Responsibility for violation of tax laws: concept, general principles

Tax liability is a type of legal liability applied for violations in the field of taxation. The general principles of application of tax liability are enshrined in Chapter. 15 of the Tax Code of the Russian Federation, and types of tax violations - in Chapter. 16 and 18. The basis for the application of tax liability measures is the decision of the Federal Tax Service, for the adoption and implementation of which there are clear procedures in the Tax Code of the Russian Federation.

The measure of tax liability (sanction) is specific - according to the Tax Code of the Russian Federation, it can only be a fine. Moreover, for most violations, a fine is the only financial consequence. These are violations not related to the payment of taxes to the budget. If you fail to comply with the tax law regarding payments, in addition to a fine, you will have to pay back to the treasury what you underpaid (pay off the arrears) and pay penalties for each day of delay.

The last two components, in fact, are not sanctions, but they also significantly hit the taxpayer’s pocket. Therefore, we talk about them along with tax liability.

Read about what arrears are in this article .

material talks about penalties .

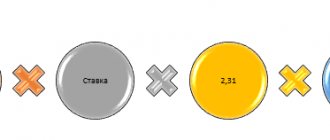

As of October 1, 2017, changes have been made to the calculation of penalties. In relation to arrears from organizations formed on October 1, penalties are calculated:

- based on 1/300 of the refinancing rate - up to the 30th calendar day of delay inclusive;

- based on 1/150 of the rate - from 31 days onwards.

Our calculator calculates penalties taking into account changes.

See instructions for using the calculator here.

The principles of tax responsibility are:

- application of sanctions only for the violations listed in the Tax Code, strictly in the manner prescribed by it (Article 106, paragraph 1 of Article 108 of the Tax Code of the Russian Federation);

- one-time application of tax liability measures: for one violation - only 1 tax fine (clause 2 of article 108 of the Tax Code of the Russian Federation);

- the presence of the taxpayer’s guilt and the presumption of innocence (Article 106, paragraph 6 of Article 108 of the Tax Code of the Russian Federation);

- proportionality of tax liability to the gravity of the violation committed, which is intended to be ensured by the presence of mitigating and aggravating circumstances in the Tax Code of the Russian Federation.

This publication talks about them.

Legislative definition

By giving citizens a range of obligations and prohibitions, called laws, the state clearly outlines those factors that go beyond these limits, that is, they are offenses.

In Art. 106 of the Tax Code provides a fairly strict definition of a tax offense. It represents an action or inaction committed by a tax agent, taxpayer or other person found guilty and subject to liability in accordance with Federal Laws:

- No. 146 of July 31, 1998, approving part 1 of the Tax Code of the Russian Federation;

- No. 117 of August 05, 2000, approving part 2 of the Tax Code of the Russian Federation.

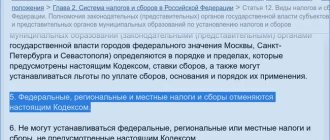

Chapter 16 of the Tax Code of the Russian Federation lists the types of non-compliance, as well as the categories of persons and/or organizations that can be held liable for each specific type of non-compliance. Clause 6 art. 108 of the Tax Code of the Russian Federation together with Art. 49 of the Russian Constitution affirms the principle of the presumption of innocence, including in the field of tax violations.

Art. 114 of the Tax Code of the Russian Federation defines the tax sanction imposed for the commission of certain types of non-compliance - this is the degree of responsibility for the committed guilty act (action or inaction) related to the tax sphere.

REFERENCE! Different types of liability may be established for tax violations. The Code of Administrative Offenses of the Russian Federation is responsible for administrative matters (Articles 15.3 – 15.9 and 15.11); If criminal liability is provided for violation of the Tax Code, it arises in connection with the data of Chapter. 22 of the Criminal Code of the Russian Federation.

Responsibility of taxpayers and tax agents: basic components

Tax liability for taxpayers is mainly represented by the following items:

- Art. 116 of the Tax Code of the Russian Federation - violations in connection with registration;

- Art. 119 and 119.1 of the Tax Code of the Russian Federation - violations related to the submission of declarations;

About the fine under Art. 119 of the Tax Code of the Russian Federation covers this material .

