Submitting reports via the Internet - which operators to use?

There are currently several electronic reporting operators on the market. The most famous of them are Taxcom and Tensor.

Taxcom has been present in the electronic document management market since 2000, has its own certification center for issuing digital signatures, and works closely with the Federal Tax Service of Russia on the development of electronic document management. Among the services offered by the operator: connection to online cash registers, submission of reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat, Rosprirodnazdor, Federal Customs Service, the ability to transmit explanatory notes to tax authorities in electronic form, implementation of interaction systems with Unified State Automated Information System. Taxcom offers the widest range of services and a flexible tariff schedule. The number of sales offices in Russia is more than 300.

The minimum cost depends on many factors. The full list of tariffs can be found here.

Tensor has been providing its services since 1996 and is also an accredited certification center with a wide range of services - from the supply of computers and office equipment to consulting and auditing services. Tensor's capabilities for transmitting electronic reporting are similar to those of Taxcom, but prices are lower: the minimum cost of services starts from 500 rubles. (for individual entrepreneurs). You can find out about the tariffs of this operator here. Namely, to send reports, “Tensor” created a new project “Sbis”, the tariffs of which can be found here.

Also large operators are Kaluga Astral, Infocenter, etc. These operators have their own software, but the widest range of services is provided by the market leaders - Taxcom and Tensor.

A complete list of electronic document management operators is available on the Federal Tax Service website.

At what point are the statements considered signed and at what point are they considered submitted?

As we can see, the fundamental issue for accepting or refusing to accept a declaration signed and (or) submitted by an authorized person is the moment of taking the corresponding action. Therefore, it is necessary to clearly define at what point the reporting is considered signed and at what point it is considered submitted.

As for the date of signing the reports, there are no special rules in the Tax Code of the Russian Federation. However, these are available in the officially approved procedures for filling out the relevant reporting forms and are universal in nature: the date of signing the reporting is entered in the appropriate fields of the reporting itself next to the signature of the authorized person (see, for example, the last paragraph of paragraph 32 of the Procedure for filling out a VAT tax return, approved by order of the Federal Tax Service of Russia dated 10/29/14 No. ММВ-7-3/ [email protected] or clause 3.3.5 of the Procedure for filling out a tax return for transport tax, approved by order of the Federal Tax Service of Russia dated 12/05/16 No. ММВ-7-21/ [ email protected] ).

That is, the date the authorized person performed such an action as “certifying the completeness and accuracy of the information specified in the reporting” is the date indicated in the reporting itself next to the corresponding signature. This means that if the power of attorney has not expired on this date, then the representative’s signature on the declaration is legal and there are no grounds for refusing to accept it because it was signed by an unauthorized person. Even if the tax authority received the declaration and a copy of the corresponding power of attorney after the expiration of the period for which the authority was granted.

The situation is similar with the authority to submit a declaration. According to the rules of paragraph 4 of Art. Tax Code of the Russian Federation, the declaration is considered submitted on the day of its submission to the Federal Tax Service (if submitted in person), or on the day of sending a postal item with a description of the attachment (if submitted by mail), or on the day of sending (if submitted by TKS and through a personal account). This means that if the power of attorney is valid on the corresponding date, then the powers of the representative are confirmed, and there are no grounds for refusing to accept the declaration.

Programs for submitting reports electronically

Electronic document management operators provide users with their own software for transmitting reports to government agencies. For example, Taxcom allows you to submit declarations through:

- “Online Sprinter” program - in this case, work is carried out through a secure online account, and the program can be launched on any computer, not just directly in the office;

- “Docliner” - the program is installed on one computer, but its functionality allows you to submit reports from several organizations at once;

- "1C-Sprinter" - integrates into the interface of the used "1C" configuration. The advantage of the solution is that you do not need to download the report from 1C to a separate folder, and then load it into the reporting program - all operations can be performed directly in 1C.

These are the most popular operator programs; At the same time, there are others designed for more specific industries, for example, working with Unified State Automated Information System or online cash registers.

