Fixed assets in the enterprise balance sheet (line 1150): definition, classification

Fixed assets of an enterprise are understood as assets (property) that were acquired for the purpose of long-term use in the course of business activities. That is, the object must have a long useful life.*

Take our proprietary course on choosing stocks on the stock market → training course

*Useful life is the period of time during which the operation of any property brings commercial benefits to the owner (provides income). For fixed assets, the useful life can be calculated not by time intervals, but by the volume of products (goods) in kind that the company plans to produce as a result of the operation of the fixed asset.

In order for any company property to be classified as fixed assets, it is necessary to check whether the following conditions are met in relation to this object:

- The property under study can be useful commercially (it will definitely generate income for the owner company).

- When purchasing an object, the company does not think about reselling it to third parties in the near future.

- The useful life of the property is at least 1 year (or it is planned to be used for at least one operating cycle lasting more than 1 year).

- The property was acquired by the organization for the purpose of:

- transfer to third parties for temporary use (possession) for a fee;

- meeting the management needs of the company;

- operation during the performance of work or provision of services;

- application in the production process.

Thus, a company accountant has the right to classify the following types of property and capital investments into the category of fixed assets:

- buildings, structures;

- capital investments in fixed assets leased;

- vehicles;

- power and working machines;

- various types of equipment;

- regulating and measuring devices, instruments;

- tool;

- Computer Engineering;

- household and industrial equipment, various types of accessories;

- breeding, productive, draft animals;

- land;

- capital investments in radical improvement of land (reclamation, irrigation, drainage);

- environmental management facilities (natural resources, subsoil, reservoirs);

- on-farm roads;

- perennial plantings;

- properties that are similar in nature.

Actual expenses for the purchase, manufacture, construction of fixed assets

In order to form the initial cost of a fixed asset, at which it will subsequently be accepted for accounting, it is necessary to sum up the expenses actually incurred by the company for the purchase (construction, production) of a fixed asset item. Such costs may include:

- non-refundable tax amounts;

- state fees for the right to purchase fixed assets;

- the cost of the purchased fixed asset (specified in the purchase and sale agreement);

- the amount of payment for setting up the property, bringing it into a condition suitable for use;

- the amount of payment for the service of delivering a fixed asset to the place of its use;

- duties and fees collected by customs;

- amounts of payment to construction contractor companies under the contract for the construction of an environmental facility;

- remuneration for the services of intermediaries in transactions related to the acquisition of an asset;

- fees for specialist consultations, legal advice, information support, etc.;

- other expenses, if they are directly related to the acquisition (independent production) of an OS item.

Valuation of fixed assets in accounting

In domestic accounting and statistical practice, several main types of valuation of fixed assets are most often used, among which we can distinguish valuation at historical cost, at original cost taking into account depreciation, at full replacement cost, at replacement cost taking into account depreciation and at book value.

Definition 2

The full initial cost represents the cost of funds in prices that take into account fixed assets at the time of their placement on the balance sheet. Using this cost, you can express the actual cost of constructing a building, structure, including the acquisition, delivery, installation and installation of funds (equipment and machinery). The assessment is carried out at prices that are valid at the time of construction or purchase of these objects.

Finished works on a similar topic

Course work Production assets on the balance sheet 470 ₽ Abstract Production assets on the balance sheet 230 ₽ Test work Production assets on the balance sheet 190 ₽

Receive completed work or specialist advice on your educational project Find out the cost

After acceptance of fixed assets into operation, this cost can be reflected in the balance sheet asset in the “Fixed Assets” account, remaining unchanged until the moment of revaluation.

Residual initial cost includes the cost measured in the prices at which an item of fixed assets was placed on the balance sheet when accounting for depreciation at the time of its determination. This cost is determined by the full initial cost of fixed capital minus the amount of depreciation that has been accumulated in accordance with accounting data:

OPst = PPst – Wear

There are two types of wear and tear: physical wear and tear (depending on the technical condition), obsolescence (reduction of production costs, decrease in the consumer value of existing assets after the introduction of new, more efficient means of labor).

Full replacement cost can be determined by measuring the cost of recreating new items of fixed assets. This cost is taken into account when revaluing fixed assets, based on the actual conditions of their reproduction (contractual prices and estimated prices for construction and installation work, wholesale prices, etc.).

Residual replacement value can be determined as a result of revaluation as the difference between the full replacement cost of fixed assets and the monetary assessment of their depreciation in accordance with accounting information:

OVst = PVst – Wear

Valuation at book value characterizes the value of funds at the time they are registered on the balance sheet. The book value includes a mixed valuation of fixed assets, since part of the inventory objects is on the balance sheet at replacement cost at the time of the last revaluation, and objects that were introduced in subsequent periods are accounted for in accordance with the original cost (acquisition cost).

