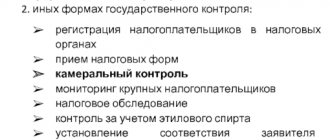

Brief information for taxpayers

Order of the Federal Tax Service of Russia dated 06/09/2011 No. ММВ-7-6/ [email protected] (registered with the Ministry of Justice of Russia on July 11, 2011) approved new forms of messages sent to the tax authorities by taxpayers. New reporting forms apply from July 30, 2011. The procedure and formats for submission by organizations and individual entrepreneurs, as well as notaries engaged in private practice, and lawyers who have established law offices, messages provided for in paragraphs 2 and 3 of Article 23 of the Tax Code of the Russian Federation, in electronic form via telecommunication channels can be found on the website of the Federal Tax Service Russia in the section “State registration and accounting of taxpayers/Registration of taxpayers/Regulatory acts regulating issues of accounting of taxpayers.” By order of the Federal Tax Service of Russia dated August 11, 2011. No. YAK-7-6/ [email protected] (Registered with the Ministry of Justice of Russia on September 14, 2011 No. 21794) approved new forms and procedures for filling out documents used when registering and deregistering Russian organizations and individuals, including individual entrepreneurs , to the tax authorities. In the near future, organizations and individuals, including individual entrepreneurs, will be able to send to the tax authority a “Request for sending a certificate of registration with the tax authority and (or) notice of registration with the tax authority (notification of deregistration in the tax authority) in electronic form" in form No. 3-Accounting, in response to which they will receive the requested documents in electronic form via telecommunication channels in PDF format. With request form No. 3-Accounting, the procedure and formats for the tax authority to send a certificate of registration with the tax authority and (or) a notice of registration with the tax authority (notice of deregistration with the tax authority) in electronic form via telecommunication channels communications can be found on the website of the Federal Tax Service of Russia.

Article 83 of the Tax Code of the Russian Federation. Accounting for organizations and individuals (current edition)

1. For the purpose of tax control, organizations and individuals are subject to registration with the tax authorities, respectively, at the location of the organization, the location of its separate divisions, the place of residence of the individual, as well as at the location of the real estate and vehicles owned by them and other on the grounds provided for by this Code.

Organizations that include separate divisions located on the territory of the Russian Federation are subject to registration with the tax authorities at the location of each of their separate divisions.

The Ministry of Finance of the Russian Federation has the right to determine the specifics of accounting by the tax authorities of the largest taxpayers, taxpayers specified in paragraph 1 of Article 275.2 of this Code, foreign organizations, foreign citizens and stateless persons.

The paragraph is no longer valid. — Federal Law of September 29, 2019 N 325-FZ.

Features of accounting for taxpayers when implementing production sharing agreements are determined by Chapter 26.4 of this Code.

The federal executive body authorized for control and supervision in the field of taxes and fees has the right to determine the specifics of accounting with tax authorities of organizations not specified in paragraphs three and five of this paragraph, depending on the volume of receipts of taxes (fees, insurance contributions) and (or ) indicators of financial and economic activity (including the total volume of income received, the average number of employees, the value of assets).

1.1. Management companies of closed-end mutual investment funds to which the real estate of the said mutual investment funds has been transferred into trust management are subject to registration with the tax authorities at the location of this real estate.

2. Registration with the tax authority of organizations and individual entrepreneurs is carried out regardless of the presence of circumstances with which this Code connects the emergence of an obligation to pay a particular tax or fee.

3. Registration with the tax authorities of a Russian organization at the location of the organization, the location of its branch, representative office, as well as an individual entrepreneur at his place of residence is carried out on the basis of information contained, respectively, in the Unified State Register of Legal Entities, the Unified State Register of Individual Entrepreneurs.

4. Registration with the tax authorities of a Russian organization at the location of its separate divisions (with the exception of a branch, representative office) is carried out by tax authorities on the basis of messages submitted (sent) by this organization in accordance with paragraph 2 of Article 23 of this Code.

