Drawing up a declaration according to the simplified tax system “income minus expenses”

The year-end declaration is submitted by “simplers” in the spring of the year following the reporting one: for legal entities the deadline for submission is March 31, individual entrepreneurs can report no later than April 30.

This material will introduce you to the special case of the “simplified” definition of the tax period.

The procedure for filling out the simplified taxation system declaration - income minus expenses is regulated by the order of the Federal Tax Service of the Russian Federation dated December 25, 2020 No. ED-7-3 / [email protected]

Starting from 2022, an updated declaration form for the simplified tax system will be used. You can read more about the innovations here.

You can download the USN declaration form “income reduced by expenses” here.

For firms and individual entrepreneurs paying tax on the difference between income and expenses, the simplified taxation system declaration - income minus expenses consists of a title page and sections 1.2 and 2.2. In rare cases, a “simplified” accountant fills out section 3 - it is needed to report on the targeted receipt of money in favor of the taxpayer. For filling details, see the table:

In the declaration updated from 2022 (order of the Federal Tax Service of Russia dated December 25, 2020 No. ED-7-3/958), several new fields have appeared:

- in section 1.2, line 101 “The amount of tax paid in connection with the application of the patent tax system, subject to offset” appeared. Here they indicate the paid amount of the patent in the event that the entrepreneur has lost the right to the SSN and automatically switched to the simplified tax system. In this case, the paid patent can be offset against tax under the simplified tax system (clause 7 of article 346.45 of the Tax Code of the Russian Federation);

- in section 2.1, line 201 “Tax rate application attribute code” appeared. The taxpayer indicates which rate - regular or increased - he applies;

- in section 2.1, line 264 “Justification for the application of the tax rate established by the law of the constituent entity of the Russian Federation” appeared. Here they indicate the norm of the law of the subject, according to which the reduced rate of the simplified tax system is applied.

NOTE! Under the names of the declaration lines there are hints - control ratios for the accountant. They help to understand how the indicator of each line should be related to the digital values in other lines of the declaration.

A simplified declaration is formed on the basis of data on the receipts and expenditures of the taxpayer’s resources, recorded in the KUDiR of the simplified tax system.

When transferred to the annual report, data from KUDiR is rounded to whole numbers.

What changed

The updated form consists of 10 pages (previously there were 8). This happened due to the fact that sections 2.1.1 and 2.2, in which the tax amount is calculated, were slightly increased. Each of them now has additional fields:

- To specify the tax rate application code. Upon reaching the income limit of 150 million rubles and/or the average annual number of employees of 101 people, increased tax rates are applied under the simplified tax system - 8% instead of 6% and 20% instead of 15%.

- To indicate the justification for the application of a reduced tax rate, if it is established by regional law.

The structure of the document remains the same. Payers on the simplified tax system Income, in addition to the title page, fill out sections 1.1 and 2.1.1, and payers of the trade tax also fill out section 2.1.2. When choosing a simplified tax system with the object “Income minus expenses,” sections 1.2 and 2.2 are filled in. If targeted funds were received during the reporting period, they must be reflected in section 3 - this applies to both objects of taxation.

Line 120 of the simplified tax system declaration “income minus expenses”

You will find line 120 in section 1.2 of the annual report “simplified” on the “receipts minus costs” system. It is necessary to record in the declaration the amount of the minimum tax under the simplified tax system to be paid for the year. For a taxpayer using the simplified tax system “income minus expenses,” the rule applies: for the year you need to pay tax in the amount of the greater of two amounts:

- the simplified tax itself is the product of the tax rate and the tax base;

- The minimum tax is 1% of the “simplified” income.

Let’s say the taxpayer’s income for 2022 amounted to 12 million rubles. Expenses - 11.5 million rubles. Then the simplified tax, subject to the application of the standard tax rate of 15%, will be:

(12 million – 11.5 million) × 15% = 75,000 rubles.

And the minimum tax is 12 million × 1% = 120,000 rubles.

The minimum tax is greater than the simplified tax, therefore, the company will pay 120,000 rubles for 2022.

