Definition of the Federal Tax Service

According to Decree of the Government of the Russian Federation No. 506 of September 30, 2004, the Federal Tax Service acts as an executive body in the field of supervision over the implementation of legislation on mandatory fees.

Division of the Federal Tax Service - Federal Tax Service Inspectorate. The Federal Tax Service is an executive body in a certain territory.

Determining whether a particular person belongs to a territorial inspection is carried out in the following ways:

- Using your taxpayer identification code. The service unit number is the first four digits of the TIN.

- On the official page of the Federal Tax Service. In a special field, you must enter the address of an individual at the place of residence, the registration address of a legal entity or individual entrepreneur, and the system will issue the details of the Federal Tax Service.

As a result of the reorganization of tax authorities, the Federal Tax Service code may change. You can find out the tax office at your registration address on the website of the Federal Tax Service of the Russian Federation. You can obtain information using a known, previously assigned code.

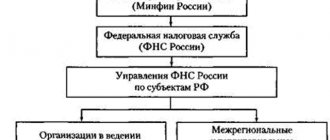

Structure of tax authorities

The structure and concept of the Federal Tax Service of the Russian Federation are determined by the Government Decree “On approval of the regulations on the Federal Tax Service”. A detailed diagram is posted on the Federal Tax Service website.

Briefly it looks like this:

- The highest tax authority in the Russian Federation is the Federal Tax Service, subordinate to the Ministry of Finance.

- Five interregional inspections.

- Tax service departments by subjects.

The head of the Federal Tax Service is the head. The proposal for appointment to the post comes from the Ministry of Finance of the Russian Federation. Approval for post and dismissal from office is carried out by the Government of the country. The chief is personally responsible for performing the tasks and functions assigned to the Federal Tax Service.

The country's tax service department by region includes territorial inspectorates.

The office of the Federal Tax Service of Russia is located in Moscow at the address: st. Neglinnaya, 23.

You can contact the state tax service in various ways:

- by phone;

- by letter by Russian post;

- using online services;

- through local branches.

All reference information is contained on the official website of the service on the Internet. A single hotline has been opened for consultations on general issues. The central office is available 24 hours a day by calling the helpline +74959130070.

The uniform of all tax employees contains a distinctive sleeve insignia with a coat of arms. The emblem of the Ministry of Taxes and Duties is used as a coat of arms. Externally, it is similar to the coat of arms of Russia. The difference is that the eagle holds the key with its right paw, and the kerikion of Hermes with its left.

System of tax authorities of the Russian Federation

The tax authorities of the Russian Federation constitute a single centralized system of control over compliance with the legislation on taxes and fees, over the correct calculation, completeness and timeliness of taxes, fees and other obligatory payments being entered into the relevant budget. This system includes the federal executive body authorized for control and supervision in the field of taxes and fees (Federal Tax Service), and its territorial bodies.

The Federal Tax Service and its territorial bodies in the established field of activity are the legal successors of the Ministry of the Russian Federation for Taxes and Duties, as well as the Federal Service of Russia for Financial Recovery and Bankruptcy in all legal relations related to the representation of the interests of the Russian Federation in bankruptcy proceedings (Article 2 of the Regulations on Federal Tax Service).

The fundamental principles of the organization of tax authorities are unity, independence, centralization and hierarchical structure.

The principle of unity is determined by the principle of unity of tax policy in the state. Ensuring the uniform application of tax legislation in the Russian Federation requires the presence of a single control body in the established field of activity. The Federal Tax Service of Russia and its territorial bodies exercise their powers in relation to both state and local taxes.

The principle of independence of tax authorities is expressed primarily in independence from local authorities. The Federal Tax Service of Russia carries out its activities in the established field directly and through its territorial bodies.

Local authorities and administration do not have the right to interfere in the activities of tax authorities, change or cancel their decisions, or give them operational guidelines. The appointment of persons to leadership positions in territorial bodies of the Federal Tax Service occurs regardless of the opinion of the authorities of the constituent entities of the Russian Federation and local governments. At the same time, tax authorities carry out their activities in cooperation with other federal executive authorities, executive authorities of constituent entities of the Russian Federation, local government bodies and state extra-budgetary funds.

