Payment order is a settlement document that contains an order from the account owner to the bank servicing him to transfer a certain amount of money to the account of the recipient of funds (clause 1? 3 of Article 863 of the Civil Code of the Russian Federation, clause 5.1? 5.10 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

Payment request is a settlement document that contains the requirement of the creditor (recipient of funds) under the main agreement to the debtor (payer) to pay a certain amount of money through the bank (clause 9.1? 9.7 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P) .

Collection order is a settlement document that is used in settlements for collection in cases stipulated by the agreement, and settlements according to the orders of collectors of funds (clause 1 of article 874 of the Civil Code of the Russian Federation, clause 7.1? 7.8 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

A payment order is a settlement document on the basis of which the bank partially executes the order of payers and recipients of funds (clause 4.5 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

What is a payment order?

A payment order as a document used by a financial institution for the purpose of partial execution of a transfer under any receipt, invoice or other obligation. It must be filled out in the prescribed form. The bank's marks are placed on the payment order, as well as the signatures of its employees responsible for transactions.

The fact of partial payment of a receipt using an order is recorded by placing a special mark on it. In addition, the bank employee indicates on the back of the receipt information about the partial payment - such as a serial number, information about the order, amount, and also certifies the information with a signature.

Copies of the order must be kept by the bank. They can be used as attachments to information statements of clients' bank accounts.

Payment order: purpose, form and other nuances

A payment order can be called the main payment document intended for processing settlement transactions with funds located in the bank accounts of an organization.

As soon as the payment order issued by the payer arrives at the bank, it undergoes a thorough check:

If there are insufficient funds in the payer's account, another document may be needed - a payment order. Next, we will talk about the possible consequences of inaccuracies in the order, as well as how a payment order differs from a payment order.

What is a payment order?

A payment order as a document used by the bank for the purpose of fully executing a transfer under any receipt, invoice or other obligation. For example, when a company pays for goods supplied, services provided, or transfers taxes to the budget.

The financial institution uses the corresponding payment order as a source of all the necessary information to make the payment - information about the recipient, his bank details, and the purpose of the transaction.

Table

| Payment order | Payment order |

| What do they have in common? | |

| A payment order can be considered as an instrument for partial execution of a payment order | |

| What is the difference between them? | |

| It is an instrument for partial payment of a receipt, invoice, transfer of part of the amount for various obligations | It is an instrument through which full payment of receipts, invoices, and transfer of amounts for any obligations is made. |

Copy - payment order

A copy of the payment order for the transfer of state duty.

The Contractor provides the Customer with copies of payment orders and invoices for the purchased equipment.

The agreement, together with a copy of the payment order with a note from the banking institution about the transfer of money to the income of the republican budget, is sent to the Ministry of Finance of the Russian Federation in the Department of Securities and Financial Market.

Along with the Agreement, a copy of the payment order with a note from the bank confirming the payment of tax on transactions with securities by the new owner is presented.

Tax inspectorates receive copies of payment orders or documents on transferred tax amounts by mail.

Submit to the Committee monthly copies of payment orders confirming the transfer of rent to the budget.

Copies of payment orders and other accounting and banking documents can also serve as advice notes.

Payment of the first insurance premium followed by provision of a copy of the payment order to the Lessor is made within ten days from the date of signing the Agreement.

Payment of the first insurance premium followed by provision to the Lessor of a copy of the payment order is made within ten days from the date of transfer of the Object to the Tenant under the acceptance certificate or signing of the Agreement if the Object is already in the possession of the Tenant.

When attending the first training session, the student must provide a copy of the payment order with a note from the bank about the transfer of payment. In the section of the order for the purpose of payment, it must be indicated: For the student’s training (last name and. Tuition fees can also be paid to the Academy’s cash desk in person by the student.

When attending the first training session, the student must provide a copy of the payment order with a note from the bank about the transfer of payment. In the section of the order for the purpose of payment, it must be indicated: For the student’s training (last name and. Tuition fees can also be paid to the Academy’s cash desk in person by the student.

Tax authorities are required to submit to the authorities of the Pension Fund of the Russian Federation copies of taxpayers' payment orders for payment of taxes, as well as other information necessary for the bodies of the Pension Fund of the Russian Federation to carry out mandatory pension insurance, including information constituting a tax secret. Taxpayers acting as policyholders for compulsory pension insurance submit information and documents to the Pension Fund of the Russian Federation in accordance with the Federal Law on Compulsory Pension Insurance in the Russian Federation in relation to insured persons.

