About legal entities

Types of tax periods According to paragraph 1 of Article of the Tax Code of the Russian Federation, a tax period is a segment

When a baby arrives in the family, many parents are interested in the question of how to calculate maternity leave.

The purpose of maintaining an income book The income book for individual entrepreneurs on a patent (KUD) is

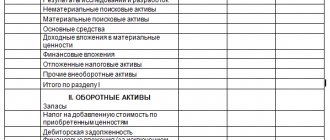

Analysis of the balance sheet data of an enterprise gives an idea of its current economic condition. Asset ratio

Who is a private entrepreneur? A private entrepreneur is an individual who, without legal education

Unified Social Tax in 2022: why is it needed? The abbreviation Unified Social Tax stands for Unified Social Tax. Before

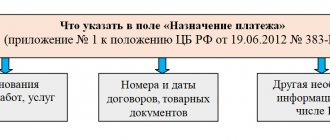

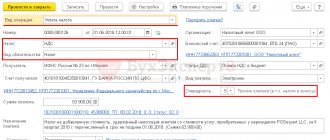

When and what errors occur? Errors in payments between counterparties are made by the drafters of payment orders,

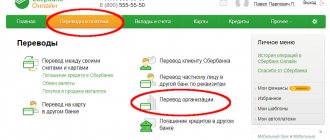

How to check for account restrictions on the Federal Tax Service website In general, taxpayers should learn about

Let's figure out what SMEs are and how to determine whether they belong to the categories of medium and small

Tax agents are business entities who, by force of law, must calculate and pay