Registration (deregistration) with the tax authorities of a foreign organization at the place of its activities on the territory of the Russian Federation:

through accredited branches, representation is carried out on the basis of information contained in the state register of accredited branches, representative offices of foreign legal entities;

through a branch of a foreign non-profit non-governmental organization is carried out on the basis of information contained in the Unified State Register of Legal Entities;

through a branch or representative office of an international organization, foreign non-profit non-governmental organization is carried out on the basis of information contained in the register of branches and representative offices of international organizations and foreign non-profit non-governmental organizations, reported by the body specified in paragraph 9 of Article 85 of this Code;

through a representative office of a foreign religious organization is carried out on the basis of information contained in the register of representative offices of foreign religious organizations opened in the Russian Federation, reported by the body specified in paragraph 9 of Article 85 of this Code;

through other separate divisions is carried out on the basis of an application for registration (deregistration) of a foreign organization. An application for registration is submitted by a foreign organization to the tax authority no later than 30 calendar days from the date of commencement of its activities in the territory of the Russian Federation. An application for deregistration is submitted by a foreign organization no later than 15 calendar days from the date of termination of its activities on the territory of the Russian Federation. When submitting an application for registration (deregistration), a foreign organization, simultaneously with the specified application, submits to the tax authority the documents that are necessary for its registration (deregistration) with the tax authority and the list of which is approved by the Ministry of Finance of the Russian Federation.

The paragraph is no longer valid. — Federal Law of July 29, 2018 N 230-FZ.

If several separate divisions of an organization are located in one municipality, the federal cities of Moscow, St. Petersburg and Sevastopol in territories under the jurisdiction of different tax authorities, the organization can be registered by the tax authority at the location of one of its separate divisions, determined by this organization independently. The organization indicates information about the choice of tax authority in a notification submitted (sent) by a Russian organization to the tax authority at its location, and by a foreign organization to the tax authority chosen by it.

4.1. No longer in force on January 1, 2022. — Federal Law of July 30, 2010 N 242-FZ.

4.2. When carried out by FIFA (Federation Internationale de Football Association), FIFA subsidiaries, FIFA counterparties, as well as confederations, national football associations specified in the Federal Law “On the preparation and holding in the Russian Federation of the 2018 FIFA World Cup, the 2022 FIFA Confederations Cup year, the UEFA European Football Championship 2022 and amendments to certain legislative acts of the Russian Federation" and being foreign organizations, activities through separate divisions on the territory of the Russian Federation, registration with the tax authority of such organizations is carried out on the basis of notifications sent by such organizations to the tax authority organ.

The form of notification on the basis of which the organizations specified in paragraph one of this paragraph are registered with the tax authority is approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

4.3. Registration of an organization as a responsible participant in a consolidated group of taxpayers is carried out by the tax authority, which, in accordance with Article 25.3 of this Code, registered an agreement on the creation of a consolidated group of taxpayers, within five days from the date of its registration, and within the same period the organization is issued (sent) notification of registration with the tax authority as a responsible participant in a consolidated group of taxpayers.

4.4. Registration of an organization as a party to an investment partnership agreement - a managing partner responsible for maintaining tax accounting - is carried out by the tax authority, to which a copy of the investment partnership agreement is sent, within five days from the date of its receipt or notification of the performance of the functions of the managing partner in accordance with Article 24.1 of this Code, and at the same time the organization is issued (sent) a notice of registration with the tax authority as a party to the investment partnership agreement - the managing partner responsible for maintaining tax records under the investment partnership agreement.

Registration of an organization as a party to an investment partnership agreement - a managing partner responsible for maintaining tax records - is carried out by the tax authority for each investment partnership agreement separately.

4.5. Registration (deregistration) with the tax authority of a foreign organization as a tax resident of the Russian Federation is carried out by the tax authority on the basis of an application from such a foreign organization to recognize itself as a tax resident of the Russian Federation (to renounce the status of a tax resident of the Russian Federation), provided for in paragraph 8 of Article 246.2 of this Code.

