What applies to household equipment and accessories?

What may be included in the list of tools, household equipment and accessories (hereinafter referred to as material assets, MC) has not been determined by anyone. The organization regulates this itself. Typically it includes:

- office furniture and equipment;

- lighting;

- stationery;

- Appliances;

- means related to fire safety;

- hygiene products;

- cleaning equipment and materials;

- tools, etc.

It is possible to purchase such goods both by bank transfer and through accountable persons.

How to account for the purchase of materials through accountable persons, read in Art. “What kind of posting reflects the acquisition of material assets under the report .

To organize accounting, it is necessary to correctly classify MC.

There are 2 options for inventory accounting:

- as part of fixed assets (fixed assets);

- as part of the MPZ.

Important! From 01/01/2021, inventories are accounted for according to new rules established by the new FSBU 5/2019 “Inventories”; the previous PBU 5/01 has become invalid. And fixed assets are accounted for according to the new rules approved by FSBU 6/2020, which are mandatory for use from 01/01/2022.

Some accounting rules have been changed significantly. ConsultantPlus will help you rebuild your inventory accounting. Get trial access to K+ for free and proceed to the material. And in this ready-made solution you will learn in detail about changes in fixed asset accounting.

In any option, objects are taken into account at the actual cost of acquisition, which consists of all costs associated with the purchase. In general, VAT is not included in this amount. It is included in the price only if MCs are used for non-taxable activities (clauses 9-11 FSBU 5/2019 “Inventories”, approved by Order of the Ministry of Finance of Russia dated November 15, 2019 No. 180n, clause 12 FSBU 6/2020 “Fixed Assets” , approved by order of the Ministry of Finance of Russia dated September 17, 2020 No. 204n).

Accounting for inventory and household supplies as part of OS

Inventory is classified as fixed assets if its useful life is more than 12 months, and its cost is above the limit established by the organization. At a lower cost, it is allowed to take it into account as part of the inventory (clause 5 of FSBU 6/2020). At the same time, the organization can set its own cost limit between fixed assets and inventories at the above limit. For example, how to take into account objects costing over 20,000 rubles as fixed assets, and cheaper ones as inventories. The cost threshold must be fixed in the accounting policy.

Let's consider a sample of accounting entries that are generated upon receipt, movement and disposal of fixed assets.

| Accounting entry | Action, document |

| Dt 08 Kt 60 (10, 71, 76) | The OS is purchased. Consignment note, form OS-1 |

| Dt 19 Kt 60 | VAT allocated. Invoice |

| Dt 01 Kt 08 | The cost of the OS has been determined. He is assigned an inventory number and an OS-6 inventory card is filled out. |

| Dt 20 (23, 25, 26...) Kt 02 | Depreciation has been calculated. There are 4 ways to calculate depreciation in accounting. The chosen method is recorded in the accounting policy |

| Dt 02 Kt 01 | Depreciation written off. This occurs at the time of disposal, sale, gratuitous transfer, shortage or damage to the OS |

| Dt 91.2 Kt 01 | The residual value has been written off. If the fixed assets are fully depreciated, the residual value is 0. Form OS-4 |

This is only a small part of the possible set of transactions for accounting for fixed assets in an organization.

Read more about asset accounting in Art. "Accounting for fixed assets - accounting entries" .

As for documentation, in this case, for inventory, you need to use documents that are usual for registering OS or approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7. For example, such as:

- OS-1 - act of acceptance and transfer of an OS object;

- OS-2 - invoice for internal movement of fixed assets;

- OS-3 - act of acceptance and delivery of repaired, reconstructed, modernized OS facilities;

- OS-4 - act on write-off of an asset (except for vehicles), etc.

Or an organization can develop such documents independently. We remind you that they must contain the mandatory details specified in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Below we will present only unified forms.

What other documents may be required to register the OS movement, read here.

How soft inventory is accounted for

The list of items related to soft inventory is determined by law. It can be found in paragraph 118 of Instruction No. 157n.

Soft inventory items include:

- protective clothing (including personal protective equipment, such as gas masks, respirators, etc.);

- shoes;

- tracksuits and shoes;

- shirts, dressing gowns;

- bed dress.

