Financial assistance from the founder is treated differently in accounting and tax accounting. Why and how exactly – you will learn from our article.

We will also look at:

- what conditions must be met for the receipt of assets from the founder to be recognized as assistance;

- is financial assistance from the founder subject to income tax;

- what document and transactions in 1C are used to document financial assistance;

- how the founder’s contribution should be reflected in the financial statements.

Step-by-step instruction

On February 12, decision No. 1 of the meeting of the founders of the Organization approved:

- participant Ivanov A.P., share of participation in the organization is 70%, provides financial assistance to the society in cash in the amount of 580,000 rubles.

On the same day, the funds were transferred to the organization's current account.

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Reflection of financial assistance by decision of the meeting of founders | |||||||

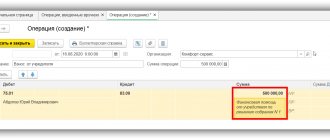

| 12th of February | 75.01 | 83.09 | 580 000 | Reflection of financial assistance of the founder | Manual entry - Operation | ||

| Receipt of financial assistance from the founder | |||||||

| 12th of February | 51 | 75.01 | 580 000 | Receipt of financial assistance from the founder | Receipt to current account - Other receipt | ||

Regulatory regulation

Accounting

The receipt of funds into the organization from the founder (participant) is an increase in its capital, which cannot be considered as income of the organization by virtue of clause 2 of PBU 9/99. This was indicated by the Ministry of Finance of the Russian Federation in the Recommendations for auditors on conducting an audit of the annual financial statements of organizations for 2016 (Appendix to Letter dated December 28, 2016 N 07-04-09/78875). Any contributions from owners that do not increase the authorized capital should be charged to account 83 “Additional capital”.

Tax accounting

Contributions of participants to the organization in the form of financial assistance from the point of view of income tax are the organization’s income, which is not taken into account when determining the tax base (Article 251 of the Tax Code of the Russian Federation) in the following cases:

- if the property is transferred to a business company or partnership as a contribution in the manner established by the civil legislation of the Russian Federation (clause 3.7, clause 1, article 251 of the Tax Code of the Russian Federation);

- if the property received by the organization free of charge is transferred by the founder (organization or individual), whose participation share in the receiving company is more than 50% (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation);

- if the property was received free of charge from an organization whose authorized capital consists of more than 50% of the contribution (share) of the receiving organization (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation).

Until 01/01/2018, property (property, non-property rights) transferred to the company were not subject to income tax if they were used to replenish net assets, on the basis of paragraphs. 3.4 clause 1 art. 251 of the Tax Code of the Russian Federation, along with unclaimed dividends. Now this norm has received a separate subclause, and the condition about net assets has been removed as redundant, since any contribution to the company’s property is a replenishment of net assets.

In order for the transfer of assets (including money) to be considered as a contribution to the property of the company in accordance with paragraphs. 3.7 clause 1 art. 251 of the Tax Code of the Russian Federation, the following conditions must be met:

- the charter of the company must provide for the possibility of making contributions by participants, determine the procedure for making contributions, form, size, composition;

- Society members need to decide on the contribution.

Otherwise, contributions from participants, including in the form of cash, will be the organization’s income subject to income tax.

Receipt of subsidies: postings

Receipts of subsidies from the budget are reflected in the manner established by the Accounting Regulations “Accounting for State Aid” PBU 13/2000, approved by Order of the Ministry of Finance of the Russian Federation dated October 16, 2000 No. 92n (hereinafter referred to as PBU 13/2000).

The formation in accounting of information about state aid related to the recipient’s activities in the sectors of the economy most affected by the spread of the new coronavirus infection, including in the form of subsidies, is carried out by commercial organizations also in accordance with PBU 13/2000. This state assistance is reflected in the accounting (financial) statements on the basis of analytical accounting (clause 6 of the information of the Ministry of Finance of the Russian Federation No. PZ-14/2020 “On the practice of generating information in accounting in the context of the spread of a new coronavirus infection”).

The company accepts accounting subsidies upon actual receipt of funds or if the following conditions are met (clause 5 of PBU 13/2000):

- there is confidence that the requirements for the provision of state aid by the company will be met. Confirmation may include contracts signed by the company, decisions made and publicly announced, feasibility studies, approved design and estimate documentation, etc.;

- there is confidence that the funds will be received.

