Setting up the inventory accounting method

Correct closure of cost accounts begins with filling out the organization's accounting policies. Let us remind you that the “accounting” in the program is created annually, and along with it you must fill out the directory “List of direct expenses”

.

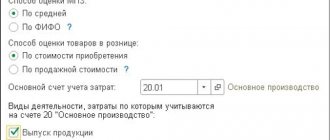

The first thing we indicate in the accounting policy is the method of assessing inventories. The functionality of the program allows you to choose between two options.

Option 1. Average rating method.

In this case, the cost of an inventory accounting unit is calculated as follows: the total cost of the type of inventory is divided by their quantity, taking into account the balance at the beginning of the period.

Option 2. FIFO method.

This is when the inventory items that were registered first are removed from the register.

Next, you can specify what the organization does:

- “Product Production”

checkbox is for organizations that are engaged in production. - “Performance of work, provision of services to customers”

checkbox is for those who provide services.

If we are talking about a trading company that does not produce anything, we do not tick the box. This means that the program does not use count 20 in this case.

Collecting production costs

Direct

company expenses that can be attributed to a specific type of product are reflected on accounts 20 and 23.

Indirect

costs - those that relate to the production of several types of products at once - on accounts 25 and 26.

The division is not formal! From the program chart of accounts we see that direct expense accounts have a subaccount “Nomenclature group”

. Therefore, these expenses can be written off for a specific product group directly into the cost of production.

Indirect cost accounts do not have the necessary sub-account and, therefore, cannot be closed directly into the cost of a specific product.

Results

The legislation regulating accounting divides all expenses of an enterprise into two large groups: those associated with ordinary activities and other expenses. Expenses associated with ordinary activities are divided into elemental groups. And the enterprise chooses the grouping of expenses by cost items independently. The main and additional lists of cost items form a complete list of enterprise costs.

Read about the procedure for accounting for certain types of costs in the materials in our section “Accounting in 2020-2021 (rules, methods).”

Sources:

- PBU 10/99, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

- chart of accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Closing account 20 for services

If you checked the box next to “Perform work, provide services to customers”

, you need to choose exactly how expenses are written off from the account on January 20 when closing the month.

To do this, a special field will appear on the tab. See table 1 for possible options. Please note: this setting applies only to services. Table 1. Write-off of costs for services at the end of the month

| Write-off method | What is |

| Excluding revenue | All costs accumulated on account 20.01 are written off by a routine operation when closing the month in Dt 90.02.1 “Cost of sales for activities with the main tax system” , regardless of whether there was revenue or not |

| Taking into account all revenue | This method is the complete opposite of the previous one. Namely: if at the end of the month there is revenue for a specific product group, the account will be closed on January 20. Otherwise, if there was no revenue, it will not close. If, at the end of the month, you need to reflect work in progress for a closed item group, post the document "WIP Inventory" . Indicate in it a specific item group that should not be closed to the cost account 90.02.1 |

| Including revenue from production services only | Only the amount of revenue that was recorded in the “Rendering of Services” . If you posted the document “Sales of goods and services” , the program will ignore the corresponding revenue for calculating write-off of costs |

We determine general business expenses

Check the box “Product release”

?

Then configure the field “Base of distribution of indirect costs”

. Table 2 will tell you which basis to choose for the distribution of indirect costs.

The program also provides the ability to set special distribution rules for certain costs.

And keep in mind: starting from 2022, we will use the only method of accounting for general business expenses - the method of incomplete (reduced) production costs (“direct costing”). The full production cost method (“absorption costing”) is no longer used, since FSBU 5/2019 “Inventories” came into effect from 01/01/2021. That is, previously it was possible to attribute administrative expenses to the actual cost of finished products. Now such schemes are prohibited.

Accordingly, in the 1C: Accounting 8 program, starting from 2022, only one option for accounting for general business expenses is possible - the “direct costing” method (used by default). The switch “General business expenses are included” in the “Accounting policy” form is hidden from 2021.

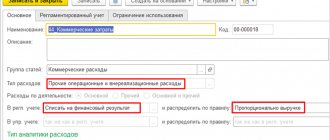

Account 26 in accounting is closed to account 90.08.1 if at least one of the checkboxes is checked in the “Accounting Policy” form - “Product output”

or

“Performance of work, provision of services to customers

.

In tax accounting, in this case, the costs recorded on account 26 are always classified as indirect. Account 26 in accounting is closed to account 90.02.1, provided that in the “Accounting Policy” form both boxes are cleared: “Product output”

and

“Performance of work, provision of services to customers

.

This option is for organizations whose activities are not related to the production process (commission agents, agents, brokers, dealers, etc., with the exception of traders) and which record all costs in account 26. Table 2. Indirect costs distribution base

| Possible base | How to close account 25 to account 20 |

| Issue volume | If the database contains the document “Production report for the shift” . Moreover, we see not only the cost, but also the quantity of products produced |

| Planned cost | If there is a document “Production report for the shift”. Moreover, with this method, unlike the previous one, we see only the amount of products produced |

| Salary | Proportional to wages by cost items in NU - wages |

| Material costs | Proportional to material costs according to cost items in NU - material costs |

| Revenue | There must be revenue, that is, sales documents or an act of provision of services |

| Direct costs | The base is the turnover of account 20, without selection by cost items |

| Individual cost items | The base is the turnover on account 20, with selection according to the specified list of cost items in the “list of cost items” field |

| Not distributed | Nothing closes automatically. You have to close it manually. The method is used in rare cases when standard closure is not suitable for the organization, none of the above options |

Primary cost accounting: why does an accountant need all these “papers” so much?

