The net profit of Aktiv JSC for the last year amounted to 22,000 rubles. Aktiv has two shareholders.

By decision of the general meeting of shareholders of Aktiv JSC, dividends on shares are paid in the amount of:

A.N. Ivanov – 10,000 rubles;

S.S. Petrov – 12,000 rubles.

Personal income tax on Ivanov’s dividends will be:

10,000 rub. ? 13% = 1300 rub.

The personal income tax on Petrov’s dividends will be:

12,000 rub. ? 13% = 1560 rub.

The Aktiva accountant should pay dividends in the amount of:

A.N. Ivanov – 8,700 rubles. (10,000 ? 1300);

S.S. Petrov – 10,440 rubles. (12,000 ? 1560).

Who makes a decision on the payment of dividends to an LLC and how?

Legislative norms related to LLCs allow the profit received by it (all or part of it) to be used to issue income (dividends) to participants (Clause 1, Article 28 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ). The right to make decisions about this is reserved for the LLC participants themselves. To do this, they hold a general meeting. Convening a meeting becomes possible if a number of restrictions are met at the time of the meeting (Clause 1, Article 29 of Law No. 14-FZ):

- The management company is fully paid;

- the withdrawn participant was given the value of his share;

- net assets exceed the sum of the authorized capital and the reserve fund, and this ratio will remain after the issuance of dividends;

- There are no signs of bankruptcy and will not arise as a result of the issuance of dividends.

Compliance with the listed restrictions and the amount of profit that can be distributed are determined based on an analysis of the LLC’s financial statements prepared by the time the meeting is convened.

Analysis of reporting also applies to LLCs on the simplified tax system. For information on preparing reports under the simplified tax system, read the article “Maintaining accounting for an LLC using the simplified tax system: submitting reports .

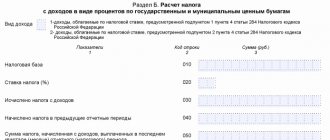

How to calculate the tax amount

When calculating the fee, standard, property, and social deductions are not applied. It is calculated with each payment, even if there are several of them during the year. If only the profit of the organization itself is distributed, the budget payment is calculated using the usual formula: income X tax rate.

For example, an LLC has two founders, Petrov I.A. and Smirnov P.O., their shares are 70 and 30%, respectively. Both are residents of the Russian Federation. The distributed profit for 2022 amounted to 180,000 rubles.

Personal income tax certificates 2 for business owners will reflect the following amounts of income and tax:

- Petrov I.A.: 180,000 X 0.7 = 126,000 X 13% = 16,380 rubles.

- Smirnov P.O.: 180,000 X 0.3 = 54,000 X 13% = 7,020 rubles.

Also, in addition to its profits, an organization can receive dividends from other organizations. If this is income subject to income tax at a rate of 0%, then personal income tax is calculated in the usual way.

In other cases, the calculation takes place in two stages:

- The amount of tax deduction is determined = (dividends (hereinafter referred to as D) of the participant / total amount D) X for D received. The latter indicator includes amounts not paid previously, as well as non-taxable income tax - 0%.

- The tax is calculated = (D of one participant - deduction) X 13%.

Example: Voskhod LLC has a 50% share in the authorized capital of Zarya LLC. The company received a profit of 500,000 rubles for distribution among the owners. The founders of Voskhod LLC are equal shares of April LLC and S.M. Ivanov. The total amount of profit distributed by the Voskhod company was 1,200,000 rubles.

Calculation for Ivanov S.M.:

- Deduction – (600,000 / 1,200,000) X 500,000 = 250,000 rubles.

- Personal income tax – (600,000 – 250,000) X 13% = 45,500 rubles.

How to draw up a protocol on the payment of dividends in an LLC

The issue of profit distribution can be either one of several discussed at the meeting, or the subject of a separate meeting. Regardless of the number of issues on the agenda, the decision of the meeting is formalized by drawing up a protocol, the indispensable details of which will be:

- number, date and indication of whether the document belongs to the LLC;

- list of participants, distribution of shares between them;

- agenda;

- results of consideration and decision on each issue.