Registration of soft equipment is carried out on the basis of primary accounting documentation. For cases where the items actually received do not correspond to the parameters specified in the accompanying papers, an act of acceptance of materials is prepared according to the unified form 0315004. It is filled out in duplicate by the admissions committee. A representative of the supplier and a financially responsible employee must be present during registration. Next, the form along with accompanying documentation is sent to the accounting department.

According to the above instructions, soft equipment must be marked. It is made by stamping with indelible paint, which does not spoil the appearance of the product. Marking is carried out by a financially responsible employee in the presence of the director (or his deputy) and an accountant.

After making a decision on the disposal of soft and household equipment, a write-off act is drawn up. A commission is appointed to complete it. Form 0504143 contains two tables, one of which reflects the parameters of the items being written off. The document is prepared in two copies, one of which is kept by the financially responsible person, and the second is sent to the accounting department. Next, you can download the act form from the link.

Write-off act

Post Views: 2,533

Accounting for tools and household equipment as part of the inventory and postings to it

Inventory with a useful life of up to 12 months must be taken into account as part of the inventory. Moreover, regardless of its cost.

It is included in the organization’s warehouse based on the corresponding primary order:

- TN (TORG-12);

- receipt in form M-4 (can be replaced with the corresponding stamp on the seller’s invoice).

After this, accounting cards are created for the registered objects, using, for example, form M-17.

What data is filled out in the M-17 form, read in Art. "Material warehouse card - form and sample" .

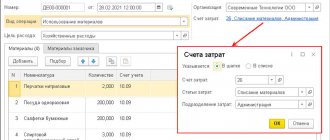

At this moment, an entry is made in the accounting records as a debit to account 10. The corresponding account depends on the method of receipt of inventories into the organization.

Important! Explanations from ConsultantPlus (new order from 2021) At each reporting date, inventories should generally be reflected in accounting at the lower of the values (clause 28 of FSBU 5/2019): actual cost; net realizable value. … The excess of the actual cost of inventories over their NPV is considered to be an impairment of inventories. If there is impairment, it is necessary to create a reserve for impairment of inventories (clause 30 of FSBU 5/2019). Recommendations from K+ experts will help you determine the net selling price and create a reserve. Trial access is free.

During the transfer of tools and accessories from the warehouse for the needs of the organization, a demand invoice is drawn up in form M-11. Also, forms M-8, M-15 (approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a) are used as primary accounting documents.

What data is indicated when filling out forms M-11, M-15, read in the articles:

- “Procedure for filling out form M-11 requirement-invoice”;

- “Unified form No. M-15 - form and sample”.

To transfer special tools from the warehouse, it is necessary to first set limits, which are developed by the organization by decision of the manager.

Form M-8, a limit-fence card, is used both for issuing special tools and for monitoring compliance with the limit. It is written out in 2 or 3 copies.

and a sample of the M-8 form is available for free by clicking on the picture below:

Inventory can be released from the warehouse to intermediate units without indicating the exact quantity of required inventory. As it is used, the unit draws up acts (reports) in any form, but with mandatory disclosure of such details as name, quantity, cost, confirmation of the feasibility of its use. Based on these acts, the cost of inventories will be written off as expenses.

The method of writing off inventory for production must be fixed in the organization’s management program (clause 36 of FSBU 5/2019):

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

If the inventories are damaged or lost, a write-off report is drawn up indicating the reason for disposal, and the losses are written off.

Read more about write-offs in the article “The procedure for writing off materials in accounting (nuances)” .

The write-off of inventory is reflected in the following accounting entries.

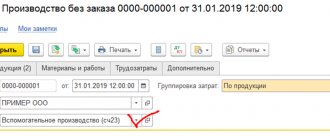

Let's look at inventory accounting as part of the inventory using an example.

Example

In February, LES LLC purchased computer chairs (5 pieces) for employees at a cost of 16,155 rubles, including VAT - 2,464.32 rubles.

The organization’s CP states that for accounting purposes, fixed assets costing less than 40,000 rubles. are written off as expenses when they are put into operation. At the same time, an entry is made on off-balance sheet account 012 “Materials transferred for operation.” Once the chairs were delivered, the accountant wrote off their cost as an expense and recorded their transfer to use in an off-balance sheet account.

