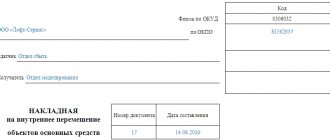

Form OS-2. Invoice for internal movement of fixed assets

When transferring property related to fixed assets within one organization, for example, from one division to another, it is necessary to fill out an invoice for the internal movement of fixed assets in the OS-2 form.

To obtain a completed completed OS-2, as well as a blank version, follow the link at the end of the page.

It is necessary to draw up a separate invoice form OS-2 for each fixed asset item that is moved within the departments and structural units of one organization. The employee who is directly involved in the transfer of an object to another department is responsible for completing the OS-2 form.

The invoice form OS-2 must be filled out in triplicate. The first copy is signed by the party who accepts the property. It is intended for the financially responsible person who made the transfer. The representative of the party that accepts the fixed asset also receives its own version of the invoice in the OS-2 form with verification from the transferring party. The employee who will enter the necessary information for the OS-6 inventory card must take the third copy of the invoice, with the signatures of both parties, to the accounting department.

Form OS-2. Invoice for internal movement of fixed assets

The invoice for the internal movement of fixed assets, form OS-2, is intended to document the actual movement of any fixed assets of the organization. This can be interaction between workshops, sections, departments. The main thing is that both sides of the process (receiving and receiving units) belong to the same company.

The fixed assets of an organization may include buildings, various equipment, machines, instruments, computer equipment, inventory, various tools, livestock, etc. All this may well be transferred from one workshop or site to another.

If the useful life of different parts of one building is different, then it is worth dividing it into two independent objects and describing it separately.

Form OS-2. Filling out an invoice for internal movement of fixed assets

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Both sides of the OS-2 form must be filled out. The front side of the OS-2 form must contain the full name of the organization that owns the fixed asset; the structural units and their full names that take part in the transfer are immediately indicated.

On the OS-2 invoice form, the date of the transfer is indicated and it receives a serial number.

The name of the fixed asset item that is subject to movement between departments is indicated in the table. They immediately enter data regarding the date when it was purchased (produced or built), the number of such objects, as well as their price. Below, below the table, general information about the status of the fixed asset or assets involved in the transfer process is briefly listed.

When the invoice form in form OS-2 is completely filled out, representatives of both parties sign it. The representative of each party enters information about the position held, personnel number, full name, signature, date. After the accountant makes a mark on the inventory card, he signs the invoice at the bottom of the form.

Filling algorithm

The invoice is filled out on both sides. It consists of a header on the title side, a table of seven columns that continues on the reverse side, as well as a place for a brief description of the transferred object and signatures of the responsible persons.

In the upper right corner of the title part of the document there is a link to the Decree of the State Statistics Committee of 2003, which approved this form as mandatory. After 10 years, it became a recommendation, but its use continues.

At the top of the invoice, the OKUD and OKPO forms and the name of the company within which the movement takes place are indicated. The unit from which the object is being withdrawn is indicated first (it is called the “delivery”). The recipient department is indicated below.

Attention! The invoice must be filled out by the delivery department.

After the names of the departments, the name of the document, the date of preparation of the paper and the assigned number are written.

Below is a table with:

- number;

- a description that includes the date of manufacture (or construction), full name, inventory number;

- number of transferred objects in pieces;

- cost;

- results.

After the table, space is left to describe the object, its technical and other characteristics. When filling out, these lines cannot be left blank.

You can mention the condition (good, excellent, satisfactory), existing defects (scuffs, chips, etc.), and describe the packaging. If warranty cards or instructions are included, these are also included.

At the end there should be signatures (deciphered) of the persons who made the delivery and acceptance. The fact that information about the movement was entered into the accounting book is confirmed by the chief accountant (or simply the accountant who carried out the data transfer).

Important! When putting signatures, mentioning the positions of persons is mandatory.

