What do personal income tax codes mean?

The Tax Code obliges tax agents to keep records of income paid to individuals, not in any form, but using special codes.

Thus, paragraph 1 of Article 230 of the Tax Code of the Russian Federation states that each tax agent must compile tax accounting registers. They need to record income paid to individuals in accordance with the codes approved by the Federal Tax Service. The current codes are given in the Federal Tax Service order No. ММВ-7-11/ [email protected] (hereinafter referred to as order No. ММВ-7-11/ [email protected] ). They are used, among other things, to fill out a certificate of income and tax amounts for an individual (Appendix No. 1 to the calculation of 6-NDFL). This means that incorrectly assigning a digital code to income will result in an error in the income certificate. This, in turn, threatens the tax agent with a fine of 500 rubles. for each incorrectly completed certificate (Article 126.1 of the Tax Code of the Russian Federation, clause 3 of the Federal Tax Service letter No. GD-4-11/14515 dated 08/09/16).

Reference

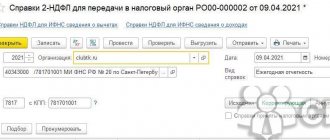

For 2022 and earlier, tax agents submitted separate income certificates in Form 2-NDFL. Starting with reporting for 2022, the income certificate is Appendix No. 1 to the annual calculation of 6-NDFL (approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] ; see “New form 6-NDFL , which included 2‑NDFL: how to fill out and when to submit”). The income certificate no longer has the official name “2-NDFL”, although out of habit many continue to call it that way. Income certificates for 2022 must be submitted as part of the 6-NDFL calculation no later than March 1, 2022.

Fill out and submit 6‑NDFL form online for free with current codes

In addition, in many accounting programs, payment codes are tied to determining the date of actual receipt of income, and it depends on it whether the payment needs to be included in the calculation of 6-NDFL for a specific period (letter of the Federal Tax Service dated 08/09/21 No. SD-19-11/ [email protected] ; see “The Federal Tax Service announced how to reflect the salary for December 2022 in the calculation of 6-NDFL and the income certificate”). Consequently, due to an error in income coding, the tax agent may incorrectly fill out the 6-NDFL calculation. For this violation, the fine is also 500 rubles. (Article 126.1 Tax Code of the Russian Federation).

Finally, this same pay encoding is used in most accounting programs to calculate average earnings. Therefore, incorrect assignment of a code may cause incorrect calculations with employees for vacation pay, business trips, sick leave, etc. If the payment turns out to be underestimated, the organization may be fined in the amount of 30,000 to 50,000 rubles, an official - from 10,000 to 20,000 rubles, and an individual entrepreneur - from 1,000 to 5,000 rubles. (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). If the employee is transferred more than is due, there may be problems with the payment of various benefits compensated from the budget.

Important

Errors in the application of codes can lead to underestimation or overestimation of vacation pay, travel allowance, sick leave and other payments “tied” to average earnings.

Therefore, it is better to calculate these payments in web services, where current codes are installed and entered into reporting automatically. Calculate salary and personal income tax with standard deductions in the web service

How to enter charges

The profitability coding is given in Order No. ММВ-7-11/ [email protected] , and the current form and the procedure for filling it out are in Appendix No. 4 from Order No. ED-7-11/ [email protected] dated 10/15/2020. When an accountant needs to fill out KND form 1175018 and indicate code 2002, he draws up the form that was in effect during the period of the request. That is, if an employee asked to fill out a certificate for 2018-2020, then we form the document on the form from Appendix No. 5 to the Federal Tax Service order No. MMV-7-11 / [email protected] dated 10/02/2018. If a form for 2022 is required, then we use the form from Order No. ED-7-11/ [email protected]

Income code 4800 with decoding

Let's start with the most universal code - 4800 “Other income”. It corresponds to any income for which there is no more suitable code in Order No. ММВ-7-11/ [email protected] (letter of the Federal Tax Service dated 07/06/16 No. BS-4-11/12127). For example, this code indicates income in the form of a one-time additional payment for vacation (letter of the Federal Tax Service dated August 16, 2017 No. ZN-4-11 / [email protected] ).