- Art. 120 of the Tax Code of the Russian Federation - tax liability for violations related to accounting;

Read more about them here .

- Art. 122 of the Tax Code of the Russian Federation - non-payment of tax;

- Art. 123 of the Tax Code of the Russian Federation - an analogue of Art. 122 for tax agents;

- Art. 126 and 129.1 of the Tax Code of the Russian Federation - tax structures arising when requesting documents and information.

Chapter 16. Types of tax offenses and responsibility for their commission

GL 16 Tax Code of the Russian Federation.

Comments to Chapter 16 of the Tax Code of the Russian Federation

- Article 116. Violation of the deadline for registration with the tax authority

- Article 117. Repealed. Evasion of registration with the tax authority

- Article 118. Repealed. Violation of the deadline for submitting information on opening and closing a bank account

- Article 119. Failure to submit a tax return (calculation of the financial result of an investment partnership, calculation of insurance premiums)

- Article 119.1. Violation of the established method of submitting a tax return (calculation)

- Article 119.2. Submission to the tax authority by the managing partner responsible for maintaining tax records of a calculation of the financial result of an investment partnership containing inaccurate information

- Article 120. Gross violation of the rules for accounting for income and expenses and objects of taxation (the basis for calculating insurance premiums)

- Article 121. Deleted.

- Article 122. Non-payment or incomplete payment of tax amounts (fees, insurance contributions)

- Article 122.1. Communication by a participant of a consolidated group of taxpayers to the responsible participant of this group of inaccurate data (failure to report data), which led to non-payment or incomplete payment of corporate income tax by the responsible participant

- Article 123. Failure of a tax agent to fulfill the obligation to withhold and (or) transfer taxes

- Article 124. Repealed

- Article 125. Failure to comply with the procedure for possession, use and (or) disposal of property that has been seized or in respect of which the tax authority has taken interim measures in the form of a pledge

- Article 126. Failure to provide the tax authority with information necessary to carry out tax control

- Article 126.1. Submission by a tax agent to the tax authority of documents containing false information

- Article 126.2. Submission by a tax agent of inaccurate information to the tax authority as part of the procedure for taxpayers receiving investment tax deductions in a simplified manner

- Article 127. Deleted.

- Article 128. Liability of a witness

- Article 129. Refusal of an expert, translator or specialist to participate in a tax audit, giving a knowingly false conclusion or making a knowingly false translation

- Article 129.1. Wrongful failure to report information to the tax authority

- Article 129.2. Violation of the procedure for registering gambling business objects

- Article 129.3. Non-payment or incomplete payment of tax amounts as a result of the application for tax purposes in controlled transactions of commercial and (or) financial conditions that are not comparable with the commercial and (or) financial conditions of transactions between persons not

- Article 129.4. Wrongful failure to submit a notification of controlled transactions, provision of false information in a notification of controlled transactions

- Article 129.5. Non-payment or incomplete payment of tax amounts as a result of non-inclusion of a share of the profit of a controlled foreign company in the tax base

- Article 129.6. Wrongful failure to submit notification of controlled foreign companies, notification of participation in foreign organizations, provision of false information in the notification of controlled foreign companies, notification of registration

- Article 129.7. Non-direction (non-inclusion) by a financial market organization of financial information about the clients of the financial market organization, beneficiaries and (or) persons controlling them

- Article 129.8. Violation by a financial market organization of the procedure for establishing the tax residence of clients of financial market organizations, beneficiaries and persons directly or indirectly controlling them

- Article 129.9. Failure to submit a notice of participation in an international group of companies, submission of a notice of participation in an international group of companies containing false information

- Article 129.10. Failure to submit a country report, submission of a country report containing false information

- Article 129.11. Failure to submit documentation for an international group of companies

