In what cases is an agreement signed?

If the parties to the agreement have outstanding claims, the creditor has the right to forgive the debt on the basis of Art. 415 of the Civil Code of the Russian Federation.

Art. 415 of the Civil Code of the Russian Federation indicates the need for the creditor to notify the debtor of the intention to close the obligation. Closing obligations requires obtaining the debtor's consent to this procedure. As a general rule, if the creditor has not received any objections, consent has been obtained (clause 34 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 11, 2020 No. 6).

In addition to notification, the parties have the right to formalize an agreement on debt forgiveness between a legal entity and an individual, between organizations or between citizens (clause 3 of Article 407, clause 2 of Article 415 of the Civil Code of the Russian Federation). It is possible to indicate detailed write-off conditions, deadlines and other important points.

Answers to common questions about debt forgiveness between individuals

Question #1:

Should an individual pay insurance premiums to extra-budgetary funds from the amount of forgiven debt under a loan agreement?

Answer:

Amounts that are transferred to an individual under a GPC agreement (including under an agreement the subject of which is the transfer of ownership of money) are not subject to insurance premiums on the basis of clause 4 of Art. 420 Tax Code of the Russian Federation.

Question #2:

What are the consequences of refusing to pay personal income tax on the amount of debt forgiven to an individual?

Answer:

If an individual does not fill out a declaration and does not transfer personal income tax at a rate of 13% of the amount of debt forgiven, a fine will be imposed on him, or the person will be subject to criminal punishment (imprisonment for up to 3 years) on the basis of Article 198 of the Criminal Code of the Russian Federation.

Basic terms of the document

The conditions are:

- the general condition is an indication of the obligation under which the debt being written off arose (Resolution of the Arbitration Court of the Ural District dated February 14, 2019 No. F09-9516/18). Without indicating the obligation, the document is considered invalid. Indicate the date and number of the agreement, describe the event in which the obligations arose, provide a link to the court decision, etc.;

- in addition to the basis, they indicate the obligation from which the debtor is released (clause 33 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 11, 2020 No. 6). The creditor has the right to exempt from payment of part of the debt, from the debt in full, from penalties and fines, etc.;

- indicate the amount of debt to be written off. If the amount is not specified, the entire debt is written off along with penalties (clauses 32, 33 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 11, 2020 No. 6).

Keep in mind: an agreement on debt forgiveness between legal entities has its own peculiarity. Since donations between legal entities are prohibited, regulatory authorities recognize gratuitous debt write-off as a donation. To avoid questions, draw up a counter-provision: an increase in delivery time for the creditor on the part of the debtor in exchange for debt forgiveness, provision of services at a discount, preferential rates, etc.

Counter provision is acceptable for legal entities and individuals. The conditions are stated in the agreement.

When concluding a deal to write off debt between subsidiaries, it is necessary to indicate that the purpose of such a mechanism is a single economic benefit. Then the transaction is not recognized as a donation (Resolution of the Arbitration Court of the West Siberian District dated January 14, 2021 No. F04-5728/2020 in case No. A81-59/2020).

When carrying out a transaction to write off debt between legal entities, check the corporate aspects of the transaction - whether approval is required for a large issue or interest.

The law does not provide for the termination of a debt forgiveness agreement: if the agreement to write off needs to be cancelled, a written cancellation document is drawn up.

ConsultantPlus experts looked at how a founder can forgive the debt of his organization. Use these instructions for free.

Forgiveness and Giving

Under a gift agreement, one party gratuitously transfers or undertakes to transfer another thing into ownership or a property right to itself or to a third party, or releases or undertakes to release it from a property obligation to itself or to a third party (clause 1 of Article 572 of the Civil Code of the Russian Federation).

Let me remind you that donations between commercial organizations are prohibited. The exception is gifts worth no more than 3,000 rubles (Clause 1, Article 575 of the Civil Code of the Russian Federation). Thus, if a debt forgiveness transaction between two companies is qualified as a gift, the court will invalidate it.

Therefore, it is advisable to carry out the debt forgiveness procedure with a condition. For example, about the percentage of interest when repaying the principal amount of the loan. In this case, forgiveness of debt “with condition” is not identical to donation.