"Tensor" offers its clients to send declarations through the software functionality "SBIS - electronic reporting". This solution has its own online account, which is accessible without being tied to a workplace, and a computer program. “SBIS” supports sending reports from several companies at once, can reconcile invoices from VAT declarations with invoices of suppliers and buyers, checks reports against control ratios of government agencies, and also allows you to quickly switch to an electronic document management system with counterparties. For an additional fee, you can connect a financial analysis module, which will check all the indicators of different reports against each other, assess the risk of a joint audit by the Pension Fund and the Social Insurance Fund, calculate the tax burden and compare it with the recommended value of the Federal Tax Service for a given region.

“Astral Report”, a program of the Kaluga Astral operator, offers similar functionality.

also offers its solution for submitting reports - “1C-Reporting”, which has already been implemented in standard configurations of “1C-Enterprise”.

Duration of power of attorney

Now let's consider the question of the period of authority for which the power of attorney was issued. According to Art. Tax Code of the Russian Federation, powers of attorney for performing actions within the framework of the Tax Code are drawn up according to the rules of civil legislation. And these rules regarding the validity period of a power of attorney are as follows. The power of attorney must indicate the date of its issue (without this, the power of attorney is void). The period for which powers are granted does not have to be indicated in the power of attorney: in this case, the power of attorney is valid for one year. But this rule does not apply if the power of attorney expressly indicates its validity period: such a power of attorney remains valid for the specified period. Moreover, neither the minimum nor the maximum period of the power of attorney is limited in any way (Article 186 of the Civil Code of the Russian Federation).

So, a power of attorney is an urgent document that gives the representative the appropriate powers only temporarily, for the period specified in the power of attorney, and if this is not specified, then for one year from the date of issue. This means that during this period of time (the period of validity of the power of attorney), the authorized person can perform on behalf of the principal all those actions for which he was authorized. That is, in relation to the situation under consideration - to certify the completeness and accuracy of the information specified in the reporting, and also to submit these reports to the tax authority. And if each of these actions was completed before the power of attorney expired, then the representative acts within the scope of his powers. This means that there are no grounds for refusing to accept the declaration because it was signed or submitted by an unauthorized person.

Receive “primary” information from clients, keep records and submit reports via a web service

Submission of electronic reporting for free - which web services to use

Electronic reporting can also be submitted through the websites of government agencies - this opportunity, for example, is provided by the Social Insurance Fund. The Federal Tax Service also accepts tax and accounting reports of taxpayers in electronic form.

ATTENTION! From 01/01/2022, the Federal Tax Service will issue digital signatures for legal entities and individual entrepreneurs free of charge. Tax authorities plan to begin providing the service as early as 07/01/2021. See details here.

When using these methods, it is possible to send reports via the Internet for free, but the company must have an electronic digital signature, and the reports themselves are generated in an accounting program and then uploaded to the department’s website. The disadvantage of this method is that the accountant will not be able to see in one program data on all the reports that he submitted to government agencies during the reporting period - 4-FSS forms will be stored on the social insurance website, and tax returns will be stored on the Federal Tax Service website. In addition, if you submit reports through an electronic document management operator, he himself takes care of the technical issues of issuing an electronic signature and setting up the user’s computer, and if reports are sent via the Internet for free, using the government agency’s website, then the accountant will have to delve into these subtleties on his own.

Another promising method of submitting electronic reporting, which we have already briefly discussed, is cloud accounting. This is an alternative to the widespread 1C Enterprise complex and its analogues, which are installed on the user’s computer and require regular updates and modifications by the programmer. An accountant goes to a website that provides online accounting services, registers there, fills in information about the company and starts working. To send reports, you will also need an electronic signature, which will be issued by employees of the company that owns the site.

The advantage of such services is that the accountant is not tied to his workplace and can keep his finger on the pulse, even while on sick leave or on a business trip. The downside is the difficulty of “moving” from one cloud accounting department to another if you don’t like the service.

Major players in the cloud accounting market are Moe Delo, Nebo, and Elba. The cost of work starts from 4 - 6 thousand rubles. per year - for this price the user receives not only an online account for accounting, but also the opportunity to submit reports electronically. The program interface is simple and will allow even a non-professional to understand taxes and fees.