- Article 129.12. Violation of the deadline for the transfer of taxes (fees, insurance premiums, advance payment, single tax payment of an individual, penalties, fines) by the local administration, federal postal service organization or multifunctional center

- Article 129.13. Violation of the procedure and (or) deadlines for the transfer by taxpayers of information on payments made when selling goods (work, services, property rights)

- Article 129.14. Violation of the procedure and (or) deadlines for transmitting information about settlements made by operators of electronic platforms and credit institutions

‹ Article 115 of the Tax Code of the Russian Federation. Limitation period for collecting finesUp Article 116. Violation of the deadline for registration with the tax authority ›

Responsibility for non-payment of taxes

Tax liability for non-payment of mandatory payments is perhaps most often used in practice. For defaulters, the Tax Code provides for 2 articles. Taxpayers who have not transferred tax or paid it in a smaller amount are fined under Art. 122 of the Tax Code of the Russian Federation. The fine is from 20 to 40% of the amount of arrears. The amount is considerable. But let us pay attention to the wording of paragraph 1 of Art. 122 of the Tax Code of the Russian Federation. It states that for a fine to be applied, non-payment must result from:

- understatement of the tax base;

- other incorrect calculation of payment by the taxpayer;

- his other unlawful actions (inaction).

What happens if the tax is calculated correctly, declared, but simply not included in the budget on time? Is there possible tax liability in this case?

Look for commentary on the topic in this article .

Another sore point: is a fine legal if there is an overpayment?

Find the answer here .

The statute of limitations for bringing to tax liability under Art. 122 of the Tax Code of the Russian Federation, as well as for other tax items, is 3 years. If your sin is discovered later, the tax authorities will no longer be able to fine you. But the countdown of these 3 years does not begin from the payment deadline, but somewhat later.

material will help you correctly determine the statute of limitations .

Not only taxpayers, but also tax agents are subject to tax liability for non-payment. Their article is 123. Here, with late payments, everything is very clear: a fine will be imposed, including for failure to remit taxes on time. However, there are also plenty of issues with the use of “agency” tax liability. For example, will there be a penalty if the tax is not withheld or paid by the agent before withholding from his own funds?

Find out in this publication .

Most often under Art. 123 of the Tax Code of the Russian Federation fines personal income tax agents. We have prepared a separate material especially for them - about the features of “income” liability.

It is located here .

And about how the statute of limitations is calculated under Art. 123 of the Tax Code of the Russian Federation, read this material .

Tax, administrative, criminal liability for offenses in the field of taxation

The main regulatory acts regulating liability for violations of tax legislation in Russia are the Tax Code of the Russian Federation, the Code of Administrative Offenses of the Russian Federation and the Criminal Code of the Russian Federation.

Tax liability is the application to a person guilty of committing a tax offense of tax sanctions provided for by the Tax Code of the Russian Federation in the form of monetary penalties (fines).

Signs:

1) is based on state coercion and represents a specific form of implementation of sanctions established by financial and legal norms;

2) occurs for the commission of a guilty unlawful act containing signs of a tax offense;

3) organizations and individuals can be subjects of liability for violation of legislation on taxes and fees;

4) for the offender, tax liability is expressed in certain negative consequences of a property nature;

A tax offense is an unlawful act (action or inaction) committed by a taxpayer, for which the Tax Code of the Russian Federation establishes liability.

A person held accountable is not required to prove his innocence of committing a tax offense. The responsibility for proving circumstances indicating the fact of a tax offense and the guilt of a person in committing it rests with the tax authorities. Irremovable doubts about the guilt of the person held accountable are interpreted in favor of that person.

All elements of tax offenses are recorded in Chapter 15 of the Tax Code of the Russian Federation. As a measure of liability, the Tax Code of the Russian Federation establishes and applies tax sanctions only in the form of a fine. The amount of the fine is determined by the articles of the Tax Code of the Russian Federation either in specific amounts or as a percentage of a certain amount.

If an individual who is not an individual entrepreneur is brought to justice, the amount of the fine is collected in court.