Sometimes accounting is associated not only with accrued salaries, but also with a bunch of receipts from stores, airline or train tickets, hotel bills, etc. Moreover, documents are strongly required to be submitted on time and in the required form. Why such literalism?

The reason is not that accountants are boring. It lies in the normative plane. Article 9 of the Law “On Accounting” states: any fact of economic life must be confirmed by a primary accounting document (PUD). If it is not there, then the operation cannot be reflected. Even when there is no doubt about its completion.

For example, the caretaker bought light bulbs. They were inserted into lamps and they are now burning. This means that the moment of purchase is indisputable. But if there is no receipt from the store attached to the advance report of the supply manager, then the accountant will not be able to accept the light bulbs for accounting. It turns out that they cannot be written off as expenses, and subsequently not included in expenses.

Being offended by an accountant because he demands timely submission of documents, and not just any documents, but in the required form, is akin to being angry with a production manager because of his serious approach to compliance with the technical process.

All accounting begins with the PUD. The tax office, by the way, too. This means that those same “pieces of paper” are an integral part of the enterprise’s information system. When its efficient operation is needed, there is no point in ignoring the requests of accountants for timely documentary confirmation of transactions. This is not their whim. This is a direct interest, including for the manager, if real cost figures are important to him, and not half-hearted ones due to the fact that someone never submitted an expense report, did not bring an invoice, or lost a check.

Shown in the diagram how accounting information flows occur. Please note: primary documents are at the very beginning. If at least one is missing, it means that the figures on assets, costs, expenses, and profits will be distorted.

Figure 2. Accounting and tax accounting of costs: document flows

And, in addition to distorted figures in reporting, you can get sanctions from the tax authorities. Why? Because the absence of DMPs and accounting registers compiled on their basis is a gross violation of the rules of accounting and reporting. This is written about in Articles 120 of the Tax Code and 15.11 of the Code of Administrative Offences.

These are the sanctions provided.

Figure 3. Reflection of costs: what happens if there are no documents

Do not think that fines and disqualification apply only to the chief accountant. An organization is usually punished under Article 120 of the Tax Code of the Russian Federation. Article 15.11 of the Code of Administrative Offenses of the Russian Federation is sometimes applied to the director. This will happen if he has not organized the accounting properly. In accordance with Article 7 of the Law “On Accounting”, it is the manager who is responsible for organizing the accounting process and storing documents.

Subtotal 3

: documents for an accountant are the same as source material for a worker. He doesn't need this. This is the interest of the organization itself. High-quality document flow is a sign of effective management. It is also a guarantee of reliable information in accounting and reporting, including costs.

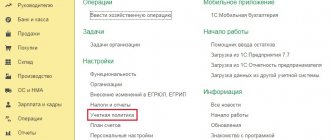

Secrets of the list of direct expenses

To ensure that the program correctly closes accounts 20 and 23, correctly fills out the Income Tax Declaration and correctly calculates income tax, set up a list of direct expenses every year (section “Main”

— Link

“Taxes and reports”

- tab

“Income tax”

- blue link

“List of direct expenses”

).

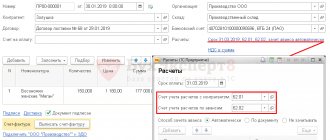

To add an entry to the list, click on the “Create” button. In the card, select the validity period, organization, type of tax accounting expenses, debit account. For greater detail, indicate the cost item in accounting.

Those expenses that are not included in the list become indirect for the program and, at the end of the month, are written off in tax accounting to account 90.08.

Tax accounting of deferred expenses

The Tax Code of the Russian Federation does not separately define the accounting of RBP. It establishes a general rule according to which expenses are related to the taxable base in the period in which they arise under the terms of the transactions concluded.

This means that you need to write off expenses for taxes, guided by the documentary rules according to which the transaction agreement was drawn up. If it follows from them that expenses are distributed over several periods, then for tax purposes they are taken into account during the entire specified time.

For example, an organization paid a certain amount for product certification. This amount is contributed to the tax base in equal shares throughout the entire validity period of the certificate.

FOR YOUR INFORMATION! If it is not possible to determine from the contract the terms to which expenses should be attributed, the organization must do this in accordance with its accounting policies.

RBP and special modes

Not all entrepreneurs deal with deferred expenses. Thus, OSNO payers most often encounter them, and those who choose the “simplified” option, as a rule, do not work with them.

If an organization switched to the simplified tax system from another tax regime, and it still has funds in account 97, they must be completely written off as expenses and reflected in KUDiR. The procedure for their accounting in the field of taxation may differ:

- if they were actually paid before the regime changed to the simplified tax system, they will not reduce the tax base, because they will no longer be included in the reporting period as deductible expenses;

- if these expenses are included in Art. 346.16 of the Tax Code of the Russian Federation and incurred after the transition to the simplified tax system, they can be included in the tax base as part of expenses that reduce it.

What to do if accounts are not closed

It happens that the month closed well, but when analyzing the balance sheet, we see that the accounts were not closed completely or were not closed at all. Then analyze:

- Postings in the routine operation “Closing accounts: 20, 23, 25, 26”.

Your task is to find to which account accounts 20 and 23 were closed. If on 90.08, then most likely there are not enough entries in the list of direct expenses - check them. - Report “Analysis of subconto.

Look at which item group and cost item did not fully/partially close account 20/23 to account 90.02. Possible reasons: work in progress, lack of entries in the directory of direct expenses, or lack of revenue for the item group.

After analyzing and changing the documents, close the month again.

It happens that the program displays errors indicating where the problem is and how to fix it. Then correct the errors by following the recommendations. Afterwards, re-close the month.