At first glance, sending payslips by email is a modern, fast and economical way of informing employees about the composition and amount of their wages. But it's not that simple. The employee’s personal data contained in the pay slip must be specially protected when transmitted via the Internet.

So far, not everything is clear on this issue: the Ministry of Labor does not see any obstacles to transmitting payslips by e-mail, and the FSB categorically prohibits doing this unless the employer takes a set of measures to protect personal data. All the details are in our material.

When can a payslip be sent by email?

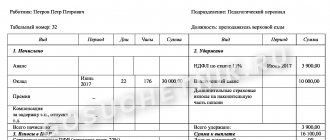

Labor legislation imposes certain requirements on the pay slip - on the composition of the information indicated on it and the employer’s responsibilities related to its transfer to employees (Article 136 of the Labor Code of the Russian Federation).

The payslip contains the employee’s personal data - at a minimum, this is the amount of his salary. Disclosure of such information is not permitted by law (Article 88 of the Labor Code of the Russian Federation, Article 7 of Law No. 152-FZ of July 27, 2006 “On Personal Data”).

As a result, the employer has the right to send the employee a payslip through the interface of the Internet postal service if he simultaneously performs:

- requirements of the legislation on the protection of personal data - will implement a set of measures to protect personal data from unauthorized or accidental access to it, destruction, modification, blocking, copying, provision, distribution of personal data, as well as from other unlawful actions in relation to personal data;

- requirements of labor legislation - will provide in its local regulations the condition for the possibility of transmitting pay slips via e-mail and will draw up all the necessary accompanying documents.

If all this is not done, the employer will face serious penalties (we will talk about this later).

Now let’s take a closer look at the legal requirements that must be fulfilled by the employer when transmitting payslips by email.

Setting up the distribution of payslips

The program's ability to create mailing reports is designed for their automatic generation and delivery to recipients. Mailing allows you to automate the process of receiving reports so that without opening the program, you can receive a ready-made report at the right time by email or in a specific directory as a file.

You can create a payslip distribution directly from the Payslip report ( Salary – Salary reports – Payslip

) by clicking

More - Send - Create report distribution ...

(or by clicking

the Send report by email button - Create report distribution ...

) or through

the Administration section - Printed forms, reports and processing - Report distribution - Create .

The mailing setup is done as follows:

- In the Name field, enter the name of the newsletter.

- Flag Prepared

indicates the mailing is ready for execution. Enabling the checkbox activates additional checks for filling in details.

- Specify the type of mailing (its purpose) in the field Send

:

- Reports to specified recipients

(set by default) – identical reports are sent simultaneously to all recipients specified in the Recipients field (select the recipient type: Users or Individuals). This type of report distribution provides not only sending by email, but also the ability to publish generated reports in the program file folder, in a network directory or on an FTP site.

- Your own report for each recipient

(in our example, select this mailing option) – used if you need to personalize the content of sent reports for each recipient. Select the recipient type (Users or Individuals) in the Recipients field (in our example – Individuals). In the report selection settings, it becomes possible to specify the recipient of the mailing list. Thus, for each recipient, its own report will be generated with selection for this recipient

- Only me

(author’s personal newsletter) – reports are received only by the user who created this newsletter (the author), by mail specified in the Mailing address field (the current user’s email address is automatically entered). Personal mailings are visible only to the author.

“Reports” tab

(the header displays the number of reports included in the newsletter):

- In the table section you can select one or more reports from the list for distribution. Later, after completing the settings for sending by button View

it will be possible to pre-generate the selected report

- In chapter Settings

report,

possible settings for the selected report are displayed. Using the checkboxes, you can select the desired settings and specify the values for which the report will be displayed. In our example, select by employees receiving the newsletter. To do this, set the flag in the Employee

, then, without removing the cursor, click on the button

Specify mailing recipient

.

This setting will allow you to generate your own report for each recipient with indicators available only to him. You can also make other report settings, for example, in the Period

, change the period for generating payslips (by default - last month).

“Schedule” tab

You can set up automatic sending of reports at a certain interval or on certain days of the week, describing on what days and at what time the program should send this mailing. Based on each report distribution, the program generates regulatory tasks of the same name “Report Distribution”.

- For regular automatic mailings, set the flag Execute on schedule

.