With regard to dividends, the meeting must determine:

- for what period they intend to pay them;

- the total amount allocated for this purpose;

- form and terms of issue.

The payment period can range from a quarter to a year. In this case, payments are also possible for the year preceding the previous one.

The total amount is distributed among the participants in proportion to the share of each, unless the charter provides for a different procedure (Clause 2, Article 28 of Law No. 14-FZ), therefore it is enough to establish its value. Although the protocol can also record specific amounts intended for distribution to each participant in accordance with the distribution rules.

The form of payment is most often monetary. However, the law does not prohibit payment in property.

Payment is made subject to tax withholding. Read about its calculation in the article “How to correctly calculate the tax on dividends?” .

Payment is made no later than 60 days from the date of the decision (Clause 3, Article 28 of Law No. 14-FZ). If a period within this period is not established by the charter, the meeting has the right to set it by its decision for each specific payment. The period is considered equal to 60 days if it is not included in the decision and charter.

You can download a sample resolution of the founders on the payment of dividends (minutes of the meeting) on our website.

Accrual of dividends to the founder-individual (not an employee) in the ZUP program 3.1

At the general meeting of the founders of the organization Confetprom LLC on February 10, 2021, a decision was made to distribute part of the net profit among the participants in proportion to their shares in the authorized capital of the company in the amount of 3,500,000 rubles, including 2,380,000 rubles. in favor of the founder Alexandrova M.G.

– a resident of the Russian Federation who owns 68% of the company’s authorized capital, and 1,120,000 rubles.

in favor of Robert Patrick

, a non-resident who owns a 32% share of the authorized capital. Both individuals are not employees of the organization.

The payment of dividends was made for the first time in 2022 on 02/01/2021 in non-cash form. The organization did not receive dividends from other legal entities.

Accrual of dividends in accounting

- In the Accounting 3.0 program

The basis for recording dividends in accounting is the decision of the general meeting of participants and an accounting certificate calculating the amount of dividends. Calculation of dividends

reflected on the date of the decision on the distribution of the company's net profit between the participants. In our example – 02/01/2021.

You can make calculations manually using the Transaction

(Operations –

Operations entered manually

–

Create

–

Operation

) or automatically using the document

Accrual of dividends

(Salaries and personnel –

Accrual of dividends

or Operations).

In the second case, in the Dividends

from the ZUP 3.1 program, you need to remove the amount of calculated tax so that the posting for withheld personal income tax is not reflected in the accounting, since the posting for personal income tax will be subsequently synchronized from the ZUP 3.1 program to the accounting program.

Accrual of dividends to an individual – Alexandrova M.G.

to a resident of the Russian Federation, not an employee of the organization:

Dt 84.01 Kt 75.02 – RUB 2,380,000.

Calculation of dividends to an individual – Patrick R.,

to a non-resident of the Russian Federation, not an employee of the organization:

Dt 84.01 Kt 75.02 – 1,120,000 rub.

Registration of accrued dividends for personal income tax reporting

- In the program ZUP 3.1

On the date of payment of dividends, the organization has an obligation to calculate, withhold and transfer personal income tax. Income of individuals received in the form of dividends and the amount of tax withheld from this income for the purposes of reporting personal income tax are registered in the program using the Dividends

. In our example, the dividend payment date is 02/01/2021.

Salary – Dividends.

- Click on the button Create

.

- In field Month

indicate the month in which personal income tax on dividends is reflected in the accounting records.

- In field date

indicate the date of registration of the document in the information database.

- In field Organization

The default is the organization set in the user settings. If more than one organization is registered in the information base, you must select the organization that is the tax agent when paying dividends.

- In field Payment date

indicate the dividend payment date. It is on this date that the amounts of calculated and withheld personal income tax will be recorded when registering the document.

- Set the flag Tax transferred

and indicate the date of transfer of personal income tax on dividends, and in the

Payment details

- details of the payment document.