What are the dangers of errors in payment orders?

A payment order with errors always entails negative consequences for the payer and recipient of funds. Money may be sent using incorrect details or stuck in the bank as an unclear payment. In most cases, such errors lead to untimely execution of the payer’s order to transfer funds.

Consequences of erroneous payments:

Bank employees may refuse to make a payment if the payment order does not contain all the necessary details or some of them are indicated incorrectly. They are not obliged to immediately inform the client about this, so he may not immediately find out that the money was not sent to its intended destination.

About processing bank orders

Bank orders are prepared by organizations issuing funds for loans, in accordance with standard legal requirements. It is acceptable to draw up a document in both paper and electronic form. When using written forms, special attention is paid to the appropriate fields.

Bank orders have a third appendix that details how these documents must be completed. There are not many recommendations given to users; most of the advice is easy to remember. A bank order and a payment order are similar in many ways, but they also have differences.

If filling out is carried out electronically, then A4 format is usually used, no more. Documents are converted to multi-page form if the information does not fit on one page in standard forms.

The organization itself can decide how the internal content is numbered. The same applies to signing.

Management can resolve any issues related to specific details in the documents. The paperwork, quantity and purpose depend on the needs of a particular enterprise at a given time. Signing must only be carried out by persons authorized to do so. That is, there must be a right of the first or second degree.

Responsibility for determining the authenticity of the order also lies with the management of the organization. Each branch can develop its own settings and requirements according to which the authenticity of the document and all the information presented in it is confirmed. The branch management is also responsible for the integrity and correctness of all content. It develops a separate sample for filling out a bank order.

What to consider

Bank orders are documents widely used in situations of interaction between client accounts and those belonging to management.

Bank order

Any changes or results after operations must be reflected in the contents of the document. Appropriate adjustments are made to it specifically for this purpose. Why do you use additional fields or lines?

There is another important point in the content of bank orders. An extract from your personal account is a mandatory application; you cannot do without it. This document describes all operations in detail. It often happens that there are not enough funds in client accounts for an instant transfer. Then the bank order is transferred to the group of documents left without payment. Or to a group of overdue accounts. To continue the operation, a payment order is issued. And the operation itself is described using the corresponding field.

The management of the organization must necessarily approve any actions related to the document. The main thing is to rely on the standards adopted by the Bank of the Russian Federation. And the current version of the Legislation of our country.

Such measures are relevant for account holders who experience any problems. Or when there are not enough funds to immediately pay for the operation.

About the difference between an order and a payment order

Both documents have found wide application in the work processes of banking systems. But there are also distinctive features that make it possible to clearly separate one instrument from another. First, let’s understand the essence of the term “payment order” itself.

The difference lies in the fact that a payment order is considered to be a certain instrument with which a partial transfer of funds can be made based on a receipt or invoice or other similar basis. Marks and signatures are placed on the document accordingly. The signature is provided by the employees who are responsible for conducting transactions. The order allows you to record changes in case of partial payment. Why do they put the appropriate mark on the document?

The main thing is that the specialist responsible for these actions has sufficient qualifications.

The turnover of the receipt contains data on the payment transferred in parts. The following information should be displayed:

- Number in order.

- The amount of the payment made.

- Information regarding the order itself.

- The personal signature of a bank employee additionally certifies what was stated earlier.

- Each existing order requires the creation of at least one additional copy.

Storage may be carried out in specific branches. This is relevant in case of loss of the main document, so that the information is still preserved. Copies are easy to use if necessary to issue statements.

Scope of application, differences from memorial orders

It has been said more than once that account transactions are the main area in which this document has found the widest application. Thanks to this form of fixation, it is easy to operate several accounts at once, owned by several branches of the company. When contacting clients, they can receive not only a simple bank statement, but also an order that is attached to it.

Memorial orders are documents that help process transfers in the event of a lack of cash. This is the main difference from other documents with similar names and purposes. A relevant tool for both debit and credit.

Calculations by payment requests

Settlements of payment requests and collection orders.