- It is possible to automatically create a schedule using a button Fill in the template

…. As a result, you can select the desired schedule from the proposed list, for example, on the first day of the month. The schedule will be filled in automatically.

- It is possible to independently select the frequency of the schedule (frequency of sending messages). Mailing can be done:

- • Daily – with a specified frequency in days. The repeat period is selected in the field of the same name.

• Weekly – on selected days of the week. The selection is made using checkboxes.

• Monthly – for selected months on the required day of the month. The selection of months is set using the checkboxes, the number of the day from the beginning or end of the month in which the mailing will be made is in the corresponding fields.

• Custom – allows you to configure each schedule parameter in detail. In the Schedule

Setting up a detailed development of your schedule.

At the same time, it is not necessary to fill it out immediately; after closing the window, the Change

... button becomes available, which you can use to return to setting up the schedule at any time. - Specify the start time of the mailing in the field of the same name. When you select a custom schedule setting, the start time is configured in the window Schedule

.

- In field Responsible

select the user – the author of the newsletter (by default – the current user). When launched according to a schedule, mailing will be performed on behalf of the specified user.

Tab "Delivery"

The header shows how the delivery is carried out.

All possible methods of delivering custom mailings are described. The contents of the bookmark may vary depending on the selected type of mailing in the Send

.

- Only for me (personal newsletter of the author)

– delivery is carried out only by email to a single address, which is indicated in the

Postal address

. - Reports to specified recipients

– in addition to delivery by mail, it becomes possible to save (publish) finished reports.

To do this, set the Publish

(indicating that the newsletter needs to be published). Select the appropriate value:- • To folder

– reports will be saved to the specified folder in the “Working with Files” subsystem.

• To network directory

– reports will be saved to the selected network directory. The recording is made from the server, so it is recommended to specify the network path in UNC format, for example, \\serer\folder\. Specify the address of this directory in the Windows or Linux field, depending on which operating system the computer is running.

• On FTP resource

– reports will be saved on the ftp server. Fill in the required parameters.

- By button Check

You can test your publication by writing and deleting a test file.

The test is considered successful if no errors occurred. The Send by email

flag is set to indicate that email is being used to send reports (or notifications). - LinkSpecify recipients

> specify the recipients of the newsletter - selection from the directory

Individuals

.

You can exclude a specific person from the list of mailing recipients by checking the flag next to him in the Excluded

. To distribute pay slips, it is more convenient to use a pre-created group of individuals in the directory of the same name as recipients. When you select a group, all its members will receive the newsletter. To be removed from the mailing list, an individual must be removed from this group. - In field From

From the drop-down list, select the organization account to send the report (the field is required).

- By button Check

The email account is verified by sending a test message. The test is considered successful if no errors occurred.

- By default, the letter template (subject and body of the letter) is generated automatically using certain parameters. If necessary, the content of the letter can be changed. Adding a parameter to the subject of a letter is done by right-clicking in the field of the same name using the command Parameter

, into the text of the letter - by clicking the

Parameter

(or right-clicking in the text field using the

Parameter

). The following options are available for selection- • Mailing date

– date of mailing

• Author

– the user who started the newsletter

• Recipient

– representation of the recipient of the newsletter. Available only for the mailing type: Your own report for each recipient

• Mailing name

– name of the newsletter

• Generated reports

– list of reports and formats in which they were saved

• System header

– infobase title (can be set in

the Administration – General settings

)• Delivery method

– representation of the resource on which the report was published

- To view a ready-made version of the subject and text of the letter, select Preview

.

- The default email format is HTML, you can change it to plain text. In HTML format, standard text formatting commands are available (some of them are located in the form of buttons, the rest can be found by clicking on the button More

).

“Advanced” tab

Additional mailing settings.

- In field Report saving formats (default)

Define the formats in which reports will be saved by default. The formats selected using the checkboxes will be common to all reports. You can select multiple formats.

- In the tabular section, for each report you can specify your own set of formats in the column Formats

.