Nuances of filling

Rows in the table should not be left empty. If a document is generated electronically, then unfilled sections of the document are simply deleted. If the paper is already printed, they are crossed out. Corrections to the invoice are not recommended. But if a mistake was made, it is corrected by a longitudinal strikethrough and the inscription “Believe the corrected one.” Moreover, next to this inscription there must be signatures of all persons who are also signed at the end of the document: the chief accountant, the handing over and receiving persons.

Control

If during the inspection it is discovered that the object is under the jurisdiction of one division, but is registered with another, then the organization will face administrative liability in the form of a fine.

If a violation is detected for the first time and it does not lead to an understatement of taxes, then the company can get off with a fine of 5 thousand rubles.

If during the audit it is discovered that there is no invoice for the movement of fixed assets, form OS-2, and this fact will underestimate the taxes due from the organization, then less than 15 thousand rubles. There is no penalty for such a violation. Moreover, an amount of 10% of the total tax not paid for this reason may be assigned (but this amount will still not be less than 15 thousand rubles).

Using the OS-2 form, an invoice is filled out for the internal movement of fixed assets - for example, from one division of the company to another. The unified form of the OS-2 form was approved by Decree of the State Statistics Committee of January 21, 2003 No. 7. You are not obliged to use only unified forms - since 2013, enterprises have the right to develop their own forms of documents. The main thing is that the documents you develop contain all the required details. If you decide to develop the form yourself, you can use the OS-2 form as a sample to fill out, shortening the form or vice versa, adding the necessary details to it.

Why do you need the OS-2 form?

Any movement of the OS requires activation.

This applies not only to the transfer of fixed assets from one organization to another, but also to the transfer of assets between internal divisions of the company. If you transfer fixed assets between departments, sites, workshops, divisions and warehouses, draw up an official transfer certificate. For internal movements, consignment note OS-2 is usually used. This is a unified form from an album of primary forms approved by Decree of the State Statistics Committee No. 7 of January 21, 2003. The act is drawn up every time there is a transfer of funds within the company, that is, with every local transfer operation.

The invoice is issued by the department or division that issues the fixed assets. This primary accounting register is the documentary basis for conducting accounting operations and filling out inventory books, cards and forms OS-6, 6a and 6b.

IMPORTANT!

The transfer of fixed assets between the parent organization and a separate division or between two separate divisions is formalized by the OS-2 act.

Operations to move property assets between separate areas are not sales, but internal movement: at the time of transfer of fixed assets, the transfer of ownership does not take place. If the department is not listed on a separate balance sheet, then issue a local transfer of the OS-2 invoice.

If a separate division is on a separate balance sheet, record the transfer of the main property in a form developed individually for this procedure. Include historical cost and accumulated depreciation information on the invoice. Together with OS-2, submit the initial asset acceptance certificate, inventory card and technical documents for the product.

Invoice for internal movement of fixed assets

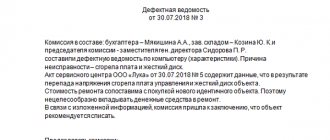

In what case might you need to register the transfer of a fixed asset? For example, you decide to repair or reconstruct a fixed asset yourself and for this you need to move the object to another premises.

In this case, you will need to complete the following documents:

- draw up a report on the defects that were identified in fixed assets;

- the manager must issue an order to eliminate the detected malfunctions;

- To register the move, fill out an invoice for internal movement.

Some people mistakenly believe that the gratuitous transfer of a fixed asset can be issued with an invoice in the OS-2 form, but this is not so. In this case, the transfer of a fixed asset must be formalized by an act of acceptance and transfer of the object in the OS-1 form, an invoice in the OS-2 form is filled out by enterprises only for internal movement.

Information that a fixed asset item has been moved to another division of the organization must also be included in the documents that are filled out in the company to record the availability and movement of fixed assets. The role of such a document can be, for example, an inventory card for recording fixed assets according to the unified form No. OS-6, if we are talking about a group of objects - a card for group accounting of fixed assets (form No. OS-6a), an inventory book for accounting for fixed assets ( Form No. OS-6b).

