Introductory information

Let us remind you that changes in legislation that made it possible to receive sick leave certificates electronically came into force in July 2022 (Federal Law dated 05/01/17 No. 86-FZ).

And at the end of 2017, by-laws were adopted regulating the procedure for issuing electronic certificates of incapacity for work (ELN), as well as the rules for electronic interaction between Social Insurance Fund bodies, employers and medical organizations (approved by Decree of the Government of the Russian Federation of December 16, 2017 No. 1567; hereinafter referred to as Rules No. 1567 ). After this, the FSS began work on a gradual transition to ELN - active information campaigns in 2022 and 2019 were dedicated to this. And in 2020, the Ministry of Health approved the procedure for issuing and processing certificates of incapacity for work in the form of an electronic document (order No. 925n dated 09/01/20; hereinafter referred to as Procedure No. 925n).

Work with electronic sick leave according to new rules

How to refuse to accept electronic sick leave

Ideally, the employer should explain to the employee that he is not yet ready to switch to electronic document management and therefore cannot receive a certificate of incapacity for work issued in an e-form from the medical organization. Since it is the employee who chooses which document to receive - paper or electronic.

The Social Insurance Fund, in a letter dated August 11, 2021 No. 02-09-11/22-05-13462, recalled that electronic sick leave from July 1, 2021 is equal in legal force to a traditional paper certificate of incapacity for work. The insured person (employee) decides in what form the sick leave will be issued.

What is an electronic certificate of incapacity for work?

As you know, sick leave benefits are calculated on the basis of a certificate of temporary incapacity for work, which is issued to a sick employee by a medical organization. According to Article 13 of Federal Law No. 255-FZ dated December 29, 2006 (as amended in force on July 1, 2017), a medical institution can generate sick leave both in the form of a paper document and in electronic form without duplicating it on paper.

Reference

From January 2022, only ELN will remain for the payment of benefits for sickness and care of a sick family member, as well as for pregnancy and childbirth. Such a bulletin will be posted in the FSS information system. The employee, if desired, will be able to obtain an extract from the specified document from doctors (clause 6 of Article 13 of Law No. 255-FZ as amended by Law dated 04.30.21 No. 126-FZ). For more details, see “How the Social Insurance Fund will pay sick leave and maternity leave from 2022 and what employers should do.”

ENL is a full-fledged document that has the same legal force as a traditional paper sick leave. At the same time, the technology for issuing an electronic certificate of incapacity for work does not provide for either printing it out for transmission by the employee to the employer, or sending it directly from the medical organization to the employer via TKS. All interaction between a sick employee, a medical institution and an employer takes place with the participation of the Social Insurance Fund through an information system specially created for this purpose, which is called the “Unified Integrated Information System “Social Insurance””. In this system, ELNs are formed and stored at all stages of working with them.

Important

All medical organizations, both public and private, have the right to create sick leave certificates electronically using the Social Insurance Unified Information System. Consequently, ELN can be issued not only by clinics or hospitals to which employees apply as part of compulsory medical insurance, but by medical organizations (including private ones) with which the employer has entered into VHI agreements in favor of its employees.

An employee brought an electronic sick note, what should I do?

How should an employer prepare so that an employee’s illness does not become a “surprise” and problems with the payment of benefits can be avoided? First of all, we note that there is nothing fundamentally new in this system; only the design technology and the method of transmitting the document itself change: instead of manual, it is automated. Let us remind you that forms of certificates of incapacity for work are documents of strict financial reporting; therefore, their certification requires the seal and signature of the head of the organization. Important documents generated electronically are signed with electronic digital signatures. The first thing an employer needs to do is check whether it has an electronic digital signature (EDS). If an organization already submits reports to government agencies electronically, then it already has an EDS.

As before, the form has three basic sections for entering information by the employer and the medical organization. Electronic sick leave: pros and cons As already mentioned, after the introduction of an electronic sick leave into circulation, the traditional paper sheet will not be withdrawn from circulation. This form will continue to be used, for example, due to insufficient technical equipment in the field or for other reasons. However, it will definitely be considered outdated. Since the transition to a virtual type of document flow is a very popular topic today, let's discuss its advantages and disadvantages.

We recommend reading: Contents Zhf Tariff Moscow Region

Conditions for switching to ELN

Based on the current version of Article 13 of Law No. 255-FZ, sick leave in electronic form is issued to a sick employee only with his written consent. Moreover, if the employee gave such consent, and it later turned out that his employer does not yet work with the ELN, the right to benefits will remain. As explained by specialists from the Federal Social Insurance Fund of Russia, in this case, the medical organization, at the request of the employee, must cancel the ETN and issue him a sick leave certificate on paper (letter dated 08/11/17 No. 02-09-11/22-05-13462).