Help your business grow

Invaluable experience in solving current problems, answers to complex questions, specially selected latest information in the press for accountants and managers. Choose from our catalog >>

If you have a question, ask it here >>

Sample agreements

Sample:

| ___________________________ (Title of the document) g. __________________ "___" ________ ___ g. ______________ represented by _______________, acting___ on the basis of _________________, hereinafter referred to as ____ the “Creditor”, on the one hand, and _________________ represented by ____________, acting___ on the basis of ________, hereinafter referred to as the “Debtor”, on the other hand, collectively referred to as the “Parties”, and individually, the “Parties” have entered into this agreement as follows. 1. ITEM 1.1. The parties agree that in accordance with Agreement No. ______ dated “___” ________ ___, the Debtor is obliged to pay:

1.2. The Creditor releases the Debtor from fulfilling all obligations specified in clause 1.1. 2. ADDRESSES, DETAILS AND SIGNATURES OF THE PARTIES Creditor:

Debtor:

On behalf of the Lender ____________________ (__________) M.P. On behalf of the Debtor ___________________ (_________) M.P. |

Example notification:

Debt Forgiveness – Tax Implications

The creditor can reflect the fact of forgiveness of debt amounts in tax accounting in two ways:

- Covering accounts receivable by reducing the volume of net profit is the least risky option, since the result of the transaction does not affect the amount of the tax base for profit; confirmation of the validity of costs is not required in accordance with the provisions of Art. 252 of the Tax Code of the Russian Federation.

- Attribution of the forgiven debt to non-operating expenses with a reduction in the tax base for profits. The Tax Code of the Russian Federation does not prohibit this, but tax authorities may disagree with the legality of this approach. The Presidium of the Supreme Arbitration Court, in Resolution No. 2833/10 dated July 15, 2010, stated that the option of including forgiven debts in expenses is possible, provided that the creditor has made attempts to collect the receivable, including in court.

Read also: Write-off of accounts receivable: postings

If the forgiven debt has not expired and the creditor cannot document its attempts to resolve the issue of debt repayment, the court decision will be in favor of the first method of reflecting the transaction in tax accounting - at the expense of net profit.

Read also: Write-off of accounts receivable and income tax

When debt forgiveness is issued, the value added tax on shipped goods is not adjusted.

The debtor's amounts of debts that have been forgiven are shown as non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation). The Ministry of Finance equates such operations to the gratuitous receipt of goods (Letter dated August 25, 2014 No. 03-03-06/1/42281). There is no need to include the value of received and unpaid property as income if the creditor owns half (or more) of the debtor’s authorized capital (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation).

If VAT on goods for which payment was not actually made was accepted for deduction, it does not need to be restored (but there is still a risk of questions from the tax authorities).

Example

Company A shipped goods worth 66,000 rubles to enterprise B. (including VAT RUB 11,000). The invoice was not paid by the buyer on time, the counterparties agreed to write off part of the obligations on the condition that the buying party repays the debt in the amount of 45,000 rubles within three days. A partial refund of the invoice was received by the seller and the debt between legal entities was forgiven. The tax consequences of this action are as follows:

- VAT is shown in accounting as usual without adjustments;

- the forgiven amount equal to 21,000 rubles cannot be recognized as an expense of the seller in tax accounting and will be repaid from net profit, and for the buyer it is non-operating income (the income amount is shown in accounting by the date of forgiveness of part of the debt).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to reflect in accounting and tax accounting

Here's how to reflect an agreement on debt forgiveness between legal entities in accounting and tax accounting.

For the debtor

The accounting entries reflect this:

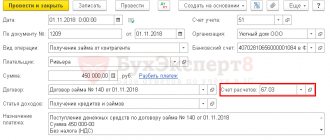

The loan debt is carried out:

For VAT, the amount is included in non-operating income. If the accrual method is used, it is included in expenses.

VAT is not charged on the forgiven amount.

For an individual, the amount written off for personal income tax purposes is taken into account as income, as is the case under the simplified tax system for individual entrepreneurs and organizations.

For the lender

The accounting entries reflect this:

There are no special features for the loan.

For VAT, the amount is not taken into account in expenses (letter of the Ministry of Finance of Russia dated September 16, 2020 No. 03-03-06/2/81343).

Debt forgiveness between individuals - individual taxation

According to paragraph 1 of Art. 41 of the Tax Code of the Russian Federation, when a debt is forgiven to an individual under a loan agreement, an economic benefit arises - the individual’s income in the amount of the forgiven loan and interest (in the case of issuing an interest-free loan). Income is taxed on a general basis - personal income tax at a rate of 13%. See Letter of the Ministry of Finance of the Russian Federation dated October 17, 2016 No. 03-04-07/60359, paragraph 1 of Art. 224 Tax Code of the Russian Federation, clause 1, art. 210 Tax Code of the Russian Federation.

Important!