In October, the management of LES LLC decided to move to a new office, which already had all the necessary furniture. In this regard, it was decided to sell the chairs to one of the employees. The transaction amount was 11,150 rubles. (including VAT - RUB 1,700.85).

The following entries were made in accounting.

In February:

- Dt 10.9 Kt 60 — 13,690.68 rub. (come computer chairs);

- Dt 19 Kt 60 — 2,464.32 rub. (we charge VAT);

- Dt 68 Kt 19 — 2,464.32 rub. (we accept VAT for deduction);

- Dt 26 Kt 10.9 - 13,690.68 rub. (we take into account the cost of computer chairs in the costs);

- Dt 012 - RUB 13,690.68. (we take into account computer chairs put into operation).

In October:

- Dt 62 Kt 91.1 - 11,150 rub. (we reflect revenue from the sale of computer chairs);

- Dt 91.2 Kt 68 - 1,700.85 rub. (we charge VAT on revenue);

- Kt 012 - RUB 13,690.68. (we write off sold computer chairs).

When generating income tax calculations for 12 months of LES LLC:

- we include in expenses for February the cost of computer chairs included in expenses - 13,690.68 rubles;

- we include in income the proceeds from the sale of computer chairs - 8,474.58 rubles.

Tax accounting under different taxation systems

Expenses on inventory and household supplies are not reflected equally in taxes

Companies with OSNO

In the process of calculating income tax when using OSNO, the write-off of the cost of industrial property occurs through the determination of depreciation charges. When household inventory cannot be recognized as property subject to depreciation, it is taken into account as part of the inventory. The company has the right to decide on the procedure for writing off IHP in the way it considers most appropriate, taking into account the length of time it was in use and other economic criteria.

For example, this can be done:

- in one go, one-time;

- evenly over not one, but several months.

When a company uses the accrual method, the tax base is reduced depending on the fact that the inventory is sent for use.

When using the cash method, the tax base is reduced after the transfer of the industrial property for use and the transfer of payment for its cost to the supplier company.

simplified tax system

In a company using the simplified tax system, costs are taken into account depending on which object of taxation it has chosen. If the object “income” is used, then the costs of economic property will not be able to reduce the tax base.

When the object is the same income, but minus costs, the tax base is reduced by the cost of purchased inventory and household property. The costs also include input VAT on these goods.

UTII

For such enterprises, expenses for household equipment do not affect the size of the tax base. The reason is that the object of UTII taxation is imputed income.

Combination of OSNO and UTII

When IHPs are used simultaneously in two types of company activities that are different from the type of taxation, the amount of expenses must be distributed. The calculation is carried out in direct proportion to the share of income from each type of activity. Indicators are determined for the period of time in which the inventory was purchased. The amount of VAT allocated in the invoice for the purchase of industrial property is also subject to proportional distribution.

Control over the movement of economic and production equipment transferred to operation

We have already said above that assets that meet the criteria for classification as fixed assets and are valued within the limit established by the organization can be reflected in the accounting system as part of the inventory. At the same time, FSBU 6/2020 directly requires that the organization is obliged to establish control over them in order to track their movement and ensure safety after they are put into operation.

Such property, as a rule, is accounted for on account 10 and its value is written off at a time when it is put into operation. At the same time, this property must continue to be taken into account off the balance sheet until it is completely worn out or lost. For this, as a rule, account MC.04 is used. When writing off an off-balance sheet, you need to draw up an act in the MB-8 form.

A sample act MB-8 was prepared by ConsultantPlus experts. Get free trial access to the system and proceed to the sample.

As for the MCs related to the MPZ, the organization is not obliged to establish control over their movement, but can do this, guided by its interests.

How exactly control over inventory should be exercised has not been determined by anyone. The organization itself develops norms and rules for its implementation.

This is often done using a separate off-balance sheet account, for example 012, on which they keep records of inventory transferred into operation (Dt 012) until it is written off due to expiration of its service life, sale, loss, etc. (Dt 012) .