In the Send empty

, set the flag to send the generated report, even if it is empty (the flag is cleared by default). Reports with graphics are always considered non-blank. - Set the flag Transliterate file names

, if it is necessary that the names of the saved files contain only Latin letters and numbers (to allow transfer between different operating systems). For example, the file "Report.mxl" will be saved with the name "Otchet.mxl"

- Set the flag Archive

in ZIP

to archive generated reports in *.zip format. If reports are sent by email, it is recommended that you enable archiving to reduce the amount of attachments. As a result, the following become available:- field for entering the name of the archive (generated automatically according to the template specified in the field). If you right-click on this field, using the command Parameter

you can change the name template (the parameters available for change are:

Mailing date

and

Mailing name

);Password field

, which is filled in if necessary.

- In field Reply address

indicate the email address to which responses to the newsletter will be sent.

- Set the flag Send emails via blind carbon copies

so that recipients do not know who else is receiving reports from this mailing.

- Mailings can be grouped according to various criteria. To place this mailing in a specific group, select it from the list in the field Group

.

- Next, click on the button Write object

.

What is determined by the Government of the Russian Federation, the FSB and FSTEC

Considering that the payslip contains the employee’s personal data, in order to legally send it to the employee via the Internet, the employer will have to comply with the requirements of the federal law on personal data, as well as regulations and orders in the field of personal data protection:

- Law of July 27, 2006 No. 152-FZ “On Personal Data” (Articles 3, 6, 7, 19, etc.);

- Decrees of the Government of the Russian Federation dated September 15, 2008 No. 687 “On approval of the Regulations on the peculiarities of processing personal data...”, dated November 1, 2012 No. 1119 “On approval of requirements for the protection of personal data during their processing...”;

- Orders of the FSB of Russia dated July 10, 2014 No. 378 “On approval of the composition and content of organizational and technical measures...”, dated February 9, 2005 No. 66 “On approval of the Regulations on the development, production, implementation and operation of encryption (cryptographic) information security means”;

- Orders of FSTEC dated 02/18/2013 No. 21, dated 06/13/2001 No. 152;

- other regulations in the field of processing and protection of personal data.

The employer should remember that the transfer (preparation of transfer) of personal data by email without the use of cryptographic information protection tools (CIPF) certified by the FSB of Russia is prohibited, since it does not protect personal data from disclosure, modification and imposition (entering false information).

In addition, in order to ensure the security of personal data, their transmission by email is permissible only if basic measures are taken: implementation of anti-virus protection (AVZ.1), ensuring the protection of personal data from disclosure and modification (ZIS.3) and other necessary measures.

Confirmation of receipt of an electronic document

When conducting an inspection of a company or individual entrepreneur, you will have to prove to the GIT inspector that the payslip by email was poisoned. Otherwise, there is a violation of labor laws. If an employer sends a payslip to an employee by email, how can I confirm receipt? To do this, you need to configure your email to receive notifications when a message is read. Most programs have this option. The employer will have to arrange for the storage of this evidence. If there is no confirmation of receipt of the pay slip by email, then it is safer to issue a paper version of the document to the employee.

Labor Code of the Russian Federation - on the transfer of payslips by e-mail

The Labor Code of the Russian Federation contains little information about the pay slip (Article 136 of the Labor Code of the Russian Federation):

- with its help, the employer fulfills the obligation to inform employees about the components of their salary, accrued and withheld amounts, as well as the total amount of money to be paid;

- The employer determines the form of the pay slip and the procedure for issuing it independently, taking into account the opinion of the trade union body in the manner established by Art. 372 Labor Code of the Russian Federation.

But the Labor Code of the Russian Federation does not say how an employer can transfer a payslip to its employees (on paper or electronically).

For remote workers, the opportunity to receive electronic payslips is implemented as part of the exchange of electronic documents (Article 312.1 of the Labor Code of the Russian Federation).

Despite strict legislative restrictions in matters of ensuring the protection of personal data, officials of the Ministry of Labor and experts of the website “Online Inspectorate. RF" do not see any particular obstacles to the possibility of transmitting payslips by e-mail. Let's take a closer look at their explanations.

YOU CAN'T DO WITHOUT A PAYMENT SHEET

In accordance with Part 1 of Art.

136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to notify each employee in writing: • about the components of the wages due to him for the corresponding period;

• on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments, etc.;

• about the amounts and grounds for deductions made;

• about the total amount of money to be paid.