For employers, the transition to ENL is currently also voluntary. No liability has been established for those who do not gain access to the Social Insurance Unified Information System and will not be able to work with the new format of sick leave. Likewise, no “bonuses” are provided (exemption from inspections, faster reimbursement of expenses, etc.) for those who connect to the electronic sick leave system.

To start working with the new system, you need to perform a number of actions. Firstly, purchase an enhanced qualified electronic signature (if you don’t already have one), since only this type of signature can be used when working with electronic electronic signature (clause 16 of Rule No. 1567 and clause 74 of Procedure No. 925n).

Attention

It follows from paragraph 74 of Order No. 925n that both the director and the chief accountant (or other employee authorized to keep accounting records) will need an electronic signature.

However, in practice, the FSS accepts electronic sick leave signed by one UKEP: either the manager or the chief accountant. For more details, see “The procedure for issuing sick leave is changing: what should an employer do.” Receive an enhanced qualified electronic signature certificate in an hour

Secondly, install a special program on the computers of employees working with electronic signatures to verify electronic signatures and protect information.

Finally, thirdly, it is necessary to select the software with which the organization will work with ENL. Currently, there are three options for such software (subparagraph “a”, paragraph 10 of Rules No. 1567). Thus, you can use software provided by the state: the policyholder’s personal account on the Social Insurance Fund website with access through the state portal, available on the fund’s website. You can also use special accounting services that have the ability to work with electronic sick leave. For example, all actions necessary to work with ENL can be performed in the system for preparing and sending reports “Kontur.Extern”.

Work with electronic sick leave and submit all related reporting through Kontur.Extern

Next, you need to inform all employees that the organization has switched to working with ENL. In particular, it should be explained to employees that they can now demand that medical institutions issue sick leave in electronic form, which will undoubtedly save them time.

At the end of the procedure, it is possible to conclude an agreement on information interaction with the regional branch of the Social Insurance Fund (the corresponding forms are usually posted on the websites of the branches).

Electronic sick leave does not wrinkle, does not deteriorate and does not burn

We all know how to carefully treat sick leave on paper. Under no circumstances should it be torn, dirty, or even folded in half. But it doesn’t always fit into a woman’s bag. The document is very capricious. But it guarantees monetary compensation for the right to improve your health at home or in a hospital. That's why you have to treat him this way.

Isn’t it easier in our electronic era to ask a doctor to write out an electronic sick leave? After all, it is as legal as a paper one. But so far, however, it is not issued everywhere - many clinics, hospitals and enterprises have not yet had time to prepare for this. The fact is that in order to issue an electronic form, both medical institutions and employers are required to enter into an agreement with the Social Insurance Fund (SIF), install suitable services and acquire electronic signatures. An electronic sick leave certificate only works when both parties are ready to complete it and are required to fill out the document in their part. Such a mutual commitment to electronic interaction is necessary, but not sufficient. To issue an electronic sick leave, the patient’s wishes in writing are also required.

If a recovered citizen declares that he wants a sick leave certificate in electronic form, the doctor opens such a document and enters all the necessary information into it. By the way, issuing an electronic sick leave is much more convenient than a paper one. After all, mistakes can be corrected during the process. And the fact that the discharged patient does not receive anything in person also has its advantages - the document never gets wrinkled or lost.

How to prepare for electronic sick leave

In order to be able to fill out electronic forms of incapacity for work for employees, a company or individual entrepreneur must sign an agreement with the FSS branch in the region where their business is registered, and purchase an enhanced qualified electronic signature (ES), if it does not already exist. Next, you need to register with State Services (the Social Insurance Fund system will definitely request it). To do this, it is first recommended to register the head of the organization as an individual and confirm his identity.

To confirm, you can use various methods:

—

contact the Service Center with your passport and SNILS;

—

receive an identity verification code by mail;

—

confirm personal data remotely, verifying it with an enhanced qualified electronic signature.

Such an electronic signature can be purchased at the accredited certification center Taksky. Then, through the confirmed director’s record, create an account for an organization or individual entrepreneur on Gosulugi. And after that, register in the policyholder’s personal account on the official website of the Social Insurance Fund.

Please pay attention!

In order to fill out electronic sick leave for employees, the employer must install a special program “Preparation of calculations for the Social Insurance Fund”. It can be downloaded from the department's website. But you can also find the ELN, fill it out and submit it to the FSS using the Taxcom company service. The software product for submitting reports to government agencies “Online Sprinter” easily copes with this too.