How are fixed assets valued in the balance sheet of an enterprise when they are registered?

Important! All fixed assets must be taken into account based on their original cost.

Depending on what kind of fixed asset we are talking about and how it was acquired, the initial cost may mean different amounts:

| Type of fixed assets | Determining the initial cost of the OS |

| Property acquired by an enterprise for a fee specified in the purchase and sale agreement | The amount of actual expenses incurred for the purchase, manufacture, construction of an asset minus the amount of VAT and other tax payments (in addition to situations specifically regulated by the laws of the Russian Federation) |

| Objects received by the company free of charge under a gift agreement | Current market value at the time of inclusion in investments in non-current assets when accepting fixed assets for accounting |

| Fixed assets contributed to the company's property as a contribution to the authorized (share) capital | Monetary value determined at the meeting of founders (participants), unless otherwise provided by law |

| Objects received under contracts that specify a non-monetary method of payment for their receipt | The cost of an asset, determined by reference to the price that would normally be paid by a company under similar circumstances. |

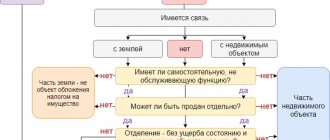

Conditions for classifying objects as fixed assets

Regulation of accounting for fixed assets is carried out in accordance with the Regulations “Accounting for Assets”, according to which, in order to recognize objects as fixed assets, they must meet several requirements:

- The use of objects must be carried out in production processes or for the management needs of the enterprise, including rental (the price of objects that are purchased for rental is not reflected in the line “fixed assets in the balance sheet”).

- The business must use the facility for more than twelve months.

- The initial price of the object must be at least one hundred thousand rubles.

- When an enterprise purchases a fixed asset, it should not be sold in the near future.

- In the future, the objects can bring profit to the company.

Get paid for your student work

Coursework, abstracts or other works

What information on fixed assets must be disclosed in the financial statements?

The minimum set of information about the fixed assets of an enterprise that must be disclosed in the financial statements includes the following points:

- initial cost, the amount of accumulated depreciation for the main groups of fixed assets (as of the beginning and end of the period);

- a list of real estate that is already in use and in relation to which the state is in charge. registration;

- movement of fixed assets during the reporting period by main groups (acceptance to the enterprise, retirement, etc.);

- methods for calculating depreciation for each group of fixed assets;

- rules for assessing the cost of fixed assets that were received by an enterprise under an agreement that does not provide for payment in money;

- property that is taken into account as profitable investments in the MC;

- a list of objects that are provided for use for a fee or, conversely, are issued under a lease agreement;

- cases of adjustment of the initial cost of fixed assets due to revaluation, partial liquidation, reconstruction, additional equipment, completion;

- about the property of fixed assets, the value of which is not subject to repayment through depreciation;

- the procedure for determining the useful life of property objects.

Statistics of fixed assets and production equipment

The formation of market relations involves competition between various producers, in which only those who most effectively use all types of available resources can win. The condition and use of fixed assets is one of the most important aspects of analytical work, since they are the material embodiment of scientific and technological progress. It is possible to identify reserves for increasing the efficiency of their use using a thorough economic analysis.

Balances of fixed assets

The balance of fixed assets is a statistical table, the data of which characterize the volume, structure, reproduction of fixed assets for the economy as a whole, industries and forms of ownership.

The basis for the calculation is the results of revaluations of fixed assets, the results of which determine the ratio of prices of the reporting year and the replacement cost of fixed assets in the base year.

To calculate fixed assets for a number of years in constant, base prices, the following indicators are used: price indices for capital-forming products; price indices for capital investments developed on the basis of average regulatory coefficients for types and groups of fixed assets, as well as for the periods of their acquisition; final statistical revaluation indices by type of fixed assets and sectors of the economy and industry; indices of changes in market prices for fixed assets, obtained from data on their market value.

The calculation of fixed assets at comparable prices is carried out by two methods - index and balance sheet. According to the index method, fixed assets of the reporting year are recalculated based on consolidated indices of changes in prices and tariffs for the period from the base year to the reporting year. According to the balance sheet method, data on the availability of fixed assets on the base date at replacement cost is reduced by the amount of assets disposed of before the reporting year and increased by the amount of fixed assets received during this period. In this case, both funds are recalculated into base year prices using the corresponding price indices.

Note! The balance of fixed assets in average annual prices is necessary for a comprehensive analysis of the availability, dynamics and use of fixed assets for a certain period of time based on average values. Based on this balance, such indicators as capital productivity, capital-labor ratio, average standard service life, degree of wear, etc. are calculated.