4.6. Registration (deregistration) with the tax authority of a foreign organization providing services in electronic form specified in paragraph 1 of Article 174.2 of this Code, the place of sale of which is recognized as the territory of the Russian Federation (with the exception of a foreign organization providing these services through a separate division located on the territory of the Russian Federation), and carrying out settlements directly with buyers of these services, as well as a foreign intermediary organization recognized as a tax agent in accordance with paragraph 3 of Article 174.2 of this Code (with the exception of a foreign organization carrying out business activities involving participation in settlements directly with buyers specified services through a separate division located on the territory of the Russian Federation), is carried out by the tax authority on the basis of an application for registration (deregistration) and other documents, the list of which is approved by the Ministry of Finance of the Russian Federation, with the exception of cases of deregistration with the tax authority of a foreign organizations in accordance with paragraph 5.5 of Article 84 of this Code. An application for registration (deregistration) is submitted by the foreign organizations specified in this paragraph to the tax authority no later than 30 calendar days from the date of commencement (termination) of the provision of these services.

Registration with the tax authority of a foreign organization that was previously deregistered in accordance with paragraph 5.5 of Article 84 of this Code is carried out by the tax authority on the basis of an application for registration and the documents specified in paragraph one of this paragraph.

4.7. Registration (deregistration) with the tax authority of an international organization recognized in accordance with Article 419 of this Code as a payer of insurance premiums is carried out by the tax authority on the basis of an application from such an international organization for registration (deregistration) as a payer of insurance premiums.

4.8. Registration (deregistration) with the tax authority of a Russian organization as a tax agent specified in paragraph 7.1 of Article 226 of this Code is carried out by tax authorities on the basis of an application submitted by this organization to the tax authority at its location in electronic form via telecommunication channels communication or through the taxpayer’s personal account, within five days from the date of receipt of such an application, and at the same time, the organization is sent a notice of registration (deregistration) with the relevant tax authority as a tax agent.

4.9. Registration with the tax authority of an organization recognized by the bank in accordance with the legislation of the foreign state in whose territory it is registered, which is not registered with the tax authorities, in connection with the opening of such an organization of a correspondent account in a Russian bank is carried out by the tax authority on the basis of an application for registration for registration of such an organization submitted to the tax authority by such organization or the specified Russian bank.

When submitting an application to the tax authority for registration by the organization specified in paragraph one of this paragraph, simultaneously with the said application, the documents necessary for registration with the tax authority, the list of which is approved by the Ministry of Finance of the Russian Federation, are submitted to the tax authority.

When a Russian bank submits to the tax authority an application for registration of the organization specified in paragraph one of this paragraph, in connection with the opening of a correspondent account for it in the specified Russian bank, submission to the tax authority with the specified application of the documents necessary for registration of such an organization, a list which are approved by the Ministry of Finance of the Russian Federation are not required.

5. The paragraph is no longer valid. — Federal Law of December 23, 2003 N 185-FZ.

Registration and deregistration of an organization or individual with the tax authority at the location of the real estate and (or) vehicles they own are located on the basis of information reported by the bodies and persons specified in Article 85 of this Code. The organization is subject to registration with the tax authorities at the location of the real estate owned by it by right of ownership, right of economic management or operational management.

For the purposes of this article, the location of property is recognized as:

1) for water vehicles (except for small vessels) - the place of state registration of the vehicle;

1.1) for air vehicles - the location of the organization or the place of residence (place of stay) of the individual - the owner of the vehicle, and in the absence of such - the place of state registration of the vehicle;

2) for vehicles not specified in subparagraphs 1 and 1.1 of this paragraph - the location of the organization (its separate division) or the place of residence (place of stay) of the individual at which the vehicle is registered in accordance with the legislation of the Russian Federation;

3) for other real estate - the place of actual location of the property;

5.1. The rules provided for in paragraph 5 of this article also apply to real estate and vehicles that are in state or municipal ownership or in the ownership of the federal territory "Sirius" and are part of the property of organizations (including in accordance with a concession agreement), on which these organizations are granted the rights of ownership, use and disposal or rights of possession and use, as well as in relation to real estate constituting the property of closed-end mutual investment funds, which is transferred to the trust management of management companies.

