Anything can happen in life; often fate awaits a person at the most unexpected moment. It happens that an employee one day does not show up for work or does not return from sick leave, and only then it turns out that his vacation will now be eternal. What should an employer do to legally terminate an employment relationship? How to manage the money earned by a deceased employee? Who should I give the work book to, and what entry should I make in it?

How to formalize dismissal due to the death of an employee ?

Death does not depend on anyone's will

The legal grounds for dismissal due to death are clause 6.1. Article 83, “termination of an employment contract for reasons beyond the will of its parties.” The death or disappearance of an employee, followed by his recognition as dead or missing, naturally belongs to such reasons.

Question: The employment contract with an LLC employee states that in the event of the death of an employee, the LLC will reimburse his close relatives for funeral expenses. The employee died. Is the LLC obligated to reimburse his daughter for funeral expenses if the employment contract is terminated due to the death of the employee? View answer

Documentary evidence of the unfortunate fact will be a state document - a death certificate issued to relatives in the registry office. A medical certificate issued by a doctor is not suitable in this case: it is issued only for registering death in the registry office. The deceased's next of kin must bring a copy of this certificate to the employer.

FOR YOUR INFORMATION! If a person does not make himself known either at work or at home for a long time, more than six months, with the consent of relatives, the employer can initiate the establishment of his civil status. After going to court and the decision gaining legal force, the missing person is declared dead or missing. The court decision will become the documentary justification for the dismissal (clause 1 of Article 45 of the Civil Code).

Employment history

So, the termination of the employment contract due to the death of the employee took place. Now it is necessary to resolve issues with documents and wages of the deceased. After all, he still has his work book, medical book and other papers.

The fact of dismissal must be recorded in the work book. To do this, in the column “Information on hiring, transfer to another permanent job, qualifications, dismissal,” the following entry is made:

The employment contract was terminated due to the death of the employee, clause 6 of part 1 of article 83 of the Labor Code of the Russian Federation.

The date is set similar to the date from the order, the record is certified by a human resources specialist or the head of the organization with a transcript of the signature. The seal needs to be affixed only if the organization uses it. After all the entries have been made, the work book can be given to the relatives of the deceased upon their written request (see paragraph 37 of the Rules approved by Government Decree No. 225 of April 16, 2003). In this case, you need to check your passport and degree of relationship (marriage or birth certificate). A receipt in any form is drawn up regarding the receipt of all papers. If none of the relatives contacted them about this, the employer is obliged to keep them for the period established by law - 75 years.

Documentary support for “perpetual” dismissal

All civil processes in our lives are associated with a certain “paper” support. Any significant changes are recorded and documented. Therefore, it is important in all cases to comply with the formal side of the process, without neglecting the preparation of relevant documents.

What to do if an employee dies while on annual leave ?

What papers will be needed to dismiss an employee due to his death?

- Justification – death certificate (or a court decision on the status of the missing employee that has entered into legal force).

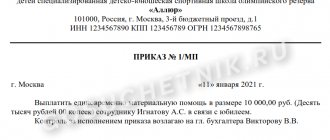

- An order for the dismissal of a deceased employee, issued in accordance with the established form No. T-8.

- personal file with appropriate notes.

- A work book with a correctly completed entry.

- Application from relatives to transfer payments due to the employee to them.

What date is the order issued?

An important point will be the correct determination of the date that will appear in the dismissal documents. According to the general rule of law, termination of the contract occurs upon notification of the death of a person, with all documents dating the day of death indicated in the submitted certificates.

Difficulties regarding what date to fire a deceased employee arise when the day of death falls on a non-working day, sick leave, or vacation. In such situations, one should proceed from the logic that it is not possible to extend the contract until the next working day or the end of vacation if, judging by the documents, the person is already considered dead.

Thus, all personnel documents and calculations are made on the date indicated in the death certificate issued by the registry office, or on the day the court decision is issued.

Download the order of dismissal due to the death of an employee (standard T-8 form is used): Order to terminate a trade agreement with an employee. Form T-8 (41.5 KiB, 2,450 hits)

Algorithm for the employer

Having received news of the death of an employee, documented by a copy of the death certificate, the employer can begin the dismissal procedure.

How to enter a notice of dismissal due to the death of an employee in the work book?

If the information was received not by the employer himself, but by a lower-level manager who is the immediate superior of the deceased, he needs to submit a memorandum about this fact to management, indicating all the personal data of the retired employee and attaching a copy of the death document.

Further, the procedure is standard and clearly defined by labor legislation and personnel practices.