Invoice for internal movement of fixed assets

At enterprises that have separate divisions, situations often arise when it is necessary to move property between these divisions. Even more often at enterprises there is a change of financially responsible persons.

Consequently, the transfer of assets belonging to the previous financially responsible employee to the new employee is inevitable. Any business action must be documented.

In order to record the movement of fixed assets within the company and subsequently reflect this operation in accounting, an invoice for the internal movement of fixed assets is used.

For this invoice, there is a unified form - No. OS-2, approved by Resolution of the State Statistics Committee of the Russian Federation No. 7 of January 21, 2003. In 2013, the Federal Law “On Accounting” No. 402-FZ was adopted. With the entry into force of this law, the use of unified forms became optional.

The accounting department of an enterprise can itself prepare a document recording the fact of the movement of property. The optimal basis for this document is the unified form OS-2.

A fundamental requirement for the prepared form: it must include all the details listed in Federal Law No. 402-FZ.

When is the OS-2 consignment note used?

Let's consider when you need to use an invoice for the internal movement of fixed assets.

- Firstly, as mentioned above, when moving property between departments, i.e. within the enterprise;

- Secondly, when changing the financially responsible person;

- Thirdly, when transferring property for repair, modification, reconstruction or modernization to a specialized department of the organization.

Rules for drawing up the OS-2 form

- The financially responsible person of the department in which the donated property is stored is responsible for drawing up the invoice;

- Three copies of the invoice are issued: the first is for the employee of the transferring party responsible for the safety of the property, the second is issued to the responsible employee of the receiving party, the third is submitted to the accounting service for timely recording of the fact of the business transaction;

- In all three copies of the invoice, the signatures of the persons of both parties involved in the movement (deliver and recipient) are affixed;

- An invoice must be prepared for each fact of internal movement of fixed assets.

An invoice in the OS-2 form is used only for internal transfer of values, i.e. within the organization.

How to fill out the OS-2 invoice

If you are using the OS-2 form, keep in mind that changes cannot be made to the unified forms, and all required fields must be filled out. The invoice OS-2 is double-sided. The name of the company is written in the header on the front side.

The line “deliver” indicates the division of the enterprise on whose balance sheet the transferred property is stored. In the “recipient” line, the division that receives the property on its balance sheet is registered. In addition, you must fill out the form code according to OKUD (0306032) and the organization code according to OKPO.

Mandatory details are the number and date of the document.

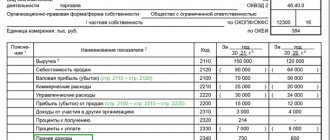

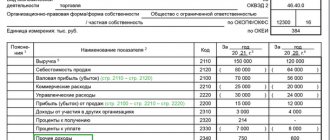

The invoice in form OS-2 consists of 7 columns:

- Number in order. When several different valuables are moved at the same time, data about them is written down line by line in order, one below the other;

- Name of the fixed asset item. The name of the property is written down according to the entry in the inventory card;

- Date of acquisition (year of manufacture, construction) of the fixed asset;

- Inventory number of the fixed asset item;

- Quantity. The quantity of property to be rented is specified;

- Unit cost. The price of one unit of fixed assets is written down in rubles;

- The cost of everything. The total value of assets is recorded in rubles.

Be sure to cross out empty lines!

Using the “note” line on the back of the form, it is necessary to characterize the moving objects of fixed assets (appearance, equipment configuration, its actual wear and tear, etc.).

The financially responsible employee of the giving party signs in the “Passed” field, and the financially responsible employee of the acquiring party signs in the “Accepted” field. The positions and personnel numbers of the signing employees must be written down in accordance with the staffing table.

As you know, the main accounting register for fixed assets is the inventory card. All information about the fixed asset object is entered there. Data on internal movements are noted on the basis of the invoice for the internal movement of fixed assets.

The inventory card must include:

- Date of;

- Number of the invoice according to which the mark was made.

In turn, a note is placed on the invoice that all the necessary entries in the card have been completed.