If we are talking about forgiveness of an interest-free loan, there is no material benefit for the individual from saving on interest for the payer, as well as taxable income. See Letter of the Ministry of Finance of the Russian Federation dated October 28, 2014 No. 03-04-06/54626.

If the debt is forgiven by the employer, he acts as a tax agent for the individual and withholds personal income tax in the general manner. In other cases, the payment of personal income tax on the taxpayer’s income is carried out by the individual himself on the basis of a notification from the tax service - information to the Federal Tax Service of the Russian Federation must come from the employer. If an individual is not employed, the obligation to pay tax remains with him - he should fill out a declaration and pay personal income tax at a rate of 13% to the budget immediately after the loan debt is forgiven.

How to apply for debt forgiveness by the founder - accounting

The company to which the founder has forgiven the debt, after the completion of the transaction, reflects the transactions in the accounting registers:

- DEBIT 66 CREDIT 91, subaccount “Other income”

- if the loan is short-term; - DEBIT 67 CREDIT 91, subaccount “Other income”

- if the loan is long-term; - DEBIT 68, subaccount “Tax Calculations” CREDIT 99

– additional entry in case the amount of the written off debt does not belong to the taxable base (such an entry allows you to update the asset of the enterprise represented by the unpaid tax on the funds written off by the founder).

OSNO and UTII

If the debtor applies the general taxation system and pays UTII, he is obliged to keep separate records of income, expenses and business transactions (clause 7 of Article 346.26 of the Tax Code of the Russian Federation). When calculating income tax, include in non-operating income only the amount of forgiven debt that arose as part of activities under the general taxation system.

If the debt is forgiven for goods (works, services, property rights) that were used in both types of activities, then when writing it off, include the entire amount of non-operating income in the calculation of the tax base for income tax. This was stated in the letter of the Ministry of Finance of Russia dated March 15, 2005 No. 03-03-01-04/1/116. This position is based on the fact that the current tax legislation does not contain a mechanism for distributing non-operating income between different types of activities.

Debt concept

Debt under a loan or credit agreement can consist of several components, namely;

- from the body of the debt, that is, from the actual amount borrowed;

- from interest on the loan;

- from penalties accrued for failure to fulfill contractual terms.

Accordingly, debt forgiveness can be either complete or related to one or two of the above debt components. Forgiveness on all three components will be considered full forgiveness.

How to apply for debt forgiveness by the founder - legal procedure

The procedure for debt forgiveness by the founder can be formalized in several ways:

| Method for completing a debt forgiveness transaction | The essence of the method |

| Conclusion of an agreement according to which the subject of the transaction will be the release of the debtor from his debt obligations to the founder. | Such a document must be submitted to the lender by the borrower at the time of receipt of borrowed funds from him. The text of the agreement must refer to Article 415 of the Civil Code of the Russian Federation. The text of the agreement is formed in any form, but it is necessary to indicate the amount of the debt written off, the name of the organization, details of the parties to the agreement, details of the loan agreement under which the company received a loan from the founder. |

| Conclusion of an additional agreement between the debtor and the founder. | The subject of such an agreement is the founder’s waiver of the right to collect debt from the debtor organization. This document does not cancel the debt, but allows you not to repay borrowed funds without causing legal consequences. |

| Execution of a gift agreement, the parties to which are the founder-lender and the debtor company, and the subject is the amount of debt. | This method is only possible if the founder is an individual. The law prohibits two legal entities from gifting assets to each other. A donation agreement can be concluded:

|

Rules to consider when drawing up a debt forgiveness agreement

- The agreement is drawn up in writing.

- The debt forgiveness agreement by the founder must contain the amount of debt that is forgiven to the debtor and the details of the loan agreement on the basis of which it was formed. Monetary obligations may be terminated in full or in part.

- The text of the document must contain reliable information about the creditor and debtor, allowing them to be accurately identified.

- If the creditor previously sent the debtor a notice of debt forgiveness, the contract must specify the period during which the debtor can refuse the initiative taken by the creditor. If after this time the debtor has not taken any action, then this is considered as agreement with the decision of the creditor.

- Current legislation does not require that debt forgiveness by the founder under a loan agreement be notarized. But in practice, many organizations turn to a notary for services. Notarization is a guarantee that the agreement is drawn up correctly and the parties will not have any claims against each other in the future.

- The agreement is drawn up in two copies, one for each party.

To complete the document you will need:

- initial loan agreement;

- payment documents confirming the fact of transfer of funds to the organization’s current account by its founder;

- founder's passport.