If the document calculates personal income tax at rates of 13% and 15%, then there is no need to set the flag. To do this, you need to enter separate documents Transfer of personal income tax to the budget

(

Taxes and contributions

-

All documents transfer to the personal income tax budget

) for each rate. - Flag Corresponds to Article 226.1 of the Tax Code of the Russian Federation

affects the deadline for transferring personal income tax, which is reflected in the calculation in form 6-NDFL. With the flag set, the deadline for transferring personal income tax is no later than a month after the payment of dividends, without the flag - no later than the next day after the payment of dividends. This is due to the fact that if dividends are paid from a joint-stock company, then personal income tax must be paid no later than one month from the date of payment of income (clause 4 of article 214, clause 9 of article 226.1 of the Tax Code of the Russian Federation). If dividends are paid from an LLC, then personal income tax must be paid no later than the day following the day of payment of income (clause 6 of Article 226 of the Tax Code of the Russian Federation).

- In the tabular part of the document, enter a new line using the button Selection

or

Add

, in which: - in a collumn Shareholder

indicate the founder to whom dividends are paid.

When selecting individuals, by default only those who have previously registered dividends are offered (the card of such individuals in the Work

indicates that this person is a shareholder of the selected organization).

If the desired person is not in the proposed list, you can either add him or find him in the full list of individuals by checking the Select from full list of individuals - in a collumn Accrued

indicate the amount of accrued dividends

- column Income tax creditable

appears if the date of payment of dividends is 01/01/2021 and later (until 01/01/2021 this was the Personal

Income Tax Deduction

, which reflected the amount by which it was necessary to reduce the tax base on income in the form of dividends for the purpose of calculating personal income tax for founders who are residents of the Russian Federation (code deduction 608) From 01/01/2021, when calculating the withholding tax on dividends, the amount of calculated tax can be reduced by the amount of income tax calculated and withheld in relation to dividends received by a Russian organization (clause 3.1 of Article 214 of the Tax Code of the Russian Federation). - column Personal income tax

is filled in automatically with the calculated tax amount for each founder.

In the program, the tax rate is determined by the status indicated in the individual’s card, established on the date of payment of dividends (link Income Tax

directory

Individuals

or

Employees

). The tax base for dividends is equal to the totality of all income in the form of dividends received by residents during the tax period. The tax on residents' dividends is calculated on an accrual basis from the beginning of the tax period (letter of the Federal Tax Service of Russia dated June 22, 2021 No. BS-4-11/8724). In addition, the tax on dividends is considered separately from the other tax bases listed in paragraphs. 2 - 9 clause 2.1 of Article 210 of the Tax Code of the Russian Federation and the applied rate (13% +15%) depends solely on the total amount of income from equity participation from the beginning of the tax period. - column 15% tax on excess

filled in with part of the tax on amounts exceeding 5 million rubles for residents

- column To payoff

is also filled in automatically with the amount of dividends that is paid to the shareholder.

Please note

: the amounts registered using this document do not create a debt of the organization to shareholders, i.e. they are not taken into account either when filling out salary payment statements or when generating analytical reports on salaries. It is assumed that all operations for the accrual and payment of dividends are recorded in the accounting program. - Fields Executor

and

Position

are first filled in manually and then filled in with the values specified in previous documents. This data is used to decipher the signature in the printed form of the dividend accrual certificate. - Conduct.

If a Russian organization does not receive dividends from other companies and pays dividends to an individual who is a tax resident of the Russian Federation, then from 01/01/2021 the tax is calculated using the formula:

Personal income tax = Dividends accrued to an individual * Tax rate

13% - for individuals who are tax residents of the Russian Federation (from the amount of income up to 5 million rubles inclusive) and 15% - from the amount of income exceeding 5 million rubles for the tax period (year) (from January 1, 2022) (clause 1 Article 224 of the Tax Code of the Russian Federation).

Calculation of personal income tax when paying dividends to a non-resident individual is carried out using the formula:

Personal income tax = Amount of dividends paid * 15%

A rate of 15% applies to non-residents, unless other rates are established in agreements on the avoidance of double taxation with foreign countries (Article 7 of the Tax Code of the Russian Federation). If the agreement establishes that this type of income is not subject to tax at all in the Russian Federation, then the paying party does not have the obligation to withhold tax.

