) goods (work, services).

3. Understatement of sales revenue due to discrepancies between the data reflected in tax returns and the data of accounting and tax accounting and primary documents.

4. Understatement of non-operating income by the amount of accounts payable subject to write-off due to the expiration of the statute of limitations.

5. Failure to include interest accrued under loan agreements in non-operating expenses.

How does the Federal Tax Service determine the understatement of the tax base?

The determination of unjustified economic benefits obtained as a result of understating the tax base is carried out during an audit by the Federal Tax Service.

Fiscal service employees request the necessary documents from the taxpayer, check them (analysis, reconciliation with the counterparty, etc.), and then draw up an act in which they indicate the presence/absence of unjustified benefits received by the organization/individual entrepreneur.

The list of documents requested by Federal Tax Service inspectors during an inspection for unjustified benefits depends on the specific situation.

If a taxpayer is “suspected” of underpayment of personal income tax, then the following documents will be required to verify the Federal Tax Service:

- staffing table approved and signed by the manager in the appropriate manner;

- employment contracts with all employees;

- GPC agreements on attracting persons to hired labor;

- payroll statements;

- reporting forms 6-NDFL, RSV;

- payment documents confirming the transfer of personal income tax to the budget.

In this case, an unjustified benefit would be an understatement of the tax base for personal income tax. If the Federal Tax Service discovers such a fact, the taxpayer will be held accountable in the form of paying a fine (we will discuss the calculation in detail below).

Checking for fictitious transactions

If the Federal Tax Service checks the correctness of the calculation and payment of income tax, then one of the areas of inspection will be monitoring the presence of fictitious transactions.

According to tax terminology, a transaction is considered fictitious if the only reason for its conclusion is an understatement of the tax base (and not the sale/receipt of goods, works, services).

According to the Federal Tax Service letter No. ED-5-9-547 dated March 23, 2017, the following markers are signs of fictitious transactions:

- unfavorable terms of the transaction (the taxpayer purchased the goods at a price significantly higher than the market average);

- the counterparty is a shell company (registration immediately before the conclusion of the contract, deregistration immediately after the transaction);

- unreasonable choice of counterparty (the contract was concluded with a company that has a low rating in the industry, negative reviews, etc.).

When checking documents to determine whether a transaction is fictitious, the Federal Tax Service pays attention to:

- existence of a preliminary agreement between the parties to conclude a transaction (correspondence);

- the possibility of additional verification of the counterparty, analysis of its activities (website, mention in the media, published reports, etc.);

- availability of data on the actual location of the counterparty;

- information about documents confirming the authority of the signatory (power of attorney) in the agreement.

If the Federal Tax Service detects several markers of a fictitious transaction, such an agreement is canceled based on the inspection report. The benefit received by the taxpayer in the form of understating the tax base due to expenses under the contract is recognized as economically unjustified.

VAT

Value added tax is ranked second in the ranking of violations most frequently committed by taxpayers. The top 5 looks like this:

1. Understatement of the tax base due to incomplete reflection of the sale of goods (work, services), including the lack of adjustment of the tax base in accordance with Art. 40 Tax Code of the Russian Federation.

2. Non-calculation of VAT when transferring goods (work, services) on the territory of the Russian Federation for one’s own needs, the costs of which are not deductible when calculating corporate income tax.

3 Non-inclusion in the tax base of construction and installation work performed for own consumption.

4.Underestimation of the tax base by the value of property transferred free of charge.

5. Wrongful application of VAT exemption due to failure to provide documents confirming the sale of goods (work, services) not subject to VAT in accordance with Art. 149 of the Tax Code of the Russian Federation.

Criminal liability for tax evasion

Those who do not pay taxes may become accused under the following articles of the Criminal Code of the Russian Federation:

- 198 – tax evasion by an individual;

- 199 – evasion of taxes and fees by representatives of a legal entity;

- 199.1 – failure to transfer deductions in favor of the state by a tax agent.

For these acts, a person over 16 years of age may be held criminally liable. However, judicial practice does not know any examples of convictions of minor citizens under these articles of the criminal law.

Tax liability for non-payment of taxes may arise by decision of the tax authority. And for a criminal case, the decision of the Federal Tax Service is also necessary. In general, the inspection is obliged to send information about detected non-payment to the investigative authorities if four conditions are simultaneously met:

- the decision to bring to tax liability has been made and has entered into legal force;

- the taxpayer was notified of the obligation to pay tax with penalties within the prescribed period;

- 2 months have passed since the expiration of the period specified in the notification;

- a large or particularly large amount of the unpaid amount has been established.

The inspection is obliged to send information within 10 days from the date of detection of violations. After which the investigative committee makes a decision to initiate a criminal case or to refuse to initiate it. It depends on the presence/absence of a crime.

