The vast majority of income and expenses of any organization are associated with the sale of goods and/or services. However, activities and financial reporting are not limited to sales alone. There are very significant income and expense items associated with other business processes; they also need accounting.

Let's analyze the specifics of these financial indicators, dwell on the features of their reflection in accounting and in the Tax Code of the Russian Federation, and consider their impact on the amount of income tax.

What income is not realized?

When the definition states that the defined concept includes all indicators except those listed, then the necessary factors can be calculated by the method of elimination. It can be said that all types of income not mentioned in Art. 249 of the Tax Code of the Russian Federation. In turn, in Art. 250 of the Tax Code of the Russian Federation states that all income of an organization is recognized as non-operating, except :

- amounts received as a result of sales;

- tax-free financial income (they are specifically stipulated in Article 251 of the Tax Code of the Russian Federation).

List of non-operating income

Another approach to determining this form of profit is to list the possible types of income that Art. 250 Tax Code classifies as non-operating:

- profit received from equity participation in other associations (if additional shares are purchased with dividends, then this income is excluded from non-operating income);

- paid ]penalties[/anchor], fines, penalties under contracts (or even not yet paid, but only awarded or recognized by the debtor);

- compensation received for damage or loss;

- insurance payments;

- profit from leasing or subletting tangible assets or real estate (except for those situations when this activity is the main activity for the company - then this is already income from the provision of services);

- assets received free of charge, for example, as a gift;

- past profit for the reporting year;

- the cost of surplus property credited to the balance sheet based on the results of the regular inventory;

- payment of debts on loans and deposits, the statute of limitations of which has already expired (“unexpectedly returned debt”);

- profit from differences in exchange rates;

- the result of revaluation of assets;

- some others.

Article 250 of the Tax Code of the Russian Federation - Non-operating income

For the purposes of this chapter, non-operating income is recognized as income not specified in Article 249 of this Code.

Non-operating income of a taxpayer is recognized, in particular, as income:

1) from equity participation in other organizations, with the exception of income used to pay for additional shares (shares) placed among the shareholders (participants) of the organization.

For the purposes of this chapter, income from equity participation in other organizations paid in the form of dividends also includes income in the form of property (property rights) received by a shareholder (participant) of the organization upon leaving the organization or upon distribution of the property of the liquidated organization among its shareholders ( participants) in an amount exceeding the cost of shares (shares, shares) actually paid (regardless of the form of payment) by the relevant shareholder (participant) of such organization.

For the purposes of this chapter, income from equity participation in other organizations paid in the form of dividends includes, in particular, income paid by a foreign organization in favor of a Russian organization that is a shareholder (participant) of this foreign organization when distributing profits remaining after taxation, regardless of the taxation procedure for such payment in a foreign country;

2) in the form of a positive (negative) exchange rate difference resulting from the deviation of the sale (purchase) rate of foreign currency from the official rate established by the Central Bank of the Russian Federation on the date of transfer of ownership of foreign currency (the specifics of determining bank income from these operations are established by Article 290 of this Code);

3) in the form of fines, penalties and (or) other sanctions for violation of contractual obligations recognized by the debtor or payable by the debtor on the basis of a court decision that has entered into legal force, as well as amounts of compensation for losses or damages;

4) from leasing property (including land plots) for rent (sublease), if such income is not determined by the taxpayer in the manner established by Article 249 of this Code;

5) from the provision for use of rights to the results of intellectual activity and rights to equivalent means of individualization (in particular, from the provision for use of rights arising from patents for inventions, utility models, industrial designs), if such income is not determined by the taxpayer in accordance with the procedure established by Article 249 of this Code;

6) in the form of interest received under loan, credit, bank account, bank deposit agreements, as well as on securities and other debt obligations (the specifics of determining bank income in the form of interest are established by Article 290 of this Code);

7) in the form of amounts of restored reserves, the costs of the formation of which were accepted as part of expenses in the manner and on the conditions established by Articles 266, 267, 267.2, 267.4, 292, 294, 294.1, 297.3, 300, 324 and 324.1 of this Code;

in the form of gratuitously received property (work, services) or property rights, except for the cases specified in Article 251 of this Code.

