Who should submit form 4-TER

Only legal entities report on fuel and energy resources. The exception is small businesses. They do not submit the form, just like individual entrepreneurs.

According to standard rules, the following categories of respondents are required to report:

- bankrupt organizations at the stage of bankruptcy proceedings until they are liquidated with a corresponding entry in the Unified State Register of Legal Entities;

- branches, representative offices and divisions of foreign companies operating in the Russian Federation;

- companies that have suspended operations.

If an organization leases equipment, then 4-TER is sent to Rosstat by the company that uses this equipment for production.

You can check whether you have to submit a report in a special Rosstat service using TIN, OKPO or OGRN. You can find out about delivery obligations for 2022 after December 30, 2022.

If the organization does not have any of the events observed in the form, it is permissible to send an information letter to Rosstat or submit a blank report. The blank form must be signed, the title page and line 9990 must be filled out. There should not even be dashes or zeros in the remaining fields.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Who submits Form 4-TER and when?

Legal entities of all forms of ownership that consume fuel and energy, as well as secondary resources, report using Form 4-TER. Fuel supply and other organizations that sell fuel and energy to the population, entrepreneurs and other legal entities report using the same form. The exception is small businesses.

Reporting on this form is annual. You must report for the past year by February 16 of the following year. That is, the report on fuel and energy use in 2022 must be submitted by February 16, 2022. Report for 2022 - until February 17, 2022 (February 16 falls on a Sunday).

The place of delivery is the territorial body of Rosstat in the constituent entity of the Russian Federation in which the activity is carried out.

Submit reports to Rosstat, tax authorities and funds from the Kontur.Accounting web service! Simple accounting, auto-calculation of taxes and auto-filling of reports with sending via the Internet, salary. Get free access for 14 days

Deadlines and procedure for delivery

Respondents take 4-TER once at the end of the year. The deadline for this is set for February 16th. If this day falls on a weekend, the delivery can be postponed until the next working day.

The form must be submitted to the Rosstat office corresponding to the location of the legal entity. If the place of actual business activity is different, the form is submitted to another department.

When the legal entity’s sole proprietorships are located in the same subject, information in the form is entered for the legal entity as a whole, including separate sections. If the legal entity's OPs are located in different regions, the divisions themselves submit the form at their location. It is also possible to submit one form at once for all educational institutions from one constituent entity of the Russian Federation; for this purpose, the manager appoints a responsible person.

Instructions for filling out the report

The 4-TER form form was approved by Rosstat order No. 419 dated July 22, 2019. Detailed explanations of the lines and columns are given in Rosstat order No. 713 dated November 28, 2019.

The form contains a title page and three sections. In them, respondents tell how many resources they received and spent during the reporting year, how much was spent on production, and also report on their equipment with accounting devices.

Compile a report on source documents that reflect data on production, as well as fuel and energy use. Let's look at each section.

Title page

Legal entities submit many forms to Rosstat and all title pages are almost identical. The title plate of form 4-TER was no exception. It must indicate the reporting year, full and short name, postal address with zip code, OKPO code or identification number.

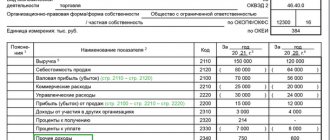

Section 1

The first section is filled out by consumers, sellers and producers of fuel and energy resources. Depending on this, the filling order differs.

Enterprises that consume, sell wholesale and retail, or act as intermediaries provide data on all fuel actually received and consumed in 2022. This includes both fuel spent on the needs of the company and sold to the population, employees, and other individuals and legal entities. Including leftover fuel.

Enterprises that simultaneously consume and produce fuel and energy reflect in the first section only the fuel that they bought from others or produced themselves and used for their own needs, sold to the population or employees. Produced resources sold to legal entities do not need to be shown in this section.

Let's consider filling out the section by column. The first three are already filled in, you will only need to write down the numerical data in the lines corresponding to the type of fuel.

In column 2, show the amount of waste petroleum products that the organization collected during the reporting year.

In column 3, show all fuel consumption, including losses and shortages. Next, distribute fuel costs by type: boiler and furnace (column 4), motor (column 5), raw materials (column 6), non-fuel needs (column 7). In this case, reflect the unallocated volumes (losses) in column 4.

In column 8, indicate the volume of fuel that was sold to other organizations. Column 9 contains fuel sold to the population and used petroleum products sent for export.

In columns 1 and 10, show the balances at the beginning and end of 2022, respectively.

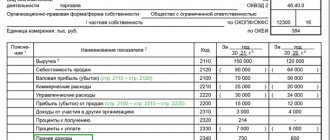

Section 2

In the second section, provide data on how many products were produced and sold, work or services performed in the appropriate units of measurement and the electricity, heat and fuel spent on them (tons of standard fuel).