Unlike all other forms of payment, this form is initiated by the recipient of funds (collector). There are 2 types of settlement documents used:

1) Payment requirements

2) Collection orders

They are presented by the recipient (collector) to the payer's account through the bank serving the recipient (collector). A bank employee checks the payment document for compliance with the established form. After verification, the bank stamp and the date of receipt are affixed to the settlement document. One copy with a signature of acceptance is returned to the recipient (collector), the rest remain in the recipient's bank. The recipient's bank is obliged to deliver settlement documents to their destination (physical delivery of documents to the payer's bank). The form of payment for delivery costs is determined by the bank account agreement. Payment documents received by the payer's bank are recorded in a free-form journal in the payer's bank. Documents executed in violation of the requirements must be returned. Next, the payer bank must debit funds from the payer’s account. If there are no or insufficient funds in the payer’s account and if there is no provision in the bank account agreement for crediting the account, payment requests and collection orders are placed in a file cabinet called “Settlement documents not paid on time.” The payer's bank notifies the recipient's bank of this fact. Payment of settlement documents is made as funds are received in the order established by law.

Payment request is a settlement document containing the recipient’s demand, made on the basis of an agreement with the payer, for the bank to write off funds from the payer’s bank account with his consent (acceptance). Used when paying for goods/work/services, etc. In addition to standard details, the payment request contains:

1) deadline for acceptance

2) date of sending the document to the payer

3) payment terms

4) name of the product/work/service

5) with a mandatory reference to the agreement under which the payment is made

settlements can be carried out with a pre-given acceptance. In this case, the calculations are carried out as follows:

1) in the “payment terms” field, the recipient enters “with acceptance”. The period for acceptance is determined by the parties to the main agreement. In the absence of such an indication, the acceptance period is considered to be 5 working days.

2) Payment requests are placed by the payer's bank in the file cabinet of payment documents awaiting acceptance for payment.

3) The payer, within the period for acceptance, must submit to the bank a document on acceptance in whole or in part or on refusal of acceptance in whole or in part. He must necessarily refer to the clauses of the contract on the basis of which he refuses acceptance.

4) The bank employee checks the formal component (correctness of filling, presence of grounds for refusal) and carries out the payer’s orders (if the payer accepted, he pays the payment request, if acceptance is refused, he returns the recipient to the bank with information).

Settlements of payment requests and collection orders.

Unlike all other forms of payment, this form is initiated by the recipient of funds (collector). There are 2 types of settlement documents used:

1) Payment requirements

2) Collection orders

They are presented by the recipient (collector) to the payer's account through the bank serving the recipient (collector). A bank employee checks the payment document for compliance with the established form. After verification, the bank stamp and the date of receipt are affixed to the settlement document. One copy with a signature of acceptance is returned to the recipient (collector), the rest remain in the recipient's bank. The recipient's bank is obliged to deliver settlement documents to their destination (physical delivery of documents to the payer's bank). The form of payment for delivery costs is determined by the bank account agreement. Payment documents received by the payer's bank are recorded in a free-form journal in the payer's bank. Documents executed in violation of the requirements must be returned. Next, the payer bank must debit funds from the payer’s account. If there are no or insufficient funds in the payer’s account and if there is no provision in the bank account agreement for crediting the account, payment requests and collection orders are placed in a file cabinet called “Settlement documents not paid on time.” The payer's bank notifies the recipient's bank of this fact. Payment of settlement documents is made as funds are received in the order established by law.

Payment request is a settlement document containing the recipient’s demand, made on the basis of an agreement with the payer, for the bank to write off funds from the payer’s bank account with his consent (acceptance). Used when paying for goods/work/services, etc. In addition to standard details, the payment request contains:

1) deadline for acceptance

2) date of sending the document to the payer

3) payment terms

4) name of the product/work/service

5) with a mandatory reference to the agreement under which the payment is made

settlements can be carried out with a pre-given acceptance. In this case, the calculations are carried out as follows:

1) in the “payment terms” field, the recipient enters “with acceptance”. The period for acceptance is determined by the parties to the main agreement. In the absence of such an indication, the acceptance period is considered to be 5 working days.

2) Payment requests are placed by the payer's bank in the file cabinet of payment documents awaiting acceptance for payment.

3) The payer, within the period for acceptance, must submit to the bank a document on acceptance in whole or in part or on refusal of acceptance in whole or in part. He must necessarily refer to the clauses of the contract on the basis of which he refuses acceptance.