If, at the end of the year, the minimum tax payable is obtained, then simplified advance payments transferred for the 1st quarter, half-year and 9 months of the reporting year can be offset against its payment. And in line 120 of the declaration, the taxpayer will show the amount of the minimum tax minus advances paid (clause 4.11 of order No. ED-7-3 / [email protected] ).

You can read more about the procedure for calculating the minimum tax in this material.

You will find additional recommendations for drawing up a declaration under the simplified tax system “income minus expenses” in ConsultantPlus. Get free trial access to the system and go to the Ready-made solution.

Declaration on simplified tax system Income

If Cozy House LLC uses the “Income” object, then you need to fill out the title page, then sections 2.1.1 and 1.1.

Title page

The first page of the report is filled out as standard for all declarations. In the top lines of the title, as on all other sheets, you must indicate the organization’s INN/KPP, as well as the page number in the “00X” format. Then indicate:

- correction number – “0–”;

- tax period code - “34” from Appendix No. 1 to the procedure for filling out the declaration, approved by the same order as the form (hereinafter referred to as the Procedure);

- reporting year – 2021;

- Federal Tax Service number;

- code at the place of registration for an organization that is not the largest taxpayer - “210” (Appendix No. 2);

- full name of the LLC as in the Charter;

- the line for reorganized/liquidated companies is filled in with dashes;

- telephone number for contact (with city code, without spaces, brackets, dashes);

- number of pages of the report and copies of documents, if attached (for example, a copy of the power of attorney);

- taxpayer code – “1” if the report is signed by the director, “2” – if the signature is signed by a representative;

- Full name of the director of the LLC or the person signing the report by proxy;

- name of the representative organization (if accounting and reporting services are provided by a third-party company);

- details of the power of attorney (when signing the declaration by an authorized person).

Section 2.1.1

Line by line this section is filled out like this:

- 101 – a new field in which you need to reflect the tax rate attribute. If the base rate is 6%, then code “1” is applied, if 8% (if the limits are exceeded) - code 2;

- 102 – organizations indicate taxpayer attribute “1” (taxpayer with employees);

- 110-113 – income for the first quarter, half a year, 9 months and a year, respectively;

- 120-123 – tax rate for each period;

- 124 – a new line that reflects the justification code for the reduced tax rate, if it was introduced by the region. The first part of the code (before the “/” sign) is selected from Appendix No. 5 to the Procedure. The second part of the code consists of the number, paragraph and subparagraph of the article of the regional law that introduced the preference. There are 4 fields allocated for each detail. If there are fewer characters in the number, zeros are placed to the left of the value. For example, if this reduced rate is specified in subparagraph 4 of paragraph 2 of Article 7 of the regional law, then this part of the code will look like this: 000700020004;

- 130-133 – tax amounts for each period before deduction of contributions (base from lines 110-113 * rate from lines 120-123);

- 140-143 – amounts of contributions transferred in each period.

Section 2.1.2

This section is filled out by payers of the trade tax (it is only available in Moscow). They have the right to reduce the calculated tax under the simplified tax system by its amount. In lines 150-153 they reflect the amounts of trade tax paid for the first quarter, six months, 9 months and a year, which can be taken to reduce the tax under the simplified tax system after deducting insurance premiums from it.

In our example, the LLC does not pay the trading fee, so the section is not completed.

Section 1.1

Section 1.1 reflects the amount of tax payable under the simplified tax system, minus insurance premiums, as well as trade tax. In line 010 indicate OKTMO, and if the location of the organization has not changed during the year, this code is not indicated in lines 030, 060 and 090. In the remaining lines enter:

- 020 – advance payment for the 1st quarter;

- 040 / 050 – advance payment / reduction for half a year;

- 070 / 080 – advance payment/reduction for 9 months;

- 100 – additional tax for the year;

- 101 – the amount credited for the patent (only for individual entrepreneurs who combine the simplified tax system and the PSN and have lost the right to a patent);

- 110 – the amount of tax to be reduced for the year.