When receiving property (work, services) free of charge, income is assessed based on market prices determined taking into account the provisions of Article 105.3 of this Code, but not lower than the residual value determined in accordance with this chapter - for depreciable property and not lower than production (acquisition) costs. - for other property (work performed, services provided). Information on prices must be confirmed by the taxpayer - the recipient of the property (work, services) documented or through an independent assessment;

9) in the form of income distributed in favor of the taxpayer with his participation in a simple partnership, taken into account in the manner prescribed by Article 278 of this Code;

10) in the form of income from previous years identified in the reporting (tax) period;

11) in the form of a positive exchange rate difference, with the exception of positive exchange rate differences arising from the revaluation of advances issued (received).

For the purposes of this chapter, a positive exchange rate difference is an exchange rate difference that arises when revaluing property in the form of foreign currency assets (except for securities denominated in foreign currency) and claims, the value of which is expressed in foreign currency, or when devaluing liabilities, the value of which is expressed in foreign currency. currency.

The provisions of this paragraph apply if the specified revaluation or depreciation is made in connection with a change in the official rate of foreign currency to the ruble of the Russian Federation, established by the Central Bank of the Russian Federation, or with a change in the rate of foreign currency (conventional monetary units) to the ruble of the Russian Federation, established by law or by agreement of the parties, if the value of claims (obligations) payable in rubles, expressed in this foreign currency (conventional monetary units), is determined at the rate established by law or agreement of the parties, respectively;

11.1) is no longer valid. — Federal Law of April 20, 2014 N 81-FZ;

12) in the form of fixed assets and intangible assets received free of charge in accordance with international treaties of the Russian Federation or with the legislation of the Russian Federation by nuclear power plants to improve their safety, used not for production purposes;

13) in the form of the cost of received materials or other property during dismantling or disassembly during the liquidation of fixed assets being taken out of service (except for the cases provided for in subparagraph 18 of paragraph 1 of Article 251 of this Code);

14) in the form of property (including funds) used for other purposes than for its intended purpose, works, services received as part of charitable activities (including in the form of charitable assistance, donations), targeted income, targeted financing, with the exception of budgetary funds . In relation to budget funds used for purposes other than their intended purpose, the provisions of the budget legislation of the Russian Federation are applied.

Taxpayers who received property (including money), work, services within the framework of charitable activities, targeted income or targeted financing, at the end of the tax period, submit to the tax authorities at the place of their registration a report on the intended use of the funds received as part of the tax return. .

The paragraph has been deleted. — Federal Law of May 29, 2002 N 57-FZ;

15) in the form of funds used for purposes other than their intended purpose by enterprises and organizations that include especially radiation-hazardous and nuclear-hazardous production and facilities, funds intended for the formation of reserves to ensure the safety of these production and facilities at all stages of their life cycle and development in accordance with the legislation of the Russian Federation on the use of atomic energy;

16) in the form of amounts by which in the reporting (tax) period there was a decrease in the authorized (share) capital (fund) of the organization, if such a decrease was carried out with a simultaneous refusal to return the cost of the corresponding part of the contributions (contributions) to the shareholders (participants) of the organization (with the exception of cases provided for in subparagraph 17 of paragraph 1 of Article 251 of this Code);

17) in the form of refund amounts from a non-profit organization of previously paid contributions (contributions) in the event that such contributions (contributions) were previously taken into account as expenses when forming the tax base;

18) in the form of amounts of accounts payable (liabilities to creditors) written off due to the expiration of the limitation period or for other reasons, except for the cases provided for in subparagraphs 21, 21.1 and 21.3 of paragraph 1 of Article 251 of this Code. The provisions of this paragraph do not apply to the write-off by a mortgage agent of accounts payable in the form of obligations to the owners of mortgage-backed bonds, as well as to the write-off by a specialized company of accounts payable in the form of obligations to the owners of bonds issued by it;