Tax authorities may file a claim in court to collect a tax sanction no later than six months after the expiration of the deadline for fulfilling the requirement to pay the tax (the statute of limitations for collecting the sanction).

Administrative responsibility in the field of taxation is the responsibility of organizations, their officials and individual entrepreneurs for tax offenses provided for by the Code of Administrative Offenses (hereinafter referred to as the Code of Administrative Offenses). The subjects of administrative liability are officials of the organization if they commit an administrative offense in connection with failure to perform or improper performance of their official duties. In this case, an official of an organization is understood as a person performing organizational, administrative or administrative functions: managers and other employees (Article 2.4 of the Code of Administrative Offenses of the Russian Federation). As for organizations, the organizations themselves, as stated above, can be prosecuted for violating the legislation on taxes and fees under the Tax Code of the Russian Federation, and their officials - under the Code of Administrative Offenses of the Russian Federation.

Signs of administrative responsibility:

-The basis for administrative liability is an administrative offense.

-The subjects of administrative responsibility can be both individuals and collective entities.

-Administrative penalties are applied by a wide range of authorized bodies and officials.

-Administrative penalties are imposed by bodies and officials on offenders who are not subordinate to them.

-Measures of administrative liability are applied in accordance with the legislation regulating proceedings in cases of administrative offenses.

-The procedure for bringing to administrative responsibility is regulated by administrative procedural norms.

Bringing to administrative liability (as well as tax liability) is permissible only if there is guilt in the form of intent and negligence. Causing harm in a state of extreme necessity or by an individual in a state of insanity excludes the possibility of administrative liability.

Criminal liability.

A tax crime differs from a crime in that it poses a greater social danger.

Russian criminal legislation currently criminalizes three types of tax crimes:

– evasion of tax payments (Articles 194, 198 and 199 of the Criminal Code);

– violation of obligations to withhold and transfer tax payments (Article 199.1 of the Criminal Code);

– obstruction of forced collection of tax payments (Article 199.2 of the Criminal Code).

Composition of persons held criminally liable. Only a sane individual who has reached the age of sixteen at the time of the commission of the crime is subject to criminal liability for committing a tax crime. A person who, at the time of committing a socially dangerous act, was in a state of:

– insanity, i.e. could not realize the actual nature and social danger of their actions (inaction) or control them due to a chronic mental disorder;

– temporary mental disorder;

– dementia;

– another painful mental state.

Forms of guilt when committing a tax crime. A person who committed an act intentionally or through negligence is considered guilty of a crime. A crime committed intentionally is an act committed with direct or indirect intent.

It is not a crime to cause harm to interests protected by criminal law:

– in a state of extreme necessity, i.e. to eliminate a danger that directly threatens the personality and rights of a given person or other persons, the legally protected interests of society or the state, if this danger could not be eliminated by other means and the limits of extreme emergency were not allowed to be exceeded necessity;

– as a result of physical coercion, if as a result of such coercion the person could not control his actions (inaction);

– a person acting in pursuance of an order or instruction that is binding on him. The person who gave the illegal order or instruction bears criminal liability for causing such harm.

Types of tax crimes. The current criminal legislation of the Russian Federation adheres to the position of classifying tax crimes as a group of economic crimes. In the current Criminal Code, tax crimes are considered in Chapter. 22 “Crimes in the field of economic activity” section. 8 “Crimes in the economic sphere.”

The text of the Criminal Code contains 4 articles devoted to tax crimes:

- Art. 198 “Evasion of tax and (or) fee from an individual”;

- Art. 199 “Evasion of taxes or fees from an organization”;

- Art. 199.1 “Failure to fulfill the duties of a tax agent”;

- Art. 199.2 “Concealment of funds or property of an organization or individual entrepreneur, at the expense of which taxes and (or) fees should be collected.”

The main regulatory acts regulating liability for violations of tax legislation in Russia are the Tax Code of the Russian Federation, the Code of Administrative Offenses of the Russian Federation and the Criminal Code of the Russian Federation.