The principle of centralization is manifested in the fact that tax authorities represent a single centralized system of tax authorities, which can be divided into four levels (links):

- the general federal level (highest level) is represented by the federal executive body authorized to control and supervise in the field of taxes and fees - the Federal Tax Service of Russia, which heads the system of tax authorities;

- the interregional level (second link) is represented by the interregional inspectorates of the Federal Tax Service of Russia;

- regional level (third link) – these are the departments of the Federal Tax Service for the constituent entities of the Russian Federation;

- local level (fourth link) - territorial inspectorates of the Federal Tax Service for districts, districts in cities, cities without district division, as well as interdistrict tax inspectorates.

In accordance with the principle of hierarchical structure of the system of tax authorities, lower tax authorities are subordinate to the higher tax authority and are controlled by them. Higher tax authorities have the right to cancel decisions of lower ones if they do not comply with the Constitution of the Russian Federation, federal laws and other regulatory legal acts. Decisions of lower tax authorities can be appealed by the taxpayer to higher tax authorities.

The system of tax authorities is headed by the Federal Tax Service (FTS of Russia). The Federal Tax Service (FTS of Russia) is a federal executive body that exercises the functions of control and supervision over compliance with legislation on taxes and fees, the correctness of calculation, completeness and timeliness of taxes and fees, other obligatory payments entered into the relevant budget, the production and turnover of ethyl alcohol, alcohol-containing alcoholic and tobacco products, as well as the functions of a currency control agent within the competence of the tax authorities.

Tax Service of Russia is an authorized federal executive body that carries out state registration of legal entities, individuals as individual entrepreneurs and peasant (farm) households, as well as an authorized federal executive body that ensures the representation in bankruptcy cases and in bankruptcy procedures of requirements for the payment of mandatory payments and claims of the Russian Federation for monetary obligations.

The Federal Tax Service of Russia is under the jurisdiction of the Ministry of Finance of Russia. In its activities, the Federal Tax Service of Russia is guided by the Constitution of the Russian Federation, federal constitutional laws, federal laws, acts of the President of the Russian Federation and the Government of the Russian Federation, international treaties of the Russian Federation, regulatory legal acts of the Ministry of Finance of the Russian Federation, as well as the Regulations “On the Federal Tax Service”, approved by the Government of the Russian Federation on September 30 2004 N 506 (as amended on July 30, 2014).

The Federal Tax Service of Russia carries out its activities directly and through its territorial bodies in interaction with other federal executive authorities, executive authorities of constituent entities of the Russian Federation, local government bodies and state extra-budgetary funds, public associations and other organizations.

The Federal Tax Service of Russia and its territorial bodies - departments of the Service for the constituent entities of the Russian Federation, interregional inspections of the Service, inspections of the Service for districts, districts in cities, cities without district division, inspections of the Service at the interdistrict level (hereinafter referred to as tax authorities) constitute a single centralized system of tax authorities.

The Federal Tax Service of Russia is headed by a director appointed and dismissed by the Government of the Russian Federation on the recommendation of the Minister of Finance of the Russian Federation. The head of the Federal Tax Service has 9 deputies, appointed and dismissed by the Minister of Finance of the Russian Federation on the proposal of the head of the Federal Tax Service. Structure of the Federal Tax Service of Russia.

- The central office is the head of the Federal Tax Service, deputy heads and 27 departments in the main areas of activity of the Service, including: the department for administering taxes on personal income; income tax administration department; Administration of the Unified Social Tax; tax control department; Department of Administration of Indirect Taxes; Department of Control and Licensing of State-Regulated Activities; department of state registration and accounting of legal entities and individuals; tax audit department; organizational and inspection department; tax authorities control department, etc.