Article 198 of the Criminal Code of the Russian Federation

Accused under Art. 198 of the Criminal Code of the Russian Federation can be a citizen as an individual (including an individual entrepreneur, private notary, lawyer, etc.). That is, the subject of this crime cannot be an official.

Non-payment of taxes under this article entails the initiation of criminal proceedings if (alternatively):

- the Federal Tax Service Inspectorate has not provided a tax return or other documentation (extracts from accounting books, sales books, business transactions journal, pay slips, etc.), the submission of which to government agencies is mandatory;

- the declaration has been submitted, but it contains deliberately false information, which results in a tax debt.

In addition, a mandatory element of a criminal offense is a certain amount of the unpaid amount. This is a large or extra large size.

Question: At what amount does criminal liability begin under Art. 198 of the Criminal Code of the Russian Federation?

Answer: A large amount is considered to be an amount of untransferred tax in excess of 900,000 rubles for three financial years (consecutive), provided that this amount is more than 10% of the total (or the tax base exceeds 2,700,000 rubles) tax liabilities.

A particularly large amount is considered to be an amount over 4,500,000 rubles over three years, if this amount of debt is more than 20% of the total (or the tax base exceeds 13,500,000 rubles).

If the amount of unpaid taxes does not reach a large or particularly large amount, then administrative liability arises against the person. No criminal case can be initiated. Although it is possible to bring both tax and criminal liability at the same time.

For a crime under Art. 198 of the Criminal Code of the Russian Federation, as for other tax crimes, it is important to establish a period for filing a return for a particular tax. Failure to pay can be prosecuted under the Criminal Code of the Russian Federation only if the individual did not complete the transfer on the date following such period.

Example No. 6 . According to Part 2 of Article 346.23 of the Tax Code, an individual entrepreneur is required to submit a simplified taxation system (Simplified Taxation System) declaration to the Federal Tax Service by April 30 of the year following the reporting year. If for three years in a row an individual entrepreneur has submitted such a declaration with false information (or did not submit it at all) and the amount of non-payment as of May 1 is more than 900 thousand rubles, he is subject to liability under Art. 198 of the Criminal Code of the Russian Federation.

Note that the three years that follow one after another before the year the case was initiated are taken into account.

The debt itself should be expressed only in the amount of unpaid taxes. Fines, penalties, etc. are not cumulative.

An individual found guilty of committing a crime under Art. 198 of the Criminal Code of the Russian Federation, punishment may be imposed in the form of:

- a fine in the amount of 100,000 rubles to 300,000 rubles or imprisonment for up to one year (under Part 1 of Article 198 of the Criminal Code of the Russian Federation, when the amount of tax debt corresponds to a large amount);

- a fine in the amount of 200,000 rubles to 500,000 rubles or imprisonment for up to 3 years (under Part 2 of Article 198 of the Criminal Code of the Russian Federation - the amount of non-payment is a particularly large amount).

Example No. 7 . An example of a criminal case under Art. 198 of the Criminal Code of the Russian Federation may serve as the following situation. For three years, Ivanov K.E. I rented out my own prestigious apartment in Moscow, the monthly payment was 250,000 rubles. At the same time, Ivanov did not declare his income and did not pay taxes. The Federal Tax Service, if such a fact is discovered, has the right to calculate the non-payment and make an appropriate decision. Then there will be a requirement to pay not only the basic amount of tax for renting out the apartment, but also fines and penalties. If Ivanov does not do this, he may be prosecuted under Part 1 of Art. 198 of the Criminal Code of the Russian Federation, since over three years the unpaid tax (without penalties and fines) will amount to 1,170,000 rubles (250 thousand rubles X 12 months X 3 years X 13%), that is, over 900,000 rubles.

Citizens can be brought to criminal liability with punishment in the form of a fine and for non-payment of taxes on the sale of an apartment or other real estate, if all the signs of a crime under Art. 198 of the Criminal Code of the Russian Federation (period, amount, intent) are confirmed by the collected evidence.

If the declaration is submitted on time and contains reliable information, but the tax is not paid, criminal liability is excluded. Here we can only talk about the use of clauses. 1.3 tbsp. 122 of the Tax Code of the Russian Federation (fine of 20% or 40% of the total debt).

Criminal liability for tax evasion by an individual is excluded when the elements of a crime are confirmed, the culprit evaded paying taxes for the first time , but at the same time paid everything in full , including penalties and fines. If the case has already been opened by the time full payment is made, it must be dismissed. Thus, the legislator makes it possible for a person to avoid a criminal record. You need to repent and agree with the charges brought against you, paying off all tax debts.

