What is meant by a contract

A contract is understood as the performance of certain works by the contractor and payment for them by the customer (Article 702 of the Civil Code of the Russian Federation).

The parties to the contract can be both individuals and organizations. Particular attention is paid by the inspection bodies (Federal Tax Service, Social Insurance Fund, Pension Fund of the Russian Federation, labor inspectorate) to contract agreements in which the contractors are individuals, and the customers are organizations or individual entrepreneurs. If a contract is drawn up incorrectly, inspection services may classify it as an employment contract, which will entail additional charges of insurance premiums and the collection of fines for misrepresentation of information in reporting.

Read about the specifics of concluding contract agreements with individuals and paying insurance premiums on them in the article “Contract agreements and insurance premiums: nuances of taxation .

When does SZV-M need to include information about employees working under a contract?

SZV-M contains information only about those individual contractors from whose income the customer pays insurance premiums (subclause 2.2 of Article 11 of the Law “On individual (personalized) registration in the compulsory pension insurance system” dated 04/01/1996 No. 27-FZ) .

Based on the above, there is no need to include in the SZV-M information on the following employees performing work under a contract:

- Individual entrepreneurs, since they independently pay insurance premiums for themselves (subclause 2, clause 1, article 419 of the Tax Code of the Russian Federation).

- Foreign citizens and stateless persons working under a contract outside the Russian Federation (clauses 5 and 7 of Article 420 of the Tax Code of the Russian Federation).

- Citizens who are studying full-time in institutions of secondary and higher education and receiving payments for work in a student group (subclause 1, clause 3, article 422 of the Tax Code of the Russian Federation).

Information on other individual contractors must be present in SZV-M.

Important! Starting from the report for May 2022, the new form SZV-M is in effect. You can download it on our website, and you can read more about the changes in it here.

A sample of filling out the SZV-M using the new form can be viewed and downloaded in ConsultantPlus, having received a free trial access:

Indication of GPC agreements in SZV-M

All employers (both legal entities and individual entrepreneurs) must submit to the SZV-M Pension Fund every month, reflecting in it, incl. and individuals on GPC agreements. But it is required to indicate those individuals from whose payments insurance premiums for compulsory health insurance are paid (clause 2.2 of Article 11 of Law No. 27-FZ of April 1, 1996).

Insurance premiums for compulsory insurance are not calculated from all payments under GPC agreements. They are subject to the following payments:

- when performing work;

- when providing services;

- by author's orders;

- when transferring copyrights;

- when granting rights to use works.

Thus, if insurance premiums are not calculated from payments under the GPC agreement, then information on it is not reflected in the SZV-M. As an option, this is renting a vehicle or premises from an individual.

In what month should information on individual contractors be reflected in SZV-M?

In a contract, unlike a labor contract, accrual and payment for contract work are carried out after its completion. In some cases, if there is a corresponding clause in the contract, an advance is paid.

The period of work performance and the period of accruals (payments) under the contract may differ significantly. What to do in such cases? In what month should information about individual contractors be included in the SZV-M?

Clause 14 of the Procedure for filling out the SZV-M report (approved by PFR Resolution No. 103p dated April 15, 2021) states that the section “Information about insured persons” reflects information about insured persons who are subject to compulsory pension insurance in accordance with Art. 7 of the Law “On OPS” dated December 15, 2001 No. 167-FZ. Among such persons, those working under the GPA for the performance of work and provision of services are also named.

At the same time, when filling out the SZV-M, you need to focus specifically on the validity periods of the construction contracts (look at when the contract is concluded, is valid and ceases to be valid). The period of accruals (payments) is not important.

Example

Bar-Men LLC decided to use the services of private craftsman D. D. Danilov for the manufacture and installation of unique bar furniture. An agreement was concluded for the performance of work by the contractor dated October 30, No. 14, according to which the period for completing the work (validity of the contract) was set from November 5 to December 29. The work completed by Danilov within the specified period was accepted by Bar-Men LLC under the acceptance certificate dated January 9 of the following year and paid for on February 1.

Information on Danilov must be included in the SZV-M reports for November and December - the months of work performed under the contract. SZV-M reports for January and February of the next year do not include information on Danilov.

IMPORTANT! If the contract does not specify the date of commencement of work (beginning of the contract), then the date of conclusion (signing) of the contract is taken as the starting date of the contractual relationship (Article 425 of the Civil Code of the Russian Federation).

Let’s assume that in the example discussed earlier, the start of contract work (November 5) is not indicated. This means that the contract period begins on October 30. In this case, the customer of Bar-Men LLC will have to include information on D. D. Danilov in the SZV-M not only for November, December, but also for October.

