What it is

Foreign funds cannot be placed together with rubles. To do this, create a separate account into which only currency, and one specific type, is placed. It is a mistake to believe that it can only be euros and dollars. There are other currencies that a significant number of banks work with. True, some financial institutions actually provide services in only two designated monetary units.

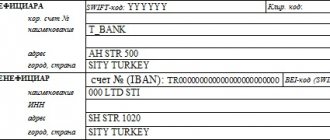

SEA BANK allows you to open a foreign currency account (dollar) for conducting foreign economic activity.

The available list of transactions, as well as the entire procedure for opening an account, is strictly regulated by federal laws. The Central Bank of the Russian Federation also takes part in lawmaking in this area.

How to open a foreign currency current account for legal entities and individual entrepreneurs

The fastest way is to open a foreign currency account in a bank that already has a ruble option. Then you will not need to go to the bank branch itself and collect a package of documents. You just need to fill out an application online, and the account will be opened within a day.

Today, banks have greatly simplified the opening of a foreign currency current account for legal entities and individual entrepreneurs thanks to online services. To open an account in a new bank you need:

- Visit a bank branch or fill out an online application.

- After some time, you will receive a call from an operator who will clarify all the details and help you choose a tariff.

- Provide copies of all necessary documents to the bank branch or upload them to the website.

- Receive your reserved account number by email.

- Visit a bank branch to sign an agreement.

Prepare a package of documents in advance:

- documentation of registration of an organization or individual entrepreneur;

- articles of association. Only for legal entities, not required for individual entrepreneurs;

- a copy of the minutes of the meeting of founders on the appointment of a single executive body. Only for legal entities, not required for individual entrepreneurs;

- passports of all founders and executors.

Varieties

The gradation in this case is very diverse. First of all, you should understand what a foreign currency account is and what this kind of product looks like. It cannot be opened instantly, but only through additional confirmation and financial control.

The first type on our list is a transit account. Cash in foreign currency is not used on it; it is only stored for a certain time. And as soon as the client submits all the certificates necessary for accounting, the funds from his account are transferred to the current RS. It can already be considered the main account. It is designed for conducting various calculations, making transactions, payments and other operations. At the same time, the same dollars or euros can be converted into rubles at any time by transferring to another RS of the same account holder. The conversion will be determined by the current rate available at the bank at that time.

The accounts themselves also have a type classification. This:

- General. A regular bank account containing money. The owner can dispose of them as he wants, of course, within the limits of current legislation and regulations of the Central Bank of the Russian Federation (Federal Law No. 208-FZ dated July 13, 2020, Methodological Recommendations of the Central Bank, Letter of the Central Bank No. IN-014-12/165 dated November 26, 2020 and others ).

- Depositary. Deposits, bills of exchange, interbank deposit certificates are credited to it. It is intended for deposits and storage, as well as receiving passive income.

- Type A. This type is required for simplified transfers to foreign counterparties, as well as when exporting funds outside the Russian Federation.

- Type B. In this case, the movement of monetary units outside the country is strictly limited. This can only be realized with a lot of reservations.

SEA BANK offers to use a convenient system of transfers in foreign currency.

In which banks can you open an account and under what conditions?

Virtually all banks provide services for opening a foreign currency current account. You can choose any of them, having first learned all the conditions from a bank representative at the branch or on the official website. We have prepared profitable offers from popular banks with all tariffs and restrictions.

Dot

The bank has become in demand recently for the following reasons:

- it has free remote account maintenance;

- in your personal account you can maintain several current accounts at once;

- there are free plans for individual entrepreneurs;

- cashback up to 2% on taxes;

- Account reservation occurs immediately after submitting an application.

At Tochka you can make transfers from 25 to 30 dollars or euros, and exchange controls range from 0.12 to 0.15%.

Modulbank

Terms and benefits:

- You can open a current account for an individual entrepreneur on the basis of only one document - a passport;

- prompt online account servicing;

- Some tariffs include free operations;

- full support and advice when working with a current account;

- receiving currency from 300 to 3000 rubles depending on the amount, sending currency - free within the bank to other banks - 30 dollars or euros.

Tinkoff

Terms and benefits:

- the operating day is the longest compared to other banks. There is no fee for early or late transfers;

- free servicing of current accounts;

- Tinkoff mobile bank is recognized as the most convenient to use in the Russian Federation;

- variety of services: from online cash registers to quick loans;

- fee for currency transfer to other banks - 0.2%, minimum 49 dollars or euros for the “Simple” tariff plan, cheaper for other tariff plans;

- currency control 0.2%, minimum 490 rubles - at the “Simple” tariff.

Sberbank

At Sberbank you can make large transfers starting from 500,000 dollars or euros. Among the advantages of opening a current account with Sberbank, we highlight:

- online operating day from 6:00 to 23:00;

- support is provided around the clock;

- wide choice of tariff plans;

- a large number of clients can transfer funds between accounts virtually instantly;

- exchange control is 1%.

