Value added tax is not an absolute charge. A number of business activities are subject to it, while others are exempt from VAT. An organization can do both at the same time. There are also frequent cases when a company has several tax regimes in effect simultaneously, for example, general and UTII, general and patent.

In such cases, accounting and financial records for such types of activities or tax systems must be maintained separately. The main thing is to choose the optimal method for this. Let's consider the principles of maintaining separate accounting for value added tax.

If you don't keep separate records

Separate accounting for VAT is mandatory for a company in the following cases:

- in the parallel conduct of taxable and non-taxable activities;

- when using two tax regimes at once;

- when providing services of both a commercial nature and those whose prices are regulated by the state;

- when working under government contracts;

- when combining commercial and non-commercial activities.

ATTENTION! The first case also includes accounting for “input” VAT for goods (works, services) purchased within the framework of different types of activities (taxable and non-taxable). This applies not only to objects, but also to intangible assets (paragraph 5, paragraph 4, article 170 of the Tax Code of the Russian Federation).

If an economic entity does not introduce separate accounting in these cases, it loses the rights to:

- VAT deductions;

- reduction of the income tax base by the amount of VAT (clause 4 of Article 170 of the Tax Code of the Russian Federation);

- tax benefits (clause 4 of article 149 of the Tax Code of the Russian Federation).

Exceptions: when there is no need to separate accounting

It is better for an entrepreneur to know when keeping separate records makes no practical sense, because without the need to increase the labor costs of the accounting department, it is unprofitable.

There are certain legally established situations in which separate accounting may not be maintained even if the above conditions are met. Among them is conducting trade outside the Russian Federation (a domestic organization operates territorially in another state). In this case, the services provided or goods sold are not the basis for calculating VAT.

IMPORTANT! In this case, reporting is carried out in accordance with the requirements of domestic legislation, however, it is recommended that the contract additionally indicate the place of sale of goods or provision of services (to reduce the likelihood of complications during inspections).

However, if an enterprise wants to keep separate records in cases where this is not provided for by law, no one will have anything against it. The purpose of such accounting can be not only purely commercial (providing VAT for deduction), but also informational, for example, detailing management data. Separate accounting in such situations is a voluntary right of any organization.

Methodology for separate VAT accounting

In ch. 21 of the Tax Code of the Russian Federation does not prescribe the methodology for separate VAT accounting, so taxpayers determine it independently. In practice, enterprises consolidate methodological recommendations for separate VAT accounting in their accounting policies.

If an enterprise actually uses separate accounting for VAT, but this is not reflected in the rules for its maintenance in the accounting policy, then it is possible to challenge the likely denial of the tax authorities’ right to deduction in court. In this case, it is only necessary to provide evidence that such a division is carried out when accounting for VAT.

However, there is also negative judicial practice for taxpayers who could not prove that separate accounting is maintained (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated July 20, 2011 No. F03-2961/2011). Therefore, you should not ignore the reflection of the rules of separate accounting in the accounting policy.

For information on what to do if there was no shipment in a certain period, see the material “Separate accounting of VAT in non-income periods is carried out according to the taxpayer’s rules .

5% threshold

This is another rule that justifies the optional division of input VAT. It is justified in paragraph 9 of paragraph 4 of Art. 170 Tax Code of the Russian Federation. This rule can only be applied by those who have VAT benefits that are timely (quarterly) confirmed.

The 5% rule states : you can ignore input VAT separately if the costs of operations supported by benefits do not exceed 5% of general production costs. In this case, it is allowed to deduct the entire input VAT without including it in the cost of goods, works, and services.

ATTENTION! The 5% rule does not apply to separate accounting of income - it is mandatory to maintain it under appropriate conditions.

If an enterprise conducts only non-taxable transactions and purchases goods (work or services) from another party, the 5% rule is not applicable for this situation: VAT cannot be deducted on these acquisitions (Decision of the Supreme Court of the Russian Federation dated October 12, 2016 No. 305-KG16- 9537 in case No. A40-65178/2015).

For a long time, the application of the 5% rule for UTII payers was controversial - the Ministry of Finance of the Russian Federation in a letter dated 07/08/2005 No. 03-04-11/143 and the Federal Tax Service in a letter dated May 31, 2005 No. 03-1-03/897/ [email protected ] argued that the 5% threshold does not apply to this tax regime. But judicial precedent put an end to this issue, and the Federal Tax Service changed its position, reflecting this in letter dated February 17, 2010 No. 3-1-11 / [email protected] ).

5% threshold in trading activities

The above rule speaks primarily about production costs. But a considerable proportion of organizations and entrepreneurs are not manufacturers, but taxpayers-merchants conducting trading activities. Will this rule be valid for trade?