Tax liability is the application to a person guilty of committing a tax offense of tax sanctions provided for by the Tax Code of the Russian Federation in the form of monetary penalties (fines).

Signs:

1) is based on state coercion and represents a specific form of implementation of sanctions established by financial and legal norms;

2) occurs for the commission of a guilty unlawful act containing signs of a tax offense;

3) organizations and individuals can be subjects of liability for violation of legislation on taxes and fees;

4) for the offender, tax liability is expressed in certain negative consequences of a property nature;

A tax offense is an unlawful act (action or inaction) committed by a taxpayer, for which the Tax Code of the Russian Federation establishes liability.

A person held accountable is not required to prove his innocence of committing a tax offense. The responsibility for proving circumstances indicating the fact of a tax offense and the guilt of a person in committing it rests with the tax authorities. Irremovable doubts about the guilt of the person held accountable are interpreted in favor of that person.

All elements of tax offenses are recorded in Chapter 15 of the Tax Code of the Russian Federation. As a measure of liability, the Tax Code of the Russian Federation establishes and applies tax sanctions only in the form of a fine. The amount of the fine is determined by the articles of the Tax Code of the Russian Federation either in specific amounts or as a percentage of a certain amount.

If an individual who is not an individual entrepreneur is brought to justice, the amount of the fine is collected in court.

Tax authorities may file a claim in court to collect a tax sanction no later than six months after the expiration of the deadline for fulfilling the requirement to pay the tax (the statute of limitations for collecting the sanction).

Administrative responsibility in the field of taxation is the responsibility of organizations, their officials and individual entrepreneurs for tax offenses provided for by the Code of Administrative Offenses (hereinafter referred to as the Code of Administrative Offenses). The subjects of administrative liability are officials of the organization if they commit an administrative offense in connection with failure to perform or improper performance of their official duties. In this case, an official of an organization is understood as a person performing organizational, administrative or administrative functions: managers and other employees (Article 2.4 of the Code of Administrative Offenses of the Russian Federation). As for organizations, the organizations themselves, as stated above, can be prosecuted for violating the legislation on taxes and fees under the Tax Code of the Russian Federation, and their officials - under the Code of Administrative Offenses of the Russian Federation.

Signs of administrative responsibility:

-The basis for administrative liability is an administrative offense.

-The subjects of administrative responsibility can be both individuals and collective entities.

-Administrative penalties are applied by a wide range of authorized bodies and officials.

-Administrative penalties are imposed by bodies and officials on offenders who are not subordinate to them.

-Measures of administrative liability are applied in accordance with the legislation regulating proceedings in cases of administrative offenses.

-The procedure for bringing to administrative responsibility is regulated by administrative procedural norms.

Bringing to administrative liability (as well as tax liability) is permissible only if there is guilt in the form of intent and negligence. Causing harm in a state of extreme necessity or by an individual in a state of insanity excludes the possibility of administrative liability.

Criminal liability.

A tax crime differs from a crime in that it poses a greater social danger.

Russian criminal legislation currently criminalizes three types of tax crimes:

– evasion of tax payments (Articles 194, 198 and 199 of the Criminal Code);

– violation of obligations to withhold and transfer tax payments (Article 199.1 of the Criminal Code);

– obstruction of forced collection of tax payments (Article 199.2 of the Criminal Code).

Composition of persons held criminally liable. Only a sane individual who has reached the age of sixteen at the time of the commission of the crime is subject to criminal liability for committing a tax crime. A person who, at the time of committing a socially dangerous act, was in a state of:

– insanity, i.e. could not realize the actual nature and social danger of their actions (inaction) or control them due to a chronic mental disorder;

– temporary mental disorder;

– dementia;

– another painful mental state.

Forms of guilt when committing a tax crime. A person who committed an act intentionally or through negligence is considered guilty of a crime. A crime committed intentionally is an act committed with direct or indirect intent.