Information about the components of wages must be brought to the attention of the employee by providing him with a pay slip. The form of this document is developed by the employer independently (taking into account the requirements of Part 1 of Article 136 of the Labor Code of the Russian Federation) and is approved taking into account the opinion of the representative body of employees (if any) (Part 2 of Article 136 of the Labor Code of the Russian Federation).

The form of the payslip can be approved by order of the employer or be an appendix to a local regulatory act that establishes the wage system in the organization (for example, to the regulations on the remuneration of employees).

The employer is required to provide employees with payslips to ensure that they can obtain reliable information about their wages. The goal is to monitor the employer’s compliance with the working conditions provided for in the employment contract.

Explanations from officials about the use of e-mail for transmitting payslips

The Ministry of Labor does not object to the transfer of payslips by e-mail if such a method is enshrined in the company’s local act (Letter No. 14-1/OOG-1560 dated 02/21/2017).

Experts from the site “Online inspection. RF” also believe that the employer has the right to refuse an employee who asks to send him a pay slip by email, if such a method is not provided for in the employment contract, collective agreement, or local regulation.

However, previously experts of this service were categorically against sending a payslip by email. They justified their position by reference to Art. 136 of the Labor Code of the Russian Federation, obliging the employer to notify employees exclusively in writing about the parts and amounts of their salary (issue No. 18276 of September 16, 2014).

But after some time, their explanations on this issue became less categorical. In one of the answers, they spoke similarly to the explanations of the Ministry of Labor: if an employment contract, collective agreement, or local regulatory act provides for a procedure for notifying an employee about the components of wages (pay slip) via e-mail, then this procedure does not violate the provisions of the current labor legislation (question No. 99711 dated July 25, 2018, issue No. 120279 dated February 28, 2020).

Expert opinion

The Labor Code obliges the employer to inform the employee in writing (Part 1 of Article 136 of the Labor Code of the Russian Federation):

- on the components of wages and other charges;

- the amount and reasons for deductions from wages;

- amount to be paid in hand.

Part 2 of Article 136 of the Labor Code also establishes the form of salary notification - pay slip. Let us remind you that you must have a local regulation that approves the form of the payslip.

If an accountant does not issue pay slips to employees when paying wages, the labor inspectorate will fine the company up to 50,000 rubles. And the director has the right to collect the amount of the fine from the accountant - this is stated in Article 238 of the Labor Code.

The Labor Code does not determine how to hand over a pay slip to an employee. You have the right to print it on paper or provide it electronically.

To issue a paper document, you must print it and invite an employee to the accounting department to receive it.

The electronic form of the payslip offers several options for its provision. The condition of electronic notification of the employee does not contradict the requirements of Article 136 of the Labor Code (letter of the Ministry of Labor of Russia dated February 21, 2022 No. 14-1/OOG-1560).

According to Rostrud, the procedure for notifying employees should be fixed in one of the documents (letter dated December 27, 2016 No. PG/36563-6-1):

- in the employment contract;

- in a collective agreement;

- in the employer’s local regulatory act (for example, in the Regulations on Remuneration).

The personnel officer must, against signature, familiarize employees with the local regulatory act, which establishes the procedure for issuing pay slips (Part 2 of Article 22 and Part 3 of Article 68 of the Labor Code of the Russian Federation). This condition may be found, for example, in the wage regulations. To collect signatures, you can draw up a sheet of familiarization with the local act and attach it to the regulation.

If there is no unity among your employees, and some want to receive payslips on paper, while others want to receive them electronically, this may also be written down in a local regulation.

Note to employers: a selection of expert recommendations “Online inspection. RF"

Many employers have already mastered paperless technologies and provide employees with payslips in electronic form. However, many questions arise about this. We present to you a selection of explanations from experts on the “Online Inspection” website. RF" on pay slips issued in electronic form.

- Is it possible to post payslips on the corporate portal?

Officials are not against posting pay slips in electronic form on the company’s corporate portal and do not consider it mandatory for the employee to provide written consent to receive pay slips in this way (question No. 112886 dated 08/15/2019).

It turns out that the employer has the right to post payslips in electronic form on the company’s corporate portal, where each employee, by entering a password, could see (print, save) his payslip. At the same time, each employee must have an individual login and password, and the company must develop instructions for accessing and working with the portal, which all employees must be familiar with.