Taxpayer status - resident or non-resident is determined on the date of payment of dividends. A tax non-resident is an individual who stays in Russia for less than 183 calendar days over the next 12 consecutive months (Clause 2 of Article 207 of the Tax Code of the Russian Federation). Nationality of a country, place of birth or residence of an individual does not affect tax status.

In the program, the tax rate is determined according to the status indicated in the individual’s card, established on the date of payment of dividends (link Income Tax

directory

Individuals

or

Employees

).

In our example, personal income tax is:

according to Alexandrova M.G.

(resident) – RUB 309,400. (RUB 2,380,000 * 13%)

by Patrick R.

(non-resident) – 168,000 rub. (RUB 1,120,000 * 15%). On the date of dividend payment, the employee was a non-resident.

12. To generate and print a certificate of accrual of dividends, use the Certificate of dividends

.

Payment of accrued dividends and payment of personal income tax on dividends

- In the Accounting 3.0 program

If the payment of dividends is carried out through a bank, then the payment is reflected in the Payment order

(

Bank and cash desk

-

Payment orders

) and

Write-off from a current account

with the transaction type

Other write-off

.

If the payment of dividends is carried out through the organization's cash desk, then the payment is reflected in the Cash Issue

(

Bank and cash desk

-

Cash documents

-

Issue

) with the transaction type

Other expense

.

Accrual document was used to calculate

, in the payment documents, indicate the type of transaction

Transfer of dividends

and the basis document by which the dividends were accrued.

A payment document can be automatically generated from the Dividend Accrual

by clicking

the Pay

.

To transfer personal income tax, you need to create a Payment order

, then, based on this document, enter the document

Write-off from the current account

.

How to decide on paying dividends to the sole founder

The sole founder has no one to hold the meeting with, so he simply makes his own decision on issuing dividends to himself. It is drawn up in the usual manner for such a document.

A sample decision on the payment of dividends to the sole founder can be viewed and downloaded on our website.

Find out which payments are not considered dividends from the article “Procedure for calculating dividends under the simplified tax system.”

Dividend payment procedure

In order to issue dividends, it is necessary to hold a general meeting of the founders and participants of the organization, in the amount of at least 50% of their total number - only in this case the meeting will be recognized as having taken place. It must be properly recorded, taking into account the opinions of all participants, then a decision must be made indicating to whom and in what amount the money should be transferred as dividends. The basis for the decision is the company’s reporting papers based on the results of financial activities. Based on the decision, an order is then issued on behalf of the director of the enterprise.

If the company has one founder, he must make a decision on the payment of dividends individually, while such stages as a meeting, and therefore the preparation of minutes of the meeting, are excluded, but the written execution of the decision and order remain.

It should be noted that when issuing dividends, several important conditions must be met. In particular, the net assets of the enterprise must be higher than the authorized and reserve capital, there should be no debts to the private owners of the LLC that have left, and the organization itself must remain firmly afloat, i.e. There should be no prerequisites for bankruptcy. Otherwise, in the future, during the liquidation or bankruptcy procedure of a limited liability company, interested departments may have serious questions for the company’s management.

Results

The law allows the profits received by the LLC to be used to pay dividends. The decision on payment is made by the sole founder or members of the company at a general meeting, subject to legally established restrictions (if the authorized capital is fully paid, there are no signs of bankruptcy, etc.).

The founders' decision to pay dividends is formalized in the form of minutes of the general meeting or a decision of the sole founder. Following the decision, an order to pay dividends is issued.

How to write an order

An order for the payment of dividends can be written in free form - there is currently no unified form for it. There is only one exception here: if an organization has a document template approved in its accounting policy, then, of course, the order must be created according to its type.

There are also no special nuances or reservations regarding the design, that is, it is allowed to be done both printed and handwritten, but if the first method is chosen, then the electronic order must be printed out - for signatures. For an order, either a form formed in a corporate style, with the logo and details of the company, or a regular sheet of paper is suitable.

for free

When a foreign citizen (not a highly qualified specialist) temporarily staying in the territory of the Russian Federation receives income from a Russian employer for services rendered or work performed under a civil law contract, it is necessary to charge insurance premiums only for compulsory pension insurance.