- The Federal Tax Service Board is an advisory body of the Federal Tax Service that considers the most important issues of the activities of tax authorities. The decisions of the Collegium are made by a majority vote of its members and are implemented by orders of the Federal Tax Service. The personal composition of the Collegium and the procedure for the participation of members of the Collegium in its meetings are determined and approved by a separate order of the head of the Federal Tax Service.

- The Central Expert Commission of the Federal Tax Service is a permanent body of the Federal Tax Service that organizes and conducts methodological and practical work on the examination of the value and preparation for transfer to state storage of management and other special documentation of the Archive Fund of the Russian Federation, which is in departmental storage in the Federal Tax Service and the tax authorities of the Russian Federation. The personnel of the CEC is appointed by order of the head of the Federal Tax Service from the most qualified employees of the departments, chaired by one of the deputy heads.

- subordinate to the Federal Tax Service that ensure the activities of tax authorities.

The Federal Tax Service of Russia exercises the following powers in the established field of activity (Article 5 of the Regulations on the Federal Tax Service):

1) exercises control and supervision over:

- compliance with the legislation on taxes and fees, as well as regulatory legal acts adopted in accordance with it, the correctness of calculation, completeness and timely payment of taxes and fees, and in cases provided for by the legislation of the Russian Federation - for the correctness of calculation, completeness and timeliness of payment to the relevant budget other obligatory payments;

- carrying out currency transactions by residents and non-residents who are not credit institutions;

- compliance with the requirements for cash register equipment, the procedure and conditions for its registration and use;

- complete accounting of cash proceeds in organizations and individual entrepreneurs;

- conducting lotteries, including the targeted use of proceeds from lotteries;

2) issues in the prescribed manner:

- certificate of registration of a person carrying out transactions with straight-run gasoline;

- certificates of registration of an organization carrying out transactions with denatured ethyl alcohol;

3) carries out:

- state registration of legal entities, individuals as individual entrepreneurs and peasant (farm) farms;

- issuance of special stamps for marking tobacco and tobacco products produced on the territory of the Russian Federation;

- federal state supervision in the field of organization and conduct of gambling;

4) registers, in accordance with the established procedure, cash register equipment used by organizations and individual entrepreneurs in accordance with the legislation of the Russian Federation;

5) leads in the prescribed manner:

- accounting of all taxpayers;

- Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs and Unified State Register of Taxpayers;

- state register of cash registers;

6) informs taxpayers free of charge (including in writing) about current taxes and fees, legislation on taxes and fees and regulations adopted in accordance with it, the procedure for calculating and paying taxes and fees, the rights and obligations of taxpayers, the powers of tax authorities and their officials, and also provides tax reporting forms and explains the procedure for filling them out;

7) carries out, in accordance with the procedure established by the legislation of the Russian Federation, a refund or offset of overpaid or overcharged amounts of taxes and fees, as well as penalties and fines;

makes, in accordance with the procedure established by the legislation of the Russian Federation, decisions on changing the deadlines for paying taxes, fees and penalties;

9) establishes (approves) the forms of various tax documents:

- tax notice;

- tax requirements;

- applications for registration and deregistration with the tax authority;

- notifications about registration and deregistration with the tax authority; certificates of registration with the tax authority;

- decisions of the head (deputy head) of the tax authority to conduct an on-site tax audit;

- form and requirements for drawing up a tax audit report;

- an act on the discovery of facts indicating tax offenses provided for by the Tax Code of the Russian Federation (with the exception of tax offenses provided for in Articles 120, 122, 123), and the requirements for its preparation;

- submission by tax agents to the tax authority of information on the income of individuals and the amounts of accrued and withheld taxes for the tax period;

- certificates of income received by individuals and tax amounts withheld;

- submission by bodies carrying out state registration of vehicles information about vehicles registered or deregistered with these bodies, as well as about persons to whom vehicles are registered;

- notifications about the opening (closing) of accounts (deposits) in foreign currency (in the currency of the Russian Federation) and about changes in the details of accounts (deposits) in foreign currency (in the currency of the Russian Federation) in banks outside the territory of the Russian Federation;