Prepare a simplified taxation system declaration online

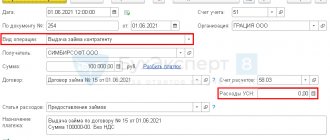

USN declaration calculator “income minus expenses”

On our website you can find a calculator for calculating simplified tax under the “income minus expenses” system.

It’s easy to use - first, select the period for which you need to calculate the tax amount:

1. If for a quarter, enter the amounts of income and expenses in the appropriate fields and check the tax rate. By default, it is 15%, but beneficiaries (for example, “simplified” workers employed in the production sector) will indicate their value here. The amount of tax to be paid will be the value you are interested in.

In order for the tax amount calculated using the calculator to be reliable, you need to correctly take into account certain incomes and expenses.

The materials in the “Income minus expenses (STS)” section of our website will help you understand this:

- “What income is recognized (accounted for) under the simplified tax system?”;

- “List of expenses under the simplified tax system “income minus expenses””;

- “Accounting for the write-off of goods when applying the simplified tax system”;

- “Expenses that officials prohibit the “simplified” to take into account”, etc.

2. The annual calculation is filled out in the same way, plus you will need to indicate advances already paid (they can be compared with those calculated automatically) and the amount of loss for previous periods of simplified activities.

When you hover over the question marks next to the names of the calculator fields, you will see hints: what amounts of income and expenses can be taken into account, where to find out about the right to a preferential rate, etc. The calculation results can be saved on the website, printed or sent by email. You can issue the resulting calculation as an accounting certificate, adding the required details from clause 4 of Art. 10 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

An example of filling out the simplified taxation system “income minus expenses” declaration for 2022

An example will help you understand the procedure for filling out a simplified declaration.

Example:

Quorum LLC operates in a simplified manner - it helps entrepreneurs and small firms prepare statements of claim, maintain accounting and tax records, submit reports and pay the budget. The receipts and expenses of a legal entity for 2021, as well as data for calculating the simplified tax, are shown in the table below:

| Reporting period | Income, rub. | Expenses, rub. | Taxable base (income minus expenses), rub. | Tax payable (15% of the taxable base), rub. | Advance and annual tax payable, rub. |

| 1st quarter | 473 500 | 331 600 | 141 900 | 21 285 | 21 285 |

| half year | 791 250 | 602 940 | 188 310 | 28 247 | 6 962 |

| 9 months | 974 300 | 716 590 | 257 710 | 38 657 | 10 410 |

| year | 1 223 400 | 940 624 | 282 776 | 42 416 | 3 759 |

| Minimum tax for the year, rub. | 12 234 | ||||

The accountant of Quorum LLC will fill out the title page in the declaration for 2022, sections 1.2 and 2.2, and will not fill out section 3 due to the lack of facts of receiving targeted funding - for more details, see the sample filling at the link below:

How to submit a declaration under the simplified tax system for 2021

For 2022, you must report on the form approved by Order of the Federal Tax Service dated December 25, 2020 No. ED-7-3/958. Depending on who is reporting - a legal entity or an individual entrepreneur - the deadlines for submission differ:

- for legal entities, the deadline for filing a declaration based on the results of 2022 is 03/31/2022;

- According to the Tax Code of the Russian Federation, individual entrepreneurs have the right to report for 2022 until the end of April 2022. Since the last day of April falls on a weekend and the May holidays follow, the last day for submitting the report for 2022 for individual entrepreneurs will be May 4, 2022.

Details about the deadlines for submitting a declaration under the simplified tax system in 2022 and its current form can be found in the article “When do you need to submit a declaration under the simplified tax system for 2021?”

On the nuances of filling out a declaration under the simplified tax system for individual entrepreneurs, see the material “Declaration of the simplified tax system for individual entrepreneurs for 2022.”

In this article, we will further consider filling out and an example of a declaration for an organization using the simplified tax system with the object of taxation “income minus expenses.”

Zero declaration of the simplified tax system “income minus expenses”

If a “simplified person” did not conduct any activity during the tax period, then the obligation to submit a declaration still remains with him (subclause 4, clause 1, article 23, clause 1, article 80 of the Tax Code of the Russian Federation). In this case, the accountant fills out:

- title page in the usual order;

- in section 1.2 indicates only OKTMO, in the remaining lines - dashes;

- in section 2.2 will record only the tax rate, in the remaining lines - dashes.