The “deadline” is approaching for some individual entrepreneurs using PSN, as well as for organizations and individual entrepreneurs who are UTII payers and who are engaged in certain types of activities - trade and the provision of public catering services. From July 1, 2022, they must switch to online cash registers.

Accounting for dividends: postings, examples, accrual

Let's look at how dividends are accounted for and taxes are reflected. The payer must reflect all transactions related to the accrual and payment of dividends, withholding and accrual of taxes on such income. To account for such calculations, account 75 is used. In relation to accounting for dividends from individuals working at this enterprise, account 70 can be used.

In accordance with the law, this tax is withheld not only from those incomes received by an individual, but also from those for which he has the right to dispose. If a shareholder refuses income in favor of the organization, then the tax should be withheld on the day of refusal and transferred to the budget.

Accrual of dividends to the founder-individual (employee) in the ZUP program 3.1

At the general meeting of the founders of the organization Confetprom LLC on February 10, 2021, a decision was made to distribute part of the net profit among the participants in proportion to their shares in the authorized capital of the company in the amount of 4,500,000 rubles, including 2,380,000 rubles. in favor of the founder Bazin

and

A.V.

is a resident of the Russian Federation who owns a 68% share of the authorized capital of the company, and 1,120,000 rubles.

in favor of John Huston

A, a non-resident of the Russian Federation, owning a 32% share of the authorized capital. Both individuals are employees of the organization.

The dividend payment was made on 01/01/2021 in non-cash form. The organization did not receive dividends from other legal entities.

Accrual of dividends in accounting

- In the Accounting 3.0 program

The basis for recording dividends in accounting is the decision of the general meeting of participants and an accounting certificate calculating the amount of dividends. Calculation of dividends

reflected on the date of the decision on the distribution of the company's net profit between the participants. In our example – 02/10/2021.

Dividends are calculated manually in the accounting program. using the Operation

(

Operations

–

Manually entered operations

–

Create

–

Operation

).

Calculation of dividends to individuals Bazin

from

A.V.

, resident of the Russian Federation, employee of the organization:

Dt 84.01 Kt 70 – 2380000 rub.

Payment of dividends to individual Houston D.,

non-resident of the Russian Federation, employee of the organization:

Dt 84.01 Kt 70 – 1,120,000 rub.

Registration of accrued dividends for personal income tax reporting

- The program ZUP 3.1.

On the date of payment of dividends, the organization has an obligation to calculate, withhold and transfer personal income tax. Income of individuals received in the form of dividends and the amount of tax withheld from this income for the purposes of reporting personal income tax are registered in the program using the Dividends

. In our example, the dividend payment date is 01/01/2021.

Salary – Dividends.

- Click on the button Create

.

- In field Month

indicate the month in which personal income tax on dividends is reflected in the accounting records.

- In field date

indicate the date of registration of the document in the information database.

- In field Organization

The default is the organization set in the user settings. If more than one organization is registered in the information base, you must select the organization in which the employee is registered.

- In field Payment date

indicate the actual date of payment of dividends. It is this date that will also record the amounts of calculated and withheld personal income tax when registering the document.

- Set the flag Tax transferred

and indicate the date of transfer of personal income tax on dividends, and in the

Payment details

- details of the payment document.

If the document calculates personal income tax at rates of 13% and 15%, then there is no need to set the flag. To do this, you need to enter separate documents Transfer of personal income tax to the budget

(

Taxes and contributions

-

All documents transfer to the personal income tax budget

) for each rate. - Flag Corresponds to Article 226.1 of the Tax Code of the Russian Federation

affects the deadline for transferring personal income tax, which is reflected in the calculation in form 6-NDFL. With the flag set, the deadline for transferring personal income tax is no later than a month after the payment of dividends, without the flag - no later than the next day after the payment of dividends. This is due to the fact that if dividends are paid from a joint-stock company, then personal income tax must be paid no later than one month from the date of payment of income (clause 4 of article 214, clause 9 of article 226.1 of the Tax Code of the Russian Federation). If dividends are paid from an LLC, then personal income tax must be paid no later than the day following the day of payment of income (clause 6 of Article 226 of the Tax Code of the Russian Federation).