Average annual price indices are calculated based on the dynamics of prices for products of capital-forming industries (mechanical engineering and the construction materials industry) according to price statistics. The average annual price index is calculated by month of the reporting period. Average monthly price indices are calculated as the average values of indicators at the beginning and end of each month, and the average annual price index is calculated as the quotient of dividing the sum of average monthly price indices by 12.

For balances of fixed assets, the following balance equation must be observed:

F1 + P = B + F2,

where F1 and F2 are the cost of fixed assets, respectively, at the beginning and end of the period;

P is the cost of funds received during the period;

B is the value of funds disposed of during the period.

Schemes of balance sheets of fixed assets at full cost and minus depreciation are presented in the layouts below (Tables 1, 2).

| Table 1. Scheme of the layout of the balance sheet of fixed assets by book value | ||||||||

| Type of fixed assets | Availability of fixed assets at the beginning of the year | Received in the reporting year | Dissolved in the reporting year | Availability of fixed assets at the end of the year | ||||

| Total | Including | Total | Including | |||||

| commissioning of new fixed assets | other receipts of fixed assets | fixed assets liquidated | other disposal of fixed assets | |||||

| Table 2. Scheme of the layout of the balance sheet of fixed assets by residual value | |||||||

| Type of fixed assets | Availability of fixed assets at the beginning of the year | Received in the reporting year | Dissolved in the reporting year | Availability of fixed assets at the end of the year | |||

| Total | Including the launch of new funds | Total | Including | ||||

| liquidated (written off) funds | depreciation of fixed assets for the year | ||||||

Fixed assets come from various sources. This may be the commissioning of new fixed assets as a result of investments, acquisition, receipt under a gift agreement, contribution of fixed assets as a contribution to the authorized capital, etc. Fixed assets are disposed of for the following reasons: liquidation of objects due to wear and tear, sale to other legal entities , gratuitous transfer, contribution to the authorized capital of other organizations, transfer for long-term lease, etc. The balance sheet can reflect all sources of income and all reasons for disposal by type.

In table 1 all indicators are assessed at residual value, with the exception of the indicator for the commissioning of new funds, which is assessed at the full initial cost. In contrast to the balance sheet at full valuation, in the balance sheet at residual value, one of the reasons for the decrease in value is annual depreciation, which is equal to the depreciation accrued for the year.

Based on balance sheets, statistics calculate a number of indicators characterizing the condition, movement, and use of fixed assets.

Indicators of movement, condition and use of fixed assets

The dynamics of fixed assets in Russia is characterized by the following data.

Indicators of the movement of fixed assets include: the dynamics coefficient, the renewal coefficient, the retirement coefficient of fixed assets.

The dynamics coefficient estimates the change in the value of fixed assets at the end of the period compared to the beginning and is calculated as the ratio of the value of fixed assets at the end of the year to the value of fixed assets at the beginning of the year.

The dynamics coefficient can be calculated using the full and residual value. Comparison of coefficients calculated using different estimates allows us to identify changes in the state of fixed assets. So, if the dynamics coefficient for the full value is less than the dynamics coefficient for the residual value, then the fixed assets were renewed during the period under review, that is, at the end of the period the share of assets without depreciation increased.

The renewal coefficient (Kobnov) characterizes the share of new fixed assets in their total volume (at full estimate) at the end of the period and is calculated using the following formula:

.

The retirement ratio (Kvyb) characterizes the share of retired fixed assets during the period in their total value (at full valuation) at the beginning of the period and is calculated by the formula:

To characterize the process of reproduction of fixed assets, the rate of renewal of fixed assets (Kint) is calculated:

The disposal of fixed assets may occur due to their complete disrepair. To assess the disposal of funds for the specified reason, you can calculate the dilapidation coefficient (Kveth):

The higher the value of this indicator, the lower the intensity of replacement of fixed assets.

Indicators of the condition of fixed assets include the wear and tear coefficient and the serviceability coefficient. These coefficients are calculated at a specific date (usually the beginning and end of the period).

The depreciation rate shows what part of its total value the fixed assets have already lost as a result of their use. The coefficient at the beginning of the period is calculated using the formula:

Kiznosa = Amount of depreciation / P.

The serviceability coefficient shows what part of its total value the fixed assets have retained as of a certain date. The shelf life coefficient at the beginning of the period is calculated as follows:

Usability = Residual value / P.