A line-by-line algorithm for filling out the SZV-M form is given in the Ready-made solution from ConsultantPlus. Get free access to the system and proceed to expert explanations and completed sample.

When is it necessary to indicate information about contractors in SZV-M?

A special feature of the contract is the payment to employees after completion of the work. In this case, there is no need to fulfill the requirements of Art. 136 of the Labor Code of the Russian Federation, which states that wages are paid at least every half month.

By mutual agreement between the customer and the contractor, it is possible to determine the advance payment.

Most often, the date of completion of work and the date of payment do not coincide. The question arises of registering contractors in SZV-M.

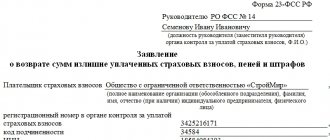

The SZV-M form was approved by Resolution of the Board of the Pension Fund of Russia dated February 1, 2016 No. 83p “On approval of the form “Information about insured persons”. The section “Information about insured persons” contains information about insured persons - employees with whom employment contracts, civil law contracts, the subject of which is the performance of work, the provision of services, author’s order contracts, contracts for alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements granting the right to use works of science, literature, art

| No. | Last name, first name, patronymic (if any) of the insured person (filled out in the nominative case) | Insurance number of an individual personal account (required to be filled in) | TIN (filled in if the policyholder has data on the individual’s TIN) |

Thus, in the SZV-M it is necessary to indicate information about the contractors with whom the contract has been concluded, is currently in force or has ceased to be in force during the reporting period. In this matter, it is necessary to be guided solely by the duration of the contract.

Example:

ABV LLC entered into a contract with a high-altitude climber to clear snow from the roof. The contract was concluded on 01/20/2022. The work period was from 01/22/2022 to 02/04/2022. The work was completed on 01/29/2022, for which both parties signed a Certificate of Completion. Payment was made on January 31, 2022.

Information about the contractor must be included in the SZV-M report for January 2022 and February 2022.

In accordance with Art. 425 of the Civil Code of the Russian Federation, if the start date of work is not specified, the contract comes into force and becomes binding on the parties from the moment of its conclusion.

“1C”: how to correctly reflect data on contractor workers in SZV-M

When generating SZV-M in 1C, information about employees registered under a contract should be included in the report automatically.

How to find and fill out SZV-M in 1C, read the article “How to generate a SZV-M report in 1C (nuances)?” .

If data on individual contractors is not included in SZV-M, check the following sections in “1C”:

- Directory "Employees".

Individual contractors for whom the organization (IP) pays insurance premiums and personal income tax must be listed in this directory. When individual contractors are entered into the “Counterparties” directory, information on them will not be included in the SZV-M. In “1C:8”, information about individual contractors is entered into a separately formed “Contractors” group in the “Employees” directory and the “Apply for a job” link is not filled out in the employee’s card. To reflect accruals (payments) in favor of individual contractors, an additional type of accrual “Payments under contract agreements” is created in the “Accruals” directory. In “1C:ZiK” it is easier to identify individual contractors: when entering information about a new employee, check the box “Employee under a civil law contract” and then fill in the personal data of the contractor and information about the contract with him.

- Personal data of employees - SNILS. If the employee does not have SNILS, information on him will not be included in SZV-M. If there are a large number of employees, the presence of SNILS is checked using the “List of Employees” report.

For information on how to submit SZV-M if an individual does not have a SNILS, read the material “If there is no SNILS - how to submit a SZV-M report (nuances)?”

The procedure for issuing SZV-M to employees working under a contract

On the day of completion of contractual obligations under the work contract (the last date of validity of the contract), the customer is obliged to generate a SZV-M report, transfer it to the individual contractor and receive from him written confirmation of receipt of the report (paragraph 3, clause 4, article 11 of Law No. 27- Federal Law).

In the section “Information about insured persons” of the SZV-M report submitted to the individual contractor, only his personal information (full name, SNILS, INN) is entered. For the rest of the insured employees of the organization (IP), information is not indicated in the SZV-M report under consideration, since they relate to personal information, the disclosure of which may lead to a fine (Articles 3, 7, 24 of the Law “On Personal Data” dated July 27, 2006 No. 152-FZ).

Pension legislation does not provide for fines for failure to issue SZV-M to employees working under a contract. But the possibility cannot be ruled out that an employee who has not received the SZV-M may file a complaint with the labor inspectorate (prosecutor's office, court). The consequence will be an extraordinary inspection of the organization (IP) by the labor inspectorate or recovery through the court of moral damages in monetary form in favor of the employee who did not receive the SZV-M report due to him.

