Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

A simplified taxation system was introduced to ease the tax burden on organizations and entrepreneurs. Rates of the simplified tax system in individual regions of the Russian Federation may differ from the generally accepted ones. The state has granted regional authorities the right to adjust the tax rate. In this article we will look at what rates are set in the regions and how to choose an object of taxation taking into account changing rates.

General rules

In Art. 346.20 of the Tax Code of the Russian Federation determines the rate for the simplified tax system, which depends on the object of taxation:

- if tax is calculated on income, the rate is 6%;

- if the tax is calculated on the difference between income and expenses - 15%.

Since 2022, changes have been made to the Code that provide for a transition period for those simplifiers whose annual income exceeded 150 million rubles, but did not exceed 200 million rubles. and/or the average number of employees became more than 100 people, but did not exceed 130 people.

Now such taxpayers can remain on the simplified tax system, but the tax rate for them will increase:

- if tax is calculated on income - up to 8%;

- if the tax is calculated from the difference between income and expenses - up to 20%.

Note! The new rates do not apply from the beginning of the year, but only starting from the quarter in which the limits of 150 million rubles were exceeded. and/or 100 people. Those. There is no need to recalculate taxes from the beginning of the year.

Example.

According to the results of the half-year, the income of Zdorovo Zhivesh LLC was recorded in the amount of 145 million rubles, and according to the results of the 3rd quarter, this amount reached 160 million rubles.

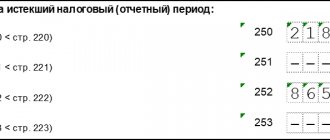

The Company determined the advance payment for the simplified tax system for the six months in the amount of:

145,000,000 * 6% = 8,700,000 rub.

The advance payment for 9 months will be equal to:

145,000,000 * 6% + (160,000,000 – 145,000,000) * 8% = 9,900,000 rub.

Moving to a region with lower tax rates

If an organization or individual entrepreneur moves to a preferential region using a simplified tax regime, it will be able to save on paying tax, as it will receive the right to apply a preferential rate from the beginning of the year. To apply the new rate, you need to register an organization or obtain registration for an individual entrepreneur in a new region.

All benefits and restrictions on simplified taxation rates are prescribed in the law of the subject. If your activity meets the criteria, you will be eligible for a reduced rate. In this case, previously paid advance payments do not need to be recalculated. But the next advance payment must be paid at the new rate, minus the previously paid advance. The overpayment resulting from the move can be returned or offset against future payments. The annual declaration is also submitted to the new address.

What can be changed in the regions

To smooth out the differences between living conditions and doing business in different regions of Russia, regional legislators are given the right to introduce benefits.

- Reduce tax rates. Instead of 6% in the region, rates can be set from 1% to 6% for the simplified tax system “Income” and from 5% to 15% if the simplified tax system “Income minus expenses” is applied. Reduced rates can be applied by all simplifiers, or can only apply to certain categories of taxpayers. Subject to the established conditions, both the organization and the individual entrepreneur can apply a reduced rate.

- Introduce tax holidays. A region can establish a zero tax rate for newly registered entrepreneurs for two tax periods (under the simplified tax system, these are two calendar years) if their activities relate to the production, social or scientific spheres. The list of types of activities (according to OKVED codes, for household services - OKVED and/or OKPD2 codes) in the regions is determined independently. Only individual entrepreneurs have the right to apply the zero rate; organizations cannot use it.

Note! In those regions where tax holidays are applied, additional restrictions may be established for those who have the right to apply them - by income level and / or by the average number of employees, i.e. make the limit less than 200 million rubles and 130 people per year, respectively. But it is impossible to set an income limit of less than 10 times, i.e. the lower limit in the region cannot be less than 20 million rubles.

Tax rate 0% for individual entrepreneurs using the simplified tax system

Individual entrepreneurs on a simplified basis can receive a special reduced rate from regional authorities, regardless of the tax base. The 0% rate will be received by newly registered individual entrepreneurs who operate in the production, social, scientific spheres or the sphere of consumer services for the population. The subject of the Russian Federation independently establishes the types of activities in these areas, based on OKVED. Another condition is that at least 70% of income must come from established types of activities.

These tax holidays last for two tax periods, but no longer than until the end of 2023. While the reduced rate is in effect, taxpayers on “Income minus expenses” do not pay the minimum tax.

A subject of the Russian Federation may limit access to the 0% rate by setting a limit on the number of personnel or a maximum income. If the restrictions are violated, the individual entrepreneur will be deprived of the right to holidays and will be required to pay tax at the base rate of the region for the period in which the restrictions were violated.