It is not a crime to cause harm to interests protected by criminal law:

– in a state of extreme necessity, i.e. to eliminate a danger that directly threatens the personality and rights of a given person or other persons, the legally protected interests of society or the state, if this danger could not be eliminated by other means and the limits of extreme emergency were not allowed to be exceeded necessity;

– as a result of physical coercion, if as a result of such coercion the person could not control his actions (inaction);

– a person acting in pursuance of an order or instruction that is binding on him. The person who gave the illegal order or instruction bears criminal liability for causing such harm.

Types of tax crimes. The current criminal legislation of the Russian Federation adheres to the position of classifying tax crimes as a group of economic crimes. In the current Criminal Code, tax crimes are considered in Chapter. 22 “Crimes in the field of economic activity” section. 8 “Crimes in the economic sphere.”

The text of the Criminal Code contains 4 articles devoted to tax crimes:

- Art. 198 “Evasion of tax and (or) fee from an individual”;

- Art. 199 “Evasion of taxes or fees from an organization”;

- Art. 199.1 “Failure to fulfill the duties of a tax agent”;

- Art. 199.2 “Concealment of funds or property of an organization or individual entrepreneur, at the expense of which taxes and (or) fees should be collected.”

Fines for reporting

We have already mentioned above that tax liability for reporting to the Tax Code of the Russian Federation is presented in Art. 119 and 119.1 of the Tax Code of the Russian Federation.

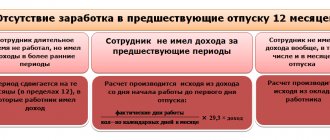

The first of them threatens those who delayed the declaration. For this, you will have to pay to the treasury 5% of the unpaid tax amount subject to payment (additional payment) on the basis of an overdue declaration, for each full or partial month of delay.

What has changed in bringing to tax liability under Art. 119 of the Tax Code of the Russian Federation in recent years, find out from this article .

At the same time, the amount of the fine “from below and from above” is limited: the minimum is 1,000 rubles, the maximum is 30% of the tax amount.

Read more about the size of fines here .

Since the amount of tax liability is directly related to the amount of tax, in practice the question often arises: will they be fined if there is no tax to pay or the declaration is completely zero? Of course, at the minimum, but they will be fined. Is it possible to reduce the minimum sanction?

Read this publication and you will know the answer .

For certain taxes, we have to report several times during the tax period: within it - on advances and at the end - on the final tax amount. In this case, interim reporting can also be called a declaration and may also be overdue. And there will also be a fine for it, but not under Art. 119 of the Tax Code of the Russian Federation. And for what?

Our material .

Tax liability under Art. 119.1 of the Tax Code of the Russian Federation applies to those who are required to submit reports electronically, but submitted a declaration in paper form. The fine for this is small - only 200 rubles. However, there is one significant point - this article does not apply to VAT returns. If instead of electronic reporting for this tax you submit a declaration in paper form, expect a fine under Art. 119 of the Tax Code of the Russian Federation, that is, for an unsubmitted VAT return.

What else will they be punished for under the Tax Code?

Quite often, tax liability occurs when tax authorities demand documents and information. This is Art. 126 and 129.1 of the Tax Code of the Russian Federation. During their use, many controversial issues arise.

Some of them are explained in this publication.

And the issue of delimiting tax liability between these articles is discussed in the material “What is the fine for failure to provide documents for a counter-inspection?” .

The amount of the fine under Art. 126 of the Tax Code of the Russian Federation, it would seem, is clearly defined - this is 200 rubles. for each document not submitted at the request of the controllers. But what if the exact number of papers is not indicated in the request, but, for example, invoices for such and such a period are requested? The Supreme Court of the Russian Federation spoke about determining the amount of tax liability in such a situation.

Find his position here .

Since 2022, tax authorities will fine companies not only for violations of the Russian Tax Code on taxes, but also for insurance premiums, as well as for delays and inaccurate data in the new 6-NDFL report. Find out more from our materials:

- Calculation of insurance premiums - fine for late submission (nuances);

- “Fines for 6-NDFL: rules for imposition”.