19) in the form of income received from transactions with derivative financial instruments, taking into account the provisions of Articles 301 - 305 of this Code;

20) in the form of the value of surplus inventories and other property that are identified as a result of the inventory;

21) in the form of the cost of media products and book products that are subject to replacement when returning or writing off such products on the grounds provided for in subparagraphs 43 and 44 of paragraph 1 of Article 264 of this Code. The assessment of the cost of the products specified in this paragraph is carried out in accordance with the procedure for assessing the balances of finished products established by Article 319 of this Code;

22) in the form of amounts of adjustment of the taxpayer’s profit due to the application of methods for determining for tax purposes the compliance of prices applied in transactions with market prices (profitability) provided for in Articles 105.12 and 105.13 of this Code;

23) in the form of the cash equivalent of real estate and (or) securities returned to the donor or his legal successors, transferred to replenish the endowment capital of a non-profit organization in the manner established by Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital non-profit organizations", minus the following amounts:

the value (residual value) of real estate for which it was taken into account in the tax accounting of the donor on the date of transfer of such property to replenish the endowment capital of a non-profit organization in the manner established by Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations” - when returning the cash equivalent of real estate;

the value at which the securities were taken into account in the tax accounting of the donor on the date of their transfer to replenish the endowment capital of a non-profit organization in the manner established by Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations” - upon return of the cash equivalent of securities;

24) in the form of the difference between the amount of tax deductions from excise tax amounts accrued when performing transactions specified in subparagraphs 21, 23 - 37 of paragraph 1 of Article 182 of this Code, and the specified excise tax amounts;

25) in the form of profit of a controlled foreign company, determined in accordance with this Code - for organizations recognized in accordance with this Code as controlling persons of this foreign company.

If the value of the real estate or securities specified in paragraph 23 of part two of this article exceeds the cash equivalent of such property returned to the donor or his legal successors, the difference between these values is recognized as a loss and taken into account for tax purposes in accordance with Articles 268 and 280 of this Code.

Don't forget to include these incomes in non-operating income

Taxpayers often miss out on certain types of profit, which are also considered non-operating, thereby, wittingly or unwittingly, underestimating the tax base. However, these revenues to the organization’s budget are included in non-operating income:

- interest on issued loans, deposits, promissory notes (both in relations with counterparties and with the Central Bank);

- market value of materials obtained as a result of dismantling written-off property;

- charitable contributions received by the company and targeted donations used for the stated purpose;

- assessment of written-off and returned printed products;

- correction of calculated profit due to changes in calculation methods;

- plus the difference between deductions and excise taxes.

NOTE! Understating profits due to the omission of certain items of income, committed due to intent or lack of knowledge, is fraught with troubles on the part of the regulatory tax authorities: this may well be regarded as tax evasion.

Non-operating income for income tax

Such income includes income not related to the main activities of the company. Their list is contained in Art. 250 Tax Code of the Russian Federation.

The text of the article itself and some explanations for it can be found in this material .

For example, non-operating income is:

- dividends;

- rent for the leased property (if renting is not your main activity);

- interest on loans issued;

- gratuitously received property and property rights, etc.

For other similar income, see here .

We have already said that non-operating income is not as simple as revenue and often gives rise to tax issues. We constantly monitor the situation and post answers to the most pressing problems in this section of our website. For example, here you will learn:

- how to determine the amount of income from the gratuitous use of property;

Details are in this material.

- is it necessary (and if so, how) to pay income tax when receiving interest-free loans;

Look for clarification in this publication .

- whether and when it is necessary to pay tax on a written-off credit card.

You will find the answer to this question in this article .

Also in this section you will learn how to take into account fines ( see here ), bonuses ( read about them here ), discounts ( see this article ) and much more.