How to figure out what benefits under the simplified tax system are available in your region

To do this, we will learn how to find the necessary information on free state and municipal resources, for example, on the official website of the Federal Tax Service of Russia.

Our goal is to find a law on the simplified tax system adopted by the authorities of a particular region and find out:

- whether a reduced tax rate applies;

- is it possible to take advantage of tax holidays, and if so, are there additional restrictions for them (relevant for individual entrepreneurs registered for the first time after the local law on tax holidays came into force and operating in the production, social and/or scientific spheres).

Let's assume that the organization is registered in the city of Ust-Kut, Irkutsk region. Field of activity: laundry and dry cleaning (OKVED code 96.01). The taxation system is the simplified tax system “Income minus expenses.” What conditions can you expect when applying the simplified tax system in this region?

Step 1. Find the local law.

On the Federal Tax Service website, in the section dedicated to the simplified tax system, we set our region.

Then scroll down the page to the heading “The information below depends on your region”, in this section we find the law and open its text.

Step 2. Let’s clarify whether reduced tax rates have been established and the conditions for their application.

From the text of the law we learn that legislators of the Irkutsk region applied a reduced rate and determined those who have the right to use it:

In particular, Article 2 of the Law states:

“Establish a differentiated tax rate of 5 percent for taxpayers applying the simplified taxation system if the object of taxation is income reduced by the amount of expenses for which during the reporting (tax) period at least 70 percent of the income will be income from the implementation of one or several types of activities on the territory of the Irkutsk region, included in: ... 3) section Q “Activities in the field of health care and social services” OKVED 2; ...”

Step 3. Let's check whether we qualify for the reduced rate.

Yes, we are suitable: section Q of the All-Russian Classifier of Economic Activity Codes (OKVED) includes codes from 86 to 96. Our code is 96.01.

Since the organization does nothing other than laundry and dry cleaning, all its income relates to this activity. This means that the 70% condition is met.

Conclusion:

Our organization, which:

- registered in the city of Ust-Kut, Irkutsk region;

- applies the simplified tax system (income minus expenses);

- provides laundry and dry cleaning services (code 96.01)

has the right to calculate the simplified tax system at a rate of 5% instead of the general rate of 15%.

By analogy, you can find out what conditions of the simplified tax system apply in your region. Based on the information received, some taxpayers decide to re-register the organization, for example, in a neighboring region, where rates are lower.

For individual entrepreneurs, this is more difficult, since they must be registered with the Federal Tax Service at the place of registration (in other words, they need to register in another region).

Rates of the simplified tax system for victims of coronavirus

The authorities of the constituent entities began to reduce rates under the simplified tax system in order to support organizations and entrepreneurs affected during the pandemic. Most regions have reduced interest rates for the entire year 2022, so businesses have the opportunity to recalculate taxes from the very beginning of 2020, but there are also exception regions.

Subjects of the Russian Federation can reduce tax rates both for all taxpayers and for those who suffered more. If the benefit is introduced only for affected industries, then the company must receive at least 70% of its income from the relevant type of activity. If the benefit applies to everyone, then the percentage of income does not matter.

For example, the Chelyabinsk region has established the lowest rates for affected individual entrepreneurs and organizations - 1% for income earners and 5% for those who calculate the tax on the difference between income and expenses. A complete list of activities is given in the law of the Chelyabinsk region dated 04/09/2020 No. 123-ZO. These types should account for at least 70% of the company's revenue. There are no requirements for inclusion in the SME register.

An opposite example is the Republic of Tyva. Local authorities have made rates minimal for all taxpayers due to the use of a simplified taxation system. This means that local entrepreneurs do not need to fulfill any special conditions to work at a preferential rate (Law of the Republic of Tyva dated April 10, 2020 No. 590-ZRT).

You can check the availability of benefits in your region on the official website of the Federal Tax Service in the “Regional Legislation” section.

List of regions in which a reduced tax rate of the simplified tax system is applied

Below is a list of territories where reduced simplified tax rates apply. If your region is not among them, you can check the information yourself. If in doubt, you can contact your Federal Tax Service directly or use the help of specialists.