Submitting reports electronically through a representative: drawing up a power of attorney

Home → Articles → Submitting reports electronically through a representative: drawing up a power of attorney

The organization represents the interests of entrepreneurs in the Federal Tax Service regarding the submission of reports. A power of attorney to represent the interests of a taxpayer before a tax authority (including filing reports electronically) was issued to an organization represented by its head. What is the procedure for issuing powers of attorney when changing the head of an organization, provided that previously issued powers of attorney are notarized with the right of substitution?

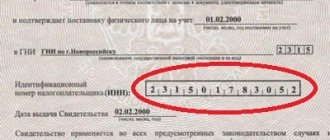

In accordance with paragraph 3 of Art. 29 of the Tax Code of the Russian Federation, an authorized representative of a taxpayer - an individual exercises his powers on the basis of a notarized power of attorney or a power of attorney equivalent to a notarized one in accordance with the civil legislation of the Russian Federation. By virtue of paragraph 1 of the same article, an authorized representative of a taxpayer is recognized as an individual or legal entity authorized by the taxpayer to represent his interests, in particular, in relations with tax authorities.

Clause 4 of Art. 80 of the Tax Code of the Russian Federation provides that a tax return (calculation) can be submitted by a taxpayer (payer of a fee, tax agent) to the tax authority personally or through a representative, sent by mail with a list of attachments, transmitted electronically via telecommunication channels or through personal taxpayer's office.

As follows from the second paragraph of clause 5 of Art. 80 of the Tax Code of the Russian Federation, a tax return (calculation) can be signed by a representative of the taxpayer. According to paragraph three of the same paragraph, if the accuracy and completeness of the information specified in the tax return (calculation), including using an enhanced qualified electronic signature when submitting a tax return (calculation) in electronic form, is confirmed by an authorized representative of the taxpayer (payer of the fee) , tax agent), the tax return (calculation) indicates the basis of the representation (the name of the document confirming the authority to sign the tax return (calculation)). In this case, a copy of the document confirming the authority of the representative to sign the tax return (calculation) is attached to the tax return (calculation).

In accordance with paragraph 1 of Art. 185 of the Civil Code of the Russian Federation, a power of attorney is recognized as a written authority issued by one person to another person or other persons for representation before third parties.

From the above provisions of the legislation it follows that a representative in tax legal relations can also be a legal entity.

Clause 1 of Art. 53 of the Civil Code of the Russian Federation provides that a legal entity acquires civil rights and assumes civil responsibilities through its bodies acting in accordance with the law, other legal acts and the constituent document.

Consequently, if the taxpayer, on the basis of a power of attorney, has authorized an organization to submit tax (accounting) reports (hereinafter referred to as reporting) to the tax authority, its head, acting on the basis of constituent documents, when signing such reports, acts as the legal representative of this organization. The authorized representative of the taxpayer in this case is the organization itself, and not its director. This also applies to cases when the text of the power of attorney indicates that it was issued to an organization represented by its head (indicating his last name, first name, patronymic, and other personal data).

The grounds on which the power of attorney is terminated are listed in paragraph 1 of Art. 188 Civil Code of the Russian Federation. This provision does not contain such grounds for termination of a power of attorney as the loss of the relevant powers by the person who was at the time of issuance of the power of attorney the head of the representative organization.

According to clause 1.11 of the Methodological Recommendations for organizing electronic document flow when submitting tax returns (calculations) in electronic form via telecommunication channels (approved by Order of the Federal Tax Service of Russia dated July 31, 2014 No. ММВ-7-6/ [email protected] , hereinafter referred to as the Methodological Recommendations) When submitting a tax return (calculation) in electronic form via telecommunication channels (TCC) by a representative of the taxpayer, a document (copy of the document) giving the right to confirm the accuracy and completeness of the information specified in the declaration (calculation) is presented to the tax authority before sending the tax return (calculation) ). A copy of this document is retained by the tax authority for 3 years after expiration. If a tax return (calculation) is submitted by a representative of the taxpayer, the submitted tax return is accompanied by an information message about the representation (clause 2.2 of the Methodological Recommendations).