In addition, code 4800 can be used, in particular, in relation to the following employee income:

- average earnings saved for the days of medical examination;

- payment for downtime caused by reasons beyond the control of the parties;

- compensation for the delay in issuing a work book to a dismissed employee;

- the average salary retained for donors on the days of blood donation and on the days of rest provided to them;

- the amount of forgiven debt on the advance report.

Important

Previously, using code 4800 it was also necessary to reflect excess daily allowances. Since November 9, 2022, the Federal Tax Service order No. ED-7-11/ [email protected] (hereinafter referred to as Order No. ED-7-11/ [email protected] ) has been in effect, which, among other things, introduced a new code 2015. It should be used to encode “daily allowances exceeding 700 rubles for each day of being on a business trip in the Russian Federation and no more than 2,500 rubles for each day of being on a business trip outside the Russian Federation.” Also see “Income and deduction codes have been updated in the 6-NDFL calculation.”

Also, code 4800 is used to reflect settlements with individuals who are not employees of an organization or individual entrepreneur, unless a special code is provided for payment. The same code is used when “requalifying” interim dividends if, at the end of the year, the amount of profit turned out to be lower than the calculated one.

Income subject to personal income tax in full

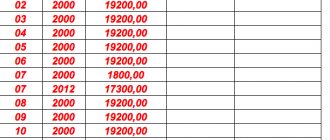

The most popular code is 2000 . This is the employee's salary. This also includes allowances for hazardous conditions and night work.

The remuneration of members of the Board of Directors is included in a special code. The role of the council may be performed by another management body. Indicate the remuneration of its participants using code 2001 in the 2-NDFL certificate.

A separate code was allocated for bonuses for results achieved in work. It is designated by number 2002 .

Employees can receive money from the company's net profit. Usually these are owners and top managers. Such income is marked with the code 2003 . This also includes targeted revenues and special-purpose equipment.

The company may employ persons engaged under a GPC agreement. Their income is accompanied by the code 2010 . Copyright agreements do not fall into this category.

Indicate income in the form of vacation pay with the code 2012 . But compensation for missed vacation is carried out according to code 2013 . Severance pay - 2014 .

Sick leave is also subject to income tax. Therefore, in the certificate there is a code for them 2300 . But maternity and child benefits are not subject to personal income tax, which means they are not included in the certificate.

An employee can give an interest-bearing loan. The amount earned from receiving interest is his income. Accompanied by number 2610 in 2-NDFL.

An individual who owns property can rent it out. For example, renting out a garage or an apartment. For such income the code is 1400 . This does not include revenue from the rental of vehicles, communications equipment and computer networks. code 2400 is allocated for them in 2-NDFL.

An employee can have their debt forgiven. Then personal income tax is withheld from him, since in essence this is already his income. The code in the help is 2611 .

For interest income on bonds of domestic firms there is code 3021 .

Indicate dividend income with number 1010 .

Rarely, but there are situations when income does not have an established number. These are accrued additional payments in excess of taxable daily allowances or additional payments for sick leave. This income is subject to personal income tax, and the certificate contains a universal code - 4800 .

There are other codes, but they are less common. For example, cash prizes are number 2750 . If you have earnings from foreign currency transactions, indicate it together with the code 2900 . There is an income code even for betting winnings - 3010 . Check out the full list of income and deductions on the 2-NDFL certificate.

Income code 2000 with decoding

The next most common code is 2000. This code corresponds to “remuneration received by the taxpayer for the performance of labor or other duties.”

Typically, the use of this code does not cause difficulties - everything that is reflected in the employer’s accounting as a salary accrued under an employment contract for the performance of job duties “passes” according to code 2000. The same value is assigned to the average earnings saved for the period of a business trip, since it is also salary (letter of the Ministry of Finance dated November 12, 2007 No. 03-04-06-01/383).

Calculate your salary and benefits taking into account the increase in the minimum wage in 2022 Calculate for free

Income codes 2002 and 2003 with decoding

But bonuses for the purpose of coding income as wages are not recognized, although they are named in Article 129 of the Labor Code of the Russian Federation as part of remuneration. Moreover, bonuses are reflected in tax registers and in income certificates in three different codes.

