What are identifiers designed for?

OKTMO is an abbreviation that stands for all-Russian classifier of municipal territories. Using this code, you can understand which municipality a certain organization or entrepreneur belongs to. Rosstat systematizes information on the activities of enterprises and individual entrepreneurs using OKTMO codes.

Since the territory of Russia is very large, it is easier to divide it into municipalities and assign each its own code. All these codes are recorded in a specialized reference book.

All entrepreneurs and heads of organizations must know their OKTMO code. It is indicated in reporting documentation, payment orders, tax reporting and other documents. The code must be indicated in the declarations of the simplified tax system, UTII, VAT, land and transport taxes, certificates and declarations 2-NDFL, 3-NDFL, 4-NDFL.

In simple words, the OKTMO code is a digital designation of the region. The purpose of territory encryption is to simplify and speed up the analysis of statistical data, as well as the correct distribution of funds from the Russian budget.

What is OKTMO in the 3-NDFL declaration for individuals

Each of us sooner or later has to pay taxes.

This is a mandatory “contribution” of any person to the development of the state in which he lives. In return, the state takes care of him.

But in order to comply with the minimum tax standards, reports and declarations were created.

In them, both individuals and legal entities indicate how much each of the employees of their enterprise paid taxes on the profit received.

This type of tax, such as personal income tax, refers to those types that are paid automatically, through deduction from wages. However, there is a variation in which individuals must calculate the amount of tax themselves and submit the appropriate document to the required authority.

Individual entrepreneurs who are on the general taxation system, businessmen and people who receive income without taking into account income tax must submit just this type of 3-NDFL declaration. Unfortunately, sometimes it causes difficulties for them, which we will try to sort out.

OKTMO in the declaration

It is with this point that more questions arise when filling out. Even people who have previously filled out a declaration experience difficulties with the address column. But if you figure it out and understand the essence, it will be simple in the future. The municipal code can be taken, as you might guess, from a specialized classifier.

What is OKTMO?

OKTMO is an all-Russian classifier of municipal territories. It is presented in the form of a set of either eight or eleven characters. The OKTMO classifier consists of two sections. These are municipalities and the settlements included in them.

The code, consisting of eight characters, is divided into three blocks. The first, two-digit, includes the identification of subjects of the Russian Federation. From the third to the fifth digits, municipalities and urban districts are determined. The remaining ones show urban and rural settlements.

The eleven-digit code is divided into two blocks. Eight-digit are municipalities. Three-digit - populated areas.

Each cell indicates the code of the municipality (OKTMO) at the place of residence of the individual.

True, there are exceptions to this rule. For example, if an ordinary citizen declares his income, he has to indicate two codes.

One by place of residence, the second by location of source of income. The second code should be entered on a separate sheet, which indicates income received from sources located in the Russian Federation.

How to find out your OKTMO code?

Most of the difficulties that arise when filling out a declaration arise due to ignorance of your address code. People filling out a declaration for the first time do not know where to get it from. Those who have already filled it out before forget it or don’t remember it. In fact, it's easy to find out your code online.

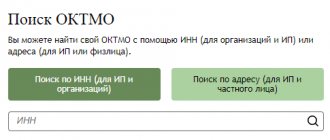

Just go to the website of the Federal Tax Service and select the heading “Find out OKTMO” in the electronic services section. Then everything is as simple as shelling pears.

Select the required city and municipality. When you fill out the latter, the service itself will tell you possible options based on the available ones. By filling out this basic form, you can immediately receive the OKTMO code, which must be included in the 3-NDFL declaration.

What should you consider?

As mentioned above, the column for filling out the OKTMO code consists of 11 free cells. Some people, when filling it out with an eight-digit code, enter zeros instead of dashes in the remaining cells. As a result, the declaration is not accepted. Why?

The completed 3-NDFL is sent for computer processing.

Let's say your OKTMO is 45386000. If you enter it into the columns with additional zeros, then it will turn into 45386000000. This is a completely different code, and non-existent. Therefore, instead of recognizing the address with dashes in it, the computer tries to decipher a completely different code and fails.

As a result, the declaration is rejected. Therefore, we enter 45386000—in the appropriate cells

A simple, but no less important rule - dashes instead of zeros

Another option

All on the same website of the Federal Tax Service, you can generate a receipt for paying income tax. What is the advantage of this method? The fact is that you can start filling out by indicating your address. Codes, both the Federal Tax Service and OKTMO, will be calculated automatically. This method can be called the simplest and most reliable.

You can also always download the OKTMO code book and use it if necessary.

How is the digital code generated?

The OKTMO code contains from 8 to 11 digits. Each sign has its own meaning. The structure of the code is based on the definition of classification levels. There are only three steps:

- The first stage contains information about the groupings of the Ministry of Defense of the constituent entities of Russia.

- The second includes municipal districts, cities, districts within a city, territories or municipalities in federal cities.