Information about individual contractors is not included in SZV-M: consequences of violations and ways to correct them

What to do if the customer forgot to enter information about individual contractors into SZV-M or entered it in the wrong period? Let's consider the consequences of such violations and the sequence of actions to eliminate them using the example of frequently occurring situations:

- The SZV-M report was not submitted because the customer did not know (forgot) about the obligation to report on employees working under a contract, and there are no full-time employees.

If a violation is detected (independently or by a unit of the Pension Fund), you must submit an SZV-M indicating information about the insured persons with the “Original” form type.

In this case, a fine of 500 rubles will be imposed on the employer. for each insured employee-contractor for whom the SZV-M has not been submitted (paragraph 4 of Article 17 of Law No. 27-FZ of April 1, 1996). A fine can be avoided if the violation is identified independently and the report is submitted before the deadline set for its submission.

Is it possible to reduce the fine if the report is not submitted due to the accountant’s illness? Find out here.

- The SZV-M report was submitted on time, but the customer did not include information about the individual contractors.

If incomplete information is found in SZV-M, a supplementary report is submitted with information only on “forgotten” contractor workers.

If a violation is independently identified and a supplementary SZV-M report is submitted to the Pension Fund and the deadline for its submission is met, no fine will be collected. If the supplementary SZV-M report is submitted later than the established deadline, the fine will be 500 rubles. for each insured person (paragraph 4, article 17 of law dated 01.04.1996 No. 27-FZ).

If a violation is detected by the Pension Fund of Russia, a fine of 500 rubles will be assessed. due to the indication in SZV-M of incomplete information (paragraph 4 of article 17 of law dated 01.04.1996 No. 27-FZ).

- The SZV-M report was submitted on time, information about individual contractors was included, but in the wrong period.

For periods in which individual contractors are erroneously included in the SZV-M, a report of the “Additional” type is submitted with information about previously not specified employees included in it.

The fine is calculated in the manner specified in clause 2.

See also “How and what errors can be corrected in the SZV-M report.”

- The SZV-M report was submitted on time, information about individual contractors was entered, but errors were made when providing information (incorrect or incomplete information on full name, SNILS or Taxpayer Identification Number).

For contractors whose information contains errors (inaccuracies), an SZV-M with the “Additional” type is submitted, indicating the correct information.

The procedure for calculating the fine is similar to the procedure described in clause 2.

Whether a typo in an employee’s personal data is considered an error for which a fine is imposed, read here.

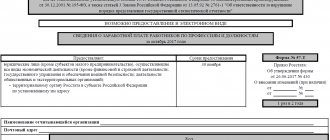

Liability if the GPC agreement is not indicated in the SZV-M

If the individual with whom the GPC agreement was drawn up is not in SZV-M, fines are possible. What is their size and how to avoid them - in the table:

| Violation | Fine | How to fix |

| SZV-M has not been submitted to the director, there are no other employees |

| Send reports with code “ref” to the director |

| SZV-M lists employees only under employment contracts, and employees under GPC contracts are not included | Send reports with the code “additional” only to workers not included under GPC agreements | |

| In SZV-M, employees under GPC contracts are indicated in the wrong period | Send reports with the code “cancelled” for erroneous periods for employees under a GPC agreement Submit reports with the code “additional” for the correct periods for employees under a GPC agreement | |

| Incorrect TIN, SNILS or personal data | Send reports with the code “cancel” for the incorrect period for employees for whom errors were identified Send reports with code “additional” for the same period for employees for whom errors were identified |

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Results

In addition to employees registered with an organization (IP) under an employment agreement, SZV-M must also include workers hired under contract agreements, under which organizations (IP) accrue (pay) mandatory insurance contributions. Information on them is entered into the report only in those months in which the contract was valid for at least one day. Failure to enter information on contractor employees in SZV-M entails the collection of a fine by the Pension Fund.

Sources:

- Civil Code of the Russian Federation

- Tax Code of the Russian Federation

- Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”

- Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”

- Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

About the report

SZV-M is handed over monthly to the Pension Fund of the Russian Federation by all employers for employees with whom an employment contract or GPC agreement has been concluded.

The deadline is the 15th of the next month. The report includes information about employees - full name, INN and SNILS. It is needed so that the pension fund promptly recalculates pensions for pensioners in the event of dismissal or hiring. Despite this, SZV-M must include the data of all employees, regardless of age.