The Ministry of Finance of the Russian Federation, in a letter dated January 29, 2008 No. 03-07-11/37, allowed the 5% threshold to be extended to trade operations, but did not definitely establish this, but only indicated this possibility.

Meanwhile, there are arbitration precedents establishing the refusal of separate accounting due to the “5% rule” for trading activities. The reason is simple: trade, be it wholesale or retail, is not production; “production” accounts are not used to reflect its operations in accounting.

Accuracy of accounting policies for VAT accounting

The organization is authorized to choose the system for introducing separate accounting. Naturally, the adopted standards should be recorded in the accounting policy (clause 2 of article 11 of the Tax Code of the Russian Federation).

But there may be some incidents that should be taken into account related to VAT benefits and the 5% rule. It is not known exactly how costs will be distributed across activities. This will only be clear based on the results of the quarter. What if the 5% threshold is exceeded and separate accounting was not maintained? You will have to restore it, and in some cases also adjust tax returns, which is expensive and inconvenient. Therefore, you need to make a decision whether to stipulate this norm in the accounting policy or not, and if not, then not to use it, even if such a threshold does arise.

Accounting policies are established for a one-year period. But what if an organization has VAT-free activities after it has been submitted to the tax authorities? Give up the opportunity to save money by avoiding separate accounting? No, you can formulate and provide an addition to the accounting policy : this will not be considered a change in it, because such operations arose for the first time, and at the beginning of the reporting period they were not provided for (clause 16 of PBU 1/98 “Accounting policy of the organization”, approved by order of the Ministry of Finance Russia dated December 9, 1998 No. 60n).

FOR YOUR INFORMATION! The accounting policy should list the types of activities that the organization is engaged in: separately - taxable and non-taxable VAT.

Distribution of VAT on fixed assets

In version 3.0, it became possible to distribute VAT on fixed assets. To do this, in the document “Acquisition of fixed assets” in the VAT accounting method, select the value “Distribute”. After an item of fixed assets has been accepted for accounting and the “VAT Allocation” document has been posted, this VAT will be distributed in proportion to revenue. In terms of the percentage of VAT for non-VAT taxable activities, this amount of VAT will be included in the initial cost of the fixed asset item. After this, depreciation of the object, as well as all analytical reports on fixed assets, will display the cost of the object, taking into account the amount of VAT included in the price.

Example.

In organization A in the fourth quarter of 2016, revenue from activities subject to VAT amounted to 1 million rubles, revenue from activities subject to the payment of UTII amounted to 250,000 rubles. During the fourth quarter, services related to both types of activities were purchased in the amount of 50,000 rubles, VAT on top. An object of fixed assets worth 150,000 rubles was also purchased, VAT on top (Fig. 1).

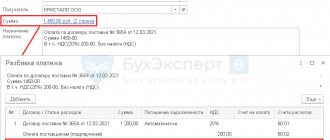

To calculate the amount of VAT distribution, we calculate the percentage. Transactions excluding VAT accounted for 20% of total revenue. Accordingly, the VAT amounts are distributed as follows: 80% – “Accept for deduction”, 20% – “Include in price”. We calculate: 9000 * 20% = 1800 rubles, 27,000 * 20% = 5400 rubles. (Fig. 2).

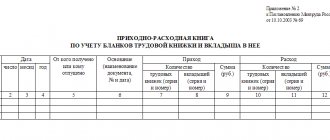

The “VAT Allocation” document includes the amounts we indicated. And after completing the document, the amount for services is 1800 rubles. will be reflected in the cost accounts (in our case this is account 44). Amount 5400 rub. will be reflected in account 08, and then in correspondence Dt. 01 Kt. 08 will increase the initial cost of the fixed asset item (Fig. 3).

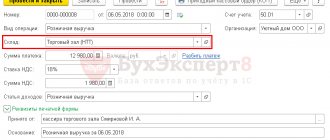

At the end of the quarter, the amount on account 19 in the “Accept for deduction” analytics is accepted for deduction by the document “Creating purchase ledger entries.” To analyze and evaluate the correctness of closing account 19, it is convenient to use a balance sheet with analytics on VAT accounting methods (Fig. 4).

For a more detailed analysis of the SALT for account 19, you can get it with analytics up to the counterparty and the movement document.

If your organization did not maintain separate VAT accounting in the program, but is required to do so, then to switch to separate accounting you need to set the settings indicated in the article and enter balances for batch accounting. You can enter batch accounting balances manually or with the help of a programmer.