How to inform the HR officer about electronic sick leave

A recovered employee must remember or even better write down his electronic sick leave number, unless, of course, for some reason he received a coupon from the doctor along with the number. It is through this that the personnel officer can find sick leave. Moreover, the employee has the right to submit the document number both on the coupon and in a message by phone or online.

The HR specialist, in turn, must process the electronic slip in the policyholder’s personal account or in his accounting program and transfer it to the accountant. The information noted on the electronic sick leave, as a rule, does not differ from that entered on the paper sheet. Their list is fixed by an internal local act. The number and composition of employees participating in the preparation of an electronic certificate of incapacity for work (ELS) is established by the company management.

Where is the electronic sick leave certificate stored?

To identify the electronic sick leave, you will need the following data: last name, first name, patronymic of the employee; his SNILS and ELN number. The HR specialist must enter them in the policyholder’s personal account. He can get to this account through the FSS website, or the ESIA (Unified Authentication and Identification System), or the UIIS “Sotsstrakh” portal. How to do this step by step, read the material.

At the same time, it is recommended to print out electronic sick leave - they may be requested by the tax office during an audit of insurance premiums. But since contributions for disability benefits are not assessed, you do not need to sign the printed ELN. The Federal Tax Service may also be interested in attachments to sick leave with calculations of benefits.

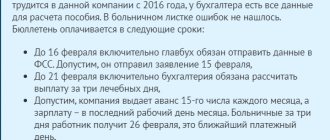

Who is involved in paying for electronic sick leave?

An electronic certificate of incapacity for work is paid in the same way as a paper one. The company compensates the benefits for the first three days of illness, the Social Insurance Fund - for all the rest. The Social Insurance Fund pays for personal income from the first day only in certain cases: if the employee had an occupational disease or an accident at work; he received prosthetics in a specialized hospital; received further treatment in a Russian sanatorium after hospitalization and in his direction; took sick leave to care for a family member; was in quarantine with a child under seven years of age attending kindergarten or with another incapacitated family member.

The benefit is assigned within 10 calendar days from the date the electronic sheet appears in the policyholder’s personal account. Paid on the next salary.

An employee brought an electronic sick leave certificate, but the company is not ready to accept it: what to do?

This also happens - the employee had no idea that the company was not connected to the system of electronic interaction with the Social Insurance Fund, but he really wanted a sick leave in electronic form and issued it. There is nothing wrong with this case. You just need to ask him to go to the medical facility for a paper duplicate, since it is issued only at the request of the patient.

In such a situation, the medical institution, canceling the electronic sick leave certificate, issues the patient a paper duplicate. This document is marked “duplicate”, the number and date of its issue are indicated, and the period of incapacity for work is indicated in one line. In this case, the ELN record is not deleted. But the date of issue of the sick leave certificate is considered to be the date of registration of the paper duplicate.

Despite the fact that every employee has the right to apply for electronic sick leave, only those who have registered with State Services can track their sick leave certificates. In order for an employee to control accruals for sick leave benefits, he needs to create a confirmed account on the portal using the same algorithm as the director’s account.

In the electronic sick leave, the accountant sees codes instead of a diagnosis

There is no need to find out from the employee what he was sick with. In order to correctly calculate the benefit, the code of the reason for disability indicated in the electronic sick leave certificate is sufficient. For example, code 01 means disease. It is used for most illnesses and indicates that the recovered employee is entitled to full payment of benefits depending on length of service. Code 02 indicates an injury that prevents the employee from going to work. It only excludes injuries sustained at work. For this, code 04 is used. Quarantine is 03, maternity leave is 05, and so on. The total number of codes is 12. The list of codes was approved by order of the Ministry of Health and Social Development of Russia No. 624n dated June 29, 2011. Codes instead of diagnosis have their advantage. They are easier to operate and there is no need to decipher the doctor’s usually incomprehensible handwriting.

electronic sick leave electronic sick leave

Send

Stammer

Tweet

Share

Share

How to get ELN

Let's consider what steps a sick employee must take in order to receive an electronic sick leave certificate. As already mentioned, such a ballot is issued only upon a written application from the employee. This means that you need to inform your attending physician about your desire to receive an ELN and receive the appropriate application form from him. The employee must also inform the medical institution about his SNILS.