- Issuance of an order (form No. T-8) on dismissal under clause 6, part 1. Article 83 of the Labor Code of the Russian Federation. Naturally, the deceased employee will not be able to sign in the column “I have read the order,” and no one except him has the right to do this. So in this case the line remains empty.

- Registration of this order in the register of orders and orders relating to personnel.

- An entry is made in the employee’s personal card about the reason for termination of the employment contract with reference to the article of the Labor Code.

- Making an entry about dismissal in the work book: the wording is the same as in the personal card.

- The accounting department calculates the due payments and enters them into the settlement document T-61.

- The work book is given to the relatives of the deceased or, with their written consent, sent to them by mail. There should be a corresponding note about this in the book for recording the movement of work records. Relatives must present a document confirming their relationship. If relatives do not appear or do not express written consent to receive a work book, it must be kept in the archives of the enterprise for at least 3 years, and then destroyed in accordance with a special act.

- After signing the statement, relatives are given appropriate cash payments. This should happen no later than a week after the written request for payment accrual. In this case, the statement will be issued to the deceased employee (must contain information about his tariff rate, position, personnel number, etc.), and in the column “Money received” the person to whom it is given, that is, a relative, will sign.

Procedure for registering termination of an employment contract

Obtain a death certificate from the relatives of the deceased employee.

As a rule, the employer receives a death certificate from the relatives of the deceased employee. The HR department makes a copy of this certificate. The original certificate remains with the employee's relatives. At the same time, according to the words of relatives or other persons, it is impossible to formalize the termination of an employment contract with a deceased employee without submitting supporting documents.

Issue and register an order to terminate the employment contract with the employee.

The order is issued in a unified form No. T-8, approved. Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1 or in a form independently developed and approved by the employer. The entry in the line “Grounds for termination (termination) of the employment contract (dismissal)” must be filled out in strict accordance with the wording of the Labor Code of the Russian Federation. It is necessary to provide a link to the relevant article, part, paragraph. In this line you need to indicate: “Death of an employee, paragraph 6 of part one of Article 83 of the Labor Code of the Russian Federation.”

The line “Document, number and date” indicates the document on the basis of which the employment contract with the employee is terminated. You also need to indicate the date and number of this document (for example, Death Certificate series 0-00 No. 1111111 dated November 20, 2020).

The day of termination of the employment contract with the employee in this situation is the date of his death indicated on the death certificate. This date is indicated in the order regardless of when exactly the employee died (after work or at work, on sick leave or on vacation, on a day off or a non-working holiday).

The date of termination of the employment contract is the day of death, regardless of when the employer received a copy of the death certificate in the prescribed form from the relatives of the deceased employee. Thus, the date of termination of the employment relationship may precede the date of issue of the order . And the date of issuance of the order to terminate the employment contract will coincide with the date of submission of the death certificate to the employer.

Make an entry in the personal card and work book, and issue the Labor Code to the employee’s relatives.

An entry on the basis and reason for termination of the employment contract should be made in strict accordance with the wording of the Labor Code of the Russian Federation or other federal law and with reference to the required article, paragraph, part.

The work book must be handed over to one of the relatives against signature or sent by mail to the address indicated in the relative’s written application (clause 37 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers, approved by decree of the Government of the Russian Federation dated April 16, 2003 No. 225).

Draw up a settlement note upon termination of the employment contract.

The calculation note is used to record and calculate wages and other payments due to the employee upon dismissal.

Make final settlements with the relatives of the deceased employee.

The final settlement of wages, including additional payments and bonuses, compensation for unused vacation due to a deceased employee, is made with a member of his family, who are spouses, parents, children (Article 2 of the Family Code of the Russian Federation) or a person who was dependent on the deceased on the day his death (Article 141 of the Labor Code of the Russian Federation).

Based on the sick leave certificate, the employer is obliged to assign and pay temporary disability benefits. The relatives of the deceased also need to be paid child benefits for pregnancy and childbirth, accrued but not received on the day of the employee’s death, and for caring for a child up to one and a half years old.

Payments are made to family members living together with the deceased - widow (widower), parents (adoptive parents), children (adopted) Art. 2 IC RF. Therefore, they must additionally be required to provide a document confirming cohabitation with the deceased (for example, the recipient’s passport, which contains a registration stamp at the same address where the deceased employee lived, or an extract from the house register).

Disabled dependents are paid regardless of their cohabitation with the deceased.

To receive benefits, a family member of the deceased must contact the employer within 4 months from the date of death of a loved one (clause 2 of Article 1183 of the Civil Code of the Russian Federation). In this case, the benefit along with wages must be paid to the relative. If no one has applied for sick leave payment within 4 months, then this amount is included in the inheritance (clause 3 of Article 1183 of the Civil Code of the Russian Federation). This means that the decision on who will get this money is postponed for at least another two months.