The labor inspectorate, according to experts, with this method of issuing pay slips will not have grounds to bring the employer to administrative liability for failure to fulfill the information obligation under Art. 136 Labor Code of the Russian Federation.

- Is it possible to issue payslips via SMS?

Experts from the website “Onlineinspektsiya.RF” spoke out against issuing pay slips by sending them via SMS. The position was justified by reference to Art. 136 of the Labor Code of the Russian Federation, which contains a requirement to provide the employee with a pay slip in writing. In their opinion, providing a payslip via SMS does not constitute compliance with this requirement (question No. 26331 dated December 19, 2014).

- Is it possible to send payslips to a third party's email address?

Employers who transmit payslips by e-mail, according to experts on the website “Onlineinspektsiya.RF”, do not have the right to send slips to the address of a third party, for example, a foreman (question No. 98625 of June 18, 2018). It does not matter that employees write an application requesting this form of transfer of pay slips, and the pay slips themselves are password-protected pdf files with a personal password for each employee.

The fact is that when sending payslips to the foreman’s e-mail, it is impossible to prove that the employee received his slip. Thus, in the event of a dispute, the employer will not be able to prove the fulfillment of its obligation to notify the employee about the components of the salary. Therefore, sending payslips to a third party's mail is not allowed.

If an employee, whose company has established the procedure for transmitting pay slips electronically, for some reason cannot receive them, there is a way out - the employer can inform him about the composition and amount of salary through the line manager if he has a power of attorney certified by the director of the company (question No. 135649 dated 08/17/2020).

- Is it necessary to obtain the employee's signature when receiving a payslip?

The employer is required to provide employees with a payslip when paying wages. However, the legislation does not establish a requirement to issue it against signature. However, despite this, experts from the website “Onlineinspektsiya.RF” recommend issuing it against signature, which will confirm, if necessary, the fact of issue (question No. 80194 dated November 21, 2016).

Experts also do not see the need to obtain the employee’s signature even if the pay slip is issued, for example, in a special terminal (question No. 89532 dated September 1, 2017). In such terminals, pay slips are created for each employee. Information on them is selected by a unique personnel number on a chipped pass, that is, it is protected. The employee has the opportunity to print out a payslip at any time convenient for him.

And if a company issues payslips electronically and the employment contracts, collective agreement or local regulations of this company provide for the obligation of employees to sign in the journal for issuing payslips, it is mandatory to comply with this requirement (question No. 107986 dated March 22, 2019).

- How often is an employer required to issue payslips?

The Labor Code of the Russian Federation does not say anything about the number of pay slips that the employer is obliged to hand over to the employee. At the same time, explanations from experts on the site “Online Inspection. RF" are contradictory. In one of the answers, they expressed the position that there should be at least two payslips per month, since with such frequency the legislation requires the employer to pay wages under Part 6 of Art. 136 of the Labor Code of the Russian Federation (issue No. 82664 of January 27, 2017).

In another answer to a similar question, it is noted that the employer can approve the frequency of issuing pay slips in a local regulation. As a rule, a pay slip is issued once at the end of the working month on the day the final payment is paid (question No. 68012 dated 03/02/2016).

Since the legislation does not clarify this point, the employer independently decides the issue of the frequency of issuing pay slips to its employees. As the local act will reflect, it is necessary to transmit payslips with such frequency. This approach can be applied to both paper pay slips and slips sent to employees via email.

- Do I need to give the employee a blank pay slip?

According to experts from the “Online Inspection” service. RF”, the employer is obliged to issue the employee a pay slip in any case. In particular, a blank pay slip is issued to an employee who is on leave without pay and who, for this reason, has no accruals in a specific period (question No. 56866 dated September 24, 2015).

On the issuance of payslips in electronic form

In accordance with the requirements of the Labor Code of the Russian Federation, all employers are required to inform employees in writing about the components of wages, the amounts of accruals and deductions.

To fulfill this obligation, employers develop and approve a payslip form. As a rule, employers use by default the form of payslip that is provided in the accounting program.

The Labor Code does not regulate how pay slips are issued to employees. Therefore, employers can independently establish the form for issuing pay slips - on paper or electronically.

Some employers believe that if they issue a pay slip on paper, there is less risk of receiving a fine.