The main code is 2002. It is used for awards that simultaneously satisfy three conditions:

- the payment is not made at the expense of profits, earmarked proceeds or special-purpose funds;

- the payment is provided for by law, labor or collective agreement;

- the basis for payment is certain production results or other similar indicators (i.e. indicators related to the employee’s performance of his or her job duties). This circumstance must be confirmed by an order for payment of the bonus.

Code 2003 reflects bonuses (regardless of the criteria for their assignment) and other remunerations (including additional payments for complexity, intensity, secrecy, etc., which are not bonuses), which are paid from special-purpose funds, targeted revenues or profits organizations.

For other bonuses, code 4800 must be used.

Also see: “We reward employees correctly: how to arrange bonuses in an organization.”

Where is this code indicated?

In 2 personal income tax code 2002 is written opposite the amount of income itself. Until 2019, a single form was used for all users, and codes were recorded in it in parallel with the means of receiving income and deductions.

At the end of 2022, the Federal Tax Service issued Order No. ММВ [email protected] dated October 2, 2022. According to it, 2 forms of income certificate were accepted:

- a separate form for tax departments, modified for the convenience and needs of fiscal services; the form has become machine-oriented and similar to other types of tax reporting; here the codes are entered in the second sheet - Appendix:

- a common form for individuals, which they submit to various departments and authorities, of a traditional type; as before, here the codes are recorded in a table:

You will also encounter code 2002 when filling out the 3rd personal income tax declaration through a special program. In the income section, you must select codes from the drop-down list:

For reference! Accountants are required to use codes accepted by the Tax Service in all reports relating to personal income tax so that there are no contradictions in accounting.

Income codes 2012 and 2013 with explanation

The 2012 code corresponds to the amount of vacation pay, that is, the average earnings retained by the employee during the vacation period. This code applies to payments for both regular vacations and additional ones, including educational ones.

Code 2012 can only be applied to vacation pay that is paid to existing employees. If the employer transfers compensation to the dismissed employee for unused vacation, this income must be assigned code 2013.

Attention

The Labor Code allows for the provision of leave followed by dismissal (Part 2 of Article 127 of the Labor Code of the Russian Federation). In this case, the employee receives the final payment and work book before the vacation, and does not return to the previous employer after the vacation. However, from the point of view of labor legislation, the transferred amounts are vacation pay, and not compensation for unused vacation. Therefore, the code 2012 must be applied to such a payment.

Using codes in the 2-NDFL certificate

Each payment made by the employer to the employee must be assigned a numerical code.

It is important to be precise here, since a small mistake is treated as a serious violation and may be punishable by a fine. For example.

If a person works under an employment agreement (contract), then the salary paid to him is indicated by code 2000, and if the relationship between the employer and employee is formalized by a civil law agreement, then the code 2010 is used. Payments for the next vacation are indicated under code 2012, and compensation to the resigning person to an employee for unused vacation is indicated by the code 2013.

There are separate codes for bonuses, dividends, financial assistance, payments from net profit, etc. If a certain type of income cannot be unambiguously classified and assigned to any code, then the universal code 4800 is used, under which other income is indicated in the 2-NDFL certificate.

All income codes have in common that they consist of four numeric characters.

Income code 2300 with decoding

Using code 2300 in personal income tax reporting, temporary disability benefits are indicated. This code must be assigned not only to the benefit that is paid in case of illness of the employee himself, but also to those amounts that are transferred in the case of caring for sick children or other family members.

Reference

Formally, maternity benefits also fall under this code, since the basis for its accrual is sick leave.

But since maternity benefits are not subject to personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation), this payment may not be recorded at all in the registers and certificate of income (clause 1 of Article 230 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated April 2, 2019 No. 03-04 -05/22860). Generate and submit documents for payment of benefits to the Social Insurance Fund Submit via the Internet

Codes of those incomes that are always subject to income tax

Income code 2000 corresponds to wages, including additional payments and allowances (for harmful and dangerous work, for night work or part-time work).

2002 – Increases for production and similar results, which are provided for in employment contracts, collective agreements or legal provisions.

2003 – Compensation paid from the organization's profits, special purpose funds or specified income.