4) The bank employee checks the formal component (correctness of filling, presence of grounds for refusal) and carries out the payer’s orders (if the payer accepted, he pays the payment request, if acceptance is refused, he returns the recipient to the bank with information).

About the filling rules

There are some recommendations that will help you understand the procedure:

- The content of the operation is described in the line called “Base”.

- The list of attached documents appears on a separate line, with attachments.

- They separately check the presence of the signature provided by the accountant. If they do not exist, then such functions are assigned to managers. Signatures must match the templates when paper forms are used.

- There must be a correspondence between the amounts indicated in figures and in words.

- It is also important that all supporting documents listed in the list are present.

- Cash dispensing is the responsibility of the cashier. Money is transferred only to the direct recipient. Usually the buyers themselves are identified by personal documents such as a passport.

- The recipient must also put a personal signature if all the information is true.

- If an enterprise or banking organization does not have divisions, then simply put a minus or a dash.

- Amounts are most often written in rubles, using commas.

Payment order and payment order difference

payment order - payment order Dictionary of Russian synonyms ... Dictionary of synonyms

payment order - Syn: payment order ... Thesaurus of Russian business vocabulary

Payment order is an order (order) taken into account in the prescribed manner by the settlement operator of a person authorized on a book-entry bill to pay a certain amount of money to another person... Securities market. Glossary of basic terms and concepts

Miscellaneous Charges Order (MCO - Miscellaneous Charges Order) is a payment document issued to a passenger by the carrier or its agent, which contains a request to issue a ticket, a paid baggage receipt, or provide other paid services related to transportation to the person specified in this document. Source: ... ... Official terminology

Suriname - (Suriname) State of Suriname, geography and history Suriname, political system State of Suriname, nature and geography, population, political and economic structure Contents Contents Nature Population and society Government and... ... Investor's Encyclopedia

Payment order - Payment order is an order of the account owner (payer) to the bank servicing him, executed by a payment document, to transfer a certain amount of money to the recipient's account opened in this or another... ... Wikipedia

payment order - Syn: payment order ... Thesaurus of Russian business vocabulary

Liquidation of an enterprise - Liquidation of an enterprise is a process that ends the activities of an organization in the absence of a transfer of rights and obligations to other persons. Liquidation can be divided into types: voluntary liquidation and forced liquidation. There are... ... Wikipedia

Liquidation of a legal entity - Liquidation of a legal entity - termination of the existence of a legal entity by making an appropriate entry in the Unified State Register of Legal Entities. Liquidation of a legal entity entails the loss of its civil legal capacity.... ... Wikipedia

Payment - (Payment) Types and purpose of payments Cash on delivery and payment order Contents Contents Section 1. Types. Section 2. Cash on delivery. Section 3. Payment order. Payment is an issue under some obligation, a transfer... ... Investor's Encyclopedia

Bookmarked: 0

A bank order is a document applicable in transactions on credit or deposit accounts of certain organizations or bank branches, both in rubles and in other currencies. An account can be opened with a specific organization for issuing credit funds, if it also acts as the payer or recipient.

Collection order from the tax authority

This type of payment is provided for organizations that carry out control functions in relation to tax payers. These include the Federal Tax Service of Russia. This obligation is provided for in Art. 46 Tax Code of the Russian Federation. The Federal Tax Service sends a demand (Federal Tax Service order No. ММВ-7-8/ [email protected] ) for payment of the tax arrears to its payer. If the requirement is ignored, the inspection makes a decision on forced payment of the arrears after the completion of the planned payment period, but no later than 2 months (clause 3 of Article 46 of the Tax Code of the Russian Federation).

Collection orders received by the debtor's bank are subject to unconditional execution. The execution and presentation of collection orders is carried out in accordance with Art. 874–876 Civil Code of the Russian Federation. In this case, calculations are made taking into account provisions No. 384-P.

NOTE! Tax officials do not have the right to issue a collection before the end of the deadline for voluntary payment of arrears by the taxpayer (resolution of the Central District Court of October 30, 2019 in case No. A83-7823/2018, FAS of the East Siberian District of August 31, 2012 No. A78-10449/2011 and the Moscow District of July 23 .2012 No. A40-12689/12-116-24).

A collection of the most important judicial practice from ConsultantPlus will help you defend your rights in disputes with tax authorities on issues related to tax collection. Get a free trial of the legal system and continue on to this helpful resource.