- The third contains information about urban and rural areas, areas in the city.

The code is distributed into two sections, which contain municipalities and settlements. The first section code consists of 8 characters. The first and second characters are objects of the first stage, the third to fifth characters are the second stage, and the sixth to eighth characters are the third.

At the first stage, objects are encoded using the ordinal method. Values of the code bit in the second stage:

- 3 - intracity territories, municipalities of federal cities;

- 6 - municipal district;

- 7 - city with or without districts within it;

- 9 - territory in the federal city itself.

Autonomous okrugs have their own value of 3 digits - 8:

- 810-849 - municipal areas;

- 850-898 - urban areas.

It happens that there are two autonomous okrugs in one region. In this case, the 3rd digit for the second AO receives identifiers 9:

- 910-949 - municipal areas;

- 950-998 - urban districts.

At the third stage of encoding, the sixth digit acquires the meaning:

- 1 - urban settlement;

- 3 - area inside the city;

- 4 - rural settlement;

- 7 - intersettlement area.

Urban settlements are coded using signs:

- 01-49 - the composition includes a city;

- 51-99 - includes a village.

OKTMO codes, located in the second section of the directory, already consist of 11 characters. The first to eighth signs are the municipalities in which settlements are located, the remaining signs are the settlements themselves.

To designate cities, a series of codes from 001 to 049 are used. Codes 051-099 belong to urban-type settlements, and for villages and hamlets they take codes from 101 to 999. For those settlements that serve as administrative centers, a three-digit number with a unit at the last digit is determined . Code 001 identifies the city, 051 - urban settlement, 101 - rural settlement.

Three levels of classification

The OKATO code consists of 8-11 characters. Classification of business entities is carried out by groups and levels. There are three levels:

Free legal consultation by phone

In Moscow and region 7

St. Petersburg and region 7

Federal number 8

The first level includes:

- Autonomous region.

- Autonomous Okrug, which is part of the general structure of the Russian Federation.

- Republic.

- Regions.

- The edges.

- Federal cities.

The second level includes:

- Autonomous regions, territories, autonomous circles, regions of the republic, regions that are directly included in the general composition of the Russian Federation.

- Urban-type settlements, which are necessarily subordinate to the regional authority.

- Autonomous okrugs, which are necessarily included in the general composition of the republic.

- Cities of regional, republican, regional subordination.

The third level consists of:

- Cities that subordinate to the region.

- Villages with central regional subordination.

- Village councils.

- Districts of a republican city, regional, republican subordination.

https://youtube.com/watch?v=dctexv99778

OKATO from OKTMO are the same or not

With the abolition of OKATO and the advent of OKTMO, a problem arose. Not everyone understands OKATO and OKTMO are the same thing or they are different codes. In fact, these are different abbreviation combinations, but they mean the same thing, with a small caveat. OKATO means the all-Russian classifier of objects of administrative-territorial division. The general difference between the codes is in the way objects are identified.

OKTMO codes appeared only in 2014. Before this, only OKATO codes were valid. But their drawback was that it was impossible to determine from them the city, the district within the city, the village in which a certain organization is located. Using OKTMO, you can identify the exact location, and this greatly simplifies the work of Rosstat.

| Code | Characteristic |

| OKATO | OKATO objects are subjects of Russia with administrative districts, cities of republican, regional, regional, district, district significance, urban settlements, rural districts, and settlements within them. |

| OKTMO | OKTMO provides systematization and unambiguous identification of municipalities and settlements within them throughout the country. The code contains the structure and stages of the territorial organization of local self-government. The OKTMO code directory is used for coding and distribution of MO. |

The OKATO code takes into account the subjects of the Russian Federation, and the OKTMO code takes into account the administrative-territorial structure of a particular municipality.

comparison table

The main features of the concepts are presented in the table:

| OKATO | OKTMO |

| General signs | |

| Some codes replaced others in 2014. | |

| The set of numbers is indicated in tax reporting. | |

| The concepts refer to the national standardization system of the Russian Federation. | |

| Differences | |

| It implies the classification of administrative-territorial objects depending on the subject of the Russian Federation in which they are located. | They imply the classification of administrative-territorial objects within a specific municipality. |

How can I find out the code

You can obtain the code in official documentation only at the Russian Tax Service office. When registering with a tax or legal entity, a letter with the codes indicated in it is sent from the regional department of Rosstat. They are assigned to each newly formed organization.

Find out how and where you can open an individual entrepreneur current account online. Choose the best offer from banks →

You can also get the OKTMO code online on the tax website in a special section. To do this, you need to enter the OKATO code that existed before, or the name of MO. If you set the search parameters by the name of the MO, you can type only the first few letters, and then wait for the system to automatically find suitable options. You can choose the one you need from those offered. You can find out the OKTMO code in several other ways, which are described below.