The movement of fixed assets within a company is an essential fact of economic activity, which is subject to mandatory documentary recording. The use of an invoice in the OS-2 form significantly simplifies the accounting of the movement of enterprise assets. In addition, the safety of property is ensured.

Source: //buh-spravka.ru/buhgalterskij-uchet/pervichnyj-uchet-dokumentooborot-arhiv/nakladnaya-na-vnutrennee-peremeshhenie-osnovnyx-sredstv.html

Unified form OS-2. Sample filling.

The invoice for internal movement OS-2 is filled out in 3 copies, one of which is kept by the person who completed the movement, the second is intended for the receiving party, and the third must be transferred to the accounting department.

In the header of the form on the front side of the invoice for internal movement, fill in the name of the organization, the deliverer and receiver of fixed assets, the form code according to OKUD, the code according to OKPO, the document number and the date of its preparation.

The main part of the OS-2 act consists of a table that contains 7 columns:

- OS number in order;

- OS object name;

- date of purchase;

- inventory number;

- number of objects;

- unit cost;

- cost of everything.

Below the table there are lines to characterize the technical condition of the object. Next come the signatures of the person handing over and receiving the object: position, signature and transcript of the signature, personnel number, date. The unified form OS-2 is signed by the chief accountant.

In order to quickly and without errors fill out the invoice according to form OS-2, download and study the sample filling:

invoice for internal movement:

When is the unified form OS-2 issued?

If a fixed asset is transferred from one department to another within an organization, it is required to fill out an internal transfer invoice.

This is necessary for accounting of the company’s property, which is carried out by the accounting department. For example, equipment needs to be moved from one production facility to another.

On the day of moving the asset, the responsible employee of the transferring department issues an invoice. Such a document is drawn up for each moved object.

An employee participating in an internal transfer of a fixed asset is obligated to complete such a document.

The information used in the invoice is used for the inventory book or card issued for the object being moved.

After signing the invoice and moving the object, the receiving party becomes responsible for the received fixed asset.

If the asset is moved without documentary support, it will remain under the responsibility of the transferor.

Why do you need the TORG-13 form?

This invoice is important for the enterprise, especially in the case when the movement process is carried out with the help of third-party forces transporting cargo from one structural unit to another.

The main purpose of the TORG-13 consignment note is to confirm the fact of departure of goods or containers from one place and their arrival in another place. A correctly drawn up and certified form allows you to carry out the write-off and capitalization procedure in accounting.

In addition, the invoice performs an additional function - it allows you to justify to the Federal Tax Service the costs of moving inventory or containers from one department to another, when additional forces are involved for this purpose - transport companies.

Costs can be caused by the process of loading, unloading, and transportation. To take these expenses into account when calculating income tax, you need a documentary justification, which will be the invoice for internal movement TORG-13.

Arbitration practice shows that an invoice, drawn up correctly and signed by representatives of the sender and recipient, can confirm the existence of expenses. Additionally, the invoice can be supported by such documents as an act of transport services provided, a transport expedition agreement, and a waybill.

Recommendations for filling out TORG-13

The standard invoice form for the internal movement of goods was put into effect by Resolution of the State Statistics Committee No. 132 of December 25, 1998. Since the beginning of 2013 organizations are not obliged to strictly use standard primary forms; companies have the right to choose a convenient type of accounting document themselves.

If the enterprise is not satisfied with the unified form, then its own form can be developed. For development, you can use a standard form, supplementing it with necessary information.

For example, in the unified TORG-13 form there are no fields for indicating the addresses of structural units, and this can be important in the process of transporting goods and containers between them. In this case, the invoice form for internal movement can be supplemented with such a field.

The TORG-13 consignment note should indicate the name of the legal entity within which the cargo is being moved. The code of the main activity of this enterprise is also entered. The invoice is assigned a personal unique number; numbers should not be repeated within the same reporting period. The day the document was issued is indicated next to the number.