Example 1

Let us determine the degree of change in the deterioration and suitability of fixed assets at a particular enterprise. The calculation results are presented in table. 3.

| Table 3. Changes in the service life coefficient and depreciation coefficient of fixed assets | ||||

| Index | For the beginning of the year | At the end of the year | Change (+, –) at the end of the year compared to the beginning | |

| absolute value | % | |||

| Fixed assets, million rubles. | 20,5 | 23,2 | +2,7 | 13,2 |

| Residual value of fixed assets, million rubles. | 14,6 | 19,1 | +4,5 | +30,8 |

| Depreciation of fixed assets | 5,9 | 4,1 | –1,8 | –30,5 |

| Usability factor, % | 71,2 | 82,3 | — | +11,1 |

| Wear coefficient, % | 28,8 | 17,7 | — | –11,1 |

The shelf life coefficient at the beginning of the year was 71.2% (14.6 / 20.5 × 100%). The shelf life ratio at the end of the year was 82.3% (19.1 / 23.2 × 100%). The depreciation rate at the beginning of the year was 28.8% (5.9 / 20.5 × 100%). The wear rate at the end of the year was 17.7% (4.1 / 23.2 × 100%).

Indicators of the use of fixed assets include capital productivity and capital intensity. To calculate these indicators, the average cost of fixed assets () is determined in several ways:

1) using the simple arithmetic mean formula:

= (OFn + OFk) / 2;

2) according to the average chronological formula, if the value of fixed assets is known for dates separated by equal periods of time:

where n is the number of periods;

3) according to data on the movement of fixed assets:

where OF1 is the cost of fixed assets at the beginning of the year;

P is the cost of fixed assets received during the year;

B is the cost of fixed assets retired during the year;

t1 - number of months of operation of received fixed assets;

t2 is the number of months of operation of fixed assets retired during the year.

The capital productivity indicator estimates the number of products per ruble of fixed assets. Capital productivity is a direct indicator of the efficiency of use of fixed assets: the higher the capital productivity, the better the use of fixed assets, and vice versa. Capital productivity (FRO) is calculated as the ratio of the output of marketable products to the average cost of fixed assets:

The capital intensity indicator is an inverse indicator of the efficiency of using fixed assets. The lower the level of capital intensity, the more efficiently fixed assets are used. Capital intensity evaluates the level of costs of fixed assets per ruble of manufactured products. Capital intensity (Fe) is calculated using the formula:

To assess the provision of labor with fixed assets, statistics use the capital-labor ratio indicator. The capital-labor ratio estimates the average volume of fixed assets per employee. Capital-labor ratio (Fe) is calculated as the ratio of the average annual value of fixed assets to the average number of employees:

Fv = P /

where is the average number of employees.

One of the general indicators characterizing the efficiency of use of fixed assets is the profitability of fixed assets. It is defined as the ratio of book profit (Pbal) to the average annual cost of fixed assets (Fosn):

Rosn. f = Pbal / Phosn.

Example 2

Using the above formulas, we will consider the change in general indicators in the organization. We present the initial data and calculation results in Table. 4.

| Table 4. Main general indicators of the use of fixed assets | |||||

| Line no. | Index | For the previous year | For the reporting year | Deviation from the previous year (+, –) | |

| absolute value | % | ||||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | Average annual cost of fixed assets, thousand rubles. | 18 850 | 20 500 | +1650 | +8,7 |

| 2 | Average annual number of employees | 255 | 258 | +3 | +1,2 |

| 3 | Product sales volume, million rubles. | 32 410 | 35 837 | +3427 | +10,6 |

| 4 | Profit (balance sheet), thousand rubles. | 303 | 395 | +92 | +30,4 |

| 5 | Capital productivity, (volume of supplies per one ruble of fixed assets), rub. (page 3 / page 1) | 1,72 | 1,75 | +0,03 | +1,7 |

| 6 | Capital intensity (fixed assets per ruble of supplies), rub. (page 1 / page 3) | 0,58 | 0,57 | –0,01 | –1,7 |

| 7 | Capital-labor ratio (fixed assets per employee), rub. (page 1 / page 2) | 7392 | 7946 | +554 | +7,5 |

| 8 | Labor productivity, thousand rubles. | 12 710 | 13 890 | +1,180 | +9,3 |

| 9 | Capital productivity through capital-labor ratio and labor productivity, rub. | 1,72 | 1,74 | +0,02 | +1,1 |

| 10 | Return on fixed assets, % (page 4 / page 1) | 1,6 | 1,9 | — | +0.3 points |

Analysis of the impact of changes in the efficiency of use of fixed assets on production volume

A change in the volume of production can occur due to a change in capital productivity and the volume of funds. To conduct index analysis, the volume of production and the cost of fixed assets are assessed at comparable prices of the base period. The production volume index (Iq) is equal to the product of the capital productivity index (IFo) and the index of the cost of fixed assets (IOF):

,

where q0, q1 are the volume of production in the base and current periods, respectively;

Fo 0, Fo 1 Fo0, Fo1—capital productivity, respectively, in the base and current periods;

— the average cost of fixed assets in the base and current periods, respectively.