- notifications about the presence of bank accounts outside the territory of the Russian Federation, opened in accordance with permits that have ceased to be valid, other forms of documents;

10) develops forms and procedures for filling out tax calculations, tax return forms and other documents and sends them for approval to the Ministry of Finance of the Russian Federation;

11) performs other functions in the established field of activity. In order to exercise powers in the established field of activity, the Federal Tax Service has the right:

- organize the necessary studies, tests, examinations, analyzes and assessments, as well as scientific research on the issues of control and supervision in the established field of activity;

- request and receive information necessary for making decisions on issues related to the established scope of activity;

- provide legal entities and individuals with explanations on issues related to the established field of activity;

- exercise control over the activities of the territorial bodies of the Service and subordinate organizations;

- involve in the prescribed manner scientific and other organizations, scientists and specialists to study issues related to the established field of activity;

- apply restrictive, precautionary and prophylactic measures provided for by the legislation of the Russian Federation, as well as sanctions aimed at preventing and (or) eliminating the consequences caused by the violation by legal entities and individuals of mandatory requirements in the established field of activity, in order to suppress facts of violation of the legislation of the Russian Federation;

- create advisory and expert bodies (councils, commissions, groups, collegiums) in the established field of activity;

- develop and approve in the prescribed manner samples of uniforms, insignia, certificates, as well as the procedure for wearing uniforms.

The Federal Tax Service provides general management, control and coordination of the activities of the tax authorities of Russia. It issues orders, instructions, guidelines and other regulatory documents related to the application of legislation on taxes and other obligatory payments.

The territorial bodies of the Federal Tax Service of Russia include:

- interregional inspections of the Federal Tax Service of Russia: interregional inspection of the Federal Tax Service for the Federal District; interregional inspection of the Federal Tax Service for central processing of data; interregional inspection of the Federal Tax Service for the largest taxpayers;

- departments of the Federal Tax Service for the constituent entities of the Russian Federation;

- inspections of the Federal Tax Service for districts, districts in cities, cities without district division;

- interdistrict tax inspectorates of the Federal Tax Service.

The basis for building a system of tax authorities is the federal structure of the Russian Federation and its administrative-territorial division. When establishing interregional inspectorates of the Federal Tax Service, certain areas of activity that require specialization of inspections are also taken into account.

Interregional inspectorates of the Federal Tax Service are territorial bodies of the Federal Tax Service, which are part of a single centralized system of tax authorities. Currently there are: interregional inspections of the Federal Tax Service for federal districts (abbreviated name - MI Federal Tax Service of Russia for ___ district); interregional inspections of the Federal Tax Service for the largest taxpayers (abbreviated name - MI Federal Tax Service of Russia for the largest taxpayers N __);

Interregional inspection of the Federal Tax Service for central data processing (abbreviated name - MI Federal Tax Service of Russia for data centers). The provisions on interregional inspections of the Federal Tax Service were approved by Order of the Minister of Finance of the Russian Federation dated August 9, 2005 N 101n (as amended on April 5, 2012). Interregional inspections are directly subordinate to the Federal Tax Service of Russia and are controlled by it.

The Interregional Inspectorate is a territorial body that exercises the functions of control and supervision over compliance with legislation on taxes and fees, over the correct calculation, completeness and timeliness of taxes and fees being entered into the relevant budget, in cases provided for by the legislation of the Russian Federation, over the correct calculation, completeness and timeliness making other obligatory payments into the relevant budget, as well as monitoring compliance with the currency legislation of the Russian Federation by the largest taxpayers.

The interregional inspectorate is headed by a director appointed and dismissed by the head of the Federal Tax Service of Russia. The head of the interregional inspection has deputies who are appointed and dismissed by the head of the Federal Tax Service of Russia on the proposal of the head of the interregional inspection. Interregional inspectorates perform the functions of tax authorities in a certain territory or in a certain field of activity.

