Main differences between indicators

In order for us to understand these two population indicators, we will consider the rules for their calculation.

The main difference is that the average headcount indicator is a component of the average. The average is calculated for a month, two months, a quarter or a year based on the average number for each month of the calculation period. To determine the monthly value of the average number of external part-time workers and those working under civil contracts.

The average list includes only those workers for whom this is their main place of work. That is, when calculating, you do not need to take into account either external part-time workers or contractors.

What specialists are taken into account?

In order to correctly find an indicator characterizing the size of the staff and correctly assess its dynamics, the accountant needs to know who to include in the formula. The fundamental document in this area is Rosstat order No. 498.

The list of employees is the number of specialists employed under fixed-term and indefinite employment agreements for permanent or temporary work. Employees who performed official duties for at least one day are subject to counting. The formula includes the owners of the company if they are paid not only dividends, but also a salary.

The payroll includes specialists who:

- actually showed up to the workplace, including those who did not perform official duties due to downtime;

- were on sick leave, which is confirmed by a certificate of incapacity for work issued by a medical institution;

- were on regular paid leave;

- were on study leave with salary retained;

- were on business trips in Russia or abroad;

- were absent from service due to the performance of public duties assigned by the employing company;

- performed official duties from home - they are taken into account as well as the number of payroll employees who came to work;

- were temporarily assigned to a specific employer without maintaining their salary at their main place of employment;

- were on a day off provided in exchange for overtime for previous periods;

- went on leave for employment or child care;

- were on leave for family reasons, agreed with the employer’s administration;

- participated in strikes, etc.

The payroll number of employees of an enterprise is a set of specialists hired on a part-time basis. They are counted as whole units regardless of whether they were on duty or absent in accordance with the previously agreed upon schedule.

When calculating the size of the staff, each employee is counted once. Internal part-time workers working in two positions in one company or individual entrepreneur are no exception.

Application of the average number of employees

We have already decided that the average number of employees for a specific period of time is recognized.

It is calculated when preparing information for the tax authorities. The average headcount is reported annually for the previous year. According to the Tax Code of the Russian Federation, information must be submitted before January 20 of the month that immediately follows the billing month. If the deadline for submission falls on a weekend, the deadline for providing information is moved to the next working day.

Important! The deadline for submitting information for 2022 is January 20, 2022, but since this date falls on a Saturday, the deadline is moved to January 22, 2022.

If you do not provide information to the tax office in a timely manner, the organization and its leader may face fines:

- 200 rubles – for the organization;

- 300 – 500 rubles – for the manager.

This indicator, which is easy to calculate, is quite important for the organization, since it determines the reporting procedure. For example, if the average headcount is over 100 people, the organization will have to report only electronically. With the exception of VAT returns and reporting to the Pension Fund and Social Insurance Fund. Absolutely all organizations and entrepreneurs are required to submit a VAT return electronically, regardless of the number of employees. For submitting reports to the Pension Fund and the Social Insurance Fund in electronic form, the limit on the number of employees is different - it is equal to 25 people. That is, if an organization’s average number of employees exceeds 25 people, then reports can only be submitted to the FPR and the Social Insurance Fund in electronic form.

Headcount

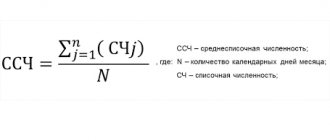

The payroll number is needed to calculate the average number of employees who are employed full time during the month. To calculate this indicator, it is necessary to sum up the payroll values for each day of the calendar month, including weekends and holidays, and divide the resulting number by the number of days in the month.

Since this calculation includes indicators of the number of employees on weekends and holidays, the question arises of how many employees should be taken into account per day off, if, for example, on the working day preceding the weekend there is one indicator, and on the first working day after the weekend - another.

When calculating, the value of employees on a day off is equal to the value of the payroll number for the working day preceding the day off.

Those employees who are on the payroll of the company, but are concluded with it only by the GPA, should be taken into account only in the payroll and only once. In this case, one employee is accepted for 1 unit.

The average number does not include individual entrepreneurs, even if they have entered into a GPA with the organization. Also, the average number does not include those unlisted persons who did not enter into a GPA with the company.

How does the average number differ from the average number?

There are quite a lot of indicators that characterize the activities of any company. Each of them is necessary for specific purposes and is calculated taking into account general formulas and recommendations prescribed in guidelines and scientific literature. And one of such criteria in the activities of an organization is the number of personnel used for various purposes.

