BLITZ! KPP stands for Registration Reason Code . The individual entrepreneur does not have a checkpoint! There is as much sense in looking for it as in a square wheel. Therefore, don’t bother yourself.

But what it is and why it is necessary, everything is outlined below.

Situations when business partners of individual entrepreneurs ask them to name their checkpoint occur all the time. However, despite the fact that legal literacy among businessmen is growing everywhere, there is still a large gap regarding the checkpoint. At the same time, the line “KPP” appears in many important documents, including reporting documents required for presentation to the tax authorities. However, often entrepreneurs do not even know how this abbreviation stands for and what the checkpoint is for, trying in vain to find its presence in their title certificates.

What is a checkpoint and what does it consist of?

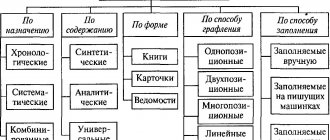

The letter combination KPP is deciphered quite simply: the code for the reason for registration with the tax authority. This code consists of 9 characters, specified in the details of the organization and allowing you to identify the enterprise by location and legal status.

The checkpoint includes three parts:

1-4 characters are information about the territorial department of the Federal Tax Service of the Russian Federation in which the organization is registered. For the largest taxpayers belonging to interregional tax inspectorates, the first two digits in the checkpoint are 99, but these are exceptional cases rather than the rule;

5-6 characters are the actual checkpoint, which is determined according to SPPUNO (a directory of reasons for registering taxpayers). For Russian organizations, the code includes numbers from 01 to 50 (by location), for foreign companies - from 50 to 99. For example, the numbers 45 indicate that the company is registered at the location where its separate representative office is located, 43 - by territory location of the branch, etc. By the way, the fifth and sixth characters of the checkpoint in some cases can be not only numbers, but also capital letters from A to Z of the Latin alphabet.

7-9 characters are the serial number of registration. In other words, the last three digits show how many times the organization was registered for a specific reason. For example, if the company is registered for the second time, then the numbers 002 will be indicated.

For your information. When moving to another region, the checkpoint previously assigned to a commercial company must be changed.

Deciphering the checkpoint by numbers

Like other individual numbers that are assigned to a legal entity upon registration, KPP is not a random set of characters, but has a precisely defined structure. It is established by Order of the Federal Tax Service No. MMV-7-6/435 dated June 29, 2012. In accordance with the provisions of this document, the structure consists of 9 digits. An example of deciphering the checkpoint by numbers is given in the table:

| Decoding | R | R | N | N | P | P | TO | TO | TO |

| checkpoint | 7 | 7 | 0 | 1 | 1 | 0 | 0 | 0 | 3 |

The symbols that are indicated in the number have the following meanings:

- RR is the serial number of the subject of the Russian Federation in the list established by the Constitution (for example, 77 is used for Moscow), in which registration is carried out. In tax offices with the largest taxpayers, the value 99 is used, so the presence of such a value in the checkpoint indicates the status of the organization.

- NN – number of the tax office where registration is carried out.

- PP - numbers that encrypt the reason for registration, in accordance with the approved classification. Companies that are residents of the Russian Federation are assigned a number from 01 to 50. Foreign companies receive a number from 51 to 99, which makes it easy to identify a foreign company by checkpoint.

- KKK - numbers that reflect how many registrations a company has for a similar reason with a specific Federal Tax Service body.

Knowing the checkpoint of a legal entity, it is impossible to accurately identify the company that is a counterparty or partner. It allows you to determine the tax inspection authority and divisions. To obtain complete information about the company, you also need an INN or OGRN. You can also use the legal address or full name of the director. It should be noted that the checkpoint is practically not used separately from the TIN or OGRN, therefore there are usually no difficulties with identifying a legal entity.

Why do you need a checkpoint?

Through this code, interested parties can easily determine whether an organization belongs to a particular branch of the tax service in the Russian Federation, as well as find out the reason for its registration.

The checkpoint is extremely important for the enterprise. Without it, it will not be possible to conclude large transactions and contracts, or participate in serious tenders - for example, when announcing tenders from government-affiliated structures, the checkpoint line in the details of the organization participating in the competition is required to be filled out. If it is not filled out, the application is unlikely to be processed.

The registration code is also necessary for processing payment orders, tax reports and accounting.

Attention! If a commercial organization has several branches and representative offices, then each of them has its own checkpoint.

In addition to all of the above, a new checkpoint is assigned upon registration of buildings and structures, vehicles belonging to the enterprise, as well as other grounds prescribed in the Tax Code of the Russian Federation. In particular, mining companies, for example, receive checkpoints in the administrative district where natural resource extraction sites are located.

To whom is the checkpoint assigned, in what documents is it indicated?

The Federal Tax Service assigns a reason code for registration only to legal entities. Individual entrepreneurs do not have this requisite.