This document also establishes the order of payment of arrears of taxes or fines and penalties. The fields of the collection order are filled in taking into account the provisions of Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. For each tax that has different BCCs, its own collection order is issued. If there is an overpayment of tax, it can be refunded.

On the court’s recognition of collection orders as erroneous, see the article “Art. 78 of the Tax Code of the Russian Federation: questions and answers" .

Features of registering a bank order

The task of drawing up a bank order lies with the organization issuing credit funds. Once completed, the document itself can be in either printed or electronic format. If the document is drawn up and filled out in writing, then you should pay attention to the fields. The rules for filling out details in the fields are described in the 3rd appendix to the bank order. When it comes to document execution in electronic form, its format should not exceed A4 format. If the text of the document exceeds these boundaries in volume, then the document must be converted into a multi-page form. The credit institution retains the right to establish a certain order in the numbering of pages, the order of signing the document, as well as other details regarding the execution. This document may use additional fields, the purpose of which can be determined by the organization itself for issuing credit funds. She is also responsible for their quantity, purpose and design, depending on needs. Only authorized persons who have the right to sign documents on behalf of this organization, that is, have the right of first or second signature, participate in the signing of the order.

In addition, the organization is responsible for confirming the authenticity of the order. Each branch has the right to personally establish the procedure in accordance with which the procedure for establishing the authenticity of the document will take place. The branch is responsible for the integrity of the document itself, as well as for the accuracy of its contents.

A document such as a bank order is widely applicable for conducting settlement transactions when customer accounts interact with the accounts of a branch of an organization for issuing credit funds.

All changes and results must be accurately reflected in the bank order. The document is subject to certain changes specifically for these purposes. Additional fields or lines are added to it, in which all the necessary data is entered.

The bank order contains another important information. An extract from your personal account must be attached to it. This document contains data on all transactions carried out specifically with this personal account of the client of the bank branch.

There are cases when there is not enough funds in the account of a bank client acting as a payer. In this case, the bank order will be moved to documents for unpaid or overdue payments. A payment order can pay a bank order. This operation can only take place in the order prescribed by the regulations of the Bank of the Russian Federation. If the situation is resolved through this procedure, then the information from the so-called “free fields” must be transferred to the payment order, to a special field called “payment purpose”.

What is a collection order used for?

According to the regulation “On the payment system of the Bank of Russia” dated July 6, 2017 No. 595-P, one of the payment documents is a collection order (clause 4.6).

This is a non-cash way of making payments. Collection orders are needed to withdraw funds from the payer in an indisputable manner. They are used if:

- the indisputable nature of the write-off is provided for at the legislative level;

- it is necessary to pay the debt according to the writs of execution;

- an agreement has been concluded on the fulfillment by the counterparty of certain delivery conditions with payment from the payer’s account without his order.

The collection order is drawn up (form 0401071):

- counterparties if there is a supply agreement;

- tax services and extra-budgetary funds for collecting arrears, fines and penalties;

- bailiffs.

Depending on the situation, it should contain links:

- to the normative act indicating its number, date and number of the applicable article;

- a supply agreement indicating its details and a reference to the clause that provides for the supplier’s right to write off funds;

- writ of execution indicating its number, date of issue, name of the organization and case number in legal proceedings; The collection order must be accompanied by an original or a duplicate of the writ of execution.

Failure to comply with these requirements will be grounds for non-payment of the order by the bank. When using a writ of execution that is presented later than the deadline specified by law, the bank will also not execute the order.

All operations with collection orders are specified in Chapter. 7 of the Bank of Russia Regulations dated June 29, 2021 No. 762-P.

The difference between a bank order and a payment order

Although both of these documents have widespread use in banking system workflows, they have several distinctive features. To do this, it is important to understand the essence of the meaning of the term “payment order”. Unlike a bank order, this document means a certain instrument with the help of which a partial transfer of funds occurs according to a receipt, invoice or other type of obligation on the part of the organization for issuing loans. The bank itself puts down special characteristic marks and signatures on this document. Those branch employees who work in the field of transactions can sign a document of this type.

When a partial payment is made using this document, then the order allows you to record the changes made. This happens due to the fact that a special mark will be placed on the document. A specialist in the field of providing banking services must have a sufficient level of qualifications. His job in this process is that he must put information on the back of the receipt regarding the partial payment that was made. The information should display the following data: serial number, information about the transferred amount of money, as well as about the order. It is important to certify all this with the personal signature of a bank employee.