How to coordinate dates

There is no notice of resignation with a specific date and there cannot be, nor is there a two-week period of work required before dismissal. What is the date to terminate an employment contract? After all, these numbers depend on:

- calculation of due wages;

- calculation of unused vacation days;

- compensation for additional leave granted to employees with young children;

- transfer of contributions for the employee to the Pension, insurance and other funds;

- many nuances associated with the position, for example, driver's insurance, etc.

In case of automatic termination of employment relations, the day of dismissal is considered to be the last working day of the employee (Article 84.1 of the Labor Code of the Russian Federation). But since the manager does not immediately learn about the death of a subordinate, especially since it takes time to prepare supporting documents, the official date that will appear in all accompanying papers will be considered the one indicated in the certificate (or in the court decision).

Since the supporting document (certificate) reaches the enterprise later, the employer is forced to prepare the documents “retroactively”. In such a situation this is not a violation.

Funeral benefit

If the person was working on the day of death, the funeral benefit is paid by the employer. From February 1, 2022, the amount of such benefit is 6,424.98 rubles. To receive it, a relative must submit an application and a death certificate or a court decision.

The benefit is paid in the amount established on the day of the insured event. For example, if a person died before February 1, 2022, and a relative applied after that date, the old amount will be paid without taking into account indexation. You can apply for payments within 6 months from the date of death.

No death certificate? Need to find

It happens that the deceased employee does not have relatives or they do not contact the company, perhaps they live far away, and they do not want to send a notarized copy of the document. How to get a copy of the death certificate, because only on the basis of this document is it possible to begin the procedure for terminating the employment relationship?

The company has the right to obtain a copy of this certificate itself by sending a request to the authority where the death of their employee could have been registered. This could be the registry office:

- at the place of actual residence of the deceased;

- at the place of last registration;

- closest to the place where the death is recorded (for example, in a hospital) or the body is discovered;

- in the burial area.

When the question arises of searching for documentary evidence, but the employer does not have the exact facts, you can send a request to all possible registration authorities.

What documents are needed from relatives

To confirm the death of a person and receive payments, relatives of the deceased must submit the following documents to his former employer:

- death certificate (issued by the registry office);

- a document confirming relationship with the deceased;

- copy of the employee's passport;

- application for payment of amounts not received by the employee;

- a certified copy of the court decision (issued within 5 days after adoption in final form).

All documents must have institutional seals and signatures of authorized persons.

Dismissal by transfer: features of the procedure

Dismissal due to change of residence - features and procedure

What is due to relatives?

For whatever reason, an employee is dismissed, including due to death, he is entitled to certain payments:

- wages for hours worked that have not yet been paid;

- compensation for “not taken” vacation;

- financial assistance to the family of the deceased is a gesture of goodwill on the part of the employer. This payment is not mandatory, but in practice the company usually supports relatives in memory of a good employee.

To receive this money, immediate relatives (spouse, children, including adopted children, parents, guardians or adoptive parents) must collect the following documents for the employer:

- application requesting payment;

- documentary evidence of relationship with the deceased;

- a copy of the death certificate of a relative;

- your passport or other identification document.

Relatives have 4 months to receive legal payments directly from the employer (clause 2 of Article 1183 of the Civil Code of the Russian Federation). If they did not come for the money with the appropriate documents, payments must be transferred to the account of the executor - any state notary (Article 327 of the Civil Code of the Russian Federation). They will be included in the total amount of money of the deceased's inheritance.

ATTENTION! The employer will not be able to ignore these payments, or information about the deposit account and hide them: the check should be presented either with a signature of relatives on the payroll, or information about the deposit account of a government lawyer.

If immediate relatives apply for payments independently of each other, for example, applications were submitted by both the wife and mother of a deceased employee, the employer is not authorized to decide which of them to give the due money. Relatives will be asked to reach an agreement among themselves or go to court.

Calculation: salary, compensation and assistance

As for wages, vacation pay and other payments, they should be paid to close relatives: spouse, children, parents (Article 141 of the Labor Code of the Russian Federation). Dependents of the deceased at the time of death, for example, persons under his guardianship, are also entitled to receive this money. Salaries can be received within 4 months from the date of death of the employee, as defined in Article 1183 of the Civil Code of the Russian Federation. This means that the employee’s relatives must have time to contact the employer within this period. From the moment of such an application, the entire due amount must be paid out within a week. To receive you will need:

- statement;

- applicant's passport;

- document on relationship (marriage, birth or adoption certificate).