Legal entities must indicate the checkpoint (as well as the tax identification number) in all documents related to taxes and insurance premiums. Among these papers:

- Declarations and calculations, income certificates in form 2-NDFL.

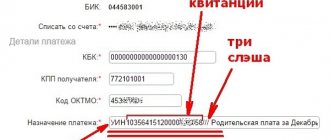

- Payment orders for the payment of taxes, fees, insurance premiums, as well as penalties and fines for them. In such payments, the checkpoints of the payer and the recipient are mandatory bank details. If money is transferred to a counterparty, this code does not need to be specified.

- Invoices, sales books, purchase books, journals of received and issued invoices. Here it is necessary to indicate the checkpoints of both the supplier and the buyer.

ATTENTION. For legal entities that have several checkpoints, it is important to choose the right code. In particular, when issuing an invoice by a separate division, it is necessary to indicate the code of this division. If an employee is registered in a branch, the 2-NDFL certificate for such an employee must indicate the branch code.

Fill out and submit 2‑NDFL online for free with new codes

Where is the checkpoint assigned?

The company receives the reason code for registration simultaneously with the TIN, immediately upon tax registration with the territorial tax service to which the founder of the organization applies. In cases where an enterprise moves to another administrative district, under the jurisdiction of a different tax office, the checkpoint must be changed, that is, you must independently contact the tax office at the new location of the company with an application to assign a new checkpoint. The same must be done when moving a branch or separate division of a company - they also have their own reason codes for registration and they must also change when changing the territory of commercial activity.

For your information! The reason code for registration with several completely different companies may well coincide. This means that these organizations are included in the same territorial Federal Tax Service on the same basis.

Important! When changing the details of the tax office, including its relocation, the checkpoint for taxpayers belonging to a given department of the tax service does not change.

What you need to know about checkpoints

The registration reason code must be assigned to the organization upon registration. It is one of the details that are indicated in all payment and accounting documents, financial documentation, reporting of a legal entity, as well as when transferring data to the Federal Tax Service. Therefore, if there is no checkpoint in the details provided by the counterparty, this is a reason for doubt.

The disadvantage of the checkpoint is the absence of a checksum in its structure, which does not make it possible to verify its correctness. In turn, incorrectly indicating this number in the payment details does not allow the payment to be processed, which can create serious problems in some cases. Therefore, it is recommended to conduct additional verification of the provided details before making a payment.

In Russia, only legal entities receive a reason code for registration. For individual entrepreneurs, as well as for individuals, it is not required to receive it. If there is a checkpoint box in the payment documents being filled out, individuals and entrepreneurs can indicate a dash in it.

How to find out the checkpoint of an enterprise

The checkpoint must always be in the details of the legal entity, but if for any reason it is missing, then the management of the enterprise must contact its tax office with a corresponding written request. In this case, tax officials will ask the applicant to present a passport and TIN and in a few days will issue an extract from the Unified State Register of Legal Entities.

In addition, information about all assigned checkpoints can be obtained on the official website of the Federal Tax Service on the “Information about legal entities” page, which also fully contains information from the State Register of Legal Entities.

Possible reason codes for setting

The reasons for the setting may be different; a large classification has been identified. 01 - this is simply at the place of registration, but there may be other cases. The Tax Code reflects the decoding of codes, there are several dozen different cases. For example, an organization may register with a specific tax office for other reasons:

- 02 - at the location of the branch that will deal with tax issues, actually accounting;

- 03-05 - for a branch that does not deal with tax issues, for a representative office with and without such responsibilities;

- 06-08 - when registration was carried out at the location of the organization’s real estate;

- 10-29 - at the location of movable property;

- 33-34 - at the place of mining.

You will find a complete list of checkpoint codes and their exact decoding in the tax code or simply on the Internet. The maximum number of codes in the classification is 87. As you can see, there are many reasons for registration.

If the organization is relatively small, then it usually has one legal entity checkpoint. But if the company is large, has several representative offices, is represented in different regions, but each division can be assigned its own checkpoint account. For example, Sberbank is divided into 11 territorial divisions, and each has its own details.

How to find out the bank details of an organization

Typically, companies provide their own transfer details. But they may be lost or unknown for another reason. What if you only know the company name, but you need to make a translation?

The easiest way is to visit the website of this company. If she is financially active, the information will always be freely available. If not, call, the manager can send you the necessary details by email.

You can obtain information by knowing the organization’s TIN. The TIN can be easily found on the Internet; information is freely available in special directories. If the company is large and is included in the banks’ database, then when making a payment through banking, it is enough to indicate the TIN; the remaining details, including the checkpoint, will be pulled up automatically.

We looked at what a checkpoint of an organization or bank is, how this concept is translated, and why it is needed. In general, it is important to know what a checkpoint is in the details of an individual entrepreneur or LLC; in the case of transferring to an individual, this bank details are not required.

5 / 5 ( 2 voices)

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email