Accountants call such a declaration “zero”.

Find out more about zero declarations for various taxes on our website:

- “Sample zero single simplified tax return”.

NOTE! If you forget to pass the zero mark, the fine will be 1000 rubles. according to Article 119 of the Tax Code of the Russian Federation.

Read about the difference between the unified simplified tax return and the “zero” of the simplified tax return in the material “Unified simplified tax return - sample for 2021” .

Declaration of the simplified tax system “income minus expenses”: loss

Entrepreneurship does not always bring profit. If a “simplified” taxpayer had a loss during the reporting period, its size must be documented in the simplified taxation system return. The negative tax base is recorded in lines 250–253 of section 2.2, and advances for reduction are recorded in lines 050 and 080. Line 110 is intended for the annual loss. Let us consider in more detail the procedure for filling out a “simplified” declaration with a loss using an example.

Let’s say that the entrepreneurial activity of Quorum LLC in 2021 was carried out with varying degrees of success - according to the results of the six months and the tax period, the company suffered a loss. The receipts and expenses of Quorum LLC for 2022, as well as data for calculating the simplified tax, are shown in the table below:

| Reporting period | Income, rub. | Expenses, rub. | Taxable base (income minus expenses), rub. | Tax payable (15% of the taxable base), rub. | Advance and annual tax payable, rub. |

| 1st quarter | 473 500 | 331 600 | 141 900 | 21 285 | 21 285 |

| half year | 791 250 | 802 940 | Loss 11,690 | — | To decrease 21,855 |

| 9 months | 974 300 | 916 590 | 57 710 | 8 657 | 8 657 |

| year | 1 123 400 | 1 140 624 | Loss 17,224 | — | 2 577 |

| Minimum tax for the year, rub. | 11 234 | ||||

NOTE! At the end of the year, the accountant of Quorum LLC will pay 2,577 rubles to the budget. This value is calculated as the difference between the calculated minimum tax and the advances paid (as well as reduced):

11234 – (21,285 – 21285* + 8657) = 2577 rub.

* Advance payment for the half-year reduction was formed due to a loss based on the results of the first 6 months of work in 2022.

If a loss is received in one of the reporting periods of the year, a dash is placed in the corresponding line 270–273. For more details, see the example of filling out the simplified taxation system declaration “income minus expenses” of Quorum LLC at the link below:

If you find errors in the submitted declaration that lead to an understatement of tax under the simplified tax system, proceed according to the scheme described in ConsultantPlus. Get trial access to K+ for free and go to the Ready-made solution.

Results

A “simplified” person fills out a declaration under the income-expenditure simplified tax system on the basis of KUDiR, certificates of advance payments and data on the amount of losses for previous years (if any). If the “simplifier” did not conduct any activity, he must submit a zero declaration, and if he received a loss at the end of the year, then he will have to pay a minimum tax to the budget equal to 1% of income for the year.

Read more about the details for paying advances, annual payments and the minimum tax on the simplified tax system “income minus expenses” here .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How many declaration sheets to fill out?

The declaration under the simplified tax system consists of a title page and six sections. However, all sections are not required to be included in the declaration. Simplified people with the base “income” and “income minus expenses” fill out their own set of sections (see in the figure):

But this composition of the declaration is not final. If a simplifier with the “income” base is not a payer of the trade tax, he does not include section 2.1.2 in the declaration. The same rule applies to section 3 - it is filled out and submitted as part of the declaration by simplified taxation tax payers who have received targeted funding, targeted revenues and other funds specified in paragraphs. 1 and 2 tbsp. 251 of the Tax Code of the Russian Federation (clause 9.1 of the Procedure for filling out a declaration under the simplified tax system, approved by order No. ММВ-7-3/). Other simplifications do not include this section in the declaration under the simplified tax system.

The Federal Tax Service plans to change the form of the declaration under the simplified tax system. She submitted the corresponding draft for public discussion.

Read about the planned innovations in the review from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.