After the doctor “closes” the sick leave, the medical organization will generate an electronic certificate of incapacity for work in the Unified IIS “Sotsstrakh”, and fill out its part in it (clause 3 and subclause “b” of clause 10 of Rules No. 1567). Next, the employee will receive a special coupon from the doctor, where the ELN number will be indicated. There is no need to collect additional signatures from medical workers or affix the medical institution’s seal to the sick leave form.

Attention

A coupon issued to an employee with an ELN number is not a strict reporting document.

There is no need to give it to the employer - just give the sick leave number indicated on the coupon. As reported on the FSS website, this can be done in any way, including by telephone or via email. The coupon, where this number is indicated, is not a mandatory document for calculating and paying for sick leave. The employer must neither demand it from the employee nor wait for the employee to produce it. If an employee loses a ticket, he will have to take the following actions. First, register on the government services website, and then go to your personal account on the FSS website, where he can see the number of his electronic sick leave. Using the same account, an employee can track the “movement” of funds according to the bulletin: the amount of the assigned benefit, the status of payment, etc.

What will happen to the employee if he does not close his sick leave?

- A reporting form is used.

- The paper is light blue in color and A4 size.

- Watermarks protect documents from counterfeiting.

- The document is signed by doctors and certified by a seal.

- A duplicate is issued if errors are made in the document.

- Cell boundaries are respected when making entries.

- The document is filled out by hand or using a computer.

- Black paste is used. Gel or capillary pen.

- Medical confidentiality is maintained, so the names of diseases are missing.

The rules on how to close and open sick leave were approved by the Ministry of Health and Social Development. The procedure is explained in Order No. 624n. The form is filled out when you first contact the doctor or when you are discharged. The form is certified by the attending physician. You need to contact the clinic at your place of registration or temporary residence. The local doctor must close sick leave when the patient has chosen treatment at home. The form is certified with three seals. After certification, the form is registered in the strict reporting journal. An employee, at his own request, can close his sick leave earlier than necessary if the doctor gives permission.

We recommend reading: Is a PCO Receipt Enough for an Advance Report?

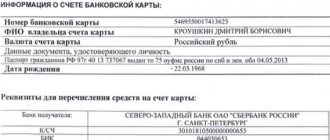

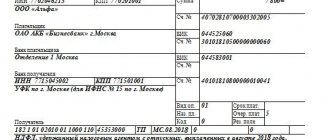

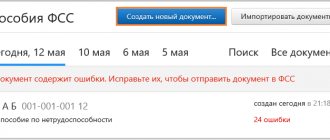

Instructions for working with ENL for employers

As soon as the employee has received information about the electronic sick leave number, the employer must begin taking the actions necessary to pay for it. First, using the selected software, you need to find this sick leave in the Social Insurance Unified Insurance Database. The search is carried out using the number provided by the employee and his SNILS (clause 72 of Procedure No. 925n).

After the electronic sick leave certificate has been found, it must be requested from the FSS database. In the received ENL, you need to fill in all the columns of the section “To be filled out by the employer” (subclause “c” of paragraph 11 of Rules No. 1567). In their content, these columns are no different from the columns of a similar section of the paper version of the certificate of incapacity for work (clause 73 of Order No. 925n). For some features of filling out the ENL, see the article “The procedure for issuing sick leave is changing: what should an employer do.”

The completed document must be saved and certified with the electronic signatures of the manager and chief accountant (or other person authorized to conduct accounting) (clause 74 of Procedure No. 925n). After this, the data will automatically go to the FSS.

Important

In order not to distract the manager and chief accountant every time, you can transfer to an authorized person the right to draw up an electronic tax record.

To do this, you need to issue an order (instruction) or issue a power of attorney. In this case, the ELN will need to be signed by the UKEP of the authorized person (clause 74 of Procedure No. 925n). Create electronic registers and submit them to the Social Insurance Fund via the Internet Submit for free

If the employer made a mistake when filling out the ENL, the changes must also be made electronically. It is necessary to send corrected information to the FSS indicating the reason for the changes (clause 72 of Procedure No. 925n).

From the message on the FSS website it follows that it is not necessary to print out the electronic tax record or create a copy of it on the employee’s computer or the organization’s server. But the calculation of benefits for electronic sick leave must be stored. This can be done either on paper or in the form of an electronic document certified by the UKEP (clause 75 of Order No. 925n).

Payment for electronic sick leave is no different from payment for a traditional paper certificate of incapacity for work. This means that the part of the benefit, which is paid at the expense of the employer, must be transferred along with the next salary (Clause 1, Article 15 of Law No. 255-FZ). The Social Insurance Fund will pay its part of the benefit within 10 calendar days after receiving documents (information) or a register of information from the employer. Also see “The FSS has approved the register forms that employers submit to the Fund for direct benefit payments.”