2010 – Income from civil contracts, with the exception of copyright contracts.

2012 – Vacation pay.

2013 – To compensate for unused vacation.

2014 – Severance pay, compensation payments in the form of average monthly earnings during the period of employment after dismissal, compensation to managers, deputy heads, chief accountants in excess of earnings for 3 or 6 months (regions of the Far North and equivalent regions).

2300 – Sick leave. It is subject to income tax, so its amount is included in the certificate. However, maternity benefits are not subject to income tax and do not need to be indicated on the certificate.

2301 – Fines and penalties paid by an enterprise by court decision for non-compliance with consumer rights on a voluntary basis.

2610 – Indicates the material benefit received by the employee from savings in excess of interest on loans.

2001 - Directors' fees and other similar payments received by members of an organization's governing body (board of directors, etc.).

1400 – Income of a person from rental or other use of property (if it is not transport, communications or computer networks).

2400 – Income of a person from the rental of transportation vehicles, pipelines, power lines and other means of communication, including computer networks.

2520 – Income in kind received in the form of full or partial payment for goods, work, services performed in the interests of the taxpayer.

2530 – Payment in kind.

2611 – Bad debt write-off balance.

1010 – Transfer of dividends.

3020 – Interest on bank deposits.

3023 – Income in the form of interest (coupons) received by taxpayers on ruble bonds of domestic organizations issued after January 1, 2022.

4800 - This is the “universal” earnings code for other employees who are not assigned special codes. For example, daily allowances in excess of the non-taxable limit, additional sick leave, stipends.

Revenue codes 2762 and 2760 with decoding

Using code 2762 in tax registers and income certificates, you must indicate the entire amount of financial assistance issued to the employee at the birth of a child. Let us remind you that such financial assistance is not subject to personal income tax up to 50,000 rubles. for each child, provided that the payment is transferred no later than one year after his birth (clause 8 of Article 217 of the Tax Code of the Russian Federation).

In case of payment to employees of other types of financial assistance, the code 2760 is used. In this case, the basis for the transfer of money does not matter. So, if the company decides to issue financial aid for vacation, then this amount must be separated from the main vacation pay and reflected with code 2760. This code must also be assigned to financial aid paid to former retired employees. Let us remind you that such income is not subject to personal income tax up to 4,000 rubles. per year (clause 28 of article 217 of the Tax Code of the Russian Federation).

Code 2-NDFL 2000 and income code 4800

One of the most common types of employee income is compensation; [email protected] dated November 22, 2016 came into force, questions arose about the application of this code in the case of payment of bonuses. This issue was resolved in the following way: it was necessary to look at what exactly the bonus was awarded for, and, depending on this, choose a code. If an employee received bonuses for labor achievements, then this income was marked with code 2000, but if the bonus was given to him in honor of any event (wedding, anniversary, birth of a child, etc.), then this income should be classified as other and designated code 4800.

From December 26, 2016, 2 new codes were introduced to indicate premiums in 2-NDFL (Federal Tax Service order dated November 22, 2016 No. ММВ-7-11/ [email protected] , Federal Tax Service letter dated April 24, 2017 No. BS-4-11/ [ email protected] ):

- 2002 - for bonuses paid for production results and other similar indicators provided for by the laws of the Russian Federation, labor and (or) collective agreements (paid not at the expense of the organization’s profit, not at the expense of special-purpose funds or targeted revenues);

- 2003 - for remunerations paid from the organization’s profits, special purpose funds or earmarked proceeds.

What does the 4800 income code refer to? Income code 4800 - decoding of other types of income will be presented below; it applies to any other income that does not have a code designation, for example:

- daily allowances received in excess of the standard established by the local regulatory act of the organization;

- compensation accrued to an employee for the use of his personal property for the purposes of the organization, etc.

Income code 4800, which means other income in the 2-NDFL certificate, is also used to indicate a scholarship or remuneration to a student for work performed by him. Payments under a student agreement often raise questions, because Art. 217 of the Tax Code of the Russian Federation, which lists income that is not subject to personal income tax, also mentions scholarships. We emphasize that this article deals exclusively with those scholarships that are paid from the budget in state educational institutions. If the stipend is paid by an enterprise, it is taxed.

