Home • Blog • Blog for entrepreneurs • How to open a current account for an individual entrepreneur

November 19, 2021

963

To open a current account for an individual entrepreneur, you will have to go through several steps. First of all, you need to study the conditions of different banking institutions in order to choose the most suitable one. Then collect the required package of documents and personally bring them to the bank branch. Opening a current account is quick - in most cases it is available for work the very next day after registration. Let's consider where it is better to open an individual entrepreneur's current account and how to do it.

Is a current account required for individual entrepreneurs?

According to current legislation, an individual entrepreneur has the right to work without a current account. However, in this case, the business owner can only make payments in cash. In addition, he will have to face certain restrictions.

| Restrictions | Description |

| Limits on cash payments | Subject to cooperation with other individual entrepreneurs and legal entities, the maximum limit within the framework of one agreement is 100,000 rubles. For exceeding it, a fine of 4 to 5 thousand rubles is provided (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). |

| Prohibition on using a personal card for business | The Central Bank prohibits the use of personal accounts of individuals for transactions related to business activities. Therefore, payment from card to card without a current account is impossible. With regular non-cash receipts, the bank may refuse service and block the card (clause 2.2 of Bank of Russia Instruction No. 153-I dated May 30, 2014). |

| Clients are not able to pay for goods or services with a bank card | Any non-cash payments with customers without first opening a current account are prohibited. This leads to a decrease in customer loyalty and, accordingly, a decrease in enterprise income. Buyers can switch to competitors who provide a convenient payment method by bank card. |

| Counterparties refuse to cooperate without a current account | Non-cash forms of payment are insurance for legal entities against inspections under Federal Law-115 of 08/07/2001. A current account is also required to participate in procurement. |

| Difficulty verifying expenses | Accounting for expenses is required by individual entrepreneurs when conducting business using the simplified tax system “Income minus expenses” or the general taxation system. This is necessary for correct tax calculation. With a current account, it is easier for the tax service to track the income and expenses of an individual entrepreneur. Therefore, there will be fewer questions for the businessman from the regulatory authority. |

Thus, it can be argued that a current account for individual entrepreneurs, although not mandatory, is highly desirable. It will allow you to conduct business in full, without serious restrictions.

Why do you need an account?

If you are an individual entrepreneur , then theoretically you can get by with cash, because individuals are allowed to make tax payments and contributions to social funds without resorting to banking services. Settlements with partners can also be made with “real” money if the amounts do not exceed the established limit of 100,000 rubles.

Legal entities are also not formally required to open an account account, however, it is almost impossible to do without it for a number of reasons.

- Tax payments from legal entities are accepted only from their current account (clause 3 of Article 45 of the Tax Code of the Russian Federation).

- Most partners prefer to make non-cash payments rather than experience the inconvenience associated with using a “cache”.

- Within one agreement, cash payments are possible only up to the 100 thousand limit (instruction of the Bank of Russia No. 3073-U dated 10/07/2013).

- If the cash balance exceeds the limit established by law, the excess will need to be deposited into a bank account (clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

Types of current accounts

The question arises: which current account to open for an individual entrepreneur? They are classified into the following types:

- The main one is a regular current account intended for transferring funds to business partners;

- Deposit - not used for transactions, used for the safety of funds and the calculation of interest on the balance;

- Card — account from a linked bank card;

- Budgetary - opens when funds are allocated to individual entrepreneurs from the state budget;

- Facial - intended for enterprises providing services to the public;

- Accredited - current account with a bank guarantee (if the terms of the transaction are not met, the money is returned to the buyer);

- Investment - similar to deposit, but is used not only to save money, but also to increase it (investments in foreign exchange markets, real estate, etc.).

The following current accounts are distinguished by type of currency:

- Rubles - used for financial transactions within the country;

- Foreign exchange - for settlements on international transactions (often used by individual entrepreneurs working with imports or exports).

Large banking organizations offer their clients a wide range of currencies for opening an account. The commission for its servicing is written off in rubles.

What are the tariffs for individual entrepreneurs?

Banks often offer budding entrepreneurs a tariff without a subscription fee: so that they can easily do repairs, get started and not overpay for services. Dot is no exception: the tariff for beginners is called “Zero”.

If you are already actively working, the “Zero” tariff is unlikely to be profitable: the fees for working with cash and replenishing your account with personal funds are too high. Then consider the “Start” tariffs for 700 ₽ per month and “Development” for 3,500 ₽ per month.

With all tariffs, you can generate payments for transfers to legal entities and individual entrepreneurs free of charge. To choose a tariff, the most important thing is to understand how much money you transfer to individuals and withdraw from ATMs. At the time of writing, with the “Start” tariff, transfers to individuals are free up to 400,000 rubles, cash withdrawals are free up to 50,000 rubles. On the “Development” tariff, respectively, 1 million rubles and 300,000 rubles per month.