The absolute change in the volume of production in the current period (TP1) compared to the base period (TP0) is determined as follows:

Δmn = TP1 – TP0.

Including:

a) due to changes in capital productivity:

∆Fo = OF1 × (Fo1 – Fo0);

b) due to changes in the average cost of fixed assets:

∆OF = (OF1 – OF0) × Fo0.

Analysis of the use of equipment and production capacity of the enterprise

After analyzing the general indicators of the efficiency of using fixed assets, it is necessary to study in detail the degree of use of the enterprise's production capacities, individual types of machinery and equipment.

Production capacity is understood as the maximum possible output of products at the achieved or intended level of technology, technology and production organization. The maximum power of the equipment is not a constant value; its level may be revised in the process of further optimization of the production process. It is calculated based on the capacity of leading workshops, sections, units, taking into account the implementation of a set of organizational and technical measures aimed at eliminating bottlenecks, and possible production cooperation. The actual power can be equal to the maximum if high equipment efficiency is achieved and the production process is organized in an optimal way.

For example, if, as a result of an analysis of the operation of production lines, it is revealed that the actual capacity differs from the maximum by more than two times, this means that to produce the same volume of products, enterprises where the efficiency of the equipment is high may require half as many units of equipment, than at an enterprise, where such efficiency is significantly lower. Consequently, enterprises that pay due attention to achieving high equipment efficiency have a real opportunity to save money “on all fronts”: they reduce the need for investment, save workshop space, reduce labor costs, etc.

The degree of utilization of production capacity is characterized by the following coefficients:

General coefficient = Actual or planned volume of production / Average annual production capacity of the enterprise,

Intensive coefficient = Average daily production output / Average daily production capacity of the enterprise,

Extensive coefficient = Actual or planned working time fund / Estimated working time fund adopted when determining production capacity.

In the process of analysis, the dynamics of these indicators, the implementation of the plan for their level and the reasons for their changes (commissioning and reconstruction of existing enterprise assets, technical re-equipment of production, reduction of production capacity) are studied.

In addition, the level of use of the enterprise's production space is analyzed: product output in rubles per 1 m2 of production area.

Analysis of equipment operation is based on a system of indicators characterizing the use of its number, operating time, and power.

To characterize the degree of equipment involvement in production, the following indicators are calculated.

Available equipment fleet utilization rate (Kn):

Kn = Amount of equipment used / Amount of available equipment.

Installed equipment fleet utilization rate (Ku):

Ku = Number of equipment used / Number of installed equipment.

The difference between the amount of available and installed equipment, multiplied by the planned average annual production per unit of equipment, is a potential reserve for growth in production by increasing the number of existing equipment.

To characterize the extensive loading of equipment, the use of equipment by time is analyzed: the balance of operating time and its shift ratio (Table 5).

| Table 5. Indicators characterizing the equipment usage time fund | |||

| Time fund indicator | Symbol | Calculation formula | Notes |

| Calendar fund | Tk | Tk = Tk. days × 24 | Tk. days - number of calendar days for the analyzed period, days |

| Nominal (regime) fund | TN | Tn = Tr. cm × tcm | Tr. cm is the number of work shifts for the analyzed period; tcm — duration of work shift, h |

| Effective (real) fund | Tef | Teff = Tn – Tpl | Tpl — scheduled repair time, h |

| Useful (actual) fund | Tf | Tf = Tef – Tpr | Tpr — time of unscheduled downtime, h |

The level of intra-shift use of equipment is characterized by the equipment load factor K3, which makes it possible to estimate the loss of equipment operating time due to scheduled maintenance, etc.:

Kz = Tf / Tk, or Tf / Tn, or Tf / Tef.

The level of conditional use of equipment is characterized by the shift coefficient (Kcm):

Intensive loading of equipment is understood as an assessment of its performance.

Equipment Intensive Load Factor (Ci):

A general indicator characterizing the complex use of equipment is the integral load indicator (Kint):

Kint = Kz × Ki.

In the process of analysis, the dynamics of these indicators, the implementation of the plan and the reasons for their changes are studied.

EXPERT'S COMMENT

O. V. Severin, Head of the Production Planning Department of JSC Unimilk Company

Our company spent three months analyzing the operation of eight pieces of equipment producing identical products at domestic food industry enterprises. As a result of the analysis, it was found that the equipment capacity achieved with the existing production organization varies at different enterprises from 2100 to 3750 tons/month. That is, the difference in the achieved power of equipment purchased from the same supplier reaches 56%. Such a significant difference is due to different levels of equipment operating efficiency, which for the most part is a consequence of the irrational organization of both the production technological process and the labor of production personnel. Naturally, before increasing the power of the equipment, it is necessary to determine how efficiently it operates and what are the limits for increasing the efficiency of the equipment.