- In the tabular part of the document, enter a new line using the button Selection

or

Add

, in which: - in a collumn Shareholder

indicate the founder to whom dividends are paid.

When selecting individuals, by default, only those who have previously registered dividends are offered (the card of such individuals in the Work

indicates that this person is a shareholder of the selected organization).

If the desired person is not in the proposed list, you can add him or find him in the full list of individuals by checking the Select from full list of individuals - in a collumn Accrued

indicate the amount of accrued dividends

- column Income tax creditable

appears if the date of payment of dividends is 01/01/2021 and later (until 01/01/2021 this was the Personal

Income Tax Deduction

, which reflected the amount by which it was necessary to reduce the tax base on income in the form of dividends for the purpose of calculating personal income tax for founders who are residents of the Russian Federation ( deduction code 601) From 01/01/2021, when calculating the withholding tax on dividends, the amount of calculated tax can be reduced by the amount of income tax calculated and withheld in relation to dividends received by a Russian organization (clause 3.1 of Article 214 of the Tax Code of the Russian Federation). - column Personal income tax

is filled in automatically with the calculated tax amount for each founder. The tax base for dividends is equal to the totality of all income in the form of dividends received by residents during the tax period. The tax on residents' dividends is calculated on an accrual basis from the beginning of the tax period (letter of the Federal Tax Service of Russia dated June 22, 2021 No. BS-4-11/8724). In addition, the tax on dividends is considered separately from the other tax bases listed in paragraphs. 2 - 9 clause 2.1 of Article 210 of the Tax Code of the Russian Federation and the applied rate (13% +15%) depends solely on the total amount of income from equity participation from the beginning of the tax period.

- column 15% tax on excess

filled in with part of the tax on amounts exceeding 5 million rubles for residents

- column To payoff

is also filled in automatically with the amount of dividends that is paid to the shareholder.

Please note

: the amounts registered using this document do not create a debt of the organization to shareholders, i.e. they are not taken into account either when filling out salary payment forms or when generating analytical reports on salaries. It is assumed that all operations for the accrual and payment of dividends are recorded in the accounting program - Link Signatures

The Contractor

and

Position

fields are first filled in manually, and then filled in with the values specified in previous documents. This data is used to decipher the signature in the printed form of the dividend accrual certificate. - Conduct.

If a Russian organization does not receive dividends from other companies and pays dividends to an individual who is a tax resident of the Russian Federation, then from 01/01/2021 the tax is calculated using the formula:

Personal income tax = Dividends accrued to an individual * Tax rate

13 %

- for individuals who are tax residents of the Russian Federation (from the amount of income up to 5 million rubles inclusive) and 15% - from the amount of income exceeding 5 million rubles for the tax period (year) (from January 1, 2021) (clause 1 of Art. 224 Tax Code of the Russian Federation).

Calculation of personal income tax when paying dividends to a non-resident individual is carried out using the formula:

Personal income tax = Amount of dividends paid * 15%

A rate of 15% applies to non-residents, unless other rates are established in agreements on the avoidance of double taxation with foreign countries (Article 7 of the Tax Code of the Russian Federation). If the agreement establishes that this type of income is not subject to tax at all in the Russian Federation, then the paying party does not have the obligation to withhold tax.

Taxpayer status - resident or non-resident is determined on the date of payment of dividends. A tax non-resident is an individual who stays in Russia for less than 183 calendar days over the next 12 consecutive months (Clause 2 of Article 207 of the Tax Code of the Russian Federation). Nationality of a country, place of birth or residence of an individual does not affect tax status.

In the program, the tax rate is determined according to the status indicated in the individual’s card, established on the date of payment of dividends (link Income Tax

directory

Individuals

or

Employees

).

In our example, personal income tax is:

by Bazin

for

A.V.

(resident) – 309,400 rubles. (RUB 2,380,000 * 13%)

in Houston

D. (non-resident) – 168,000 rubles. (RUB 1,120,000 * 15%). On the date of dividend payment, the employee was a non-resident.

13. To generate and print a certificate of accrual of dividends, use the Certificate of dividends

.