By taxpayer code

The OKTMO code can be found from Internet sources. To carry out a search, you only need the TIN of a legal entity or individual entrepreneur. OKTMO encoding by TIN can be obtained on the official website of Rosstat. For this:

- Open the Rosstat website.

- In the TIN request line, enter the appropriate number and click “Get.”

After this, the system will automatically download all the codes that have been assigned to the organization. This list also contains the OKTMO code.

By location

You can also find the OKTMO code at the legal address of the organization - at the official registration address. You can also search for a code by address on the official website of Rosstat. For this:

- Go to the main page of Rosstat.

- Find the “Respondent Information” tab in the menu and hover your cursor over it.

- Select the section with all-Russian classifiers in the list that appears and click on it.

- Specify the OKTMO classifiers item on the page that opens. After this, a list will appear with links to 8 volumes of federal districts.

- Click on the required volume. The electronic file will begin downloading to your computer.

- Open the downloaded document and select the desired location in it.

The corresponding OKTMO code will be written opposite the selected locality. If you know where to find OKTMO and correctly indicate its value, then all payments and taxes will go to their destination. Therefore, it is better to look for such information in advance so that you do not have to redo the documents several times.

5 / 5 ( 1 voice )

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

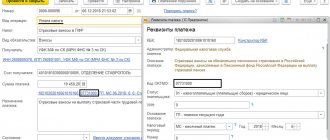

Indication of OKTMO in the payment order

The OKTMO code is a special digital designation that is assigned to each municipal entity in Russia. The OKTMO code in the 2022 payment order is entered in accordance with the Order of the Ministry of Finance No. 107n of 2013, which defines the basic rules for filling out payment orders. According to his instructions, all fields and lines of the payment must be filled out accordingly. If any mandatory details are not included in the document, the bank will not accept such an order for execution. Therefore, the territory code in the form OKTMO should always be indicated on the payment slip.

What is it needed for

The digital designation of the territory in which the taxpayer conducts its activities and receives income was introduced for:

- quick identification of received payment;

- assigning it to the budget of the corresponding municipal entity, subject of the Russian Federation.

Where to find

To understand which OKTMO code to indicate in a payment order, you need to know that all the values of the codes in question are listed in the All-Russian Classifier of Municipal Territories - abbreviated OKTMO, which was approved on June 14, 2013 by order of Rosstandart No. 159-st. This reference book was adopted to replace OKATO - the classifier of administrative-territorial divisions. Thus, the question in itself disappears - what to indicate - the OKATO or OKTMO code in the payment order.

Please note that since the beginning of 2014, in tax returns and in payment slips, the value in field 105 has been entered in accordance with the OKTMO classifier. It represents the code of the municipality in which the organization operates or makes payments.

If the tax is transferred on the basis of a declaration, then the OKTMO code in the payment order is indicated in accordance with such a declaration.

The code in question consists of 8 or 11 digits. In accordance with the Classifier, the last 3 digits - from 9th to 11th - indicate a specific small settlement.

Any payer can find out his or the required OKTMO using a special service on the website of the Federal Tax Service of Russia www.nalog.ru. It allows you to determine the code using a directory through the name of the municipality.

There is a feature whose OKTMO is indicated in the payment order in relation to payments at customs. It is necessary to take the code of the territory that accumulates the corresponding payment.

What to do if it is specified incorrectly

If the OKTMO code in the payment order is indicated incorrectly, this will not affect the receipt of tax to the budget. When an error is discovered in this detail, in accordance with clause 7 of Art. 45 of the Tax Code of the Russian Federation, an organization should contact the Federal Tax Service with an application to clarify the details. Such a petition is written in free form. In this case, the document must indicate:

- date of payment, transferred amount, purpose of payment;

- details that are specified incorrectly;

- the correct value of this attribute.

Along with the application you must submit:

- A copy of the erroneously completed payment slip.

- Statement of transfer of the amount.

In the event of an error in OKTMO in a payment order, the tax office may invite the organization to reconcile the calculations. The Federal Tax Service must make a decision no later than 10 working days from the date of receipt of the application from the organization, taking into account the execution of a settlement reconciliation report. The tax office is obliged to notify the payer of its decision.

If the OKTMO code is entered incorrectly in the payment slip when paying insurance premiums in 2022, clarification of the payment is not required, since the Treasury does not take its value into account when distributing insurance premiums between budgets. This payment does not fall into the unknown, but will be taken into account in a special settlement card with the budget, which indicates the OKTMO code at the place of activity of the organization

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

Empty code

You can find out the statistical code of a business entity if you meet the criteria that determine the presence of:

- status of a legal entity or individual entrepreneur;

- registration address having legal status;

- a specified amount of money in the organization’s bank account;

- registration in all services of authorized bodies.

A prerequisite for the formation of a database is the timely and regular submission by the organization of the necessary reports.

If at least one requirement is not met, when a business representative submits a request, information about the statistical code will be missing.

Innovations regarding OKATO can be learned from this video.