State aid funds accepted for accounting are reflected as the occurrence of targeted financing and debt on these funds. As the subsidy is actually received, the corresponding amounts reduce the debt and increase the cash accounts.

If state aid is taken into account as it is actually received, then with the emergence of targeted funding, cash accounting accounts increase (clause 7 of PBU 13/2000).

Accounting records are made in accordance with the instructions approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

Reflection in the accounting of a company receiving subsidies depends on the method adopted in the accounting policy:

- as confidence emerges in receiving funds from the budget;

- upon actual receipt of money.

The following entries are possible in accounting.

1. The subsidy to finance upcoming expenses is taken into account before they are actually received.

| Operation | Debit | Credit |

| The amount of the allocated subsidy to finance expenses, including capital costs, is reflected | Score 76 | Score 86 |

| Budget funds received | Score 51 | Score 76 |

| Budget funds are used to finance expenses (materials, fixed assets, work, services purchased, wages accrued, etc.) | Score 86 | Score 98-2 |

| Budgetary funds are recognized as part of other income (as depreciation is calculated on fixed assets, materials are released into production, etc.) | Score 98-2 | Score 91-1 |

2. Funds to finance expenses incurred are taken into account before they are actually received.

| Operation | Debit | Credit |

| The amount of the allocated subsidy to finance the expenses incurred, including capital expenses (in the amount of accrued depreciation) is reflected. | Score 76 | Score 86 |

| The amount of the subsidy to finance incurred expenses, including capital expenses (in the amount of accrued depreciation), is recognized as other income | Score 86 | Score 91-1 |

| The amount of budget subsidy received to finance capital costs is reflected (in an amount exceeding accrued depreciation) | Score 86 | Score 98-2 |

| Budget funds received | Score 51 | Score 76 |

3. The subsidy to finance upcoming expenses is taken into account upon their actual receipt

| Operation | Debit | Credit |

| Reflects the amount of budget subsidy received to finance costs | Score 51 | Score 86 |

| Budget funds are used to finance costs (materials, fixed assets, work, services were purchased, wages were accrued, and so on) | Score 86 | Score 98-2 |

| Budgetary funds are recognized as part of other income (as depreciation is accrued on fixed assets and materials are released into production) | Score 98-2 | Score 91-1 |

4. Budgetary funds to finance incurred expenses are taken into account upon their actual receipt

| Operation | Debit | Credit |

| Reflects the amount of budget subsidy received to finance costs | Score 51 | Score 86 |

| The amount of the subsidy to finance incurred expenses, including capital expenses (in the amount of accrued depreciation), is recognized as other income | Score 86 | Score 91-1 |

| The amount of budget subsidy received to finance capital costs is reflected (in an amount exceeding accrued depreciation) | Score 86 | Score 98-2 |

Receipt of financial assistance from the founder

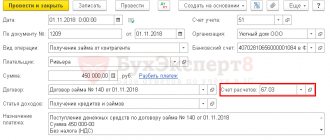

Receipt of financial assistance provided to the current account is reflected in the document Receipt to the current account, transaction type Other receipt, section Bank and cash desk – Bank – Bank statements – Receipt button.

When filling out the document, you should pay attention to the following fields:

- Settlement account – 75.01 “Settlements on deposits in the authorized (share) capital”;

- Income item – Other contributions of founders to equity capital type of movement Receipts of cash deposits of owners (participants) .

When you select this Income Item in the Cash Flow Statement, the amount will fall into:

- section Cash flows from financial transactions;

- page 4312 “Receipts of cash deposits from owners (participants).”

Postings according to the document

The document generates the posting:

- Dt Kt 75.01 – receipt of funds in the form of financial assistance from the founder.

to generate a document Transaction entered manually with income accrual transactions in tax accounting, since the funds received are exempt from taxation under paragraphs. 11 clause 1 art. 251 Tax Code of the Russian Federation.

Authorized capital – depositing funds into the current account and cash register

The easiest way to make a deposit is to pay it in money: to a current account or to a cash desk. For foreign participants, payment to a foreign currency account is acceptable.

