What expenses are taken into account under the simplified tax system?

A closed list of justified and documented expenses related to business activities, for which a “simplified person” applying the taxation object “income minus expenses” can reduce his income, is given in Art.

346.16 Tax Code of the Russian Federation. You can view the full list in the material “List of expenses under the simplified tax system “income minus expenses”” .

Please note that in 2022, the list of expenses under the simplified tax system has been supplemented with two new subparagraphs that allow the following to be taken into account:

- expenses for ensuring safety measures provided for by legal regulations, and expenses associated with the maintenance of premises and equipment of health centers located directly on the territory of the organization;

- expenses for the purchase of medical devices for the diagnosis (treatment) of a new coronavirus infection according to the list approved by the Government, as well as for the construction, manufacturing, delivery and bringing of these medical devices to a state in which they are suitable for use.

These costs can be taken into account in the tax base for 2022 (Clause 8, Article 10 of Law No. 305-FZ dated 07/02/2021).

We also advise you to look at recommendations for accounting for expenses incurred due to the COVID-19 epidemic from ConsultantPlus experts. You can get trial access to the legal system for free.

Costs should be taken into account in this order:

- Material expenses are recognized when the debt to the supplier is repaid. In particular, materials must be fully paid for regardless of the date of their write-off for production and the date of sale of the products on which these materials were used.

- For wages - at the time of payment of debt to staff.

- Upon payment of interest - at the time of payment.

- For payment for work and services - at the time of repayment of debt for work performed or services rendered.

- Goods - paid expenses for the purchase of goods are taken into account when determining the tax base as these goods are sold to customers.

- Taxes and fees - in the amount of actual payment.

- The costs of purchasing OS are taken into account in the manner established by clause 3 of Art. 346.16 Tax Code of the Russian Federation.

ConsultantPlus experts explained in detail how to take into account the costs of software and website creation. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

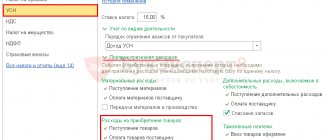

Program settings

1.1 Changing the object of taxation according to the simplified tax system to “income minus expenses”

Form “Taxes and reports” (Fig. 1):

- Section: Main

–

Taxes and reports

. - In the list of taxes on the left, place the cursor on Taxation system

, then on the right side of the window follow the link

History of changes

. - Click the Create

, add a new entry, in the

Applies to

, indicate the beginning of the new tax period (“January 2022”) and set the

Taxation system

to the “Simplified (income minus expenses)” position, uncheck the “UTII” checkbox (for the current release, when a new release is released in 2022, this checkbox will be unchecked automatically and will not be available for editing). - Button Record and close

.

Rice. 1

After changing the taxable object, a new entry is automatically created in the Main - Accounting Policies

, in which the switch

Method of estimating the inventory

is set to the “By FIFO” position and is not available for change (Fig. 2).

Rice. 2

OS costs

The procedure for including fixed assets costs in expenses depends on when they were purchased:

- At the moment when the taxpayer was already on the simplified tax system.

- Before switching to the simplified tax system.

“Simplified”, which applies the simplified tax system for the difference in income and expenses, writes off investments in the purchase of OS from the moment the OS is put into operation on the last day of the reporting period in which this commissioning took place, in the amount of actual payment.

IMPORTANT! OS can be taken into account only on the condition that they are used in the entrepreneurial activity of a “simplified person” (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation). OS purchased for other purposes cannot reduce the base under the simplified tax system.

Similarly, VAT, included in the initial cost of the operating system and paid upon its purchase, is also accepted as expenses.

When a taxpayer purchases an asset before it switches to the simplified tax system, recognition of expenses is determined by the useful life of the asset. This period is established in accordance with Art. 258 of the Tax Code of the Russian Federation and classification of OS.

When determining the period as lasting 3 years or less, the residual value of the fixed assets is written off on the last day of each quarter during the first year of application of the regime.

When setting a period of 3 to 15 years inclusive, the residual value of the fixed assets is written off as expenses in the following order: in the first year of application of the described regime, 50% of the residual value of the fixed assets is written off, in the second - 30%, in the third - the remaining 20%.