The following is information about the parties involved and the corresponding accounts:

- The name of the structural unit sending the goods and the direction of its activity;

- The name of the structural unit receiving the materials and the type of its activity;

- The number of the accounting account where the goods are sent (if analytical accounting is maintained for this account, then the corresponding code is indicated).

The table contains data on those items of inventories that are subject to internal movement between financially responsible persons:

| Column number | Procedure for filling out the column |

| 1 | Name of the valuables being moved (goods, semi-finished products, raw materials, containers). The main characteristics of the MPZ are also given. |

Errors in filling out the TORG-13 invoice

An invoice for internal movement is a primary accounting document that allows you to:

- The accountant must make an entry for writing off inventories from one structural unit and accepting them for accounting in another unit.

- Justify before the Federal Tax Service the legality of accepting transfer expenses to reduce taxable profit when calculating income tax.

That is, the TORG-13 form performs important functions, and therefore errors in filling out the invoice are not allowed. First of all, it is necessary to provide a clear list of the goods being moved; there should be no errors in indicating the names, quantities, and costs.

The date of the transaction for the transfer of valuables between MOLs must be indicated. An invoice that is not certified by the sending and receiving parties will not allow the document to fulfill its purpose. That is, the uncertified TORG-13 form will be compiled with an error.

The signatures confirm that the internal displacement operation has been completed. The representative of the receiving party needs to sign only after the actual quantity and documentary data have been compared. By signing the TORG-13 form, the recipient confirms that he has accepted the amount of valuables stated in the invoice.

It would be a mistake to fill out the TORG-13 invoice regarding the movement of goods to another legal entity or individual entrepreneur. This form is intended exclusively for internal movements, when the transferred inventories remain in the organization, only their location changes.

What is an Internal Move Invoice?

This is a document that records the movement of products or material assets within one legal entity; depending on the type of objects being moved, unified document forms TORG-13 or OS-2 are used.

This document is evidence of the movement of values within the enterprise between structural units, departments, workshops or responsible persons. Also, this information about the movement is entered into special production documentation, which additionally records the disposal of property in one workshop and its arrival in another.

The invoice is used at the time of transfer of the object, according to this document, one party hands over the object, and the other accepts it; after the event, the document is submitted to the accounting department to make the appropriate entries in the reporting and record the movement.

You will learn how to perform an internal move from one warehouse to another in this video:

Important: the TORG-13 consignment note form is also used when transporting enterprise cargo by company vehicles and when returning goods by customers in retail trade.

Therefore, this document, despite its modest design, is of great importance for accounting and preparing reports to the tax authorities.

Internal movement - what is it?

The movement of materials, objects and papers within an organization is called internal movement; such movement is carried out by order of management between structural units or from one responsible person to another.

The movement of any material assets within the enterprise is recorded with certain documentation, and if objects of any nature are moved, an invoice in the form TORG-13 is used, and when moving fixed assets, which often happens, an invoice OS-2 is used.

Such an action can be caused by any internal need of the organization, for example, the reorganization of one of the workshops or the transfer of an object that is not needed in one of the departments, in the production of goods consisting of several elements, their movement between workshops, etc.

Types of movements

A wide variety of goods can be transferred within an organization; therefore, various forms of documentation are used to record this moment.

In addition to the two main documents for the movement of ordinary goods TORG-13 and fixed assets OS-2, there are several more:

- When moving small items intended for sale in street kiosks and stalls - TORG-14;

- M-11 – invoice demand, used when for some reason the objects were not transferred upon request, or if they have defects, breakdowns, or are a consequence of the disassembly of one of the objects.

Each document is generated in accordance with the requirements for its completion and contains the required number of copies. You will learn what an act of acceptance and transfer of goods is and how to draw it up correctly by following the link.

When is the document drawn up?

The document is drawn up at the time of the immediate transfer of the object from one hand to another or before the upcoming transfer, and all participants in the process must sign it.

Registration of an invoice for internal movement of objects

In the process of moving property, which is part of fixed assets, between divisions of one company, an invoice is drawn up in the OS-2 form. For each transferred property, the form must be filled out separately. The employee who is a direct participant in the process of transferring the object is responsible for issuing the invoice.