Important

An employee who has been issued an ELN does not have to submit an application for payment of benefits to the employer.

Work with electronic sick leave with a “complicated” salary with bonuses and coefficients

How is sick leave paid?

Payment of sick leave through State Services is not carried out; this issue is dealt with by the FSS in cooperation with the employer. The initial sick leave period cannot exceed 15 days. If the person has not recovered during this period, a commission is appointed that decides on the further extension of the document.

Payment order:

- The employee transfers the closed sick leave to the accounting department or reports the number of the electronic sheet.

- Within 5 days, the employer sends information to the Social Insurance Fund.

- Within 10 days after receiving the information, the Fund sends the required amount of benefits to the employee’s account.

In some regions, the benefit is paid by the employer, and later receives compensation from the Social Insurance Fund. But from 2022, all payments will be made only by the fund.

State services and the Social Insurance Fund do not issue sick leave. The State Portal can only provide information about the sheet. The FSS also provides support for sick leave and regulates payment for it. Only doctors can issue forms or electronic versions. Due to quarantine, the issuance period through State Services ended in the summer of 2022.

5 / 5 ( 2 voices)

Pros and cons of electronic sick leave

For policyholders, the transition to electronic insurance has undoubted advantages. These include:

- complete protection against payment for fake sick leave. The authenticity of the ELN is checked by the FSS at the stage of issuing the document by the medical institution. This means that the employer, when requesting an electronic sick leave using the number provided by the employee, receives a document for payment that has already been verified and approved by the fund;

- no need to store sick leave certificates and present them during inspections. All information about ELN is always at the disposal of the FSS, which can check it without the participation of the organization. This means you won’t have to present electronic sick leave certificates during checks. This is confirmed on the FSS website.

There are also conveniences for workers who issue electronic sick leaves. They can receive the appropriate payment faster, since to assign a benefit they do not need to write an application and give the employer the original ballot, but only need to provide its number. In addition, the electronic form of sick leave makes it impossible to lose or damage it. Finally, in the ENL there simply cannot be errors in indicating information about the employer, since the medical institution takes all the information from the Social Insurance Fund database. Another advantage is the ability to track the “movement” of payments via an electronic newsletter through your personal account.

As for the disadvantages of switching to a new system, perhaps the most significant of them at the moment is the need to register “personal” UKEP to the chief accountant or other authorized person. Also, difficulties when working with electronic devices may arise due to technical failures in the functioning of the corresponding electronic systems. This leads to the inability to receive an electronic sick leave by number, fill it out or send it, etc. Judging by the information posted on the FSS website, errors in the operation of systems are quickly eliminated.

Electronic sick leave certificates: not everything is as good as we would like

- you can issue certificates of incapacity for work on paper or in the form of an electronic document (with a large number of “ifs” described above)

- the form, procedure for issuing and procedure for processing certificates of incapacity for work (paper and electronic) are established by the federal executive body exercising the functions of developing and implementing state policy and legal regulation in the field of healthcare - i.e. Ministry of Health. Let me remind you that no changes have been made to the current “Procedure for issuing personal insurance” and there is not a word about electronic sick leave.

- The procedure for information interaction between the insurer, policyholders, medical organizations and federal state medical and health insurance companies in terms of working with electronic health insurance is approved by the Government of the Russian Federation - and this procedure has not yet been developed, which equates all services offered for use to a departmental gag...

We recommend reading: 217 Tax Code of the Russian Federation Between Relatives

For patients, nothing will change radically with the introduction of electronic sick leave. They also come to the initial appointment, but some media publications say that at closing they will not have to stand in line to get stamps for the form—confirmed data is immediately sent to the employer. The patient decides which sick leave to take - paper or electronic - but if the company is not registered in the system, the doctor will not be physically able to open the digital version of the document.

Practical conclusions

Let's summarize. The transition to working with electronic certificates of incapacity for work has positive aspects both for the employer (the risks of receiving fake sick leave are eliminated, as well as loss of documents during storage), and for employees (they can receive benefits faster). The disadvantages of working with ELN are currently related to the technical side of the issue. You will also have to purchase the necessary software and UKEP certificates (if they do not already exist).

In any case, today every employer has the right to decide on the issue of switching to ENL independently. Current legislation does not oblige insurers to ensure work with electronic sick leave certificates, and does not establish any liability for those who have not connected to the Social Insurance Unified Insurance System.