Non-operating income and taxation

The significance of this type of profit is its influence on the formation of the tax base. Non-operating income must be taken into account when calculating the following types of taxes:

- profit tax - types of profit are summed up both from the sale of goods, works, services (under Article 249 of the Tax Code of the Russian Federation), and non-sales turnover (under Article 250 of the Tax Code of the Russian Federation);

- determination of the tax base under the special regime of the simplified tax system (Article 346.16 of the Tax Code of the Russian Federation);

- taxable base for the tax regime of the Unified Agricultural Tax (Article 346.5 of the Tax Code of the Russian Federation).

Don't make a mistake when accounting for non-operating income

Determining all profit items is a rather complex and cumbersome task in which it is not easy to avoid mistakes. Let's look at the most common difficulties that arise when recognizing non-operating income, and also analyze how to more effectively avoid them.

- Dating problems. Income tax is “tied” to a certain accounting period, usually a year. Therefore, it is very important what date a particular receipt will be assigned to. Sometimes the issue of determining the date can be controversial. For example, insurance compensation was paid - undoubtedly non-operating income. To what period should this profit be attributed? There are two different possible answers, depending on which tax calculation method the taxpayer uses:

- with the cash method, the date of transfer of funds from the insurance company will be important (clause 2 of Article 273 of the Tax Code of the Russian Federation);

with the accrual method, the key date will be the day when the insurer made the decision to pay (subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation).

- Issues of reimbursement and compensation. Often, compensation obtained legally does not cover the damage received by the company. The businessman believes that since he actually suffered a loss, which was not covered by the funds received, they will not be included in profit, and therefore no tax is due on them. The letter of the law says something else: any insurance compensation is subject to taxation, even if the property cannot be restored or there is absolutely nothing to take from the person convicted of its theft (letter of the Federal Tax Service dated November 15, 2005 No. 22-2-14-2096).

- Free services. If the company was provided with certain services free of charge, this is not a personal matter of the managers at all, but a change in the balance. These services must be reflected in non-operating income at the average market value (Article 105.3 of the Tax Code of the Russian Federation). The value of the asset itself, in which the gratuitous services were “invested,” will not increase - after all, the owner did not spend his own money on it.

- Reduction of authorized capital . When the authorized capital becomes less than net assets, the resulting difference must either be divided among all participants or attributed to non-operating income. If the capital reduction is triggered by legal requirements, no adjustment is required.

- A debt that will no longer be called upon . If the creditor is overdue on your debt or the counterparty company was liquidated without demanding payment of obligations, this is again non-operating income. You should not try to hide an unexpectedly generated surplus of funds - tracking such “delays” is the responsibility of the taxpayer. If the tax office finds this, you will be charged with a violation, even if there is no director’s order to write it off (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 8, 2010 No. 17462/09).

- Money received from penalties . Any contract usually contains obligations in case of violation of any provisions. If the counterparty “got” a fine, this does not mean that your company has already automatically received this income. These funds will become accountable non-operating profit only when the debtor recognizes the required amount or there is a corresponding court decision.

The same difficulties may arise when setting the date for receipt of rental income. According to the agreement, rent is paid at one frequency or another, and the accounting date may be shifted from that specified in the agreement to the day the money is actually received.

Conditional income tax income is...

Conditional income for income tax at first glance (judging by the wording) can be taken as a type of income that is taken into account in the tax base in some special order.

However, this income is not directly related to tax accounting. This concept is not from the field of taxation at all, but from accounting. It arises in those companies that keep records of differences between accounting and tax accounting in accordance with PBU 18/02 (approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n) and is calculated as the amount of tax corresponding to the loss obtained according to accounting data. By adjusting it by the amount of deferred tax liabilities and assets (ONO and ONA), we obtain a tax amount either equal to 0 (if a loss has been formed for tax purposes) or corresponding to its amount due for payment.

Do you want to know what conditional income is for income tax, and also get acquainted with IT and SHE? Read the article “What is deferred income tax and how to account for it?” .