However, it is not. The employer faces penalties based on an employee’s complaint for failure to issue pay slips.

Administrative liability for failure to issue pay slips is provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

At the same time, monthly printing and issuing payslips to all employees is more labor-intensive work than sending payslip files to employees’ email addresses.

Employers have the right to send payslips to employees electronically. The main thing is that this method is prescribed in a local act or employment contract.

If we issue pay slips in several ways, we write down both options.

Courts agree that an employer is not violating anything if they send payslips by email.

In the local regulations on the remuneration of workers for small enterprises or in the employment contract with employees for micro-enterprises, the following wording of the employer’s obligations regarding the issuance of pay slips can be stated:

The employer undertakes to issue payslips on the day of payment of the final payment for the month worked in one of the following ways: - on paper; — in electronic form to the employee’s email address.

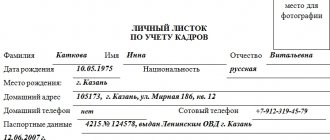

At the same time, the employer must prove that it issued pay slips to its employees. To do this, we will have to ask employees to write a statement indicating which email address to send pay slips to.

To select the form of the pay slip, the employee must submit an application to the employer in the form approved by the employer.

In order to receive a pay slip in paper form, the employee must contact the employer and receive the pay slip in person against a signature in the pay slip issuance journal.

In order to receive a payslip electronically, the employee must indicate his email address in the application.

In a statement addressed to the employer, the employee writes:

In accordance with Article 136 of the Labor Code of the Russian Federation, I ask you to send me payslip files by email to the address (such and such). I refuse to receive paper payslips.

According to the rule established by Part 6 of Article 136 of the Labor Code of the Russian Federation, wages are paid at least every half month per day. This raises the question: how many times should pay slips be issued?

Since the employer is obliged to pay wages twice a month, there must be two pay slips, since labor legislation establishes that a slip is issued when wages are paid, and it does not matter whether it is an advance or a settlement.

In practice, employers issue a payslip only once a month - at the final payment for the month.

However, this is unlikely to be a violation, since the main function of the payslip is to inform the employee about all charges and deductions.

Employer's liability

By sending payslips by email, the employer may face penalties for the slightest miscalculations:

- For violation of labor legislation under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

For example, for handing over pay slips to employees in a manner other than that specified in the company’s local regulations or employment contracts, the fine may be:

- from 30,000 rub. up to 50,000 rub. - for the company;

- from 1,000 rub. up to 5,000 rub. - on officials (IP).

- For violation of the requirements of the law on the protection of personal data.

For example, for transferring a payslip through a third party (an employee’s colleague) and the absence of the employee’s written consent to this method of transfer, that is, for violating clause 1 of Art. 3, art. 7 of Law No. 152-FZ. The fine in this case may be 75,000 rubles. (Part 2 of Article 13.11 of the Code of Administrative Offenses of the Russian Federation).

For the transfer of personal data by e-mail without the use of cryptographic information protection means (CIPF) certified by the FSB of Russia, the following types of liability may be applied to the employer:

- disciplinary (clause “c” of clause 6 of Article 81 of the Labor Code of the Russian Federation);

- administrative (part 1 of article 13.6, part 6 of article 13.12, article 13.14, part 7 of article 15.15 of the Code of Administrative Offenses of the Russian Federation);

- civil law (Article 151 of the Civil Code of the Russian Federation);

- criminal (Article 272 of the Criminal Code of the Russian Federation).

The employer may also face a fine for using an unapproved form of pay slip (Resolution of the Armed Forces of the Russian Federation dated December 23, 2010 No. 75-AD10-3).

Automatic distribution of payslips in the program “Salaries and personnel management, 3.1”

Article 136 of the Labor Code of the Russian Federation establishes that the employer’s responsibilities include informing employees in writing about the components of the wages due to him for the corresponding period. In this regard, the 1C Salary and Personnel Management program has added the ability to send out payslips via email. To do this, you need to make certain settings. First of all, you need to create an email account. This can be done from the “Administration” - “Organizer” section, select “Mail”, then go to “System Account Settings” or “Email Accounts”.