The Interregional Inspectorate is a legal entity, has a form and seal with the image of the State Emblem of the Russian Federation with its full and abbreviated name, other seals, stamps and forms of the established form, as well as accounts opened in accordance with the legislation of the Russian Federation. The Federal Tax Service departments for the constituent entities of the Russian Federation (abbreviated name - Federal Tax Service of Russia for ___) are territorial bodies of the Federal Tax Service and are part of a single centralized system of tax authorities.

The Federal Tax Service for the constituent entities of the Russian Federation is directly subordinate to the Federal Tax Service of Russia and is controlled by it. The department is headed by a director who is appointed and dismissed by the Minister of Finance of the Russian Federation on the recommendation of the head of the Federal Tax Service of Russia. The head of the department has deputies who are appointed and dismissed by the head of the Federal Tax Service on the recommendation of the head of the department.

The Federal Tax Service for a constituent entity of the Russian Federation carries out the functions of monitoring compliance with legislation on taxes and fees, the correctness of calculation, completeness and timeliness of taxes and fees being entered into the relevant budget, as well as the production and circulation of ethyl alcohol, alcohol-containing, alcoholic and tobacco products and compliance with foreign exchange regulations. legislation of the Russian Federation within the powers of the tax authorities.

The Federal Tax Service for the constituent entities of the Russian Federation carries out state registration of legal entities, individuals as individual entrepreneurs, peasant (farm) farms, represents in bankruptcy cases and in bankruptcy procedures demands for the payment of mandatory payments and demands of the Russian Federation for monetary obligations.

The Federal Tax Service for a constituent entity of the Russian Federation carries out its activities directly and through inspections in districts, districts in cities, cities without district divisions, inspections at the interdistrict level and in interaction with territorial bodies of federal executive authorities, executive authorities of constituent entities of the Russian Federation, local governments and state extra-budgetary funds .

The powers of management in the established field of activity are determined by the Regulations “On the Administration of the Federal Tax Service for the Subject of the Russian Federation”, approved by Order of the Minister of Finance of the Russian Federation dated August 9, 2005 N 101n (as amended on April 5, 2012).

Inspections of the Federal Tax Service for a district, a district in a city, a city without district division and the Federal Tax Service inspection at the interdistrict level (IFTS) are the main link in the system of tax authorities. The Federal Tax Service is directly subordinate to the department of the Federal Tax Service of Russia for the constituent entity of the Russian Federation and is controlled by the Federal Tax Service and the department.

The Federal Tax Service Inspectorate is a territorial body that exercises the functions of control and supervision over compliance with legislation on taxes and fees, over the correct calculation, completeness and timeliness of taxes and fees being entered into the relevant budget, in cases provided for by the legislation of the Russian Federation, over the correct calculation, completeness and timeliness of entering to the appropriate budget of other obligatory payments, as well as for the production and turnover of ethyl alcohol, alcohol-containing, alcoholic and tobacco products and for compliance with the currency legislation of the Russian Federation within the competence of the tax authorities.

The Federal Tax Service Inspectorate carries out state registration of legal entities, individuals as individual entrepreneurs, peasant (farm) farms, and represents in bankruptcy cases and in bankruptcy procedures requirements for the payment of mandatory payments and requirements of the Russian Federation for monetary obligations.

The legal status of the Federal Tax Service , their powers, organization of activities are determined in the Regulations “On the inspection of the Federal Tax Service for a district, a district in a city, a city without district division and the inspection of the Federal Tax Service at the interdistrict level”, approved by Order of the Ministry of Finance of the Russian Federation of August 9, 2005 N 101n (in ed. dated 04/05/2012). The Federal Tax Service Inspectorate for a district, a district in a city, a city without district division and the Federal Tax Service Inspectorate at the inter-district level exercises the following powers in the established field of activity:

- exercises control and supervision over compliance with the legislation on taxes and fees, as well as regulatory legal acts adopted in accordance with it, the correctness, completeness and timeliness of the payment of taxes and fees, and other obligatory payments;