Article 199 of the Criminal Code of the Russian Federation

In accordance with Art. 199 of the Criminal Code of the Russian Federation, the following persons can be brought to criminal liability for non-payment of taxes:

- managers of the taxpayer organization (for example, directors of an LLC);

- chief accountant (or ordinary accountant, if the organization’s staff does not provide for the position of chief accountant);

- other persons who actually perform the role of a manager or accountant are required to sign documentation sent to the Federal Tax Service.

In some cases, ordinary employees of a legal entity are also charged under this article. If they draw up accounting documents and enter false information into them to deliberately evade the organization from paying legal deductions. In such situations, these people are recognized as accomplices in the commission of a crime.

Based on practice, according to Art. 199 of the Criminal Code of the Russian Federation, cases of non-payment of income tax or VAT are often initiated and investigated.

The signs of this crime are similar to those of Art. 198 of the Criminal Code of the Russian Federation, with the exception of large and especially large sizes. According to Art. 199 of the Criminal Code of the Russian Federation, the legislator provides the following amounts from which liability for non-payment of taxes by a legal entity begins:

- A large amount is an amount exceeding 5 million rubles for three financial years (consecutive), provided that this amount is more than 25% of the total amount of tax liabilities (or the tax base exceeds 15,000,000 rubles).

- An especially large amount is considered to be an amount over 15 million rubles over three years, if this amount is more than 50% of the total (or the tax base exceeds 45,000,000 rubles).

If the subject of a crime under Article 199 of the Criminal Code of the Russian Federation is found guilty, he may be sentenced to:

- a fine in the amount of 100,000-300,000 rubles , as well as imprisonment for up to 2 years (for part one, in case of failure to pay a large amount);

- a fine in the amount of 200,000-500,000 rubles , as well as imprisonment for up to 6 years (for part two, in case of failure to pay an especially large amount and/or when committing a crime as part of a group of persons by prior conspiracy).

In addition, the person convicted under both parts of the article may be given an additional punishment. Prohibition to hold managerial positions (including those related to accounting) for a period of up to 3 years.

Similar to Article 198 of the Criminal Code of the Russian Federation, the head of an organization cannot be held criminally liable, and the case initiated is subject to termination if the debt on fees is paid in full, including penalties and fines.

Article 199.1 of the Criminal Code of the Russian Federation

In accordance with Art. 199.1 of the Criminal Code of the Russian Federation, charges may be brought against a tax agent. He can be an individual entrepreneur, as well as the head of an organization that is obliged to calculate and withhold, as well as transfer tax (for example, income tax) for the taxpayer. That is, a citizen (for example, its employee) received income from the organization (individual entrepreneur) (in the form of a salary), but out of personal interest, the director of the company did not transfer 13% of the personal income tax for the employee to the budget in a large amount. This is a tax agent crime.

The crime is considered committed from the moment of failure to transfer within the period established by the requirements of the Tax Code of the Russian Federation; the punishment and values of the amount of underpayment are similar to the description contained in Article 199 of the Criminal Code of the Russian Federation.

simplified tax system

Companies operating on a simplified system have recently not caused inspectors too much trouble, occupying only third place on the list.

1. Illegal use of the simplified tax system due to non-compliance with the indicators that grant the right to this taxation system, in particular, by organizations with branches and (or) representative offices; those under a special tax regime (UST); with a share of participation of other organizations of more than 25%; with more than 100 people.

2. Understatement of income due to failure to include amounts of income from the sale of goods (works, services).

3. Unreasonable reduction of income by the amount of expenses not specified in clause 1 of Art. 346.16 of the Tax Code of the Russian Federation, such as: amounts of paid loans, the cost of land plots acquired by construction organizations, amounts of fines, payments for periodicals, funeral services and other expenses.

4. Unreasonable inclusion in expenses when calculating the base according to the simplified tax system of expenses without appropriate documentary evidence.

5. Taxpayers who use income reduced by the amount of expenses as an object of taxation do not calculate the minimum tax at the end of the tax period.

Are there taxes that reduce the tax base?

There are three tax regimes in which expenses must be taken into account when determining the tax base - OSNO, simplified tax system and unified agricultural tax.

Organizations on OSNO pay income tax, entrepreneurs pay personal income tax. When calculating, you can recognize expenses that meet three criteria:

- confirmed by documents;

- economically justified;

- lead to future income.

The amounts of taxes, fees, customs duties and insurance premiums can be taken into account in other expenses when calculating income tax. This rule is enshrined in Art. 264 Tax Code of the Russian Federation. But there are exceptions, which are listed in Art. 270 of the Tax Code of the Russian Federation: sanctions to the budget, tax for excess environmental pollution, VAT to the buyer, amounts of taxes previously included in expenses, etc.