Staff, number of employees: what is it, why is it needed

To begin with, I would like to note that the number of personnel is an important indicator by which an enterprise can receive the status of small or not.

In addition, using this criterion, an organization has the right to receive subsidies from the budget, maintain simplified accounting and tax records, operate under a simplified taxation system, etc.

But the main thing here is not only to use such an indicator, but also to calculate it correctly, since there is an average and average headcount, which have their own fundamental differences.

Why you might need an indicator:

- To provide statistical information to external users, for example, Rosstat;

- To make management decisions, for example, in the HR segment: which category of employees can be reduced, which can be increased, where there is enough staff, and where there is an oversupply;

- To calculate some financial and economic indicators, for example, production rates;

- To submit tax reports and maintain tax records for enterprises;

- Other goals that arise for a business entity.

As you can see, it is important, but a logical question arises: how does the average number differ from the average number of employees, and when is one or the other used? Or maybe these are generally the same criterion, just different names.

Number and average number: what is the difference

To begin with, I would like to note that the payroll and average number of employees are two complementary factors that take into account the number of all categories of employees in the enterprise. This amount includes

- Administrative personnel, including management personnel, officially accepted into the company’s staff;

- Production workers, regardless of profession and education;

- Service personnel who work in the field of service and maintenance of core activities;

- Highly qualified specialists and employees, for example, accountants, engineers, etc.

- Other employees who are related to the activities of the institution.

But the main thing is that the difference between the average number and the average number is that when determining the average, all people without exception working within the organization are taken into account.

This includes those who work under employment contracts, under civil law, under contracts, etc., and it makes no difference whether for such workers the work is the main one or not.

When determining the simple average number, the accountant must take into account even part-time workers who do not provide their work book to the HR department.

If we are talking about calculating exclusively the average payroll, then only the main employees enrolled in the company’s staff are taken into account. It is in this nuance that the difference between the number and the average number lies.

Headcount

Speaking about the differences between the average and the average number of employees, one cannot fail to mention the difference in the calculation of such an indicator. It should be noted that the payroll itself includes the average payroll, and without the latter it is impossible to calculate the first.

According to the approved Rosstat methodology, the average number of employees includes three main components:

- Average number;

- Average number of people working part-time;

- The average number of people registered in an organization under civil law contracts.

Thus, the most important thing to understand is how this average is calculated. According to the recommendations presented, the person making the calculation needs to add up the total number of workers at the main place of work for each day of the calendar month, taking into account both weekends and holidays. Then divide the resulting number by the number of calendar days in the reporting period.

At the same time, it is necessary to know that when calculating such an indicator, it is very important to know that the number of employees cannot include certain categories of workers who are not currently at work. This category, for example, includes those who are on maternity leave and parental leave.

The other two indicators are calculated using the same methodology. The only difference is in the category of employees by which such calendar days are counted. In one case, the number of those who are part-time workers is determined, in the other - those who are allowed to work under a signed civil law contract.

When all three criteria are calculated, they are all summed up, and such a general indicator as the average is obtained.

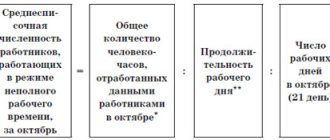

In addition, it is very important to know that when calculating, those people who are not registered as full-time employees, for example, at 0.5 rates, are not taken into account as one staff unit, but only in the proportion at which rate they accepted.

Thus, the difference between the average number and the average number of employees is that the first takes into account all workers without exception and is the final statistical indicator.

The average payroll is based solely on the staffing table, that is, taking into account the rates and professions for which people are registered at their main place of work.

All other categories of specialists are taken into account in the indicators calculated on the basis of civil contracts and combination documents.

Source: https://okbuh.ru/otchetnost/chem-otlichaetsya-srednyaya-chislennost-ot-srednespisochnoy-chislennosti

Application of average strength

In order for a company to confirm its right to preferential taxation, it is necessary to calculate the average number of employees. Calculation will be required in the following cases:

- When an organization or individual entrepreneur switches to taxation regimes such as the simplified tax system or UTII. In order for a company to do this, the average number of employees per year should not exceed 100 people. If this indicator is exceeded, the use of special modes is impossible;

- When an individual entrepreneur switches to a patent taxation system. In order for an entrepreneur to exercise his right to apply such a regime, the average number of people should not exceed 15 people;

- To receive tax benefits.