Calculation method based on equipment efficiency reporting

The essence of this method is to analyze the statistics of production reports on the operation of equipment, in which employees record all the actions carried out while working on this equipment. Having collected statistics for a certain period, it is necessary to analyze how the production process actually took place, and what exactly the production time was spent on. Using this data, it is easy to track the actual organization of the production process, and then calculate the actual capacity of the equipment. Advantages of the method: accuracy, objectivity, use of actual data for calculations, complete clarity as to what the result consists of. An additional advantage is that the same reporting can later be used to solve other production problems. Disadvantages of this method: it will take some time to implement the above-mentioned reporting on the operation of production equipment and to train production personnel (the workload on personnel will increase).

There are also several methods for estimating the maximum power of equipment, and in essence they are in many ways similar to methods for estimating actual power.

The most optimal method seems to be a calculation based on reporting on the efficiency of equipment operation. This is what we will consider next.

Time accounting loves

Equipment efficiency reporting is compiled to provide detailed accounting of the use of production time. Systems for working with such daily reporting in one form or another have been implemented at the vast majority of foreign manufacturing enterprises, and in essence they are not much different from each other. The physical medium of the report is a form filled out daily during a shift by an enterprise employee responsible for the operation of a specific piece of equipment. The report records all actions carried out during the production process on this equipment. An example of a completed reporting form on the efficiency of equipment operation for a shift (12 hours) is given in Table 6.

| Table 6. Completed equipment efficiency report form for the shift | ||||||||

| Products released, pcs. | Machine speed (pcs/min) | Start time (h, min) | End time (h, min) | Equipment operation (min) | Planned downtime (min) | Unscheduled downtime (min) | Unoccupied time (min) | Action |

| 8:00 | 8:20 | 20 | Warming up the car | |||||

| 22 000 | 100 | 8:20 | 12:00 | 220 | Production of “Sterilized milk” | |||

| 12:00 | 12:30 | 30 | Lunch break | |||||

| 2000 | 100 | 12:30 | 12:50 | 20 | Production of “Sterilized milk” | |||

| 12:50 | 13:30 | 40 | Switch to another product | |||||

| 20 500 | 100 | 13:30 | 16:55 | 205 | Production “Sterilized cream | |||

| 16:55 | 17:15 | 20 | Broken upper bag gripper foot | |||||

| 4500 | 100 | 17:15 | 18:00 | 45 | Production “Sterilized cream | |||

| 18:00 | 18:50 | 50 | Washing | |||||

| 18:50 | 20:00 | 70 | Free time | |||||

| … | … | … | … | … | … | … | … | … |

| Total: 49 000 | 490 | 140 | 20 | 70 | ||||

The data reflected in the report can be used:

- to determine the actual and maximum power of the equipment;

- assessment of the workload of production equipment (current, predicted);

- analysis of how production time is used (primary document about what happened to the equipment in past periods);

- control of planned downtime, determination of standards for their duration;

- calculating key production performance indicators, comparing work results over certain periods of time.

Looking for hidden reserves

Based on the data recorded in the report on the operation of the equipment for the shift, it is possible to estimate the power of the equipment. We'll show you how to do this with an example.

Example 3

Let's use the data in table. 6.

From the report on the efficiency of equipment operation for a shift, the following data can be highlighted:

- the total analysis period (total shift time) is 720 minutes, of which:

— equipment operating time (OO) — 490 min;

— total planned downtime (PP) — 140 minutes;

— total time of unscheduled downtime (UP) — 20 minutes;

— unoccupied time (NV) — 70 min;

- apparatus speed (C) - 100 pcs./min;

- Products produced for the period - 49,000 units.

Based on data on the distribution of working time, it is possible to assess the efficiency of equipment operation for a given period. It is convenient to do this by calculating the conditional indicator “Productivity” (PR), which is one of the key indicators of production efficiency, allowing for its constant monitoring. It is calculated by the formula:

where BP is the minimum operating time required to produce a given amount of product;

PP, VP - duration of planned and unscheduled downtime, respectively.

In our example, the “Productivity” indicator for the shift report is 75.4% (490 / (490 + 140 + 20) × 100%).

The obtained value of the indicator should be interpreted as follows: of the entire period of working time (total time of the period minus non-working time), 75.4% was spent on production (working time), the remaining 24.6% was spent on various types of downtime. It is in the last component that one should look for reserves for a possible increase in productivity and increasing the power of equipment.