For the simplified tax system of 15%, all expenses that reduce the tax base are listed in Art. 346.16 Tax Code of the Russian Federation. These also include customs duties, taxes and fees, insurance premiums, and in some cases VAT.

It turns out that taxes can actually reduce the tax base. But it's not that simple. As always, there are many nuances and controversial situations in tax legislation, which we will try to sort out.

UTII

In terms of the total volume of violations committed, payers of the single tax on imputed income did not make it into the top three, for which we can congratulate them.

1. Illegal application of this special regime for services and works falling under the general taxation system.

2. Lack of separate accounting of property, liabilities and business transactions in relation to business activities subject to a single tax and business activities subject to a different taxation regime, which resulted in an understatement of the tax base for corporate income tax (when applying the general taxation regime) or a single tax paid in connection with the use of the simplified tax system.

3. Understatement of tax amounts by illegally reducing the amount of accrued but not actually paid insurance contributions for compulsory pension insurance.

4. Failure to pay UTII as a result of understatement of physical indicators (number of employees, sales floor area, etc.), adjustment coefficients of basic profitability K1 and K2.

5. Unjustified application of a special regime using business “splitting” schemes and an unlawful reduction in the amount of tax (by more than 50%) by the amount of insurance premiums paid for compulsory health insurance.

Late advance payment under the simplified tax system

Entrepreneurs and LLCs must make advance payments by the 25th of each quarter, that is, by April 25, July and October. If this is not done, there will be no fines, but the penalty counter will be activated. They are calculated based on 1/300 of the Central Bank refinancing rate for each day of delay. From October 1, 2022, it has become even more unprofitable for enterprises to have tax debts - from the 31st day of delay, penalties will be calculated based on 1/150 of the refinancing rate.

An example of calculating penalties for advance payments of the simplified tax system

Morozko LLC owed an advance payment to the budget for the first quarter in the amount of 25 thousand rubles. The refinancing rate in 2022 is 7.5%.

25,000 x 9% x 1/300 = 6.25 rubles. for each overdue day.

From day 31 the calculation will look like this:

25,000 x 7.5% x 1/150 = 12.5 rubles. in a day.

If Morozko LLC continues not to pay, then penalties for advances made in the 2nd and 3rd quarters will be added to this amount. The Federal Tax Service will issue penalties for late payment of the simplified tax system only when it receives the annual declaration and calculates everything, and during this time the amount will accrue noticeably.

You can calculate taxes and submit any reports online using the online accounting service “My Business”

Try for free

Understatement of the tax base

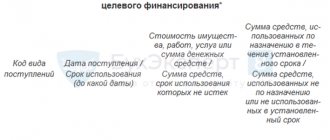

Underestimating the base for calculating tax is one of the most common errors that is discovered during an audit. The table below shows the most common violations that lead to erroneous understatement of the VAT tax base:

| The essence of the violation | Tax Code norm |

| Sales of products are not fully reflected in accounting (most often the tax base is not adjusted in accordance with the market price). | section VI, paragraph 1, article 146, art. 153 |

| The database does not include construction and installation work for one’s own consumption (it is recommended to clarify what exactly is included in construction and installation works according to OKVED). | pp. 2 p. 1 art. 146 |

| The database does not reflect property transferred free of charge. | Clause 1 Article 146 |

| The database does not include prepayment amounts (full or partial) for upcoming deliveries. | Clause 1 Article 154 |

| Tax agent companies (most often tenants of state property) underestimate the base or do not fulfill their obligations to calculate and pay VAT at all. | clause 2, 3 art. 161 |

Failure to restore VAT amounts

The legislation provides for cases when VAT previously accepted for deduction must be restored - all of them are listed in paragraph 3 of Article 170 of the Tax Code of the Russian Federation. Federal Tax Service specialists point out that a typical mistake of taxpayers is failure to restore tax amounts in the following situations:

- when a company switches to a special tax regime;

- when a company sells a product for which an advance payment was previously made, and VAT was deducted from it.

In the first case, VAT on goods (services, works, property rights), including fixed assets and intangible assets, should be restored in the period preceding the transition to a special tax regime. In the second case, VAT is restored in the period when the company can claim a deduction for the goods for which an advance was received, that is, as they are sold.

Lack of separate accounting

If a company, along with activities subject to VAT, carries out transactions that are not subject to this tax (exempt from it), then in accordance with the requirement of paragraph 4 of Article 149 of the Tax Code of the Russian Federation, separate accounting of such transactions should be kept. In the absence of separate accounting, the taxpayer cannot deduct VAT due to paragraph 4 of Article 170 of the Tax Code of the Russian Federation, nor does he have the right to reduce taxable profit due to these expenses. However, companies often neglect the requirements of these legal norms, for which, based on the results of a desk audit, they receive additional VAT charges and penalties.