For information on how to return income tax paid on amounts spent on education, read the article “Procedure for the return of income tax (NDFL) for education .

Revenue codes 2720 and 2721 with decoding

According to Order No. ED-7-11/844, two different codes are used to reflect the value of property received as a gift. If the tax base is determined according to the rules of paragraph 6 of Article 210 of the Tax Code of the Russian Federation (that is, taking into account the deductions provided for in paragraphs 1 and 2 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation, or taking into account the features established by Articles 213, 213.1 and 214.10 of the Tax Code of the Russian Federation) , then you need to use code 2720. For other gifts - 2721. Let us recall that previously the cost of gifts for employees was included in personal income tax reporting only under code 2720.

Attention

Gifts worth no more than 4,000 rubles. per year, are exempt from personal income tax (clause 28, article 217 of the Tax Code of the Russian Federation). This income must be reflected in the tax registers, regardless of the amount of the gift. But in income certificates the cost of gifts does not exceed 4,000 rubles. for a year, you don’t have to show it (letters from the Federal Tax Service dated 07/02/15 No. BS-4-11/ [email protected] and dated 01/19/17 No. BS-4-11/ [email protected] ).

Also see: “Tax accounting for gifts and bonuses, or what an accountant should do after February 23 and March 8.”

How to fill out a payment form from June 1, 2022

The form of the payment order has not changed; the income code must be entered in field 20 “Payment purpose code”.

You can only put one code on a payment. Thus, it is impossible to transfer an employee’s salary and daily allowance in a total amount; for this, two payment orders with codes 1 and 2 are issued. Salary and vacation pay can be sent in one payment - they have a common code.

If writs of execution have been sent to the employee, and the employer withholds funds from the debtor’s income, then in text field 24 “Purpose of payment” you need to make the following entry:

//VZS// withheld amount in figures without spaces // .

Rubles are separated from kopecks by a dash sign “–”, and if the amount collected is in whole rubles, then “00” is indicated after the dash.

For example, alimony in the amount of 15 thousand rubles was withheld from the salary for July. In the “Purpose of payment” field, you need to make an entry like this:

//VZS//15000–00//. Salary for July 2020.

Sample of filling out a payment order

If there were no deductions under writs of execution, you do not need to write anything, just enter the income code in field 20.

In a salary project, when a register is created for payments to employees, the withheld amount is entered in each line with the full name of the debtors in the same format as for payments. Deductions are also indicated in the payment order for the total amount, but in this case field 20 “Name of pl.” do not fill out.

Forms of registers may differ from bank to bank. If you are in doubt about the correctness of filling out, contact your bank where the salary project is open for clarification.

Revenue codes 2400, 1400, 1401 and 1402 with explanation

To indicate rental income, you need to select one of four codes (depending on the object that is transferred under the contract). Thus, income from the rental of any cars, as well as sea, river and aircraft, is reflected in personal income tax reporting using a special code 2400. It is necessary to show the fee for the rental of these types of transport, even if it is paid to the employee (including h. to the manager). The same code also covers income from other uses of vehicles. Therefore, it includes income from contracts for the provision of services for driving your own car, rental agreements with a crew, etc.

Reference

Compensation for the use of a personal car, paid within the framework of an employment relationship in the amount established by the parties, is not subject to personal income tax.

There is no income code for this payment, and it does not need to be indicated in personal income tax reporting. Also see: “How to more profitably register an employee’s use of his car (new edition).” In addition, code 2400 applies to rental payments for fiber-optic and (or) wireless communication lines, and other means of communication, including computer networks.

Income from the provision of rent or other use of residential real estate is reflected under code 1401, and other real estate objects - under code 1402 (both codes were introduced by Order No. ED-7-11 / [email protected] ).

If the income is received from renting out any other property, then you need to use code 1400 (remember that previously all “rental” income that did not fall under code 2400 was coded with this code).

Note that when choosing a code for rental payments, it does not matter who exactly receives this income from an organization or individual entrepreneur: a manager, an ordinary employee or an outsider.

Also see “Lease agreement: in what cases it can be concluded and how to draw it up correctly.”

Why are codes needed in the 2-NDFL certificate?