Another situation when the “Maintaining separate VAT accounting” setting will help an organization is the need to write off inventory. Write-offs can be carried out for various reasons, for example, in the event of a identified shortage. In this case, since the goods are written off as a result of shortages (for activities not subject to VAT), the VAT previously accepted for deduction must be restored to payment to the budget. When using the specified setting, the program will automatically restore VAT for payment after posting the “Write-off of goods” document. If the separate accounting setting is not used, for correct accounting it is necessary to reflect this operation using the “VAT Restoration” document.

Calculation of proportions when maintaining separate accounting

By proportion here we mean determining the share of input VAT that falls on taxable and non-taxable transactions. It must be calculated to determine what share of VAT (as a percentage) can be deducted. Expenses need to be grouped:

- expenses for activities subject to VAT;

- expenses for non-VAT-taxable transactions;

- other costs that are difficult to unambiguously attribute to the first or second group.

Formula for calculating the proportion of VAT on taxable transactions:

DVObl. = (VOBL.VAT + DPrObl.VAT / V_VAT + DPr_VAT) x 100% , where:

- DVObl. – share of revenue from taxable transactions for the accounting period;

- VOBL._VAT – revenue from taxable sales excluding VAT;

- DPRobl_VAT – other income from taxable transactions excluding VAT;

- V_VAT – total sales revenue excluding VAT;

- DPR_VAT – other income excluding VAT for all transactions.

All indicators are taken into account without VAT so that the cost of non-taxable transactions is comparable to preferential ones.

NOTE! The accounting period for VAT is a quarter, which means that the proportion must be calculated quarterly.

To calculate the share of non-VAT-taxable transactions, the same principle of proportion is applied, only the ratio of revenue from non-VAT-taxable transactions to the total amount for the accounting period is sought.

The third group, mixed, is not required to be distributed for separate accounting purposes. It’s easier to attribute it all to either the first or second operations.

Output

First, we will release “School Desk” products, which will be sold without VAT. In the document “Production Report for a Shift” No. 000007 dated May 20, 2016, on the “Materials” tab (Fig. 10) we see methods for accounting for VAT on all components.

Fig.10

A separate document reflects the release of “The Dining Table” (Fig. 11).

Fig.11

What if there is temporarily no income?

In practice, sometimes there are certain periods when the company does not conduct business operations that generate income, while expenses are still incurred. This is often observed, for example, among newly registered organizations. It happens that among expenses transactions there are both VAT taxable and preferential ones. Is it necessary to divide such expenses in accounting? After all, there was no actual sale of goods and services.

Until 2015, the Ministry of Finance of the Russian Federation allowed in such cases to neglect separate accounting due to the lack of transactions with VAT benefits. However, in 2015, he voiced a different position regulating separate VAT accounting in such “non-shipment” periods.

Transfer of material to production

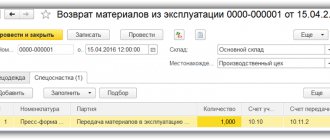

We will transfer all the necessary materials to production using the 1C document “Requirement-invoice” - Fig. 7. In the “VAT accounting method” column, select the accounting method for each item.

Fig.7

Document movements contain several bookmarks. The first one contains entries for accounting and tax accounting (Fig. 8).

Fig.8

The second tab contains data from the “VAT Separate Accounting” register (Fig. 9)

Fig.9

Now let's reflect production and sales.

Borrowing operations and separate accounting

Providing loans, selling securities and other similar transactions are subject to VAT. A significant nuance in calculating the proportion for such operations is the indicator of income amounts, which is key in the formula. For operations of one type or another, it will have a different composition, which is influenced by the current provisions of federal legislation. Federal Law No. 420 of December 28, 2013 proposes that for transactions with securities not subject to VAT, the following amount should be considered income:

D = Tsr – Rpr , where:

- D – tax-free income;

- CR – selling price of securities (according to the provisions of Article 280 of the Tax Code of the Russian Federation);

- Ррр – expenses for the acquisition of these securities (and/or sale).

If the difference is less than 0 (that is, there will be a loss), then the income is not taken into account.

The proportional calculation method for separating taxable and non-taxable transactions in this situation involves calculating the ratio between the cost of all goods sold (both in Russia and abroad) and the item of interest. The amount of income will also include:

- the entity's revenue;

- the cost of its fixed assets;

- his non-operating income.

Currently, there is no consensus on the need to maintain separate accounting for borrowing transactions. However, the Ministry of Finance of the Russian Federation is increasingly inclined to this position due to the introduction of significant changes to the Tax Code of the Russian Federation.