Payment of accrued dividends and payment of personal income tax on dividends

- In the Accounting 3.0 program

If the payment of dividends is carried out through a bank, then the payment is reflected in the program by the Payment order

(

Bank and cash desk

-

Payment orders

) and

Write-off from a current account

with the transaction type

Other write-off

.

If the payment of dividends is carried out through the organization's cash desk, then the payment is reflected in the Cash Issue

(

Bank and cash desk

-

Cash documents

-

Issue

) with the transaction type

Other expense

.

To transfer personal income tax, you need to create a Payment order

, and then, based on this document, enter the document

Write-off from the current account

.

Reflection of personal income tax on dividends in accounting

- In the program ZUP 3.1

To synchronize data with Accounting 3.0

in

ZUP 3.1,

a document is created,

Reflection of salary in accounting

(

Salary

-

Reflection of salary in accounting

), which will reflect the accrual of personal income tax on income in the form of dividends with the type of operation -

personal income tax on dividends to employees

.

When synchronizing data in an accounting program ( Administration

–

Data synchronization settings

), the document

Reflection of wages in accounting

(

Salaries and personnel

–

Reflection of wages in accounting

) will appear, which contains transactions for withheld personal income tax from dividends.

Dt 70 Kt 68.01.1

– for the amount of personal income tax withheld for an individual who is an employee of the organization.

Accounting entries for dividend payments

Accrual of dividends - entries from recipients (founders, participants) are reflected in the accounting records on the date when the meeting of shareholders (participants) decided to pay them (clause 7, subclause a-c, clause 12, clause 16 PBU 9/99 , approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n):

When the legal entity paying dividends is also their recipient, the tax paid by residents can be reduced by reducing the total tax base (the total amount of dividends allocated for distribution), which in this case will be calculated as the difference between the amounts intended for payment and received dividends (clause 2 of article 214 and clause 2 of article 275 of the Tax Code of the Russian Federation).

How to pay dividends to LLC founders in 2019

At their core, dividends are part of the profit (or rather, net profit) that remains after taxes. Accordingly, if, for example, an LLC works for UTII, then this is the amount that remains after the single tax on imputed income has been paid.

An LLC has a number of advantages over an individual entrepreneur: in particular, this concerns the fact that the founders of a limited liability company are not liable for the company’s debts with their own property. In addition, this type of organization allows you to open branches and expand the scope of activity.

Salary certificate: form, contents and sample filling

If provided to an employment office, or otherwise to an employment center, for the calculation and assignment of unemployment benefits, a period of three months preceding the date of dismissal of the employee is taken. This takes into account the average earnings.

- Registration with the labor exchange - a document will be needed to calculate benefits for unemployed citizens while looking for a job.

- Obtaining credits and advances by citizens from financial and credit institutions.

- Receiving benefits and subsidies from the budget to pay for utility costs.

- Registration of pensions in the Pension Fund of the Russian Federation.

- Obtaining a visa to travel abroad of Russia.

Sample certificate of salary and other accruals

- Name;

- date of issue;

- registration number;

- details of the employee to whom the certificate is issued;

- information about the employee’s salary for at least the last six months;

- signature of the head of the organization;

- signature of the chief accountant;

- organization seal (if available).

The main difference between such certificates (depending on which specific authorized body it is submitted to) is the period for which payments from the employer in relation to a specific person are taken into account. Certificates submitted to social security authorities usually require information about income for the previous 3 months. For example, in order to recognize a citizen as low-income and provide him with appropriate state social support, such a citizen must submit to the authorized body a certificate of income for the last 3 calendar months (Article 4 of the Law “On the Procedure for Accounting for Income.” dated 04/05/2003 No. 44-FZ), etc. . P.

Purpose and procedure for issuing a certificate of income for 3 months

Certificates of income of family members for 3 months are provided to social security to recognize the family as low-income. Such families are entitled to various payments and benefits - monthly child benefits, compensation for kindergarten fees, travel benefits and others. Exactly what types of income are taken into account in this certificate are regulated by Federal Law No. 44 of 04/05/2003. “On the procedure for recording income and calculating the average per capita income of a family and the income of a citizen living alone in order to recognize them as low-income and provide them with state social assistance.”