Individuals can receive different types of income. The main ones are:

- wages at the place of main work (employment under an employment contract or contract), this same type includes payment for night work and hazardous working conditions;

- vacation pay, sick leave, and other social benefits;

- income from civil contracts;

- dividends, profits from transactions with securities;

- income from rental property and real estate;

- winnings and prizes from participation in lotteries;

- material assistance in property or monetary terms, etc.

It is inconvenient to list income in the 2-NDFL certificate by item. Firstly, it requires a lot of space, and secondly, the use of terms and formulations can lead to ambiguity and uncertainty.

The problem is solved using a coding system. It is approved at the federal level and must be used when filling out 2-NDFL certificates.

Income code 2610 with decoding

The material benefit that results from savings on interest when providing employees with interest-free or low-interest loans must be assigned code 2610.

Let us remind you that income with this code is generated on the last day of each month of using the loan (subclause 7, clause 1, article 223 of the Tax Code of the Russian Federation). And the tax on it is calculated at an increased rate of 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation).

Also see “Interest-free loan agreement: with whom it can be concluded, and how to draw it up correctly.”

interest-free loan agreement

Revenue code 2001 with decoding

Code 2001 is used for remuneration paid to directors on the board of directors and other members of the organization's collegial governing body.

At the same time, the salary of the manager according to code 2001 is not “posted”, even if the corresponding position is called “director”. However, if the manager is a member of the board of directors (board, other collegial body) and receives additional remuneration for this, then this payment must be separated from the salary and reflected for personal income tax purposes using code 2001.

Income code 2014 with explanation

The amounts of severance pay, as well as the average monthly earnings saved for the period of employment, are reflected in personal income tax reporting with the code 2014. This code applies only to that part of the payments that is subject to personal income tax (in total, it exceeds three times the average salary, and for “northerners” - sixfold). The income tax-free amount of severance pay and average earnings for the period of employment for personal income tax purposes is not fixed or coded.

Also see: “Payments if an employee is laid off in 2022.”

Prepare a termination agreement for free using a ready-made template

For what incomes in payment cards have new codes been introduced?

Employers who have to work with the new rules naturally have a question: for what payments do they need to indicate codes in their payment slips?

Law No. 12-FZ does not specify a specific list of income for which codes are required in payment documents, although their groups are generally outlined. These include wages and other income, in respect of which Art. 99 of Law No. 229-FZ establishes restrictions, as well as income that cannot be levied under Art. 101 of Law No. 229-FZ.

This material talks about the maximum permissible deductions from citizens' salaries.

Directive of the Central Bank No. 5286-U provides three codes:

| Code | When to bet | Examples of payments |

| 1 | In income payments for which there is a limit on the amount of debt withholding (Article 99 of Law No. 229-FZ) |

|

| 2 | In payments for payments, from which deductions are not made, except for compensation for damage to health (Article 101 of Law No. 229-FZ) |

|

| 3 | In payments for the payment of compensation for harm to health, as well as for budgetary compensation to victims of radiation or man-made disasters (subclauses 1 and 4 of clause 1 of Article 101 of Law No. 229-FZ). These are amounts from which only alimony can be withheld. | |

*What is included in the salary for these purposes can be found in paragraph 1 of the List of income from which child support is withheld, approved. Decree of the Government of the Russian Federation dated July 18, 1996 No. 841.

Other personal income tax codes with decoding

Quite often in practice there are other income codes. For ease of use, we have compiled them into a table, providing the necessary explanations. In particular, the table shows which three codes should be used to reflect income received in kind.