In the example, we will select “System account settings”, and in the window that opens, you must specify the address of an existing email and password for it, and also fill out the “Sender’s name” field if necessary, this can be the user name or the name of the organization, etc. The "sender's name" will be indicated automatically in sent emails. An email account and sending letters through it can be available for all users or for a specific user, in this regard, there are two settings options: “For everyone” or “Only for me”.

There are also two options for setting up an email connection: automatic and manual.

When automatically detecting connection parameters, the program sets the appropriate ports for a given email client. If an error occurs at this stage, it is recommended to use manual connection parameters and manually specify the server, port and encryption for the outgoing mail server and the same and additional protocol for the incoming mail server.

If an error occurs as a result of checking your account settings, you should check that the specified email address and password are correct.

If the verification is successful, sending letters from 1C will become available. But in order to automatically send out payslips, employees must have information filled in at their email address. You can enter this data in the “Personnel” section, select the “Employees” directory, then follow the “Personal data” link.

Or select the directory “Individuals” and go to the “Addresses, telephone numbers” tab.

After entering your email address, you can proceed directly to setting up the mailing; to do this, open the “Administration” section - “Printed forms, reports and processing”, then select the “Report mailings” link and click on the “Create” button. You can also create a mailing list from the “Salary” - “Salary Reports” section, find “Payslip” and click on the “More” - “Submit” button and select “Create a report mailing”.

In the window that opens, fill in the “Name” field, and also select one of the values in the “Send” field.

Report to specified recipients - this means that the same reports will be sent to all recipients at once.

Only to me (personal mailing list of the author) this means that reports will be sent only to the user who creates this mailing list, indicating the address.

A separate report for each recipient This means that each employee or recipient will be sent their own personal report with selection only based on it. This option is most suitable for sending out payslips.

In the “Recipients” field, you must select “Individuals”. Next, on the “Reports” tab, click on the “Select” button and select “Salt slip”.

In the form below “Report Settings”, specify the parameters of the report to be sent by checking the boxes. In the example, selection will be made by period, organization and employee. In order to correctly set the selection by employee, you need to check the “Employee” checkbox, select the line and click on the “Specify mailing recipient” button and the “Recipient” link will appear in the “Value” column.

Next, go to the “Schedule” tab and check the “Run according to schedule” checkbox if you need automatic sending of data at a specified interval. The mailing interval can be completely different; it can be configured individually; you can use the “Fill in template” button to automatically set up a schedule.

After completing the steps, you must go to the “Delivery (email)” tab and click on the “Specify recipients” link to select individuals.

In the “From” field, select the email account through which the newsletter will be sent.

You can also set a letter template. Message parameters can be changed using the “Options” and “HTML” buttons.

After the settings have been completed, the mailing configuration is completed on the “Advanced” tab, where the “Format for saving reports” is set. Click the “Record and close” button to save the specified information.

You can perform the mailing manually by clicking the “Run Now” button, or if a schedule is configured, wait for it to start automatically.

Let's sum it up

- Labor legislation allows the employer to choose the method of transmitting pay slips to employees: on paper or electronically. The main thing is that the method used is recorded in employment contracts with employees or in the local act of the company (in the regulations on remuneration, collective agreement, etc.). The Ministry of Labor does not argue with this.

- The payslip contains the employee’s personal data, so its transmission in electronic form is possible only if the requirements of the legislation on the protection of personal data are met.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

What the law says

The Labor Code prescribes the issuance of pay slips to staff, and their written form is required. The possibility of electronic transmission of a document is directly mentioned only in Article 312.1 of the Labor Code of the Russian Federation - for remote employees. For them, the law directly provides for the possibility of transmitting data electronically, but for other personnel there is no such instruction. However, the issuance of payslips by e-mail is not directly prohibited in the code.

Opinion of the Ministry of Labor

On 02/21/2017, in response to an employer’s request, the Ministry of Labor and Social Protection issued letter No. 14-1/OOG-1560, in which it outlined the department’s position on whether it is possible to send pay slips by email. According to experts, such notification of employees about earnings does not contradict the Labor Code, however, it is necessary that the electronic form be provided for in a collective or individual labor agreement, or other local document of the employer. Later, a similar position was confirmed in the letter of the Ministry of Labor dated May 24, 2018 N 14-1/OOG-4375. Thus, the department has recognized that sending payslips by email is legal.