What is inventory?

The inventory is carried out on the basis of the order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 “On approval of guidelines for the inventory of property and financial obligations.”

In accordance with clause 1.5 of the Methodological Guidelines for Inventory of Property and Financial Obligations, inventory is required:

| Situation | A comment |

| Transfer of the organization's property for rent, redemption, sale | And also in cases provided for by law during the transformation of a state or municipal unitary enterprise |

| Before preparing annual financial statements | Except for property, the inventory of which was carried out no earlier than October 1 of the reporting year. An inventory of fixed assets can be carried out once every three years, and of library collections - once every five years. In areas located in the Far North and similar areas, inventory of goods, raw materials and supplies can be carried out during the period of their lowest balances |

| When changing financially responsible persons | on the day of acceptance - transfer of cases |

| When establishing facts of theft or abuse, as well as damage to valuables | |

| In case of natural disasters, fire, accidents or other emergencies | caused by extreme conditions |

| During liquidation (reorganization) of an organization before drawing up a liquidation (separation) balance sheet and in other cases | provided for by the legislation of the Russian Federation or regulations of the Ministry of Finance of the Russian Federation |

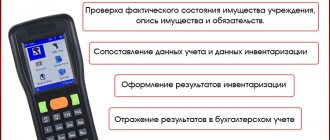

How to register inventory results

Read in the berator “Practical Encyclopedia of an Accountant”

How to register inventory results

After the inventory, submit the completed inventories and acts to the company’s accounting department. If they record discrepancies between the actual balances of material assets and the balances according to accounting data, enter the amounts of deviations in the matching statements. Unified forms are provided for these statements. Each type of value has its own form. For example, in form No. INV-18 the results of the inventory of fixed assets are indicated, in form No. INV-19 - inventory items, etc.

What is an inventory of funds in a current account?

In accordance with clause 3.43 of the Methodological Guidelines for the Inventory of Property and Financial Liabilities, an inventory of funds held in banks in settlement (current), currency and special accounts is carried out by reconciling the balances of the amounts listed in the corresponding accounts according to the organization’s accounting department with data from statements banks.

Thus, each legal entity is obliged to carry out verification activities aimed at determining the compliance of financial statements with bank statements received for the reporting period .

According to clause 3.44 of the Methodological Guidelines for the Inventory of Property and Financial Liabilities, the inventory of settlements with banks and other credit institutions for loans, with the budget, buyers, suppliers, accountable persons, employees, depositors, other debtors and creditors consists of checking the validity of the amounts in the accounts accounting.

The following types of calculations must be checked:

| Calculations | A comment |

| Account “Settlements with suppliers and contractors” | For goods paid for but in transit, and settlements with suppliers for uninvoiced deliveries. It is verified against documents in accordance with the corresponding accounts |

| Debt to employees of the organization | Unpaid amounts of wages to be transferred to the depositors' account are identified, as well as the amounts and reasons for overpayments to employees |

| Accountable amounts | Reports of accountable persons on advances issued are checked, taking into account their intended use, as well as the amount of advances issued for each accountable person (dates of issue, intended purpose). |

Based on the results of the inventory of funds in the current account, an Inventory Report for settlements with buyers, suppliers and other debtors and creditors is drawn up (unified form No. INV-17).

Who conducts the inspection

Any inventory is carried out by order of the director, who also appoints members of the commission. The composition is not strictly regulated, but the commission must have at least three representatives; it must include a person from the administration and an accounting employee. The inclusion of internal services in the auditors or the involvement of third-party audit services on a contractual basis is encouraged. The results of the commission’s work are documented as an inventory report of the current account and other deposits.

The appointed commission checks the compliance of internal accounting documents on the movement of monetary assets with the statements provided by banks. Any doubts that have arisen about the authenticity of documents attached to a bank statement require a counter-reconciliation of the bank’s document flow to be resolved.

Who takes inventory of funds in the current account?

There are no specific regulations for conducting an inventory of funds in a current account, but, basically, most legal entities adhere to the following steps:

- order to conduct an inventory of funds in the current account (unified form No. INV-22). The inventory commission specified in the order must include an accountant, a representative of the organization’s administration, and other employees at the discretion of the manager)

- inventory of funds in the current account;

- drawing up an Inventory Report for settlements with buyers, suppliers and other debtors and creditors (unified form No. INV-17)

The inventory commission, through a documentary check, must also establish:

- the correctness of settlements with banks, financial, tax authorities, extra-budgetary funds, other organizations, as well as with structural divisions of the organization allocated to separate balance sheets;

- the correctness and validity of the amount of debt recorded in the accounting records for shortages and thefts;

- the correctness and validity of the amounts of receivables, payables and depositors, including the amounts of receivables and payables for which the statute of limitations has expired.

The procedure for conducting a cash register inventory

Inventory of funds in the cash register is carried out according to a certain algorithm. Before the start of the transaction, all cash transactions are stopped, the cash register is closed, and documents on the latest transactions not included in the cash report are transferred to the commission. The cashier or an employee performing his duties gives a receipt for the delivery of all documents not recorded in accounting to the accounting department or commission.

Next, the actual inventory of the cash register begins, consisting of two stages:

- cash inventory;

- inventory of monetary documents.