In addition, relatives may be entitled to financial assistance. This must be provided for by the terms of the employment or collective agreement. The employer can also arrange such a payment by its internal act. In some cases, at the place of work of the deceased, it is also possible to receive a social benefit for funeral, which is paid from the Social Insurance Fund.

In accordance with the provisions of Article 217 of the Tax Code of the Russian Federation, all money earned by a deceased person after his dismissal is not subject to personal income tax. Therefore, you need to hand over the entire amount without deductions. Insurance premiums for such payments are also not charged.

Issuance of documents to relatives

The work book is issued to the relatives of the deceased upon their written request against signature. It can be sent by a valuable letter with a list of the attachments, if relatives cannot or do not want to come up for the document in person (clause 37 of the Decree of the Government of the Russian Federation “On work books”). It can also be received by a third party by proxy.

Relatives who can be issued a work book:

- spouses with whom the marriage is officially registered;

- parents and adoptive parents;

- children (including adopted children);

- brothers and sisters.

Theoretically, more distant relatives can also obtain a work book. The main difficulty lies in confirming the fact of relationship, without which the document cannot be issued.

Expert commentary

Leonov Victor

Lawyer

The relatives do not need to sign the deceased’s work book. They will only need to sign in the log book indicating that they received it. When receiving the document, it is advisable to carefully study it and verify all records, since the work book may be needed in the future to receive compensation or other payments.

If the relatives of the deceased did not come to pick up the work book themselves, they are sent a notification that it needs to be collected from the employer. Be sure to inform that upon request it can be sent by mail to the specified address. If relatives do not need a work book or the deceased was single, then the document is stored in the organization for at least 50 years, and in the event of liquidation of the company, it is transferred to the archive. After this period, the book can be destroyed in the prescribed manner.

If the relatives of the deceased required other documents (medical record, copies of personnel orders, certificate of wages and deductions), they must also be issued within three days of the request.

It is advisable to take a receipt filled out in free form regarding the issuance of all documents. It states:

- Full name and passport details of the relative;

- number and series of the death certificate;

- list of documents received;

- At the end they put the current date and signature.

How to receive wages after the death of an employee

As statistics show, a number of our compatriots do not live up to the age of a well-deserved retirement. Some people continue to work even after retirement, because their income is so small that it is almost impossible to live on it. One of the grounds for termination of an employment relationship is the death of an employee. This is reflected in clause 6, part 1, article 83 of the Labor Code of the Russian Federation. Upon dismissal, it is the Employer's responsibility to make a final settlement with the employee. The same applies to the death of an employee, only in this case other persons receive the money due to him. But here, as practice shows, a considerable number of difficulties arise. To understand all the intricacies and nuances of receiving wages for a deceased employee, it is necessary to turn to the legal norms enshrined not only in labor, but also in civil and family legislation.

Who is the recipient

The list of persons who are entitled to receive payments due for a deceased employee is reflected in Art. 141 of the Labor Code. Such obligated persons include:

- Family members. Close relatives can be classified as family members. Difficulties in receiving money for the deceased arise for spouses when they did not register their relationship in the manner prescribed by law, but lived in a civil marriage. Such persons do not have the right to receive wages for a deceased employee.

- Persons who were dependent on the employee on the day of death. This category of citizens includes incapacitated persons who were fully supported by the deceased, as well as persons for whom financial support from an employee was the main source of livelihood.

What types of payments are due?

The issue regarding all payments due for the deceased deserves great attention. To do this, you must refer to the following legal provisions:

- Labor Code, art. Art. 127,129, 141;

- clause 33 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR dated April 30, 1930 No. 169 and valid to the extent that does not contradict the Labor Code of the Russian Federation;

- Part 5 Art. 15 of Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

In accordance with the requirements of the above legal norms, after the death of an employee, persons entitled to receive funds must be paid:

- Wage. This also includes bonuses and allowances, various types of additional payments.

- Compensation for unused vacation. If the deceased used vacation in advance, then in accordance with the requirements of Part 2 of Article 137 of the Labor Code, the Employer does not have the right to withhold money from obligated persons for days not worked.

- Other monetary payments that are stipulated by the employment contract with the employee. This could be sick pay, compensation for the use of one’s property for business purposes, for example, a vehicle, etc.

The procedure for obtaining it in accordance with the Labor Code of the Russian Federation. In what cases is the Labor Code of the Russian Federation applicable?

The timing of payment of wages to employees is fixed in labor legislation. In addition, specific dates for salary payment are reflected in the employment contract concluded between the Employer and the employee.