The document must be completed in triplicate. The first remains with the materially responsible person (MRP) carrying out the transfer. This copy must be signed by the entity accepting the property.

The receiving party retains a second copy of the invoice with the signature of the transmitter. The third copy must contain the signature of both parties and is transferred to the accounting department by the employee who enters the necessary data for the OS-6 inventory card.

unified form OS-6

Purpose and standards of the document

The invoice for the internal movement of objects confirms the fact of the transfer of property, which allows for the write-off and receipt of valuables in accounting. The basis is the content in the document of complete information about the participants in the fact of transfer and the parameters of the object.

The essential details that any invoice contains include:

- a list of all parties participating in the procedure;

- type of transferred object and its characteristics;

- quantity and price of transferred property;

- signatures and list of all responsible persons;

- related documentation.

Depending on the type of operation being carried out, it is possible to enter additional details without changing or excluding the required ones. It is allowed to use unified forms of documents that were approved by Decree of the State Statistics Committee No. 132 or independently developed templates with the preservation of mandatory information

Federal Law No. 402 defines the mandatory details that must be present in the primary document. In case of non-compliance with this norm, the document will be refused acceptance for registration.

Federal Law No. 402-FZ

Methodological recommendations adopted by Roskomtorg Letter No. 1-794/32-5 dated July 10, 1996 confirm the need to document the movement of property with shipping documentation. The invoice is drawn up by the financially responsible person during the transfer process.

Shape characteristics

Depending on the property being transferred, unified forms such as TORG-13 and OS-2 can be used. TORG-13 is applied in case of transfer of goods or materials to a company. OS-2 is used when the movement of fixed assets is required. Unlike OS-2, the TORG-13 invoice requires only two copies and does not need to be filled out in a strict form.

The document is valid if transferred by any MOL or department. The form is a guarantor of the movement of goods to another entity. Most often, such a document is completed before or during the transfer.

Download the completed sample OS-2

filling out the TORG-13 form

forms TORG-13

Invoice form for internal movement of objects:

Sample filling

The invoice for the internal movement of objects OS-2 is drawn up in triplicate. The first goes to the entity performing the registration of the movement, the second goes to the recipient, and the third goes to the accounting department.

The header located on the front side of the document is filled with information including the name of the company, the deliverer and receiver, codes for OKUD and OKPO, the date when the filling took place and the serial number are also entered.

In the main part of the OS-2 act there is a table containing the following points:

- OS number;

- name of the property;

- transfer date;

- inventory number;

- number of transferred objects;

- price of one unit;

- total cost.

Below the table there are lines where technical information about the condition of the transferred property is recorded. Afterwards, the signatures of the parties, their transcript, the position of each of the MOLs, the report card number and date are located. Form OS-2 must be signed by the chief accountant.

Tips for maintaining an invoice for internal movement of objects

A transfer within an organization is not a sale because there is no transfer of ownership. Both independent development and approval of the document and the use of a unified form are allowed.

In the case where the division is not allocated to a separate balance sheet, the use of the OS-2 form is allowed. Otherwise, this form will not be enough, so it is better to develop and approve your own form.

Information about the fact of moving objects must be included in the OS-6 inventory jacket of the transferred OS (if a unified form is used).

If the OP is allocated to a separate balance sheet, together with the invoice, the recipient must receive the following documents:

Reflection of the fact of transfer of an object in accounting is carried out depending on the allocation of the EP to a separate balance sheet. If the division is allocated to a separate balance sheet, then the movement is reflected using the “intra-business settlements” account (sub-account “Settlements for allocated property”).

In cases where a division is not allocated to a separate balance sheet, analytical accounting is maintained using the “Fixed Assets” account. If such analytics are not carried out, then it is permissible not to enter the movement into accounting.

Expenses that arose in the process of moving property in accounting are classified as production costs of the department. To calculate income tax, expenses that were associated with the movement of property are usually classified as other expenses and confirmed by a certificate of work performed.