Cash recalculation is carried out continuously under the supervision of all members of the commission participating in the audit. The actual availability of money is compared with the balances according to accounting documents and cash registers.

If the company’s activities involve the use of cash registers, then the audit begins with checking the availability of funds in the operating cash registers. In this case, it is mandatory to check the documents confirming the legality of the operation of each cash register.

At the second stage, the availability of monetary documents and their compliance with accounting data are checked. These include vouchers, coupons for special meals, fuel, lottery tickets, receipts for various fees, etc. For each type of document, registration books must be opened at the cash desk, in which receipts and expenses are recorded, and BSO balances are displayed.

What agreements with the bank for maintaining a current account are subject to inventory?

If the organization has a bank account, i.e. a corresponding agreement has been concluded - such an organization is obliged to carry out an inventory of funds in the current account. An agreement concluded between a legal entity and a credit institution to conduct settlement transactions in the currency of the Russian Federation or a foreign state is called a settlement agreement.

Important! Any legal entity has the right to conclude several settlement agreements and, accordingly, open several current accounts both in one credit institution and in several. Current accounts can be opened in parallel to each other.

If an organization has several current accounts, an inventory of funds is carried out in relation to each current account or deposit.

In the event that an organization needs to make settlements with a counterparty exclusively in the currency of a foreign country, then such a current account will be classified as a foreign currency account and will also be subject to inventory, but indicating the currency for which it was opened.

What funds are subject to inventory?

Inventory is required to be taken:

- cash;

- check books;

- letters of credit;

- payment documents on various accounts in credit institutions.

Important! Bills of exchange are not subject to inventory.

It is worth noting that in that case. If an organization is registered on the territory of the Russian Federation, but at the same time has open accounts both in Russian and foreign banks, all of these accounts must undergo an inventory procedure.

Thanks to inventory, it is possible to determine the movement of funds and evaluate their intended use.

Violations during the inventory of funds on the current account

When conducting an inventory, it is necessary to comply with the legislation of the Russian Federation, otherwise the inventory will be considered not completed.

The most common errors in this procedure are:

Error No. 1. Absence of one or more members of the inventory commission on the day of the inventory.

By order of the director to conduct an inventory of ABV LLC, the composition of the inventory commission was approved. On the day of the inventory, one of the commission members went on sick leave, and therefore it was decided to carry out the procedure without him. At the end of the inventory, all members of the commission, with the exception of the one who was absent, put their signatures on the Inventory Report of settlements with buyers, suppliers and other debtors and creditors. Such an inventory will be considered invalid due to the work of the commission in its incomplete composition.

In this case, it is necessary to replace the sick employee by issuing a replacement order.

Error No. 2. Absence of one or more members of the inventory commission during the inventory.

By order of the director to conduct an inventory of ABV LLC, the composition of the inventory commission was approved. At the time of the inventory, one of the commission members went on sick leave, another left to resolve urgent production issues, and therefore it was decided to carry out the procedure in the person of only one commission member. Upon completion of the inventory, all members of the commission signed the Inventory Report for settlements with buyers, suppliers and other debtors and creditors. Such an inventory will be considered invalid due to the work of the commission in its incomplete composition, and, therefore, a violation of the procedure for conducting the inventory.

In this case, the presence of all commission members at the inventory procedure is mandatory.

Error No. 3. Failure to inform the person responsible for the shortage of funds.

During the inventory, a shortage was identified and the culprit was assigned. The director's order determines the deadline for paying the culprits the shortfall by repaying the culprits from the wages. At the same time, no one was familiar with the Inventory Report and no explanation was given. In this case there is a violation.

If a shortage is identified, the duty of the inventory commission is to familiarize the violator with the Inventory Act and demand an explanation in writing.

2.4. Cash register inventory

Within the time limits established by the manager, as well as when cashiers change, an inventory of the cash register must be carried out. When making an inventory, you should be guided by Methodological Instructions No. 49. Carrying out an inventory is entrusted to a permanent inventory commission, which includes representatives of the administration and various services of the enterprise. The commission includes a representative of the accounting department, but not the chief accountant. The cash register inventory is usually carried out at least once a quarter. The enterprise issues an order to conduct an inventory.

Based on the results of the inventory, acts are drawn up in form No. inv-15 “Cash Inventory Act” and in form No. inv-16 “Inventory list of securities and forms of strict reporting documents.” If surpluses or shortages are detected, the acts indicate their amount and the circumstances of their occurrence. The acts are drawn up in 2 copies, one of which is sent to the accounting department. Identified cash surpluses in the cash register are accounted for and are included in other income (Ct. Account 91/1 “Other income”). The identified shortage of funds in the cash register is attributed to the guilty person (Dt. 73/2 “Calculations for compensation of material damage”).

Questions and answers

Question No. 1. I have been a member of the inventory commission for several years now. Can I cancel this membership?

Yes, you can refuse membership in the inventory commission by submitting an application to the director. In the event that your absence from the commission is possible, your candidacy will be replaced.

Question No. 2. When is it better to take inventory of funds in a current account?

It is most convenient to organize this procedure closer to the end of the calendar year. If you conduct an inventory after October 1, then such an inventory can be timed to coincide with the submission of the annual report.