5.2. Registration of a Russian organization created as a result of reorganization in the form of transformation or merger, as well as a Russian organization reorganized in the form of merger, with the tax authority at the location of the real estate owned by the reorganized (merged) organization is carried out on the basis of information about the reorganization of the Russian organization contained in the Unified State Register of Legal Entities.

6. Registration of a notary engaged in private practice is carried out by the tax authority at his place of residence on the basis of information reported by the bodies specified in Article 85 of this Code.

Registration of a lawyer is carried out by the tax authority at his place of residence on the basis of information reported by the bar association of a constituent entity of the Russian Federation in accordance with Article 85 of this Code.

Registration of an arbitration manager, an appraiser and a patent attorney engaged in private practice is carried out by the tax authority at the place of their residence on the basis of information reported in accordance with Article 85 of this Code.

Registration of a mediator is carried out by the tax authority at the place of residence of this individual (place of his residence - if this individual does not have a place of residence on the territory of the Russian Federation) on the basis of an application from this individual submitted to any tax authority of his choice.

7. Registration with the tax authority of an individual is carried out by the tax authority at his place of residence (place of stay - if the individual does not have a place of residence on the territory of the Russian Federation) on the basis of birth information contained in the Unified State Register of Civil Status Records, and (or) information received in accordance with paragraphs 1 - 6, 8 and 13 of Article 85 of this Code, or on the basis of an application from an individual submitted to any tax authority of his choice.

Registration with the tax authority of an individual who is not an individual entrepreneur and does not have a place of residence (place of stay), real estate and (or) vehicles belonging to him on the territory of the Russian Federation is carried out on the basis of an application from such an individual by the tax authority to which it is the individual's choice to submit this application.

7.1. No longer in force on January 1, 2022. — Federal Law of July 3, 2016 N 243-FZ.

7.2. Registration (deregistration) of an individual as a payer of insurance premiums, recognized as such in accordance with Article 419 of this Code, is carried out by the tax authority at his place of residence (place of stay - if the individual does not have a place of residence in the territory of the Russian Federation) at based on the application of this individual for registration (deregistration) as a payer of insurance premiums, submitted to any tax authority of his choice.

7.3. Registration (deregistration) of an individual (except for the persons specified in Article 227.1 of this Code) who is not an individual entrepreneur and provides services to an individual for personal, household and (or) other similar needs, without the involvement of hired workers, in the specified quality is carried out by the tax authority at the place of residence (place of stay - if an individual does not have a place of residence on the territory of the Russian Federation) of this individual on the basis of a notification submitted by him to any tax authority of his choice about the implementation (termination) of activities providing services to an individual for personal, household and (or) other similar needs.

7.4. Registration with the tax authority of a foreign citizen, a stateless person who is not an individual entrepreneur and does not have a place of residence (place of stay) in the territory of the Russian Federation, real estate and (or) vehicles owned by them, as well as those who are not registered with the tax authorities authorities on the grounds established by this Code, is carried out in the tax authority at the location of the organization, the place of residence of the individual entrepreneur, which are the sources of payment of income to such a foreign citizen, stateless person, on the basis of information provided by this organization, individual entrepreneur in accordance with paragraph 2 of the article 230 of this Code.

If there are several organizations (individual entrepreneurs) that are sources of payment of income to the foreign citizen or stateless person specified in paragraph one of this paragraph, such persons are subject to registration with the tax authority on the basis of the first information submitted in accordance with paragraph 2 of Article 230 of this Code .

8. Lost power. — Federal Law of July 23, 2013 N 248-FZ.

9. If taxpayers have difficulty determining the place of registration, a decision based on the data they provide is made by the tax authority.

10. Tax authorities, on the basis of available data and information about taxpayers, are obliged to ensure their registration (deregistration) and recording of information about taxpayers.