Before choosing a bank to open a current account for an LLC or individual entrepreneur, decide what the transfer amounts will be. This is an important point, because in some banks even with the most expensive tariffs it is not possible to transfer large amounts.

Why do you need to open a foreign currency account?

Having understood the types a little, let’s see why, in principle, an enterprise needs such a service. It is important to note that all actions with finances are possible either within the framework of a transaction or a transaction based on the movement of funds.

Let's look at each of these groups.

Current:

- Lending from a credit institution in the medium term. That is, if the duration of the contract does not exceed six months.

- The appearance of dividends due to the use of the current array of capital.

- Standard import and export operations, settlements for deliveries from foreign countries.

- Cash charges. Free remuneration, pension contributions or wages, settlements under contracts and work agreements, various types of fees.

Based on capital flows:

- Lending transactions, but in the long term, that is, when the time period exceeds six months.

- Acquisition of real estate located outside the Russian Federation. Actions of this kind are used if they are not limited in any way by law. And the law directly prohibits the acquisition of foreign real estate for some categories of enterprises and individuals.

- You need to open a bank account in foreign currency if you decide to purchase securities, shares, or a share in a company founded outside the Russian Federation. Also for direct influence on the authorized capital of such companies.

- Deferred payment when it comes to import or export transactions already described. If the calculation cannot be carried out instantly, then the current PC is no longer suitable for this role.

Accept payments for goods and services using bank cards, regardless of the card currency!

Why do you need a foreign currency current account?

A foreign currency current account is a type of bank account that allows individuals, legal entities and individual entrepreneurs to make transactions with foreign partners using foreign currency notes.

There are no additional fees for transactions and storage of foreign currencies. Every resident of our country can open current accounts in any quantity thanks to Art. 14 Federal Law “On Currency Regulation and Control”. If you already have an account in rubles, then most banks will provide services for maintaining a foreign currency account for free.

Design features

This is a simple procedure and there are no serious differences from opening alternative banking systems, the only difference being the slightly different composition of the package of documents. Before choosing, you should evaluate the main aspects: availability of commissions, management capabilities and species diversity.

This service is relevant not only for enterprises; ordinary users can also use it. Let's briefly look at what is needed in this case.

How to open a foreign currency account in SEA BANK

Fill out an application, we will reserve a PC for you and send you the details. With the help of automated systems, counterparties will be assessed, thus reducing the risk of blocking the RS. You will also have the opportunity to make online currency exchanges for your own benefit in the Internet banking system - manage your business from anywhere in the world. Secure access to your accounts is always in your pocket.

Current account in foreign currency for clients

Individuals use this tool to save money. If they believe that one of the currencies will be more resistant to various economic unrest. In addition, citizens often play on price fluctuations of various exchange rates. Yes, this is a much less advanced technique than direct access through brokerage services. But some people prefer not to go into the realm of trading.

MARINE BANK offers its clients high-quality brokerage services in the securities market. Our Clients can carry out transactions with traditional instruments of stock exchanges (stocks, bonds, Eurobonds), as well as expand their capabilities.

In addition, the usual services are available: purchasing goods and receiving money transfers. There is also the possibility of opening a multi-currency PC. Its peculiarity lies in the fact that a person focuses on several types of currencies at once, freely transferring funds from one deposit to another. And in this option no commissions are established. Conversion takes place at the current rate, which fully reflects the real state of affairs.

Opening an organization account in a bank in foreign currency

Russian enterprises have the right to conduct export-import transactions and settlements with foreign counterparties only in the currency of the country with which relations are carried out. It is simply impossible to do this in rubles, because... the law prohibits. It is worth considering that a company can apply not only to a Russian bank, but also to a foreign bank. Such an action does not contradict the law.

If settlements with non-residents are implied, then a special account will be needed. This procedure cannot be carried out using a standard current PC. To store funds or bills, as already mentioned, you will need a depository type. A current currency account is the most universal product.

To go through the procedure for opening a company at the preliminary stage, you will need to collect a certain package of documentation. It includes:

- Statement. It is compiled according to the presented sample, so it is better not to use free forms downloaded from unauthorized resources.

- Agreement. A standard form is used, but each banking structure has its own. Please read it carefully before signing the person responsible.

- To confirm the status of a legal entity, you will need a certificate of state registration.

- In addition, there are some constituent documents. You can find out the exact list from your consultant.

- Certificate of tax registration with the Federal Tax Service.

- Personal documents of official representatives who will interact with the RS.

- Original signatures of all persons authorized to monitor and manage the account.

- Extract from the Unified State Register of Legal Entities. This is a standard document that is required in all cases.

Is it possible to open a foreign currency account abroad?