Non-operating expenses

The Tax Code devoted non-operating expenses to Art. 265. This type of documented, justified costs does not have a direct connection with trade in goods, payment for services and work, and some types of losses may also be included in such costs.

IMPORTANT! One of the main criteria for classifying expenses (as well as income) as non-operating is the main activity of the organization. For example, if a company engaged in the production and sale of office supplies rents out one of the rooms in its office, then the costs of maintaining this room will be non-operating (as will the rental income). And if rent is the main business of the company, then you have to deal with production costs.

How do non-operating incomes fall into the VAT return?

If we turn to the VAT return (in 2022, the form approved by the order of the Federal Tax Service of October 29, 2014 No. ММВ-7-3 / [email protected] ), then we will not see a line directly related to non-operating income. Quite often, non-operating income is not subject to VAT and is not included in the relevant tax reporting. But not always.

From the report for the 3rd quarter of 2022, the VAT declaration must be completed on a new form, as amended by the Federal Tax Service order No. ED-7-3 dated March 26, 2021 / [email protected] The changes are related to the introduction of a goods traceability system.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial access to the system can be obtained for free.

One such example is the amount of accrued interest receivable from loans. It is one of the types of non-operating income and must be included in Section 7 of the VAT return during the interest period. It is exempt from VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation).

For an example of filling out Section 7 of the declaration when granting a loan, see ConsultantPlus. If you don't already have access to this legal system, get a trial access. It's free.

Income from the rental of property is also non-operating, except in cases where the provision of property for rent is defined in the charter as one of the main areas of business. Renting out property is not an operation exempt from VAT, so the amount for it will have to go to line 010 of section 3 and form the basis for calculating the tax.

Open list of non-operating expenses

Article 265 of the Tax Code of the Russian Federation lists 20 types of such expenses. Undoubtedly non-operating costs and financial losses of the organization include:

- funds spent on the maintenance and servicing of tangible assets rented or under a leasing agreement;

- interest that had to be paid on certain obligations during the reporting period: loans, credits, securities;

- costs of issuing the organization’s own securities (these include not only shares, but also forms, registers, magazines, publications in the media);

- registration costs;

- servicing purchased securities;

- losses caused by exchange rate fluctuations;

- expenses for liquidation of fixed assets, insufficient amount of accrued depreciation, liquidation of unfinished objects;

- expenses for conservation and re-preservation of the production process (to justify the costs, the decision of the manager and the availability of an estimate are required);

- costs for containers and packaging;

- obligation to pay fines, penalties, compensation;

- spending on various corporate events;

- funds for organizing and holding meetings of LLC founders or shareholders;

- the result of markdown of goods, inventories;

- some other expenses.

Could other expenses be non-operating?

Listing in Art. 265 of the Tax Code is open, that is, it provides for the subclause “and others”. There are costs for which it is not always possible to unambiguously determine their affiliation; they can equally belong to both the implementation ones and their opposite. In such cases, the law provides the taxpayer with a choice; only this choice must be justified in the relevant internal documents.

NOTE! Other costs recognized as non-operating expenses must comply with the requirements of the Tax Code, that is, be economically justified, supported by documentation and related to the generation of income.

Examples of expenses that can be legitimately considered non-operating:

- banking fees;

- discounts provided;

- expenses for maintaining a trade union organization;

- legal costs if a case concerning the company’s production activities is being considered in court;

- interest on a loan taken to pay dividends or to purchase fixed assets.

ATTENTION! Interest is an independent type of expense, for which there are accounting rules provided for by the Tax Code. Therefore, depending on the purpose of the loan, interest on it can be classified as non-operating expenses or other types of expenses.

Are losses also expenses?