In the event that the employee died before the corresponding date for payment of funds, then persons entitled in accordance with the Law to receive them will need to send a corresponding application addressed to the Employer to which a list of necessary documents must be attached.

In accordance with the requirements of Art. 141 of the Labor Code, after providing the Employer with an application with the necessary package of documents, the Employer is obliged to pay all funds due within seven days.

The procedure for obtaining in accordance with 1183 of the Civil Code of the Russian Federation. In what cases is 1183 of the Civil Code of the Russian Federation applicable?

For various reasons, persons entitled to receive cash payments after the death of an employee do not always promptly contact the Employer with a corresponding application, as stated in Art. 141 Labor Code of the Russian Federation. In this case, in order to receive the payments due, you must be guided by the requirements enshrined in Art. 1183 of the Civil Code of the Russian Federation: “Inheritance of unpaid amounts provided to a citizen as a means of subsistence.”

In accordance with Part 1 of this article, the Heir, for the deceased employee, must receive not only wages, but also other payments as a means of subsistence. Such payments include:

- pensions;

- social benefits insurance;

- scholarships;

- alimony;

- payments that were due to the deceased as a result of damage to his life or health during his lifetime, etc.

In Part 2 of Art. 1183 of the Civil Code of the Russian Federation it is noted that the heirs are obliged to apply to the Tenant to receive the funds of a suddenly deceased citizen no later than 4 months from the date of opening of the inheritance. The day of opening of the inheritance is considered to be the day of the employee’s death.

What documents must be attached to the application for the issuance of salary and other payments?

In order to receive the payments due for a deceased employee, in addition to the application addressed to the Employer, you will need to provide a number of other documents. This list includes:

- Identification document of the applicant.

- A copy of the death certificate. The form of the death certificate was approved by Decree of the Government of the Russian Federation No. 709 of 07/06/1998 “On measures to implement the Federal Law “On Civil Status Acts””.

- A document that confirms that the applicant has the right to receive the deceased’s wages and other payments, i.e. is a family member or was a dependent of the deceased at the time of death.

Are payments subject to tax (personal income tax, insurance)?

All persons who have the right to receive funds from the Employer after the death of an employee are concerned with the question: Are the payments due taxable or not?

Turning to the legal norm reflected in Art. 1183 of the Civil Code, we see that the funds of the deceased are received by his close relatives through inheritance. In pp. 3 p. 3 art. 44 of the Tax Code of the Russian Federation stipulates that death is grounds for the abolition of all fees and taxes. Accordingly, his heirs of the deceased will not have to pay taxes.

Based on this, the conclusion suggests itself: persons who received from the Employer the payments due for a deceased employee (wages, bonuses, allowances, etc.) do not pay tax.

This is due to the fact that the amount of wages accrued for hours worked and compensation for unused vacation are paid to close relatives of the deceased employee. A similar approach is reflected in paragraph 18 of Art. 217 of the Tax Code of the Russian Federation: “Income not subject to taxation (exemption from taxation)”, which reflects that amounts received by persons through inheritance are not subject to taxation.

What about the insurance premiums of a deceased employee? In accordance with current legislation, the Employer should not charge such contributions, since the insured person died suddenly, i.e. there is no person in respect of whom the corresponding deductions should be made. The deceased's funds are transferred to obligated persons, but they do not have an employment relationship with a specific Employer, i.e. there is no object of taxation.

To summarize, we note that no tax is imposed on any funds of a deceased employee received after his death by obligated persons.

What number should I use for payment?

According to Art. 84.1 of the Labor Code of the Russian Federation, the day of dismissal of an employee is considered his last day of work. However, the day of termination of the contract with a deceased employee is the day of his death, established by the death certificate, or the day a court decision to recognize such a person as missing or deceased enters into legal force.

It is incorrect to talk about the dismissal of a deceased employee. Therefore, the order only talks about the date of termination of the employment contract.

In practice, relatives of the deceased do not always notify the administration of the enterprise (company) about the death of an employee. If such a situation arises, the employer gives the employee absenteeism.

After two absences have been recorded, the employer can legally dismiss the employee. However, if the employee died, such actions of the official are considered a violation of labor rights. Therefore, the employer should find out the reasons for the employee’s temporary absence from his workplace, and then make the necessary personnel decisions. Information about the death of a citizen can be obtained from the police .

If an employer decides to fire an employee for absenteeism because he cannot contact relatives and obtain information about the death, the documents must be completed correctly - send a letter to the employee inviting him to provide an explanation for his absence from work and record the fact that the letter was sent.