A family is considered low-income if its average total income for the three months preceding the application for social security, divided by the number of family members, is below the subsistence level. When making your own calculations to determine whether you are included in this category of citizens, keep in mind the following: what is taken into account is not the amount that each working family member actually received in person, but the amount of wages before taxes and fees are deducted.

Sample applications for the issuance of a 2-NDFL certificate, for the payment of dividends on securities

JSC "DRAGA" is authorized to generate and, after signing by the Issuer, transfer to registered individuals (their authorized representatives) certificates of income of an individual in Form 2-NDFL (if they apply to the Registrar) in relation to income from securities of the following joint-stock companies

- PJSC Gazprom

- PJSC Gazprom Neft

- PJSC Gazprom avtomatizatsiya

- PJSC Energy and Electrification Mosenergo

- PJSC "TGC-1"

- PJSC "OGK-2"

- PJSC "Podzemburgaz"

- JSC Gazprom Gas Distribution Leningrad Region

- JSC Saratovgaz

- PJSC RSC Energia

- JSC Gazprom Promgaz

- JSC Gazprom Gas Distribution Far East

| Title of the document | Effective date | DOCUMENT FORM |

| Application for issuance of a certificate of income of an individual in form 2-NDFL | 01.01.2010 | |

| Requirement for a one-time payment of dividends on securities | 21.08.2017 |

Please note that from 01.01.2014, the Federal Law of December 29, 2012 No. 282-FZ “On amendments to certain legislative acts of the Russian Federation and the recognition as invalid of certain provisions of legislative acts of the Russian Federation” came into force, obliging the joint-stock company to carry out payment of dividends in cash exclusively by bank transfer: by postal or bank transfer of funds.

Taking into account the above, payment of dividends at the cash desk of the Registrar of DRAGA JSC has not been made since 01/01/2014, including if such payment method is indicated in the Questionnaire of the registered person.

Payment of previously unclaimed and newly declared dividends from 01/01/2014 is carried out by postal or bank transfer.

If your Registered Person Questionnaire indicates the method of receiving dividends “at the Registrar’s cash desk/in cash”, we draw your attention to the need to fill out a new Questionnaire with up-to-date data , or send a written Request for payment of dividends (the Request is filled out only by persons who sold the relevant securities to at the time of filing such a Request and only for Companies whose dividends are paid by the registrar ). The signature on the Request must be affixed in the presence of an employee of the Registrar, or certified by a notary. A request for payment of dividends may be signed by an authorized representative on the basis of a power of attorney executed in accordance with the requirements of current legislation.

How to prepare a 3-month salary certificate for social security

Similar data is provided to receive benefits. A certificate from the social security system from the place of work for receiving benefits looks similar and contains the same list of information - about the position and length of service of the employee, about the income that has been received recently.

Every officially employed citizen has the right to demand from his employer a certificate stating that there are no wage arrears of any kind. It is possible to draw up the document in free form, since there is no unified form. There is a requirement that it be officially certified by the signatures of responsible persons - the general director, the accountant, the chief accountant.

2-NDFL reporting in the absence of payroll in 2022

Accountants have to face various difficulties at the time of filing reports. Every year they need to present form 2-NDFL to the tax service and thereby confirm the fact that employees receive income. But what if no one received a salary in 2022?

If the salary was not accrued, then you do not need to submit 2-NDFL. Organizations acting as tax agents for several employees should simply not submit certificates using this form for those who did not receive income during the reporting period. 2-NDFL with zeros in all columns is not provided for by law. Moreover, most accounting programs will generate an error when trying to draw up such a certificate.

Tax rate

Let us remind you that from 2022, an increased personal income tax rate applies to income (salaries, income from equity participation, etc.) exceeding 5 million rubles. For each type of income, the tax base must be calculated separately. Tax must be paid at the rate:

- 13% - if the sum of the tax bases on an accrual basis from the beginning of the year is 5 million rubles. or less;

- 650,000 rub. and 15% of income exceeding 5 million rubles. — if the amount of the bases is more than 5 million rubles.

For more details, see “New personal income tax rate and other innovations: what awaits individuals and tax agents in 2022”).

Calculate your salary and personal income tax with standard deductions in the web service Calculate for free