When an employer pays insurance premiums, arrears, penalties, and fines to the Pension Fund, he may experience overpayments. There are options. You can offset this overpayment, or you can return it. To offset, you will need to fill out and submit Form 22 of the Pension Fund to the Fund branch. But in order to claim the excess transferred amount of contributions, the policyholder must contact the Pension Fund of the Russian Federation with a corresponding application for the return of this amount in accordance with the established Form 23 of the Pension Fund of the Russian Federation.

How to fill out Form 23 PFR

Form 23 of the Pension Fund of the Russian Federation is now in use; it has been in force since February 2016 and is called “Application for the return of the amount of overpaid insurance premiums, penalties, and fines.” It was approved by resolution of the Pension Fund Board of December 22, 2015 No. 511p.

Funds that were overpaid by an organization (IP) to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund can only be returned upon the payer’s statement about the resulting overpayment. If a fund employee has identified a paid surplus, the Pension Fund must inform the policyholder about this within 10 days. After which a joint reconciliation is carried out, in which each party reflects its data. Based on its results, the overpayment will be confirmed, or an updated calculation will be required.

To return overpaid funds to the Pension Fund, you must prepare an application in paper or electronic form by filling out Form 23 of the Pension Fund (the form can be downloaded below).

An application is submitted to the territorial branch of the Pension Fund of the Russian Federation at the place of registration of the payer of contributions within three years from the date of payment of the amount that resulted in the overpayment. In turn, fund employees make a decision on this application no later than ten working days from the moment they receive an application for the return of the overpaid amount. If the decision is positive, the excess amount will be returned within 1 month. If the Pension Fund fails to comply with the established deadlines, the payer must be returned the amount of the overpayment along with the accrued percentage of the penalty for each day of delay.

Refund of fees without trial

The Federal Tax Service will write off the debt on insurance premiums of individual entrepreneurs who were accrued amounts based on 8 minimum wages (Federal Law dated December 28, 2017 No. 436-FZ). But for this you need to submit reports for previous periods (if not submitted).

Pension Fund specialists are recommended to reread the contributions of entrepreneurs who have applied to the Pension Fund with a corresponding application.

If the branch of your Pension Fund refuses to pay overpaid contributions, you will have to go to court - judges en masse make positive decisions in such cases in favor of individual entrepreneurs.

An explanation in any form must be attached to the application, indicating the reason for the overpayment. It is necessary to provide calculations of payment based on the difference in income and expenses and it is necessary to indicate court decisions in such cases. Be sure to attach copies of tax returns for the specified period to these documents.

It will take ten days for the Pension Fund to review the application, which will result in either a refund of the overpayment or a denial of the claim. If the pension fund agrees, the money will be transferred to your account by the tax service (from 2022, contributions will be managed by the Federal Tax Service), a positive decision will be sent to them the next day.

If the Pension Fund refuses to return the overpayment, then you must go to court.

If there is a debt to the Pension Fund

If an organization or individual entrepreneur has a debt to the Pension Fund, it will be repaid from the overpaid amount. That is, the Fund will first reconcile your payments, then the amount of arrears will be deducted from the amount of your overpayment. And the remainder (if anything remains) will be returned to the policyholder.

However, you will not always get your money back. It is impossible to return the surplus if it was deposited and paid in the RSV-1 form and distributed to the individual accounts of employees. In this case, an offset may be made against future payments by the policyholder.

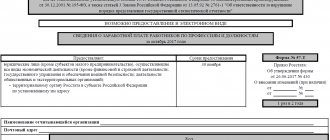

In Form 23 of the Pension Fund of the Russian Federation, the form contains the payer’s data, the name of the overpayment amount and the details for which the refund will be made.

Form 23-FSS. Application for refund of overpaid insurance premiums

“Form 23-FSS RF” is a special unified standard document that is filled out in cases where an enterprise or organization wants to return overpaid funds to extra-budgetary funds (Pension Fund, Social Insurance Fund, etc.). Such situations are not uncommon; as a rule, this occurs as a result of the “human factor”: accounting errors, incorrect calculations, or simply inattention, as well as failures in accounting programs.

What happens if you don't return the money?