| Code | Type of income | Explanation |

| 1011 | Interest on the loan agreement | This code reflects the amount of interest under the loan agreement that the organization received from individuals. It is used both for loans provided by “our” persons - founders, participants, managers, employees, etc., and by other persons. |

| 1300 | Income received from the use of copyright or other related rights | This code reflects payments that are made on the basis of licensing agreements, under which an organization receives from individuals the rights to use various objects of intellectual property (texts, images, programs, etc.). Code 1300 also shows the remuneration under the author's order agreement, if it only provides for the transfer of rights to use created objects. But this code does not apply to benefits paid to employees whose functions include the creation of such objects. For these payments, codes 2201, 2202, 2204, 2209 are provided. |

| 1301 | Income received from the alienation of copyright or other related rights | This code is useful if an organization pays the author a remuneration for an object of intellectual property (text, image, program, etc.), the rights to which are completely transferred to the organization, including under an author’s order agreement. As in the case of code 1300, code 1301 is not used when paying remuneration to authors of proprietary works. |

| 2201 | Author's fees (rewards) for the creation of literary works, including for theatre, cinema, stage and circus | These codes are used when paying remuneration to the authors of official works, that is, employees whose responsibilities include the creation of the corresponding objects of intellectual property. |

| 2202 | Author's fees (rewards) for the creation of artistic and graphic works, photographic works for printing, works of architecture and design | |

| 2204 | Copyright royalties (rewards) for the creation of audiovisual works (video, television and cinema films) | |

| 2209 | Royalties for discoveries, inventions, utility models, industrial designs | |

| 1542 | Income in the form of the actual value of a share in the authorized capital of the organization, paid when a participant leaves the LLC | The code is used when paying the withdrawing participant the actual value of his share, the value of which is determined according to the accounting data of the LLC as of the last reporting date preceding the date of filing the application for withdrawal. |

| 2301 | Amounts of fines and penalties paid by an organization on the basis of a court decision for failure to voluntarily meet consumer requirements | This code should be used by retailers, as well as other organizations and individual entrepreneurs whose activities are subject to the Law of the Russian Federation dated 02/07/92 No. 2300-1 on the protection of consumer rights. Payments are reflected under this code only if they are transferred by court decision. In case of voluntary (pre-trial) satisfaction of the corresponding consumer claim, code 4800 is used. Code 2301 covers the amounts of fines and penalties provided for in Articles 13, 23 and 31 of the Law on the Protection of Consumer Rights. The penalty that is paid for violating the deadline for the delivery of prepaid goods, as well as for violating the deadline for completing work (rendering services) is not reflected under this code. For these amounts you need to use code 4800. |

| 2510 | Payment for the taxpayer by organizations or individual entrepreneurs for goods (work, services) or property rights, including utilities, food, recreation, training in the interests of the taxpayer | With regard to income received in kind, it is necessary to clearly monitor the essence of the corresponding payment, since there are three separate codes for this type of income. Code 2510 reflects income in the form of the cost of goods, work, services, property rights that are received by an individual from third parties and paid for by a tax agent organization. We are talking about the fulfillment by a tax agent of the obligations that an individual has to third parties. Code 2520 reflects income in the form of the cost of goods, work, services, property rights received by the taxpayer free of charge or with partial payment from the tax agent himself. Code 2530 reflects the part of wages that is paid in kind. That is, this code is additional to code 2000, through which the monetary part of the salary “passes”. |

| 2520 | Income received by a taxpayer in kind, in the form of full or partial payment for goods, work performed in the interests of the taxpayer, services rendered in the interests of the taxpayer | |

| 2530 | Payment in kind |

What is this code and why is it needed?

Since the dashing nineties, the Russian government has been consistently and methodically developing measures to withdraw the population’s income from the shadow sector. The success of these actions is obvious from their results: at the moment, the shortfall in taxes is slightly less than 5% of GDP, and twenty years ago this figure reached 17-18% of GDP.

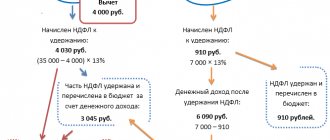

One of the reasons for this success was the tightening of control over the sphere of taxation in Russia, as well as, at the same time, liberalization in relation to tax payments themselves (for example, the use of deductions has become a common practice in the Russian Federation). Code 2002 in 2-NDFL is a consequence of that very tightening of control, since the “fragmentation” of the item of taxable income made it possible to track and divide the funds used by the enterprise to reward employees, while maintaining the final tax burden of the citizen.

What does code 2002 mean in the 2-NDFL certificate? The decryption reveals the following meaning of the code: “a production bonus received by an employee for full or partial fulfillment of the set plan.” If a certain amount is indicated in the 2-NDFL certificate in column 2002, this means that the employee was awarded a bonus by the employer for achieving certain indicators.