If you realize that you have made the wrong choice, it will not be difficult to change the tariff. You simply select a new one in the application, and it will take effect on the 1st of the next month.

Which bank should I open a current account for as an individual entrepreneur?

When choosing a bank to open a current account, you should be guided by the following criteria:

- 1. Distance from the place of registration of the company's main office. The closest availability will allow you to easily pick up statements, deposit cash, make transfers, etc.

- 2. Operating mode. Clients prefer to cooperate with banks with long working hours.

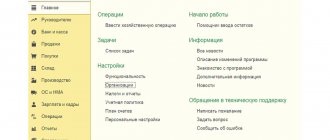

- 3. Possibility of connecting to Internet banking. This service is now provided by almost all banks. It allows you to make financial transactions remotely, without the need to visit a bank branch. Certain types of banks offer Internet banking in the form of a mobile application.

- 4. Providing additional tools for business. For example, built-in products: verification of counterparties, certificates, generation of payments, etc.

- 5. Convenient tariff plan. By comparing offers, you can choose the most suitable tariff.

In addition, to open a current account, individual entrepreneurs should choose banks with a reliable reputation.

So, where to open a current account for an individual entrepreneur? Let's present a list of popular banks in Russia:

- Sberbank;

- Alfa Bank;

- PromsvyazBank;

- ModulBank;

- Tinkoff.

In any case, before choosing the services of a particular bank, you need to study and compare the conditions in detail.

| Read also: “Tax holidays for individual entrepreneurs” |

How to choose a bank?

It is very difficult to give specific recommendations on choosing a bank, because each entrepreneur has his own preferences. Some people prioritize name and reputation; for others, ease of service is more important; for others, cost is more important. However, we can highlight the main points that an entrepreneur should pay attention to when choosing a bank:

- Reliability. The stronger a bank is on its feet, the less likely it is to encounter financial difficulties or lose its license. This is especially important because currently the deposits of individual entrepreneurs are not included in the deposit insurance system. How can you tell if a bank is reliable? You should focus on different indicators - assessments of expert agencies, popular ratings, financial indicators and even the news background.

- Maintenance cost. It consists of several types of costs:

- account opening fee (today there are banks that do not charge this);

- monthly fee (you can find offers without a subscription fee);

- service tariffs, that is, the cost of carrying out specific operations.

- Remote service capabilities. Everyone has Internet banking, but the difference lies in the convenience of the interface. Banks also often offer work through a mobile application. This should also include the option of “visiting a representative to open a current account.” The entrepreneur does not even have to waste time visiting a credit institution.

- Map . If an individual entrepreneur plans to use a plastic card, you need to find out in advance whether the bank offers its issuance for a “business” account. It is also important to find out about the cash withdrawal limit, the cost of card servicing, and the extensiveness of the ATM network.

- Additional benefits. For example, some banks offer interest on your cash balance. In addition, there is an offer with preferential rates for small businesses, various promotions, etc.

Collection of payments by banks

When opening a current account, an individual entrepreneur must be prepared to make additional payments. They are awarded for the provision of certain services. These are:

- Monthly maintenance;

- Connecting a service for remote transactions;

- Payment for remote service;

- Commission for processing payments;

- Cash withdrawal fee;

- Deposit insurance - even if the bank goes bankrupt, the entrepreneur will receive funds from his current account (insurance up to 1.4 million rubles is allowed).

Each bank has its own conditions and additional fees. Some banks offer an acquiring service that allows you to accept payments from clients with bank cards.

Why are checking account fees so high?

This is already outdated information. If you are just planning to register a company or LLC, even an individual entrepreneur, then it is safe to say that you do not yet know that immediately after registration you will be bombarded with calls with offers from various banks to open a current account with them. And many will be attracted by zero service fees. But they are still going to make money from you. And banks do this, as a rule, in three ways, in various combinations:

- They charge you service fee For a month, for a quarter or for a year. In state and some private banks it can amount to amounts up to 1000 rubles per month. However, many work for 0;

- They are going to sell you additional services . Payments by cards (acquiring), card projects, salary projects, will issue you foreign currency earnings, maybe even give you a loan;

- They will definitely make money for you when withdrawing cash . There are banks with established minimum withdrawal amounts for free, but taking advantage of the fact that the Central Bank is fighting cash withdrawals, they simultaneously earn huge amounts of money whenever they try to withdraw any large amount from their account.

How to open a current account for an individual entrepreneur

To open a current account, an entrepreneur will need to collect the necessary documents and submit the appropriate application to the nearest bank branch.