If the moving work was carried out in-house, then an accounting certificate is drawn up with invoices attached for the materials used, payroll statements, waybills, etc. Input VAT on work that was performed by third-party companies must be deducted based on the invoice - textures.

Sample of filling out an invoice for internal movement of objects:

Reflection of actions on paper

How to take into account the movement of an object depends on the presence of a separate balance sheet for a separate unit.

In the case where the division is on the general balance sheet, the following transactions must be made: D01, subaccount OP-2 - K01, subaccount OP-1 - fixed assets are moved from the transferring division to the receiving one. Then, depreciation accumulations are moved: D02, subaccount OP-1 - K02, subaccount OP-2.

In the case where the division is on a separate balance sheet, the following entries should be made: D79, subaccount 1 - K01 - the initial cost of the moved object is written off. Afterwards, the accumulated depreciation savings are transferred: D02 - K79, subaccount 1.

The second division receives fixed assets from the transferor: D01 - K79, subaccount 1, as well as accumulated depreciation: D79, subaccount 1 - K02. In this case, the initial cost of the object does not change. For this reason, depreciation on the received property of the unit that receives the object is calculated in accordance with the previous procedure.

Registration procedure

Form TORG-13 is filled out as follows. The header must include information about the company within which the move is being made. In addition, it is necessary to indicate the date when the invoice was drawn up and its number. Next, a table is filled in, the upper part of which is intended for information about the entity transferring the property and the recipient.

The table contains the following data on the transferred goods:

- number of objects;

- units;

- accounting value (established independently by the organization);

- the total value of the transferred property.

You can find a form and sample for filling out this document on the Internet. Upon completion of filling out, it is necessary to sign the parties.

Form OS-2 is filled out on both sides. The front side contains information about the legal entity with the full name of the divisions between which the object is transferred.

The document also indicates the date of transmission and the serial number of the form.

Afterwards, the table indicates the list of transferred property, date of manufacture or release, inventory number, number of transferred objects and their cost.

Examples of non-financial assignments

An invoice for the internal movement of an object constituting non-financial assets is used when registering and accounting for the movement between structural divisions of an institution of such objects as fixed assets, intangible assets, finished products produced by the enterprise.

Previously, a form was used that related only to fixed assets, but the instructions prescribed it for intangible assets and legal acts. Now even from the name it follows that the invoice is intended for all types of non-fiscal assets, despite the fact that the header only talks about fixed assets.

The composition of the indicators has undergone almost no changes: only details have been added that are associated with an increase in the scope of use of the form. “Base (type of document, date and number)” was added to the header. The table has been updated with units of measurement, which is directly related to the change in the purpose of the form.

Instructions for adding

To add an invoice for internal movement of property, you need to enter the context menu and click on add. The document parameters are indicated in the window that appears. The document type must be selected only when entering the first invoice into the system. In the future, this parameter will be selected automatically.

The data for automatically entering information into the “Organization” field is taken from the last invoice entered into the system for movement within the enterprise. The program will automatically assign a document number based on a unique sequence for a specific enterprise. The date of the document is set automatically.

The structural unit, as well as the Mol field, can be filled in automatically after entering the inventory property.

If the base document is not registered by the system, its details can be saved. To do this, fill in the required fields, after which you need to press the create button. This button is located next to the input fields.

If the base document is registered by the system, then the fields type, type, number and date of the document can be filled with information necessary for searching and further selection from the list of the base document. If there is only one document in the list that appears, it will be filled in automatically. The “Note” is filled with additional information.

After the basic parameters of the document have been filled in, detailed information about the object being moved is required. To do this, you need to open the “Invoice Specification” tab. Information can be added either as a list or individually.

To enter information about one of the objects, you need to select “Add” in the context menu. Next, the OS object is selected. After all fields have been filled in, you need to click “OK”. You can close without saving changes by pressing the “Cancel” button.