Funds lost or underreceived during the reporting period may also be classified as non-operating expenses if they meet their criteria. The Tax Code of the Russian Federation includes:

- any losses that were received earlier, but were identified precisely during the reporting period (don’t forget to check your tax return!);

- unpaid debt that is recognized as bad (unsecured, overdue);

- results of production downtime due to internal reasons;

- losses caused by emergencies, catastrophes, natural disasters, cataclysms, etc.;

- expenses to eliminate the consequences of such situations;

- a deficiency identified by an audit without the possibility of identifying the culprit;

- other qualifying losses.

Recognition of expenses as non-operating

The importance of attributing expenses specifically to this type of expense helps in reducing the tax base for income tax.

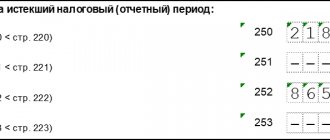

Write-off of expenses is carried out using one of two methods, and for each the Tax Code of the Russian Federation has its own procedure:

- When using the accrual method, you need to use clause 7 of Art. 272 Tax Code of the Russian Federation;

- for the cash method , the procedure described in paragraph 3 of Art. 273 Tax Code of the Russian Federation.

The moment of recognition of expenses depends on the choice of method: in the first case, this is the date of documentary confirmation of the basis, and in the case of using the cash method, the actual occurrence of the event.

It is necessary that expenses have mandatory documentary evidence; this requirement is clearly stated in the Tax Code of the Russian Federation. What kind of confirmation this will be will have to be decided on a case-by-case basis.

For example, when writing off as a non-operating expense losses from a fire that occurred in a given period, one of the documents can serve as confirmation:

- a certificate issued by the fire service (government body);

- report from the scene of the incident;

- act of establishing the cause of the fire;

- inventory acts, etc.

Updates

If you have access to support, the latest development version can be ordered here

Version 1.24

- Improved definition of returns for Income Tax and for separate divisions (the previous version may not have shown returns for the main tax authority if the place of registration changed during the reporting analysis period)

Version 1.23

- Added analysis of adjustments to implementation adjustments

- Identified issues have been fixed

- The development is adapted to the new profit declaration from the fourth quarter of 2022

Version 1.22

- Automatic determination of items of other income not subject to VAT (91.01)

- New difference: returns in the commission agent's report.

- New difference: adjustment of implementation (correction in primary documents) - analysis of additional records. sheets

- Improved analysis of Returns to suppliers (turnovers excluding VAT are taken into account)

- Improved analysis of Returns from customers (turnovers excluding VAT are taken into account)

- Improved analysis of Sales Adjustments (turnovers excluding VAT are taken into account)

- Improved opening of SALT according to 91.01 from settings (grouping of income by VAT)

Version 1.21

- We added automatic analysis of a new difference - sales in foreign currency (when offset with an advance payment).

- Fixed mechanisms for determining submitted reports

- We also adapted the report to the current version of 1C:Accounting

Version 1.20

- The analysis takes into account additional VAT sheets

- Fixed bug with finally unconfirmed VAT

- Minor bugs fixed

Version 1.19

In this version, we have updated the declaration forms, corrected several important details and made working with the report even more convenient:

1. The report has been updated for the Profit and VAT declaration forms from the 4th quarter of 2022, the diagnosis of filling errors has been improved due to the update of reporting forms 2. The verification of amounts in the Profit declaration and in accounting data for complex transactions has been corrected 3. The line “ has been highlighted in the analysis Proceeds from the sale of other property" 4. Simplified the work with setting the flag "Not subject to VAT" for other income. After setting the flag, you no longer need to re-open the discrepancy analysis; the new settings will be accepted automatically. 5. Added the ability to quickly open OSV for 91.01 from the report settings form

Version 1.17

- Fixed minor inconvenience of adding other income

- Improved determination of the required declaration in the presence of separate divisions

Version 1.16

- the long-awaited decoding of discrepancy indicators

- other income “Return of goods sold in the previous tax period” has been added to the default exceptions

Version 1.15

- added analysis of returns to the supplier (if it is made on the basis of an adjustment invoice)