In column 1, show the volume of production and work performed for the reporting year. Next, in columns 2–4, reflect the actual annual consumption of electricity and heat, as well as fuel for production.

Show the data in column 4 in tons of standard fuel. You need to convert it into a conditional one using the formula:

Volume of fuel in physical terms × K

K = Q / 7000 kcal/kg,

where: K is the conversion factor to conditional; Q—lower calorific value, kcal/kg; 7000 kcal/kg is the calorific value of 1 kg of standard fuel.

Next, column 4 needs to be deciphered by type of fuel; columns 5–27 are intended for this. Their sum for each line should be equal to column 4.

Section 3

In the third section, show how many metering devices you have and what is the total need for them, this will allow you to assess the equipment. In total, there are four types of metering devices: electricity, heat, water and gas.

In the first column, show the total need for metering devices at settlement points, including those that you already have and for which energy suppliers make payments to consumers.

In the second column, show the number of devices actually installed at the design points for which calculations are carried out. The installation time does not matter. In column 3, indicate the number of devices that were put into operation in the reporting year.

Sample filling

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Instructions for filling out form 4-TER

Instructions for preparing a 4-TER report for statistics are in Appendix No. 3 to Rosstat Order No. 461 dated July 27, 2018.

Form 4-TER includes a title page and three sections. We will tell you how to fill them out further.

Title page

The simplest element of any statistical form.

- Indicate the full name of the organization from the constituent documents and its short name in brackets.

- In the “Postal Address” line, indicate the legal address with a postal code, and if it does not coincide with the actual address, enter the actual location.

- In the code part, indicate the OKPO and identification number for the units.

Section 1. Remains, receipt, consumption of fuel and heat energy

The first section contains information on all fuel received and consumed by the organization in the reporting year, as well as on its balances. Fuel sold to the public, employees and other organizations is also reflected in this section.

Enterprises that consume fuel and energy and simultaneously produce them provide data only on the fuel produced, intended for their own needs and sales to the public/employees. Fuel sold to other legal entities is not included in the section.

In the first column, indicate the remaining fuel at the beginning of 2022, and in the second column - the amount of fuel received in the reporting year - purchased externally and produced independently.

In the third column of the first section, indicate all fuel/energy consumption at the enterprise, including losses and shortages. In the total volume of consumption, data on fuel consumption is highlighted:

- boiler and furnace fuel (column 4);

- motor fuel (column 5);

- raw materials (column 6);

- for non-fuel needs (column 7).

In column 8, indicate the volume of waste petroleum products sold to other legal entities and oil depots. If you are engaged in exporting fuel, reflect the data on it in column 9.

Enter the balance at the end of 2022 in column 10.

Section 2. Actual consumption of fuel and energy resources

The second section contains data on fuel consumption in tons of standard fuel.

To convert fuel into conventional fuel, multiply the volume of fuel in physical terms by K - the actual thermal equivalent.

When filling out column A of this section, be guided by the list of types of products, works and services that consume fuel and energy. The list is presented in the appendix to form 4-TER.

In column 1, provide data on the heat and electricity supplied from the buses and collectors of power plants, except for losses and expenses for own needs. Energy received from someone and sold to consumers is not included in this column.

In column 2, indicate electricity costs for your own needs for electricity production and heat supply. Data on actual fuel consumption in power plants for the reporting year are given in conventional terms in columns 5–27.

Submit reports to Rosstat, tax authorities and funds from the Kontur.Accounting web service! Simple accounting, auto-calculation of taxes and auto-filling of reports with sending via the Internet, salary. Get free access for 14 days

How to pass 4-TER through Extern

The form can be submitted in one of two ways: paper or electronic. To submit a paper form to Rosstat, you will need to go to the post office, hire a courier, or personally visit a territorial office. Everything is complicated by the fact that if errors are found, the form will be returned to you - you will have to correct it and submit it again.

It is more convenient to submit reports electronically. This can be done right at your computer, all you need is an electronic signature. Extern helps to submit reports to regulatory authorities: Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat, RPN and FSRAR. The service also includes built-in automatic checking of reports before sending and correspondence with controllers - all problems can be solved remotely. Extern gives a free “Test Drive” for 14 days.

To send a report, log in to the system and go to the “Rosstat” tab. Download the finished report or fill out 4-TER in the system interface. Some fields are filled in automatically, according to the data entered during registration. Before submission, the report will be automatically checked against the control ratios established by Rosstat.

Sign the report electronically and send it to the department. Complete instructions for submitting reports.