Each existing order must have at least one more copy, which can be left for safekeeping at a specific bank branch. Some people have a question about why one copy should remain in the bank’s file cabinet. In addition to the fact that in case of loss of one document, it will be possible to obtain a copy of it, this document can be used for information extracts.

A document of this type is also used for a full transfer of funds, for example, for the supply of goods, products, services received, or for the payment of taxes.

In short, a bank order has many differences with a payment order and a payment order. These concepts should be clearly distinguished from each other and the essence of the impact they have on the conduct of banking operations on personal accounts should be understood. However, what these types of documents have in common is that on their basis, credit institutions and bank branches can receive accurate and up-to-date information about clients, their details, as well as about bank transfers made.

The concept of a bank order was brought up for discussion eight years ago, and after two years from the start of consideration, it was introduced into the legislation of the Russian Federation. If we note some features of the document’s design, it is important to mention that when drawing up a printed document, paper is used that both Sberbank of Russia and other banks actively work with. If employees of an organization or a bank branch notice any shortcomings, then they undertake to make appropriate changes, be it an electronic or printed document.

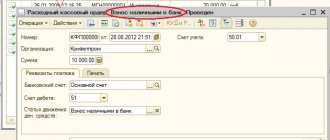

Document “Payment order: debiting funds with the operation Transfer of wages”

Use outgoing payment orders to debit funds from your current account. However, in many configurations, for example, complex automation 1.1, there is a document Payment order for debiting funds to account for debiting non-cash funds when the bank partially pays settlement documents. That is, when you need to reflect the debiting of funds from a current account made using documents different from the outgoing payment order. The demo version of the program uses this document for other write-offs, but not for salary transfers . When creating a new document Payment order for debiting funds, you are asked to select the type of operation (See Fig. 1)

Fig 1 Payment order: debiting funds with transaction with transaction Transfer of wages

The document Payment order for debiting funds with the operation Transfer of wages does not create postings. It is intended to register the fact that wages are credited to the personal accounts of employees if the organization exchanges information with the bank electronically using the processing of Export/Import transactions on the personal accounts of employees. The peculiarity is that a document with such an operation is not entered through a list form, but is created automatically by the program during registration by processing the fact of crediting funds “transferred” by the document Payment order outgoing with the operation Transfer of wages (See Fig. 2)

0

Share link:

- Click to share on Twitter (Opens in new window)

- Click here to share content on Facebook. (Opens in a new window)

Liked this:

Like

Similar

Author of the publication

offline 1 day

Areas of application of bank orders and differences from memorial orders

Most often, this document is widely used to carry out settlement operations. An organization in which the payer has his own personal account can freely operate simultaneously with several other accounts provided by bank branches. It is important to note that all such interactions must be clearly reflected in the bank order. That is why, amounts according to the number of the party - the payer and the number - must be entered in the appropriate lines, added at the discretion of the organization to the contents of the document. When a client receives a statement from his account, at the same time he receives a bank order attached to it.

Having understood the meaning of a bank order, it is important to understand what is behind the term “memorial order”. A memorial order is a document with which you can make a transfer without using cash. This is its significant difference from a bank order, because the latter acts as an extract for the deposit or withdrawal of money in the form of cash, from the personal card of a bank client. The memorial order, in turn, is a very popular form for accounting. With its help, accounting departments and individual specialists can very quickly and reliably carry out calculations and bring together the necessary amounts, both in working with loans and in debit operations. The main advantage of this order is that with its help you can very easily settle all the necessary accounts.

Another important difference is that the bank order may contain the necessary auxiliary details. There is even a special place for them in the document, usually at the end of all mandatory information.

Using bank orders

How is a bank order used? An order from a bank can be used for payment transactions in which the payer credit institution interacts with several other accounts in credit institutions. In this case, the corresponding amounts for the payer number are indicated on separate lines. A bank transfer reflecting transactions made on the personal account is attached to the client’s account statement.

If it is a question that the payer of the client's account does not have funds or their quantity is insufficient, the document written on paper is placed in the files that were not paid on time. The information is then transmitted in the “Payment” payment order. The bank establishes the transfer procedure to the credit institution.