This category includes bonuses for:

- Fulfillment and/or overfulfillment of the production plan;

- Solving the tasks set by management regarding the volume and/or quality of finished products produced;

- Achieving target and/or additional indicators for sales of goods and services;

- For the successful implementation of a project set by management to increase the volume or quality of production.

Important: Please note that all types of bonuses included in the “2002” category are directly related to the production of goods or services of the company. A separate code “2003” has been introduced for non-production bonuses.

Now it’s clear what this code means, but why was the 2002 income code introduced in the 2-NDFL certificate? At first glance, it is not entirely clear for what purpose the codes “2002” and “2003” appeared, because the amount of taxation has not changed - it is still necessary to pay a 13% tax on most premiums exceeding the amount of 4,000 rubles.

But the meaning of the new practice becomes clear when studying the Order of the Federal Tax Service of Russia dated November 22, 2016 N ММВ-7-11/ [email protected] The document clarifies that payment under code 2002 can only be made from special-purpose funds of the organization or targeted cash receipts. At the same time, a ban is being introduced on the payment of production bonuses from the company’s total profit.

It is obvious that the state is thus trying to stop the legalization of criminal proceeds (“dirty money laundering”). Previously, money obtained by criminal means could be recorded in one way or another as a profit of the enterprise, and then transferred to the right people in the form of bonuses (through dummies). Now this has become impossible, since any payment under code 2002 directly from the profit of the enterprise is a violation of the law, and at the same time becomes a signal for the Federal Tax Service attached to the organization.

Recoding income

As already mentioned, the new codes approved by Order No. ED-7-11 / [email protected] (2015, 2721, 1401 and 1402) are valid from November 9, 2022. What if the income for which these codes are intended was paid before this date and, accordingly, was recorded in the registers using the old codes? Do they need to be recoded? In our opinion, it is not necessary.

Clause 5.8 of the Procedure for filling out 6-NDFL (approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] ) says: “In the “Income Code” field, indicate the income code selected in accordance with the “Income Type Codes” taxpayer" (clause 1 of article 230 of the Tax Code of the Russian Federation)." And paragraph 1 of Article 230 of the Tax Code of the Russian Federation states that: a) tax agents keep records of income, deductions, calculated and withheld taxes in tax registers; b) registers must contain information allowing to identify the type of income paid in accordance with the approved codes, as well as the amount of income and the date of their payment.

It follows from this that at the moment when income enters the register (on the date of its payment), it is assigned one of the approved codes. And then income with the same code is included in the income certificate (Appendix No. 1 to 6-NDFL). The new codes apply from November 9, 2022. This means that if the income was paid earlier, it had a different approved code. And there is no reason to change it, including when transferring it to the 6-NDFL calculation. Moreover, if this is done, it turns out that the income is reflected in the registers not in accordance with the approved codes, since on the date of its payment the new codes introduced by Order No. ED-7-11 / [email protected] had not yet been approved.

In conclusion, we note that correct assignment of codes to payments that an organization or individual entrepreneur makes in favor of individuals will allow you to avoid claims from tax authorities regarding the calculation and payment of personal income tax, as well as filling out the 6-personal income tax calculation and income certificates. Knowledge of the rules for coding income will simplify the work of accounting departments in calculating average earnings, as well as various compensations, benefits and other payments “tied” to this indicator.

Differences from 2003 code

We found out what income code 2002 is in 2-NDFL, but the Order of the Federal Tax Service also introduced “code 2003”. What is the difference? This category includes all types of bonuses that are in no way related to the employee’s direct work (bonus for non-productive results).

For example, column 2003 may include a one-time remuneration for employees before the holidays, a “gift” to an experienced employee before his retirement, gratitude for altruistic assistance in the organization, for example, vacations for colleagues, etc.

In addition, the difference is in the sources of payments: money can be allocated for a non-production bonus only from special-purpose funds, targeted financing funds or from additional profit of the enterprise. Again, payment directly from the company's general profits is prohibited.

To summarize, code 2003 performs the same function as code 2002 - control over the movement of corporate funds, as well as countering the criminal activities of some fictitious companies.