If a fixed asset has a useful life of more than 15 years, then the residual value is written off during the first 10 years of application of the simplified tax system.

NOTE! When switching to the simplified tax system, the VAT paid when purchasing an operating system should be restored taking into account the residual value of the operating system and paid to the budget. This must be done in the last tax period before using the special regime.

The amount of the residual value of fixed assets, which can be taken into account in expenses for the purposes of calculating the simplified tax system, is determined according to the rules specified in clause 2.1 of Art. 346.25 of the Tax Code of the Russian Federation, and depends on the tax regime in which the taxpayer was before the transition to the simplified tax system with the object “income minus expenses”.

Example

If, before the transition to the simplified tax system with the object “income minus expenses,” the taxpayer applied the simplified tax system with the object “income,” then the residual value of fixed assets is not determined. If, before the transition to the simplified tax system with the object “income minus expenses,” the taxpayer used the general taxation system, then the residual value of paid fixed assets is determined on the date of transition to the simplified tax system as the difference between the purchase price (construction, manufacture, creation) of the fixed asset and the amount of accrued depreciation according to the rules Ch. 25 “Profit Tax” of the Tax Code of the Russian Federation.

If before the transition to the simplified tax system with the object “income minus expenses” the taxpayer used UTII, then the residual value as of the date of transition to the simplified tax system is formed as the difference between the price of acquisition (construction, production, creation) of a fixed asset and the amount of accrued depreciation according to accounting rules for the entire period application of UTII.

How to write off material expenses using the simplified tax system

Organizations that apply the simplification and pay a single tax on the difference between income and expenses can include paid material expenses in the calculation of the tax base (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Material expenses are taken into account in the manner prescribed by Article 254 of the Tax Code of the Russian Federation, taking into account the provisions of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

One of the items of material costs is the cost of purchasing raw materials and supplies used in the process of producing goods (performing work, providing services). When calculating the single tax, expenses for the purchase of raw materials and supplies (intended for use in production) are recognized provided that these expenses are economically justified and documented (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation).

When determining the tax base for a single tax, it is necessary to separately take into account: - the cost of material assets (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation); — amounts of input VAT paid to suppliers upon their acquisition (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Estimation of the cost of raw materials and supplies

Estimate the cost of raw materials and materials at the actual cost, which includes:

— purchase price under the contract; — commissions paid to intermediaries; — import customs duties and fees; — transportation costs; — other costs associated with the acquisition of inventories.

This is stated in paragraph 2 of Article 254 of the Tax Code of the Russian Federation (Clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Situation: at what point can the cost of inventories (raw materials, inventory, components, etc.) be written off as expenses? The organization applies the simplification and pays a single tax on the difference between income and expenses

Write off material expenses immediately after actual payment.

Organizations on a simplified basis with the object of taxation “income minus expenses” have the right to reduce the tax base for material expenses (clause 1 of Article 346.14, subclause 5 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation). Such expenses (if economically justified) are recognized immediately upon actual payment. This follows from the provisions of subparagraph 1 of paragraph 2 of Article 346.17, paragraph 2 of Article 346.16 and paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Based on the literal interpretation of the provisions of paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation, material expenses must be recognized according to the rules of Article 254 of the Tax Code of the Russian Federation. However, clarifications from the Russian Ministry of Finance allow us to conclude that such expenses can be included in the calculation of the single tax if two conditions are simultaneously met:

– goods and materials (raw materials, materials, inventory, components) are received and entered into the warehouse; – expenses have been paid, that is, the debt to the supplier has been repaid.

This rule also applies to customer-supplied raw materials transferred for processing to another organization (letter of the Ministry of Finance of Russia dated May 21, 2013 No. 03-11-11/17871).

Additional conditions provided for in Article 254 of the Tax Code of the Russian Federation are not required to recognize material expenses. In particular, there is no need to wait for raw materials to be transferred to production. And there will be no need to adjust the amount of material expenses to the cost of unused balances (letter of the Ministry of Finance of Russia dated July 31, 2013 No. 03-11-11/30607).