To add a list of positions, select the add list item in the specification menu. You can select more than one position in the window that appears by holding down the ctrl button on the keyboard. After all fields are filled in, click “OK”.

Once the invoice has been registered, it can be sent for printing. To do this, select the required print item in the application menu. After printing, the document is sent to the financially responsible persons for signature.

Afterwards, the invoice is processed in accounting. To do this, select “Workout” in the application menu, then “Work out”. After indicating the actual date of property movement in the window that appears, you need to press the “OK” button.

Upon completion of the work, the corresponding entries are generated and entered into the inventory file.

Source: //buhuchetpro.ru/nakladnaja-na-vnutrennee-peremeshhenie-obektov/

Form and details of the invoice

Each invoice is drawn up in accordance with the requirements of the law, however, there are details that must be present in each document:

- Name of the organization and number of the structural unit transferring the value or full name of the responsible person. you will learn how to correctly draw up an act of acceptance and transfer of material assets;

- Company details;

- Date and place of compilation;

- Name and number of the document;

- The basis for its compilation;

- Information about the object - name, quantity, cost of one unit and total cost;

- Signatures of persons are required; without this, the document is not valid.

Sample invoice for internal movement of goods.

Features of each form

As already mentioned, each form has its own characteristics:

- Form TORG-13 contains the following data:

- Name of the enterprise and its details;

- Formation date;

- The invoice number is indicated;

- Next is filling out a table in which you should enter information about the parties transferring and receiving the goods, information about the product - name, quantity, cost of one copy and general;

- Signatures of the parties.

- Form OS-2 is filled out on both sides and contains the following data:

- The front side is used as a header, as it contains basic information about the persons transferring funds;

- After which the date of preparation and document number are indicated;

- Next comes filling out a table in which you should indicate the name of the object, production date, inventory number, quantity of funds and price;

- Under the table you should indicate the general characteristics of the objects - their technical condition, the presence of defects and breakdowns, and make a unique description of the object.

Important: after drawing up the document, it must be checked for correctness and signed by all participants and the production accountant.

What are the rules for filling out a consignment note in the TORG-12 form - read.

Step-by-step filling instructions

This documentation, according to the features of the forms, also has features for filling out:

- When creating a document for the transfer of fixed assets, it is necessary to make 3 copies:

- The first remains with the transferring party to write off funds from the balance. You can find out what an order to write off fixed assets is and how to draw it up by following the link;

- The second is transferred to the receiving workshop for registering the object;

- The third one will go to the author of the document; it is this copy that bears the signatures of all participants, including the accountant.

- The TORG-13 invoice is available in a simpler filling option and is generated only in 2 copies:

- It is used when transferring materials, goods or containers and during transportation by road;

- This form can be used when transferring property between any kind of financially responsible persons or departments of various ranks;

- This document is drawn up by the responsible party for the object and serves as a guarantee that the transfer has occurred.

Important: when generating these documents, you must remember that the use of unified forms is mandatory, so any of the necessary forms can be adjusted to the specifics of the organization.

Invoice form in the form TORG-13.

How to fill out an invoice

Unified forms are not mandatory for organizations; companies have the right to develop their own form and consolidate it in their accounting policies (402-FZ dated December 6, 2011). But for convenience, a unified invoice is used for internal movements of fixed assets. The form contains all the necessary information to reflect the procedure in accounting.

Instructions on how to draw up an act:

- Indicate the name of the organization and OKPO.

- Determine the deliverer and recipient: departments between which fixed assets are moved.

- Enter the basic details: document number and date.

- Fill out the table: list the fixed assets to be transferred, their dates of acquisition and inventory numbers, units of measurement and cost.

- Indicate the financially responsible persons: their positions, full names, personnel numbers. Enter the date of the procedure.

IMPORTANT!

The document is signed by financially responsible persons representing the delivery department (deliver) and the reception department (recipient) of the property asset. The local transfer is certified by the chief accountant of the enterprise.

The invoice is printed in triplicate (for each party and for the accounting department), signed by the financially responsible persons and provided to each department involved in the procedure.