Postings for contributions to the authorized capital in cash will be as follows:

- at the payee: Dt 50 (51, 52) – Kt 75;

- for the Russian founder: Dt 76 – Kt 50 (51).

Find out how to determine the amount of authorized capital in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Checking settlements with the founder according to the decision

To check settlements with the founder, you can generate a report Analysis of account 75.01 “Settlements on contributions to the authorized (share) capital”.

The founder's obligation to provide financial assistance has been fulfilled.

Reporting

The founder's contribution is reflected:

On balance:

- page 1350 “Additional capital” of the balance sheet liability. PDF

In the statement of changes in equity:

- page 3310 “Increase in capital - total” in the column “Additional capital”. PDF

On the cash flow statement:

- page 4312 “Receipts of cash deposits from owners (participants).” PDF

See also:

- Financial assistance from the founder: features of registration and taxation

- What is the difference between a founder's loan and financial assistance?

- Financial assistance to founders: potential tax risks

- Loan forgiveness by the founder

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Financial assistance from the founder: features of registration and taxation In this article we will consider the procedure for registration and taxation of financial assistance...

- Financial assistance from the founder in the form of a loan...

- Financial assistance to founders: potential tax risks...

- Separate accounting for VAT: interest on the use of other people's money is not included in the proportion for determining the deduction If a company carries out both taxable and non-taxable VAT...

Transactions with subsidies for capital investments

Budgetary (autonomous) institutions reflect transactions with these subsidies in the following order*(2):

1. Debit KDB1 6,205 62,561 Credit KDB1 6,401 40,162 - accrual of deferred income for the provision of subsidies for capital investments in the amount of the Agreement. 2. Debit KBK2 6,201 11,510 (increase in account 17, analytics code 150, KOSGU 162) Credit KDB1 6,205 62,661 - reflects the receipt of a capital subsidy. 3. Debit KDB1 6,401 40,162 Credit KDB1 6,401 10,162 - recognition of income in the form of a subsidy for capital investments as current year income based on information about the achievement of the conditions for the provision of a subsidy (Notice, Report, other document provided for by the Agreement). 4. Debit KDB1 6,401 40,162 Credit KDB1 6,205 62,661 - decrease in deferred income for subsidies for capital investments on the basis of the amended Agreement and (or) additional Agreement. 5. Formation at the end of the year of settlements for subsidies for capital investments on the basis of the Notice, Report on the fulfillment of the terms of the Agreement (transactions are reflected on the last day of the reporting year, unless otherwise provided by the founder): 5.1. Debit KDB1 6 401 40 162 Credit KBK3 6 303 05 731 - closing settlements in the amount of unused balances of the subsidy for capital investments, subject to return to the budget in the next year. 5.2. Debit KDB1 6,401 40,162 Credit KDB1 6,205 62,661 - closing settlements in the amount of unused financial support for the subsidy, if it was not transferred to the institution. 5.3. Debit KDB1 6,401 40,162 Credit KDB4 6,303 05,731 - formation of settlements for the unused balance in the presence of obligations assumed at the expense of it and unfulfilled (the need to confirm the need for these funds). When confirming the need, the entry is reflected: Debit KDB4 6,303 05,831 Credit KDB1 6,401 40,162. 5.4. If settlements with the founder under the subsidy are “closed” completely, but the institution still has accounts payable accepted at the expense of the subsidy funds (accepted and unfulfilled monetary obligations), then there is no need to record additional entries. The balance of funds in the personal account in the next year will be used to repay the accepted monetary obligation. 5.5. If, at the expense of a subsidy for capital investments, an advance was paid that was not confirmed by the counterparty’s documents for the reporting year, then the difference between the indicators Dt 6,205,62,000 and Kt 6,401,40,162 is equal to this advance. If a decision is made to return (not confirming the intended nature of the accepted monetary obligations), the operation specified in clause 5.1 is reflected in the next financial year. 6. Debit KBK3 6 303 05 831 Credit KBK2 6 201 11 510 (increase in account 18, analytics code 610, KOSGU 610) - return of the unused balance of the subsidy for capital investments of previous years.

More on the topic: The next innovations in the KBK for 2022: what else do public sector accountants need to know