Russian legislation, in particular Part 1 of Art. 12 of Law No. 173-FZ does not prohibit domestic firms and entrepreneurs from acquiring foreign currency accounts in foreign banks. At the same time, the procedure for opening, maintaining and closing them is established by the legislative acts of the relevant country. Law No. 173-FZ no longer has anything to do with these aspects, but will continue to regulate the list of operations that a Russian resident can perform on accounts maintained in foreign banking institutions. In addition, the law obliges Russian clients of foreign banks to report to the tax office every fact of opening or closing such accounts within a month.

Find out how to fill out a line-by-line notification to the tax office about opening a bank account outside the Russian Federation in ConsultantPlus. Get trial demo access and upgrade to the ready-made solution for free.

Late or failure to provide information about opening, closing accounts or changing their details threatens the company or entrepreneur with a huge fine - up to 1 million rubles. (Parts 2 and 2.1 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation).

How to choose the right option

To make an informed decision, you should know exactly what goals the procedure pursues. Whether you need an account to carry out import and export transactions, or to store funds and pay your own employees, pay attention to the features of the services provided by the bank: are there any commissions for certain actions and what is their size. Identify the functionality, timing of transactions and withdrawals, the rate at which the cash flow will be converted, and its difference with the market rate.

Currency control from SEA BANK - professional support for beginners and experienced participants in foreign trade activities.

About foreign trade service packages

If you need to open a foreign currency account in a bank to conduct regular transactions with foreign partners, it is better to choose a financial organization that provides exactly the package of services. This is not just conducting financial transactions and standard currency control. Additionally, clients receive full support and assistance.

For example, Sberbank provides the following services:

- Consulting support 20 hours a day. Communication with the client in English, Chinese and Russian;

- minimizing client risks, identifying them in a timely manner and assisting in solving problems that arise;

- individual course for transactions over $100,000;

- plus 20 kopecks to the rate for new clients for 4 months;

- accounting support of foreign exchange transactions;

- seminars and webinars for foreign trade managers of client companies;

- consulting services;

- VAT refund service, etc.

A similar list of services for the category of international business clients is available in almost every bank that specializes in foreign trade services. The price for the service package is high, but the client receives comprehensive support.

Which is better – foreign currency bank accounts or deposits?

It all depends on your initial goals. In the first case, the bank client has much more options, and, from a functional point of view, this is a more acceptable option. But this is only if its functions will be used in principle. For settlements with counterparties, regular transactions, purchases and sales, payments for services, of course, you need extensive capabilities. But this choice does not provide a way to receive direct dividends. And the deposit, in turn, will not help to conduct transactions, but receives substantial accruals. The bank uses them to work on the stock exchange. And as long as the owner does not touch the funds being saved, he receives fair dividends for this investment. Moreover, in the described case they are higher than with ordinary savings, which cannot always overcome natural inflation. Therefore, the deposit is more suitable for saving and accumulation.

But this approach is often more suitable for an investor, rather than for a company that aims to sell inventory or services. In this case, almost the entire money supply is always in use, sent to direct and working capital.

How to use a foreign currency account and replenish it

Almost all types of banking products discussed do not have special conditions for replenishment. In other words, they can be replenished at any time when the owner decides to do so. But there is one important nuance: often the replenishment process itself is accompanied by a commission, which has a lower limit. Therefore, depositing funds in small shares is simply unprofitable. So the owner will lose a significant percentage. Therefore, it is better to replenish large volumes at once, albeit less frequently.

Exercising currency control

As we have already said, in order to credit funds you will first need to go through a verification procedure. While this is happening, the money is in the transit account. The bank, in turn, is waiting for supporting documents to appear. Only 15 days are allotted for submission and verification. Therefore, there is no need to delay the procedure.

After all the documents have been submitted, you need to study the acts, supply lists and issue the appropriate permits.

Of course, you cannot transfer money without control. After all, regulatory authorities do not allow organizations to dispose of foreign currency funds just like that, unless there are objective reasons for this (for example, during export or import transactions).

Documents for control

Most of this package of documentation is requested by the Federal Tax Service, because the supreme supervisory body here is precisely this government structure.

What you will need:

- Certificate of state registration.

- A document proving the identity of the applicant, as well as a power of attorney certified by a notary if necessary.

- Certificate that the organization is registered with the Federal Tax Service.

- Transaction passport.

- Completed customs declaration.

- Certificates that confirm that the second party also has accounts for settlement of the transaction.

Risks

The market is unstable. Everyone understands this. Fluctuations in the price equivalent of currency pairs are a great way to make money, but also an easy way to lose. To some extent, an account containing currency is also compared with these risks. Yes, small fluctuations have almost no effect on it, but large changes in charts due to macroeconomic news can cause significant damage.

Moreover, this factor affects not only the owners, but also the organization itself. Understanding the increased level of risk, it makes additional write-offs based on revaluation after each transaction. This is a way to protect your financial interests, especially if the total amount in custody exceeds $50 thousand.

SEA BANK offers to issue a customs card. Make all types of payments in Russia around the clock.