- identified errors have been fixed

Version 1.14

The extension is adapted to the new form of the regulated Profit report from the 4th quarter of 2022 (1C: Accounting 3.0.75)

Version 1.13

- The extension is adapted to version 1C: Accounting 3.0.75

Version 1.12

We decided to make development even more convenient and transferred the functionality to the Extension. This will allow:

- more convenient to open development

- It’s more convenient to set up other income and expense items

- improve checking the compatibility of development with future versions of 1C:Accounting

But we haven’t forgotten about the development of functionality:

- We show differences only if there is something to show

- simplified setting up the item of other income from expenses (the “Not subject to VAT” flag)

- added a certificate for the indicator “Sales at a rate of 0%” (to open you need to click the “?” sign)

Version 1.11

- Added a new indicator “Sales of shipped goods” (actual transfer of ownership)

- We have finalized indicator 040 of section 4 of the VAT return. Now all the lines of this column are summed up

Version 1.10

- Added a new indicator “Shipment without transfer of ownership”

- Identified errors have been corrected

Version 1.9

- This release adds checking for discrepancies in gratuitous transfer transactions

Version 1.8

- We added revenue data for other operations (Appendix No. 3 to Sheet 02) to the analysis of the convergence of accounting and reporting data - this is usually the sale of fixed assets or intangible assets

- Added the ability to open regulated reports via hyperlink (in one click you can open everything you need for reconciliation)

- Added a description of the “Difference” column - the main reasons and necessary actions

Version 1.7

- The 2022 analysis shows a VAT rate of 20%

- The indicator “Confirmed export sales” (Section 4 line 020) in the 2022 reports has been corrected

- The difference of 1 ruble between SALT and the Profit Declaration is not controlled

Version 1.6

- Added control for discrepancies in revenue and other income according to accounting data (90.01 and 91.01) and according to the profit declaration data

Version 1.5

- Adjustments to sales taken into account (downward)

- Adjustments to sales downwards from sales from previous years have been taken into account

Version 1.4

- New indicators have been added to the allowed differences: Unconfirmed sales 0% (in case of additional VAT charges)

- Sales according to 90.01.1 without VAT

- Implementation according to 90.02.2 UTII and Patent

- the year-end closing mechanism was taken into account when analyzing accounts 90 and 91

- fixed determination of differences in returns to suppliers and from customers

Version 1.3

- the report has been prepared for use in cloud versions

- Fixed errors in report generation for users with limited rights

Version 1.2

- interface fixes

Version 1.0

- the extension contains the main functionality from BP 3.0

- While some checks have not been implemented, we will add according to user requests

Version 2.1

Fixed checks for:

- sales adjustments (downward)

- returns of goods

Non-operating expenses and accounting

The accountant must take these expenses into account in the reporting period, because their amounts will affect the size of the tax base in the next period.

FOR YOUR INFORMATION! In the accounting provisions “Income of the organization” (PBU 9/99) and “Expenses of the organization” (PBU 10/99) the lists of amounts received and spent do not coincide with the Tax Code. Non-operating income in accounting is classified as “Other”, where it is taken into account together with operating income. Therefore, temporary expense differences may arise, which are constantly adjusted.

Income tax income: classification, accounting methods

An organization's income is the economic benefit it receives in cash or in kind.

For income tax purposes, income is divided into:

- on income from sales;

- non-operating income;

- income not taken into account for tax purposes.

Accounted income, that is, the first 2 types, is recognized in the tax base by the method that the organization has chosen to account for income and expenses. Let us remind you that there are 2 of them:

- Accrual method. It assumes that income is taken into account in the period to which it relates, regardless of the actual receipt of money into the organization.

- Cash method. Accounting is carried out according to the date of receipt of funds.

Read more about income recognition methods in the following articles:

- “Accrual method and cash method: main differences”;

- “What is the procedure (conditions) for recognizing income and expenses using the cash method?”.

Income that is not taken into account does not affect the tax base (and therefore the tax) in any way.