Having established the actual value of the “Performance” indicator, we will calculate the actual power of the equipment. To do this, it is recommended to determine the value of this indicator for a period of at least one month, since data on work during just one shift will not be representative for the specified purpose. The "Performance" value for one shift is suitable for monitoring the efficiency of equipment, but not for assessing its capacity.

The power (MS) of equipment for a certain period is calculated using the formula:

MSH = PR × ORP × V,

where PR is the actual value of the “Productivity” indicator, %;

ORP - the total time of the period for which it is required to estimate the power;

V is the operating speed of the equipment.

Let's calculate the daily power of the equipment based on the data given in table. 6:

- equipment operating speed (V) - 6000 pcs./h (100 pcs./min × 60 min);

- equipment productivity - 75.4%;

- The period for which power is determined (ORP) is 24 hours.

Thus, the actual capacity will be equal to: MSH = 0.754 × 6000 × 24 = 108,576 (pcs./day).

In order to calculate the maximum power of the equipment, it is necessary to clearly plan improvements in the organization of the production process. Most often, they are aimed at reducing the duration of planned and unscheduled downtime.

Let’s assume that in our example it is planned to cancel the planned downtime “Lunch break” by hiring additional staff to replace employees having lunch, and the duration of downtime “Wash” is to be reduced from 50 to 30 minutes (thanks to a revision of the washing procedure). It is impossible to implement other improvements, as studies of equipment operation have shown. Thus, the total duration of planned downtime (PP) in the given example would be not 140, but 90 minutes.

Next, you need to recalculate the “Productivity” indicator based on new data, and then recalculate the power. This will be the maximum power: PR = 490 / (490 + 90 + 20) × 100% = 81.7%; MS = 0.817 × 6000 pcs./h × 24 h = 117,648 pcs./day.

So, calculations showed that the planned improvements will increase productivity by 6.3% and increase the power of the equipment in such a way that it will produce 9072 more units of product per day than at actual capacity.

What is reflected in line 1150 “Fixed assets”

It is obvious that the line of the Balance Sheet, which is called “Fixed Assets,” should reflect the fixed assets of the enterprise as of the reporting date. However, not everything is so simple - accountants should be aware of three nuances associated with filling out line 1150:

- The mentioned line does not account for all fixed assets of the company without exception. Only those objects that are reflected in account 01 “Fixed Assets” are taken into account. The situation is relevant when registering objects, the sole purpose of which is for the owner company to rent them out for temporary use (possession) for a fee to third parties. Such operating systems will be reflected on line 1160, and not on line 1150.

- Like other indicators, fixed assets should be displayed on the balance sheet in a net valuation (i.e., at residual value).

- It is also possible to display in line 1150 information about the debit balance of account 08 for subaccounts 01-04 in terms of fixed assets, as well as the debit balance of account 07. The accounting department of an enterprise has the right to independently make such a decision on the inclusion of this information; the law does not prohibit this. However, if the data values are insignificant, it is recommended to reflect them on line 1190.

How to calculate the value of line 1150 “Fixed assets” (balance sheet formula)

When filling out line 1150, the value of the indicator can be calculated using the formula below based on the Balance Sheet database:

Important! The cost of fixed assets must be reduced only by depreciation related to fixed assets (which are recorded on account 01). Often, missing this point leads to errors in calculations. As mentioned earlier, line 1150 does not take into account fixed assets that are intended for rental and are subject to accounting under account 1160 “Income-generating investments in tangible assets.” But depreciation on such fixed assets is also accrued on account 02. Therefore, it is important to remember that depreciation related to fixed assets of account 03 is not taken into account when calculating the value on line 1150, because such fixed assets are not included in this line.

Fixed assets on balance sheet

Any organization records fixed assets on its balance sheets, for which a separate line is provided that determines the cost of fixed assets on the balance sheet (line 1150).

Line 1150 of the balance sheet reflects the residual value of all fixed assets of the enterprise, which was formed at the end of the reporting period.

To do this, subtract from the primary price of fixed assets (recorded in the debit of account 01) the amount of depreciation that has accumulated on them (reflected in the credit of account 02). Thus, this line records the difference between the debit balance of account 01 and the credit balance of account 02.

Additional equipment (reconstruction, revaluation of property), which leads to an increase in the initial price of the object, is prescribed in the appendix to the balance sheet.

Note 2

Revaluation of property is usually carried out once a year by indexing the current value of the property or recalculating to the actual market price. The difference that results from these calculations increases the amount of additional capital.

In accordance with the letter from the Ministry of Finance, fixed assets that are not suitable for further use are subject to write-off with the residual price assigned to other costs.

How are fixed assets depreciated on the company's balance sheet?