- carries out state registration of legal entities, individuals as individual entrepreneurs and peasant (farm) farms;

- maintains, in accordance with the established procedure, records of taxpayers in the territory under its jurisdiction: the Unified State Register of Legal Entities, the Unified State Register of Individual Entrepreneurs and the Unified State Register of Taxpayers, as well as accounting (for each taxpayer and type of payment) of the amounts of taxes and fees payable and actually received by the budget , as well as amounts of penalties, tax sanctions;

- provides a refund or credit for overpaid or overcharged amounts of taxes and fees, penalties and fines;

- carries out inspections of the activities of legal entities and individuals in the established field of activity;

- collects arrears and penalties for taxes and fees in accordance with the established procedure, brings claims to the courts for the collection of tax sanctions from persons who have committed violations of the legislation on taxes and fees, as well as in other cases established by the legislation of the Russian Federation;

- performs other functions provided for by federal laws and other regulatory legal acts.

The Federal Tax Service Inspectorate is headed by a director who is appointed and dismissed by the head of the Federal Tax Service of Russia. The head of the inspection has deputies who are appointed and dismissed by the head of the Federal Tax Service on the recommendation of the head of the inspection. Other inspectorate employees are appointed to positions by order of the head of the inspection.

Head of Inspectorate:

- organizes and exercises, on the principles of unity of command, general management and control over the activities of the inspectorate;

- distributes responsibilities among his deputies;

- submits for approval to the management the structure of the inspection and the estimate of income and expenses for its maintenance, approves, within the established number and wage fund, the staffing table, as well as regulations on the structural divisions of the inspection and job descriptions of its employees;

- issues orders, instructions and gives instructions on the activities of the inspection, mandatory for execution by all employees of the inspection;

- appoints and dismisses inspection employees in accordance with the established procedure;

- submits reports on the work done for the relevant reporting period to the department in the prescribed manner and within the appropriate time frame;

- resolves, in accordance with the legislation of the Russian Federation on public service, issues related to the passage of federal public service in the inspection;

- brings, in accordance with the legislation of the Russian Federation, to disciplinary liability of inspectorate employees for violations committed by them in their work, if administrative or criminal liability is not provided for these violations.

The Federal Tax Service Inspectorate is a legal entity, has a form and seal with the image of the State Emblem of the Russian Federation, with its full and abbreviated name, other seals, stamps and forms of the established form, as well as accounts opened in accordance with the legislation of the Russian Federation.

All employees of tax authorities are subject to mandatory state personal insurance at the expense of the federal budget. In the event of the death of a tax authority employee in connection with the performance of official activities, the family of the deceased or his dependents is paid a lump sum benefit in the amount of ten years of the deceased’s salary from the federal budget, with subsequent recovery of this amount from the perpetrators.

If a tax authority employee inflicts grievous bodily harm that precludes further opportunity to engage in professional activity, he is paid a one-time benefit in the amount of five years' salary from the federal budget with subsequent recovery of this amount from the perpetrators, as well as for ten years - the difference between the amounts salary and pension.

If a tax authority employee inflicts less serious bodily injuries, he is paid a one-time benefit in the amount of five monthly earnings from the federal budget, with the subsequent recovery of this amount from the perpetrators. Damage caused to the property of a tax authority employee (or his close relative) in connection with official activities is compensated in full from the federal budget, with the subsequent recovery of this amount from the perpetrators.

Managerial employees and specialists of tax authorities are assigned class ranks in accordance with their position, qualifications and length of service. The regulations on class ranks of tax authorities employees and the amount of additional payments for class ranks are approved by the President of the Russian Federation.

Citizens appointed to government positions in tax authorities are subject to mandatory state fingerprint registration in accordance with the legislation of the Russian Federation.

Functions of the tax service

To achieve the objectives set by law, the Federal Tax Service performs the following functions:

- to ensure strict implementation of legislation, develop a procedure for managing tax proceedings;

- on participation in the development of bills and other official documents in the field of taxation;

- for the provision of services, explanation of rights and obligations to taxpayers;

- to inform taxpayers about legislative changes that have occurred.