In relation to tools, devices, inventory, instruments, workwear and other property, the initial cost of which does not exceed 40,000 rubles, it is not necessary to comply with the norms of subparagraph 3 of paragraph 1 of Article 254 of the Tax Code of the Russian Federation. That is, the costs of purchasing such objects can be written off as a reduction in the tax base, regardless of whether they were put into operation or not. The main thing is that material assets are paid for and entered into the warehouse. This is stated in letters of the Ministry of Finance of Russia dated July 5, 2013 No. 03-11-06/2/26056 and dated July 29, 2009 No. 03-11-06/2/137.

In the book of income and expenses, costs for the purchase of raw materials (materials) are reflected on the basis of the payment order that was used to pay for the received resources. At the same time, the organization is not obliged to keep records of raw materials and materials written off for production. This follows from the provisions of subparagraph 1 of paragraph 2 of Article 346.17 and subparagraph 1 of paragraph 1 of Article 254 of the Tax Code of the Russian Federation. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 27, 2010 No. 03-11-11/284 and dated January 23, 2009 No. 03-11-06/2/4.

The same procedure is used to recognize expenses for raw materials and materials that the organization acquired and paid for during the period of application of the simplified tax system, and used in production after the transition to the general taxation system. The amount of expenses in such a situation is fully taken into account when calculating the single tax. This was stated in the letter of the Ministry of Finance of Russia dated October 21, 2011 No. 03-11-11/259.

An example of reflecting in the book of income and expenses the costs of purchasing raw materials and household equipment. The organization applies the simplification and pays tax on the difference between income and expenses

CJSC "Alfa" is engaged in the production of food products, applies a simplified tax system and pays a single tax on the difference between income and expenses.

In March, Alpha acquired:

— raw materials for use in the main production for a total amount of 118,000 rubles. (including VAT RUB 18,000); — inventory for use in production activities for a total amount of 11,800 rubles. (including VAT 1800 rub.).

The raw materials were paid for on March 25, entered into the warehouse on March 28, and written off for production on April 4. The accountant included the cost of raw materials, as well as the amount of “input” VAT, as expenses in March (Q1), without waiting for them to be written off for production.

The inventory was paid for on March 29 and put into operation on April 2. The accountant decided to reflect the cost of inventory in expenses after its commissioning, that is, in April (Q2).

The listed transactions were reflected in the book of income and expenses.

Situation: is it possible to reduce the tax base for a single tax on the cost of raw materials received as a contribution to the authorized capital? The organization applies the simplification and pays a single tax on the difference between income and expenses

Answer: no, you can't.

When receiving property as a contribution to the authorized capital, the organization does not incur any expenses (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). Therefore, the organization does not have the right to take into account the value of such property when calculating the single tax. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated February 3, 2010 No. 03-11-06/2/14 and dated January 29, 2010 No. 03-11-06/2/09.

Situation: is it possible to reduce the tax base for a single tax on the cost of materials purchased in cash, but without a cash receipt? When purchasing materials, the seller issued an invoice, invoice and receipt for the cash receipt order

Answer: yes, you can.

In order to take into account expenses when calculating the single tax, they must be paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). For cash payments, payment is confirmed by a cash receipt, which the seller must issue. If for some reason he did not do this, you can prove the fact of payment using a receipt for the cash receipt order, which must be issued by the seller. This follows from paragraph 5.1. Instructions of the Bank of Russia dated March 11, 2014 No. 3210-U.

Thus, the cost of materials purchased for cash can be taken into account when calculating the single tax, even if the seller did not issue a cash receipt. To confirm payment of such expenses, it is enough to have a receipt for the cash receipt issued by the seller.

This conclusion is also confirmed by arbitration practice (see, for example, decisions of the FAS of the East Siberian District dated July 14, 2005 No. A19-22317/04-52-Ф02-3320/05-С1 and the North-Western District dated September 15, 2005 A66-13879/2004).

Situation: how to write off the costs of paying for raw material processing services? The organization applies the simplification and pays a single tax on the difference between income and expenses

For organizations using the simplified system, the costs of paying for services for processing raw materials are material (subclause 5, clause 1, article 346.16, clause 2, article 346.16, subclause 6, clause 1, article 254 of the Tax Code of the Russian Federation). Their cost can be included in the calculation of the tax base if two conditions are simultaneously met: services for processing raw materials must be accepted from the contractor and paid for (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). At the same time, the costs of purchasing customer-supplied raw materials reduce the tax base, regardless of the provision of these services. The cost of raw materials transferred for processing is recognized as an expense immediately after these raw materials have been capitalized and paid to the supplier. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated May 21, 2013 No. 03-11-11/17871.