An item of fixed assets is depreciated from the 1st day of the month following the month in which the property was accepted for accounting. Depreciation is accrued until the property is written off or until its cost is fully repaid (depreciation stops on the 1st of the month following the month in which one of the above 2 events occurred).

Important! The depreciation method chosen by the company for a group of fixed assets characterized by homogeneity must be applied throughout the entire useful life of the property included in this group.

In total, there are 4 methods of calculating depreciation available when paying off the cost of fixed assets:

Whatever depreciation method is chosen by the enterprise, depreciation charges are accrued in the amount of 1/12 of the annual amount during the reporting year. Depreciation is carried out in compliance with the following rules:

| Controversial issue regarding depreciation of fixed assets | Solution |

| Suspension of depreciation charges for fixed assets | Depreciation continues throughout its useful life. Exception: — OS recovery time is more than 1 year, — conservation of the object for more than 3 months by order of the authorities. |

| Dependence of depreciation charges on fixed assets on the results of the company’s work in the reporting period | Depreciation is reflected in the accounting of the period to which it relates and does not depend on the results of the enterprise for the reporting year. |

| Displaying summary information about asset depreciation | Generalized data on deductions accumulated over the period of use of the operating system are reflected in account 02. |

| Reflection of fixed assets depreciation amounts in correspondence with various accounting accounts | Accrued depreciation payments are indicated according to Kt. 02 in correspondence with production (sales) expense accounts. |

| Depreciation of retired and damaged fixed assets | Written off in CT account. 01 subaccount “Disposal of fixed assets”. Likewise for: - completely worn out OS, - lost OS, - realized objects, - decommissioned OS, - donated free of charge, - partially liquidated. |

Basic accounting entries for fixed assets

The following accounting entries are most often found in financial statements when it comes to fixed assets:

| Operation | DEBIT | CREDIT |

| The initial cost has been formed, the OS has been put into operation | 01 | 08 |

| The residual value was written off upon disposal of fixed assets | 91 | 01 |

| Depreciation accrued | 20, 23, 25, 26, 29 (depending on production) | 02 |

| Accumulated depreciation was written off due to disposal of property | 02 | 01 |

| Depreciation was accrued due to the revaluation of fixed assets | 83 | 02 |

| Depreciation has been accrued on an object transferred to third parties under a temporary use agreement | 91 | 02 |

Capitalization of a fixed asset (example, calculation, postings)

The hypothetical enterprise Rabotyaga LLC buys new equipment for production to replace completely worn-out equipment. Its price is 310,000 rubles, including the company’s expenses for delivering the fixed asset to the workshop and for bringing it into working condition by a specialist. VAT on the cost of equipment is 42,155 rubles. When new equipment is put into operation, the accountant will make the following entries:

| Operation | Amount (rubles) | DEBIT | CREDIT |

| The costs of purchasing equipment are taken into account (the price includes delivery and setup services) | 267 845 | 08 | 60 |

| Input VAT reflected | 42 155 | 19 | 60 |

| The initial cost of the equipment was formed, the facility was put into operation | 267 845 | 01 | 08 |

| Submitted for deduction of input VAT | 42 155 | 68 | 19 |

Answers to frequently asked questions about fixed assets in the balance sheet of an enterprise

Question: Can the initial cost of a fixed asset at which the object was accepted for accounting be changed?

Answer: Changing the initial cost of a fixed asset previously accepted for accounting is generally unacceptable. However, the law makes an exception for cases of revaluation of fixed assets, their partial liquidation, modernization, reconstruction, additional equipment and completion. When one of the listed moments occurs, recalculation of the initial cost is allowed.

Question: Are all fixed assets subject to depreciation?

Answer: No, depreciation is not charged on those fixed assets that do not lose their consumer properties (plots of land, reservoirs and other natural objects, museum exhibits, etc.).

What to disclose in notes to financial statements

As you can already understand from the above, the answer will be different for each company.

Experts recommend preparing explanations after the contents of the balance sheet and financial results report are already clear. It is necessary to analyze whether there are significant quantities in:

- intangible assets (for example, trademarks);

- fixed assets (including the cost of premises, equipment, land, etc.);

- financial investments (shares or debt securities that the company purchased; funds placed on deposits in banks);

- stocks;

- accounts receivable and payable;

- production costs;

- estimated liabilities (for example, for vacation pay, long service awards, legal proceedings, possible warranty repairs of previously sold goods);

- securing obligations (for example, they received or transferred property as collateral, and also issued their securities against accounts payable);

- received material government assistance (financial subsidies or assistance in the form of equipment, which is valued in monetary terms).

For each significant value, additional disclosures must be provided in the explanations.

Next, we will consider in more detail the aspects that need to be disclosed most often.