In cases where legal entities or individual entrepreneurs do not require the return of excessively transferred funds, employees of extra-budgetary funds can, at their discretion, independently decide to credit such amounts to the transfer of future contributions or to pay off existing debts and fines with them.

Should I return the entire amount?

Sometimes the overpayment is quite significant, but the payer does not feel a great need for a full refund.

A completely reasonable question arises: is it possible to partially return the paid amount or distribute it in some non-trivial way. The answer is simple: yes, the law in no way limits the right of the payer to dispose of overpaid funds as he pleases.

For example, you can demand the return of only a certain percentage of the amount, and use the rest to pay off arrears, fines and penalties, you can set aside part of it for future payments, etc.

What to do if the money has already been credited by fund employees

If, before the application was received, the money had already been used to cover fines and penalties, then it will be possible to return only the amount that turns out to be the difference between the excessively overpaid funds and the money spent for these purposes. If the funds were offset against future payments, then there should be no problems with their full return.

Deadlines for the return of overpaid funds

According to the law, the possibility of returning money paid in excess is strictly limited to a period of three years. Applications received after this will not be accepted.

If the application arrived in a timely manner and the facts indicated in it are true, then the return of funds must occur within a month after its receipt by the employees of the extra-budgetary fund with which the incident happened. At the same time, if the fund violates its obligations and is overdue for the return of funds, then by writing a corresponding statement, for each day of delay, you can demand interest in the amount of 1/300 of the refinancing rate (if representatives of the organization refuse to pay voluntarily, you can safely go to court ).

An important clarification: if the fact of overpaid contributions was revealed during reconciliation, then the period for their return is counted from the date of signing the reconciliation act.

Rules for filling out form 23-FSS of the Russian Federation

There are a few important things to keep in mind when filling out the form.

- Firstly, any errors when specifying the organization’s details can lead to very unpleasant consequences, so you need to pay especially close attention to them.

If everything is more or less clear with the TIN, KPP and other parameters, then many people have difficulty with the line called “OKATO code” (stands for All-Russian Classifier of Objects of Administrative-Territorial Division). Today, it is necessary to put the OKTMO code in this line (in other words, the All-Russian Classifier of Municipal Territories), which can be found, for example, on the tax service website.

The application is drawn up in two copies, one of which is transferred to the specialist of the extra-budgetary fund, and the second, as potential evidence, remains in the hands of the payer. In this case, the employee of the institution is obliged to stamp both documents.

Below is an example of filling out Form 23-FSS of the Russian Federation - Application for the return of amounts of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation.

Instructions for filling out Form 23-FSS

The second part of the document concerns the actual funds. First, you need to enter the required amounts in the appropriate boxes. Then enter the details of the organization’s bank account, as well as the OKATO code (explanations for it were given above)

The line entitled “Personal Account Number”, marked with an asterisk, is filled in only by those organizations that have a personal account with the Federal Treasury.

In conclusion, the document must be signed by the head of the organization, as well as the chief accountant.

If the director simultaneously performs the functions of the chief accountant, then he must again sign in the second line.

The telephone number next to each name is indicated in case the institution's employees have any questions for the applicant. Lastly, the date and stamp (if any) are placed on the document.

If the application is written by a person who is a representative of the applicant, then he needs to fill out the lines below, including indicating personal passport details and the document on the basis of which he is acting.

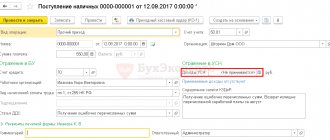

Sample of filling out Form 23 of the Pension Fund of Russia

Form 23 PFR

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to follow

Since March 3, 2022, Resolution of the Board of the Pension Fund of January 21, 2020 No. 46pa has been in force, which approved the Administrative Regulations for the provision of information about the labor activity of a registered person contained in his individual personal account in the personalized accounting system of the Pension Fund of the Russian Federation.

The Pension Fund of Russia issues such information on the STD-PFR certificate form (approved by Order of the Ministry of Labor of Russia dated January 20, 2020 No. 23n, Appendix No. 2). Its full official name is “Information on labor activity provided from the information resources of the Pension Fund of the Russian Federation (STD-PFR).”

To obtain STD-PFR, you need to make a request. Its form is given in the Appendix to the said Regulations.