As provided in clause 5 of the Methodological Recommendations for the formation of an information message on the power of attorney issued to a representative granting him the authority to perform duties in the tax authorities during information interaction between taxpayers and tax authorities in electronic form via telecommunication channels (approved by letter of the Federal Tax Service of Russia dated January 24, 2011 No. 6-8-04/ [email protected] , hereinafter – Methodological recommendations for generating an information message about a power of attorney), the information message about a power of attorney indicates the details of the power of attorney and the powers of the person, the owner of the signature key certificate, who signs and submits the electronic document. In this case, the details of the signatory in the tax return (last name, first name, patronymic) must match the details (last name, first name, patronymic) of the owner of the signature key certificate.

In accordance with clause 2 of Section II of Appendix No. 1 to the Methodological Recommendations, checking the authority to sign a tax return (calculation) includes checking, using information resources of the tax authority, the right of a taxpayer official (representative) to confirm the accuracy and completeness of the information specified in the tax return (to sign a tax return). declaration).

Information resources used in the activities of tax authorities include, in particular, the Unified State Register of Legal Entities (USRLE) (clause 5.3 of the letter of the Federal Tax Service of Russia dated July 25, 2013 No. AS-4-2/ [email protected] , clause 2.5 of the letter Federal Tax Service of Russia dated July 16, 2013 No. AS-4-2/ [email protected] ).

Information about a legal entity in the Unified State Register of Legal Entities includes the last name, first name, patronymic and position of the person who has the right to act on behalf of the legal entity without a power of attorney, as well as passport data of such person or data of other identification documents in accordance with the legislation of the Russian Federation, and identification number taxpayer, if any. When changing a person who has the right to act on behalf of a legal entity without a power of attorney, the organization must, within three working days, submit an application to the registration authority to make appropriate changes to the Unified State Register of Legal Entities (subclause “l”, clause 1, clause 5, article 5, p 2 Article 17 of the Federal Law of 08.08.2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”).

Therefore, in our opinion, in the event of a change in the head of the organization, the need to cancel the previously issued power of attorney and issue a new power of attorney to the person elected to the position of head would arise provided that the power of attorney was issued directly to the head of the organization as an individual. Since the representative when submitting reports to the tax authority is the organization itself, and not its head (he is a representative of this organization, and not the taxpayer), there is no need to replace (re-issue) the power of attorney in such circumstances. The powers of the new head as the legal representative of the organization are confirmed by the information of the Unified State Register of Legal Entities (see in this regard, the decisions of the FAS of the Volga District dated December 4, 2012 No. F06-9545/12, FAS of the North-Western District dated February 14, 2011 No. F07-5/2011). In this case, the organization must indicate in the information message the data of the individual who has acquired the powers of the legal representative of this organization in connection with his election to the position of manager, ensuring that the details of the individual in the file of the information message about the representation correspond with the corresponding values of the details of the owner of the electronic signature in the key certificate verification of the electronic signature (clauses 3, 5 of Section I of Appendix No. 1 to the Methodological Recommendations, clause 13 of the Methodological Recommendations for the formation of an information message about the power of attorney). The authority of the organization to submit reports is confirmed by a power of attorney previously issued by the taxpayer, which is at the disposal of the tax authority.

If, when submitting reports to the tax authority, the organization is represented not by the head, but by another person (in particular, another employee of such an organization), his powers are confirmed by a power of attorney issued by the organization in the person of its head, which is certified in accordance with clause 4 of Art. 185.1 of the Civil Code of the Russian Federation. Such a power of attorney (its copy) must be presented to the tax authority at the time of filing reports (letters of the Ministry of Finance of Russia dated September 25, 2012 No. 03-02-07/1-227 and dated August 7, 2009 No. 03-02-08/66, Federal Tax Service of Russia dated 09.11.2015 No. ED-4-15/ [email protected] ). In this case, the power of attorney is signed by the person who exercises the powers of the head of the organization at the time of issuance of the power of attorney.

Answer prepared by: Erin Pavel, expert of the Legal Consulting Service GARANT Response quality control: Aleksandrov Aleksey, reviewer of the Legal Consulting Service GARANT

Latest news of the digital economy on our Telegram channel

| Do you want to submit reports electronically? All you have to do is leave a request. We will help you organize the presentation of electronic reporting in a secure form directly from your workplace. Leave a request >> |

Results

You can submit reports electronically in different ways: using special computer software or using web services.

The main aspect that you need to pay attention to is reliability and security, since the company’s reporting is its trade secret and must be carefully protected. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.