List of regions where reduced tax rates of the simplified tax system are provided:

- Moscow

- Saint Petersburg

- Leningrad region

- Republic of Crimea

- Sevastopol

- Astrakhan region

- Belgorod region

- Bryansk region

- Vladimir region

- Volgograd region

- Voronezh region

- Jewish Autonomous Region

- Transbaikal region

- Ivanovo region

- Irkutsk region

- Kabardino-Balkarian Republic

- Kaliningrad region

- Kaluga region

- Kamchatka Krai

- Karachay-Cherkess Republic

- Kemerovo region

- Kirov region

- Kostroma region

- Kurgan region

- Kursk region

- Lipetsk region

- Magadan Region

- Moscow region

- Murmansk region

- Nenets Autonomous Okrug

- Novgorod region

- Orenburg region

- Oryol Region

- Penza region

- Perm region

- Primorsky Krai

- Pskov region

- Altai Republic

- The Republic of Buryatia

- The Republic of Dagestan

- Republic of Kalmykia

- Republic of Karelia

- Komi Republic

- Mari El Republic

- The Republic of Mordovia

- The Republic of Sakha (Yakutia)

- Republic of Tatarstan

- Tyva Republic

- The Republic of Khakassia

- Rostov region

- Ryazan Oblast

- Samara Region

- Saratov region

- Sakhalin region

- Sverdlovsk region

- Smolensk region

- Stavropol region

- Tambov Region

- Tomsk region

- Tula region

- Tyumen region

- Udmurt republic

- Ulyanovsk region

- Khabarovsk region

- Khanty-Mansiysk Autonomous Okrug

- Chelyabinsk region

- Chechen Republic

- Chuvash Republic

- Chukotka Autonomous Okrug

- Yamalo-Nenets Autonomous Okrug

- Yaroslavl region

What are differentiated rates under the simplified taxation system?

The provisions of Art. 346.20 of the Tax Code of the Russian Federation establishes several types of tax rates under the simplified taxation system. Namely:

- General rates:

- 6% - under the “income” scheme;

- 15% - under the “income minus expenses” scheme.

- Rates established by the legislator of the constituent entity of the Russian Federation within the limits:

- 1–6% - under the “income” scheme;

- 5–15% - with the “income minus expenses” scheme.

In this case, the specific rate can be determined differentially, depending on the category of taxpayer.

- Additional increased rates effective from 2022:

- 8% - with the “income” scheme;

- 20% - under the “income minus expenses” scheme.

From 01/01/2021, the limits for the use of the simplified tax system have been increased through the emergence of a transition period. In accordance with this innovation, enterprises that exceed the number of employees of 30 people and/or the income limit of 50 million rubles will not lose the right to apply the special regime, but will pay tax at the above rates.

- The rates set by the authorities of Crimea and Sevastopol for the simplified tax system “income minus expenses” are within the range of 3–15%. Similarly, the authorities of the Crimean region can practice a differentiated approach to setting rates, that is, tie them to specific categories of simplified tax payers. At the same time, legislators in Crimea and Sevastopol also have the right to reduce simplified taxation tariffs under the “income” scheme on a general basis.

- Zero rates under the simplified tax system, established by the legislator of the constituent entity of the Russian Federation for individual entrepreneurs under the simplified tax system “income minus expenses”.

The preferences under consideration can be established by any region along with reduced rates under the simplified tax system.

Note! Clause 4 art. 346.20 of the Tax Code of the Russian Federation, which provides for a 0% rate under the simplified tax system for individual entrepreneurs, becomes invalid as of 01/01/2021.

Thus, differentiated tax rates according to the simplified tax system are those that:

- differ from ordinary ones to a lesser extent;

- are applied when the limits for the use of the special regime are exceeded;

- are established for specific categories of taxpayers by the authorities of the constituent entities of the Russian Federation.

Let’s take a closer look at the simplified tax rates available to entrepreneurs in 2020-2021, which are lower than standard in accordance with regional legal acts.

Minimum tax under the simplified tax system “income minus expenses” in 2022

If the simplifier has chosen the “income-expenses” object, then at the end of the year, instead of the usual tax, he will have to pay the minimum tax if the following condition is met:

(Income – Expenses) × STS rate < Income × 1%

The minimum tax is 1% of the simplified person’s income for the tax period. At the same time, he can take into account the difference between the minimum tax and the tax calculated in the usual manner in expenses under the simplified tax system next year. And if a loss is received, include it in the loss. This loss under the simplified tax system can be taken into account when calculating tax for 10 years following the year the loss was received (clause 7 of article 346.18 of the Tax Code of the Russian Federation).

When paying the minimum tax, the simplifier can reduce this amount by advance payments under the simplified tax system already transferred in 2022 based on the results of the reporting periods.