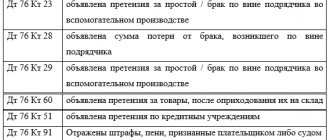

Posting input VAT on preferential activities

In accounting, input VAT will be reflected in account 19 (different subaccounts are used for different transactions). This is what the wiring will look like:

- debit 41 “Goods”, credit 60 “Settlements with suppliers and contractors” - reflection of the receipt of goods from the supplier excluding VAT;

- debit 19 “VAT on acquired values”, credit 60 - allocation of VAT, which can subsequently be deducted;

- debit 68 “Calculations for taxes and fees”, credit 19 - acceptance of input VAT for deduction;

- debit 41, credit 19 - reflection of VAT for non-taxable transactions and included in the cost of the purchased product (service, work).

Depending on the type of activity of the company, you need to use along with account 41 “Goods” and other accounts - 10 “Materials”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General expenses”, 29 “Service production and facilities” and other.

Cost comparison example

The company produces children's shoes, including medical orthopedic boots, the sale of which is exempt from taxation. The accounting records reflect direct costs for the production of autumn boots on account 20 “Direct expenses” - on the sub-account “Boots” and “Orthopedists”. During the reporting quarter, direct production expenses of the enterprise amounted to RUB 9,000,000. (of which 600,000 for boots and 200,000 for orthopedic shoes), general business expenses were also incurred - 4,000,000 rubles, and general production expenses - 3,000,000 rubles.

Let's calculate the cost ratio to determine whether this case falls under the 5% rule. 600,000 / (9,000,000 + 4,000,000 + 3,000,000) x 100% = 3.7%. Since the threshold turned out to be less than the coveted 5%, the accounting department may not keep separate records for input VAT, presenting for deduction the entire amount of value added tax billed by suppliers.

But in the tax return you will need to reflect the direct cost of production with tax benefits - 200,000 rubles.

“Input” VAT from the supplier

Input VAT is the one that the supplier presented to you for the purchased goods, works and services. To reflect it, account 19 is used. The basis document for the posting is the invoice received from the supplier. Then it must be registered in the sales book.

The wiring is as follows:

- we reflect the VAT presented by the supplier - Dt 19 Kt 60;

- We accept for deduction the submitted VAT - Dt 68-VAT Kt 19 (only on the basis of an invoice).

Sometimes VAT cannot be deducted. In this case, it is included in the initial cost of the property. The credit entry will have an account of 19, and the debit will depend on the type of item purchased.

If you work on the simplified tax system and do not have the right to deduct VAT, then you do not have to reflect the amount of input VAT on account 19. This should be stated in the accounting policy.

Checking the correct distribution of expenses

In modern practice, accounting calculations are carried out using special software. The calculation of the proportion for separate accounting is also automated. To check the final data, it is convenient to create special tables from which the entire calculation will be visible: separately for transactions subject to VAT and for non-taxable ones. The table will summarize the main indicators used to calculate the proportion:

- acquisition/sale expenses – transactions not subject to taxation (it is better to list all their types);

- qualifying expenses for taxable transactions;

- total line of direct expenses;

- mixed group of expenses (also list);

- summation.

In order to maintain separate VAT accounting correctly and when it is really necessary, you need to constantly monitor the updating of current information. The rules for maintaining separate accounting for VAT are directly related to updates in the Tax Code of the Russian Federation, which happens constantly, and recently - especially intensively.

Distribution of VAT in 1C 8.3 - step-by-step instructions

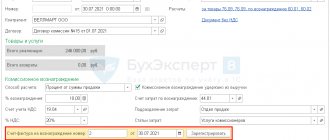

Step 1. At the end of each quarter, create a VAT Allocation (section Operations - VAT Regular Operations - Create button).

Fill out the Sales revenue .

Step 2. Check the revenue amounts calculated by the 1C 8.3 program. How to check sales amounts in the VAT Distribution document.

Step 3. Distribution tab displays all documents for which VAT should be distributed.

Postings

If in the current quarter the “5% rule” is followed and the entire “total” VAT can be deducted, then in the VAT Distribution follow the instructions in the figure:

Read more Compliance with the 5 percent rule

Step 4. At the end of each quarter, create a document Formation of purchase ledger entries in the Operations section - VAT routine operations - Create button.

It is recommended to create the document in 1C 8.3 at the end of each quarter after the VAT Distribution .

The tabular part will be filled in with documents that have the VAT accounting method to Accepted for deduction .

Learn in more detail How to maintain separate accounting of incoming VAT in 1C if there are transactions subject to VAT and non-taxable transactions?

We looked at how to set up separate VAT accounting in 1C 8.3 Accounting.