OS implementation

When implementing an OS, it is necessary to take into account the useful life of the OS and the moment of its implementation. The same rule applies to any disposal of fixed assets, except for its loss (for example, when transferring fixed assets to the authorized capital of another company).

In some cases, it will be necessary to recalculate the base according to the simplified tax system for the periods in which the costs of purchasing fixed assets being sold were taken into account. This should be done while the following conditions are met:

- The useful life of the OS is determined to be up to 15 years inclusive, and the period from the moment of its acquisition (and writing off the purchase price as expenses) is less than 3 years.

Or:

- The useful life of the OS is more than 15 years, and the period from the date of purchase is less than 10 years.

The tax base should be adjusted in the following order:

- Exclude all recorded fixed assets costs from the expenses of those years when they were taken into account when calculating the simplified tax system.

- Include in monthly expenses the amount of accrued depreciation according to the rules established by Art. 259 of the Tax Code of the Russian Federation for the period of use of the fixed assets, and the under-depreciated part of the fixed assets cannot be included in expenses.

- Calculate and additionally pay to the budget the amount of tax according to the simplified tax system and penalties for those periods when fixed assets expenses were included in the expenses for tax reduction.

You can learn how to correctly calculate the tax from the material “The procedure for calculating the simplified tax system “income minus expenses” (15 percent) .

- Submit an updated tax return for those periods in which the costs of the sold fixed assets were taken into account.

Find out how to account for the sale of a fixed asset under the simplified tax system in ConsultantPlus. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Example

Vympel LLC, located on the simplified tax system, purchased a wood carving machine worth 449,988 rubles in September 2020. without VAT. In October 20XX, the machine was fully paid for and put into operation. Vympel LLC approved the service life for the purposes of calculating depreciation - 84 months.

The cost of the machine is 449,988 rubles. was included in expenses under the simplified tax system.

In June 20XX, Vympel LLC sold the machine at a price of 300,000 rubles.

In June 20XX, the accountant of Vympel LLC:

- I excluded from last year’s expenses the costs of purchasing a machine in the amount of 449,988 rubles.

- In the expenses of the previous year, I took into account the depreciation of the machine for 2 months (November and December) of the year 20XX: 10,714 rubles. (monthly depreciation is 449,988 / 84 = 5,357 rubles, for 2 months the amount of accrued depreciation is 5,357 × 2 = 10,714 rubles).

- I recalculated and paid additional taxes for last year. The amount of tax to be paid additionally was (449,988 – 10,714) × 15% = 65,891 rubles.

- Calculated and paid the fine.

Let's assume that the additional tax payment was made on 06/17/20XX. The number of days of delay from 04/02/20XX (postponement of the payment deadline from 03/31/20XX is a day off) to the date of additional payment of the simplified tax system = 76 days.

With a key rate of 7.75%, penalties payable amounted to RUB 2,076.66, including:

- for the period from 04/03/20XX to 05/02/20XX the penalties amounted to 510.66 rubles. (RUB 65,891 × 30 days / 300 × 7.75%);

- for the period from 05/03/20XX to 06/17/20XX the fines amounted to RUB 1,566.01. (RUB 65,891 × 46 days / 150 × 7.75%).

Our Penalty Calculator will help you calculate the amount of the penalty.

- I submitted an update on the simplified tax system for last year.

- I recalculated downwards by the amount of accrued depreciation for 6 months (January - June) advance payments under the simplified tax system for the year 20XX.

Results

Expenses are written off under the simplified tax system “income minus expenses” according to a closed list established by the Tax Code of the Russian Federation.

When including certain amounts in expenses, one should be guided by the rules set out in Art. 346.17 Tax Code of the Russian Federation. The procedure for accounting for the receipt and disposal of fixed assets under this type of simplified tax system deserves special attention, since the final result (tax base according to the simplified tax system) will depend on both the useful life and the period of actual ownership of the fixed asset object. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.