Other features include:

- conducting audits of the financial activities of the organization in the field of tax accounting;

- through credit institutions, return of previously paid excess tax;

- work on analyzing statistics in the field of taxation, developing advisory amendments in order to improve the tax system;

- assistance in determining the value and sale of seized property.

Tax administration

Tax administration is the process of managing tax proceedings, implemented by tax and other authorities (tax administrations) that have certain powers in relation to taxpayers and payers of fees.

The subject of tax administration is tax proceedings.

The object of tax administration is the process of managing tax proceedings.

Subjects of tax administration are tax and other authorities (tax administrations).

Tax proceedings are a set of legally established techniques, methods and techniques that determine the procedure for the voluntary fulfillment of a taxpayer’s tax obligation, and the powers of tax administrations to control, regulate and force taxpayers to fulfill this obligation.

Tax administrations are state tax and other bodies that, on a legislative basis, are granted certain authority (administrative) powers in relation to taxpayers and payers of fees.

In accordance with Art. 30 of the Tax Code of the Russian Federation, tax authorities constitute a single centralized system of control over compliance with the legislation on taxes and fees, over the correctness of calculation, completeness and timeliness of payment (transfer) to the budgetary system of the Russian Federation of taxes and fees, and in cases provided for by the legislation of the Russian Federation, over the correctness of calculation, completeness and timely payment (transfer) of other obligatory payments to the budget system of the Russian Federation.

This system includes the federal executive body authorized for control and supervision in the field of taxes and fees, and its territorial bodies.

Tax authorities act within their competence and in accordance with the legislation of the Russian Federation.

Tax authorities carry out their functions and interact:

- with federal executive authorities;

- with executive authorities of the constituent entities of the Russian Federation;

- with local governments;

- with state extra-budgetary funds

through the implementation of powers provided for by the Tax Code of the Russian Federation and other regulatory legal acts of the Russian Federation.

Interregional and interdistrict inspections

Interregional and interdistrict inspections appeared during the reform.

The area of responsibility of the interdistrict inspection includes:

- administrative regions;

- largest payers.

Data on the largest payers is contained in the Unified State Register. Interregional divisions operate within a specific territory.

Rights and responsibilities of the tax service

In Art. 31 of the Tax Code stipulates the rights of the tax service.

Basic powers enshrined in the code:

- Request all necessary documentation from the payer.

- Perform checks.

- Seize documents under lawful circumstances.

- Call taxpayers for clarification.

- Limit the right of ownership or other property right, temporarily stop operations on taxpayer accounts.

- Calculate tax amounts to be sent to the budget.

- Engage in forced collection of arrears and fines.

- Within the scope of its powers, submit claims to the courts.

The duties of the Federal Tax Service are given in Art. 32 NK. The primary ones include:

- execution of legislation;

- keeping records of payers;

- providing free information to taxpayers in the field of taxation;

- ensuring the safety of tax secrets;

- sending taxpayers documentation on payment of taxes, audit results and decisions made;

- provision of reference information upon request, reconciliation of calculations.

In their activities, service employees are required to be guided by the explanations of the Ministry of Finance and current legislation.

Interregional tax inspectorates

The classification of tax authorities of the Russian Federation, its basis and statistics include interregional entities and divisions. In fact, these are the same territorial tax authorities that are part of the Federal Tax Service. The activities of such a municipal tax entity or division and the established principles are also based on the norms of current legislation.

The classification of tax authorities establishes that municipal or other entities are tax authorities, the principles, actions, measures and interaction of which are carried out within one specific territory.

The concept and legal status of tax authorities of regional significance, as well as the responsibilities of tax authorities, permissible interim measures and their implementation, principles, types, procedures, liability, inaction, classification, etc., are established in relation to a specific municipal or other entity.

The norms and principles of the current legislation of the Russian Federation use the concept of “territorial body” precisely to designate the spatial limit for the implementation of certain activities.