Copies of documents that must be presented when applying to open a current account:

- Passport (all pages);

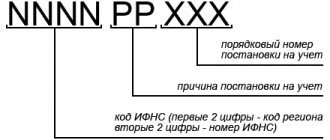

- Certificate of registration with the Federal Tax Service;

- Certificate of business registration (record sheet from the Unified State Register of Entrepreneurs).

The application form will be issued by a bank employee, the entrepreneur will only have to fill it out. In addition, you will need to sign an agreement on opening a current account, for servicing and connecting services (if this is carried out), fill out a card with sample signatures (done according to form No. 0401026 according to OKUD or developed by the bank).

Registration takes one business day. The current account is usually ready for use the next day. The entrepreneur receives his unique number and then registers in the connected services.

What documents should I collect?

Simplified rules for opening an account for an individual entrepreneur have been in effect for almost 2 years now. If previously it was necessary to bring to the bank a whole set of documents, including a certificate of registration of an individual entrepreneur, a notice of tax registration, an extract from the register, and so on, now this is not required. These data and documents will be received by the bank from the Federal Tax Service .

According to the above-mentioned instruction 153-I, to open a bank account you will need:

- passport or other identity document of the individual entrepreneur;

- entrepreneur signature card (done at the bank if the individual entrepreneur opens the account himself);

- card of signatures of persons whom he entrusts to sign documents;

- documents confirming the data of third parties, if any are allowed to sign the documents;

- IP licenses (if available).

An entrepreneur can open an account personally or entrust this to his representative , whose powers are confirmed by a notarized power of attorney. Then the entrepreneur’s signature card must be issued by a notary.

How to withdraw money from a current account

After you have managed to quickly open a current account for an individual entrepreneur, the next question arises: how to withdraw money from it? There are several ways:

- 1. Personally go to a bank branch and contact a specialist. Please note that cash withdrawals are usually subject to limits and fees.

- 2. Transfer money from your current account to your personal card. Limits may also be set for such an operation, in accordance with current tariffs.

- 3. Use a business card attached to your current account. With its help, you can pay for purchases in a store, make purchases, and pay in cafes and restaurants by non-cash method. You can also cash out.

As practice shows, the easiest way is to use a business card. It allows you to avoid additional fees.

What you need after opening an account

Until May 2014, individual entrepreneurs reported to the tax service, the Pension Fund and the Social Insurance Fund about opening a current account within 7 days. This responsibility is now gone. Banks independently notify the Federal Tax Service and other authorities that an individual entrepreneur has opened a current account for business transactions. To withdraw money from your current account for personal needs, it is recommended to connect a plastic card to it.

Bottom line

Here are the basics of getting started using a tool like a current account. In recent years, both banks and the tax authorities have applied many relaxations for entrepreneurs. But this is not a reason to behave inattentively. Let us remind you that every operation and every ruble of your account is in full view of the state, and if a dispute arises with the Federal Tax Service, you may, albeit temporarily, be left with a frozen current account. Therefore, always pay attention to all documents, read them, understand them, and act carefully.

After all, opening and using an account will provide a lot of convenient advantages if you plan to develop your commercial business.

Advantages

- A bank account is an indicator of the reliability and stability of a company. Its presence significantly increases the status of the company and increases trust in it from suppliers and clients. Many enterprises categorically refuse to cooperate with other companies if they do not have a current account.

- Non-cash payments are superior to cash payments in terms of security . By choosing this payment option, you can be sure that counterfeit banknotes will not fall into your hands, money will not be stolen, and other force majeure events will not occur to it.

- The existence of turnover on current accounts allows the bank to make sure that its clients are solvent . When applying for a loan, you can count on more favorable conditions . In addition, there will be no need to submit documents confirming the profitability of the company.

- Thanks to the capabilities of the Internet, all payments can be made online , eliminating the need to visit the bank. Funds are credited promptly, and if the payment takes place in the system of the same bank, then you will not have to pay a commission.

- All payments will become more mobile , since payments can be made anywhere in the world where there is access to the Internet.

- Online you can monitor the status of your account and control the timeliness of receipts of funds from counterparties.

- When conducting transactions using a current account, you don’t have to think about restrictions on the funds transferred. When using cash amounts for settlements, you should always remember that no more than 100 thousand rubles can be transferred under one agreement.

- You can keep track of transactions on your current account yourself . It is enough to transfer accounting to one of the 1C programs, and all income and expenses will always be under your strict control. You will also be able to view statistics of completed transactions in your personal account.

- As a bonus, banks offer their clients a number of additional services , such as issuing bank cards for employees of the organization or acquiring.